Canadian Federal Legal Forms and Templates

Documents:

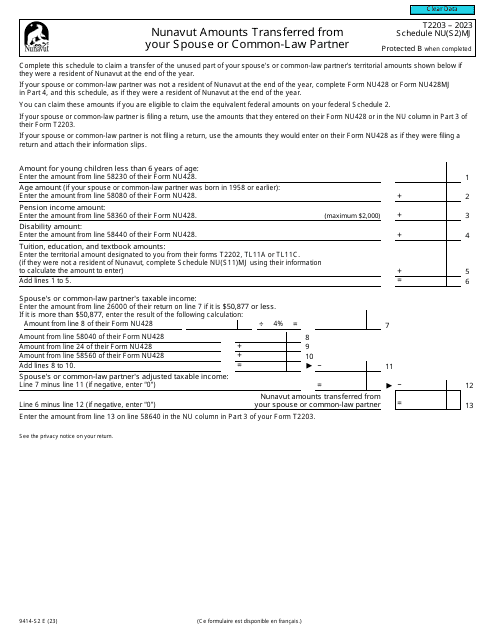

5112

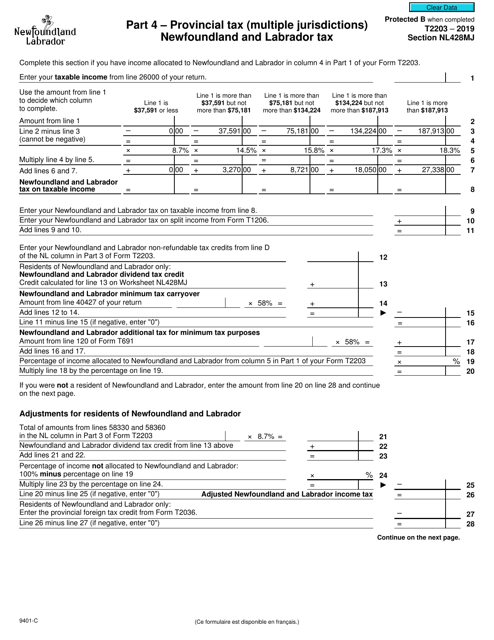

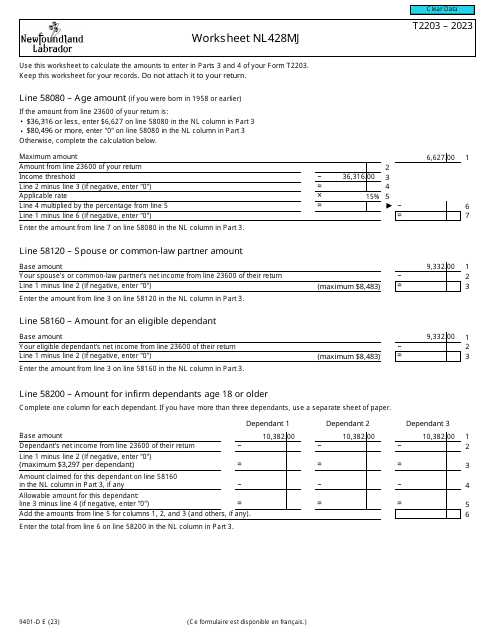

This Form is used for reporting provincial tax (multiple jurisdictions) for Newfoundland and Labrador Tax in Canada.

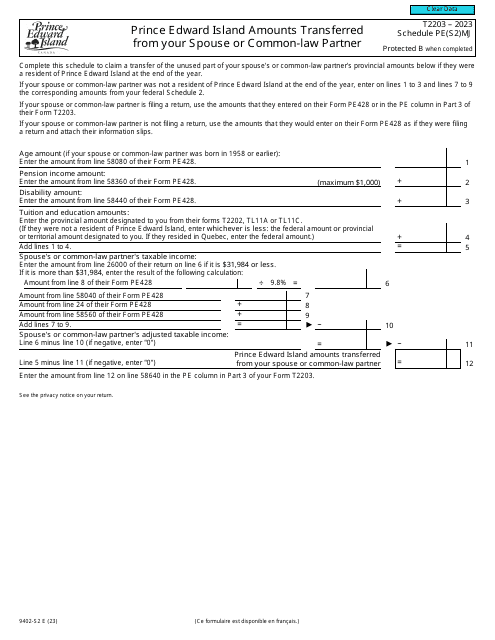

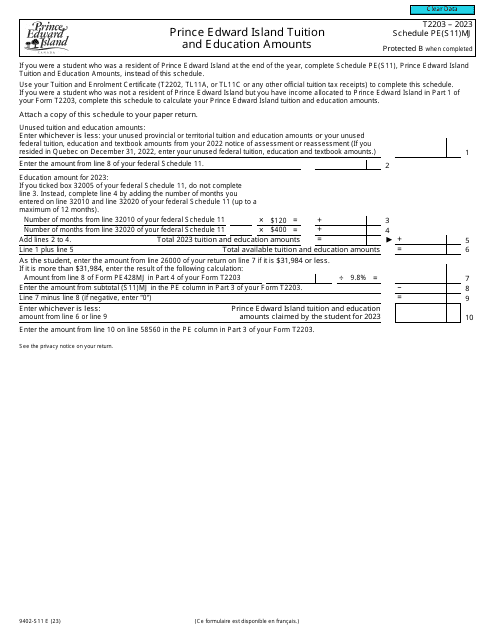

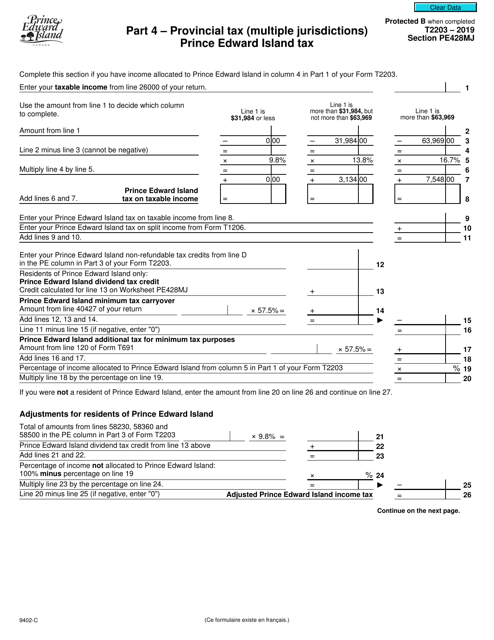

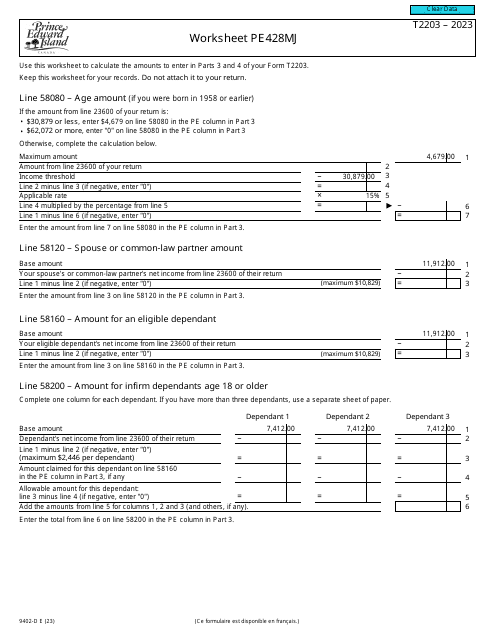

This form is used for reporting provincial tax for multiple jurisdictions in Prince Edward Island, Canada.

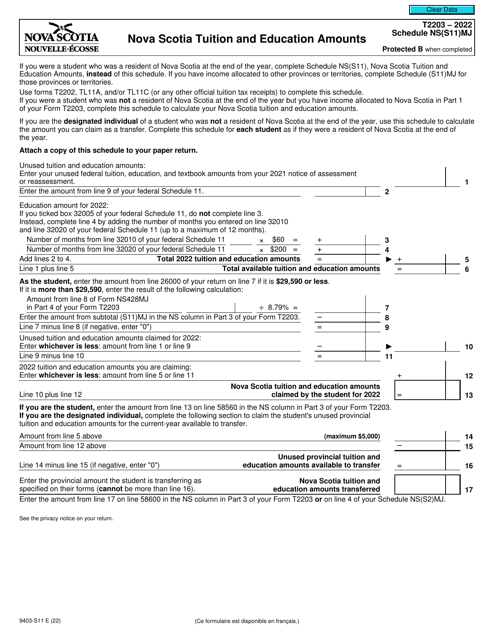

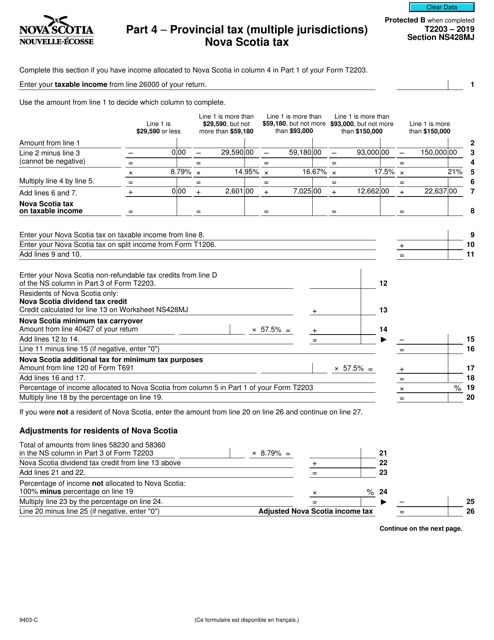

This form is used for calculating and reporting provincial tax for Nova Scotia residents in Canada.

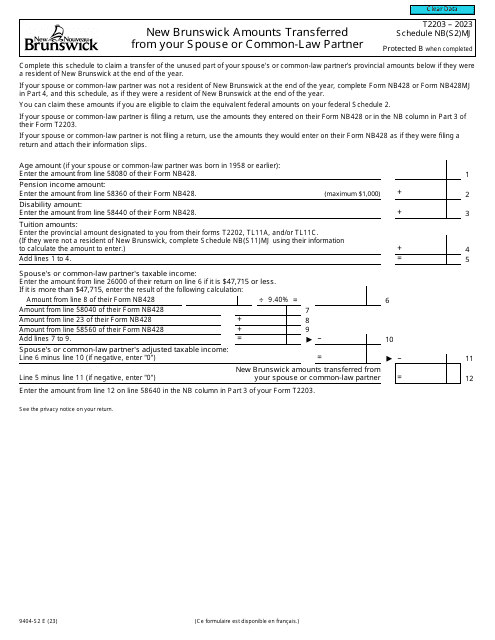

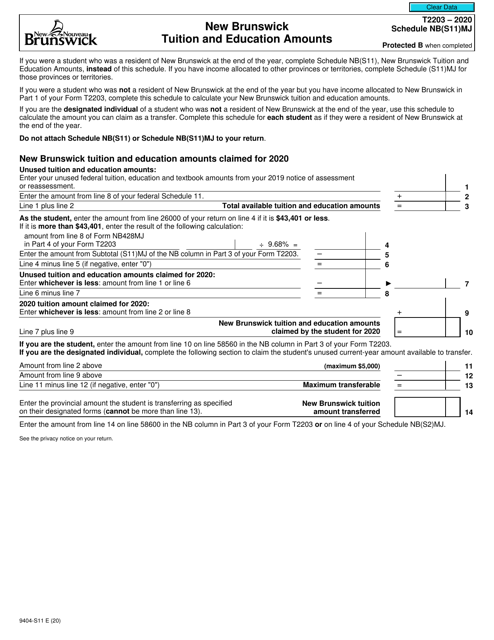

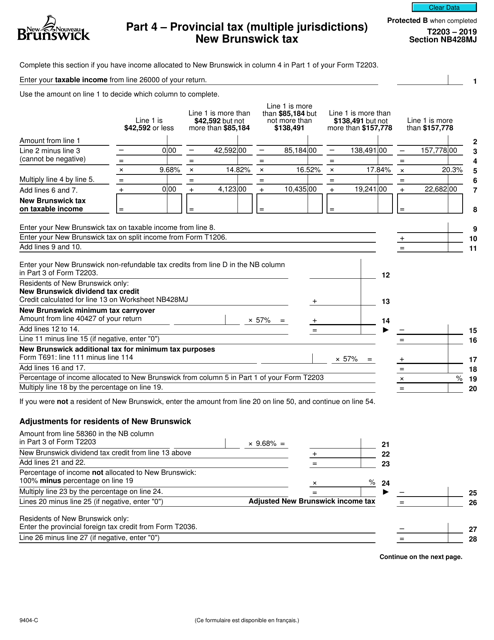

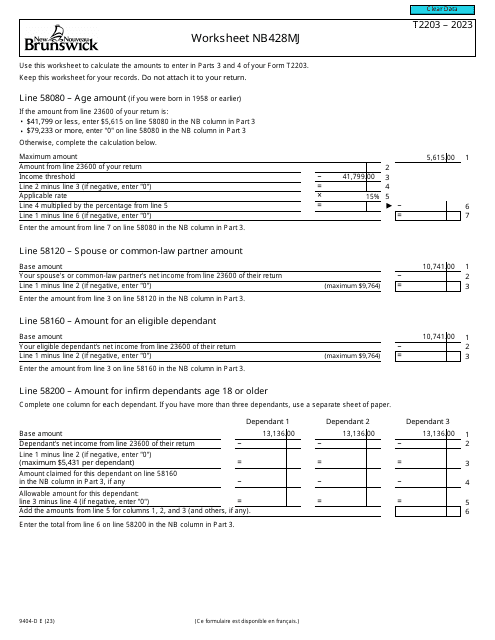

This form is used for reporting provincial tax in multiple jurisdictions, specifically for New Brunswick in Canada. It is referenced as Section NB428MJ Part 4 on the T2203 (9404-C) form.

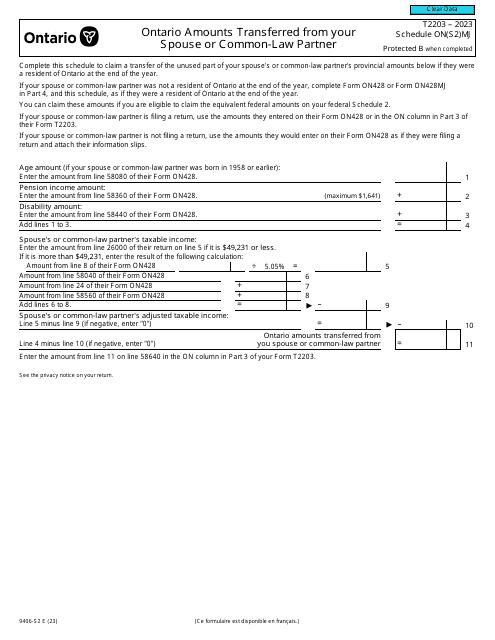

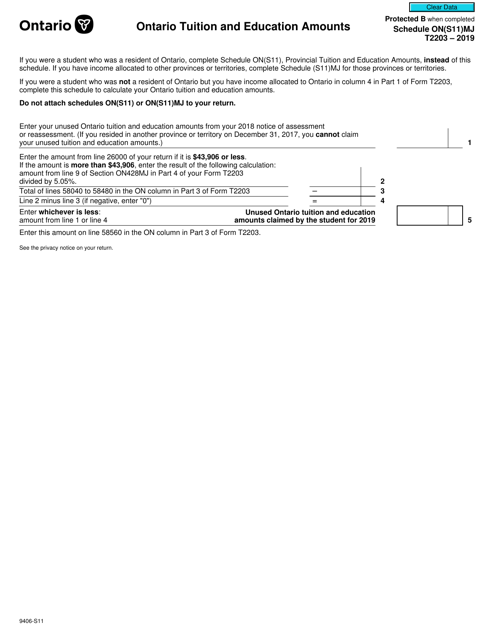

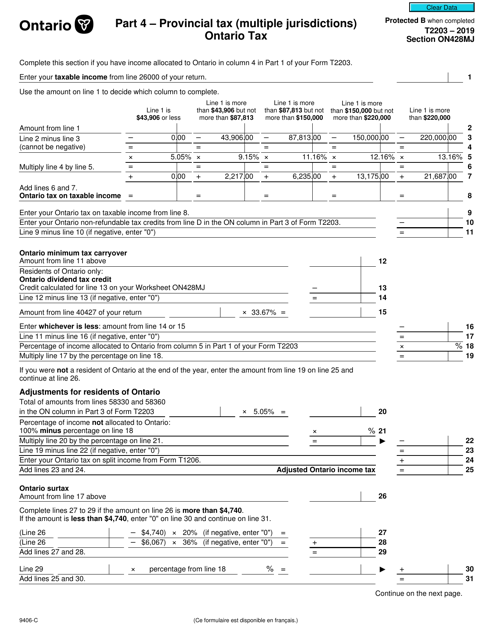

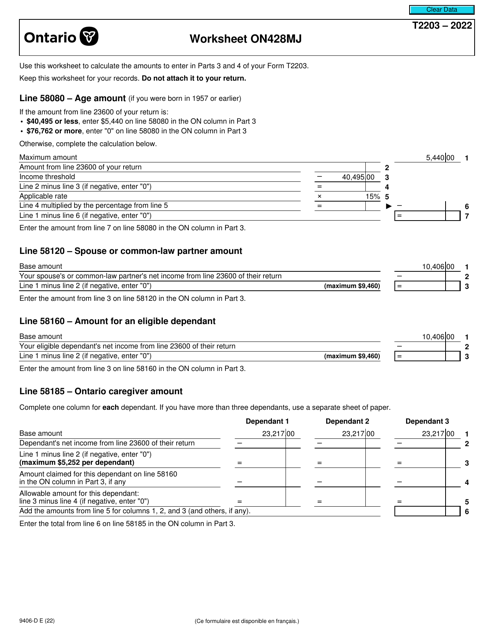

This form is used for reporting provincial tax in Ontario, Canada, when there are multiple jurisdictions involved.

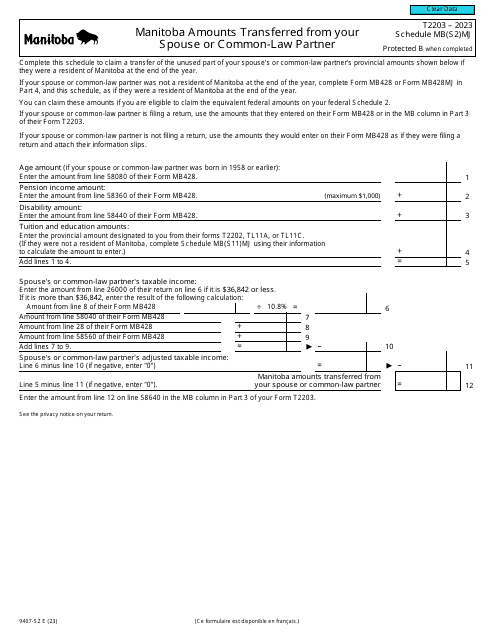

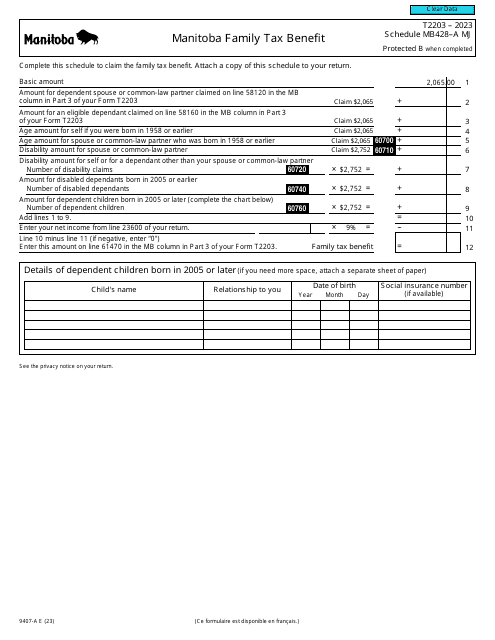

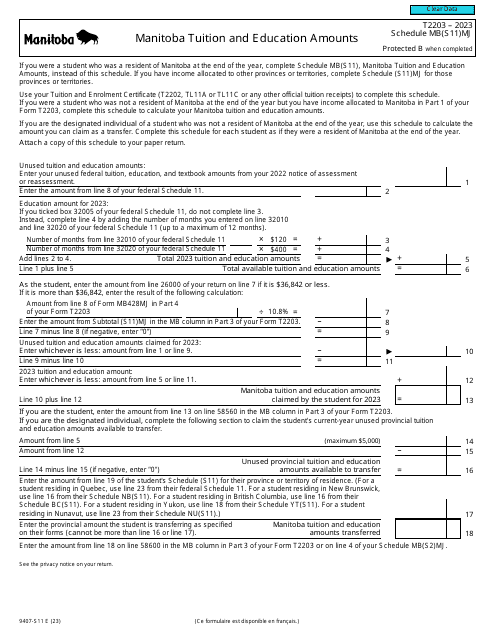

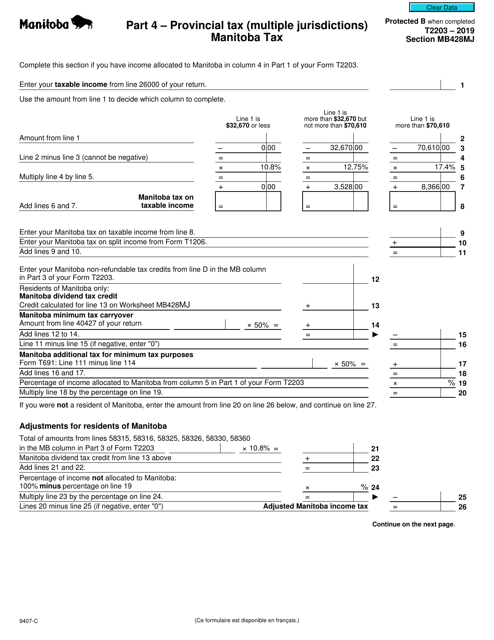

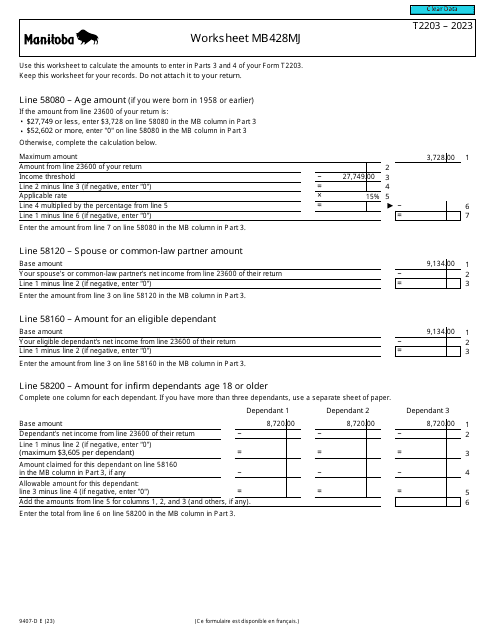

This form is used for calculating and reporting provincial tax liabilities in multiple jurisdictions within Canada, specifically for Manitoba.

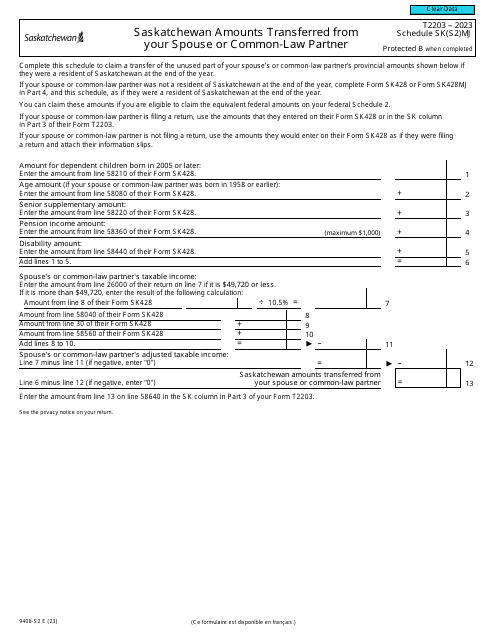

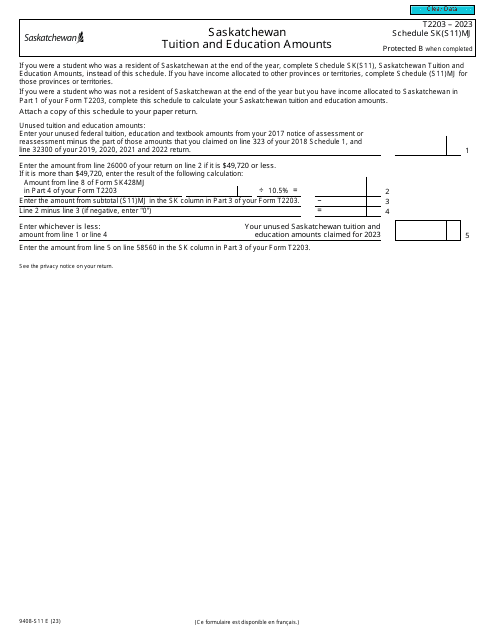

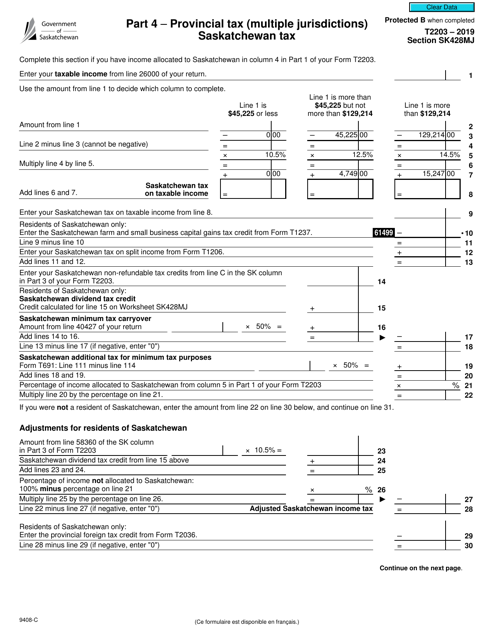

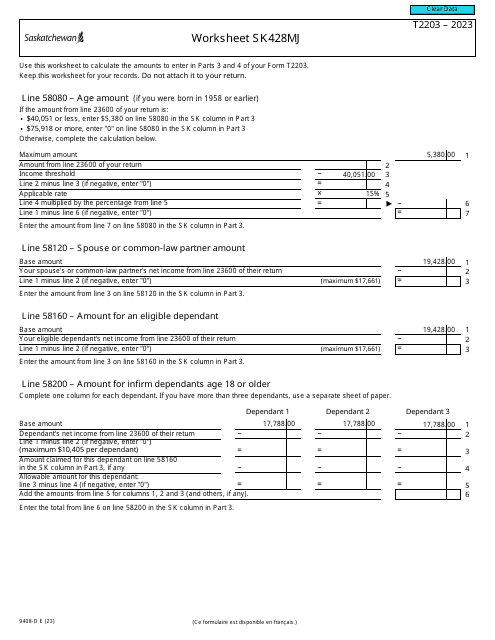

This form is used for reporting provincial tax in multiple jurisdictions, specifically for Saskatchewan Tax in Canada.

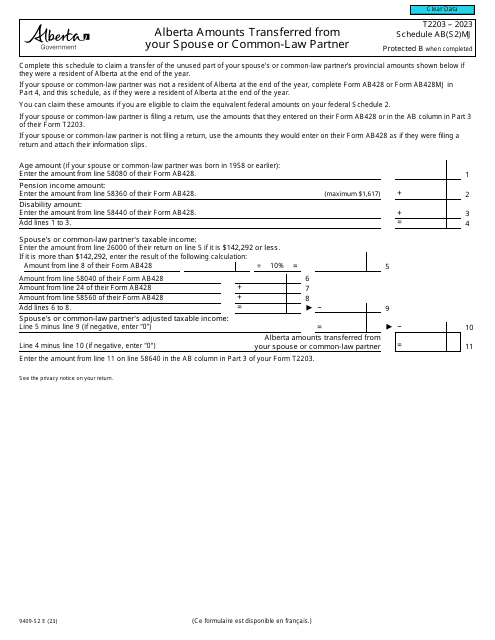

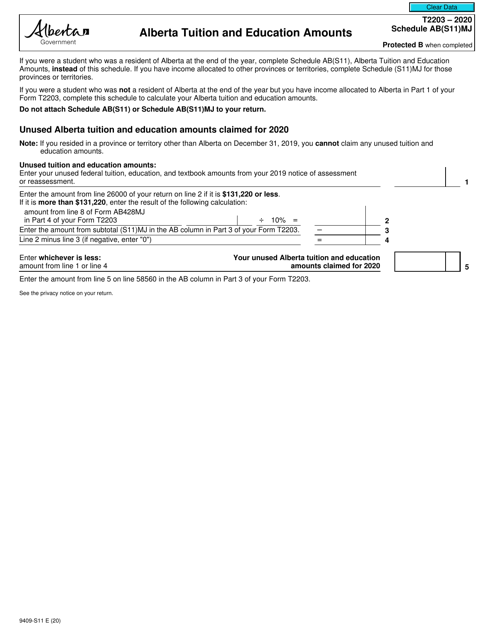

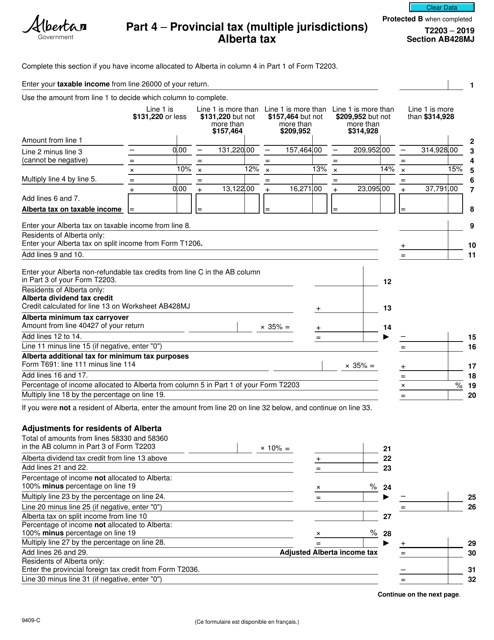

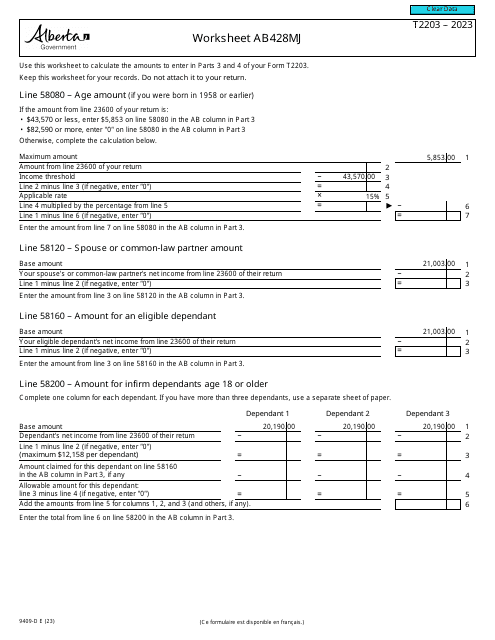

This Form is used for reporting provincial tax deductions in Alberta, Canada. It is specifically designed for taxpayers who have multiple tax jurisdictions within the province.

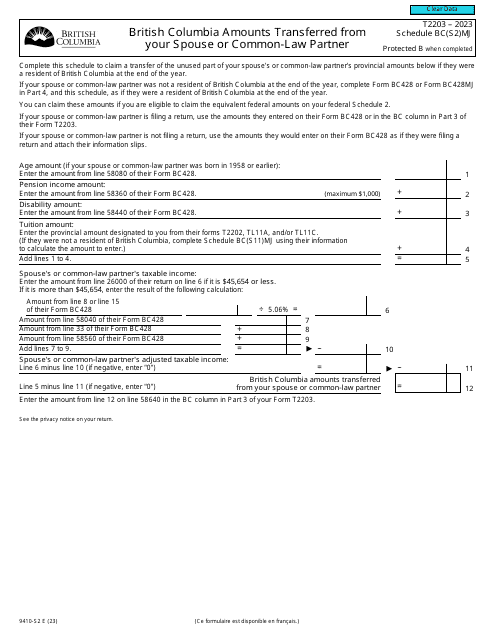

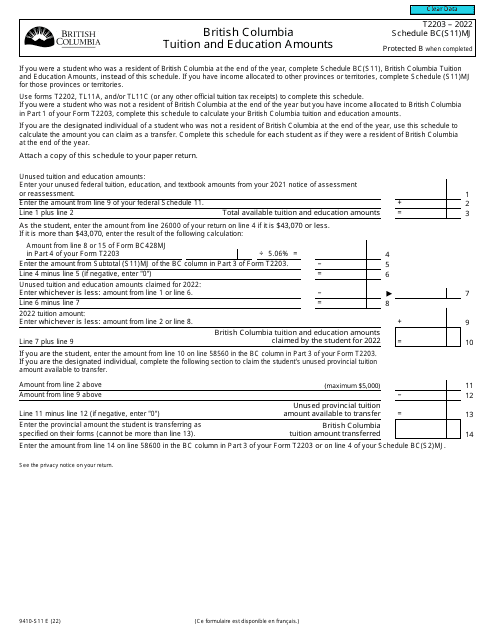

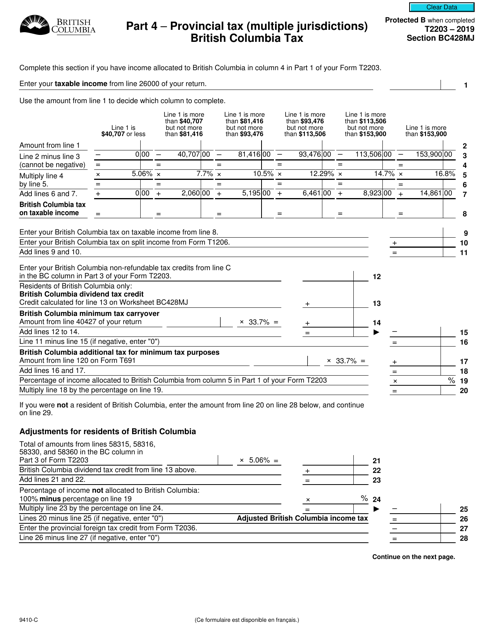

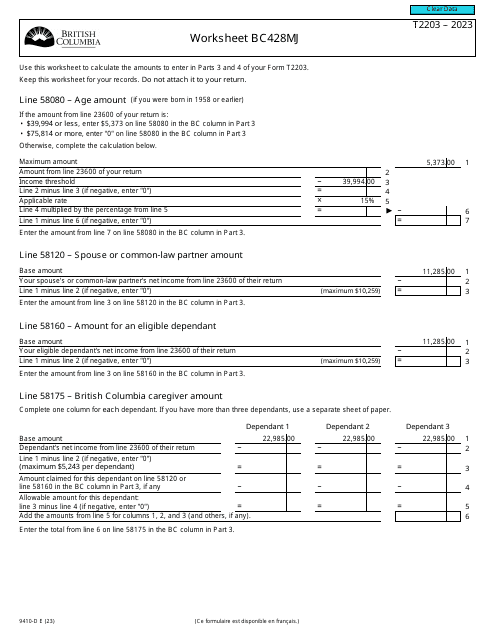

This Form is used for reporting provincial tax in British Columbia for individuals in Canada.

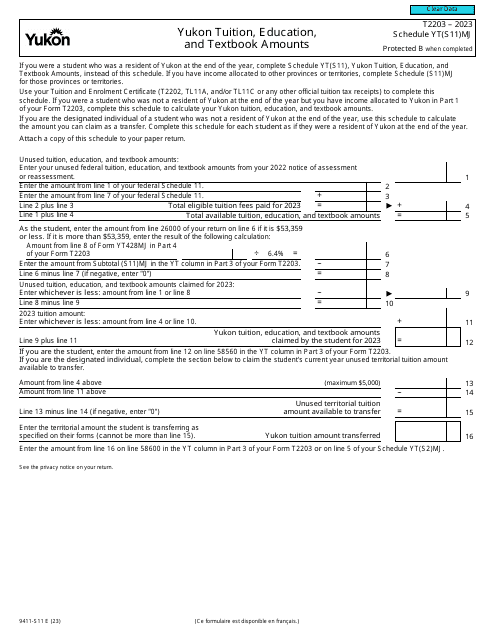

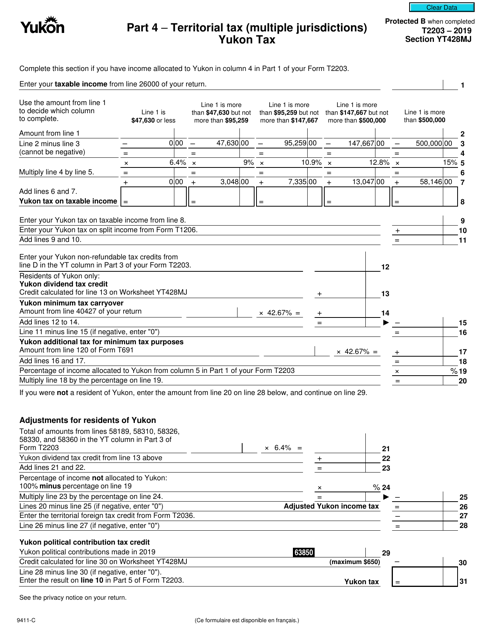

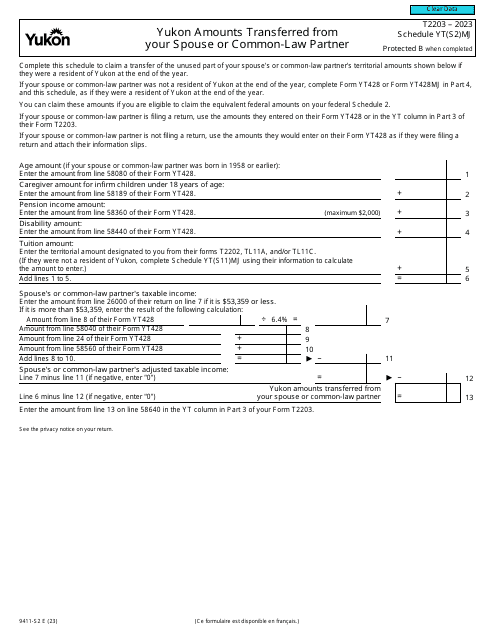

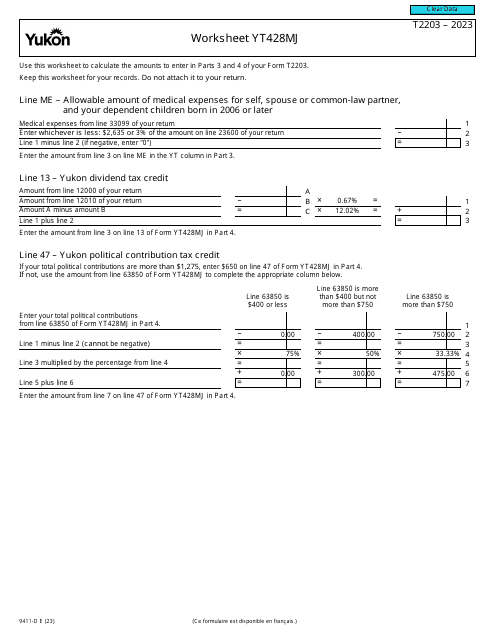

This type of document, form T2203, is used for reporting territorial tax in Yukon, Canada. It is specifically meant for individuals or businesses with multiple jurisdiction tax obligations.

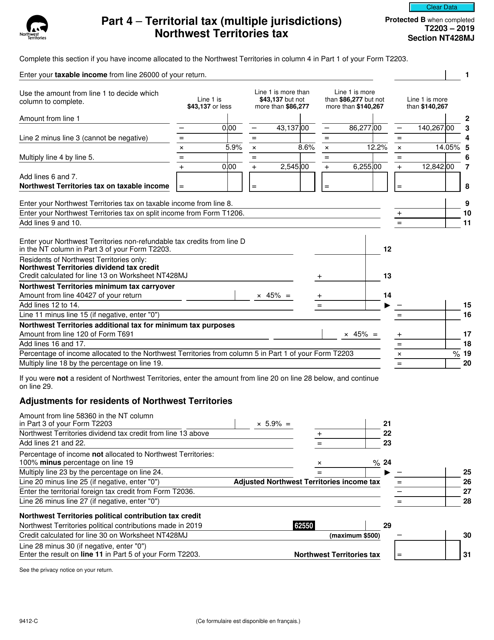

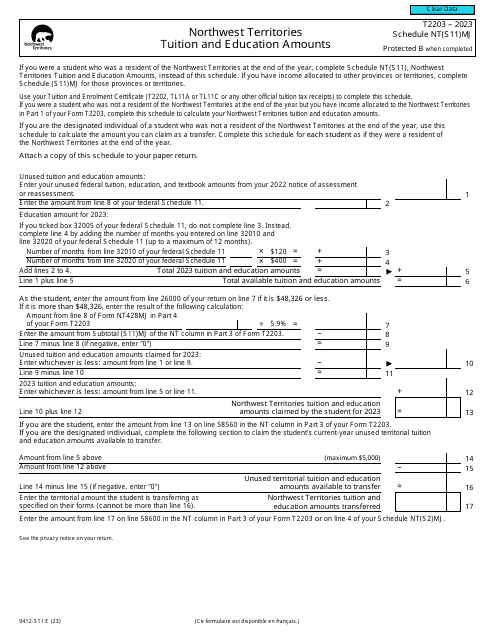

This form is used for reporting territorial tax in the Northwest Territories of Canada. It is specifically applicable to individuals or businesses operating in multiple jurisdictions within the Northwest Territories.