Canadian Federal Legal Forms and Templates

Documents:

5112

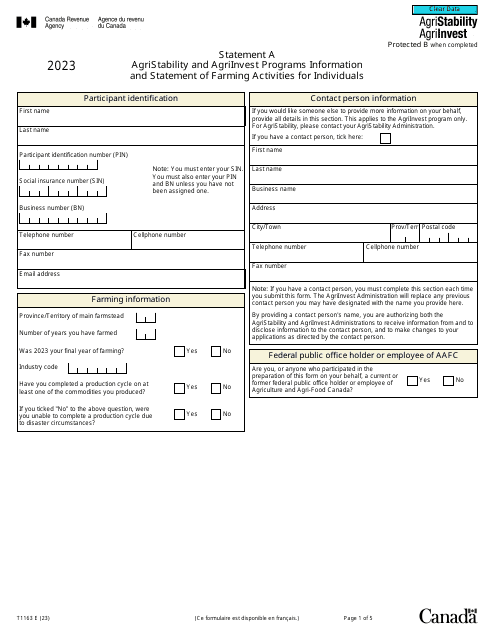

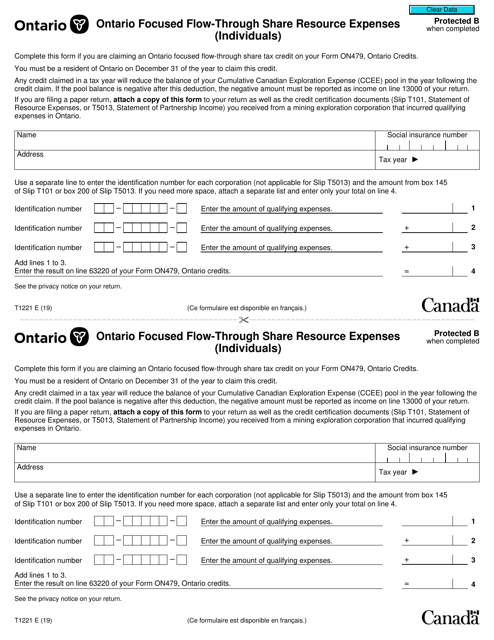

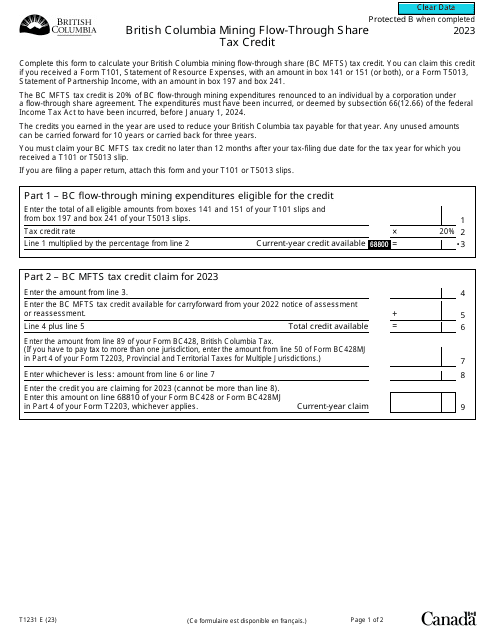

This form is used for claiming resource expenses on flow-through shares in Ontario for individuals in Canada.

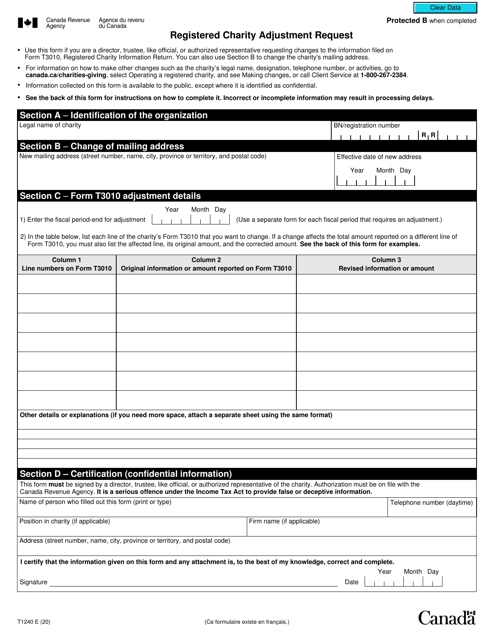

This form is used for registered charities in Canada to request adjustments to their information on record.

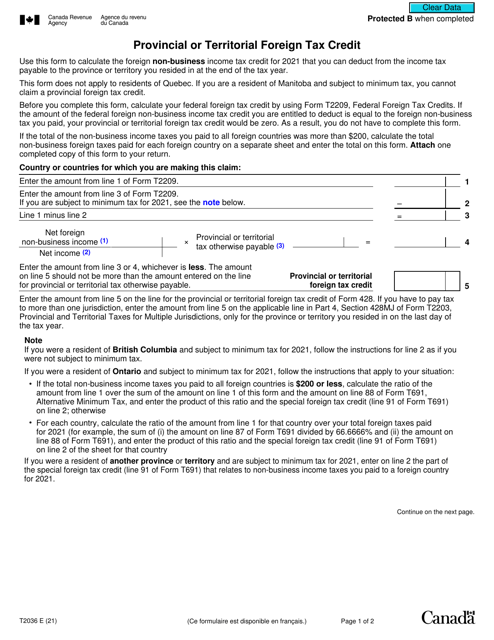

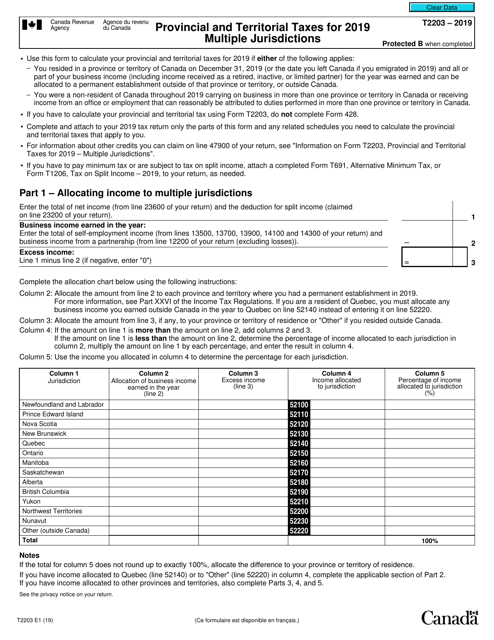

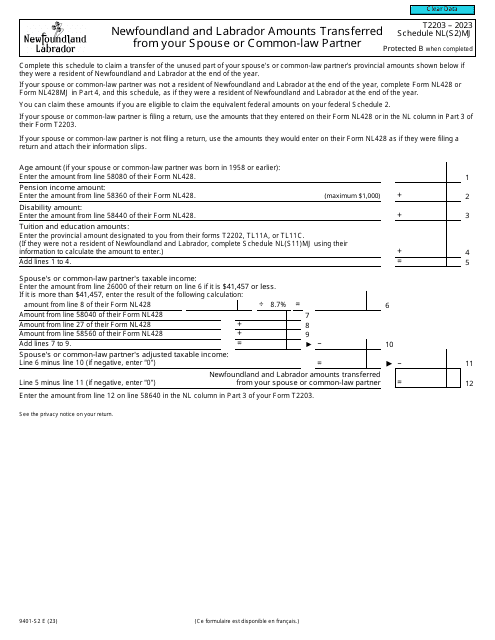

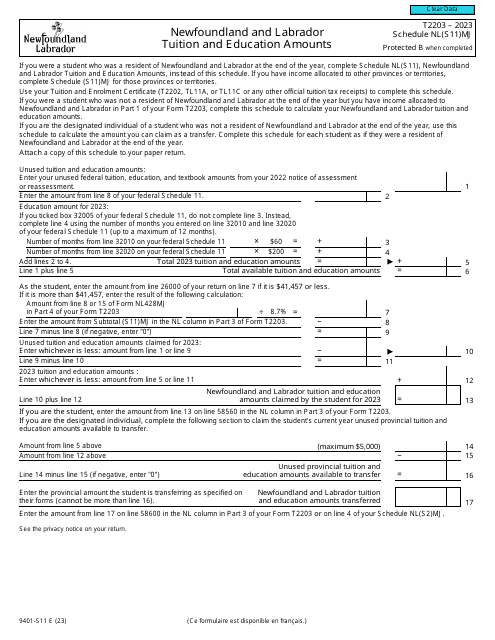

This form is used for calculating and reporting provincial and territorial taxes for multiple jurisdictions in Canada. It is used by individuals who have income or are residents in more than one province or territory.

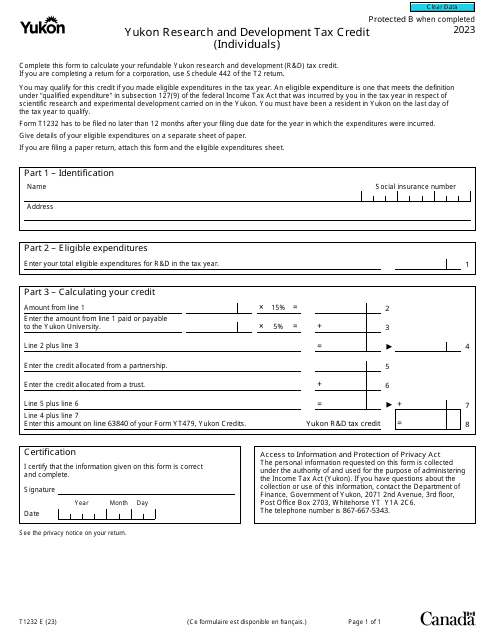

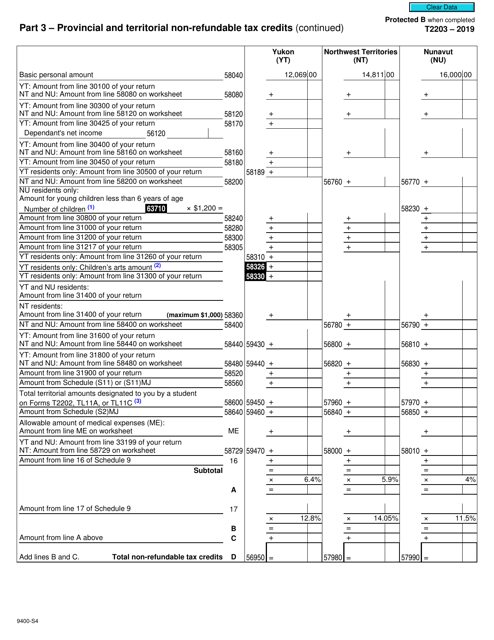

This form is used for claiming provincial and territorial non-refundable tax credits in the Yukon, Northwest Territories, and Nunavut regions of Canada.

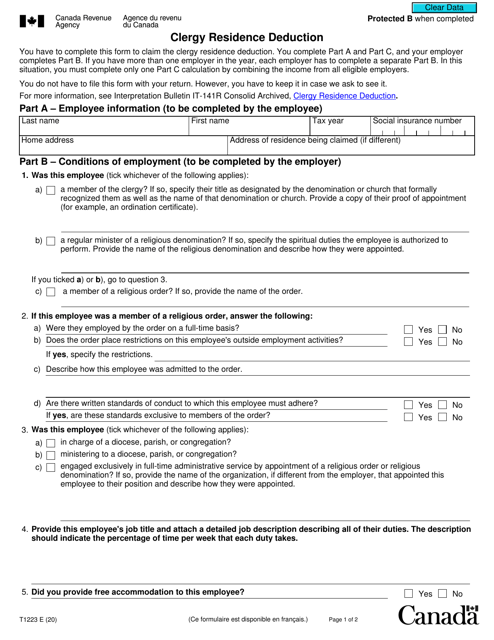

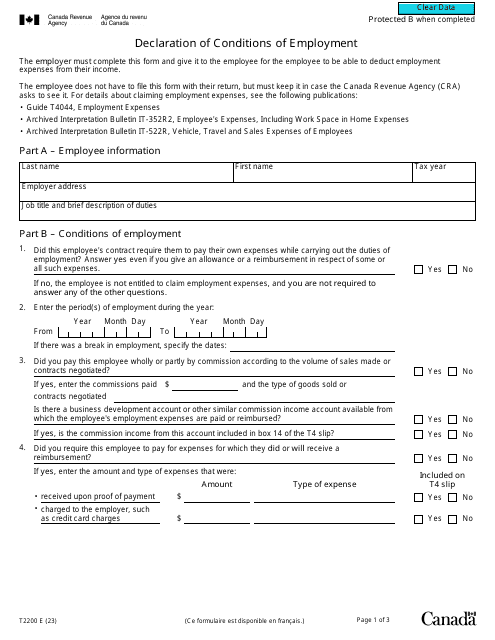

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.