Free Tax Filing Templates

Documents:

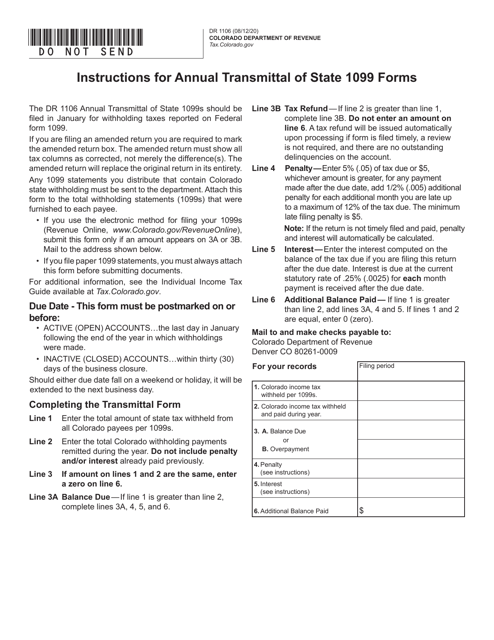

3000

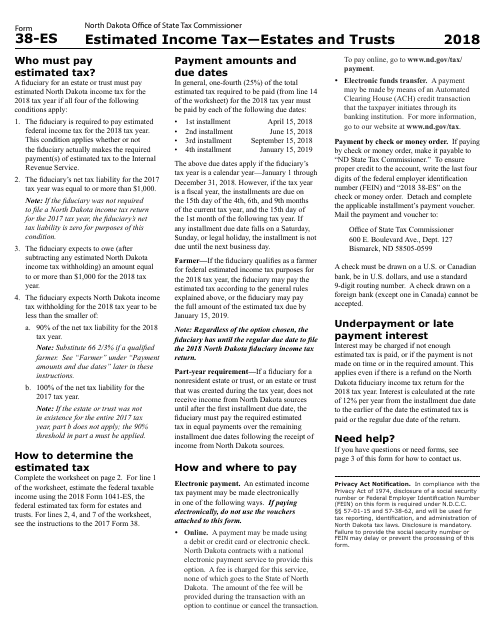

This Form is used for estimating income tax for estates and trusts in North Dakota.

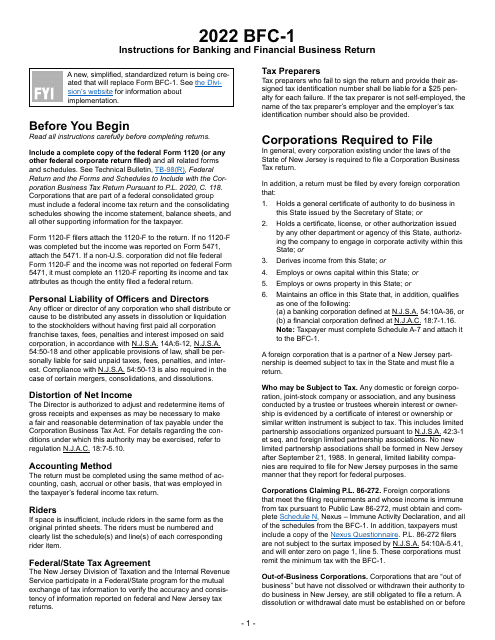

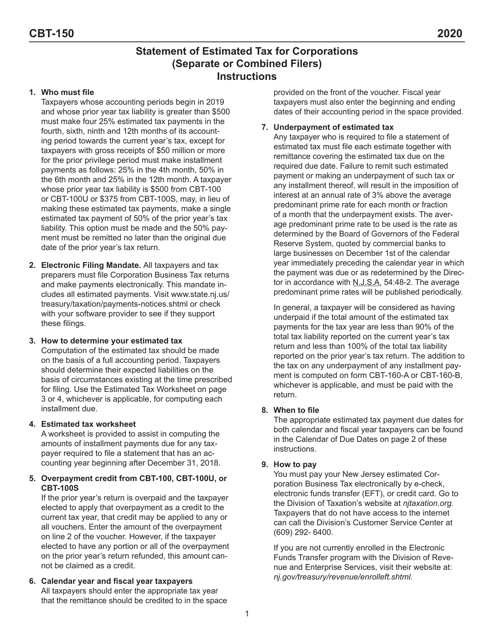

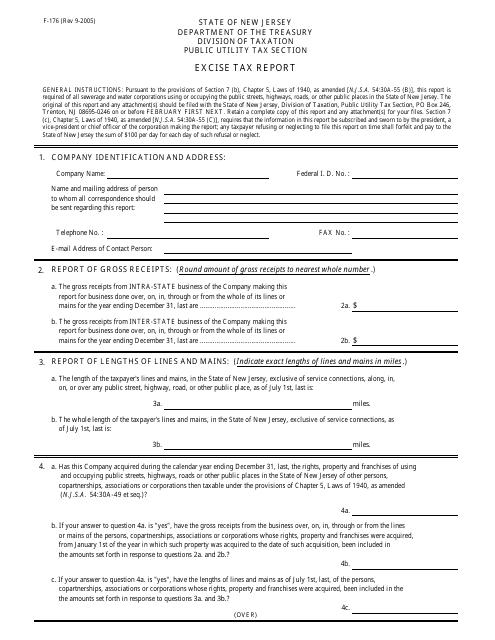

This form is used for reporting excise tax in the state of New Jersey.

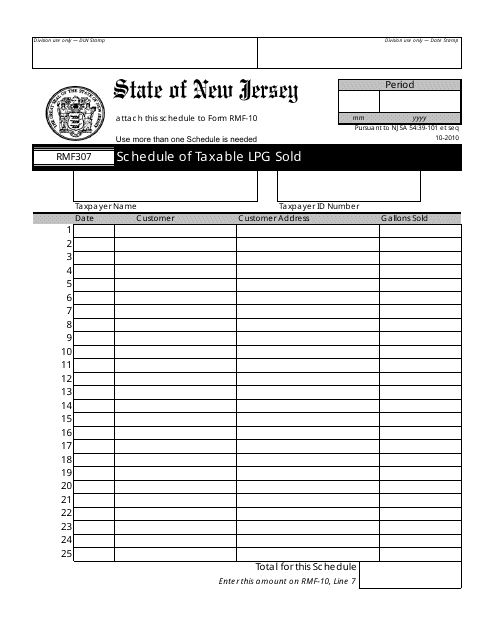

This Form is used for reporting the schedule of taxable LPG (liquefied petroleum gas) sold in the state of New Jersey.

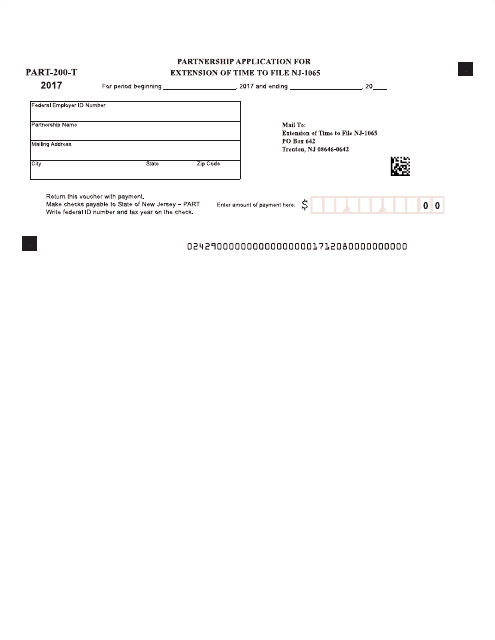

This Form is used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

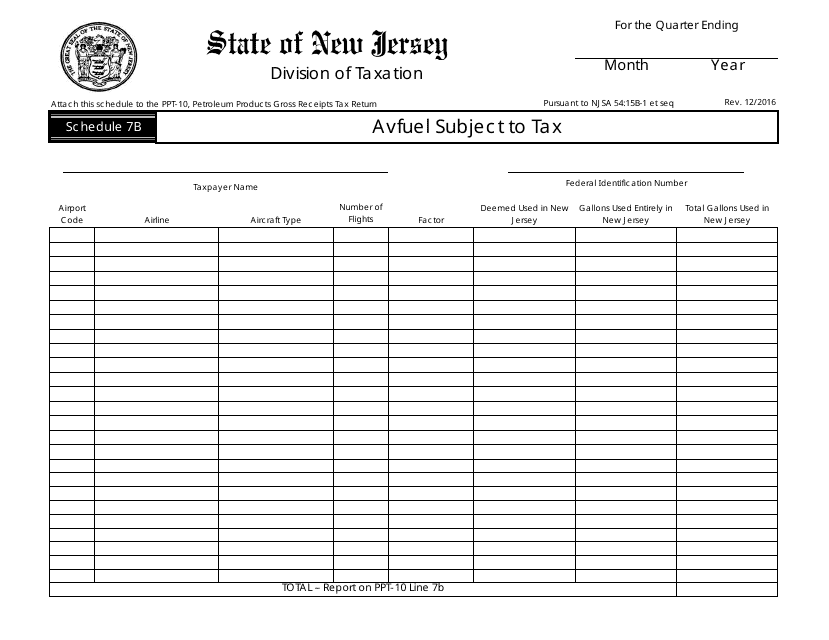

This Form is used for reporting Avfuel subject to tax in New Jersey.

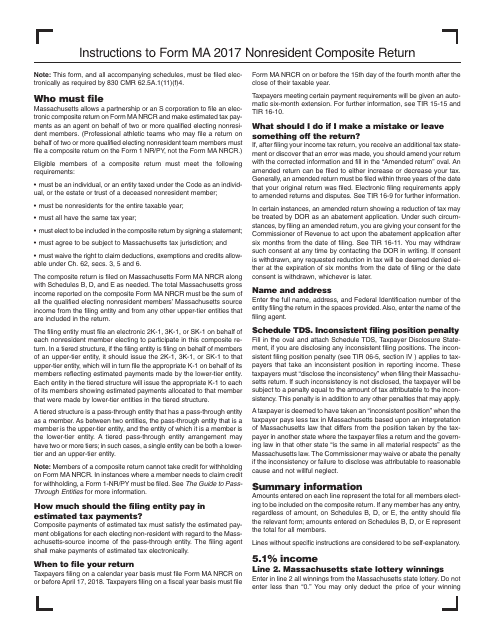

This form is used for filing a nonresident composite return in Massachusetts. It provides instructions for completing and submitting the Form MA Nonresident Composite Return.

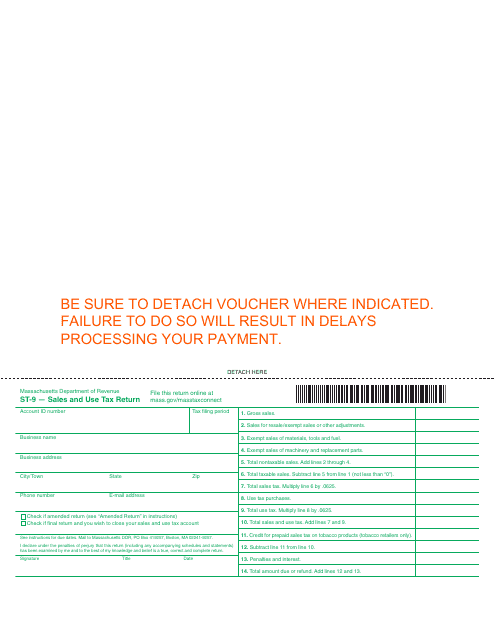

This Form is used for filing sales and use tax returns in the state of Massachusetts. It is used by businesses and individuals to report and remit taxes on sales and purchases made within the state.

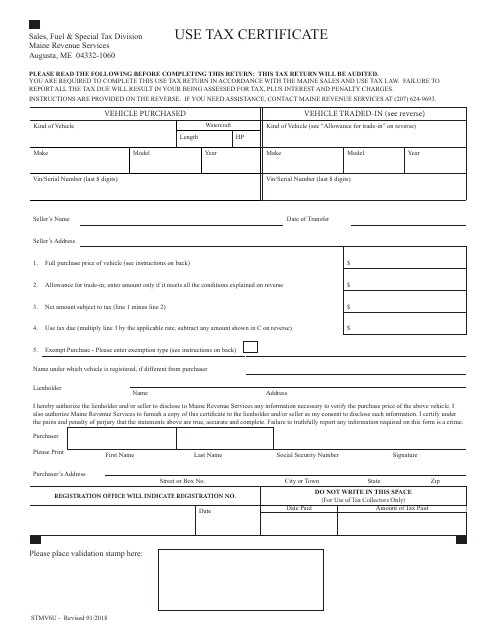

This form is used for certifying use tax payments in the state of Maine.

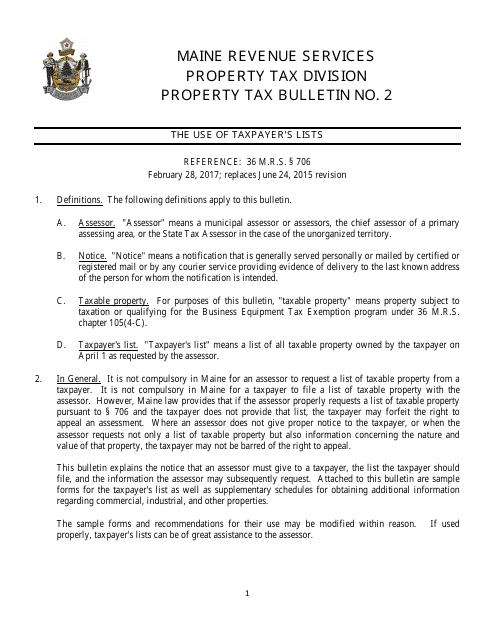

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

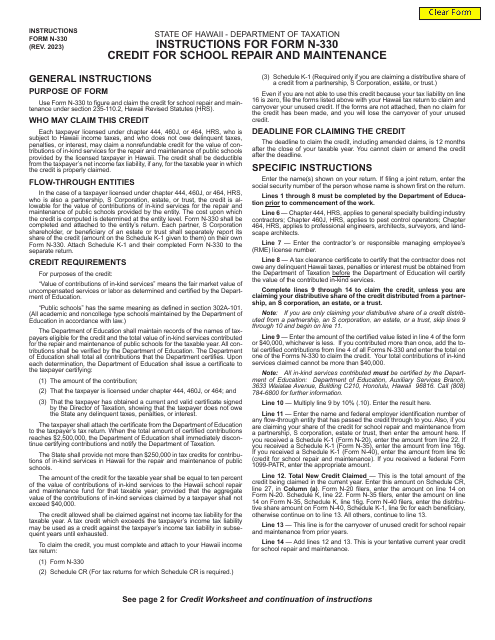

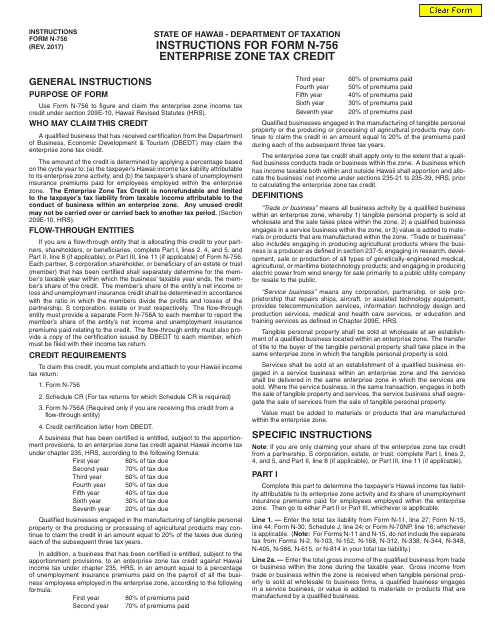

This form is used for claiming the Enterprise Zone Tax Credit in Hawaii. It provides instructions on how to accurately fill out the form and submit it to the appropriate authorities.

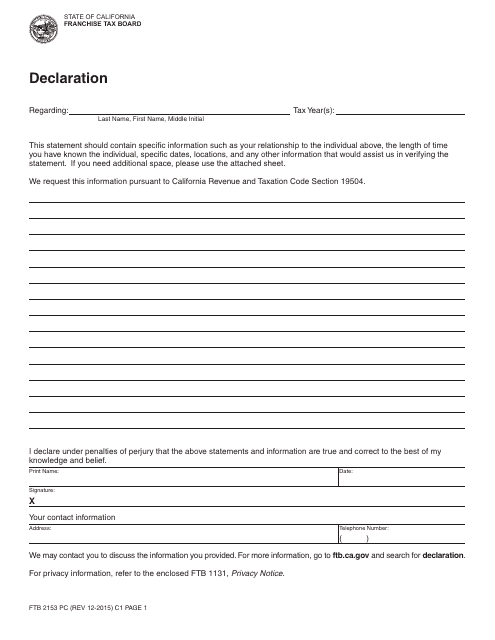

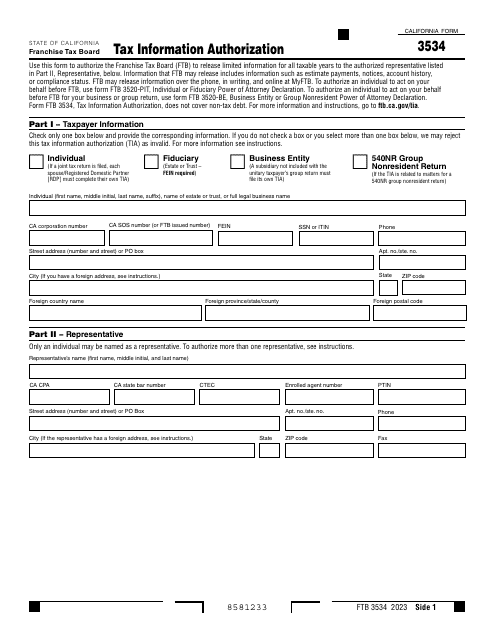

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

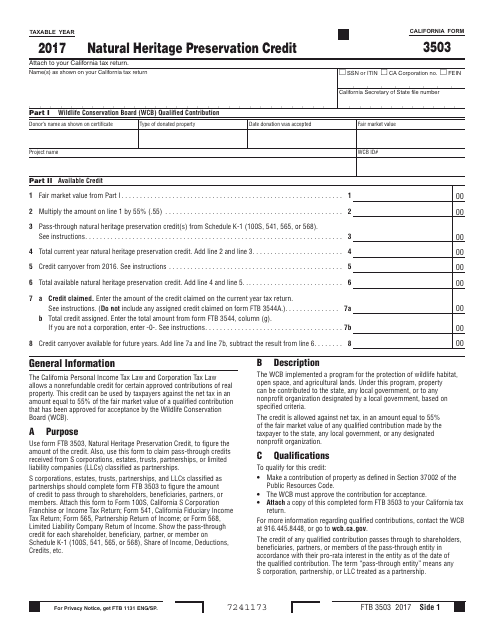

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

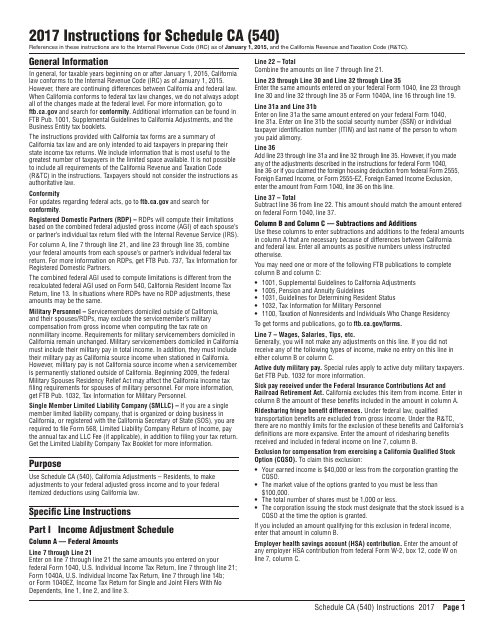

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

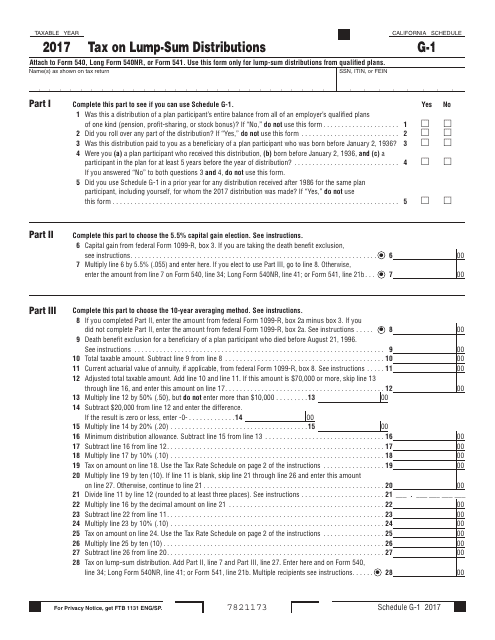

This Form is used for reporting and calculating the tax on lump-sum distributions in the state of California.

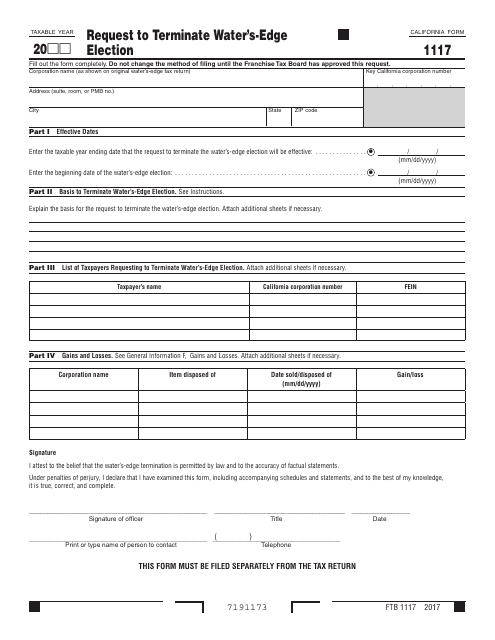

This form is used for requesting to terminate the Water's-Edge Election in California.

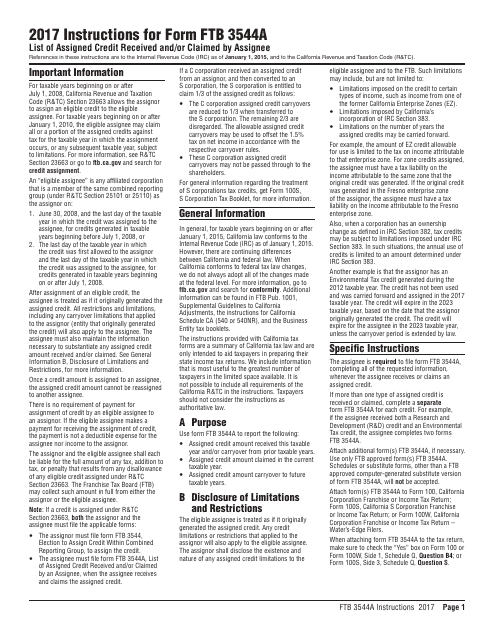

This Form is used for listing the assigned credits received and/or claimed by an assignee in California. It provides instructions on how to properly fill out the form to report the assigned credits.

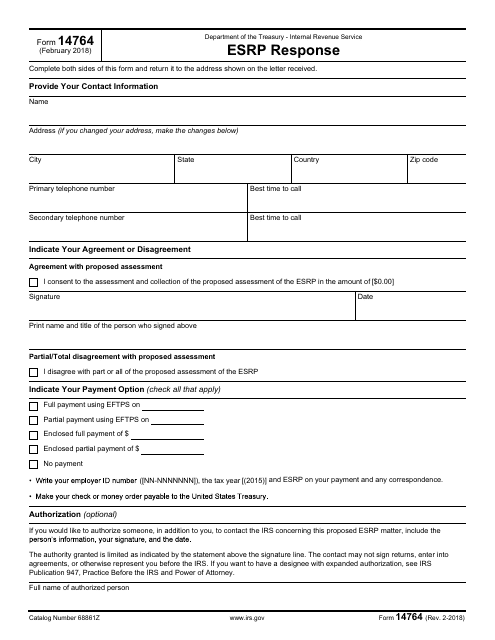

This form is used to respond to an IRS notice regarding the Employer Shared Responsibility Payment (ESRP). It is used to provide an explanation or dispute the proposed penalty.

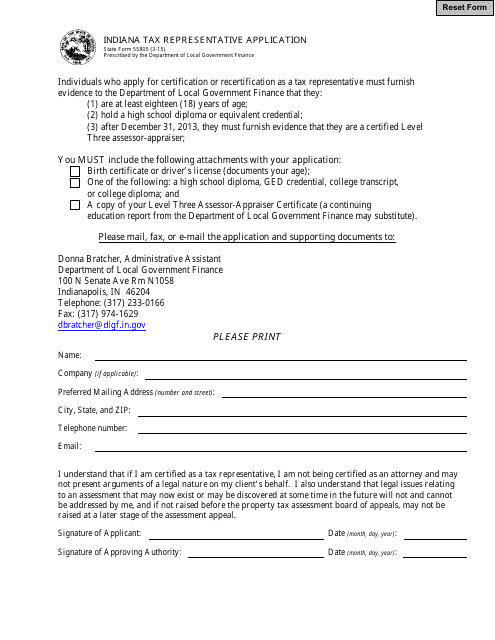

This Form is used for individuals who want to become a tax representative in the state of Indiana.

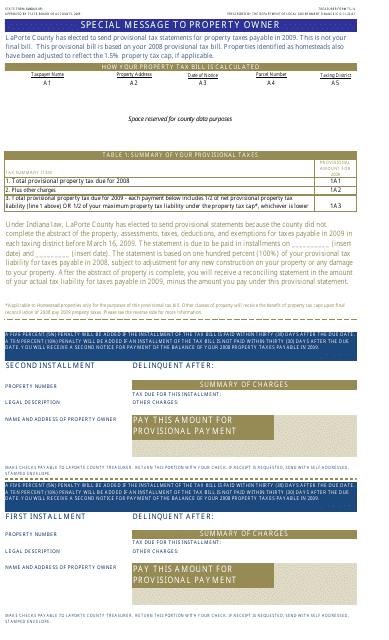

This form is used for filing your tax statement in the state of Indiana.

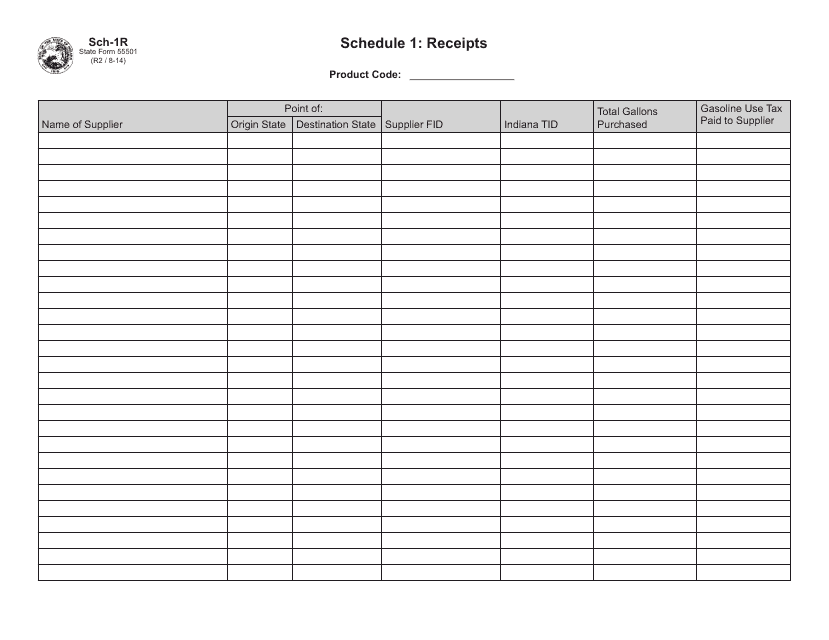

This document is used for reporting and tracking the receipts in the state of Indiana.

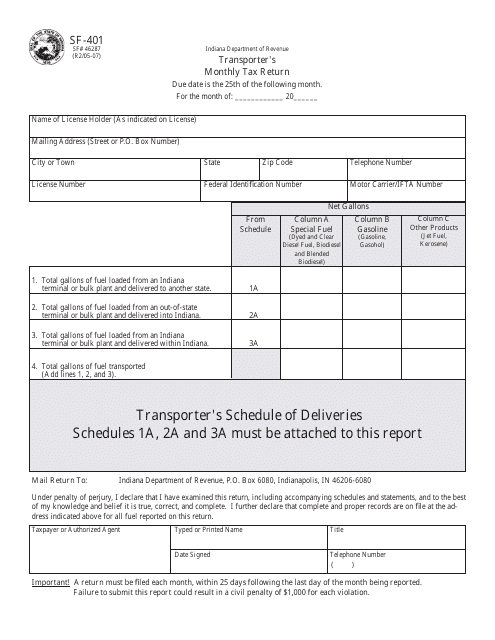

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.