Free Tax Filing Templates

Documents:

3000

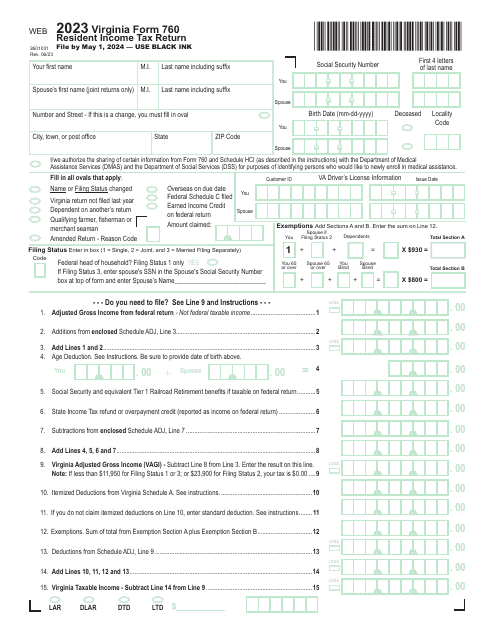

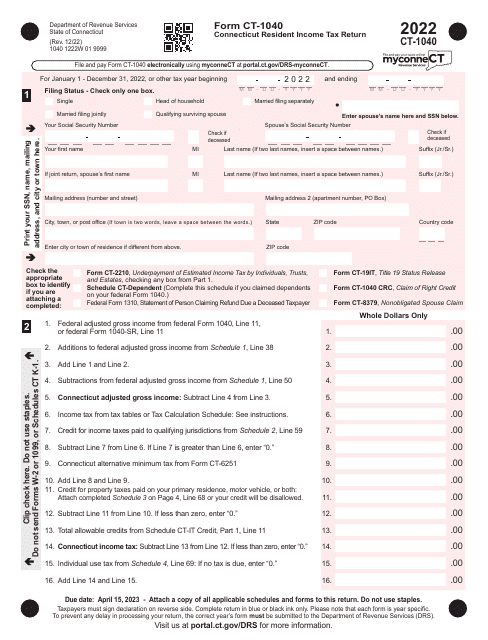

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

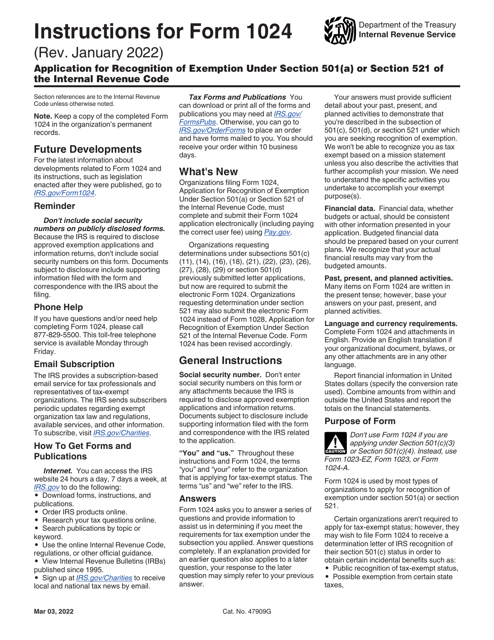

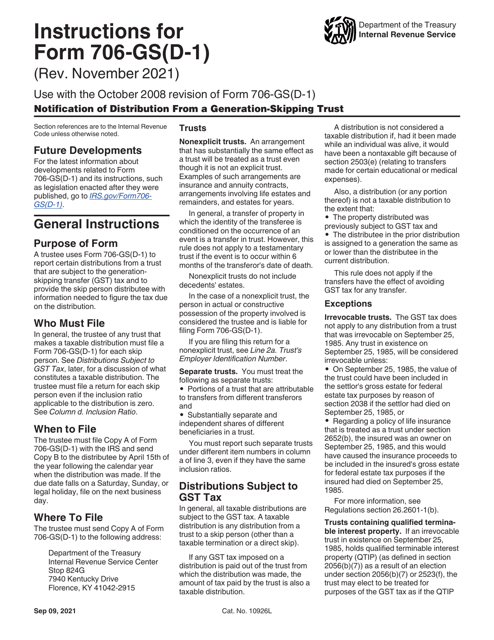

This type of document provides instructions for reporting organizational actions that affect the basis of securities to the Internal Revenue Service (IRS). It is used by individuals and organizations to accurately file their tax returns.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

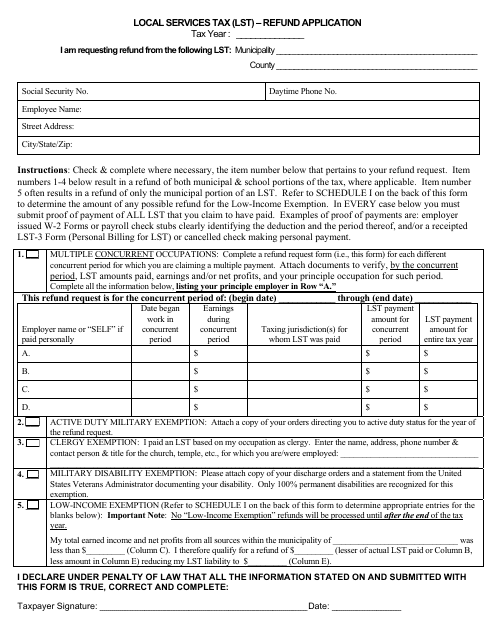

This Form is used for applying for a refund of the Local Services Tax (LST).

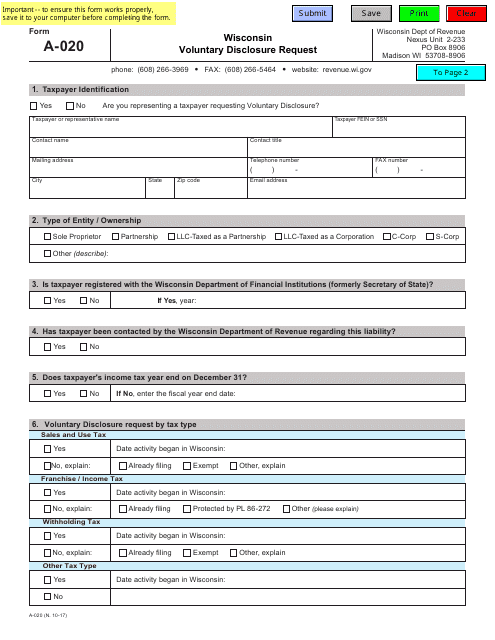

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

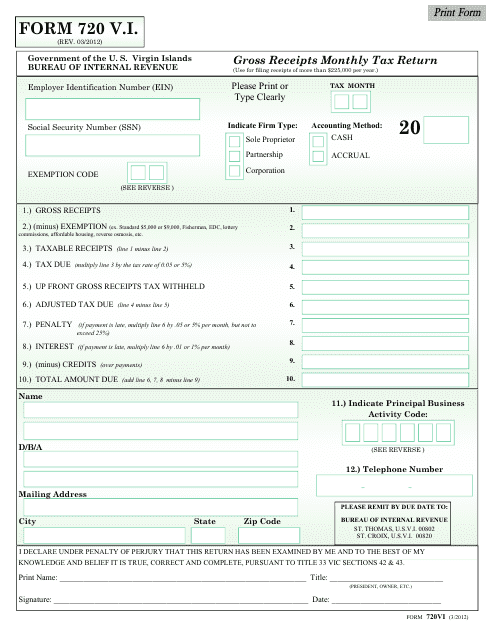

This form is used for reporting monthly gross receipts tax in the US Virgin Islands.

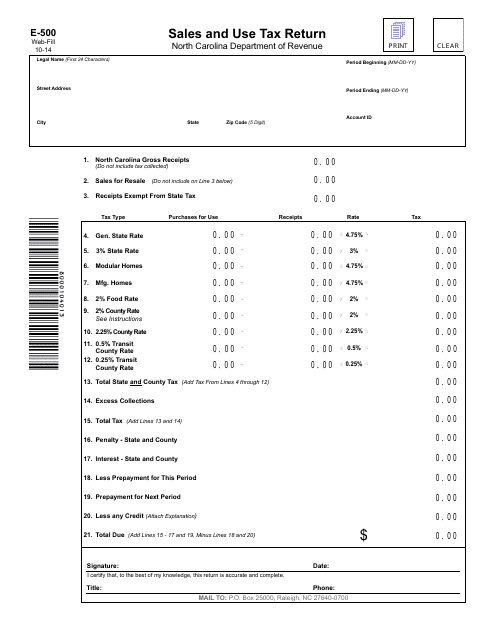

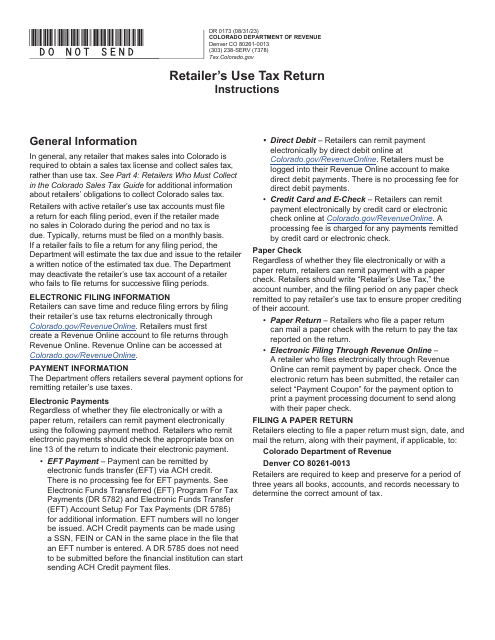

This Form is used for filing sales and use tax returns in the state of North Carolina. It ensures that businesses report and remit the correct amount of sales and use tax owed to the state.

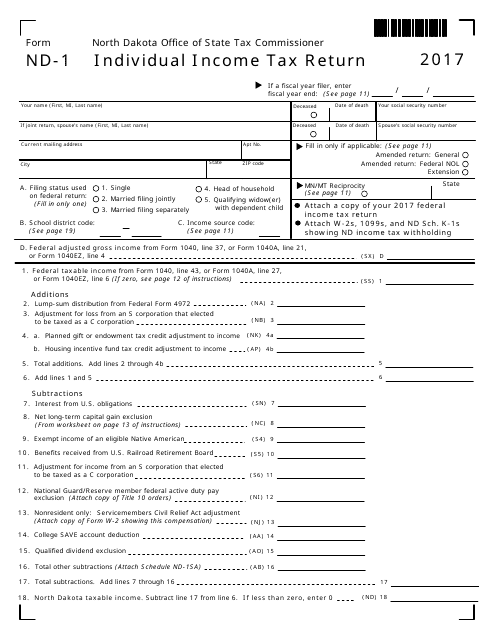

This form is used for filing individual income tax returns in the state of North Dakota.

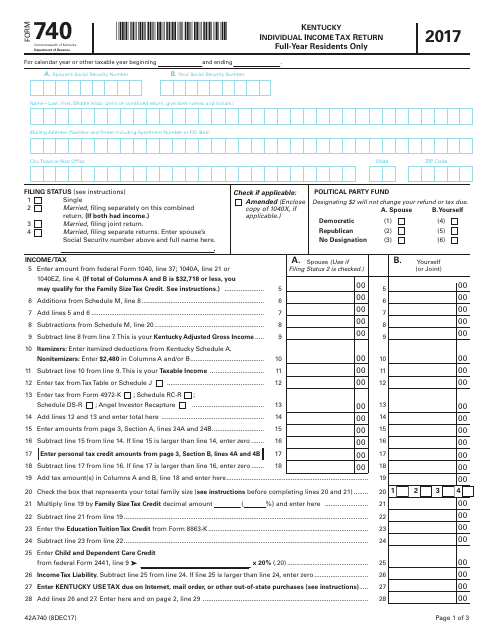

This form is used for filing individual income tax returns for full-year residents of Kentucky.

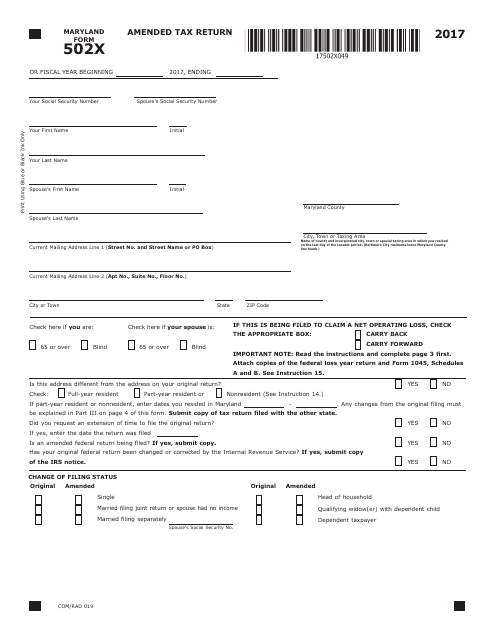

This form is used for filing an amended tax return in the state of Maryland.

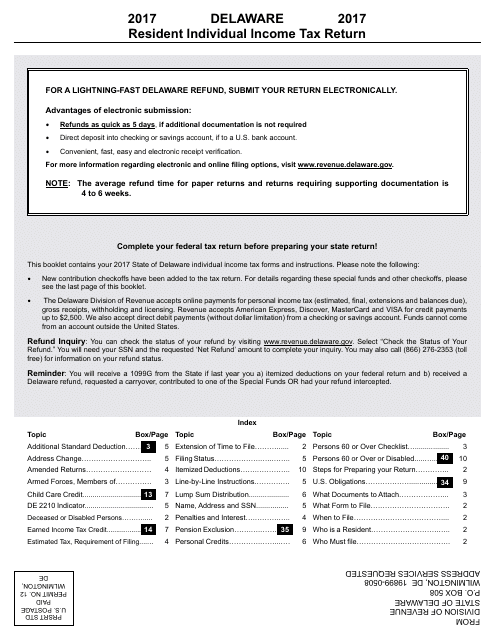

This Form is used for reporting and paying individual income taxes for residents of Delaware.

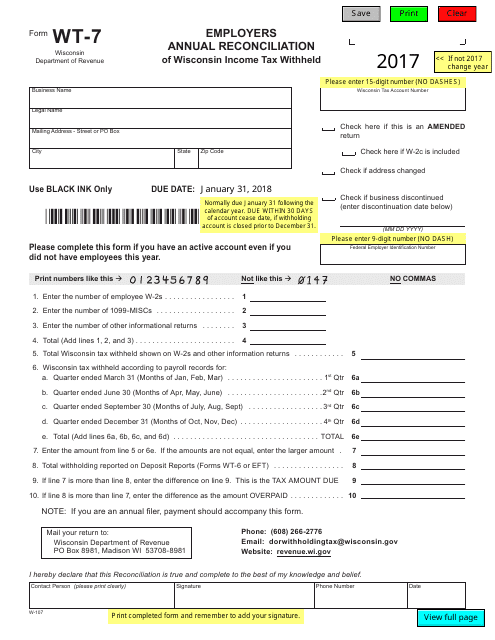

This Form is used for employers in Wisconsin to reconcile their annual income tax withholdings.

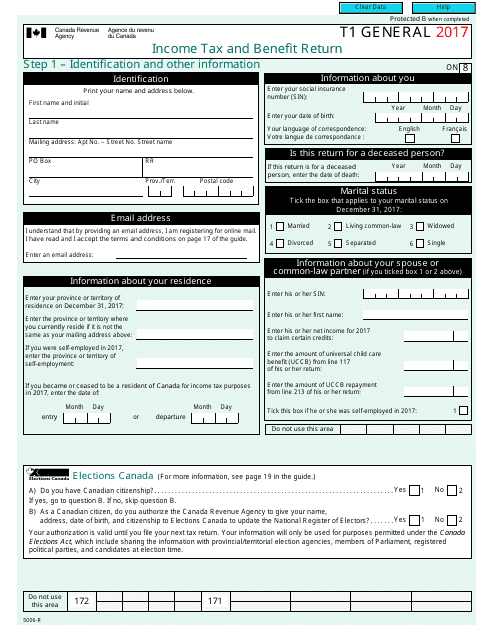

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

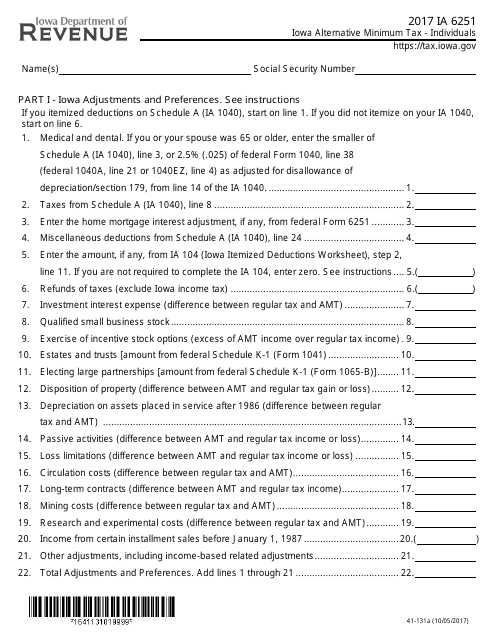

This Form is used for calculating the alternative minimum tax for individuals in the state of Iowa.

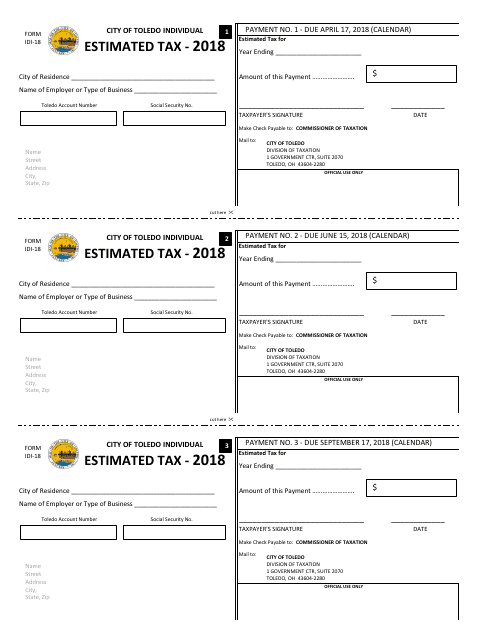

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

This form is used for reporting and declaring quarterly franchise and excise taxes in the state of Tennessee.

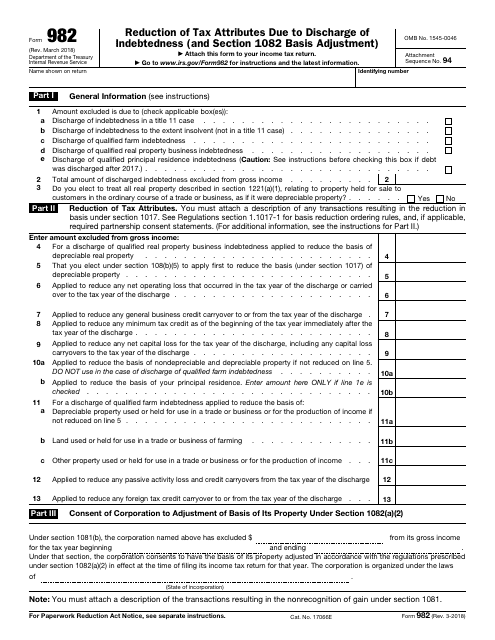

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.

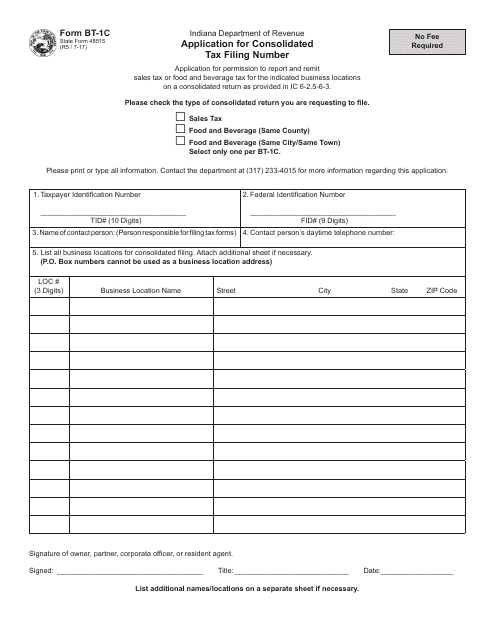

This form is used for applying for a consolidated tax filing number in the state of Indiana.

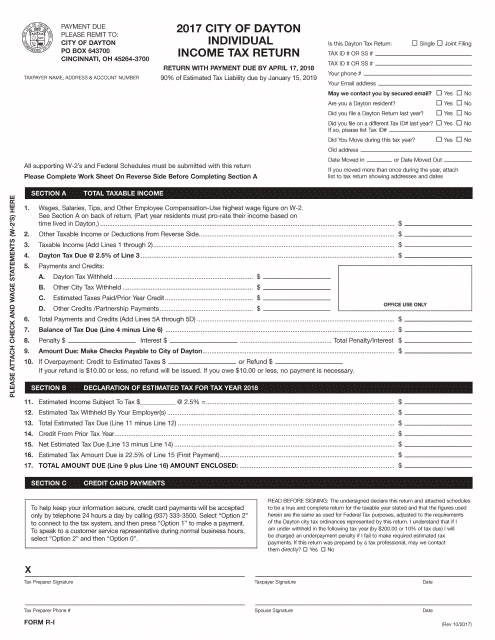

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

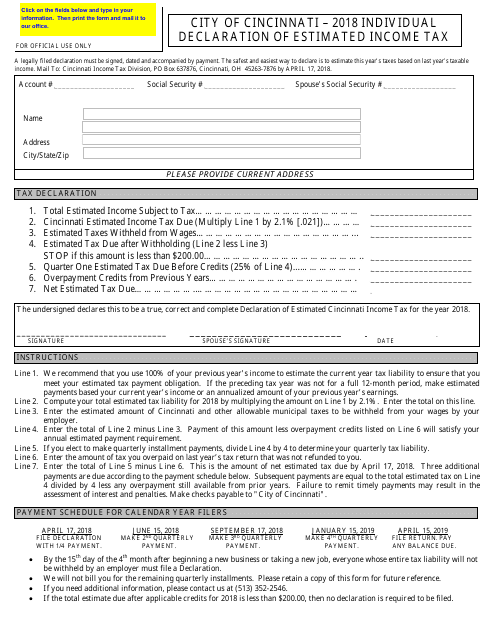

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

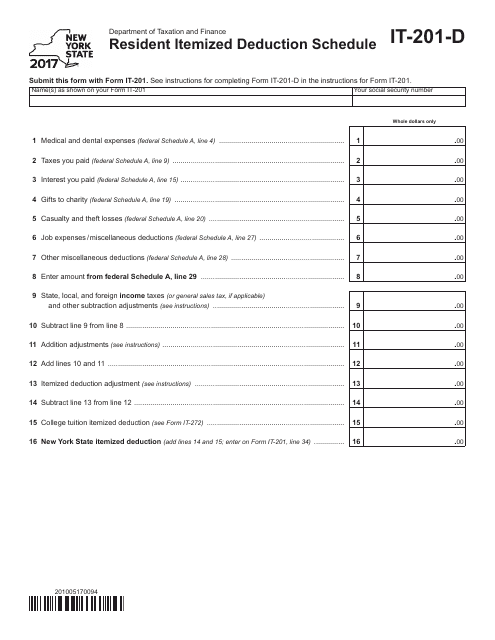

This form is used for reporting itemized deductions for residents of New York on their state tax return.

This Form is used for filing income tax returns specifically for residents of the city of Brunswick, Ohio.

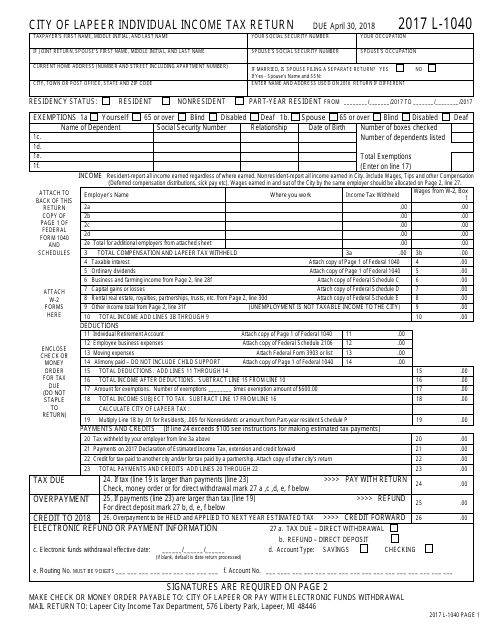

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

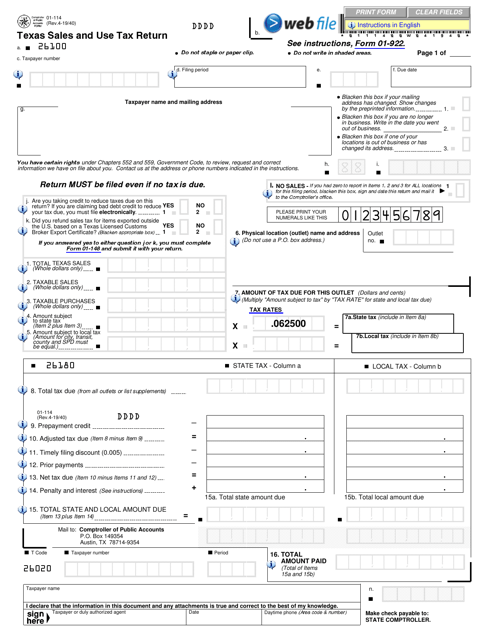

This is a form used in the state of Texas that is used by taxpayers when they want to report information related to the Sales and Use Tax they are supposed to pay.

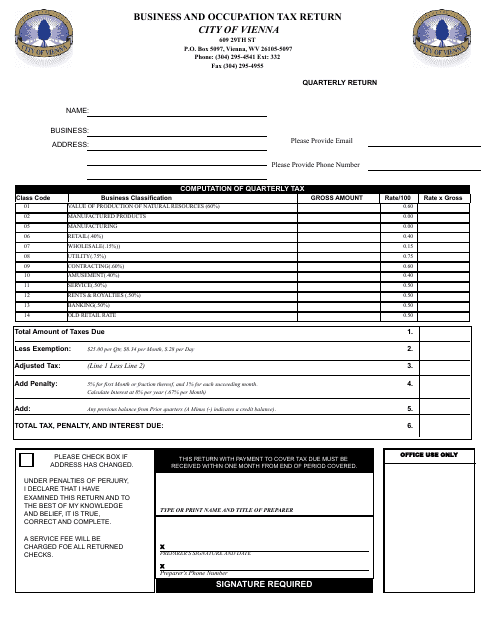

This form is used for filing the Business and Occupation Tax Return with the City of Vienna, West Virginia.

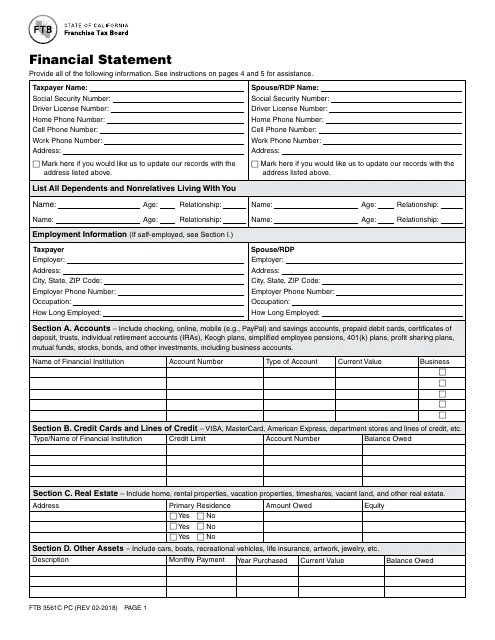

This form is used for filing a financial statement in California.

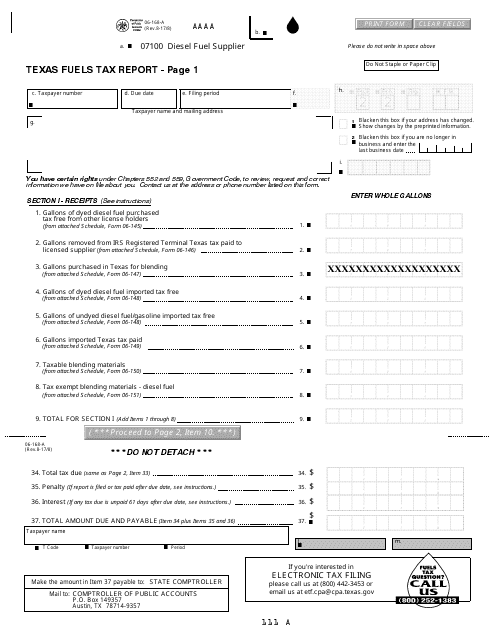

This form is used for reporting fuels tax in the state of Texas. It is required for businesses that sell, distribute, or use motor fuel in Texas.

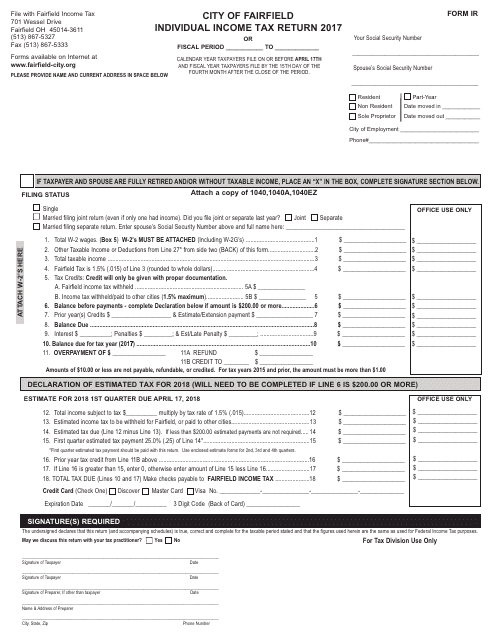

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.