Free Tax Filing Templates

Documents:

3000

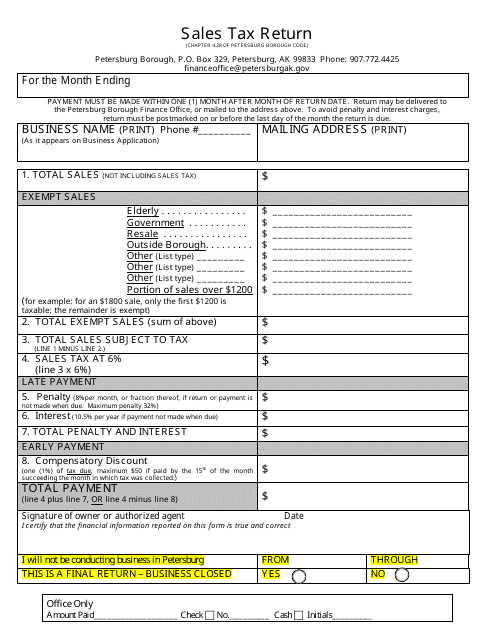

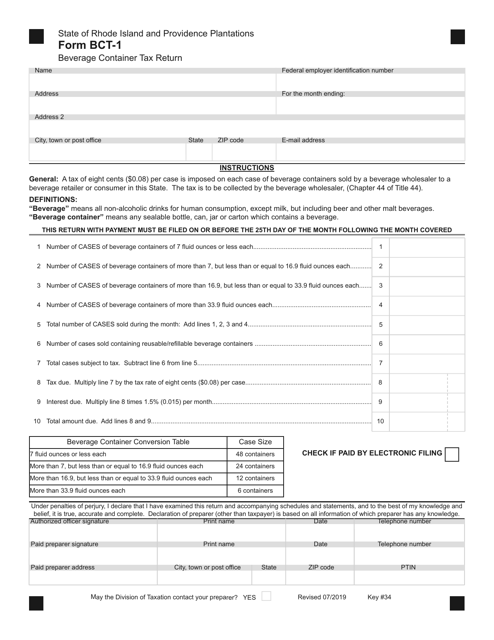

This document is used for reporting and remitting sales tax in Petersburg Borough, Alaska.

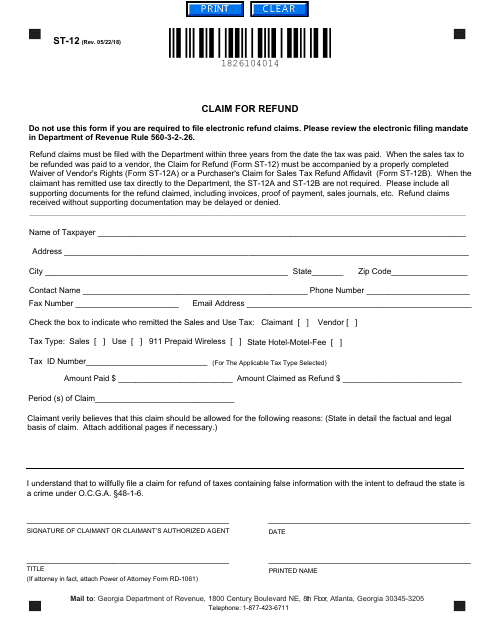

This Form is used for claiming a refund in the state of Georgia, United States.

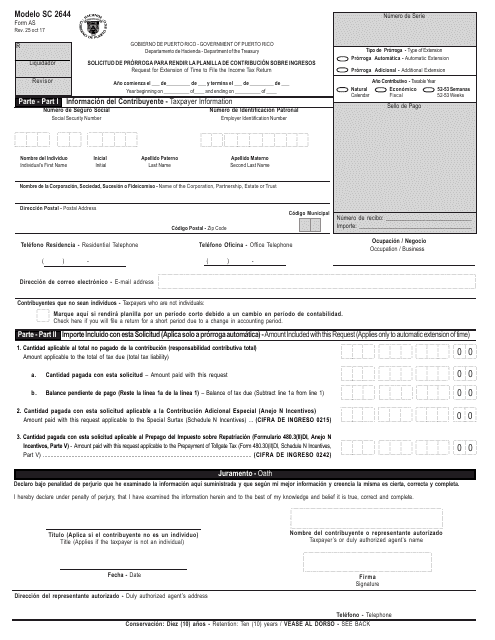

This form is used for requesting an extension to submit the income tax return in Puerto Rico.

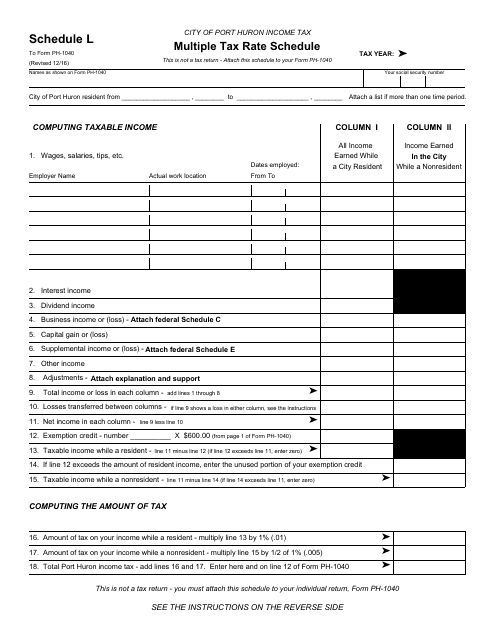

This form is used for determining the applicable tax rate for residents of the City of Port Huron, Michigan.

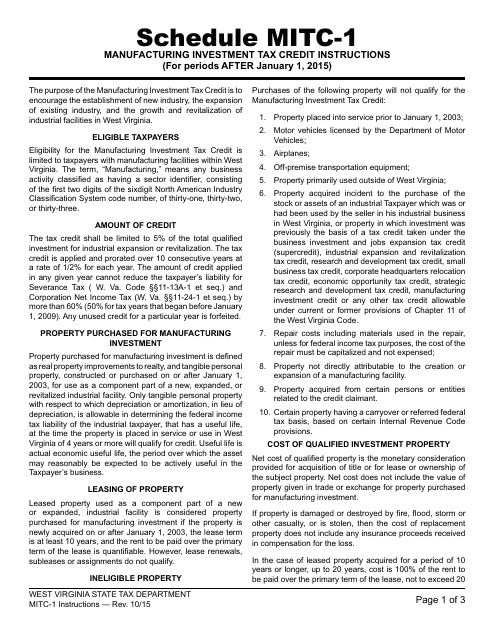

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

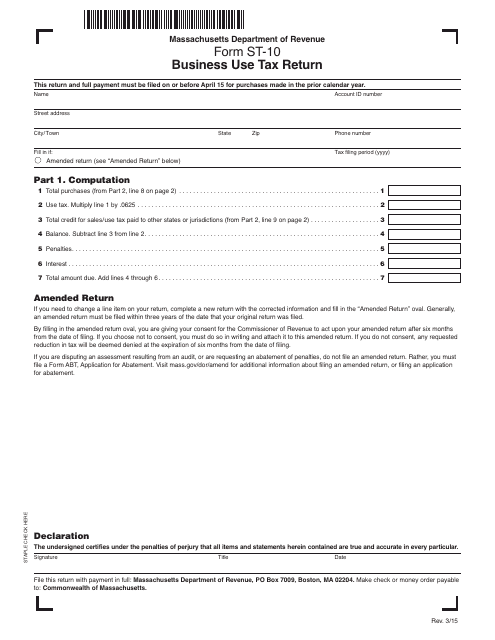

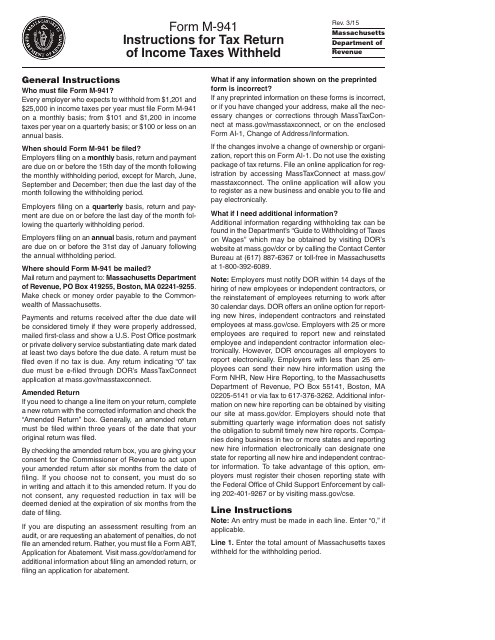

This form is used for reporting and paying business use tax in the state of Massachusetts.

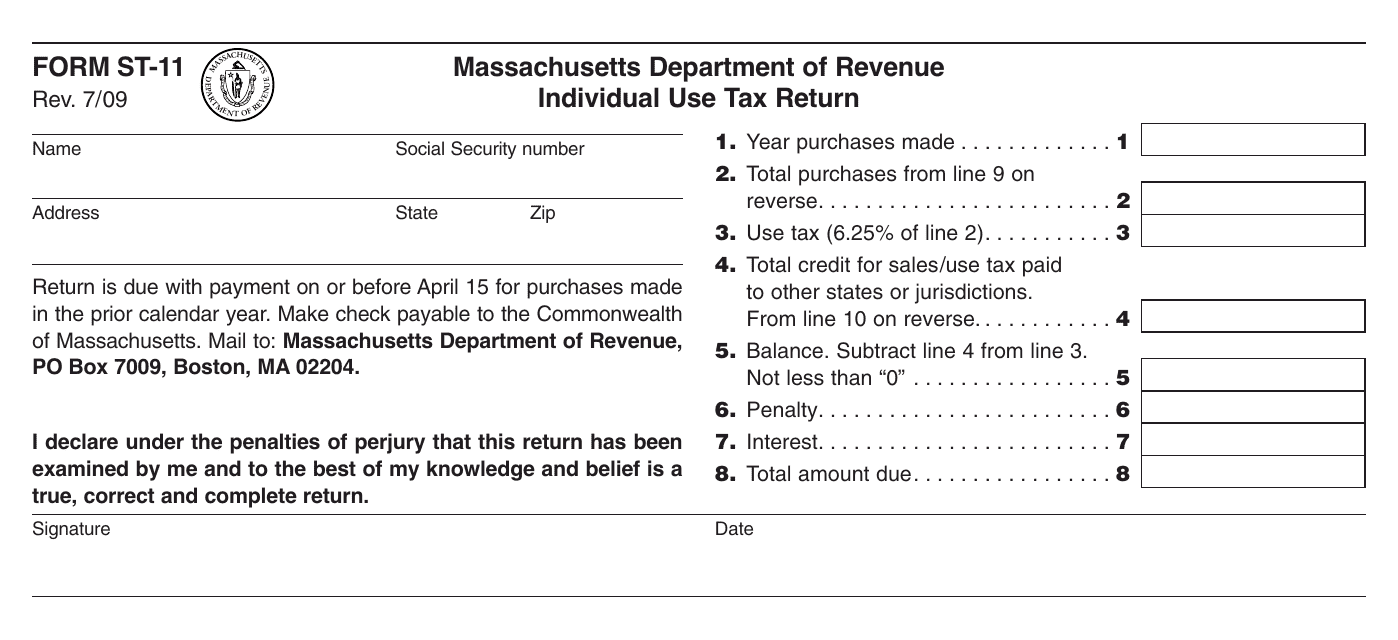

This form is used for reporting and paying use tax by individuals in Massachusetts. Use tax is a tax on goods purchased outside the state of Massachusetts for use within the state.

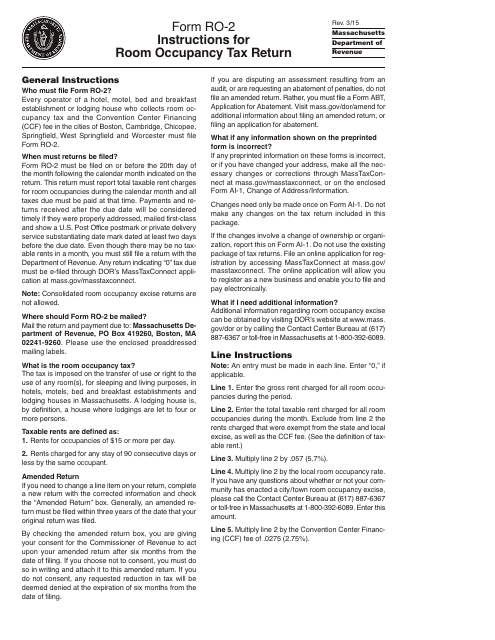

This Form is used for filing the Room Occupancy Tax Return in Massachusetts. It provides instructions on how to accurately complete and submit the form for reporting and paying the room occupancy tax.

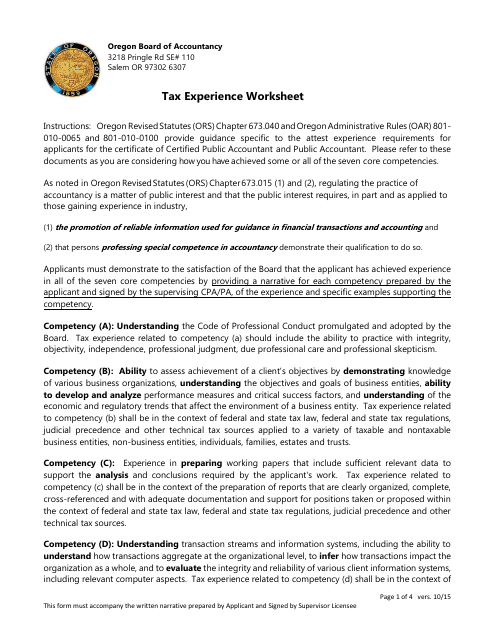

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

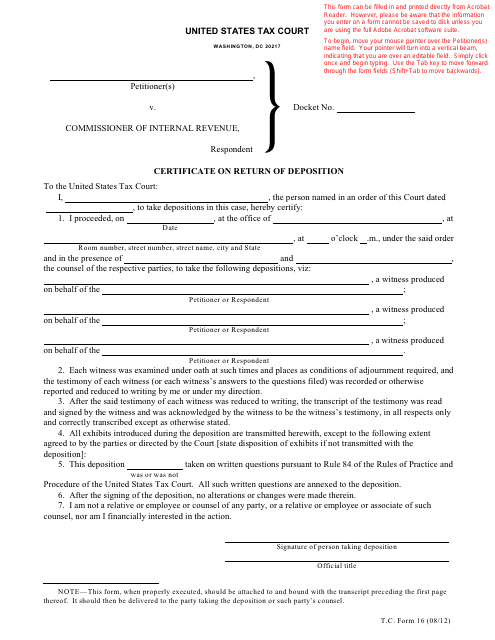

This Form is used for filing a certificate on the return of a deposition in a legal case.

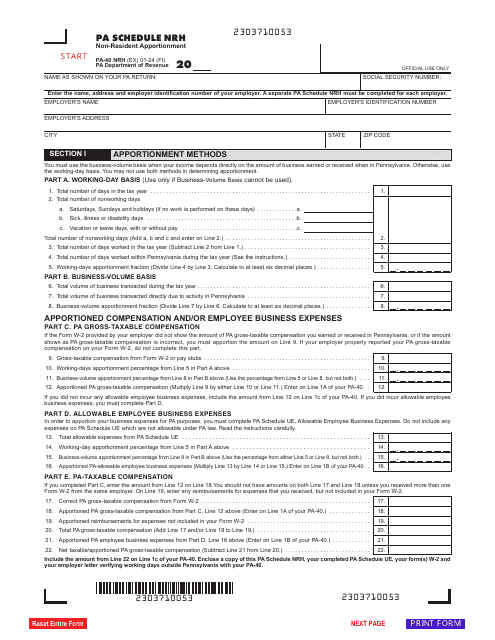

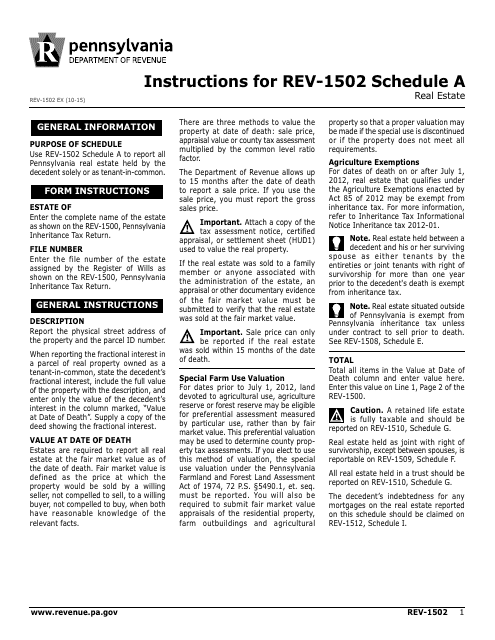

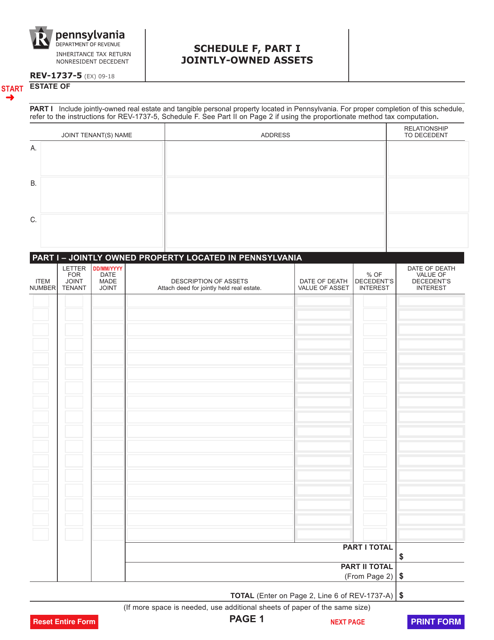

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

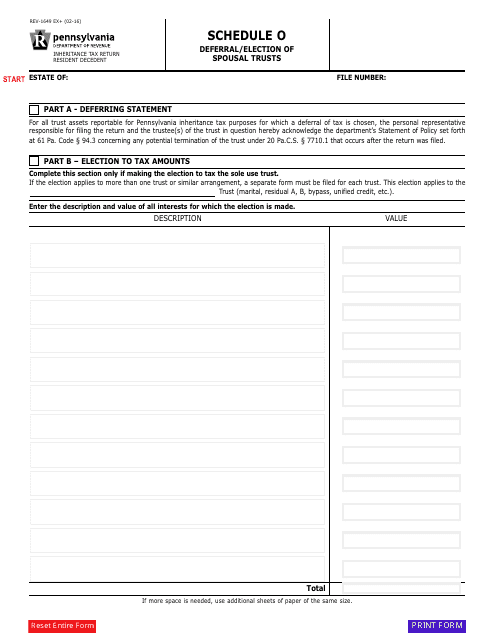

This form is used for deferral or election of spousal trusts in Pennsylvania.

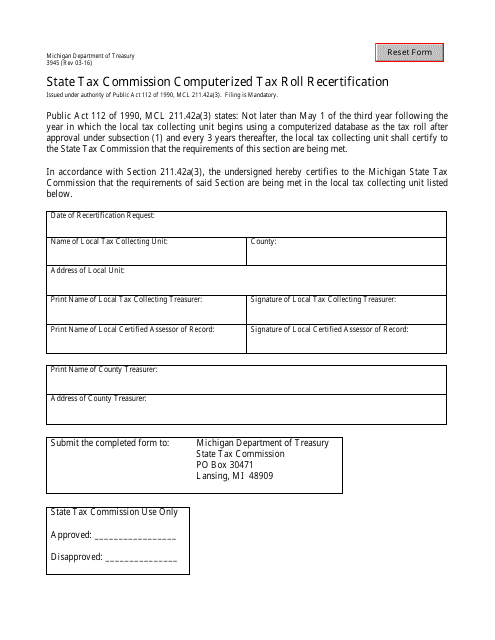

This document is used for recertifying the computerized tax roll with the State Tax Commission in Michigan.

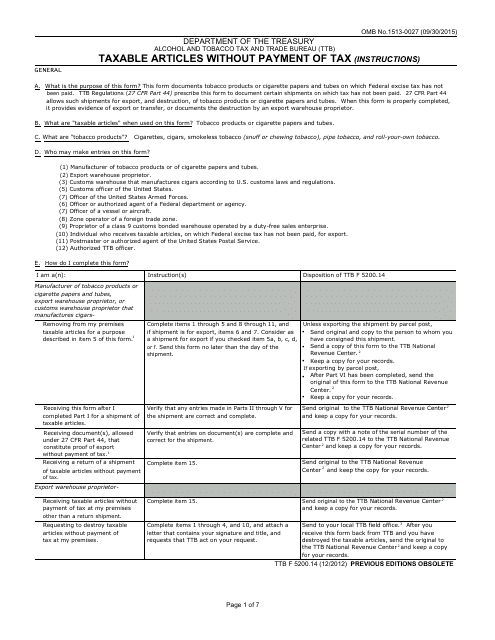

This document is used for reporting the taxable articles that are not paid for with tax.

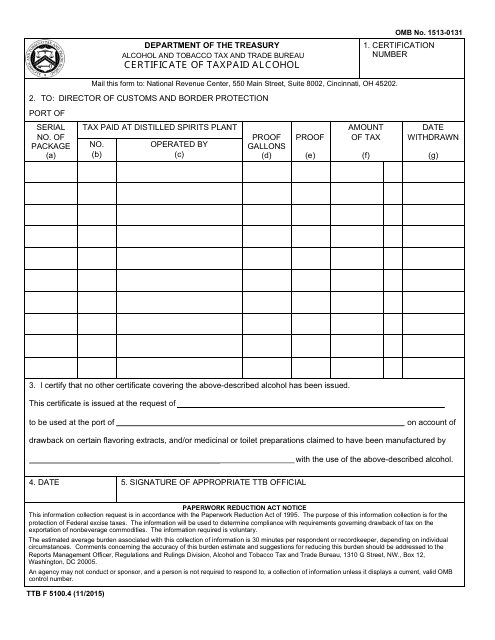

This form is used for obtaining a certificate for alcohol on which taxes have been paid.

This Form is used for applying for a Taxpayer Identifying Number, such as an Employer Identification Number (EIN) or a Social Security Number (SSN). It is necessary for individuals and businesses to have a TIN for tax purposes.

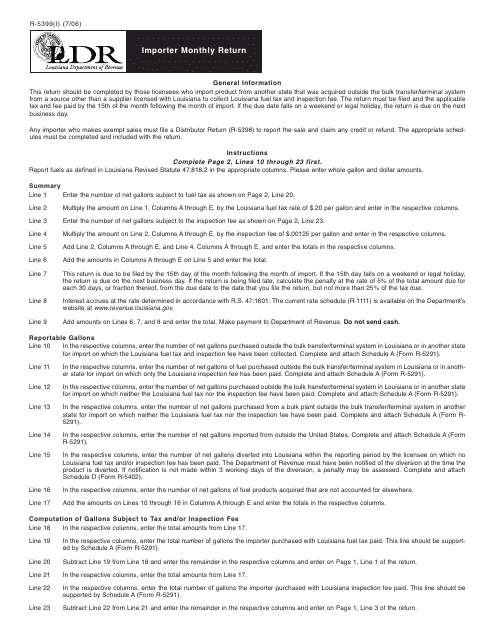

This Form is used for reporting monthly imports to the state of Louisiana.

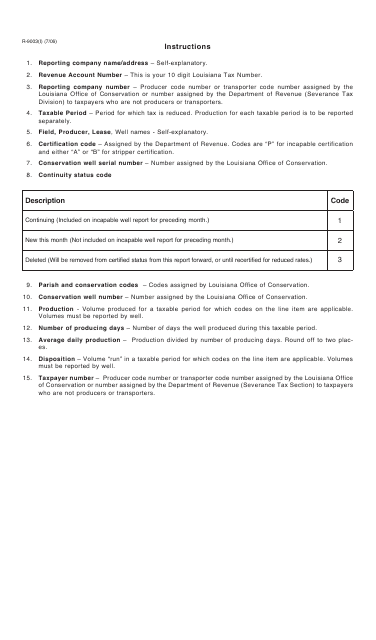

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

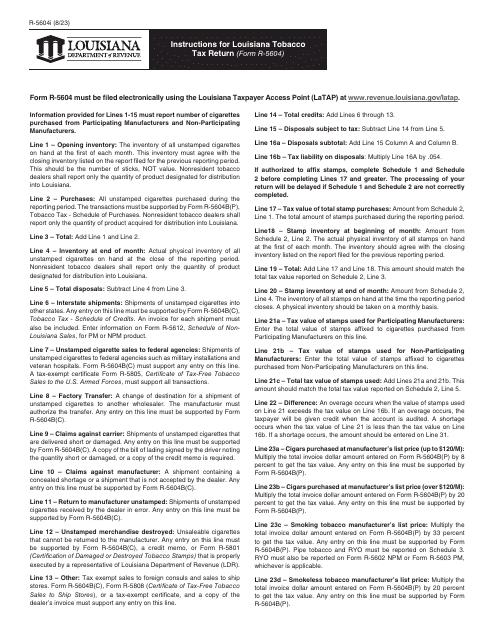

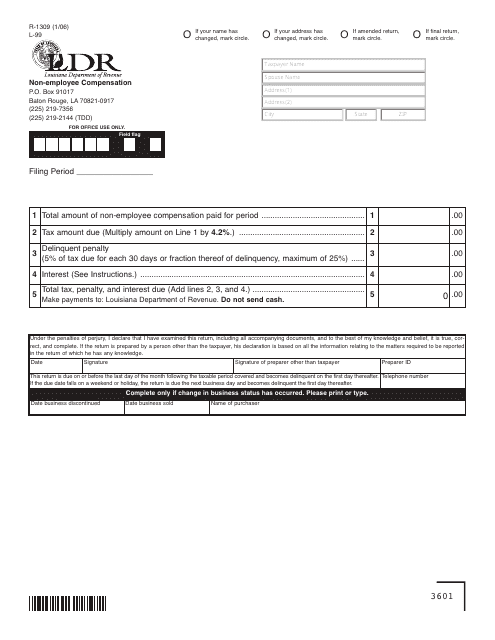

This form is used for reporting non-employee compensation in the state of Louisiana.

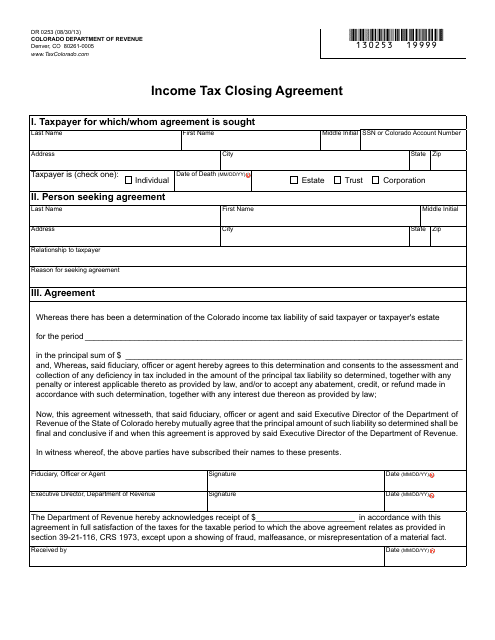

This form is used for filing an income tax closing agreement in the state of Colorado. It is used to resolve any outstanding tax issues with the Colorado Department of Revenue.

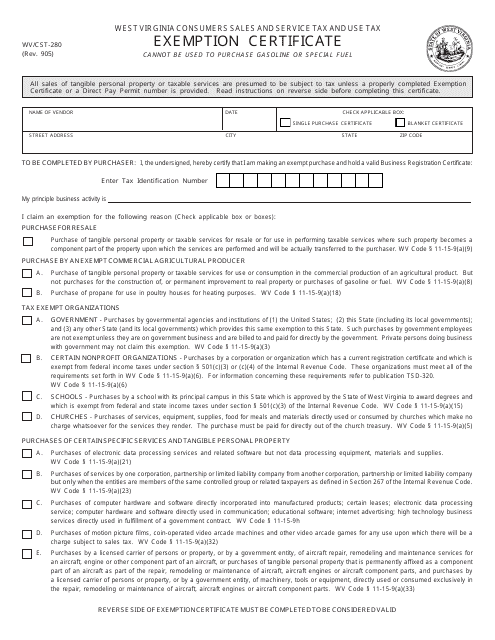

This form is used in the state of West Virgina to claim exemption from paying sales tax on the purchase of tangible personal property or services which will be used for exempt purposes.

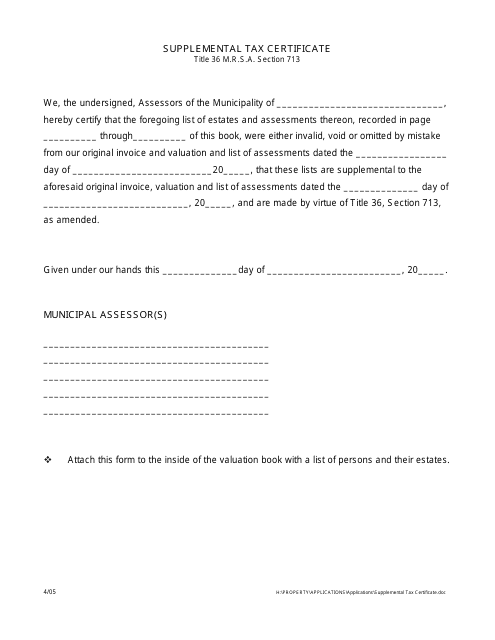

This type of document is used for reporting supplemental taxes in the state of Maine.

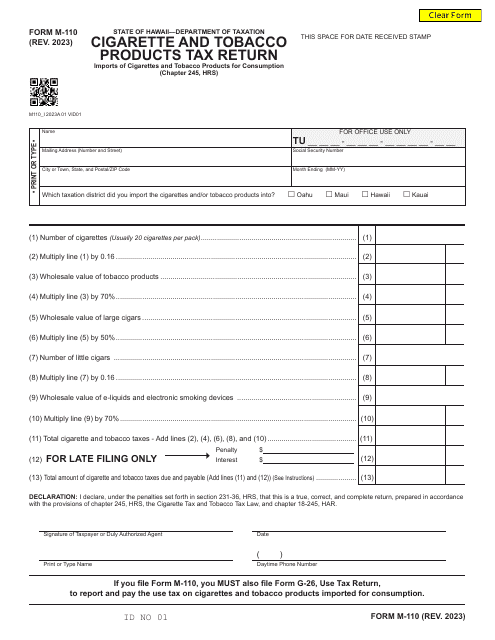

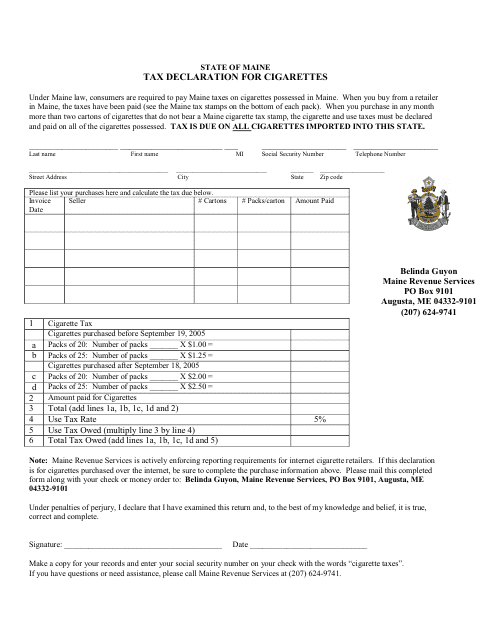

This Form is used for declaring and reporting taxes on cigarettes in the state of Maine.

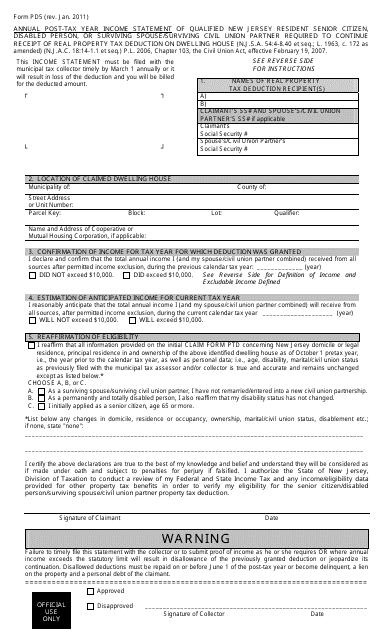

This form is used for reporting annual post-tax year income for residents of New Jersey.

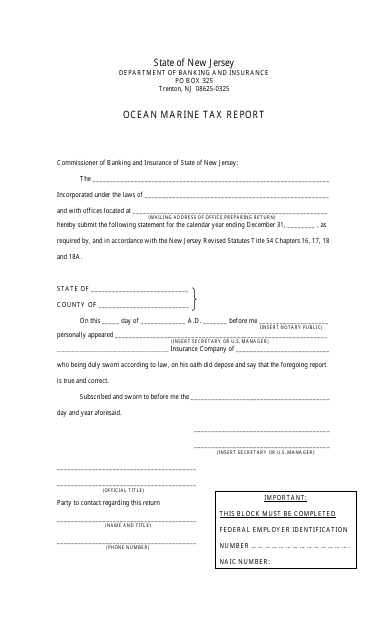

This document is used for reporting taxes related to ocean marine activities in the state of New Jersey.

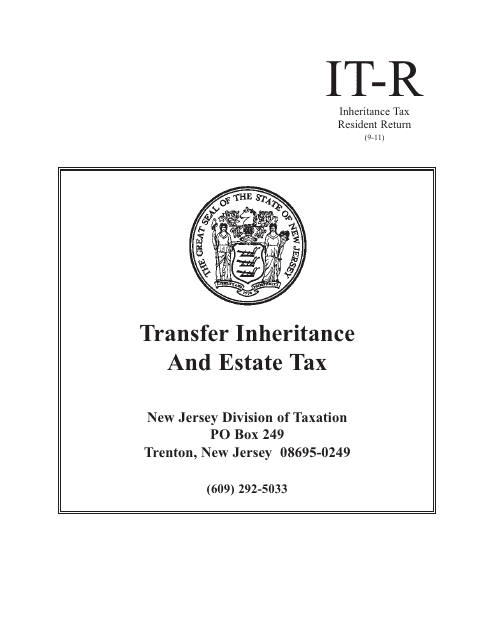

This form is used for reporting and paying inheritance tax for residents of New Jersey.

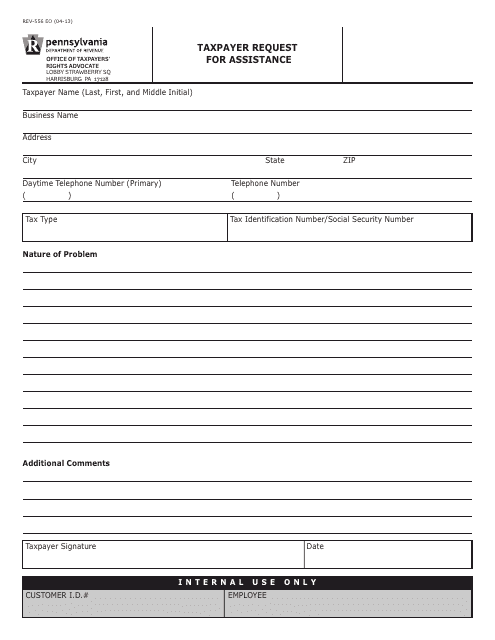

This form is used for Pennsylvania taxpayers to request assistance from the state tax authority.

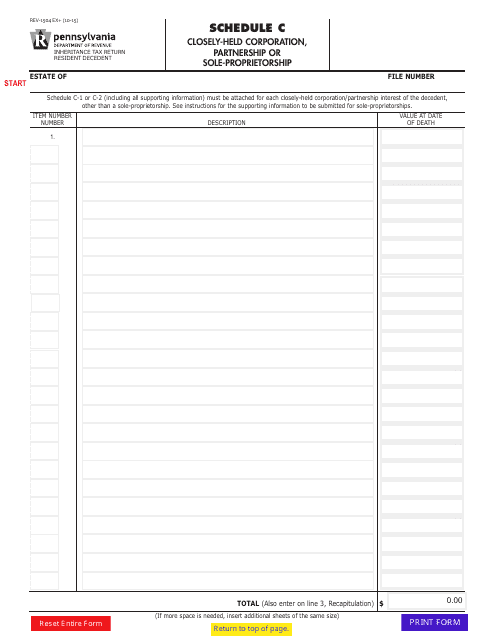

Form REV-1504 Schedule C Closely-Held Corporation, Partnership or Sole-Proprietorship - Pennsylvania

This Form is used for reporting the income, deductions, and credits of a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania.

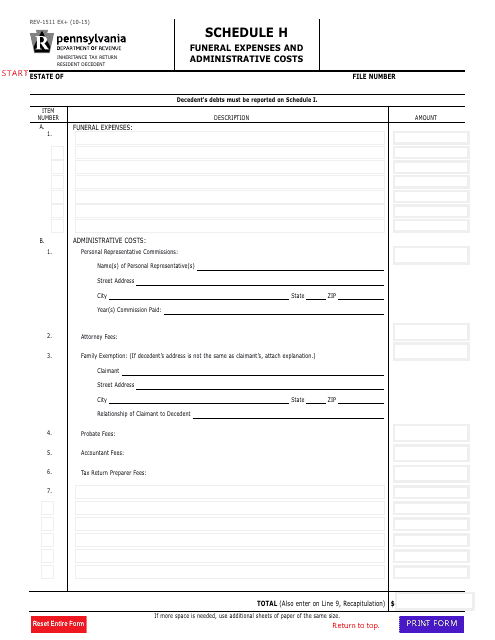

This Form is used for reporting funeral expenses and administrative costs in Pennsylvania.

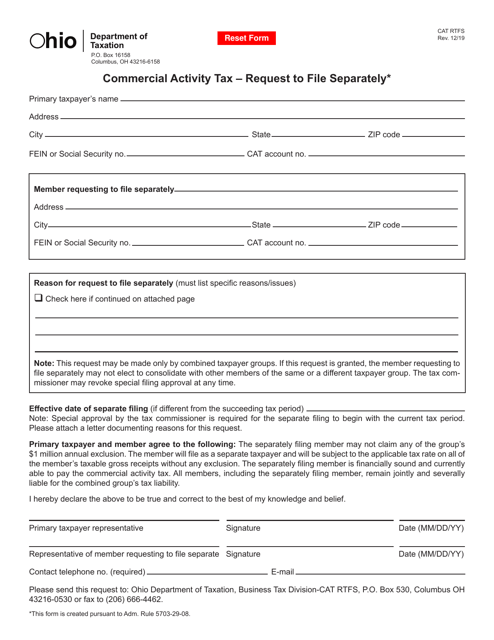

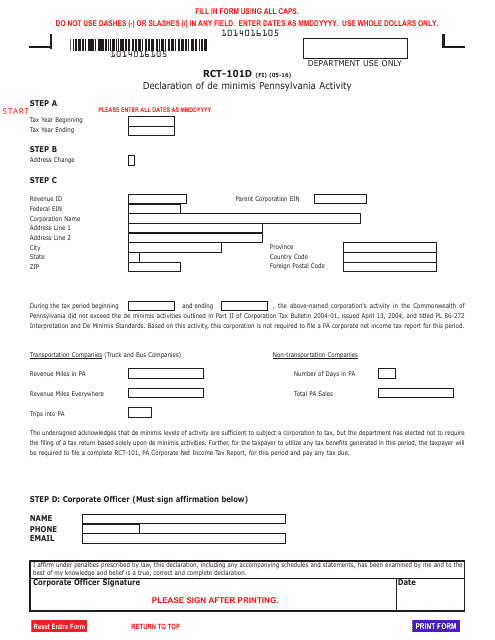

This form is used for declaring de minimis Pennsylvania activity in the state of Pennsylvania.

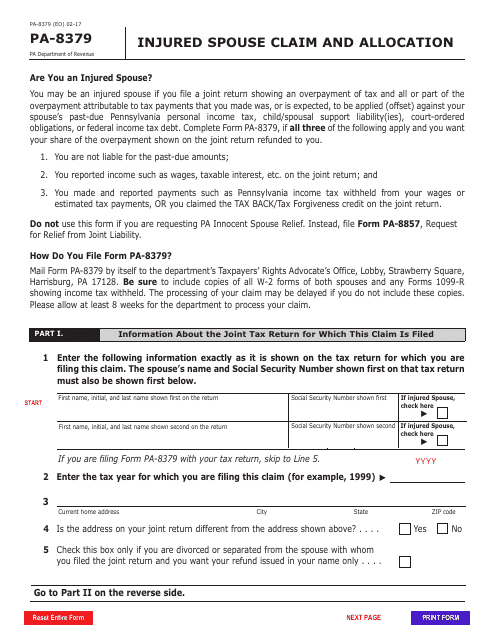

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.