Free Tax Filing Templates

Documents:

3000

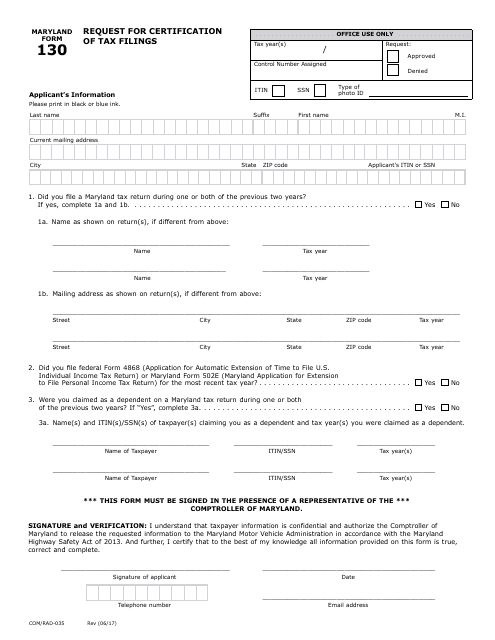

This form is used for requesting certification of tax filings in the state of Maryland.

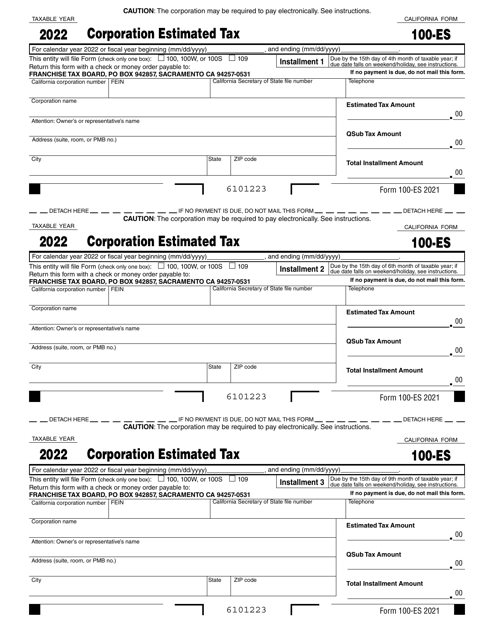

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

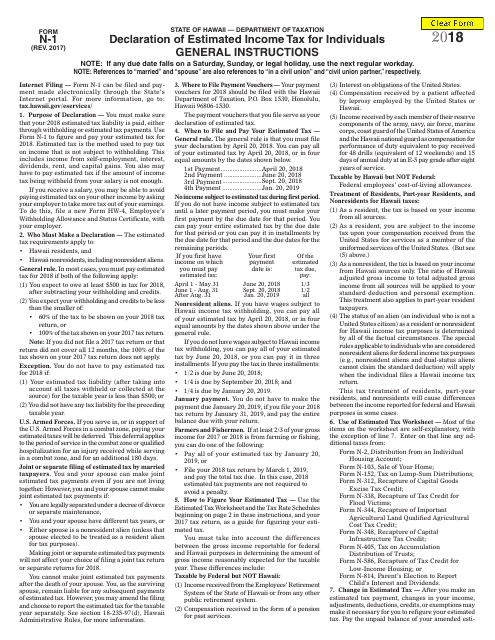

This form is used for individuals in Hawaii to declare their estimated income tax for the year. It is used to estimate and pay taxes throughout the year, rather than waiting until the tax return is due.

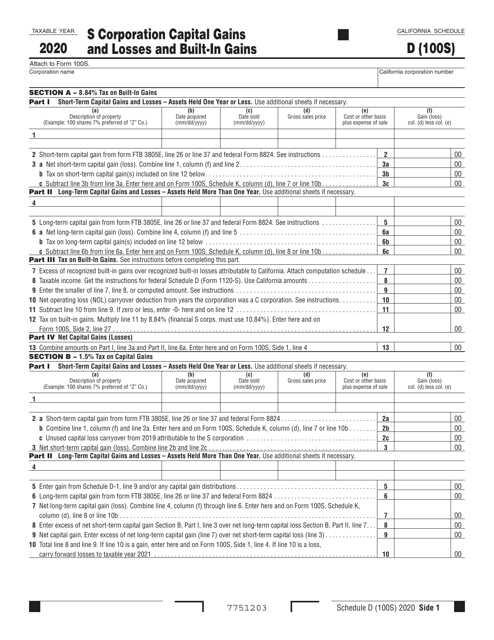

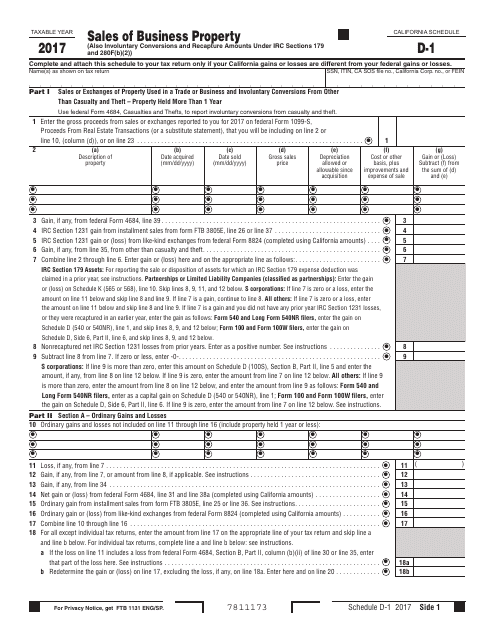

This form is used for reporting sales of business property in California on Form 540 Schedule D-1.

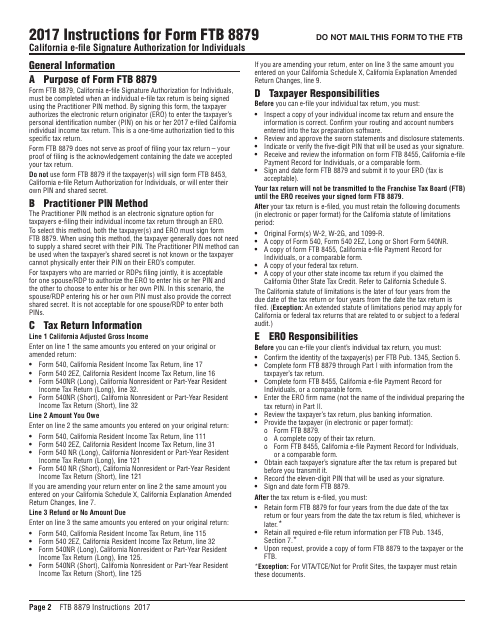

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

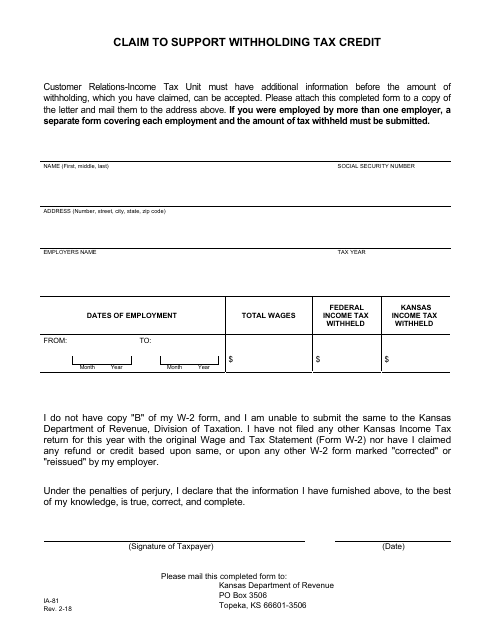

This Form is used for residents of Kansas to claim a withholding tax credit.

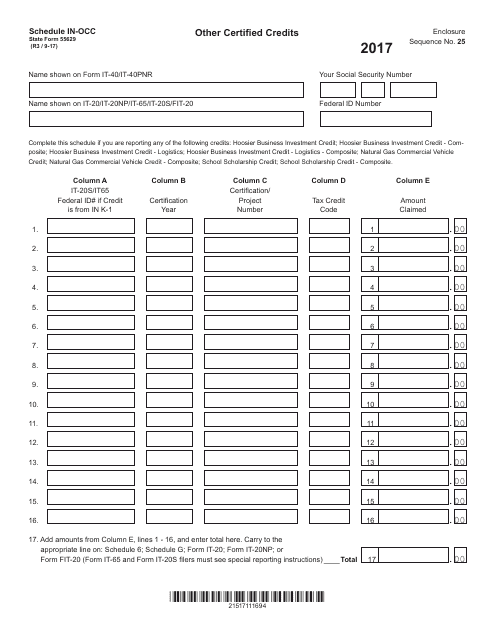

This form is used for reporting and claiming other certified credits in the state of Indiana.

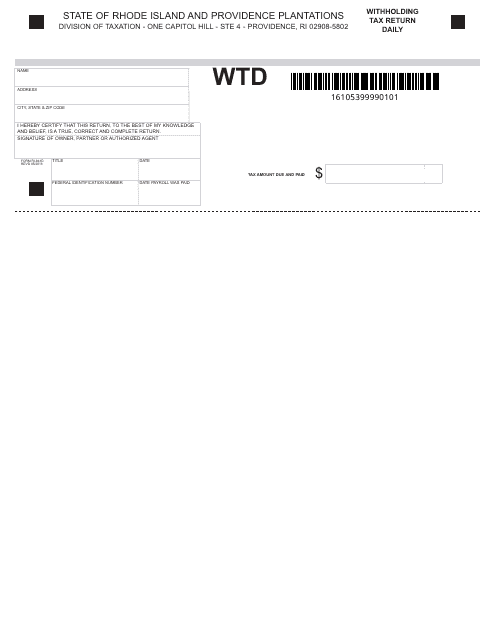

This Form is used for reporting and remitting the withholding tax withholdings made on a daily basis in the state of Rhode Island.

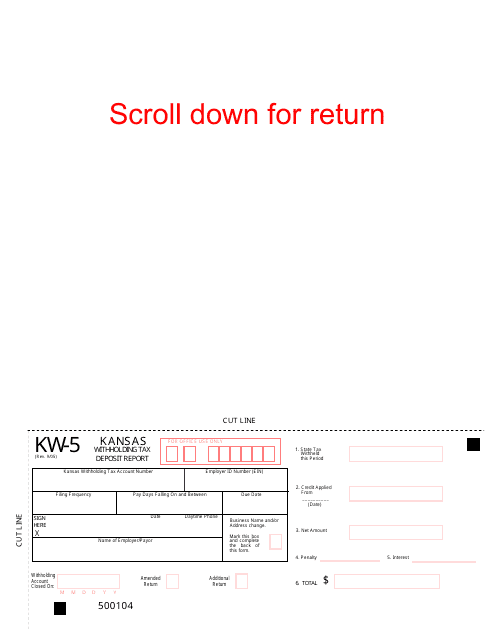

This Form is used for reporting and submitting withholding tax deposits in the state of Kansas.

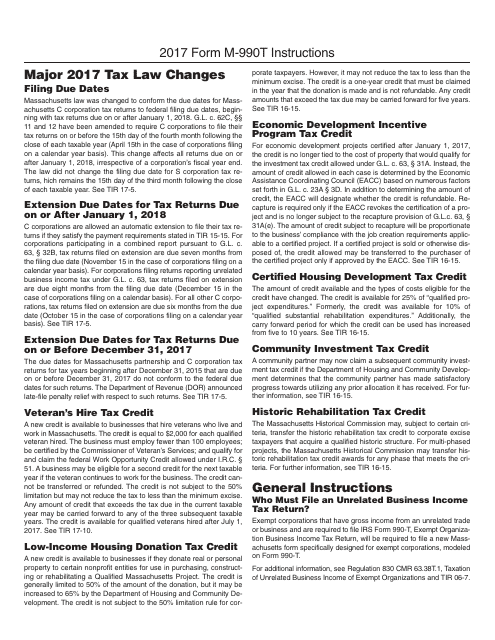

This Form is used for reporting and paying the Massachusetts Unrelated Business Income Tax. It applies to tax-exempt organizations that engage in unrelated business activities in Massachusetts. The form provides instructions on how to report and calculate the taxable income, exemptions, and credits for the tax year.

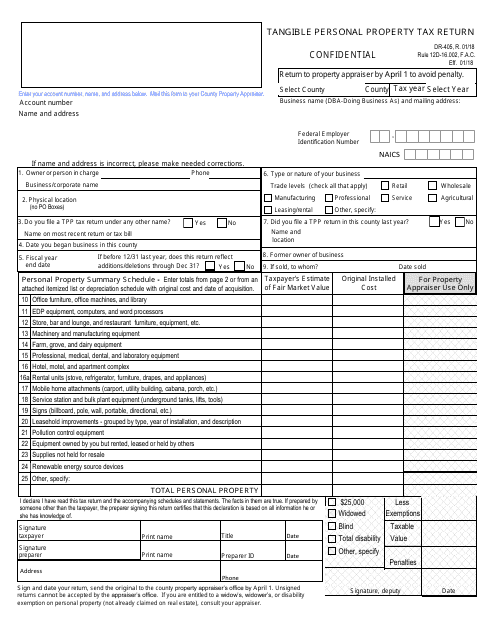

This Form is used for reporting tangible personal property and calculating tax owed in the state of Florida.

This Form is used for reporting income and expenses of electing large partnerships in the United States.