Canadian Federal Legal Forms and Templates

Documents:

5112

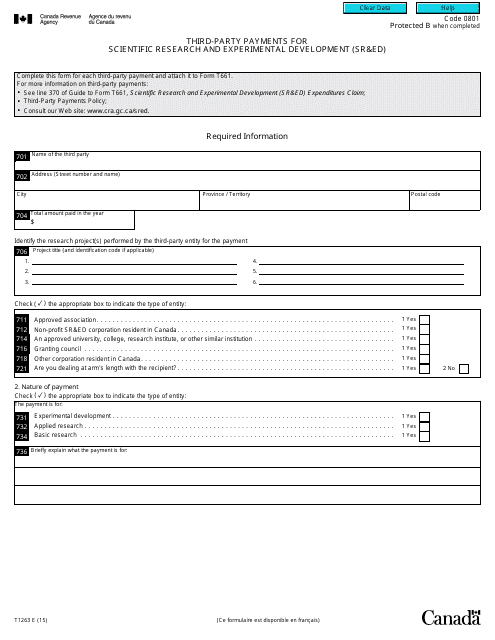

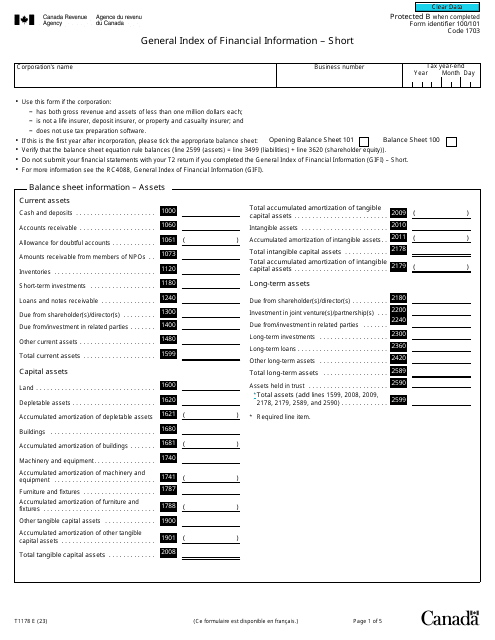

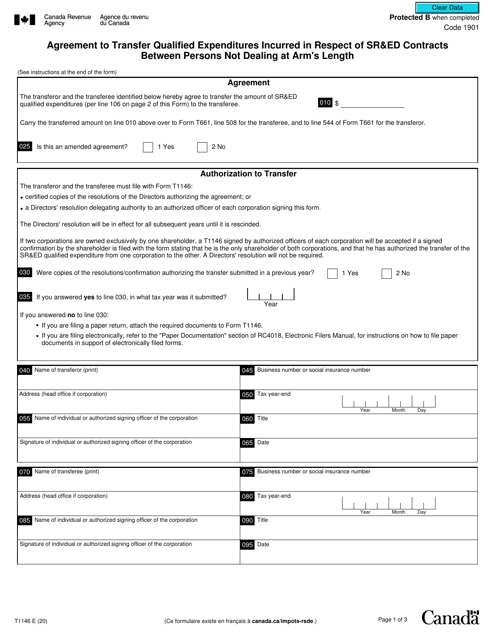

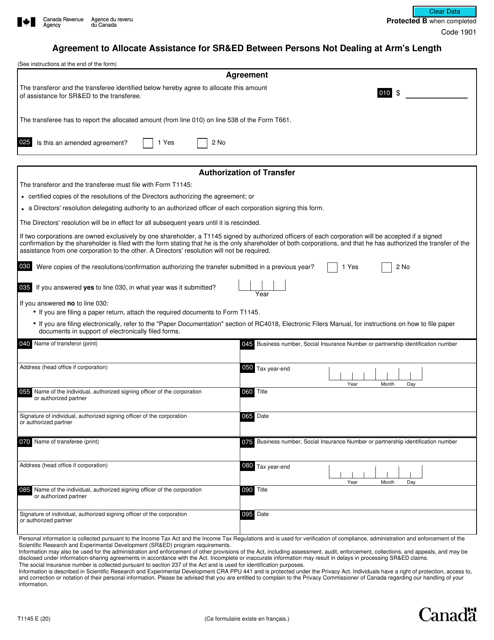

This Form is used for reporting third-party payments made for scientific research and experimental development (SR&ED) in Canada. It is necessary for organizations to complete this form to claim their tax credits for SR&ED expenditures.

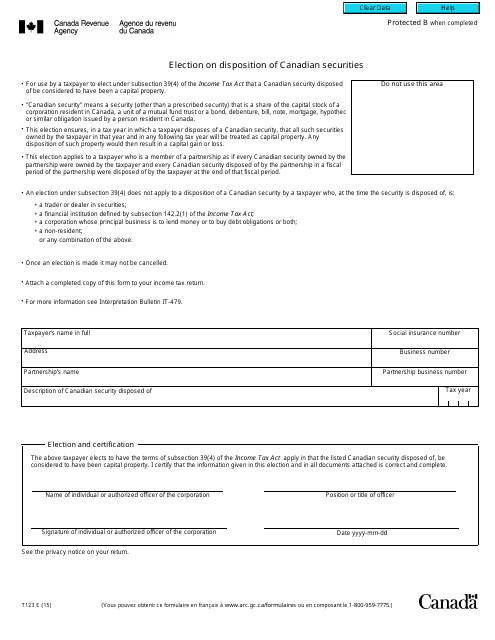

This form is used for reporting the election on the disposition of Canadian securities in Canada.

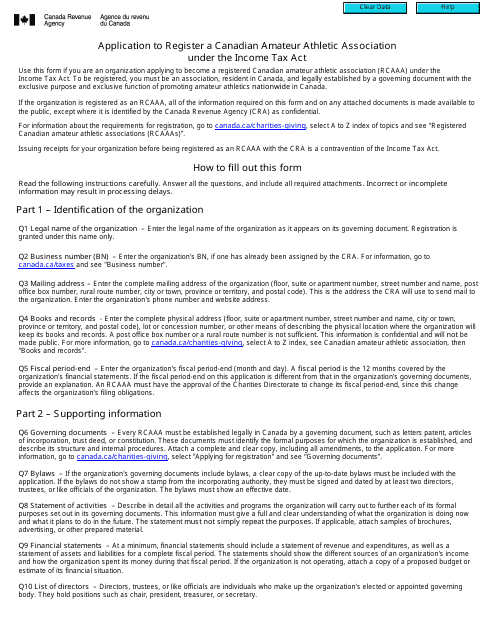

This form is used to apply for the registration of a Canadian Amateur Athletic Association (CAAA) under the Income Tax Act in Canada. The CAAA will be eligible for certain tax benefits as a registered charity.

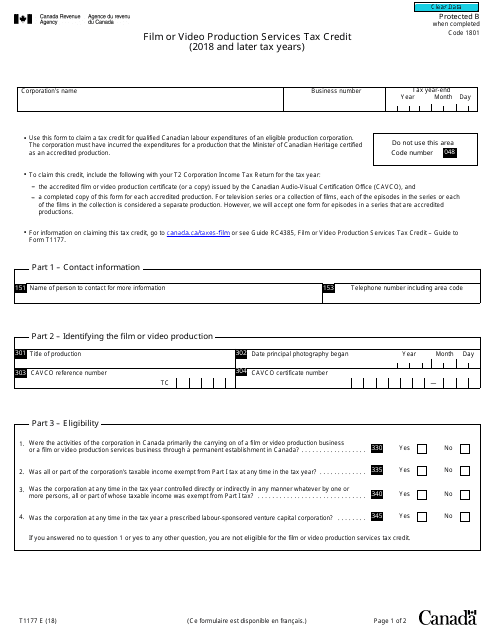

This form is used for claiming the Film or Video Production Services Tax Credit in Canada for the tax years 2018 and later.

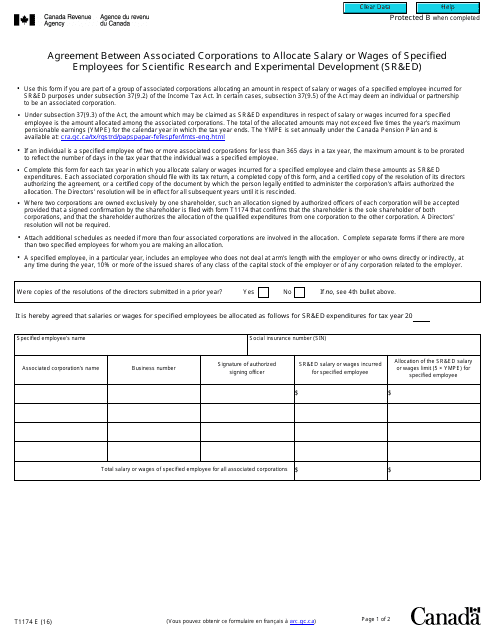

This Form is used for allocating salary or wages of specified employees for Scientific Research and Experimental Development (SR&ED) between associated corporations in Canada.

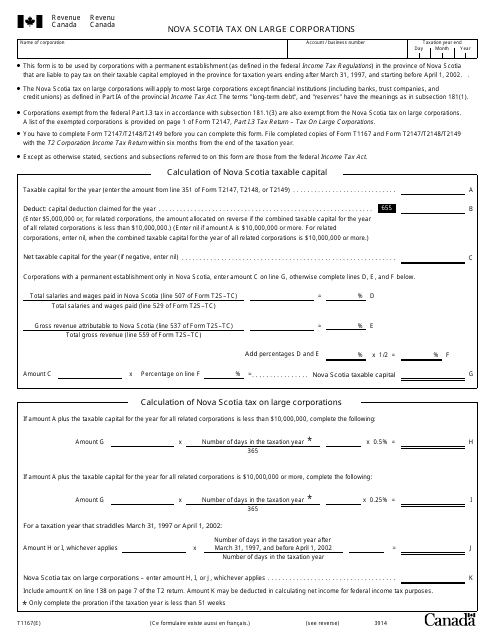

This form is used for reporting and paying the Nova Scotia Tax on Large Corporations in Canada.

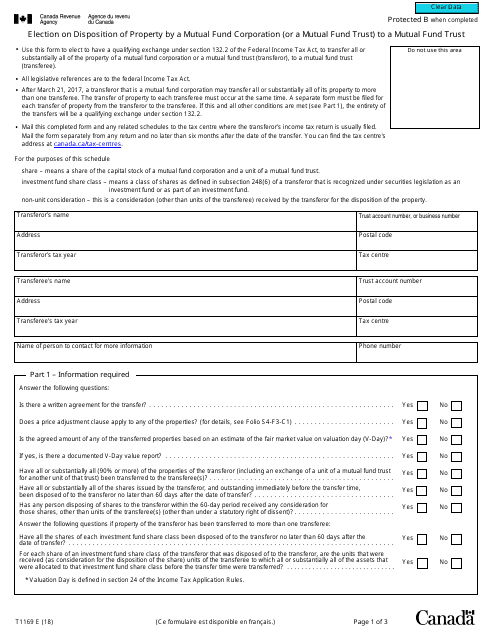

This Form is used for electing the disposition of property by a mutual fund corporation or a mutual fund trust to a mutual fund trust in Canada.

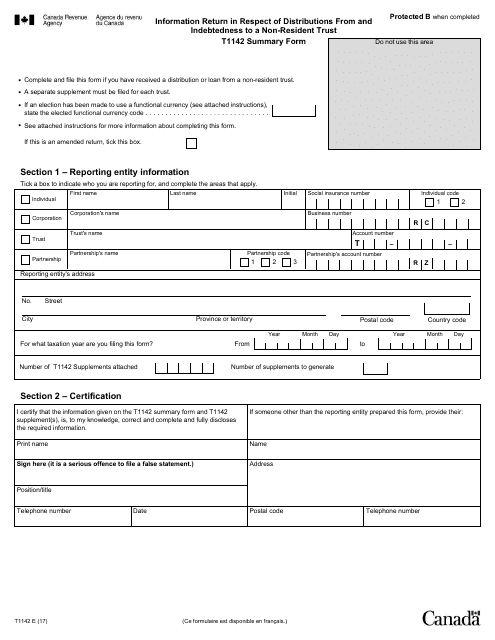

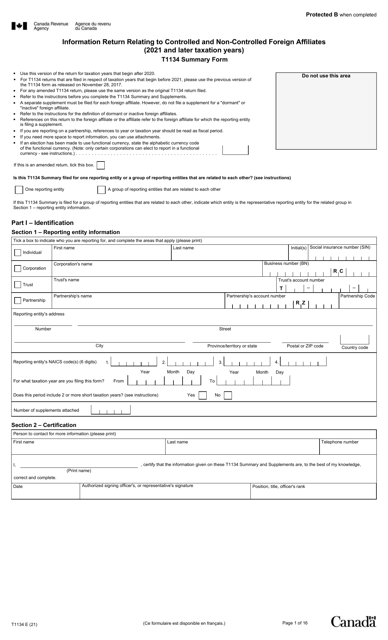

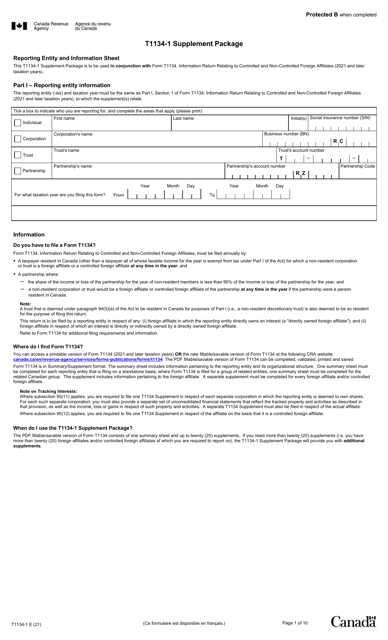

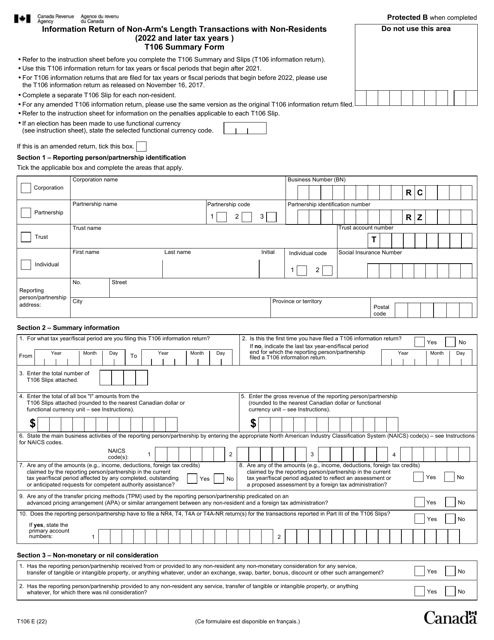

This form is used for reporting information about distributions from and debts owed to a non-resident trust in Canada. It helps ensure that the appropriate taxes are paid on these transactions.

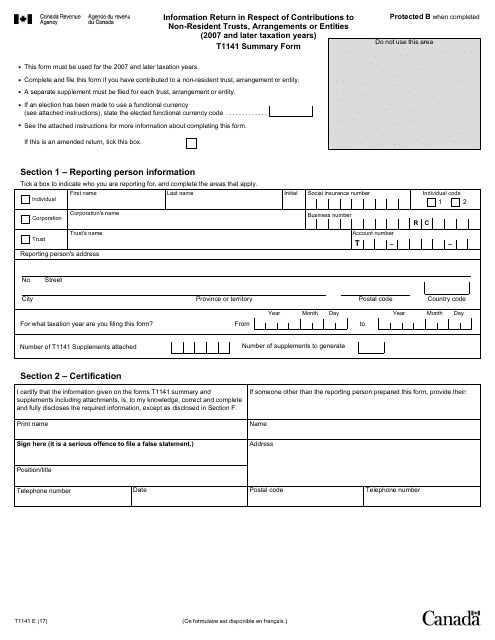

This Form is used for reporting contributions to non-resident trusts, arrangements, or entities in Canada. It is used by individuals or businesses to provide information to the Canadian government.

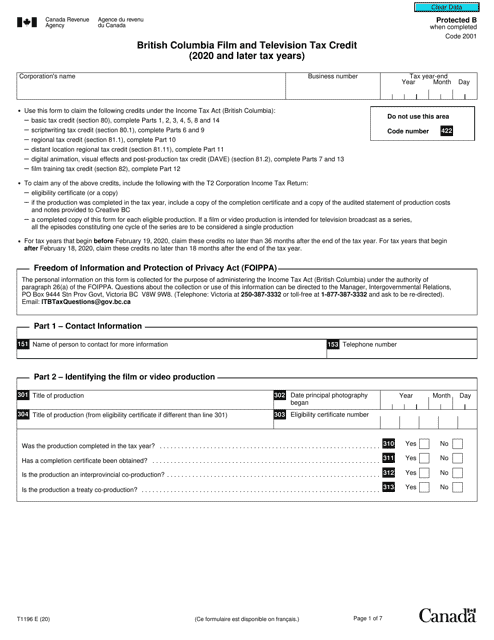

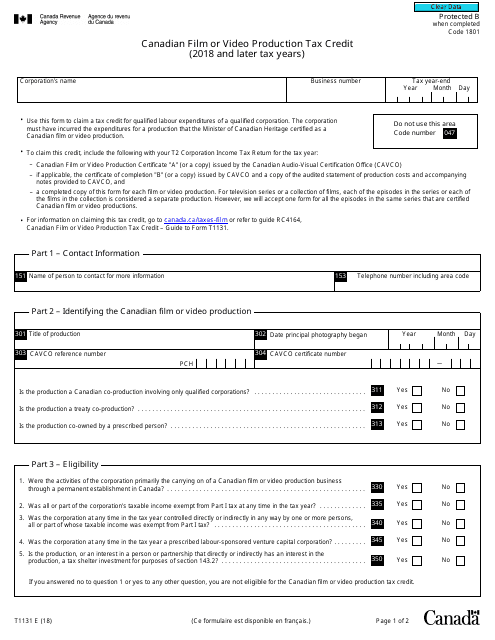

This Form is used for claiming the Canadian Film or Video Production Tax Credit for tax years 2018 and later in Canada.

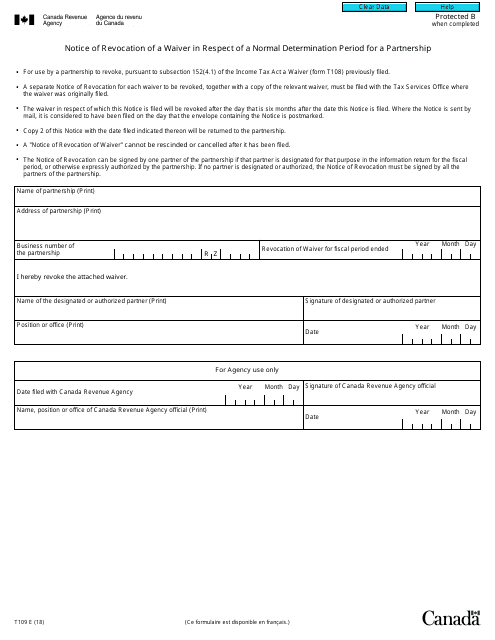

This form is used for revoking a waiver related to the determination period of a partnership in Canada. It allows for the cancellation of the previous agreement regarding the timeframe for assessing the partnership's taxes.

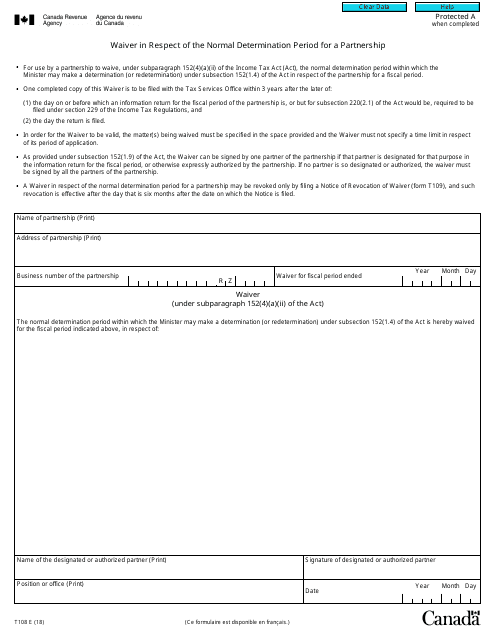

This form is used for requesting a waiver in respect of the normal determination period for a partnership in Canada. It allows for an extension of the deadline for filing partnership tax returns and related documents.

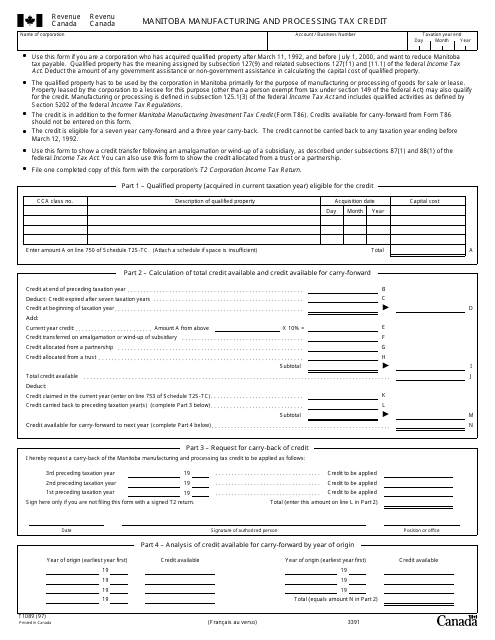

This form is used for claiming the Manitoba Manufacturing and Processing Tax Credit in Canada. It is used by individuals or businesses involved in the manufacturing and processing sector in Manitoba to claim a tax credit based on their eligible expenditures.

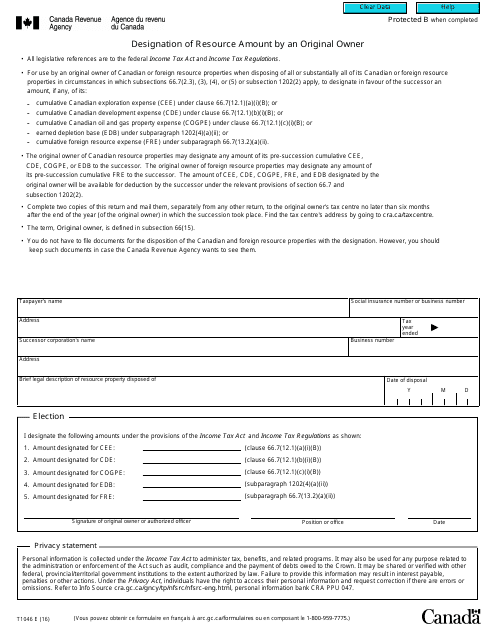

This form is used for designating the amount of resources by an original owner in Canada.

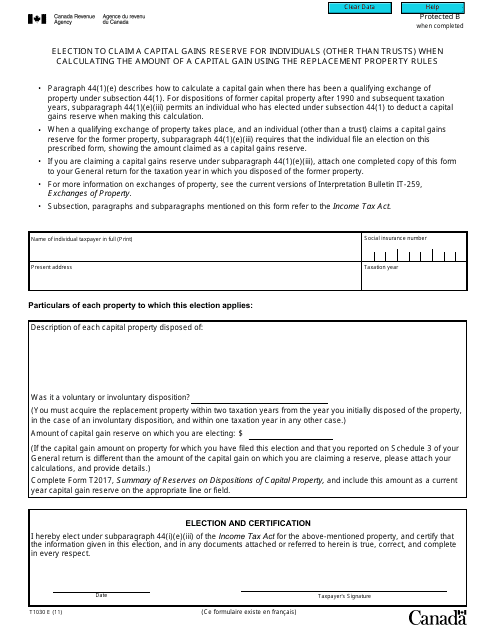

This form is used in Canada for individuals to elect to claim a capital gains reserve when calculating the amount of a capital gain using the replacement property rules.

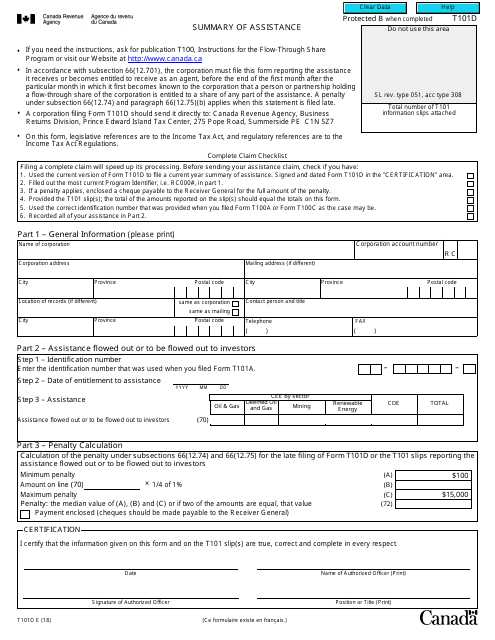

This Form is used for summarizing assistance received in Canada.

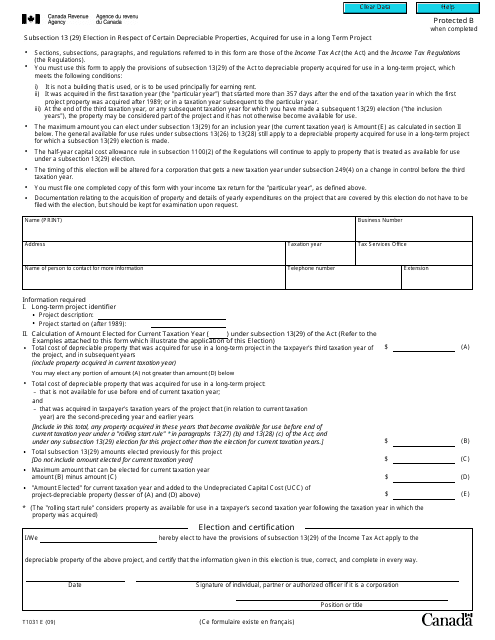

This Form is used for making an election related to the acquisition of depreciable properties for a long term project in Canada.

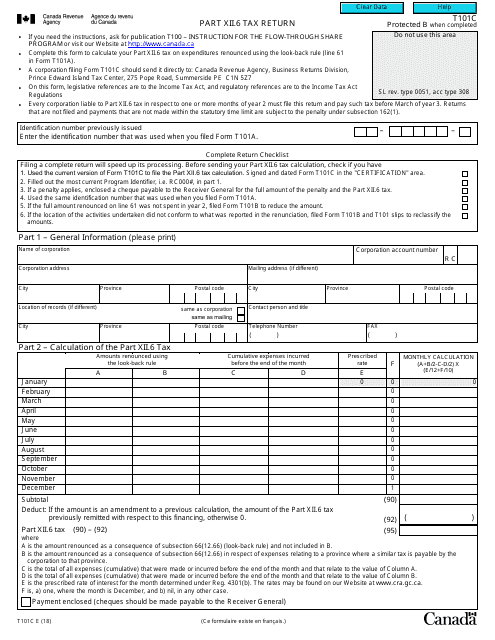

This Form is used for reporting tax returns in Canada.