Canadian Federal Legal Forms and Templates

Documents:

5112

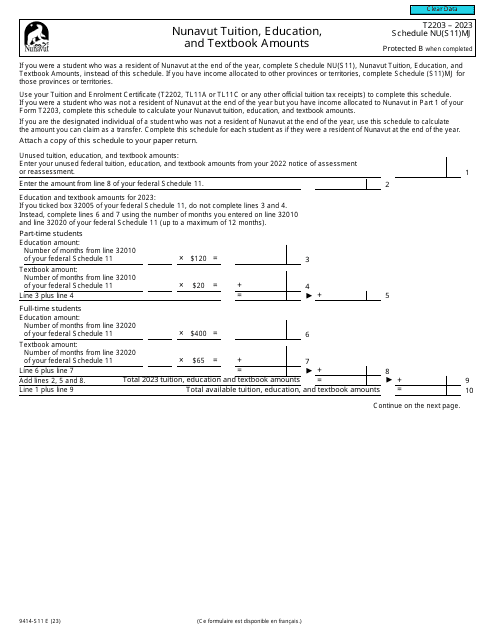

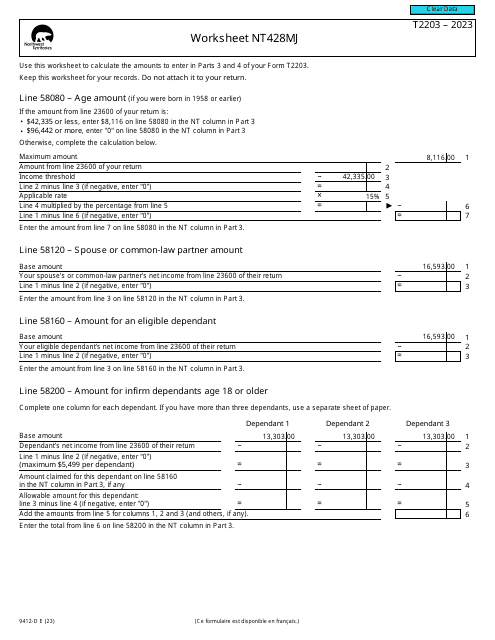

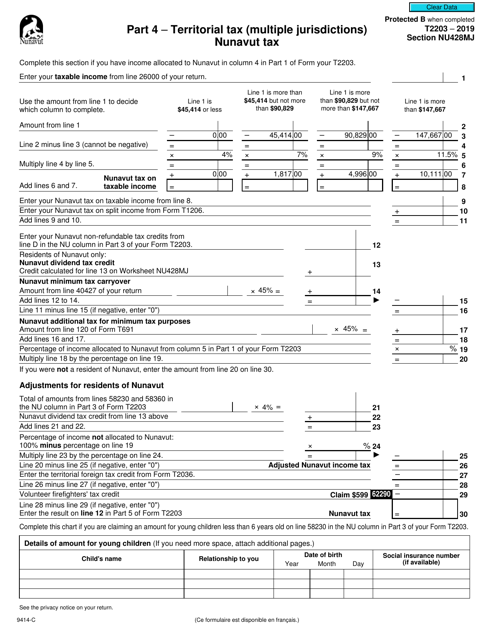

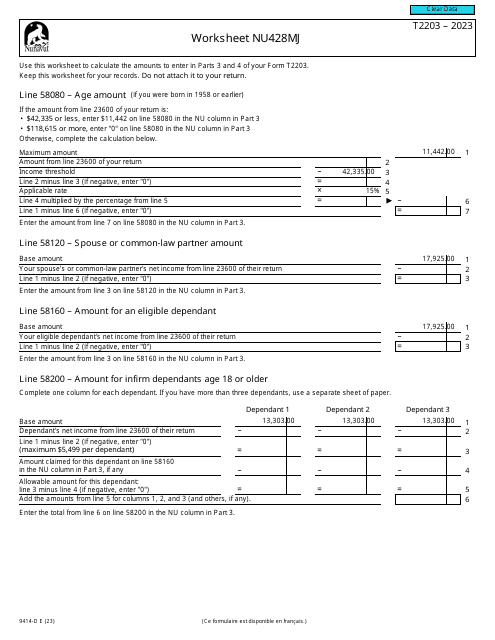

This form is used for reporting territorial tax for Nunavut in Canada.

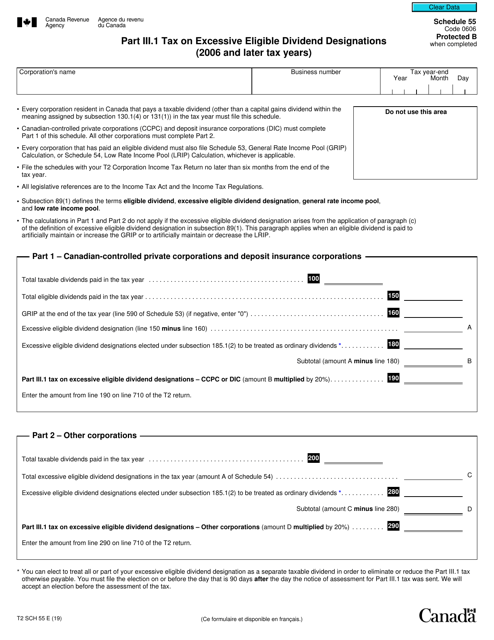

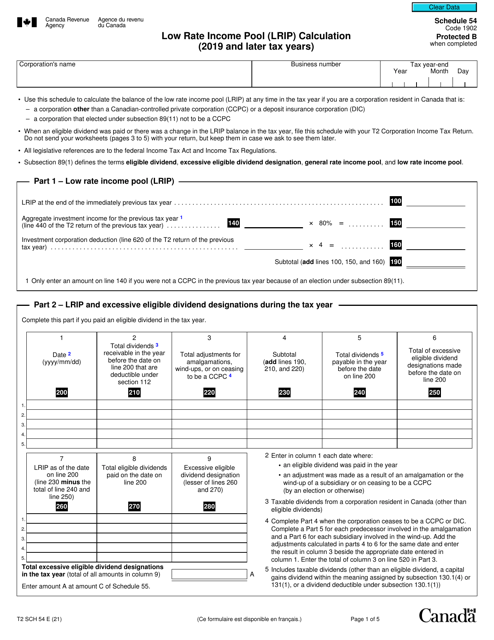

This form is used for calculating and reporting the tax payable on excessive eligible dividend designations for the tax years 2006 and later in Canada.

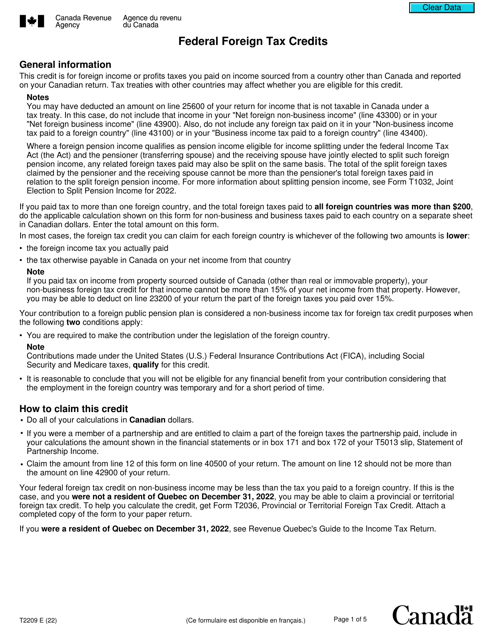

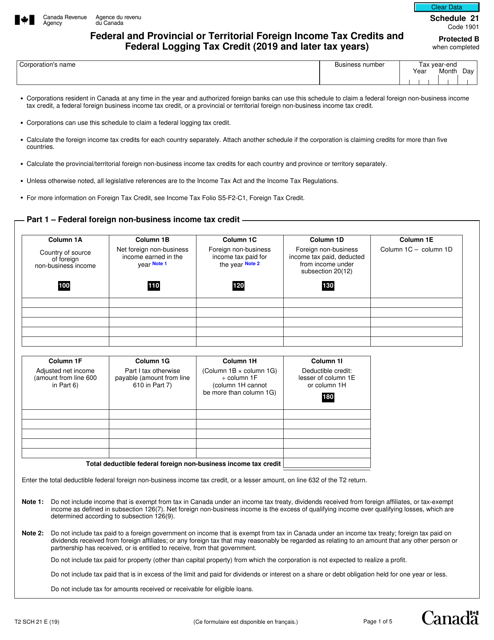

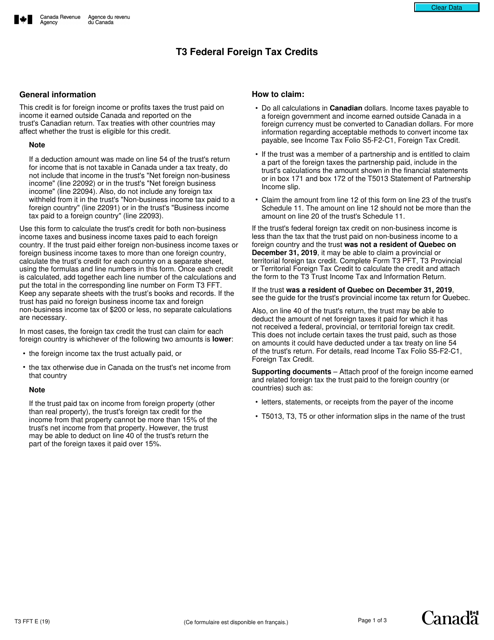

This form is used for claiming foreign tax credits on your Canadian federal tax return.

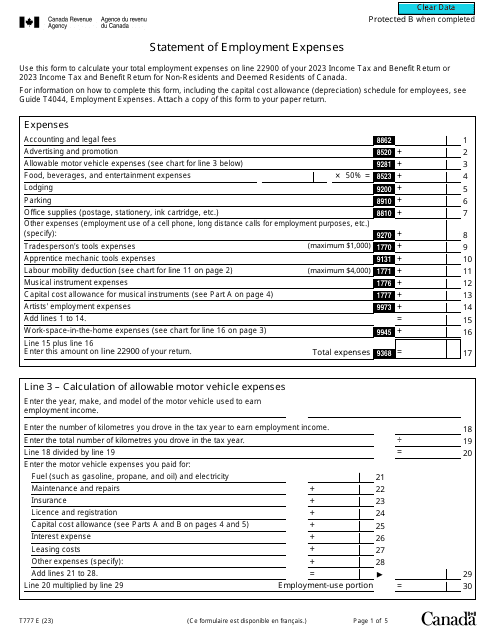

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.