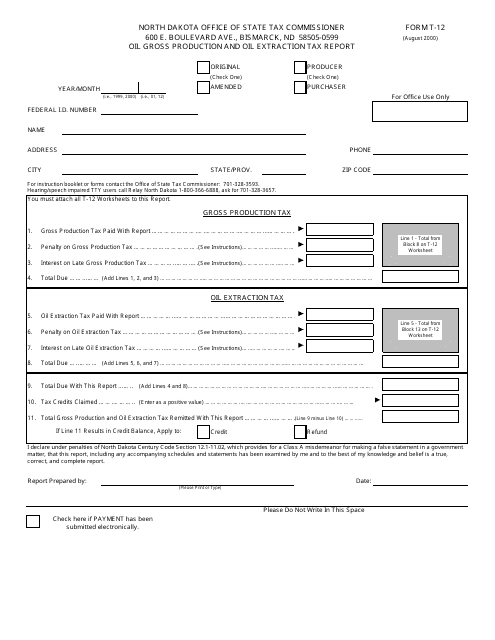

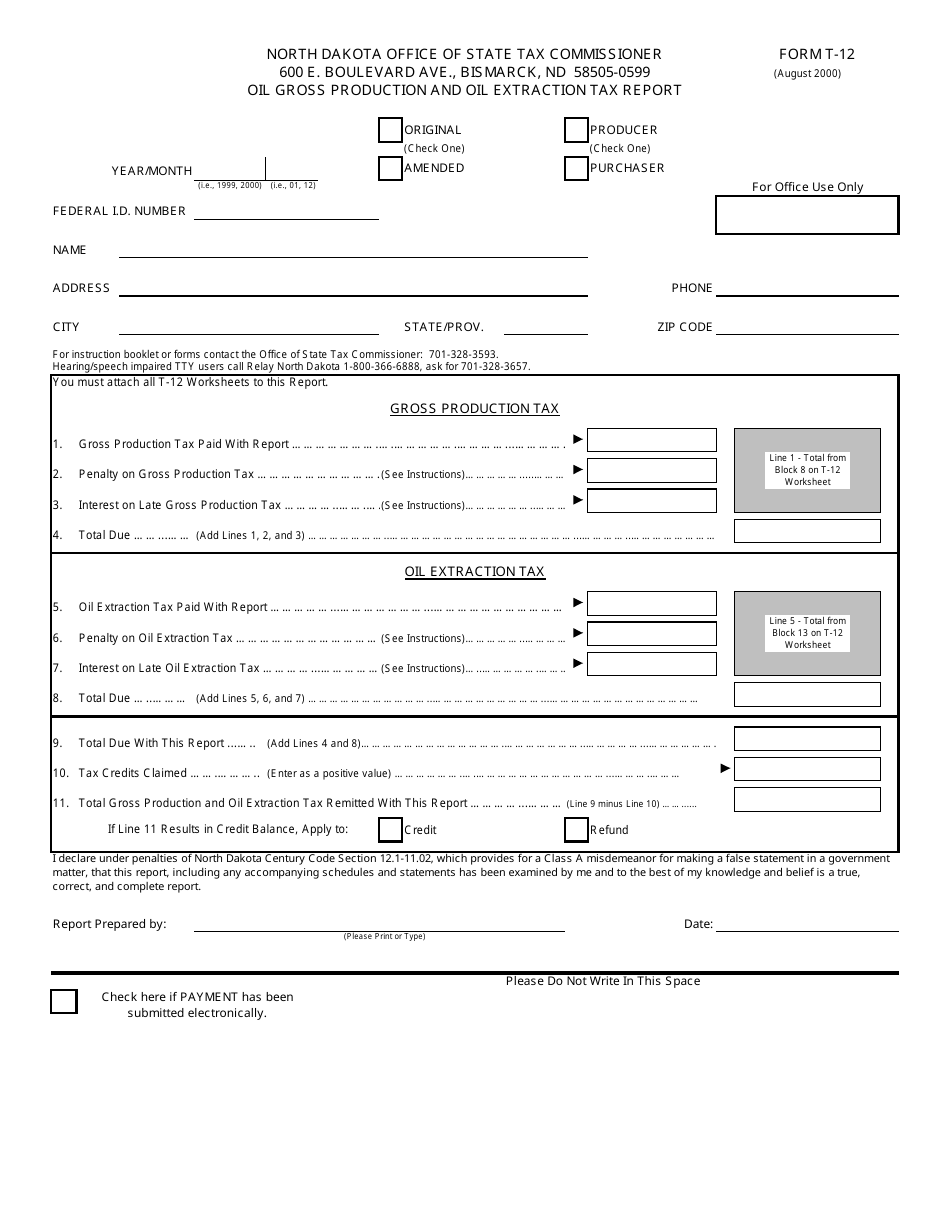

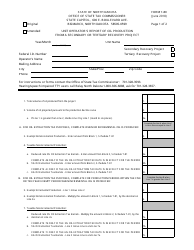

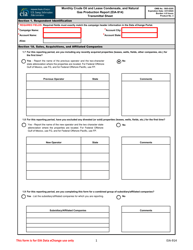

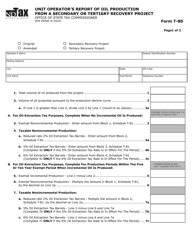

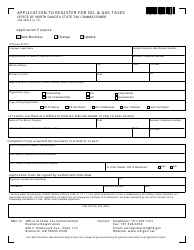

Form T-12 Oil Gross Production and Oil Extraction Tax Report - North Dakota

What Is Form T-12?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form T-12?

A: Form T-12 is the Oil Gross Production and Oil Extraction Tax Report in North Dakota.

Q: What is the purpose of Form T-12?

A: The purpose of Form T-12 is to report the oil gross production and oil extraction tax in North Dakota.

Q: Who needs to file Form T-12?

A: Oil producers and extractors in North Dakota need to file Form T-12.

Q: How often is Form T-12 filed?

A: Form T-12 is filed monthly.

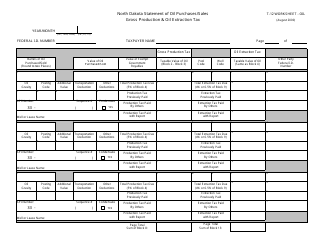

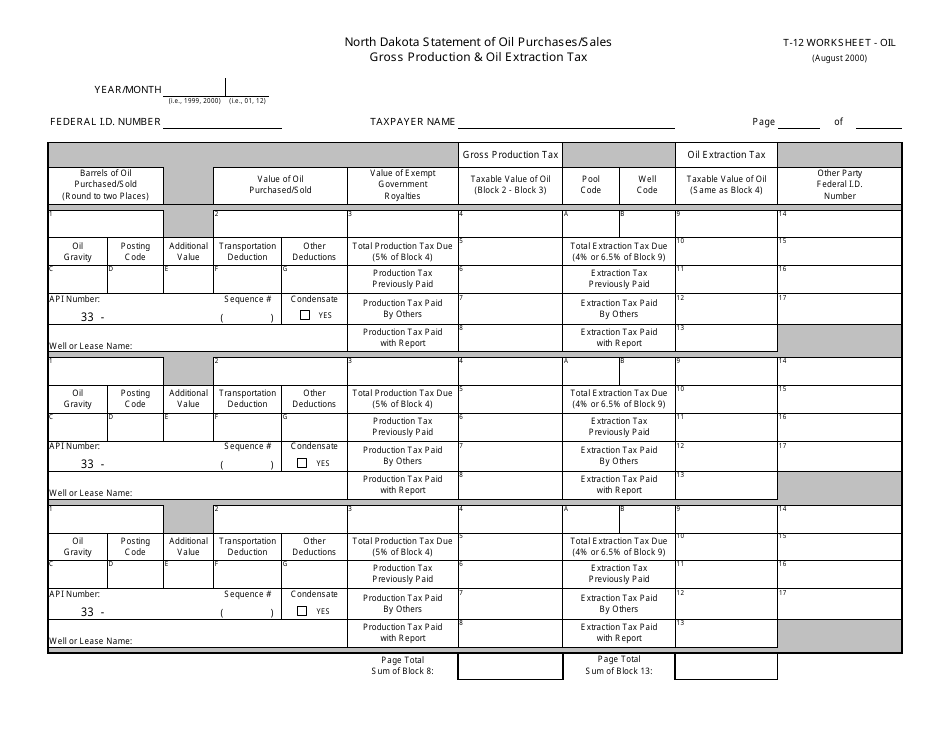

Q: What information is required on Form T-12?

A: Form T-12 requires information such as gross production of oil, taxable extraction, and tax liability.

Q: What are the deadlines for filing Form T-12?

A: Form T-12 must be filed by the 15th day of the following month.

Q: Are there any penalties for late filing of Form T-12?

A: Yes, there are penalties for late filing of Form T-12, including interest charges on unpaid taxes.

Q: Is Form T-12 only for oil producers?

A: No, Form T-12 is also for oil extractors in North Dakota.

Form Details:

- Released on August 1, 2000;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-12 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.