Free Tax Filing Templates

Documents:

3000

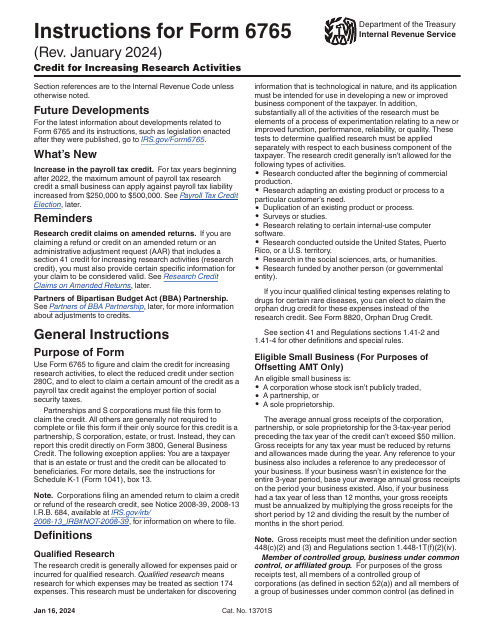

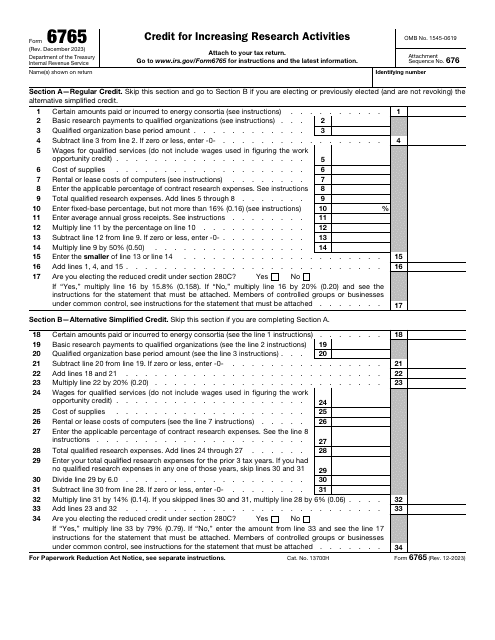

This is a document you may use to figure out how to properly complete IRS Form 6765

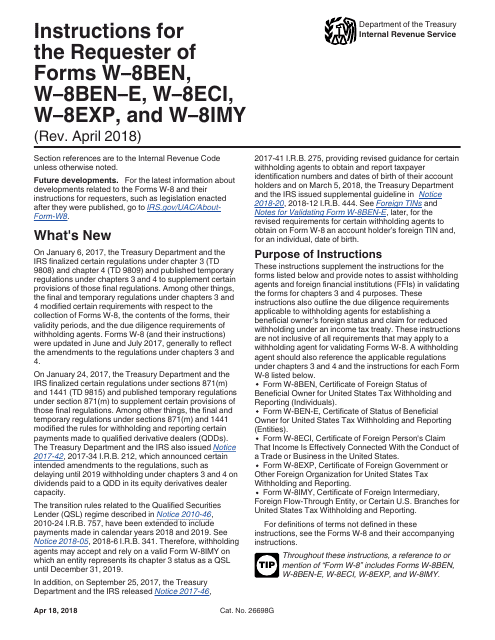

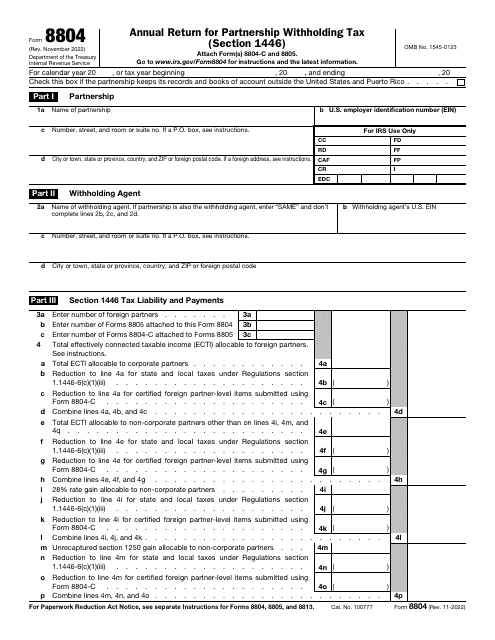

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

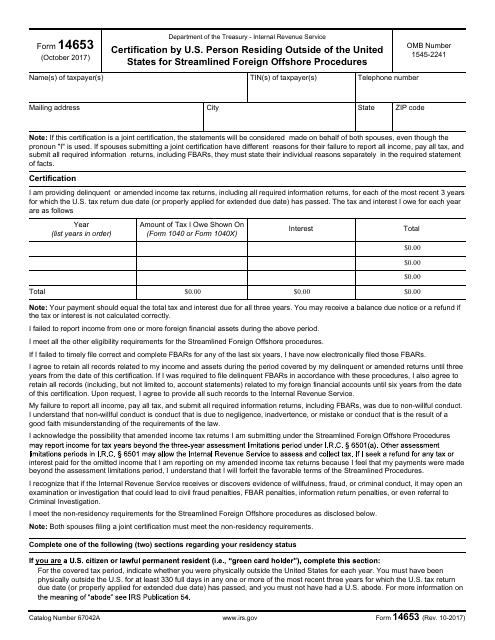

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

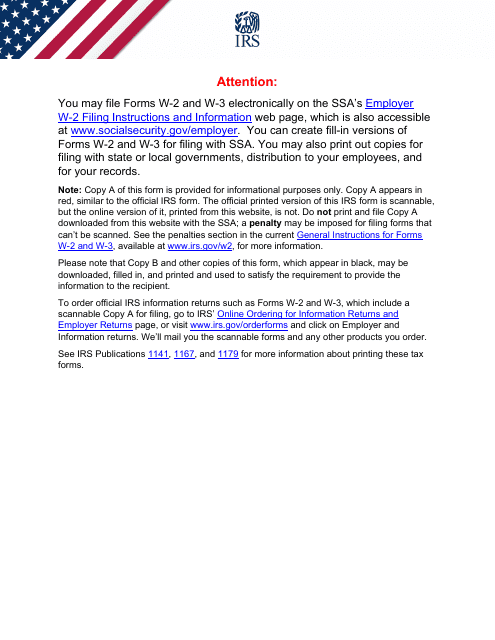

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

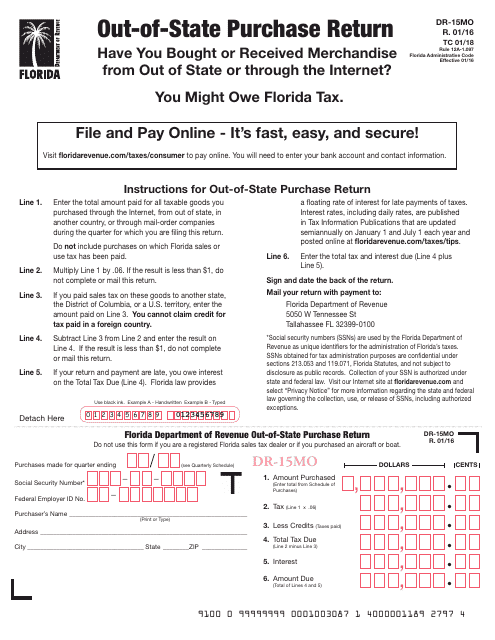

This form is used for reporting out-of-state purchases made by residents of Florida. It is used to calculate and pay the appropriate sales and use tax on these purchases.

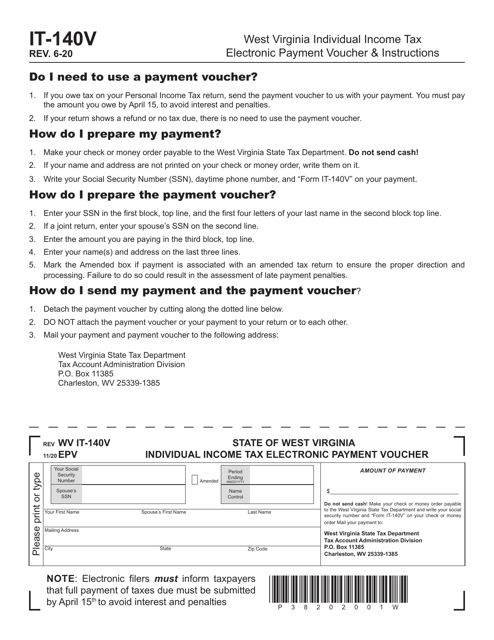

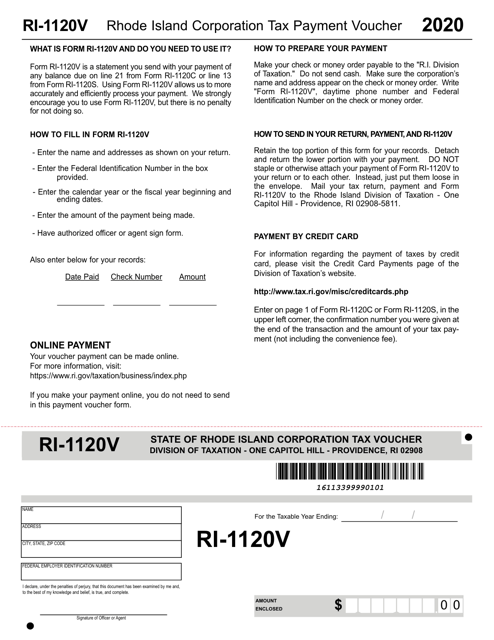

Form IT-140V State of West Virginia Individual Income Tax Electronic Payment Voucher - West Virginia

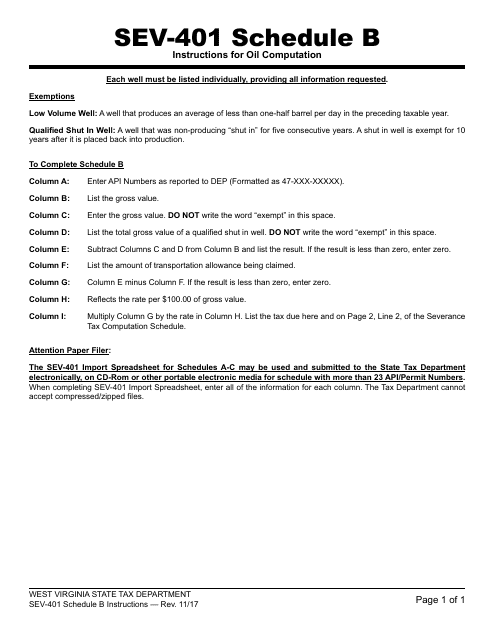

This Form is used for calculating oil production for tax purposes in the state of West Virginia.

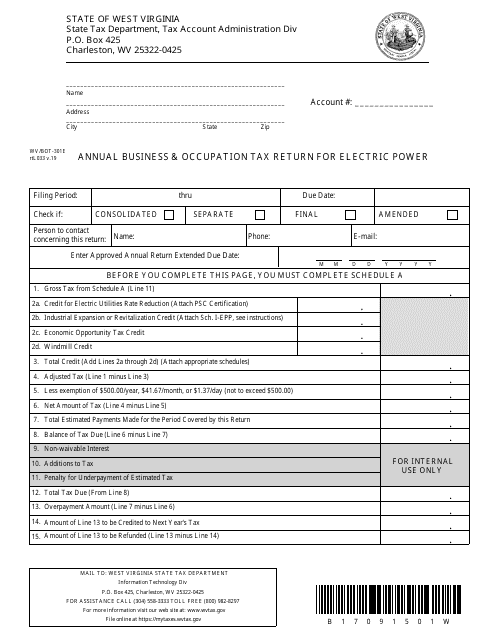

This form is used for filing the annual business and occupation tax return specifically for electric power companies operating in West Virginia.

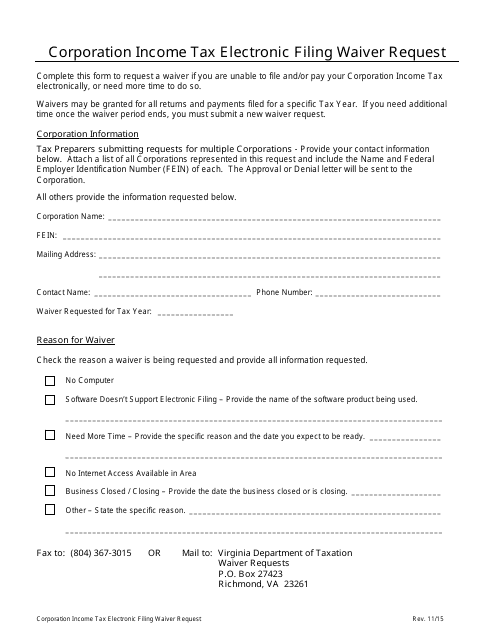

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

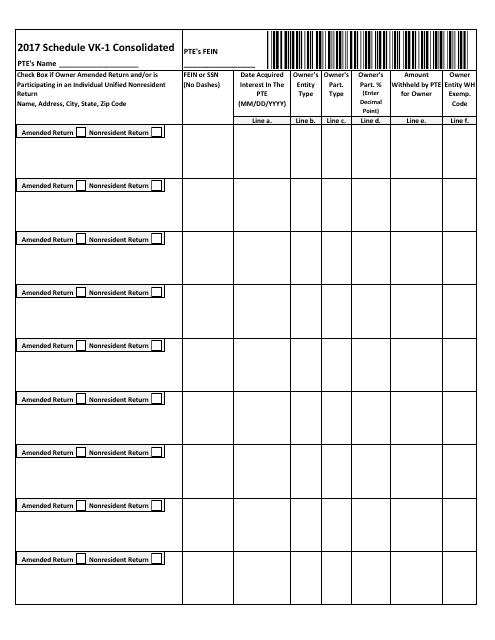

This document is used for reporting consolidated income and expenses in the state of Virginia.

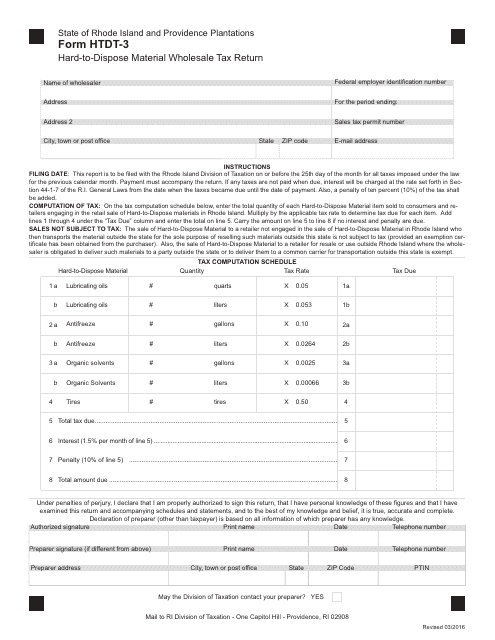

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

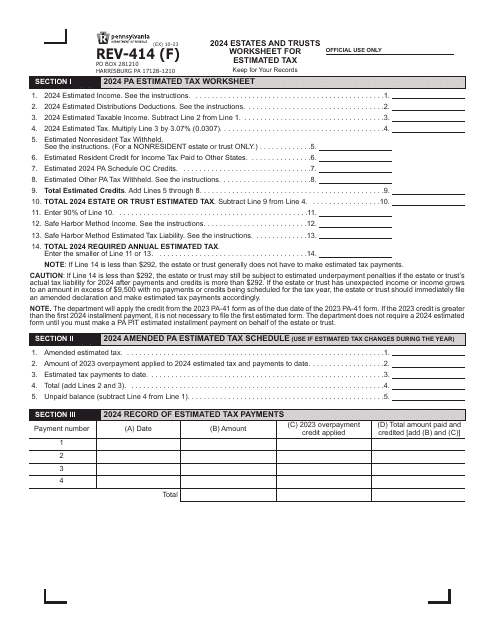

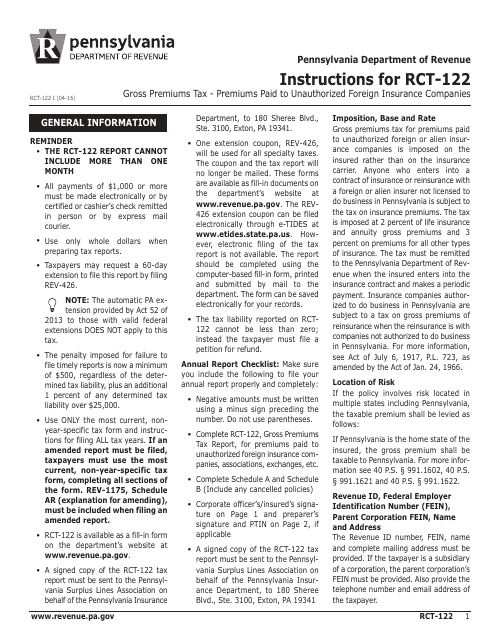

This Form is used for reporting and paying gross premiums tax on premiums paid to unauthorized foreign insurance companies in Pennsylvania.

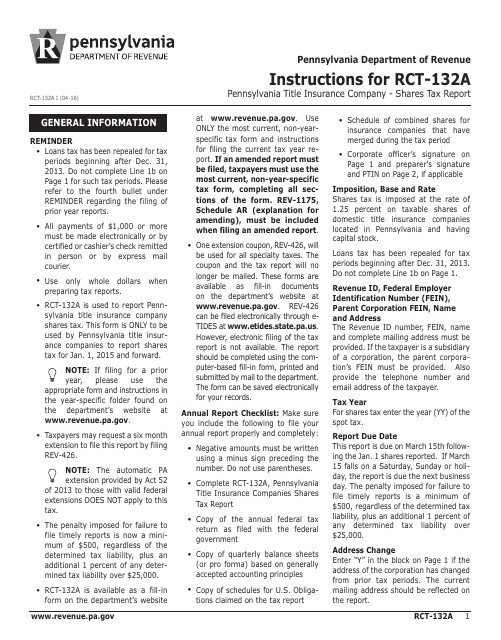

This Form is used for reporting shares tax by Pennsylvania title insurance companies. It provides instructions for completing Form RCT-132A.

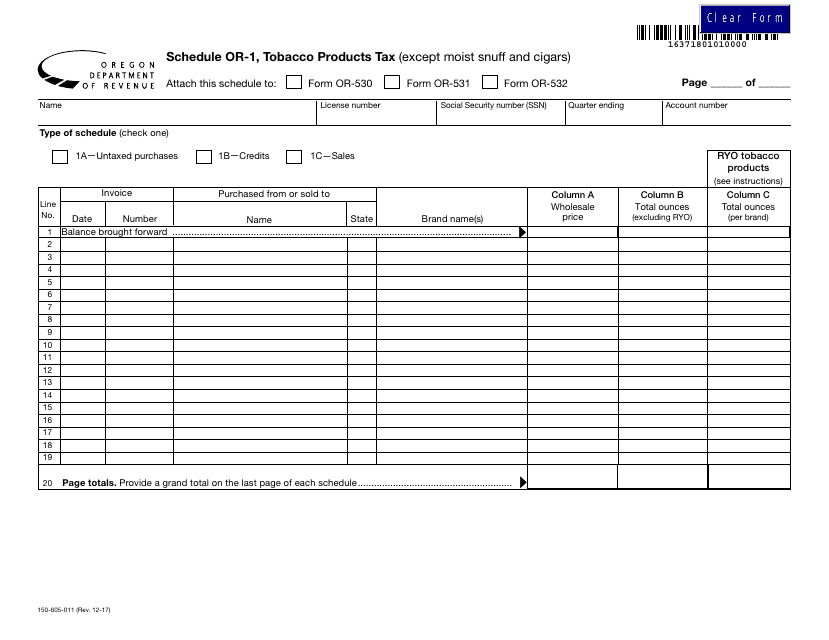

This Form is used for reporting and paying taxes on tobacco products, excluding moist snuff and cigars, in the state of Oregon.

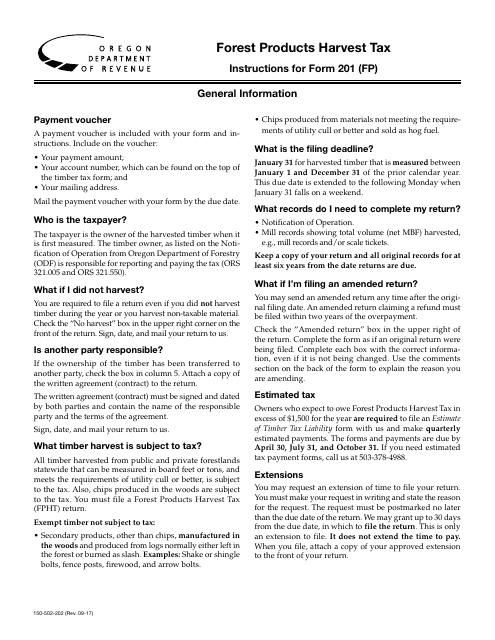

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

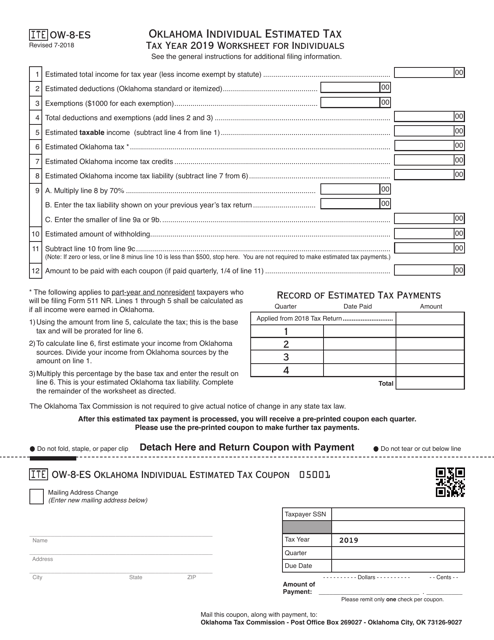

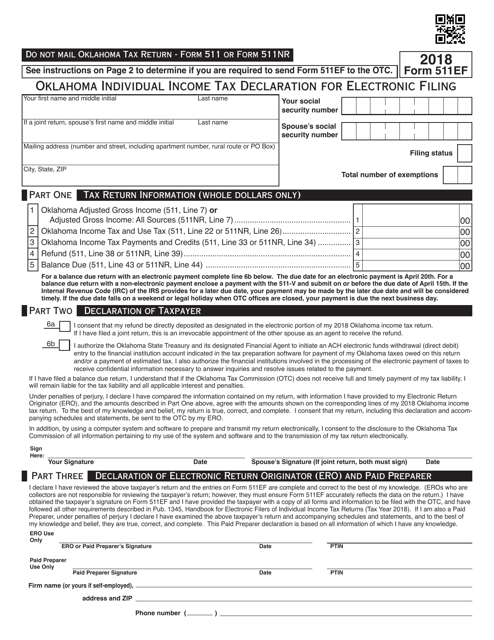

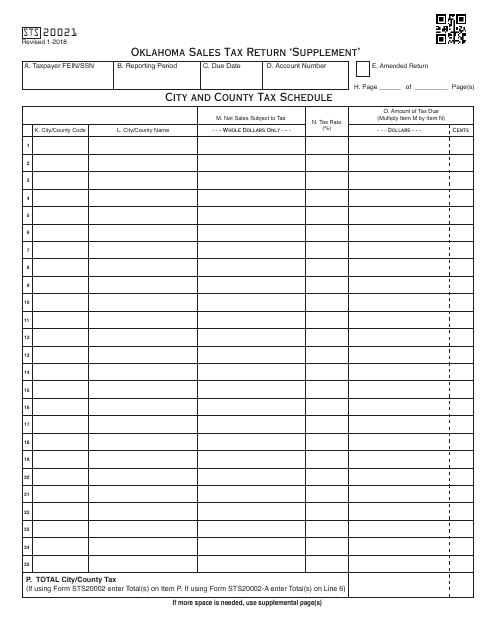

This Form is used for filing supplementary sales tax return in Oklahoma.

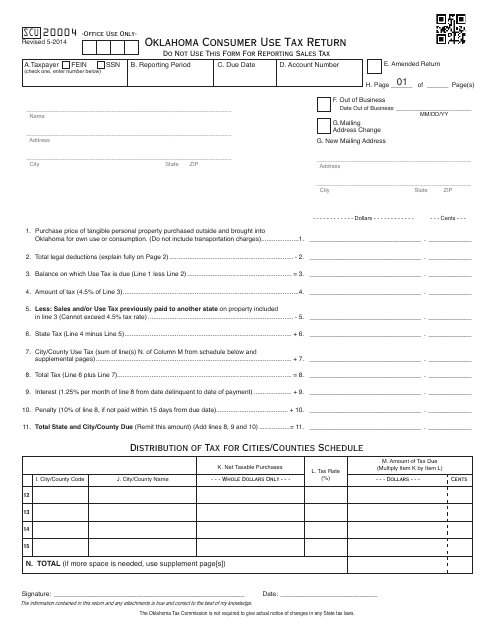

This form is used for reporting and paying consumer use tax in Oklahoma. It is necessary for individuals who have made purchases out-of-state or online and did not pay sales tax at the time of purchase. The form helps ensure that individuals fulfill their tax obligations.

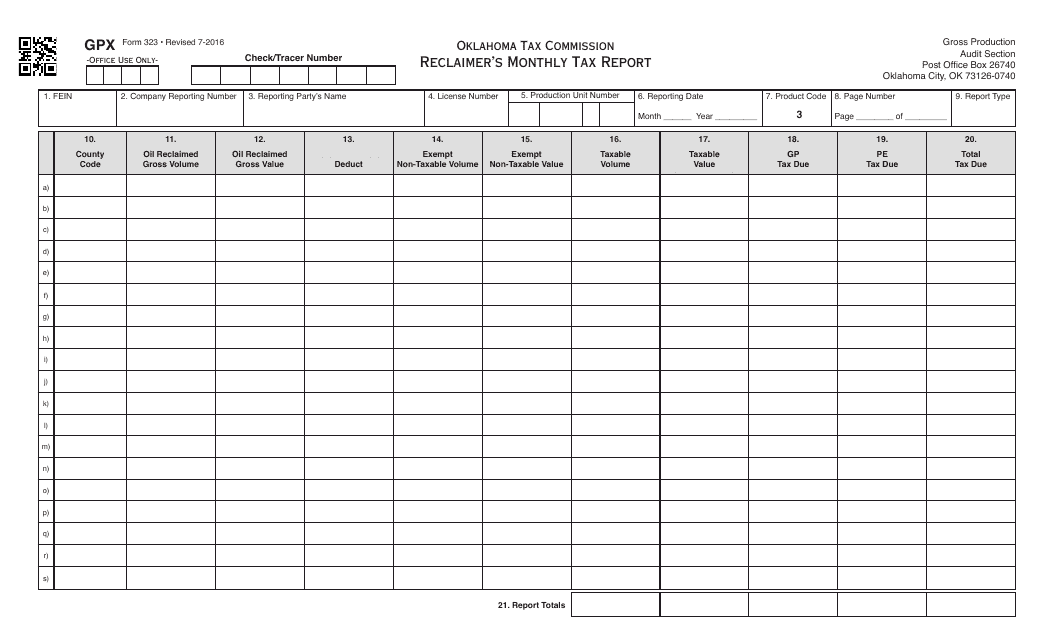

This form is used for the monthly tax report for reclaimers in Oklahoma. It is required to report and pay taxes on reclaimed items in the state.

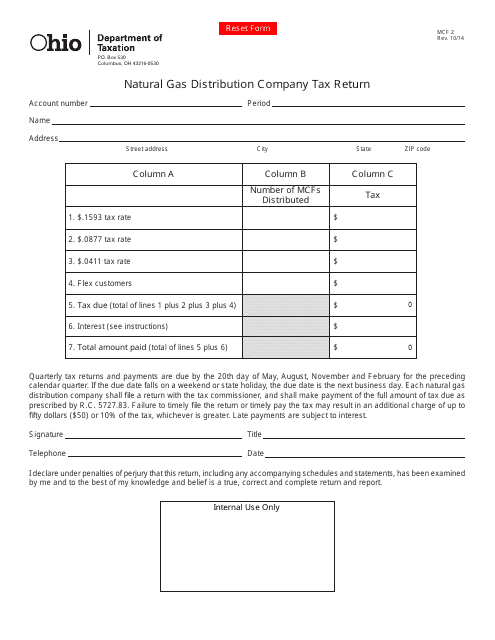

This form is used for filing the Natural Gas Distribution Company Tax Return in the state of Ohio. It is specifically designed for businesses involved in the distribution of natural gas.