Canadian Federal Legal Forms and Templates

Documents:

5112

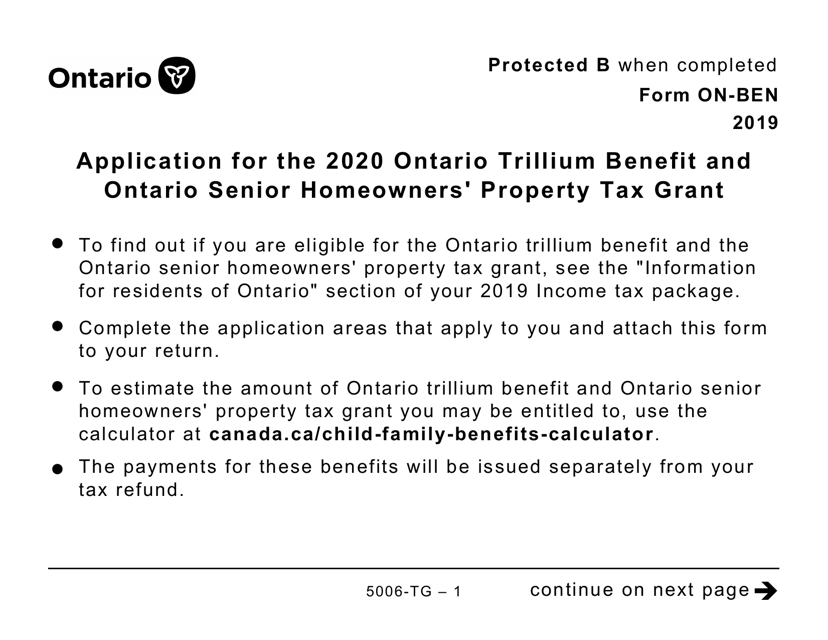

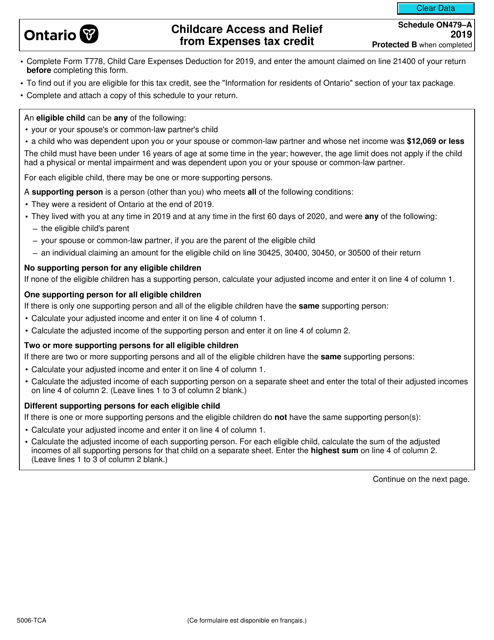

This Form is used for claiming the Childcare Access and Relief From Expenses Tax Credit (CARE) in Canada. It is specifically for residents of Ontario (ON479-A).

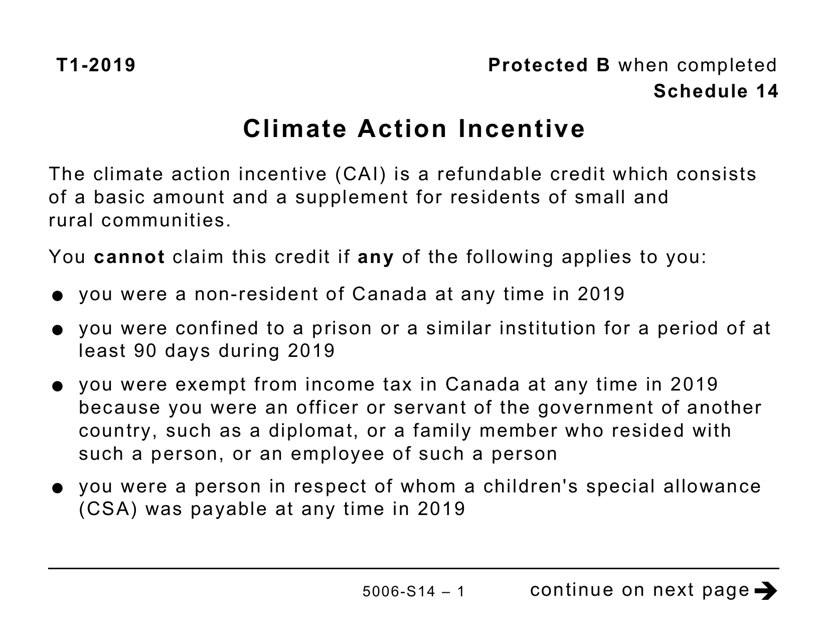

This form is used for Schedule 14 Climate Action Incentive in Ontario, Canada. It is available in a large print format.

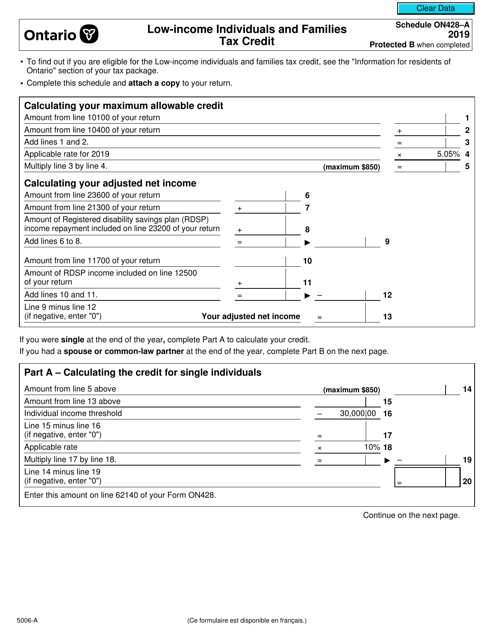

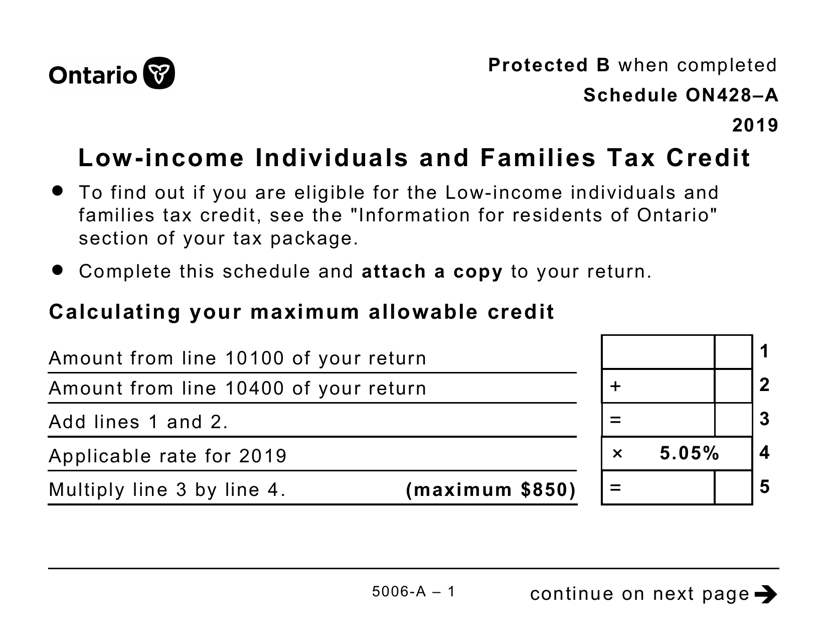

This form is used for claiming the Low-Income Individuals and Families Tax Credit in Canada. It is a schedule that needs to be filled out and submitted along with Form 5006-A. This tax credit is designed to provide financial assistance to individuals and families with low incomes.

This form is used for claiming the Low-Income Individuals and Families Tax Credit in Canada. It is specifically designed for individuals who have low income. The form is available in large print format for easier reading and accessibility.

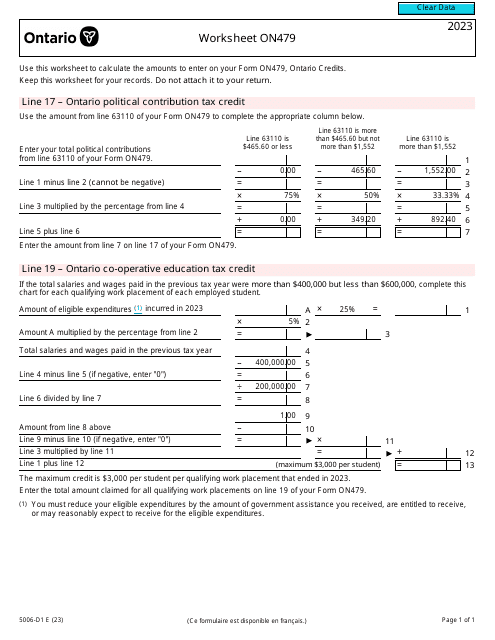

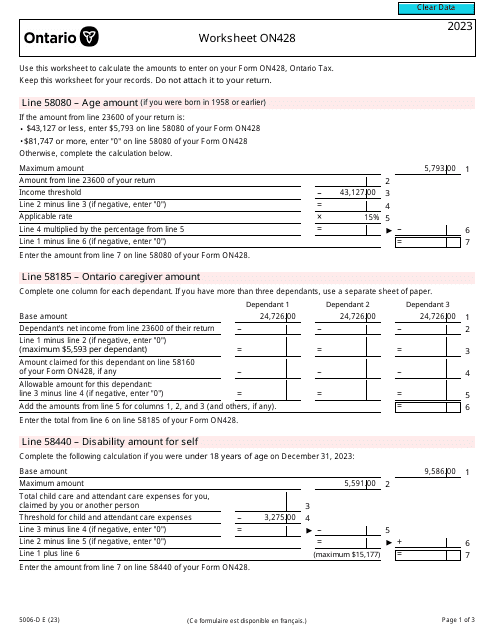

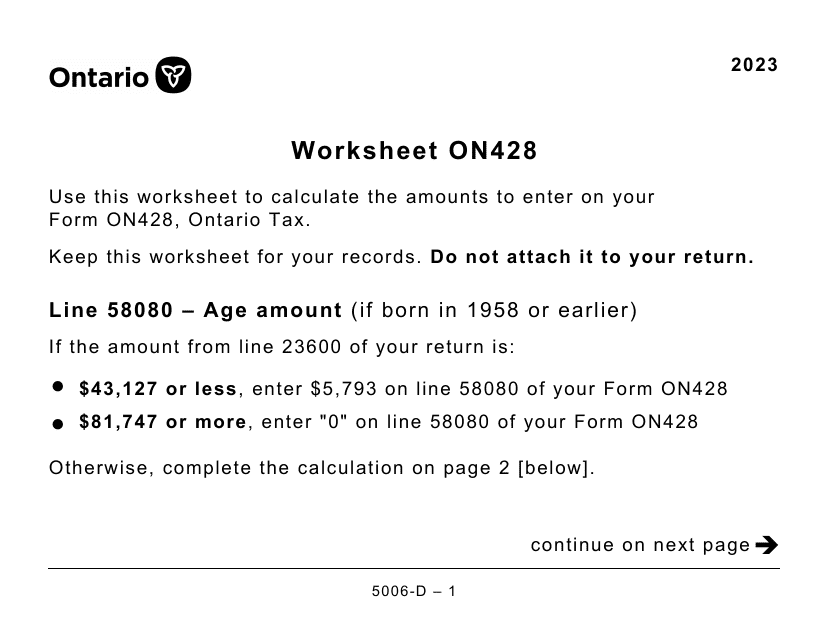

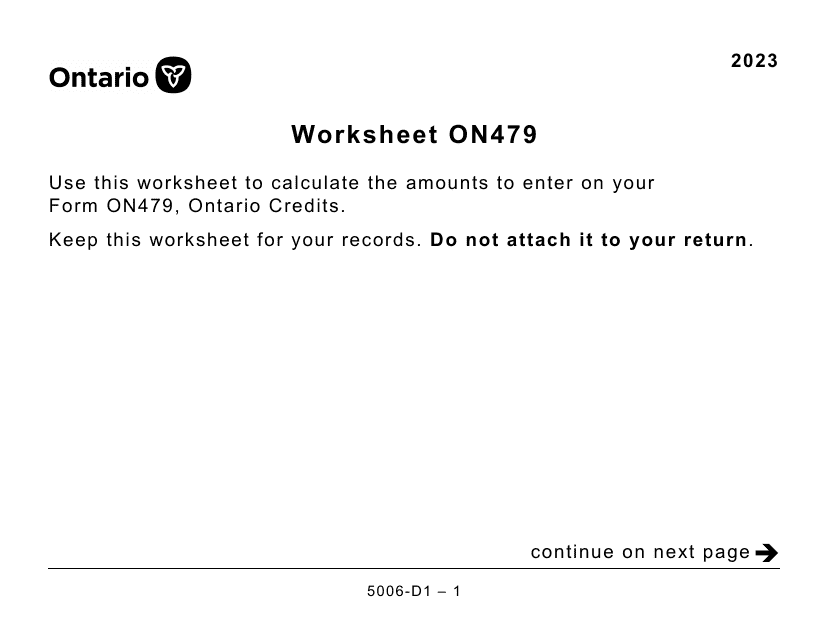

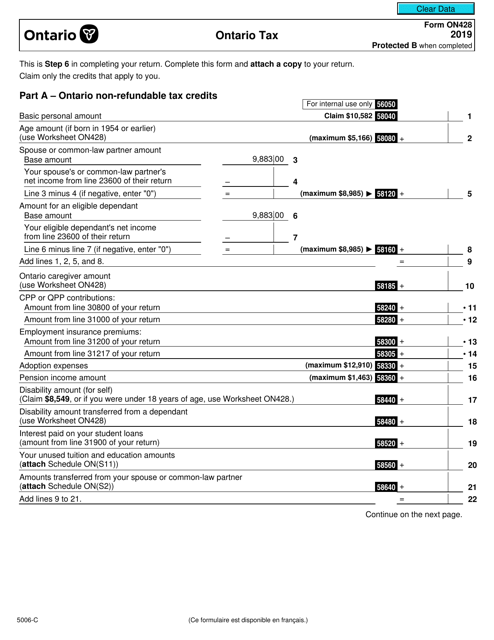

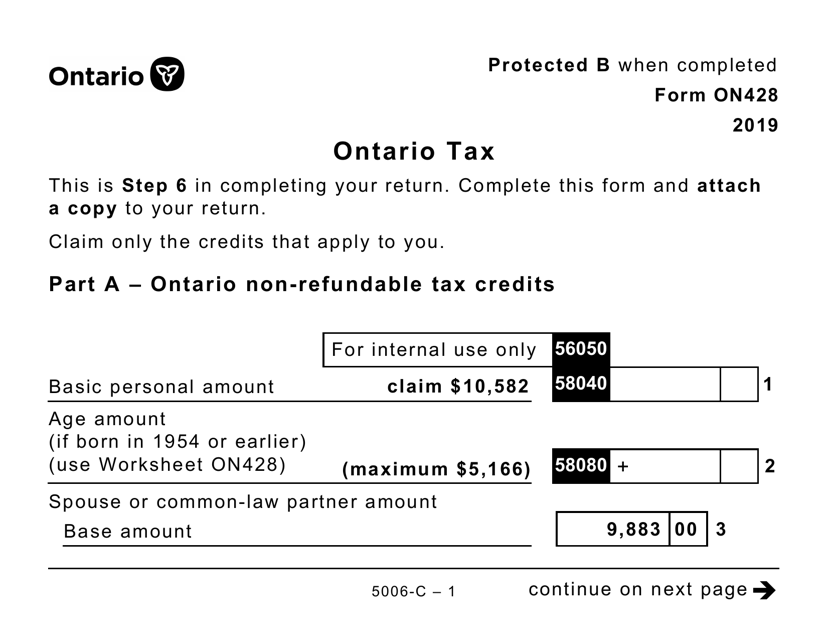

This Form is used for reporting Ontario tax information to the Canada Revenue Agency (CRA).

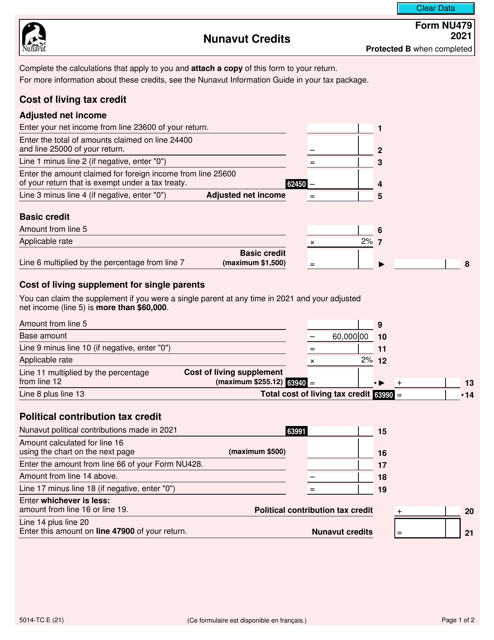

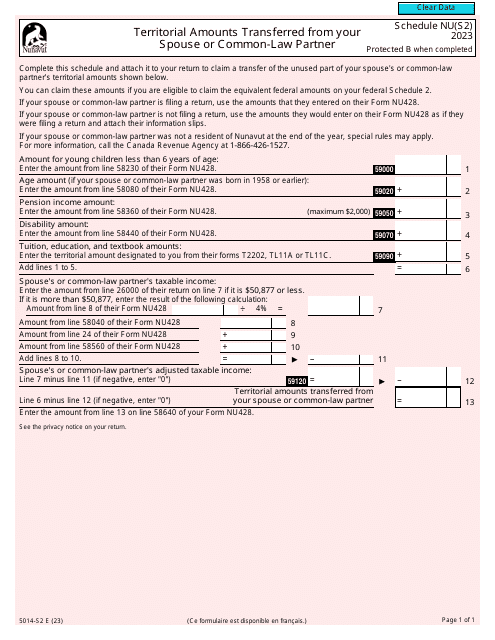

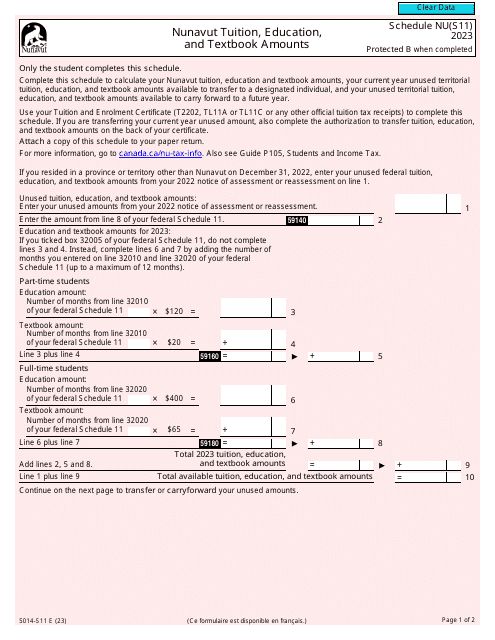

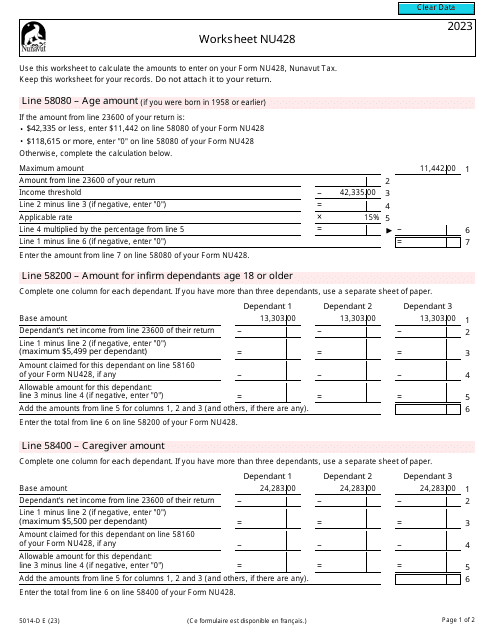

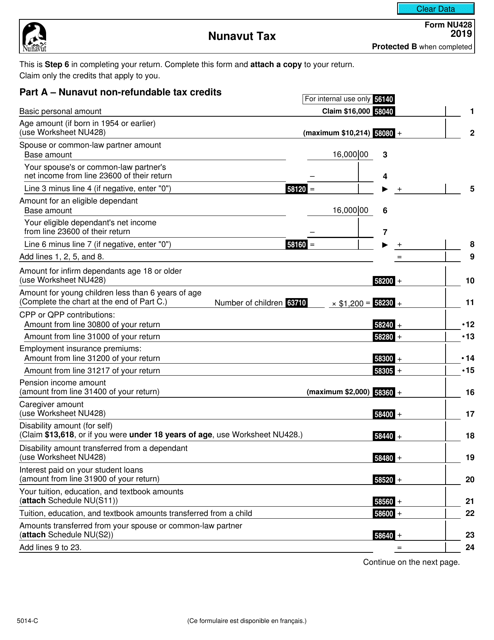

This form is used for filing taxes in the territory of Nunavut, Canada.

This document is a large print version of Form ON428 (5006-C), which is used for filing taxes in the province of Ontario, Canada.

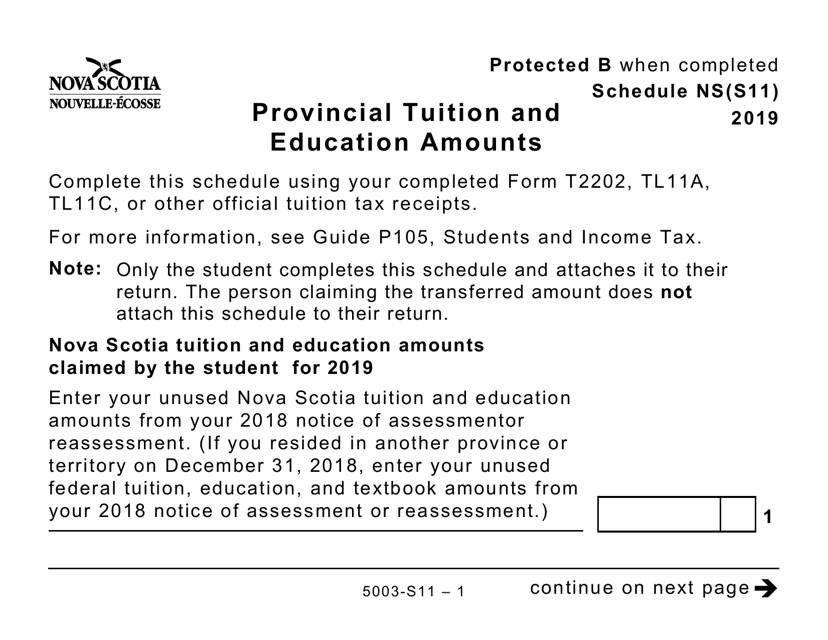

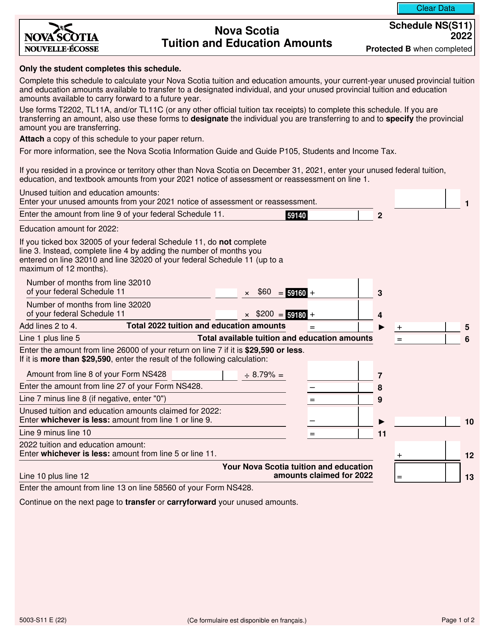

This form is used for reporting provincial tuition and education amounts specific to Nova Scotia in a large print format. It is applicable for residents of Canada.

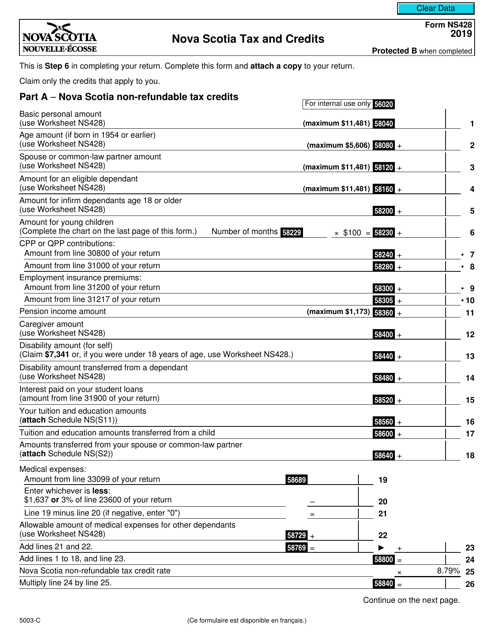

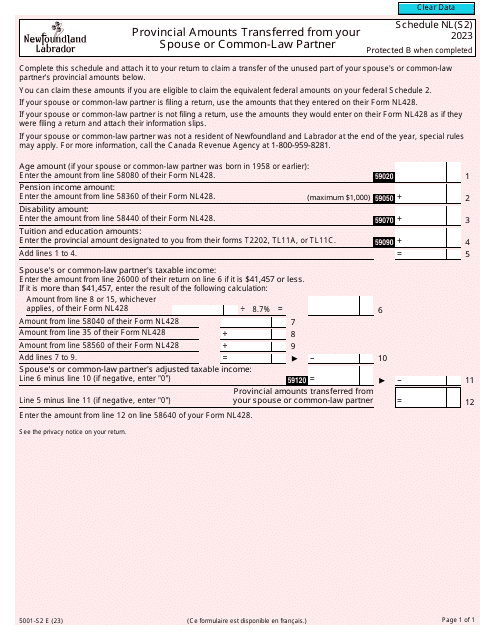

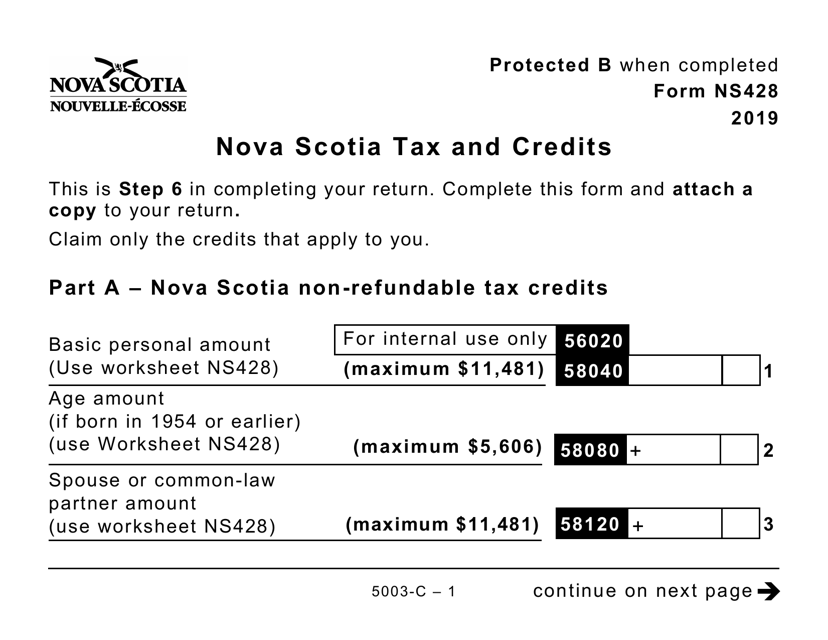

This form is used for reporting and claiming tax credits in Nova Scotia, Canada. It is specific to residents of Nova Scotia and helps calculate their provincial tax liabilities and determine any eligible credits they may be entitled to.

This form is used for reporting Nova Scotia tax and credits in a large print format for residents of Canada.

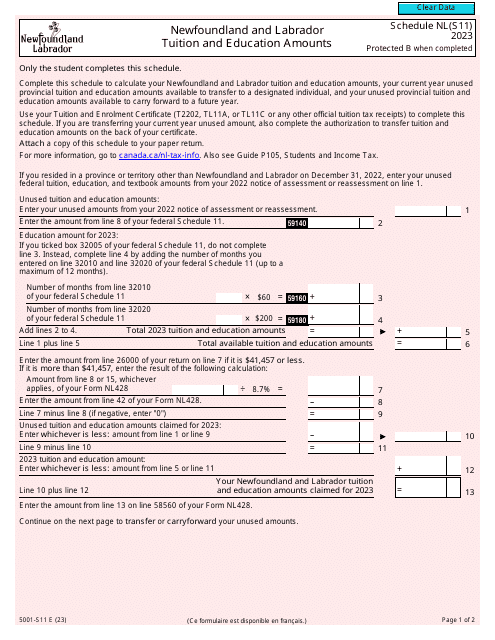

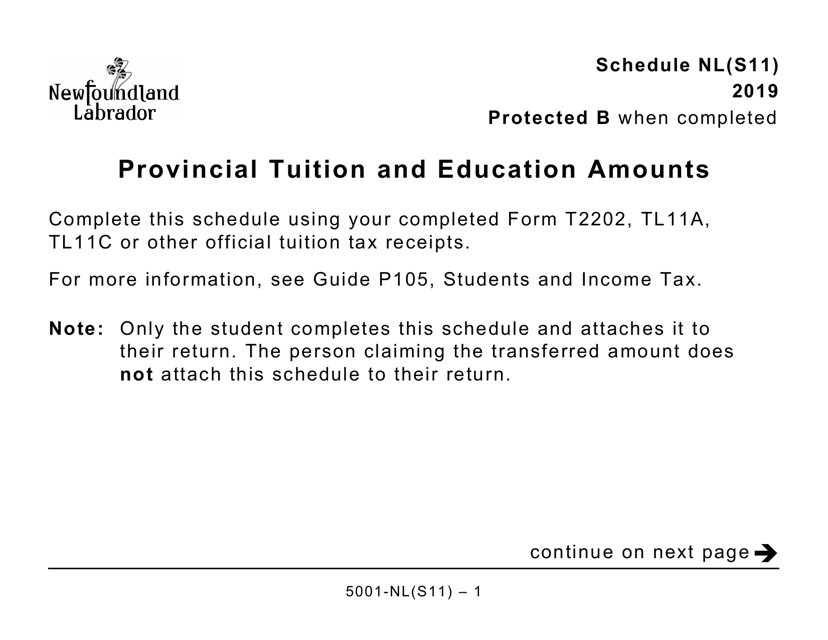

Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2019

This document is used for reporting provincial tuition and education amounts on Schedule NL(S11) in Canada. It is available in large print format.

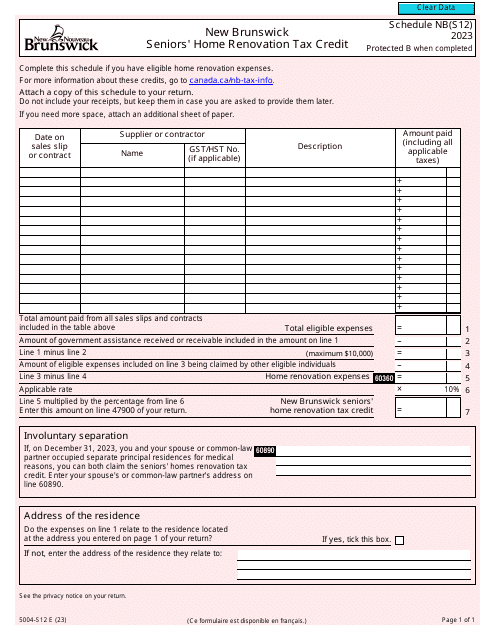

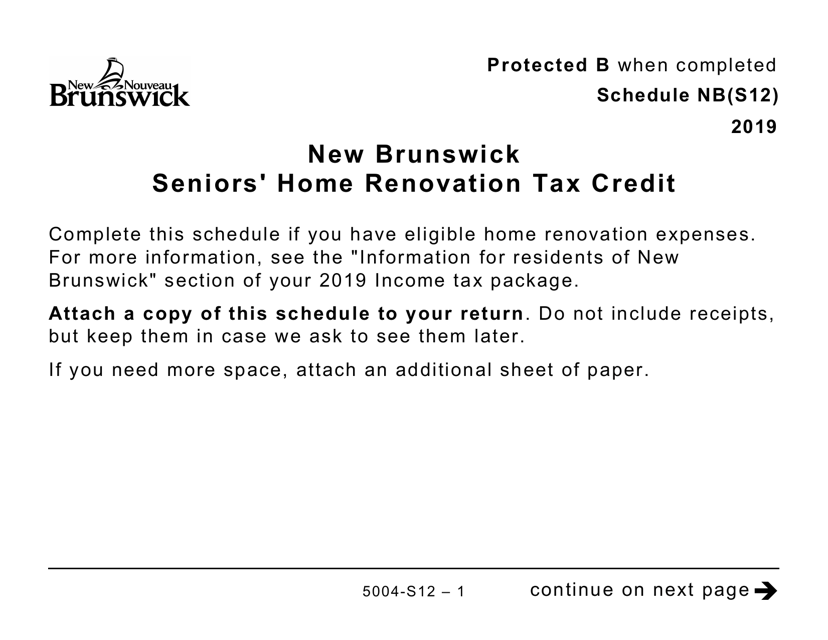

This form is used for claiming the New Brunswick Seniors' Home Renovation Tax Credit in large print format for residents of Canada.