Canadian Federal Legal Forms and Templates

Documents:

5112

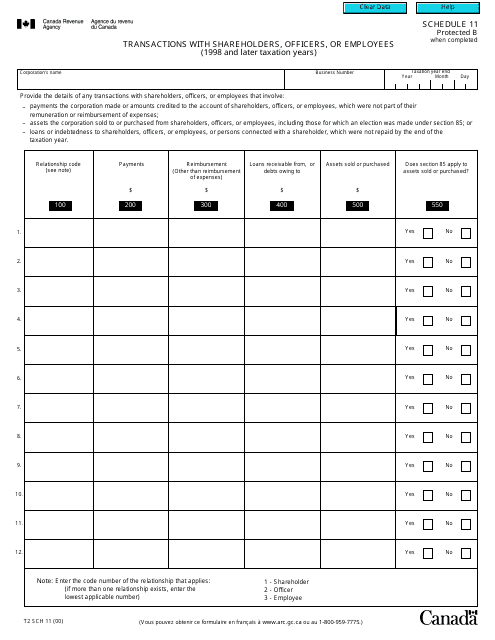

This Form is used for reporting transactions between shareholders, officers, or employees of a company during the taxation years of 1998 and later in Canada.

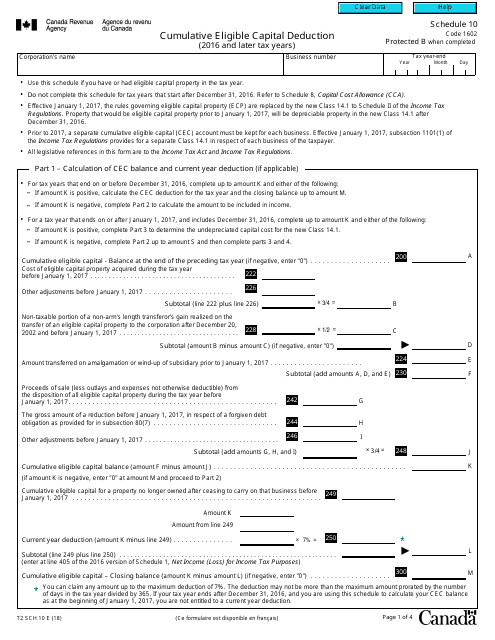

This form is used for claiming the cumulative eligible capital deduction on the T2 corporate tax return in Canada for the 2016 and later taxation years.

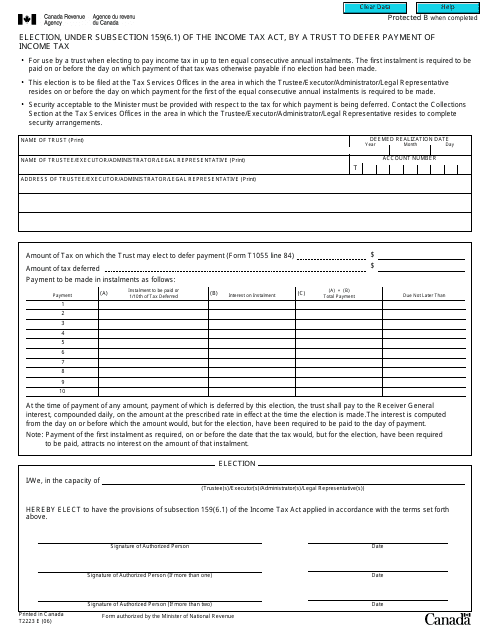

This form is used by a trust in Canada to make an election under subsection 159(6.1) of the Income Tax Act. It allows the trust to defer the payment of income tax.

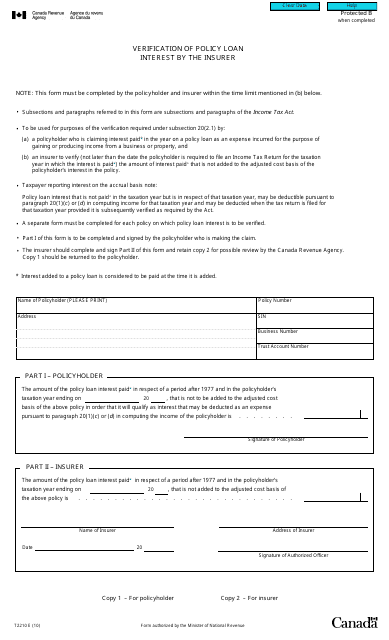

This form is used for verifying policy loan interest by the insurer in Canada. It ensures transparency and accuracy in reporting policy loan interest to the tax authorities.

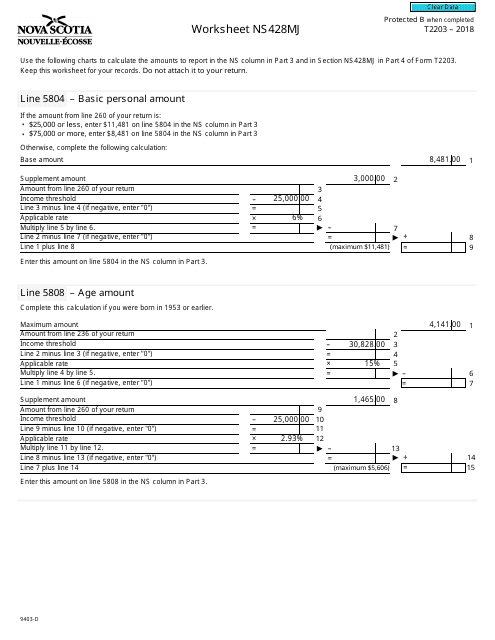

This form is used for completing the Worksheet Ns428mj as part of the T2203 (9403-D) tax filing process in Canada.

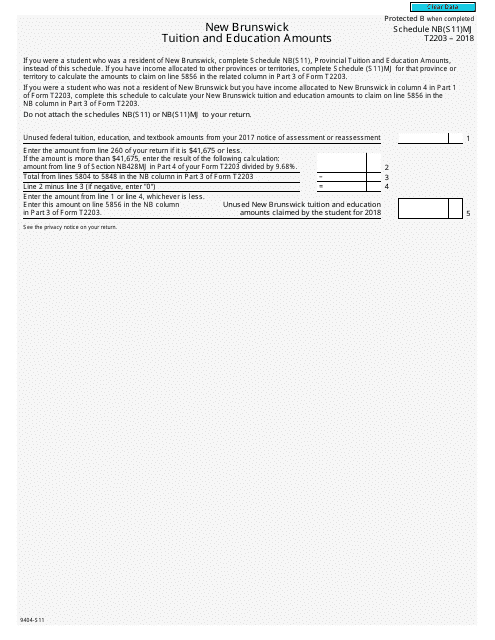

This form is used for claiming tuition and education amounts in the province of New Brunswick, Canada.

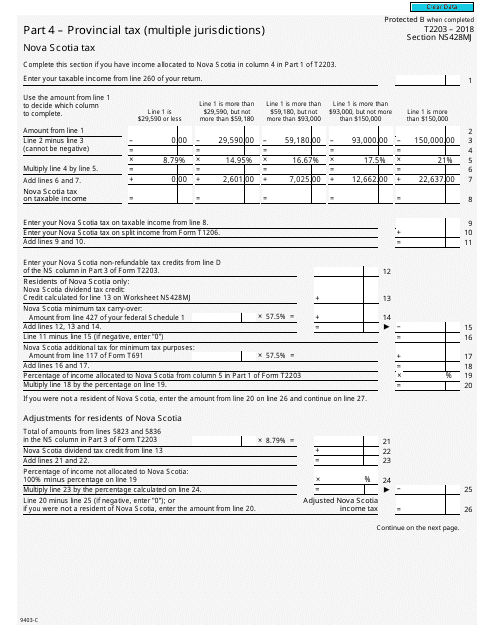

This form is used for reporting provincial tax information in multiple jurisdictions, specifically for Nova Scotia tax in Canada.

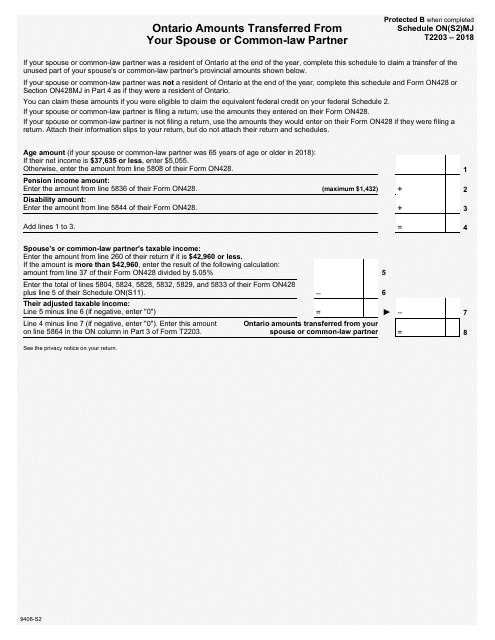

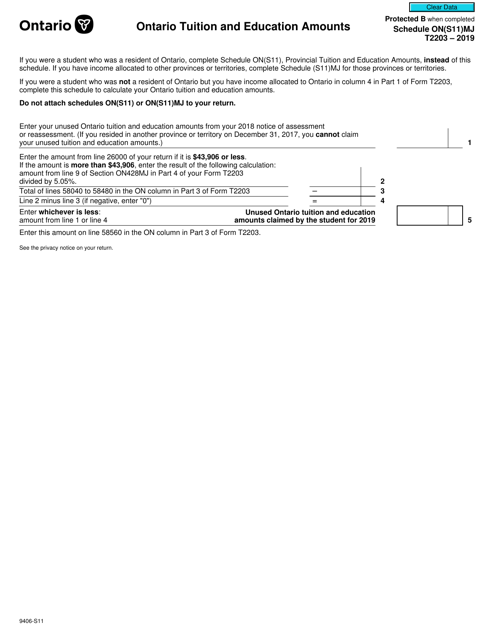

This form is used for reporting the amounts transferred from your spouse or common-law partner on your income tax return. It is specific to the province of Ontario in Canada.

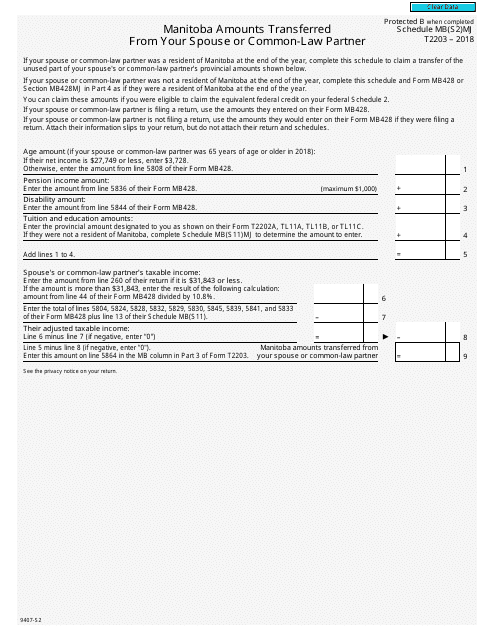

This form is used for reporting the amounts transferred from your spouse or common-law partner for tax purposes in the province of Manitoba, Canada.

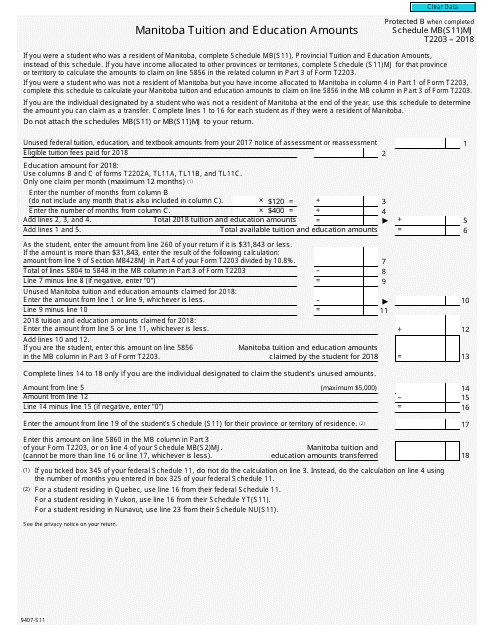

This form is used for reporting and claiming tuition and education amounts for residents of Manitoba, Canada.

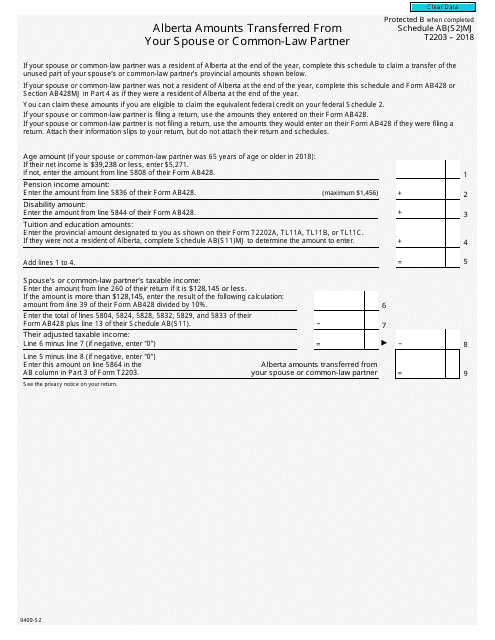

This form is used for reporting Alberta amounts transferred from your spouse or common-law partner in Canada.

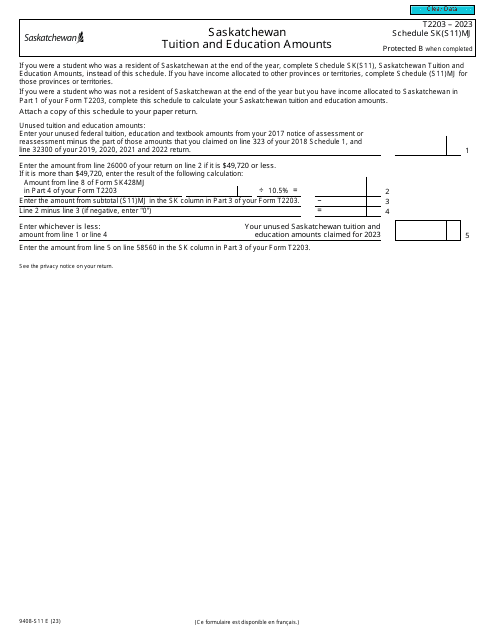

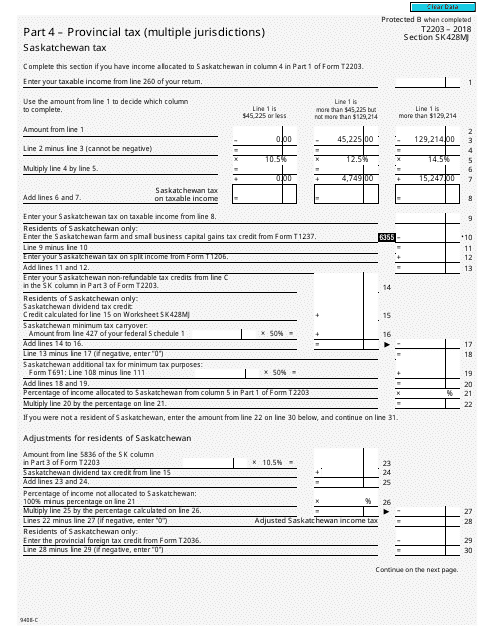

This form is used for reporting provincial tax owed in Saskatchewan, Canada. It applies to taxpayers who have tax obligations in multiple jurisdictions within the province.

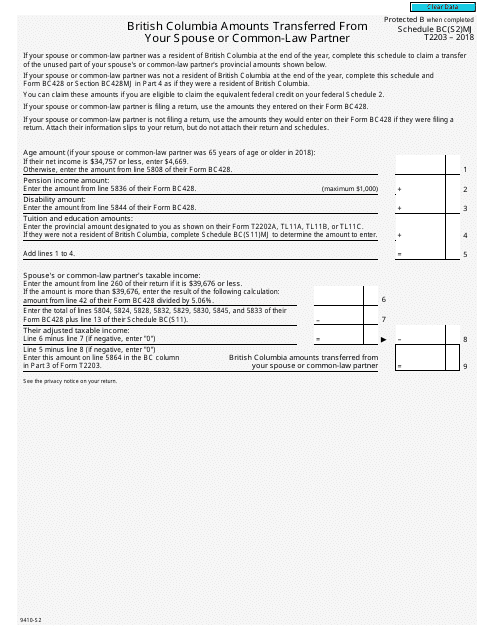

This form is used for reporting the amounts transferred from your spouse or common-law partner in British Columbia, Canada.

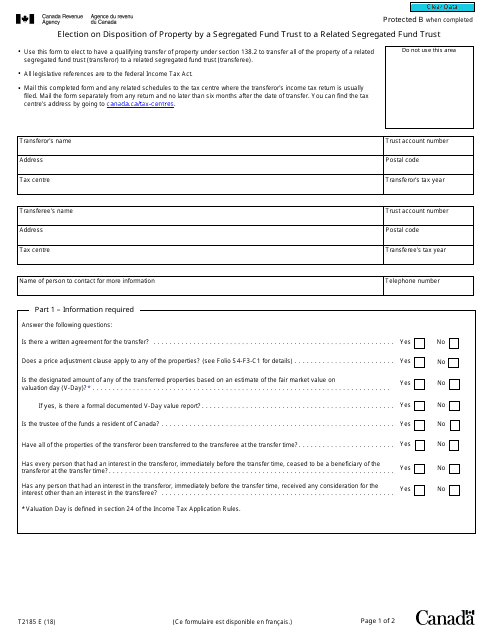

This Form is used for electing the disposition of property by a segregated fund trust to a related segregated fund trust in Canada.

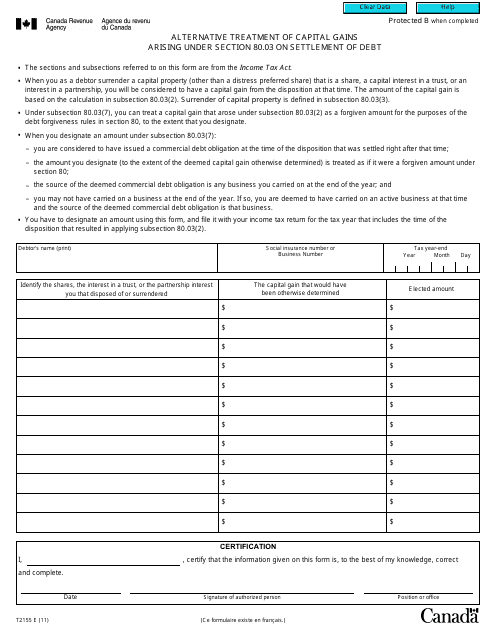

This form is used for reporting alternative treatment of capital gains that arise from the settlement of debt under Section 80.03 in Canada. It helps individuals comply with tax regulations and accurately report their capital gains.

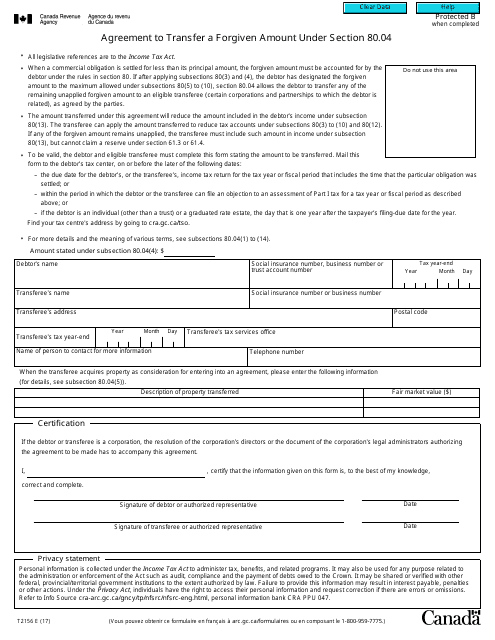

This form is used for transferring a forgiven amount under Section 80.04 in Canada.

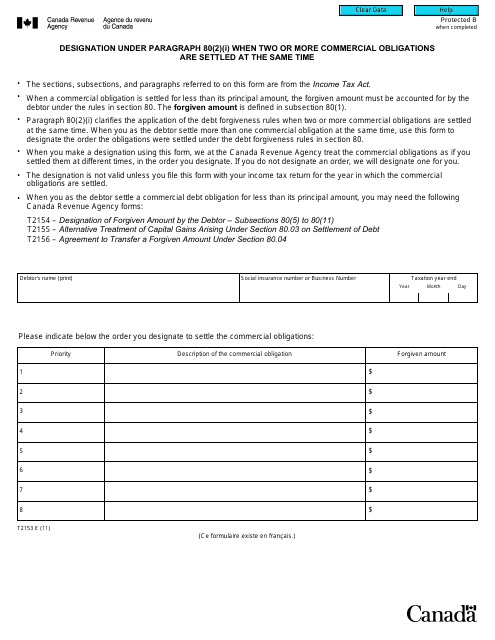

This form is used for designating under paragraph 80(2)(i) when two or more commercial obligations are settled at the same time in Canada.

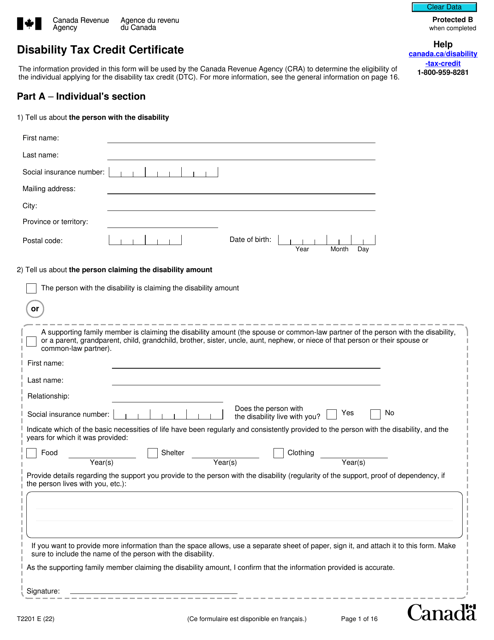

The purpose of this document is to provide the Canada Revenue Agency with information that will be enough for them to make a decision on whether an individual is eligible to receive a Disability Tax Credit.

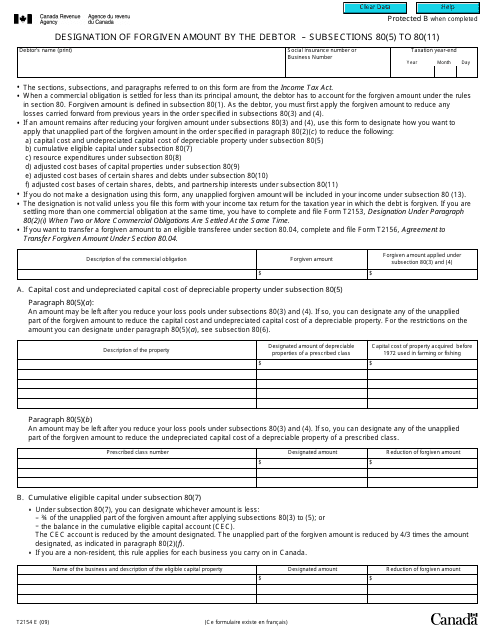

This form is used for designating the forgiven amount by the debtor under subsections 80(5) to 80(11) of the Canadian tax law.

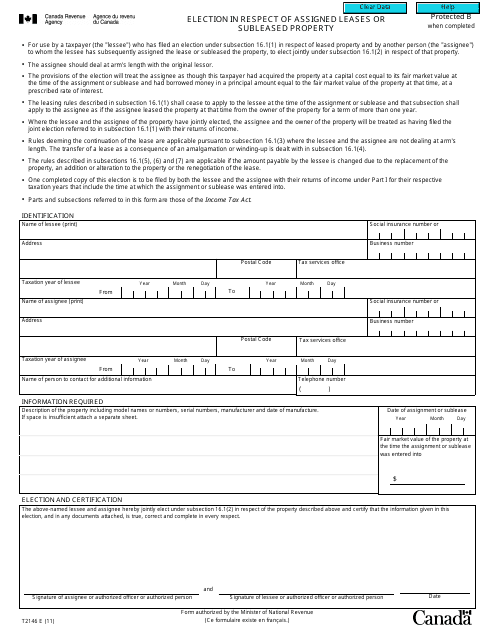

This form is used for making an election in respect of assigned leases or subleased property in Canada. It allows individuals or businesses to declare their choice regarding the tax treatment of these transactions.

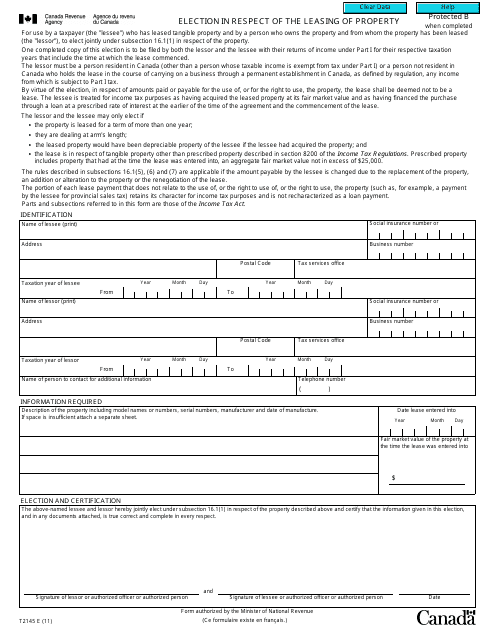

This form is used for making an election related to the leasing of property in Canada. It is used for tax purposes and allows individuals and businesses to choose how they want to report their rental income and expenses.

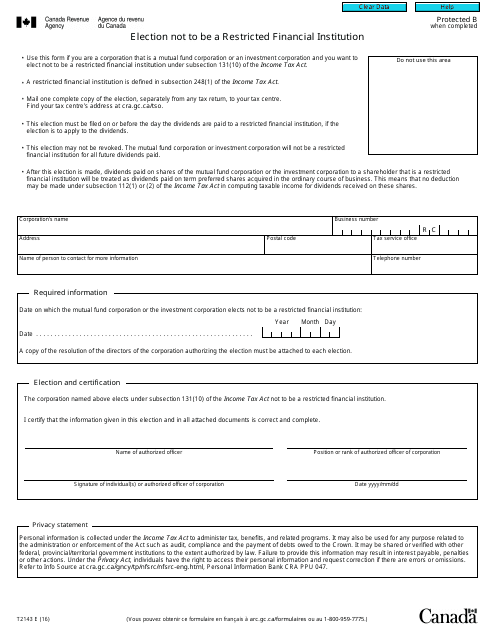

This form is used for Canadian individuals or entities to declare that they do not want to be classified as a restricted financial institution.

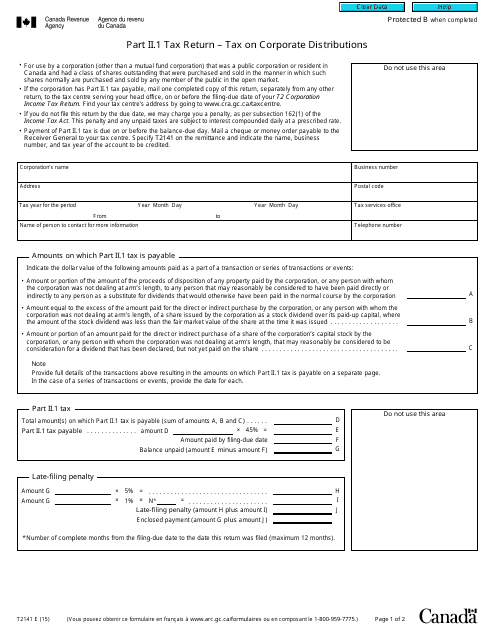

This Form is used for reporting tax on corporate distributions in Canada.

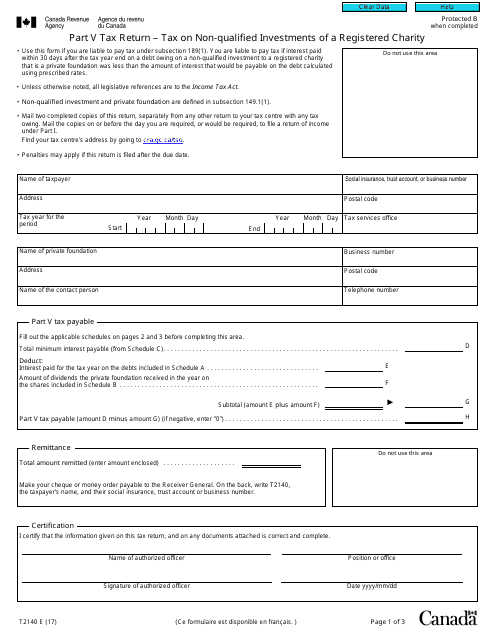

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

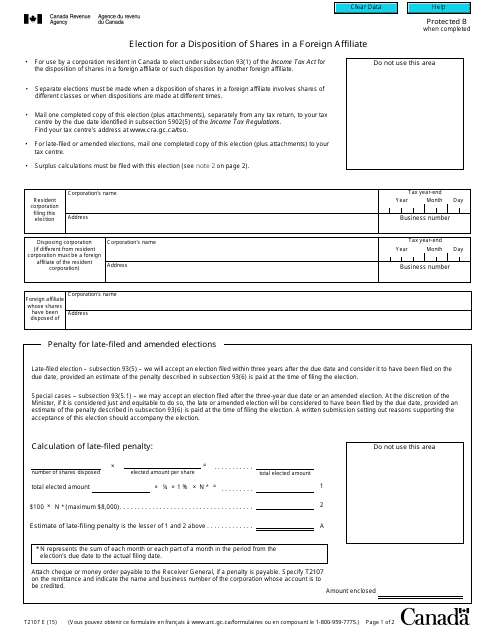

This form is used for electing how to dispose of shares in a foreign affiliate for taxpayers in Canada.

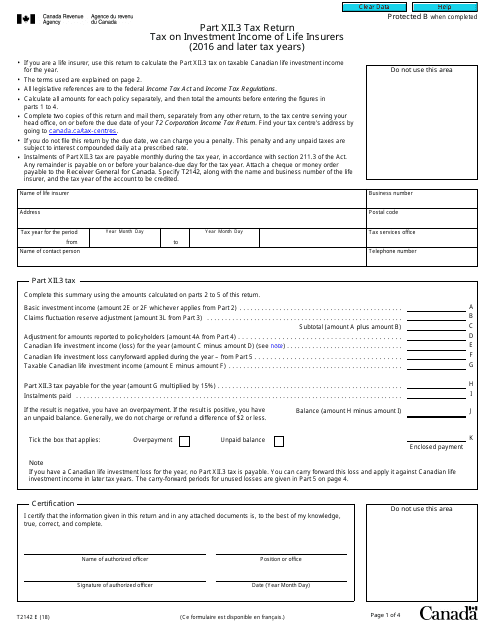

This form is used for Canadian life insurers to report and calculate tax on their investment income for tax years 2016 and later.

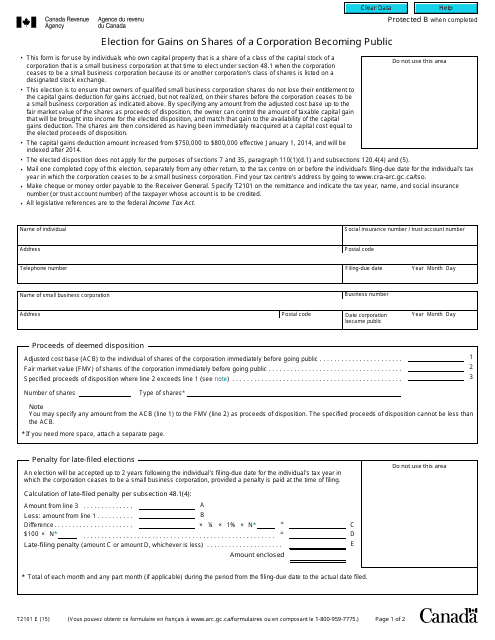

This form is used for electing gains on shares of a corporation becoming public in Canada.

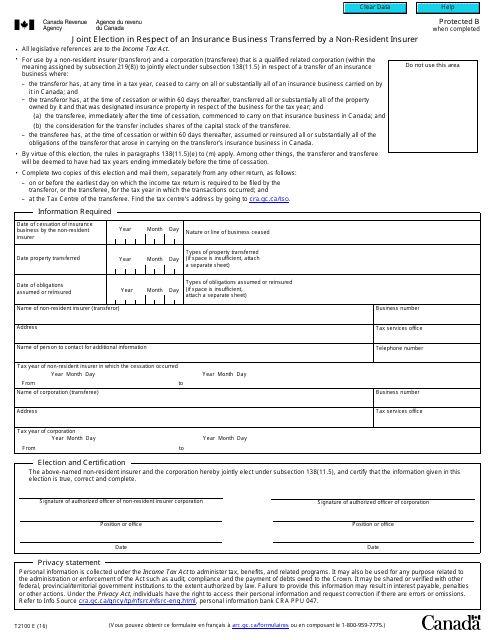

This form is used for making a joint election in Canada with respect to an insurance business transferred by a non-resident insurer.

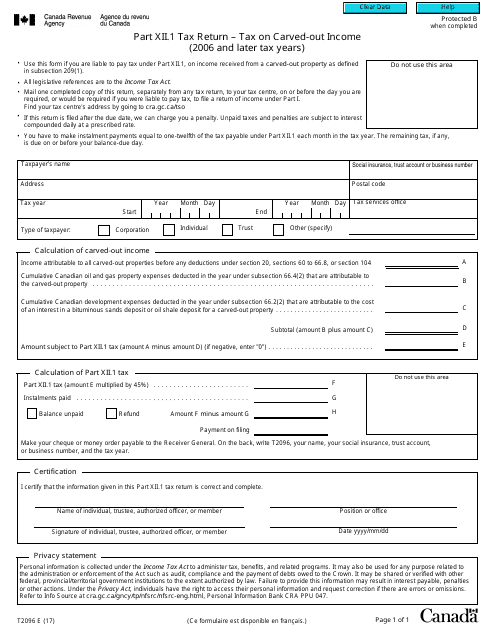

This Form is used for reporting and calculating the Tax on Carved-Out Income for the years 2006 and later. It is specific to tax reporting in Canada.

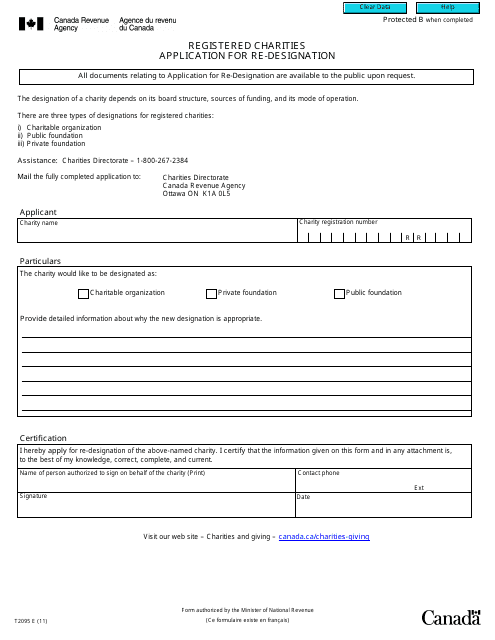

This Form is used for registered charities in Canada to apply for re-designation.

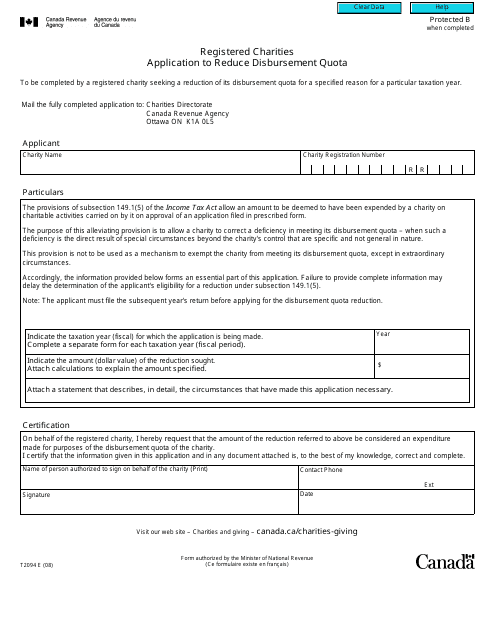

This form is used for registered charities in Canada to apply for a reduction in their disbursement quota.