Canadian Federal Legal Forms and Templates

Documents:

5112

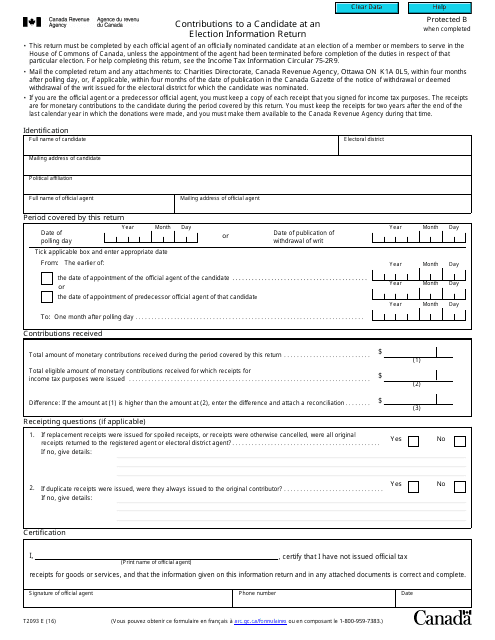

This form is used for reporting contributions made to a political candidate during an election in Canada.

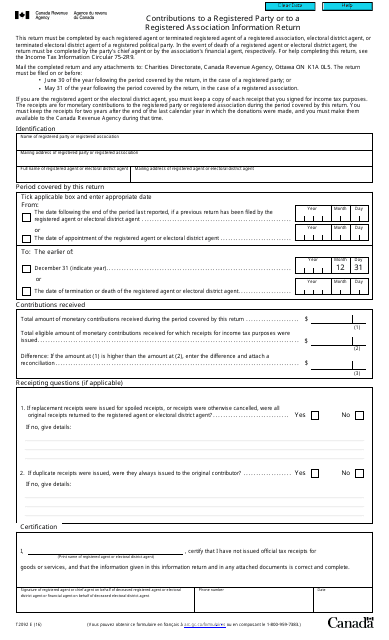

This form is used for reporting contributions to a registered political party or registered association in Canada. It provides information about the contributions made and helps ensure transparency and accountability in political fundraising.

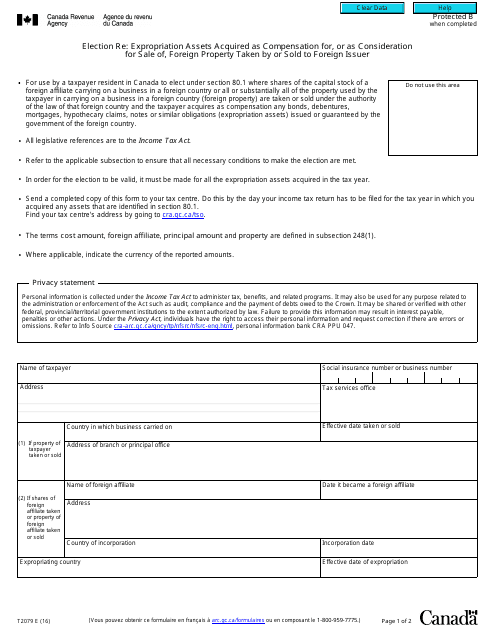

This form is used for making an election regarding the expropriation of assets acquired as compensation for or a consideration for the sale of foreign property taken by or sold to a foreign issuer in Canada.

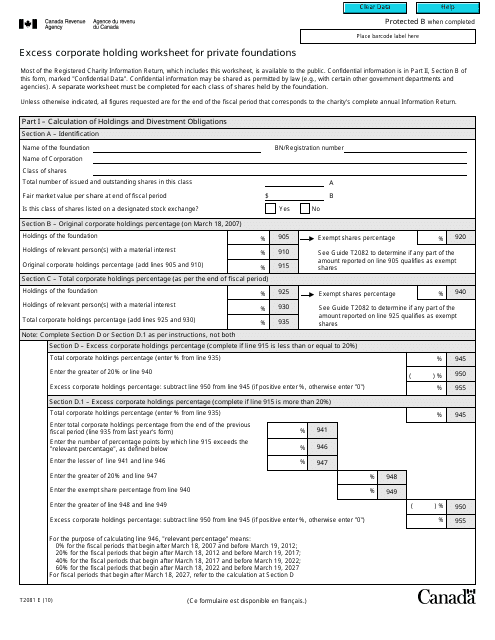

This Form is used for private foundations in Canada to calculate and report any excess corporate holdings they may have. It helps ensure compliance with regulations regarding the limits on holding shares of private corporations.

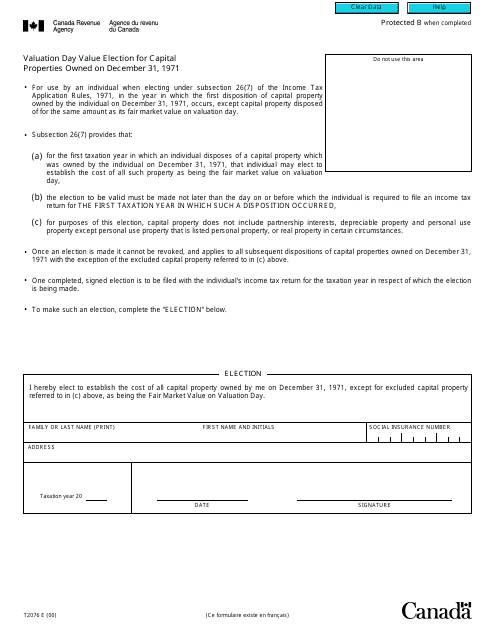

This form is used for electing the valuation day value of capital properties owned on December 31, 1971 in Canada. It is used for determining the cost base of these properties for tax purposes.

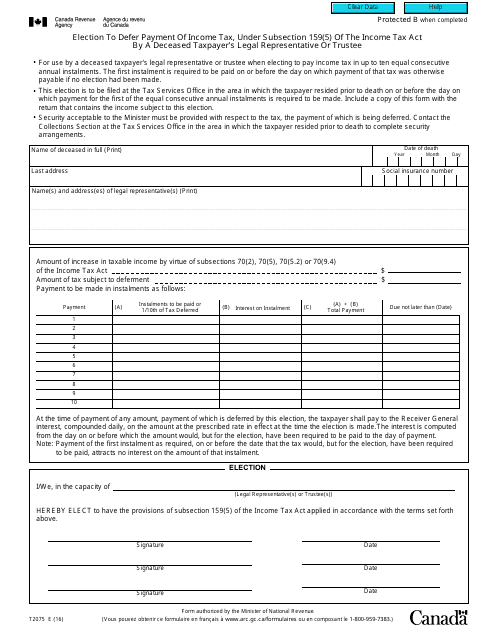

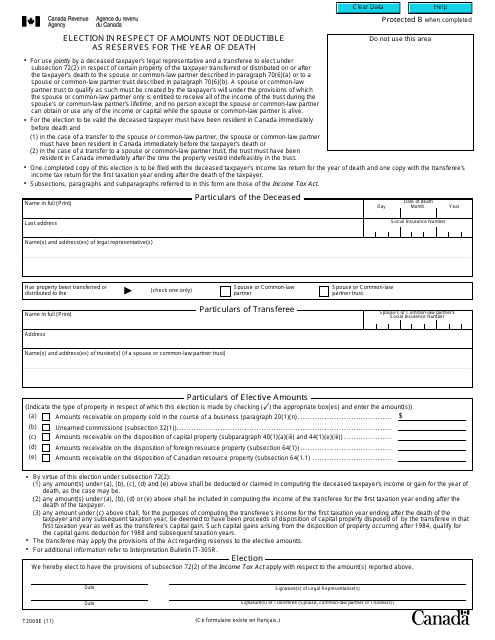

This form is used for making an election in Canada for amounts that are not deductible as reserves in the year of death.

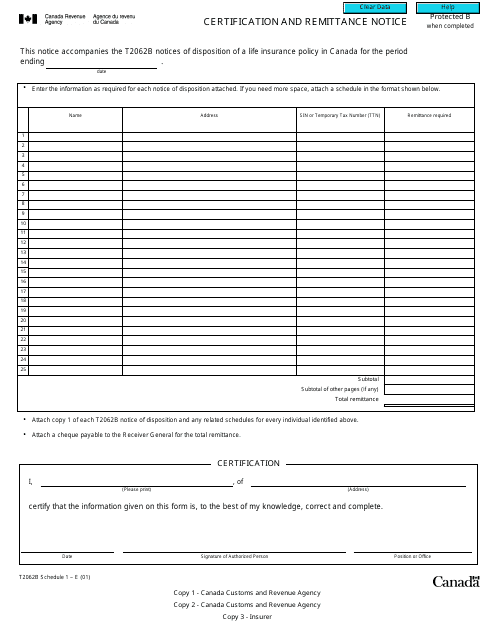

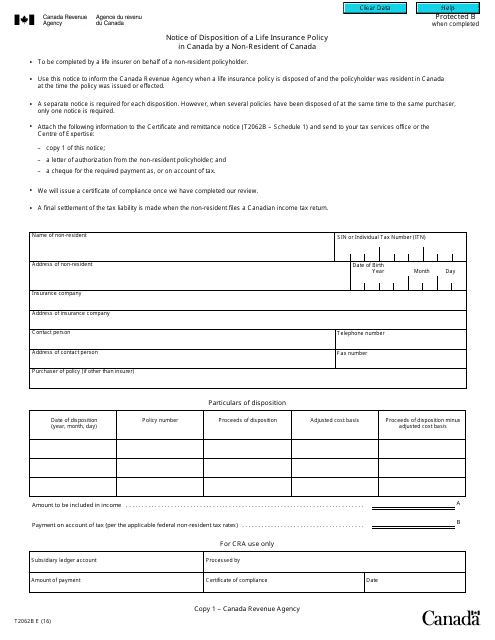

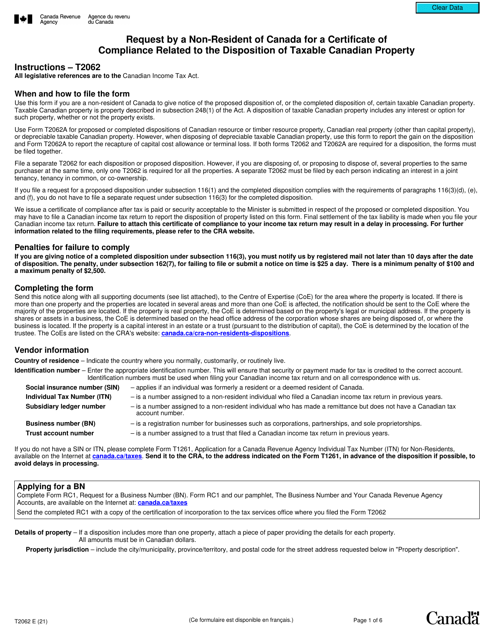

This form is used for providing certification and remittance notice as part of the T2062B process in Canada.

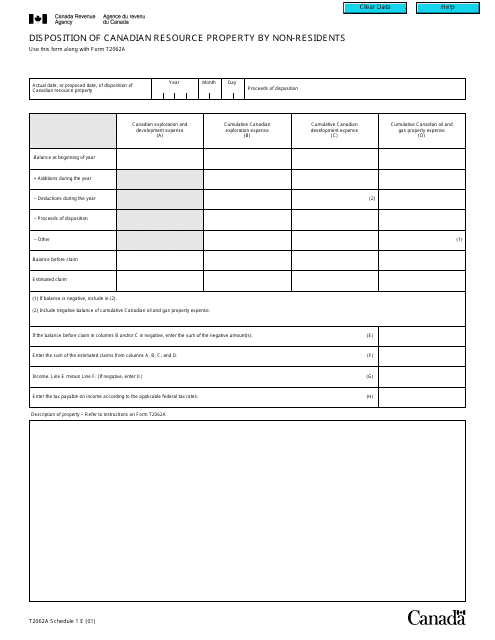

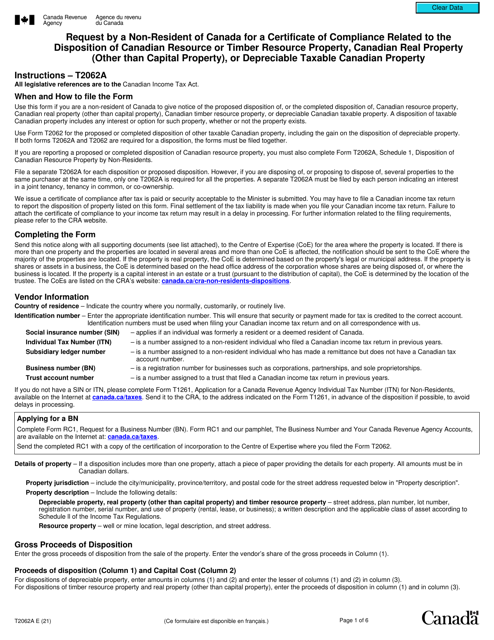

This form is used for reporting the disposition of Canadian resource property by non-residents in Canada. It provides details of the property and helps ensure compliance with Canadian tax laws.

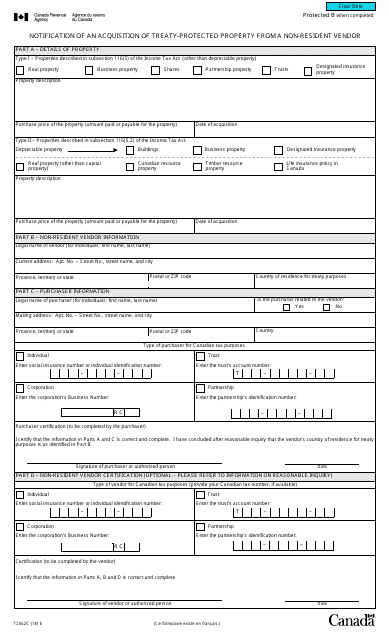

This form is used for notifying the Canadian government about the acquisition of treaty-protected property from a non-resident vendor.

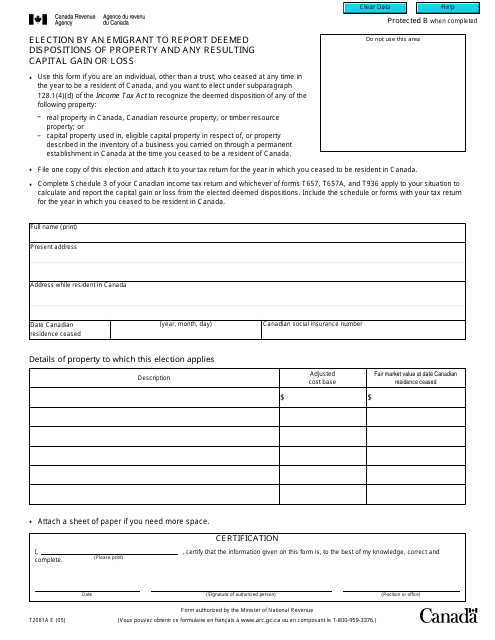

This form is used for reporting deemed dispositions of taxable Canadian property and capital gains and/or losses by individuals who have emigrated from Canada.

This form is used for non-residents of Canada to notify the Canadian government about the sale or disposition of a life insurance policy in Canada.

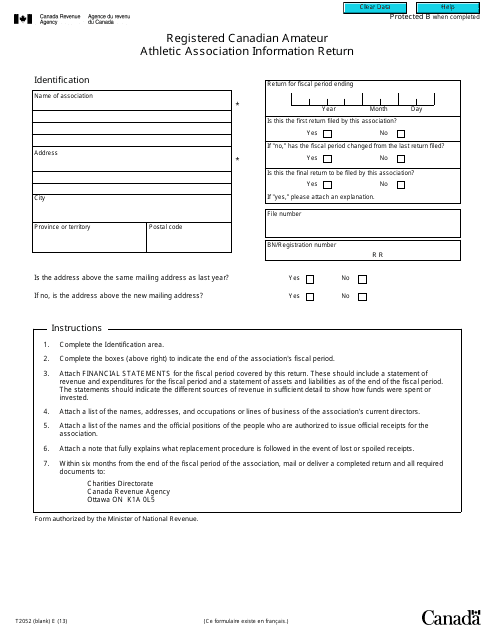

This form is used for filing the information return of a registered Canadian amateur athletic association.

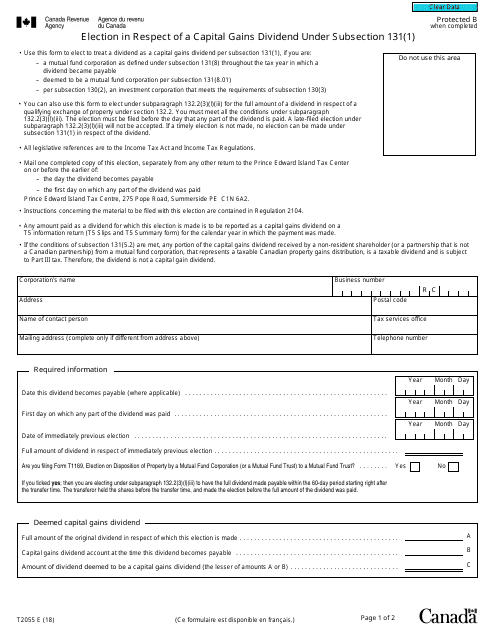

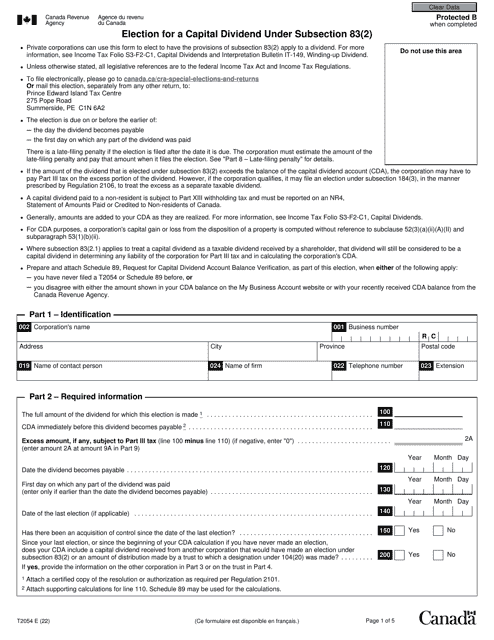

This form is used for making an election in regards to a capital gains dividend in Canada. It is filed under subsection 131(1) of the tax code.

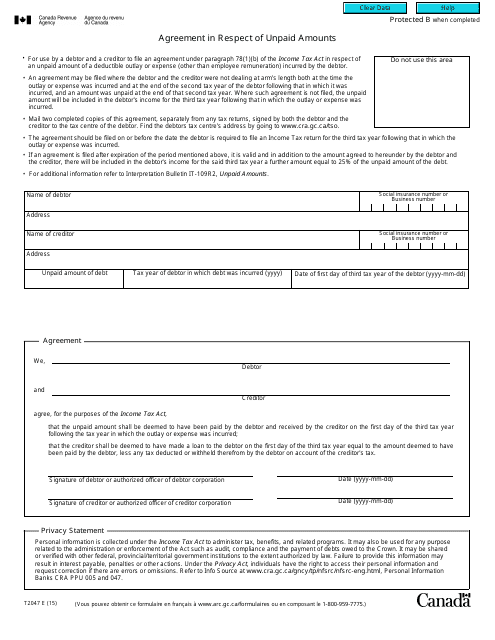

This form is used for an agreement in Canada regarding unpaid amounts.

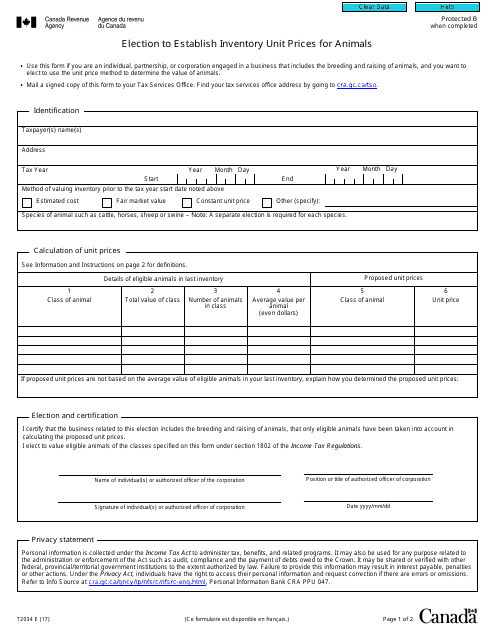

This form is used for electing to establish inventory unit prices for animals in Canada.

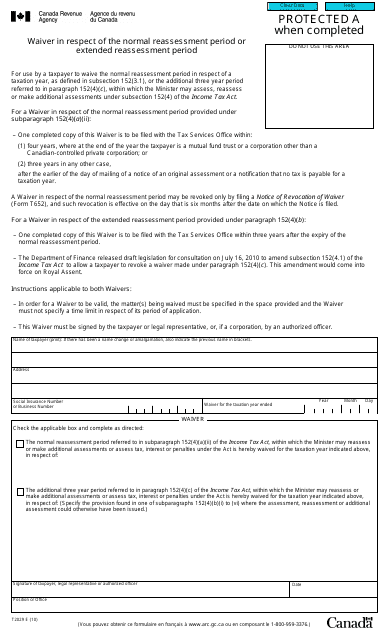

This form is used for requesting a waiver in respect of the normal reassessment period or extended reassessment period in Canada.

This form is used for calculating the tax on payments made to the Canadian government by a tax-exempt individual or organization.

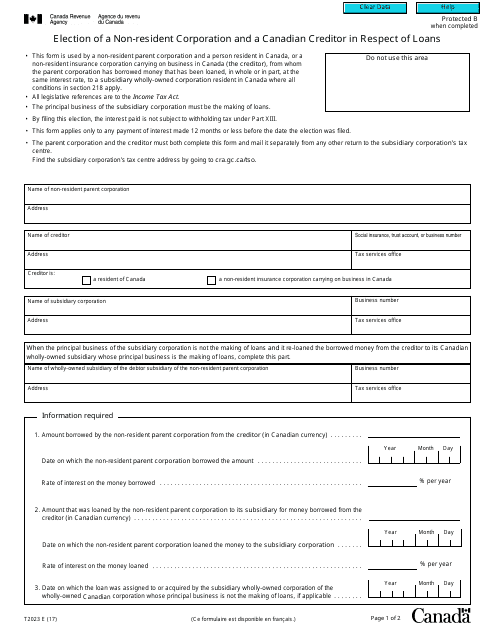

This form is used for non-resident corporations and Canadian creditors to make an election regarding loans in Canada. It allows them to specify the tax treatment of the interest payments on those loans.

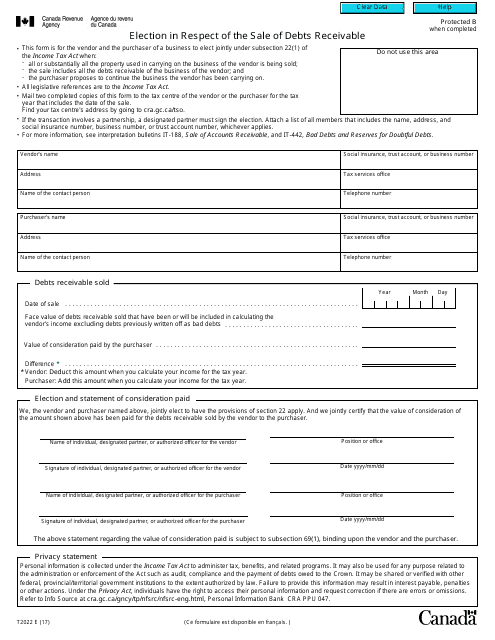

This form is used for reporting the sale of debts receivable for tax purposes in Canada. It is used by individuals or businesses who have sold their debts to another party.

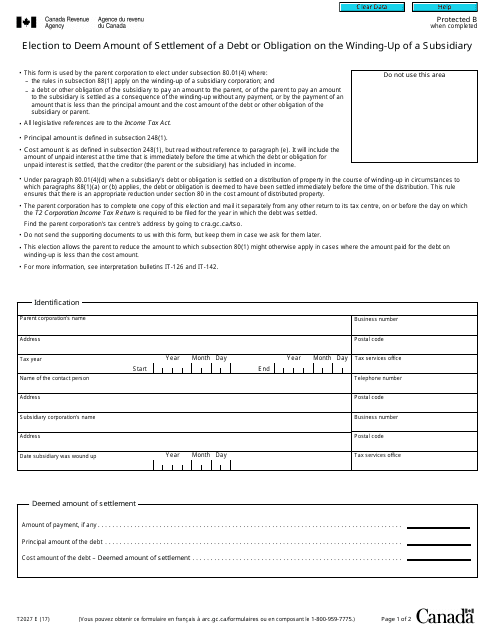

This form is used for electing to deem the amount of settlement of a debt or obligation when a subsidiary is winding up in Canada.

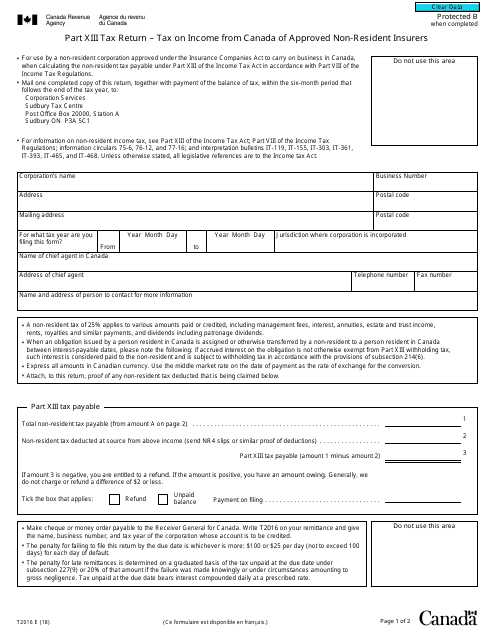

This form is used for reporting and paying taxes on income earned from Canada by approved non-resident insurers.

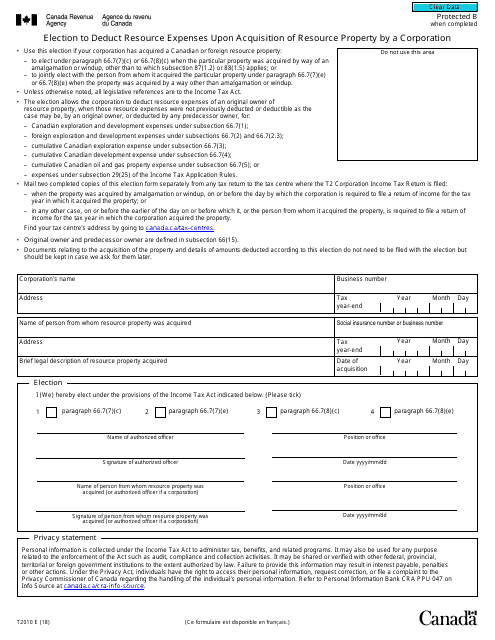

This form is used for a corporation in Canada to elect to deduct resource expenses upon acquiring resource property.

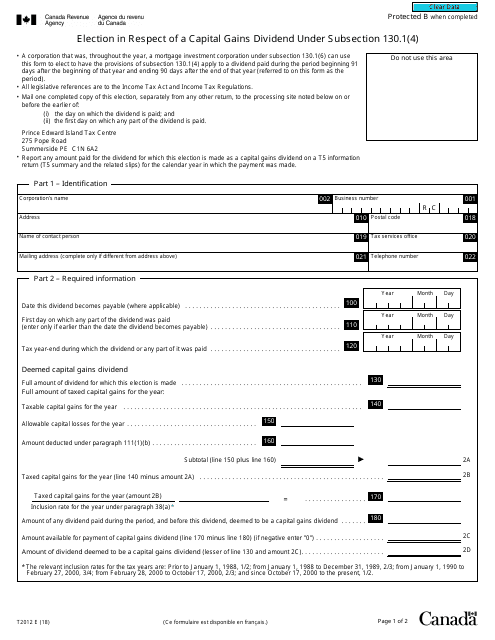

This form is used for reporting an election in respect of a capital gains dividend under subsection 130.1(4) in Canada. It is used by individuals to declare capital gains dividends received from Canadian corporations.

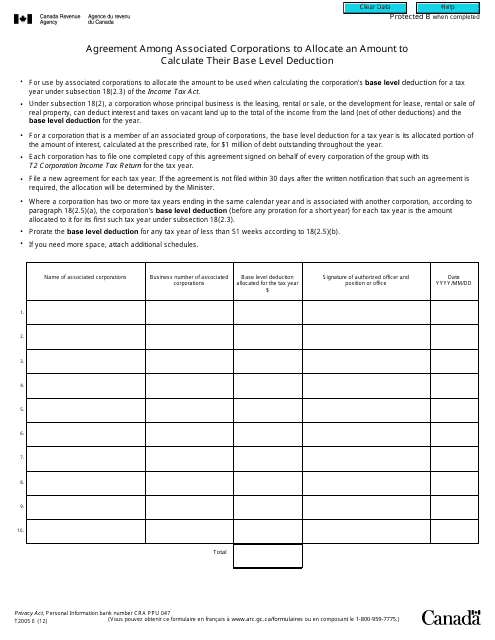

This form is used for an agreement among associated corporations in Canada to allocate an amount for calculating their base level deduction. It helps determine their tax deductions based on their business relationships.

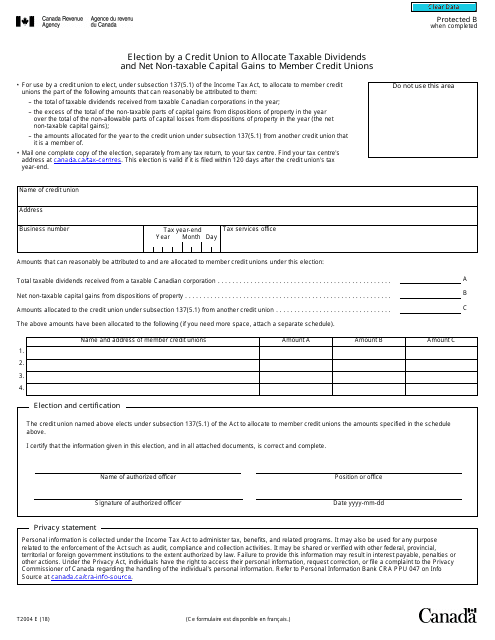

This form is used for credit unions in Canada to allocate taxable dividends and net non-taxable capital gains to member credit unions during elections.

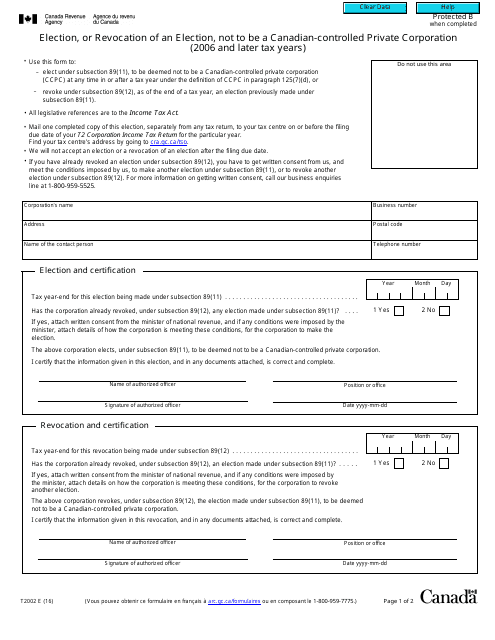

This form is used for making or revoking an election to not be considered a Canadian-controlled private corporation for tax purposes in Canada starting from the 2006 tax year onwards.