Canadian Federal Legal Forms and Templates

Documents:

5112

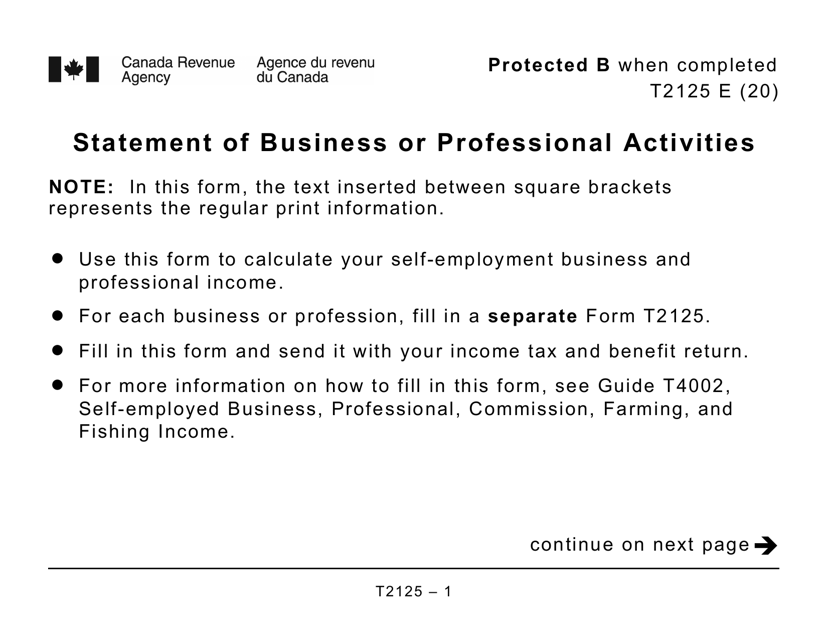

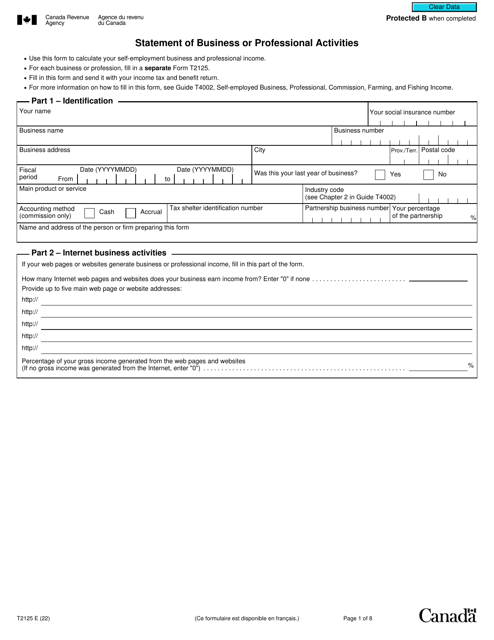

This a legal document that was specifically developed for Canadian taxpayers who receive self-employment business or professional income that they may use when they want to report their income.

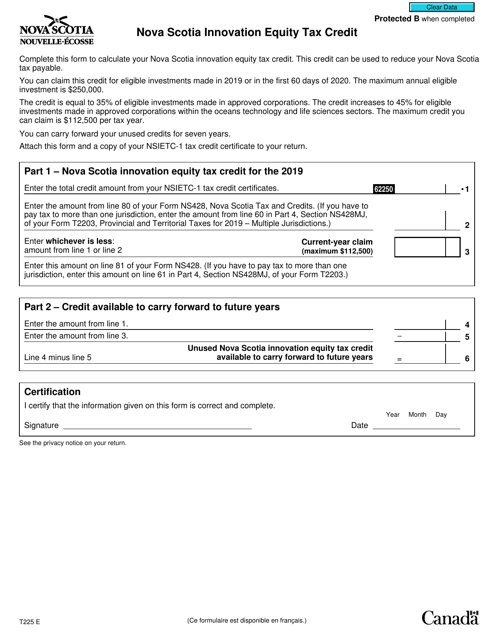

This form is used for claiming the Nova Scotia Innovation Equity Tax Credit in Canada. It allows individuals or corporations to receive a tax credit for investing in eligible Nova Scotia companies.

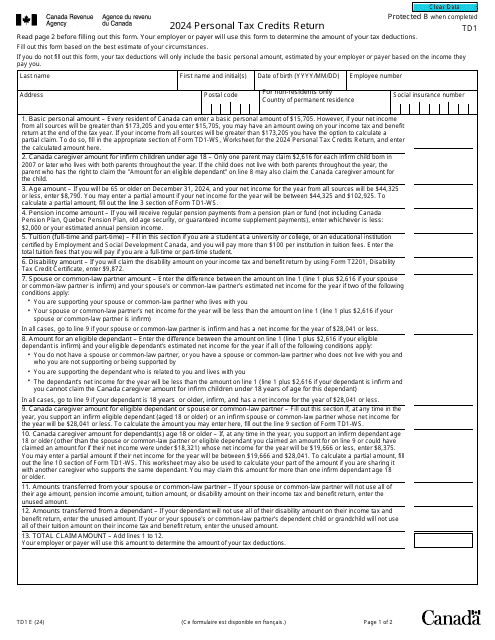

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

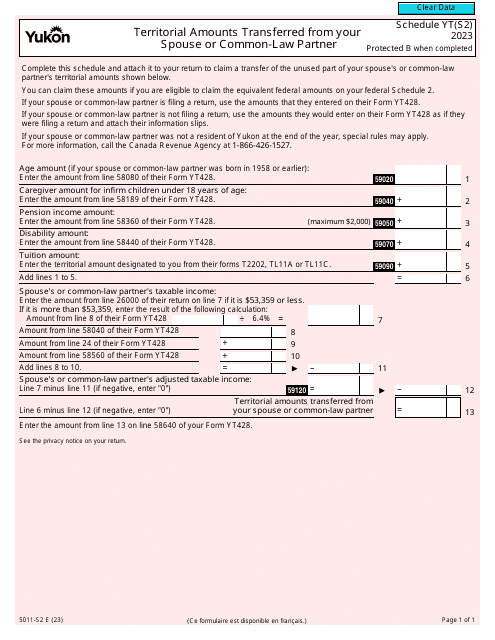

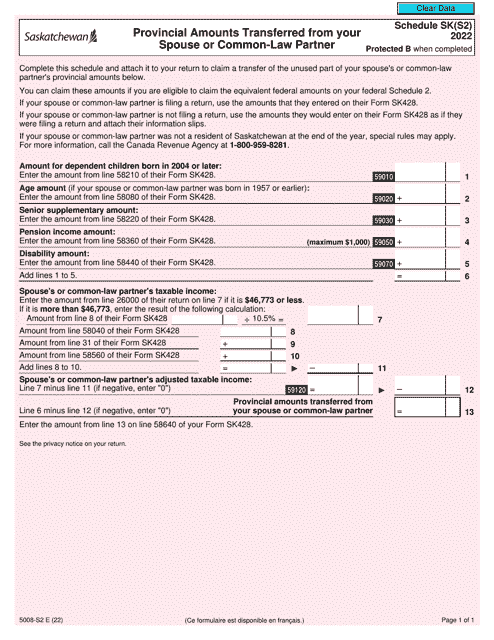

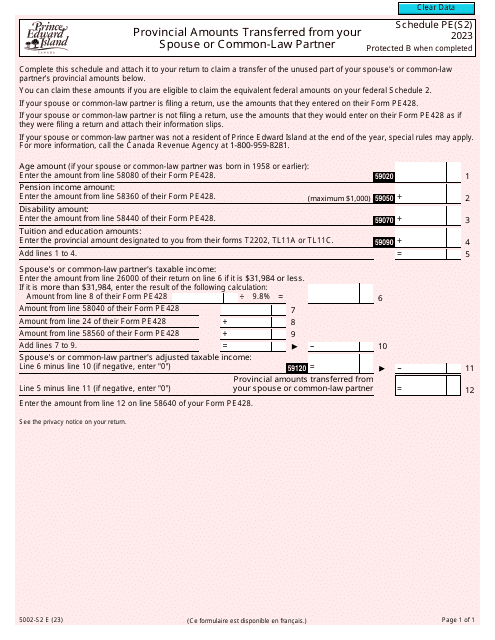

This type of document is used in Canada for reporting provincial amounts transferred from your spouse or common-law partner. It is a large print version of Form 5008-S2 Schedule SK(S2).

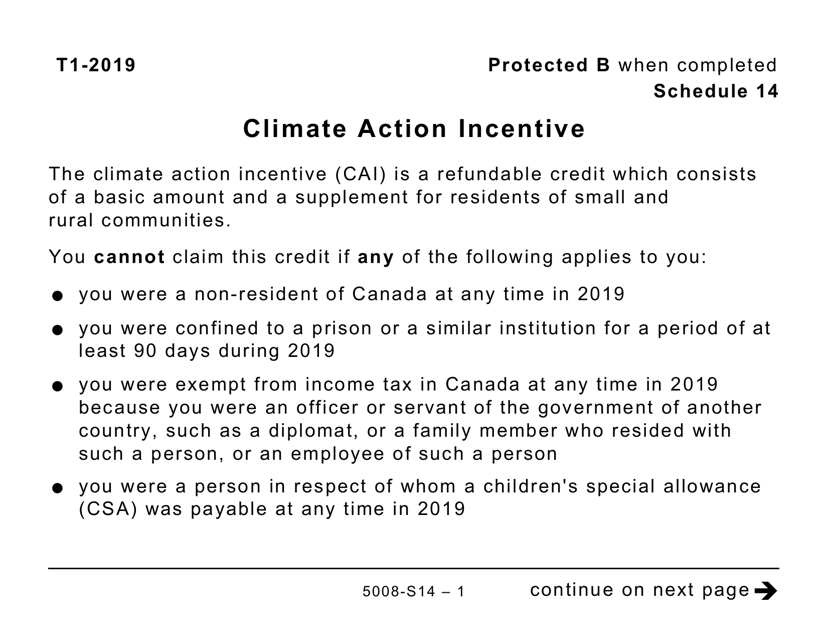

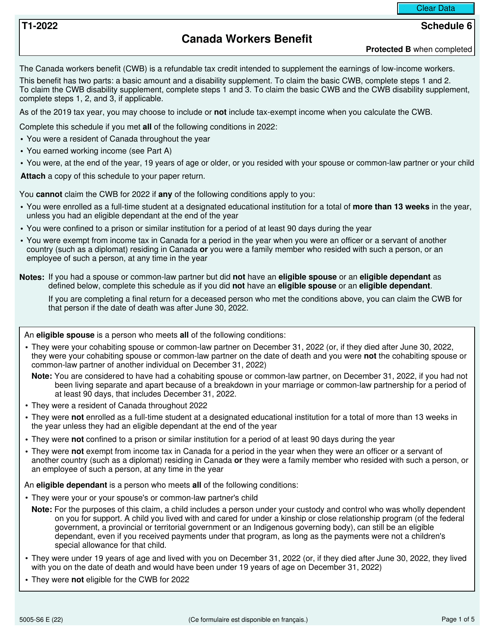

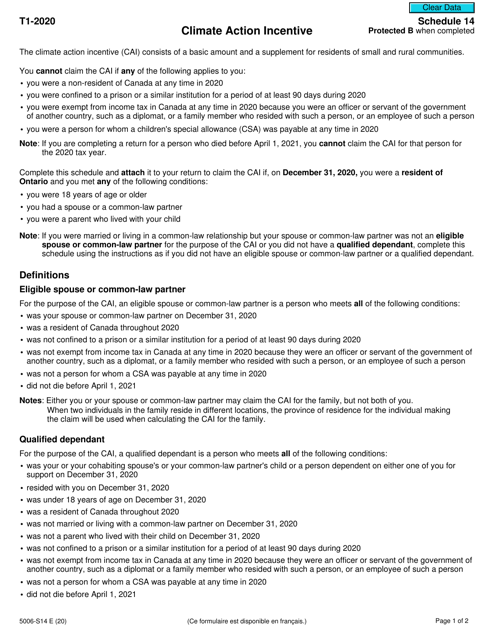

This form is used for reporting and claiming the Climate Action Incentive in the province of Saskatchewan, Canada.

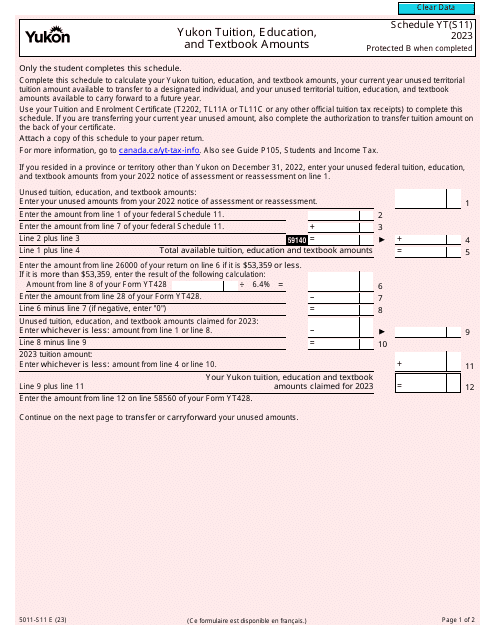

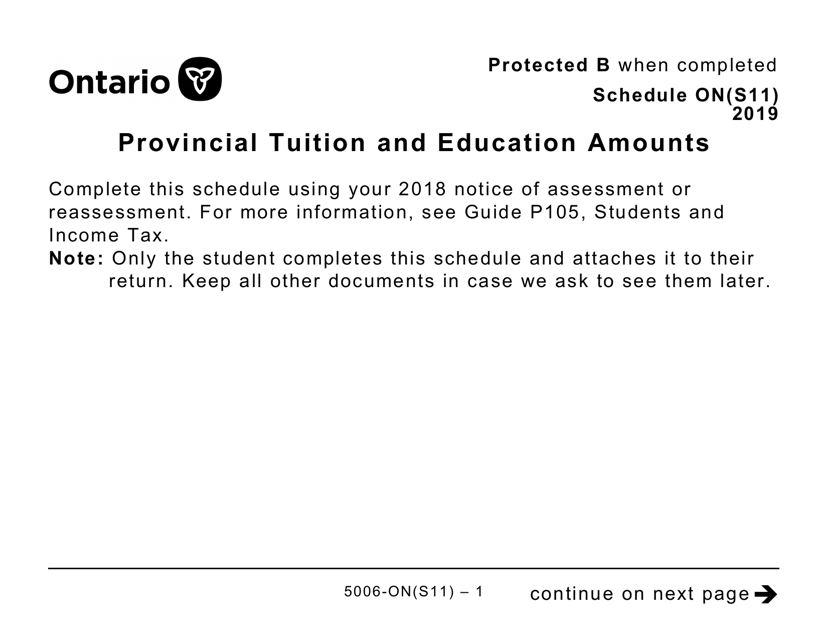

This Form is used for reporting provincial tuition and education amounts in the province of Saskatchewan in Canada. It is a larger print version of the form.

This Form is used for reporting and claiming the Climate Action Incentive in the province of Saskatchewan. It is specifically designed to be accessible for individuals with visual impairments, with a larger print format.

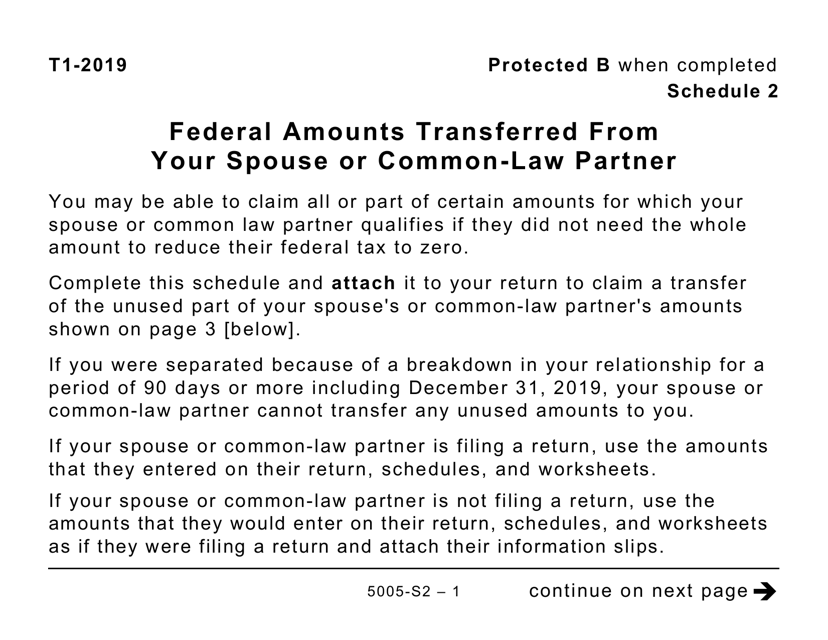

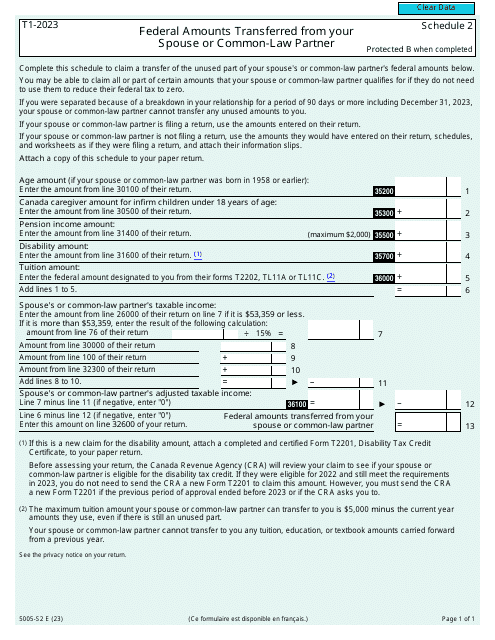

This form is used for reporting federal amounts transferred from your spouse or common-law partner in Canada. It is provided in large print format for easier reading.

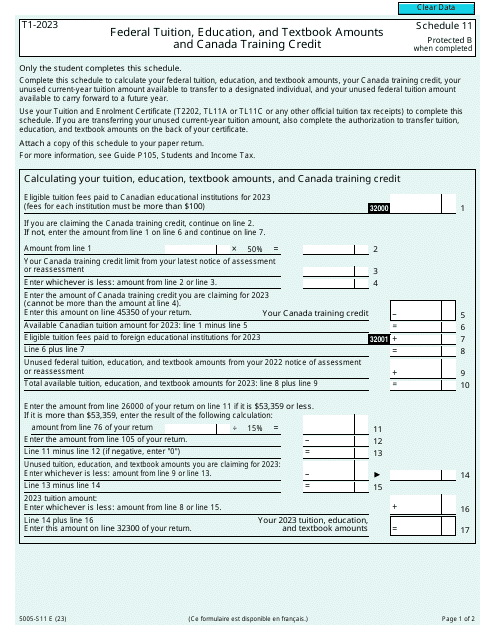

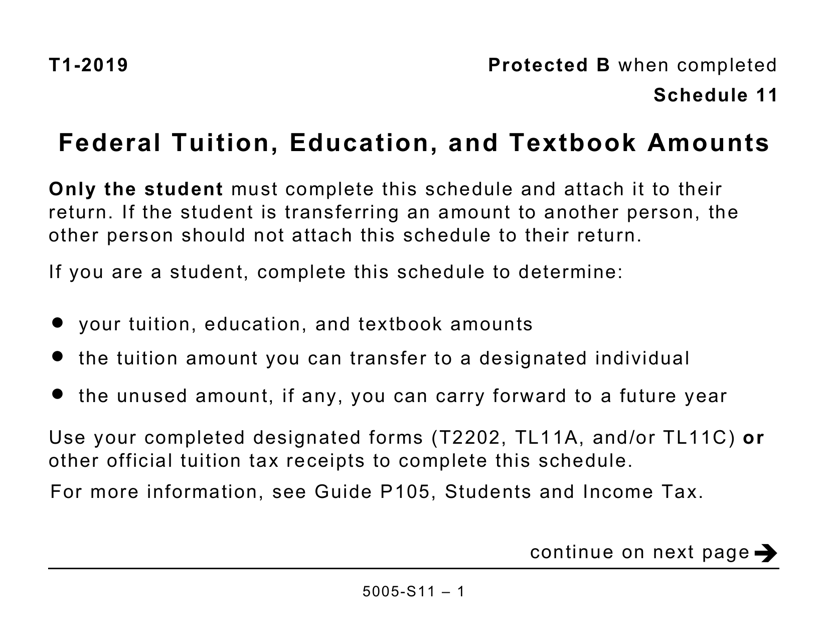

This Form is used for reporting federal tuition, education, and textbook amounts in Canada. It is a large print version of Schedule 11 for individuals with visual impairments.

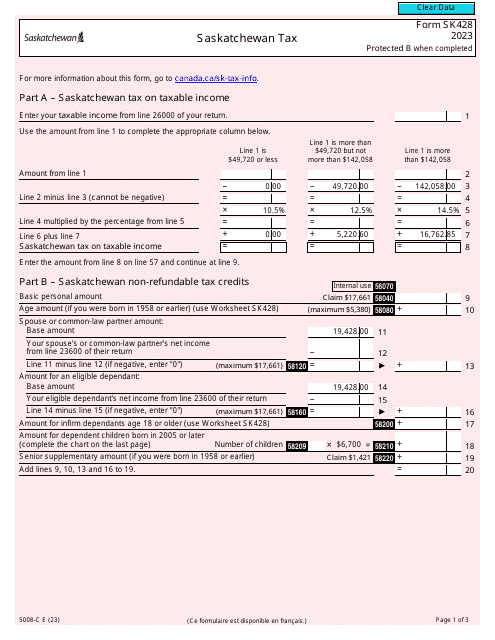

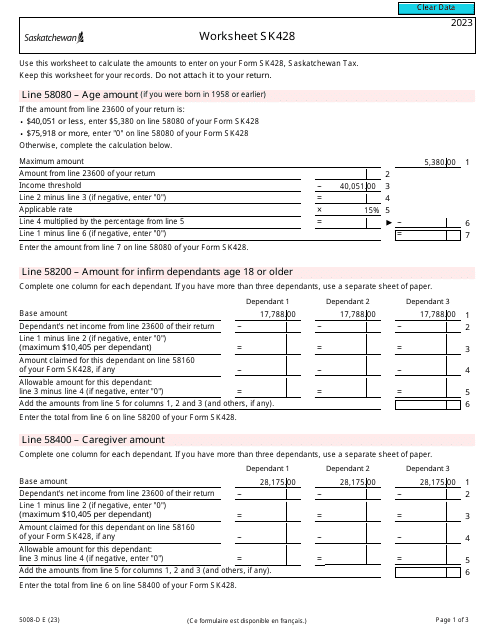

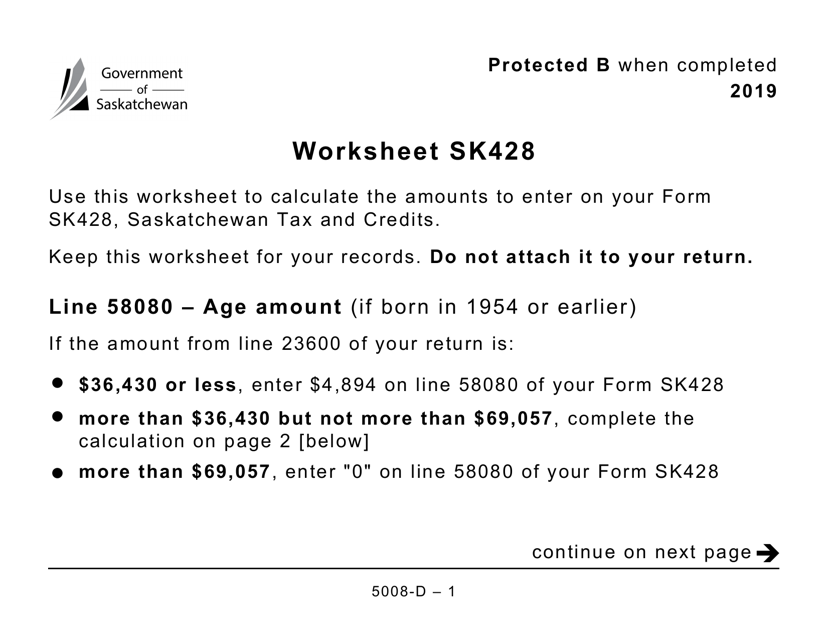

This form is used for completing the Worksheet SK428 in Saskatchewan, Canada. It is a large print version of the form.

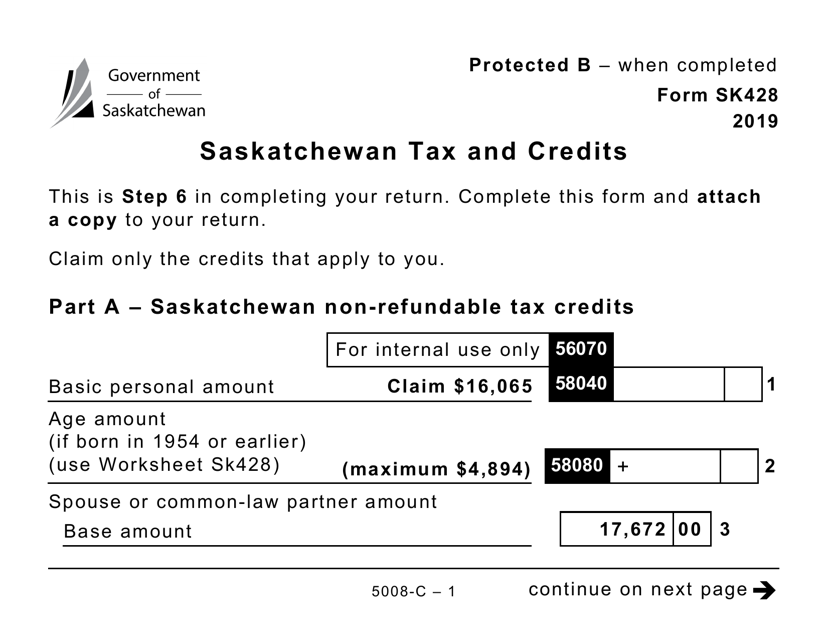

This form is used for reporting Saskatchewan tax and credits in larger print size. It is specifically designed for taxpayers in Canada.

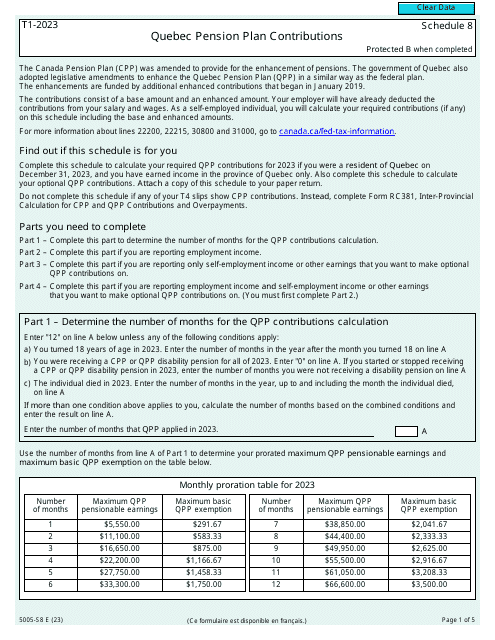

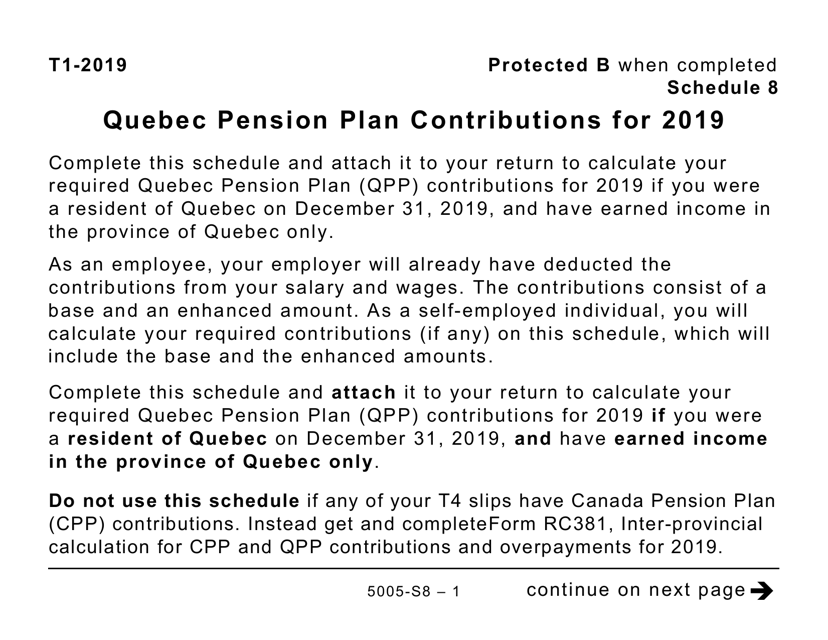

This form is used for reporting Quebec Pension Plan contributions in large print format for residents of Canada.

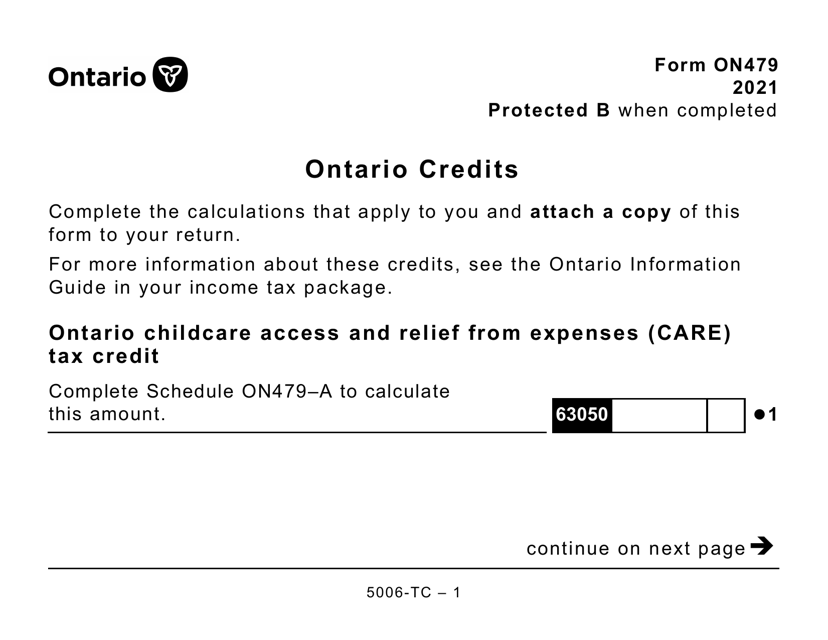

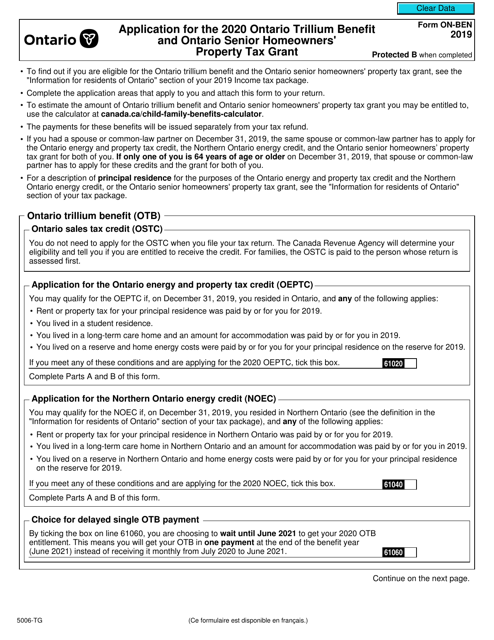

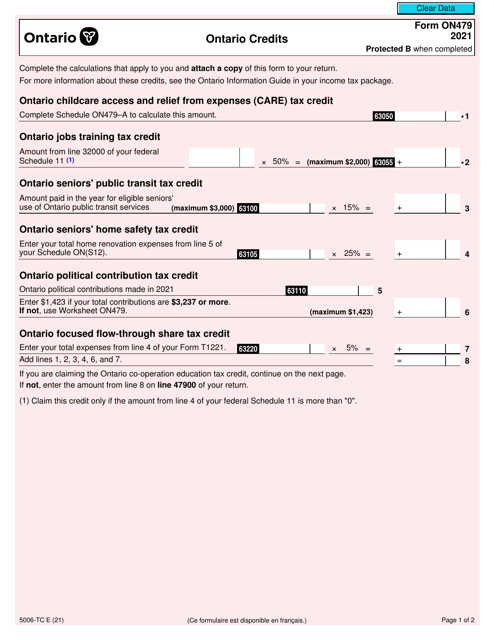

This form is used for applying for the 2020 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant in Canada.

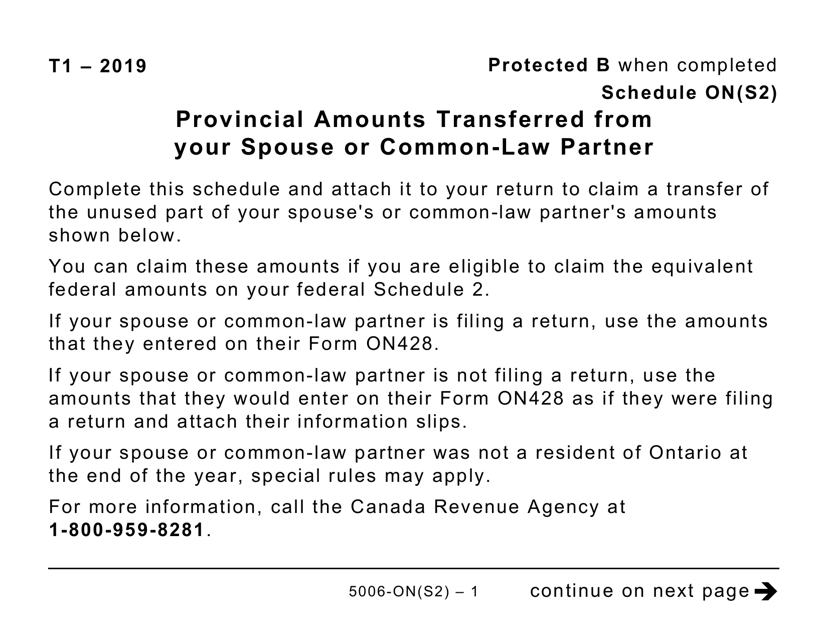

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner in Ontario. It is specifically designed for individuals who have visual impairments as it is available in large print format.

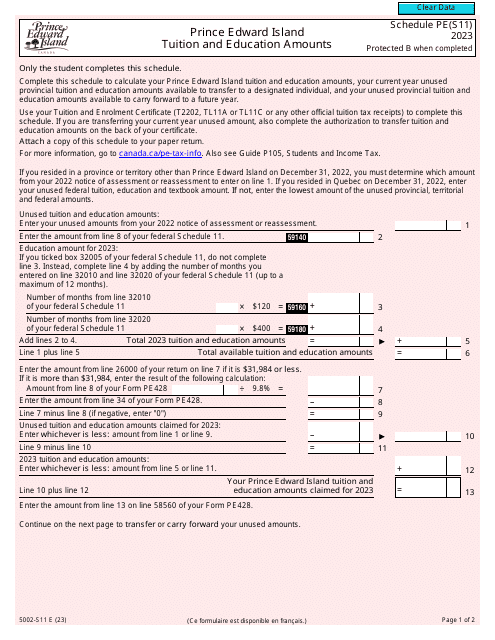

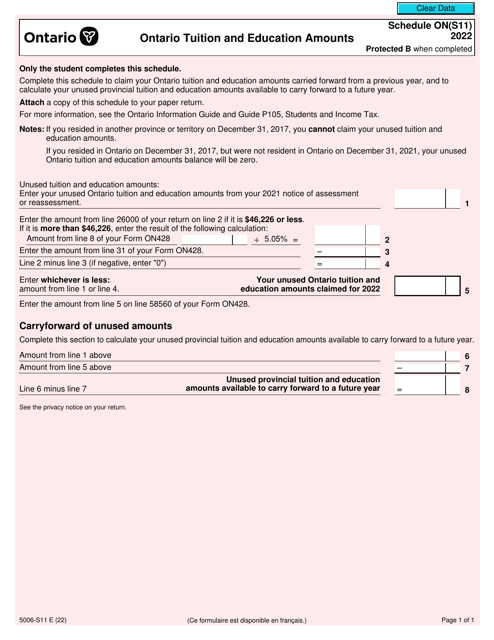

This Form is used for reporting provincial tuition and education amounts in Ontario. It is specifically designed in large print format for the convenience of Canadian taxpayers.