This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 7207

for the current year.

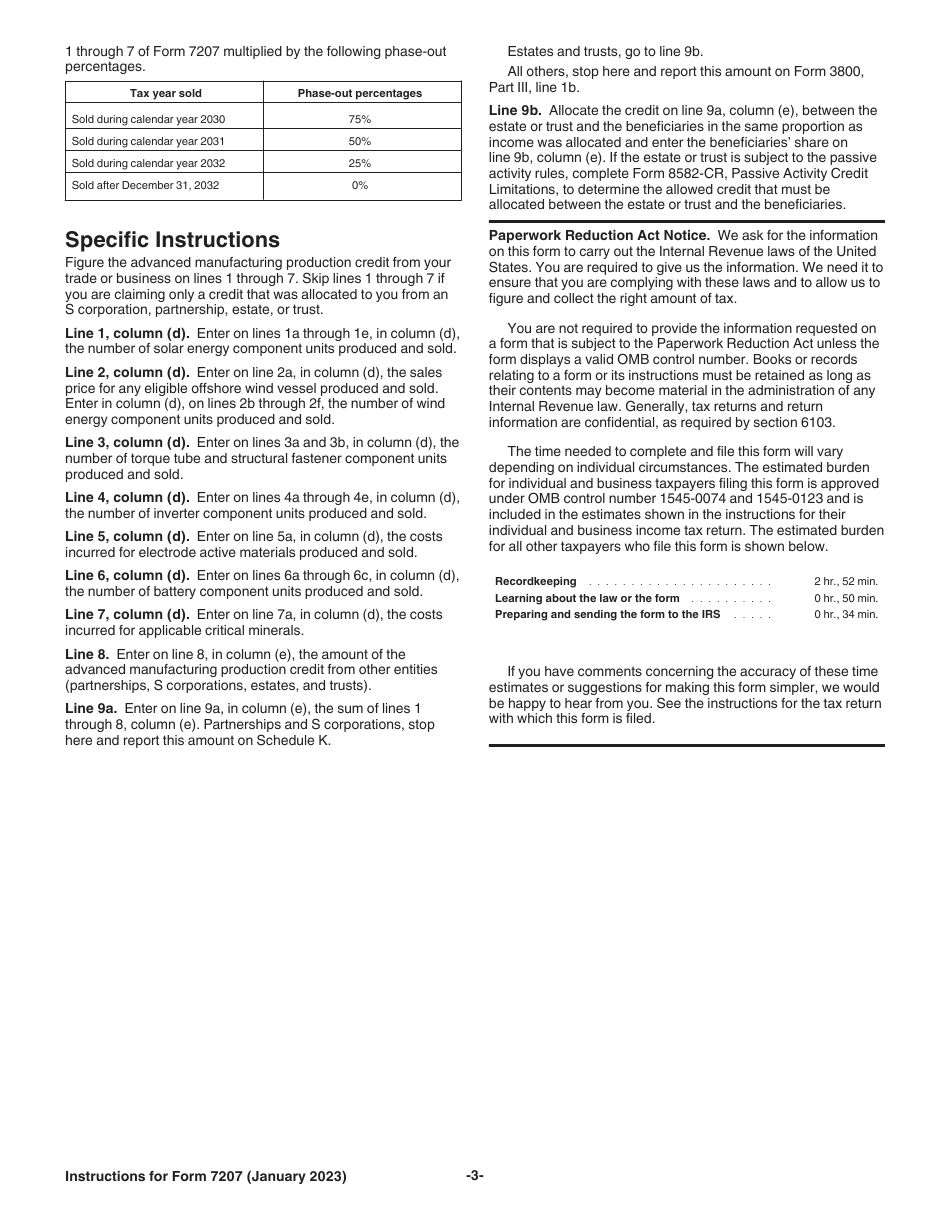

Instructions for IRS Form 7207 Advanced Manufacturing Production Credit

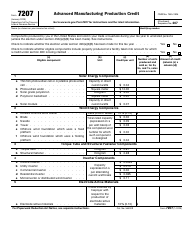

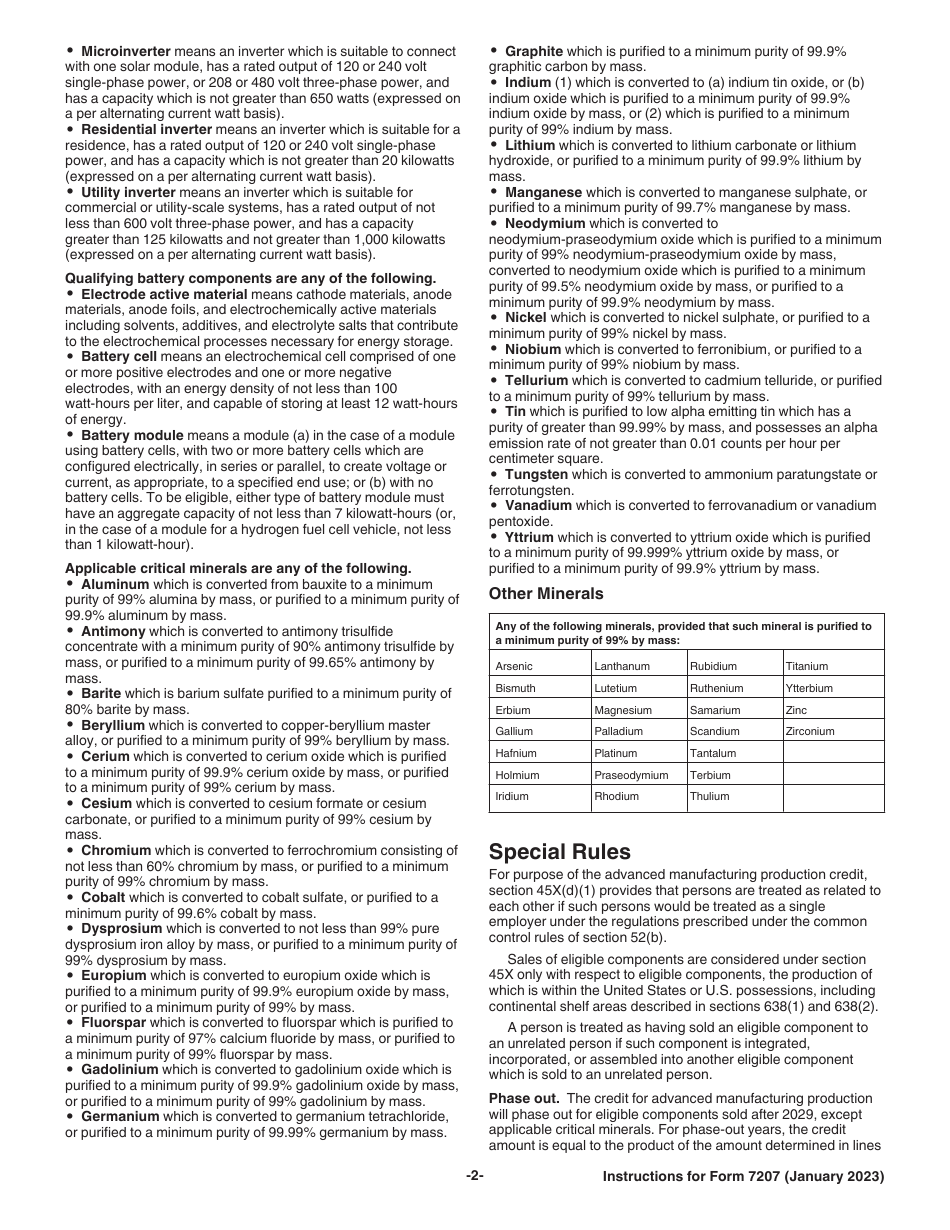

This document contains official instructions for IRS Form 7207 , Advanced Manufacturing Production Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7207 is available for download through this link.

FAQ

Q: What is IRS Form 7207?

A: IRS Form 7207 is a form used to claim the Advanced Manufacturing Production Credit.

Q: What is the Advanced Manufacturing Production Credit?

A: The Advanced Manufacturing Production Credit is a tax credit available to businesses engaged in advanced manufacturing.

Q: Who is eligible to claim the Advanced Manufacturing Production Credit?

A: Businesses engaged in advanced manufacturing, including those in the United States and U.S. possessions, are eligible to claim this credit.

Q: What is considered advanced manufacturing?

A: Advanced manufacturing is a subset of manufacturing that incorporates new or improved technologies in the production process.

Q: What are the requirements to qualify for the Advanced Manufacturing Production Credit?

A: To qualify, a business must meet certain wage and employment requirements and must have met a qualified investment requirement.

Q: How much is the Advanced Manufacturing Production Credit worth?

A: The credit amount is generally 9% of the eligible qualified investment.

Q: How do I claim the Advanced Manufacturing Production Credit?

A: To claim the credit, you must complete and file IRS Form 7207 with your tax return.

Q: Is there a deadline to submit IRS Form 7207?

A: Yes, Form 7207 must be filed by the due date of your tax return, including extensions.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.