Free Tax Filing Templates

Documents:

3000

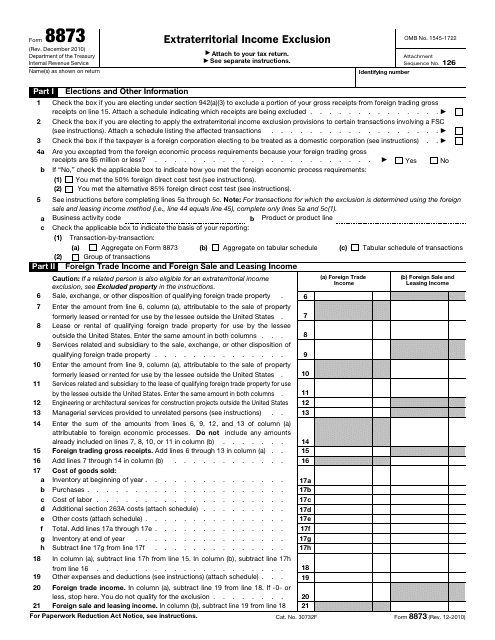

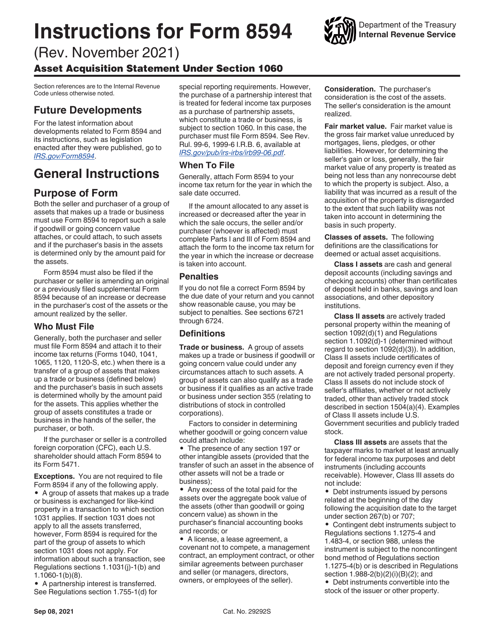

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

These are instructions for IRS Form 1128, Application to Adopt, Change, or Retain a Tax Year.

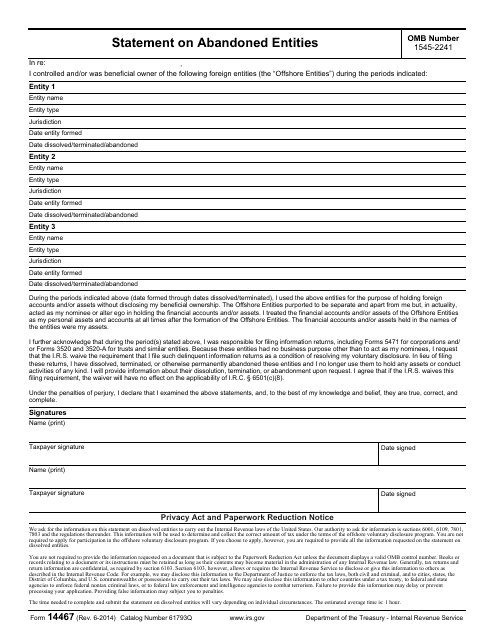

This document is a statement used by the IRS to report abandoned entities.

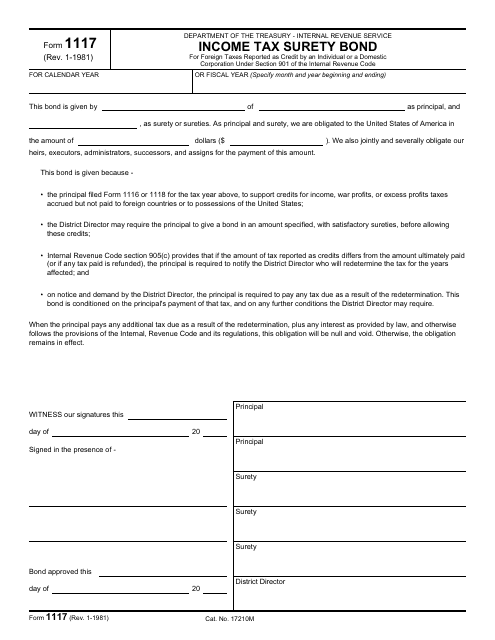

This document is used for filing an income tax surety bond with the Internal Revenue Service (IRS).

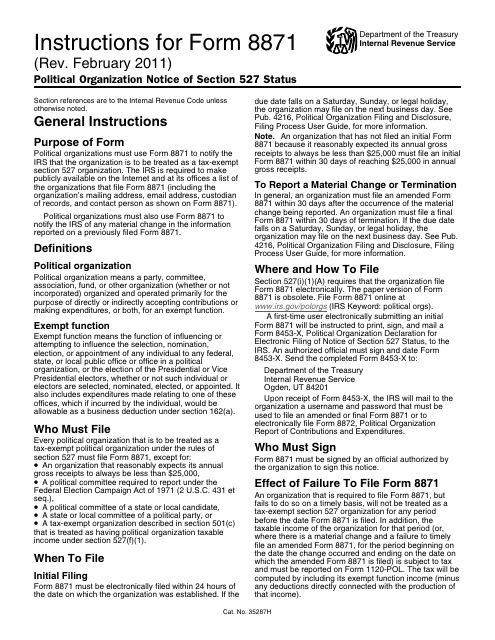

This Form is used for providing notice of section 527 status for political organizations to the IRS.

This Form is used for claiming the exclusion of certain foreign-earned income from your taxable income.

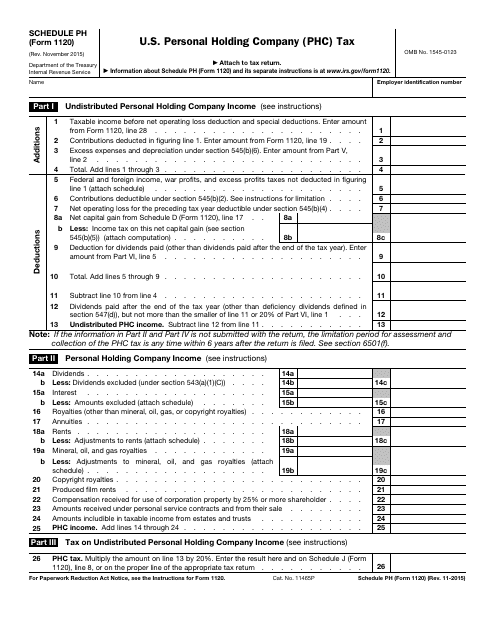

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

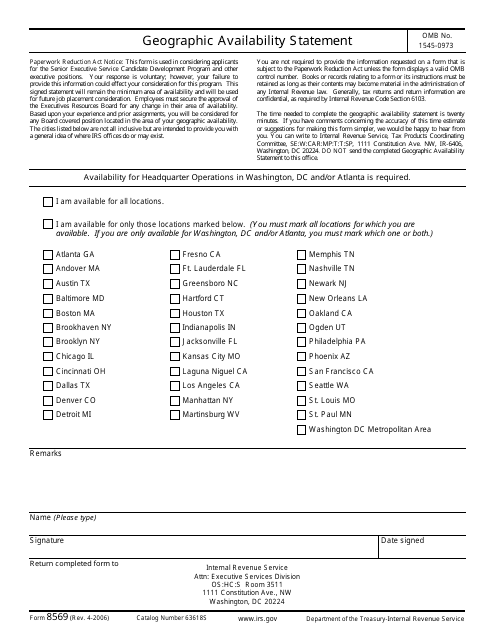

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

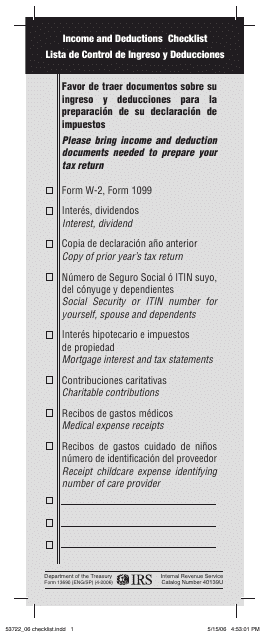

This form is used for checking income and deductions. It is available in both English and Spanish.

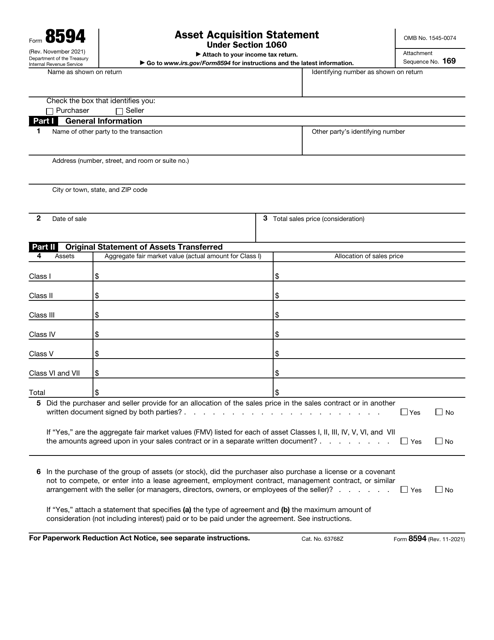

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

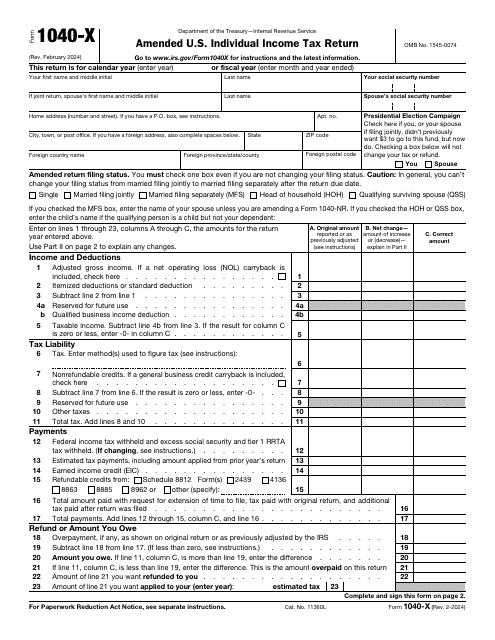

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

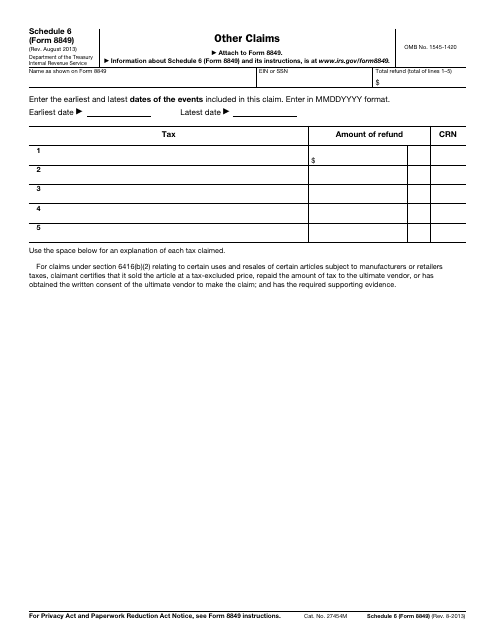

This Form is used for making other claims such as refunds for certain fuel-related taxes paid in error or excessive amounts.

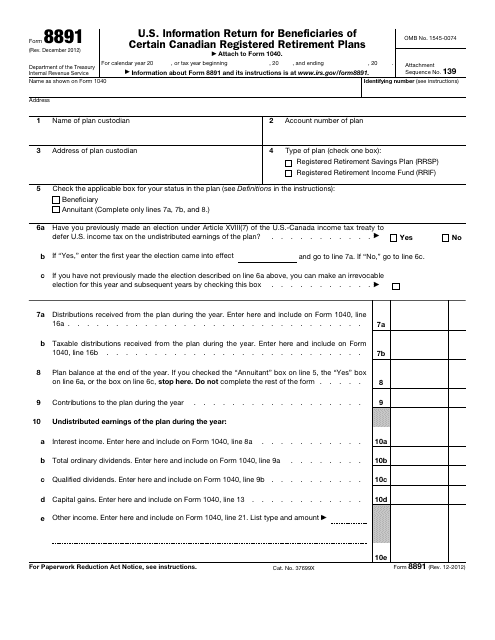

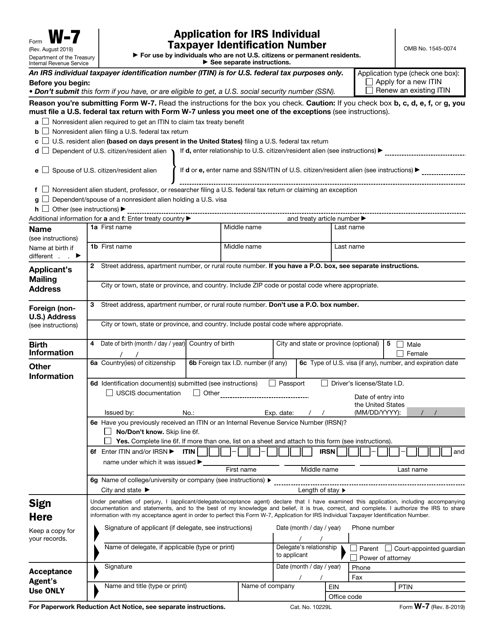

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

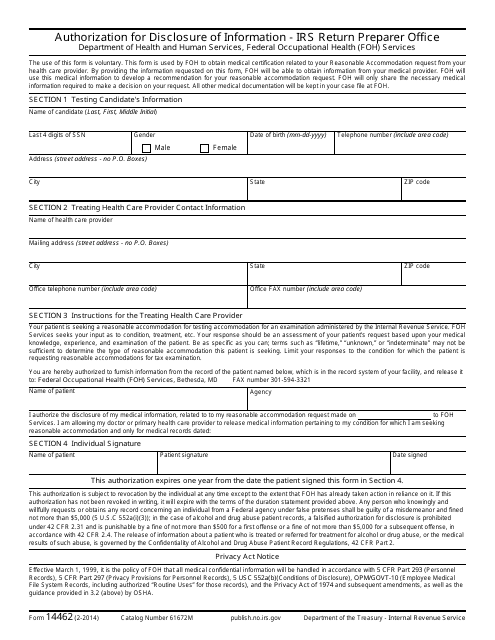

This document for authorizing disclosure of information to the IRS Return Preparer Office.

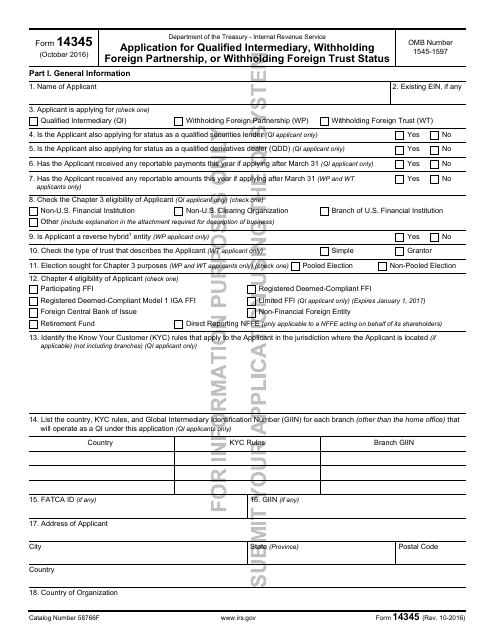

This Form is used for applying for Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust Status.

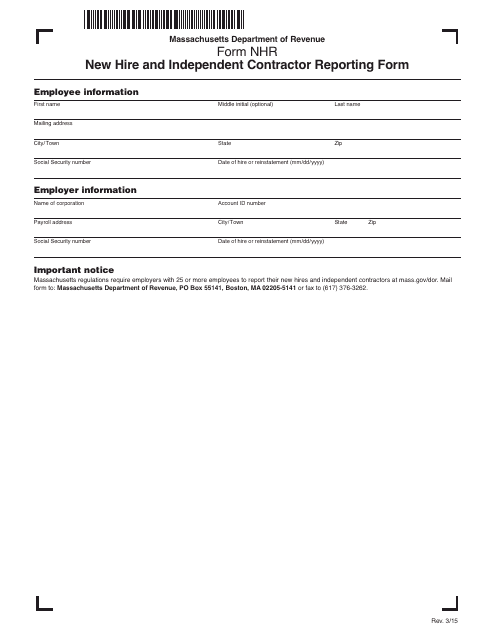

This Form is used for reporting new hires and independent contractors in Massachusetts.

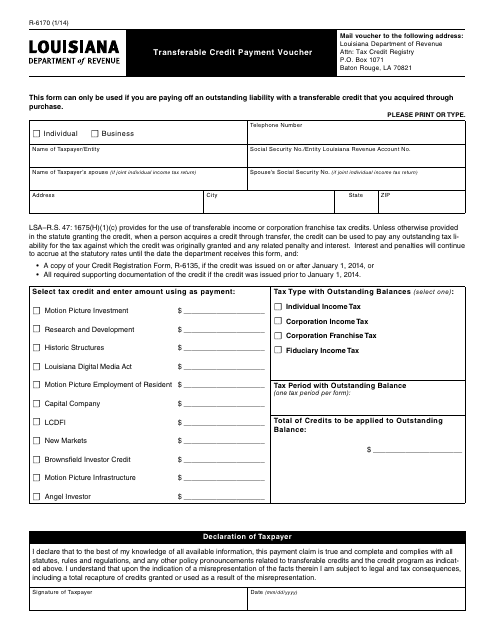

This form is used for making transferable credit payments in the state of Louisiana.

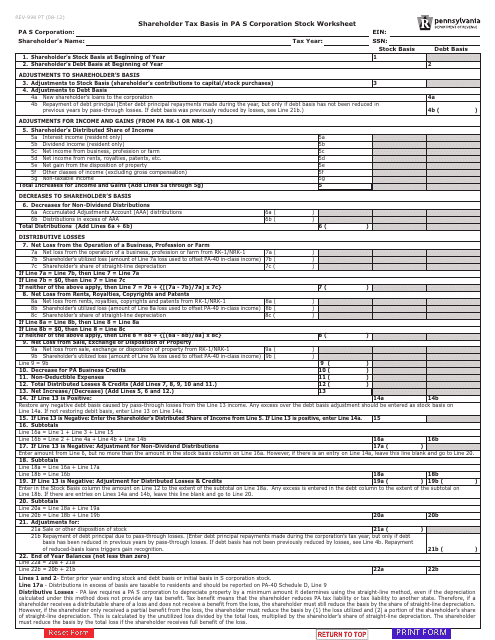

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

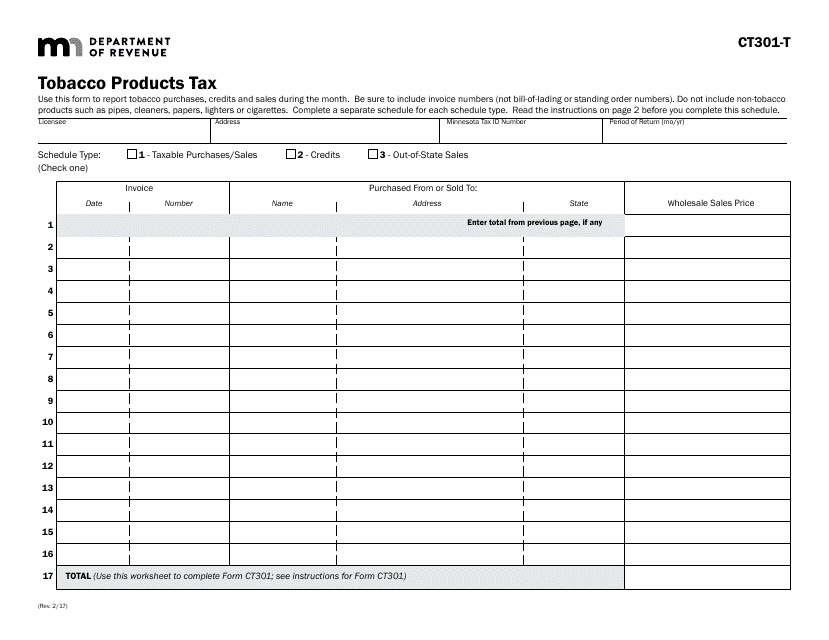

This document is used for reporting and paying tobacco products tax in the state of Minnesota.

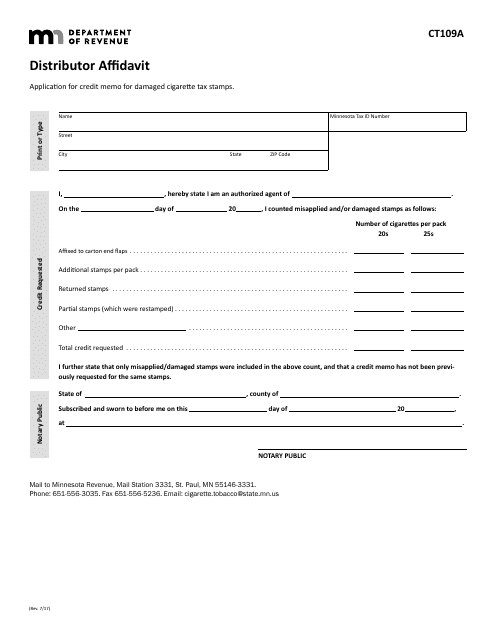

This Form is used for distributors in Minnesota to provide an affidavit.

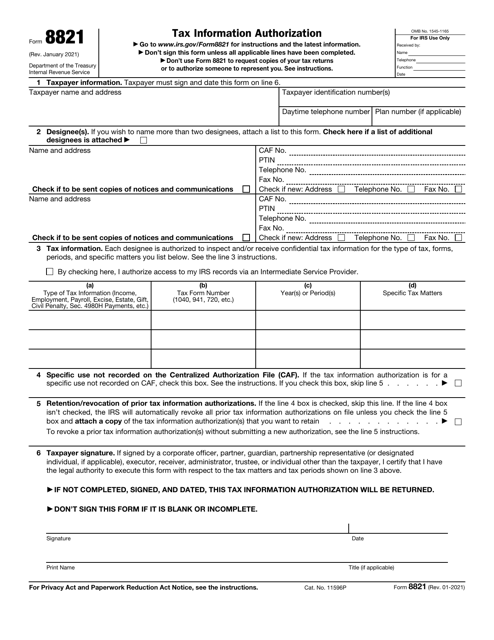

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

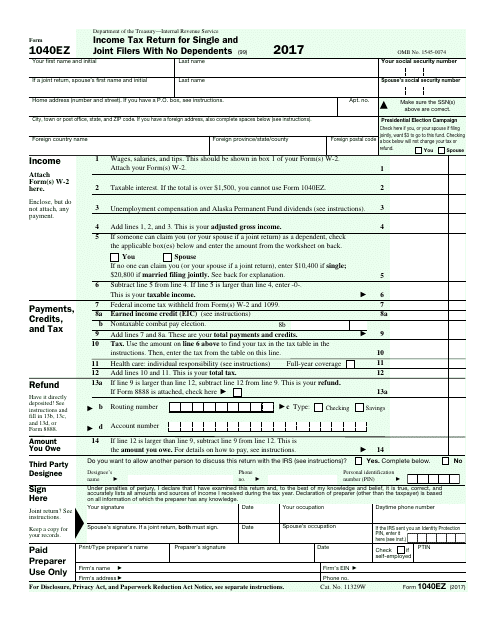

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.