Canadian Federal Legal Forms and Templates

Documents:

5112

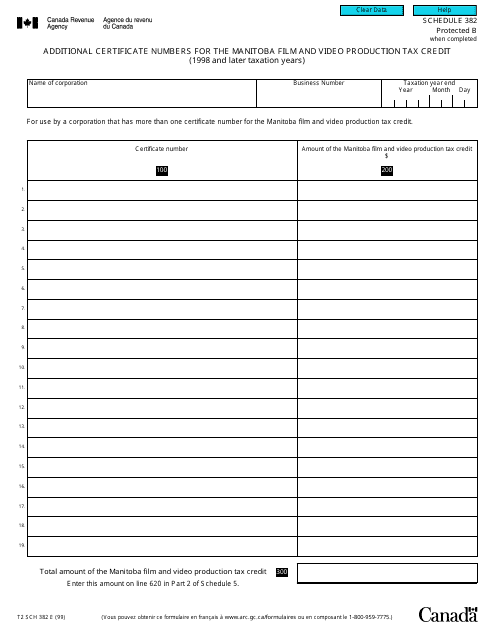

This form is used for reporting additional certificate numbers for the Manitoba Film and Video Production Tax Credit in Canada for taxation years 1998 and later.

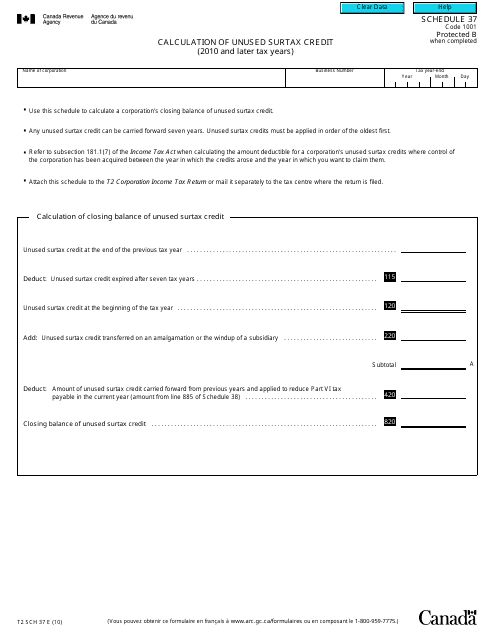

This Form is used for calculating the unused surtax credit for tax years 2010 and later in Canada.

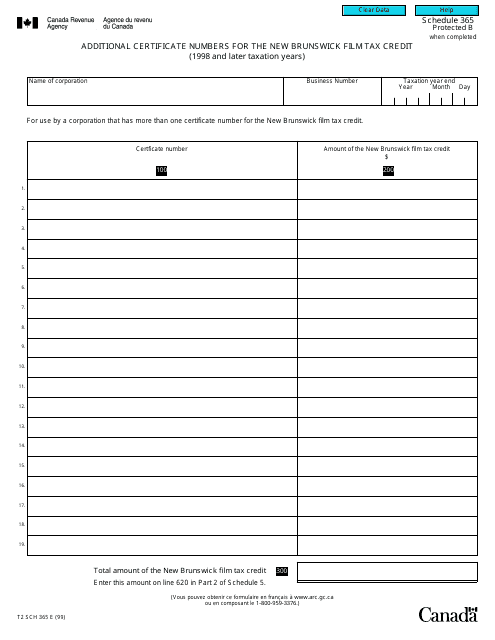

This form is used for reporting additional certificate numbers for the New Brunswick Film Tax Credit in Canada. It is applicable for taxation years 1998 and later.

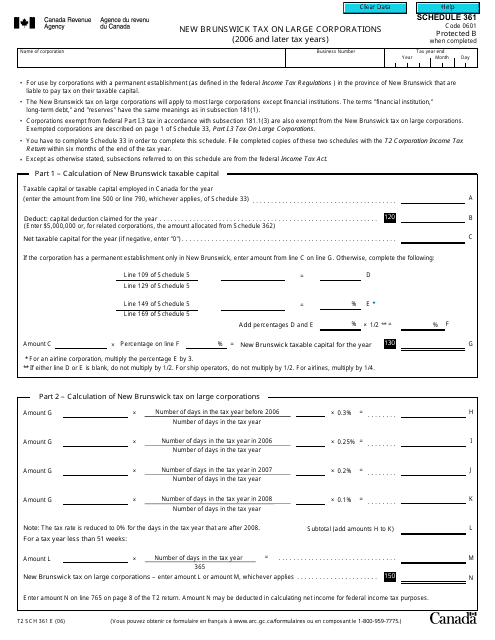

This form is used for calculating and reporting the New Brunswick tax on large corporations for the tax years 2006 and later in Canada.

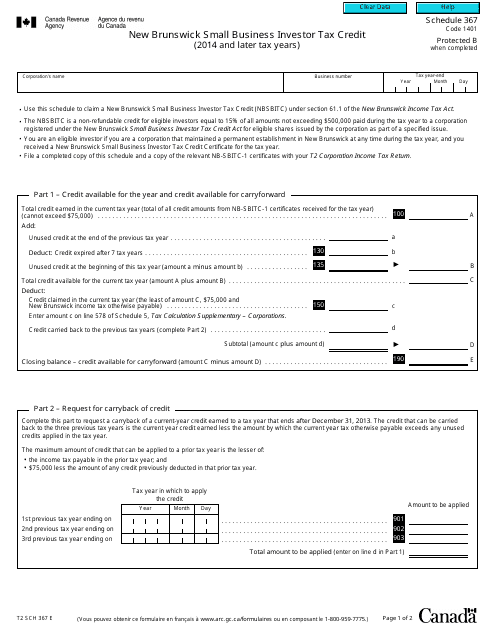

This form is used for claiming the New Brunswick Small Business Investor Tax Credit in Canada for the tax years 2014 and later.

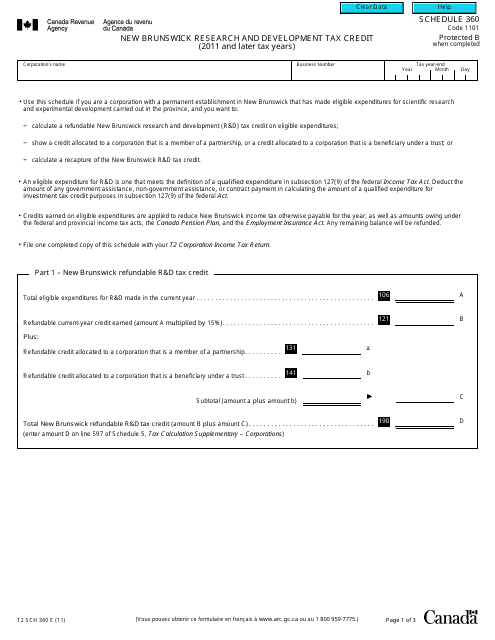

This form is used for claiming the New Brunswick Research and Development Tax Credit in Canada for tax years 2011 and later.

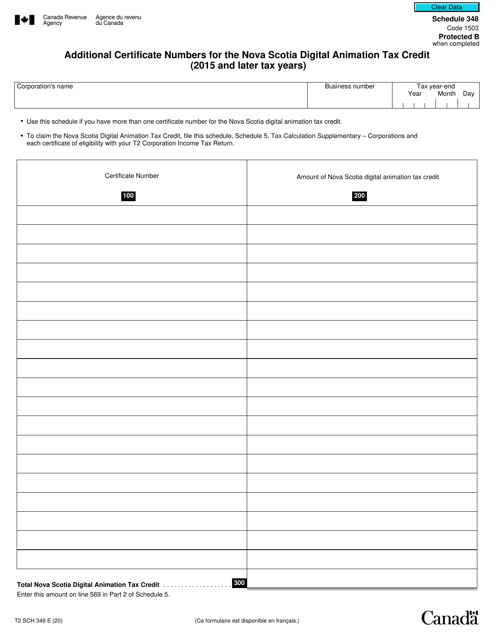

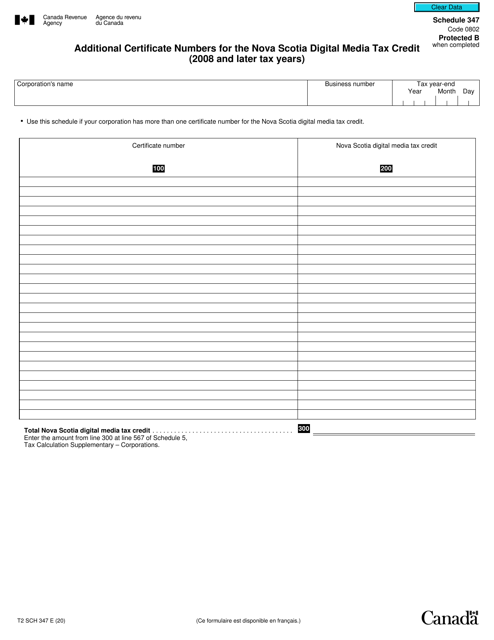

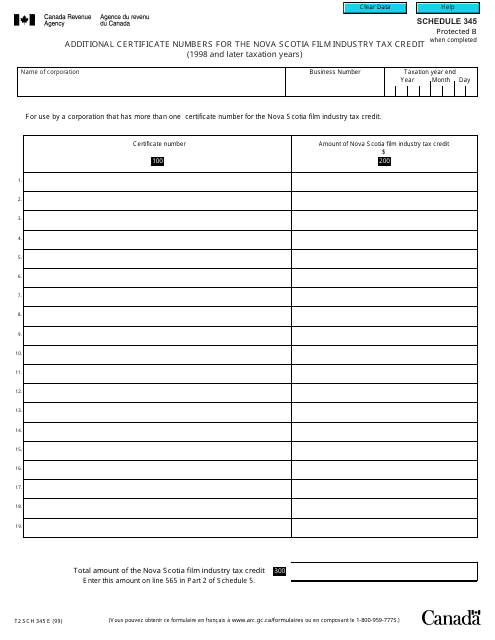

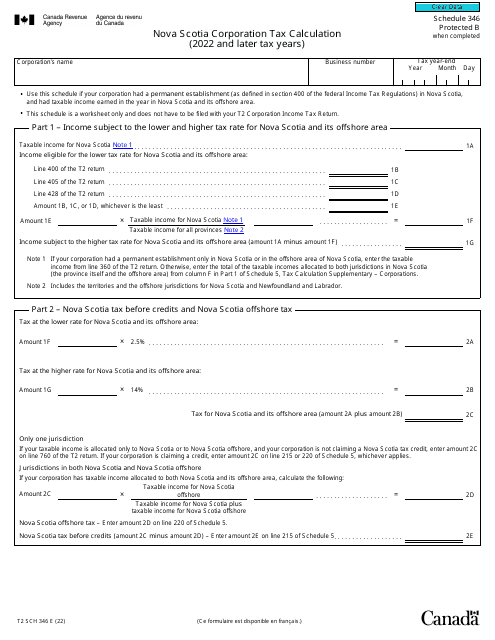

This form is used for reporting additional certificate numbers for the Nova Scotia Film Industry Tax Credit in Canada for taxation years 1998 and later.

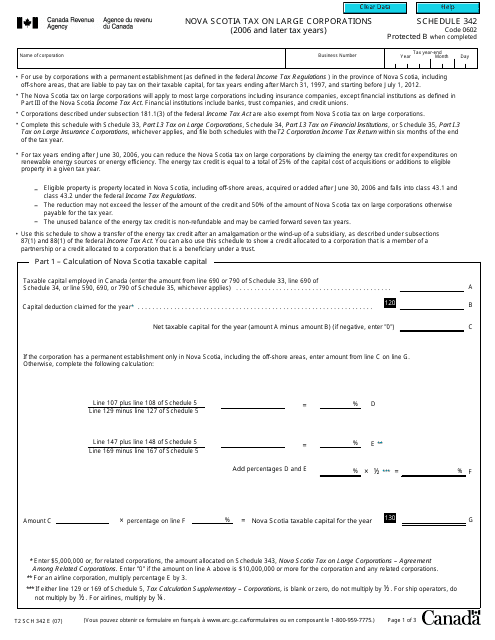

This form is used for reporting and calculating the Nova Scotia Tax on Large Corporations for the 2006 and later taxation years in Canada.

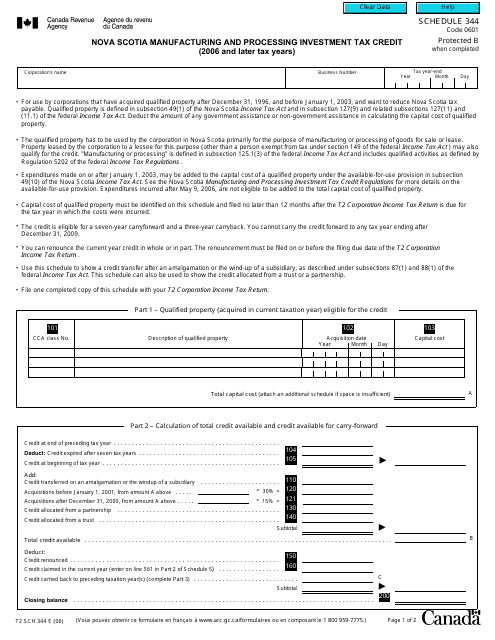

This form is used for claiming the Nova Scotia Manufacturing and Processing Investment Tax Credit for the tax years 2006 and later.

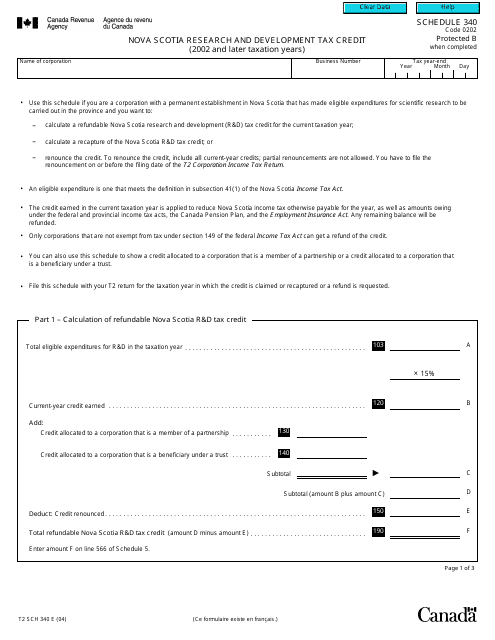

This Form is used for claiming the Nova Scotia Research and Development Tax Credit in Canada for the years 2002 and later.

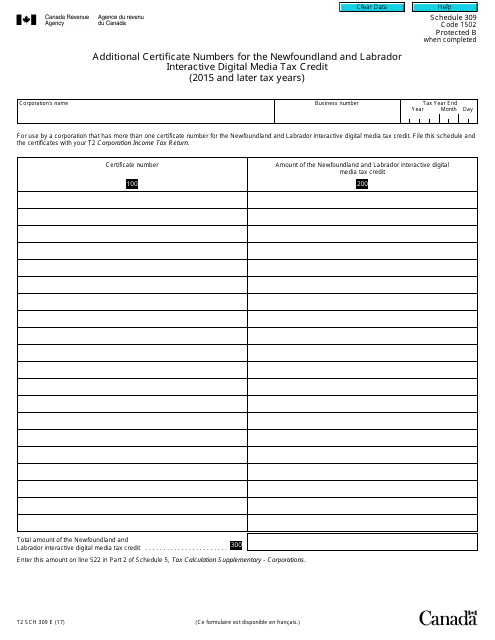

This form is used to report additional certificate numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit. It is applicable for the tax years 2015 and later in Canada.

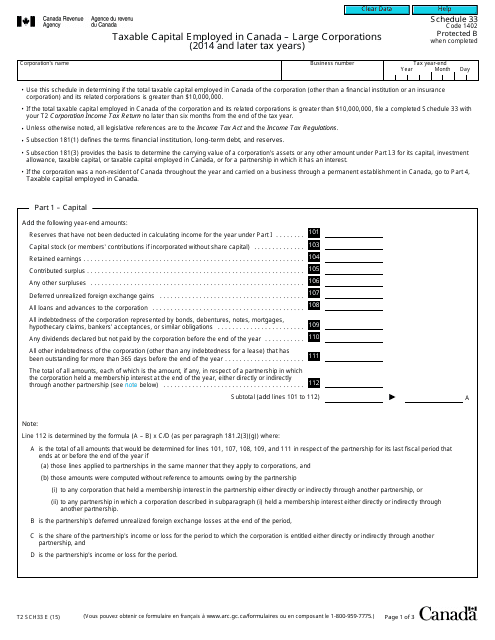

This form is used for calculating the amount of taxable capital employed by large corporations in Canada for the years 2014 and later.

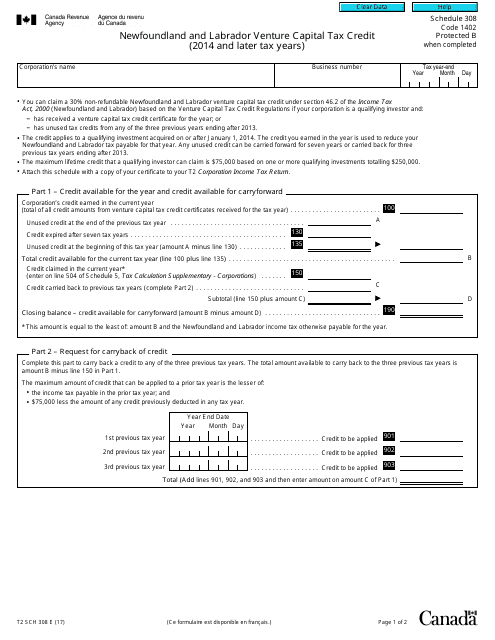

This form is used for claiming the Newfoundland and Labrador Venture Capital Tax Credit in Canada for tax years 2014 and later.

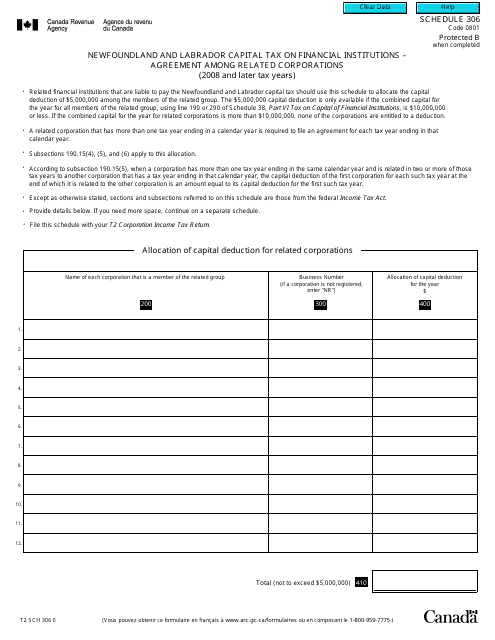

This form is used for reporting the capital tax on financial institutions in Newfoundland and Labrador. It is specifically for related corporations and applies to tax years starting from 2008 and onwards.

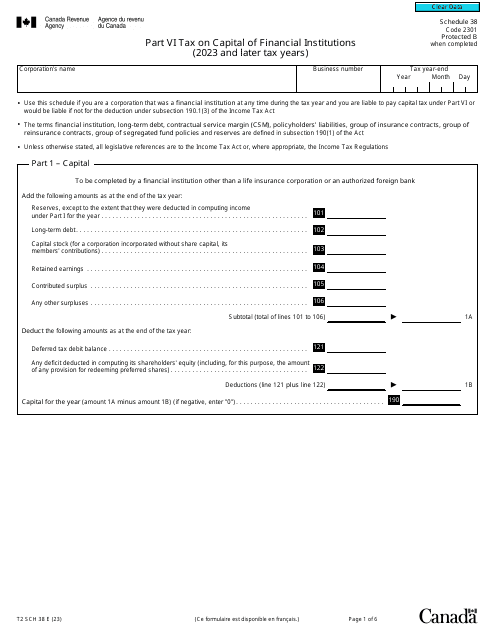

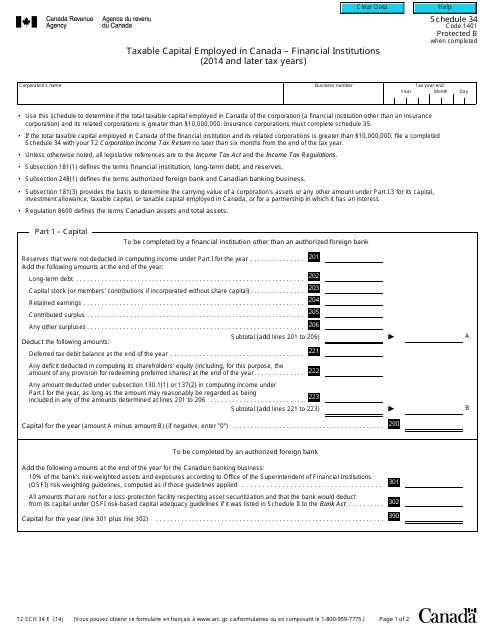

This Form is used for reporting the taxable capital employed by financial institutions in Canada for the tax years 2014 and later.

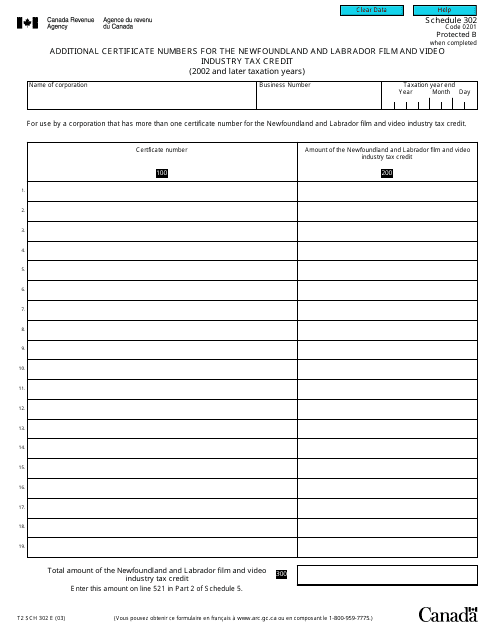

This form is used for reporting additional certificate numbers for the Newfoundland and Labrador Film and Video Industry Tax Credit for the taxation years 2002 and later in Canada.

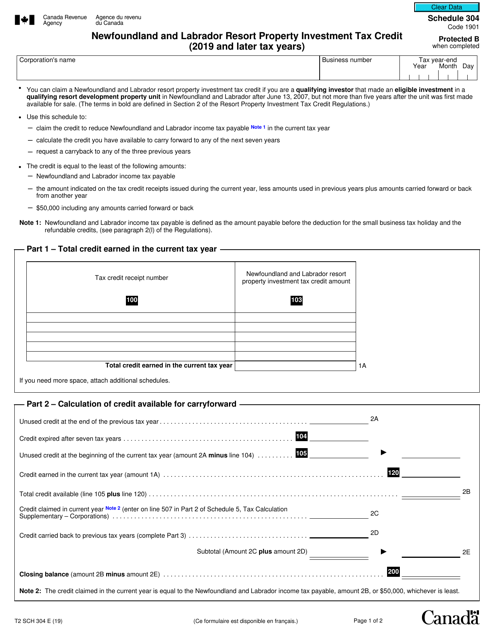

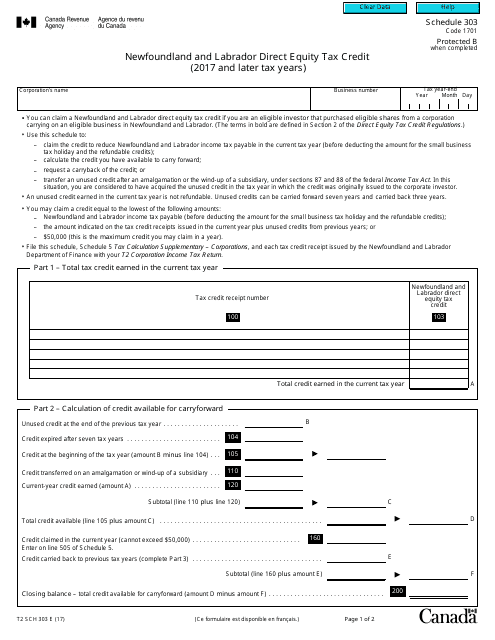

This form is used for claiming the Newfoundland and Labrador Direct Equity Tax Credit on your Canadian tax return for the years 2017 and later.

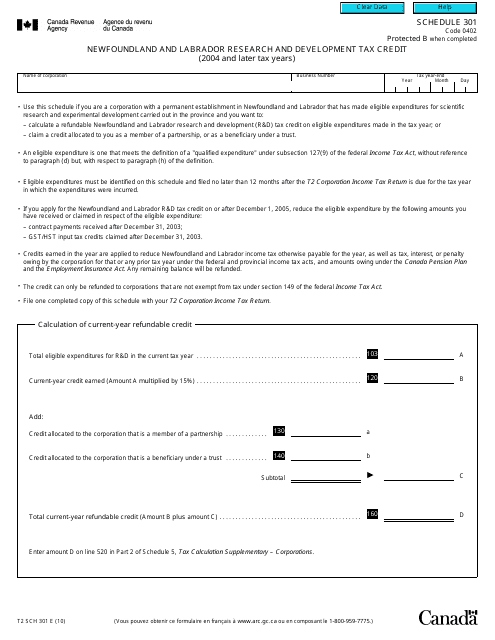

This form is used for claiming the Newfoundland and Labrador Research and Development Tax Credit for the tax years 2004 and later in Canada.

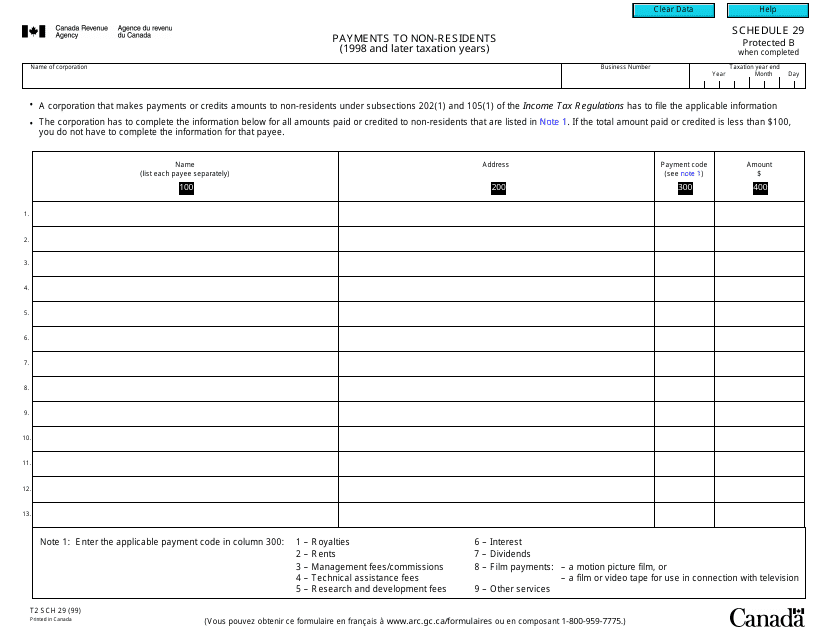

This form is used for reporting payments made to non-residents for the 1998 and later taxation years in Canada.

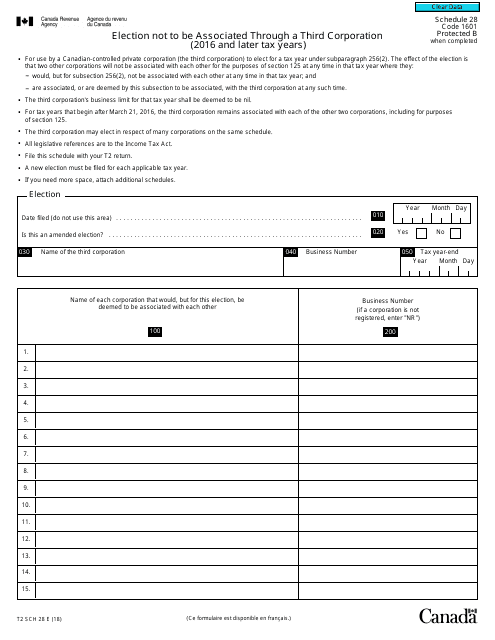

This form is used for making an election to not be associated through a third corporation for tax purposes in Canada for the years 2016 and later.

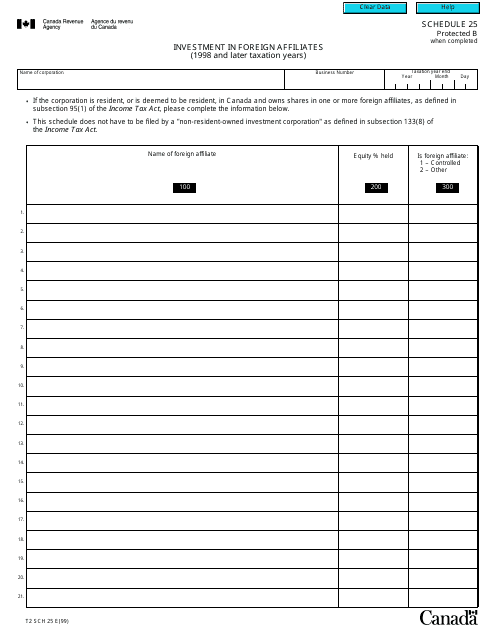

This form is used for reporting investment in foreign affiliates for taxation years 1998 and later in Canada.

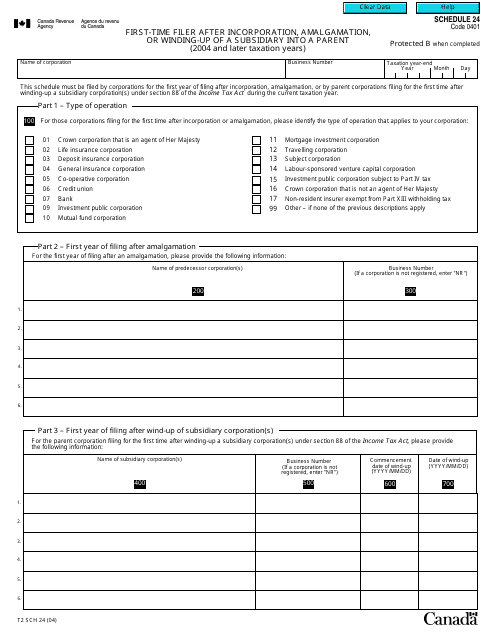

This form is used for first-time filers in Canada who have incorporated, amalgamated, or winded up a subsidiary into a parent company. It is specifically for the taxation years 2004 and later.

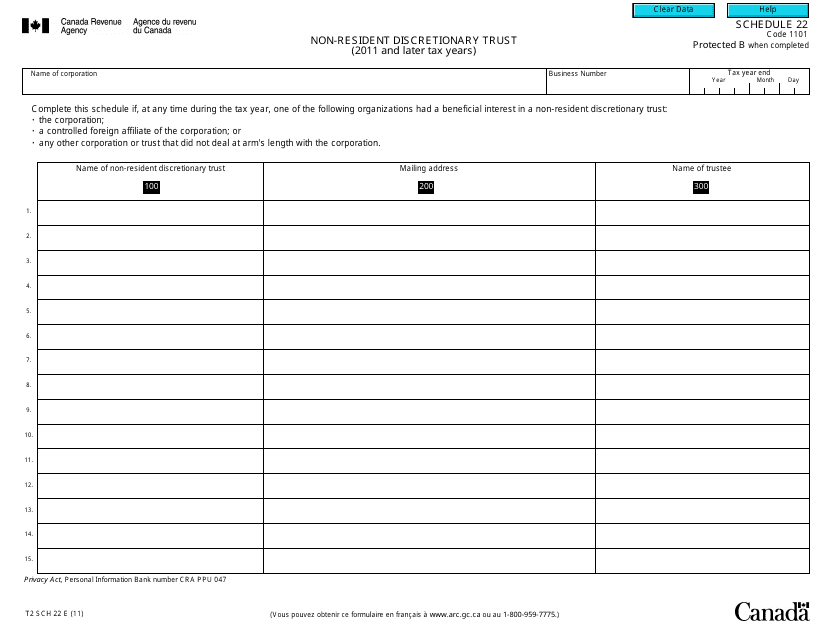

This form is used for reporting the income and deductions of a non-resident discretionary trust for tax years 2011 and later in Canada.

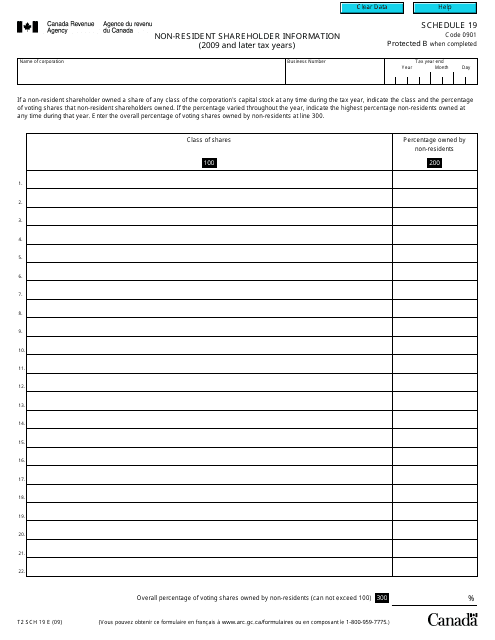

This form is used for reporting information about non-resident shareholders in Canada for tax years 2009 and later. It is required by the Canada Revenue Agency.

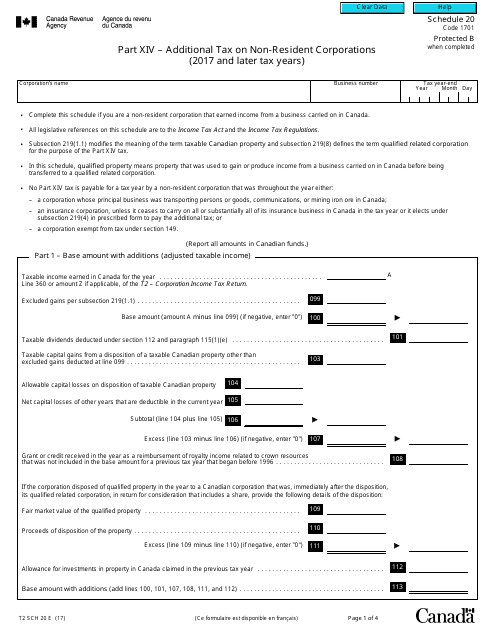

This document is a tax form used in Canada for non-resident corporations to report and calculate additional taxes for the 2017 and later tax years.

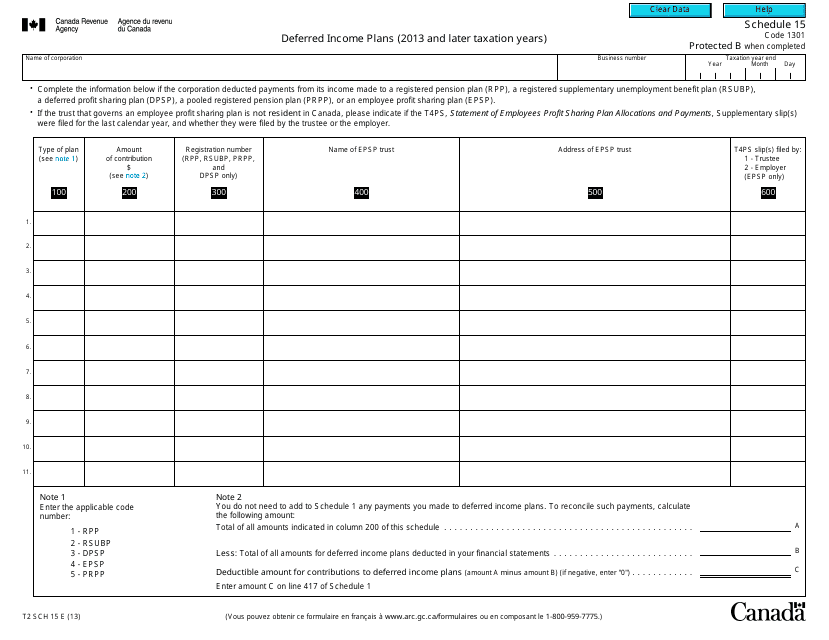

This Form is used for reporting deferred income plans for the 2013 and later tax years in Canada.