Canadian Federal Legal Forms and Templates

Documents:

5112

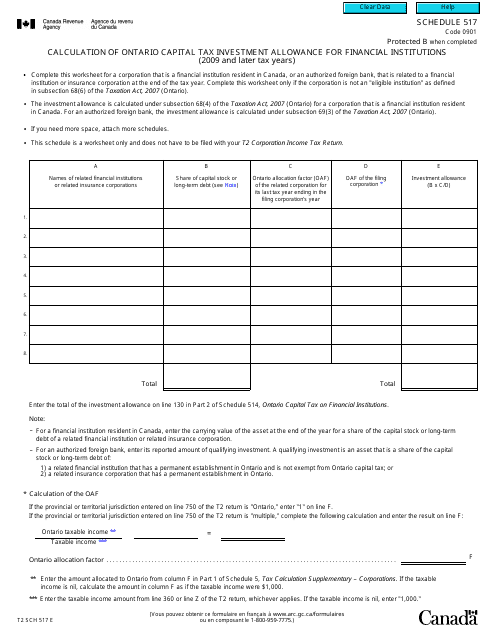

This form is used for calculating the Ontario Capital Tax Investment Allowance for financial institutions in Canada for tax years 2009 and later.

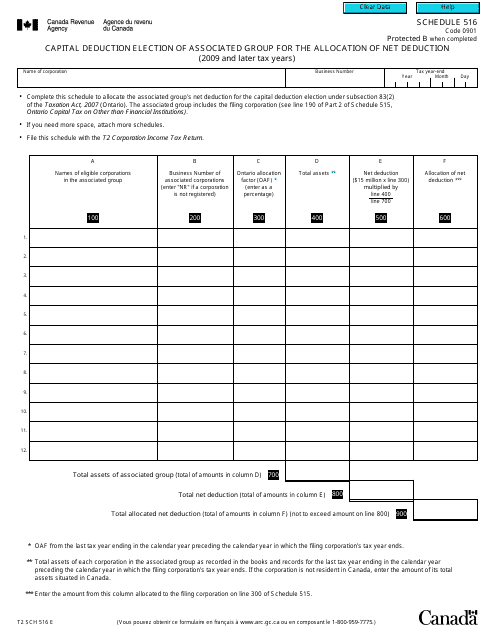

This form is used for making a capital deduction election of an associated group for the allocation of net deduction in Canada for tax years 2009 and later.

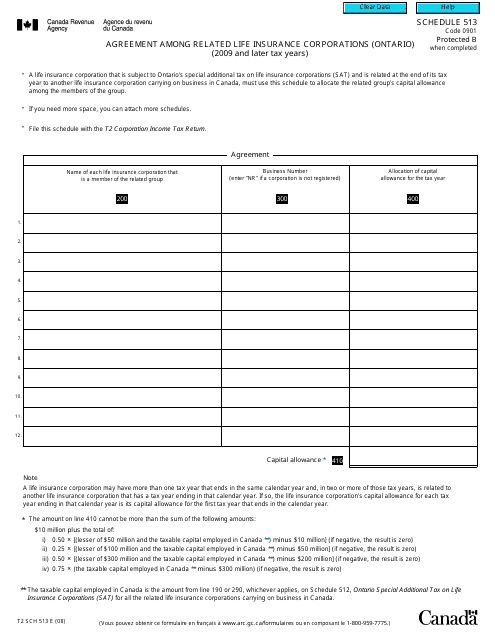

This form is used for reporting and documenting agreements among related life insurance corporations in Ontario for tax purposes in Canada. This document is specifically for the tax years 2009 and later.

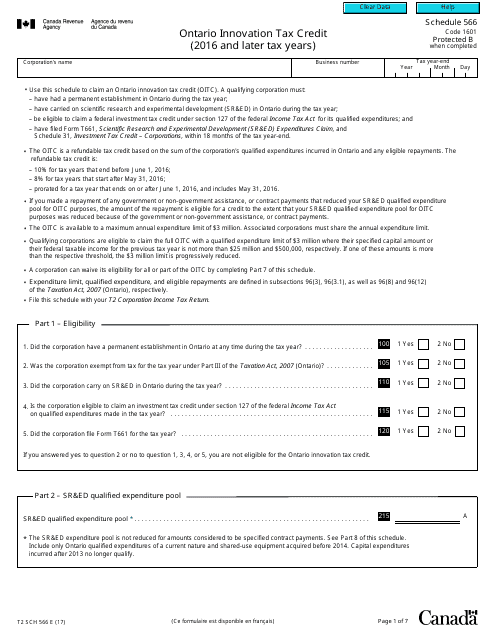

This Form is used for claiming the Ontario Innovation Tax Credit for businesses in Canada for the tax years of 2016 and later.

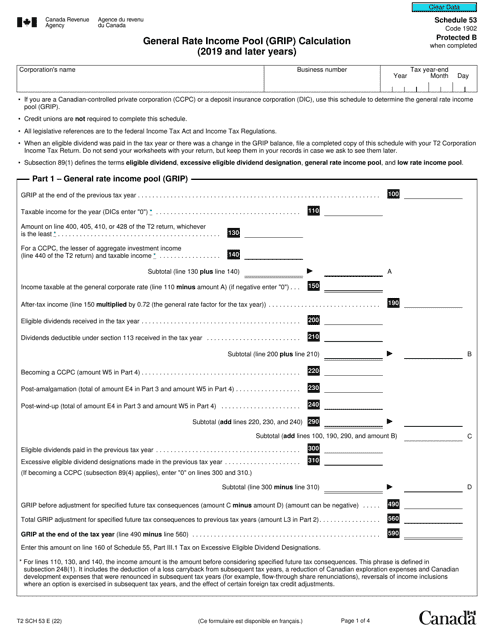

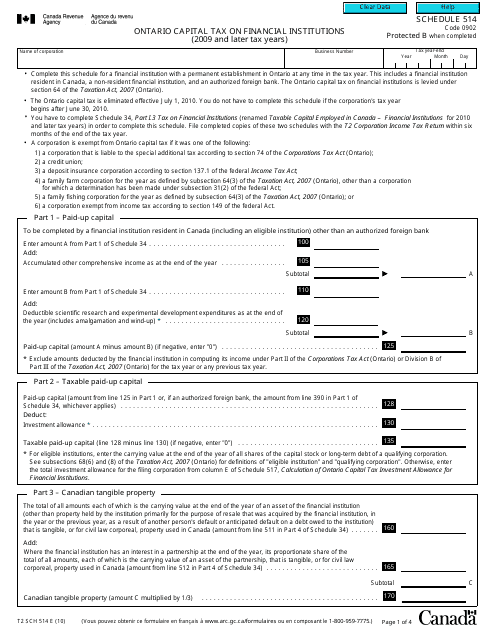

This form is used for reporting and calculating the Ontario Capital Tax on Financial Institutions for the tax years 2009 and later in Canada.

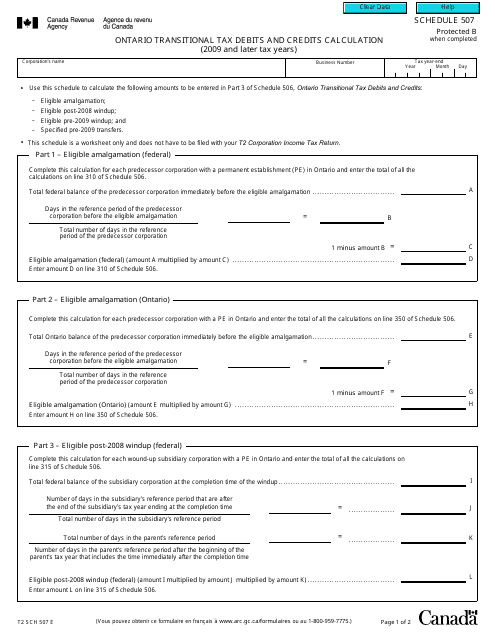

This document is used for calculating transitional tax debits and credits in Ontario for the tax years of 2009 and later.

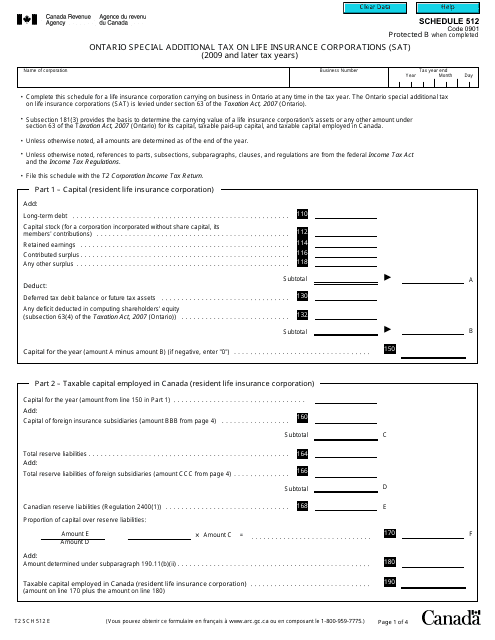

This form is used for reporting and calculating the Ontario Special Additional Tax on Life Insurance Corporations in Canada for the years 2009 and later.

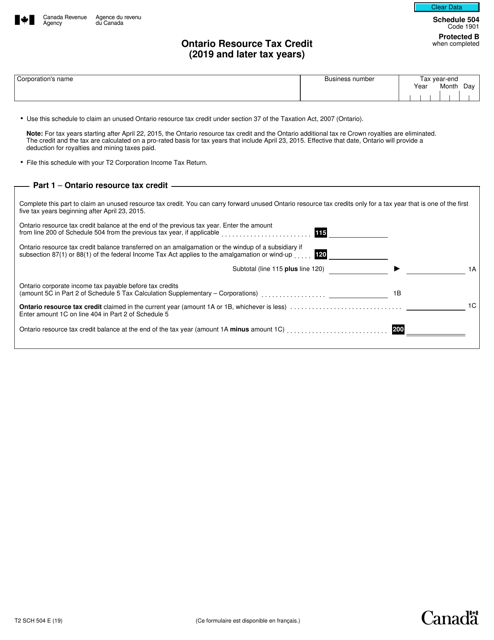

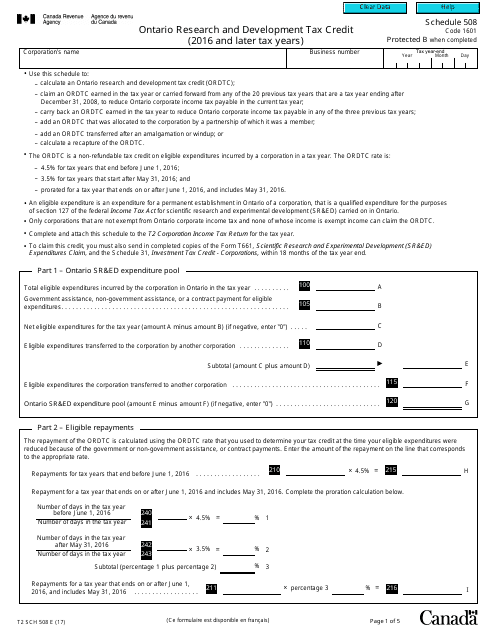

Form T2 Schedule 508 Ontario Research and Development Tax Credit (2016 and Later Tax Years) - Canada

This form is used for claiming the Ontario Research and Development Tax Credit in Canada for tax years 2016 and later.

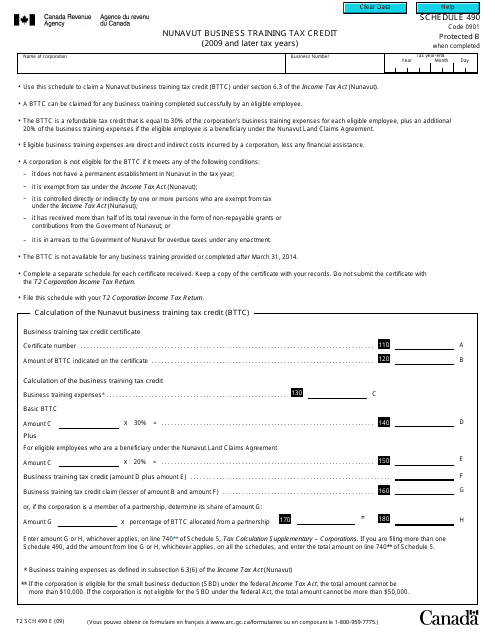

This form is used for claiming the Nunavut Business Training Tax Credit in Canada for tax years 2009 and later.

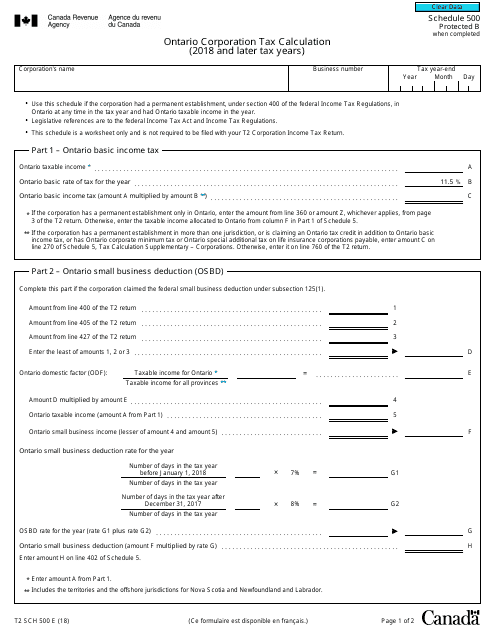

This Form is used for calculating Ontario Corporation Tax for Canadian corporations for the 2018 and later tax years.

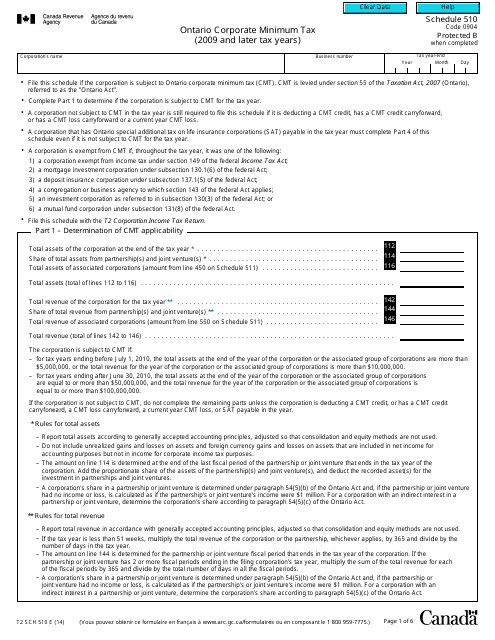

This form is used for reporting and calculating the Ontario Corporate Minimum Tax for Canadian corporations for the tax years 2009 and later.

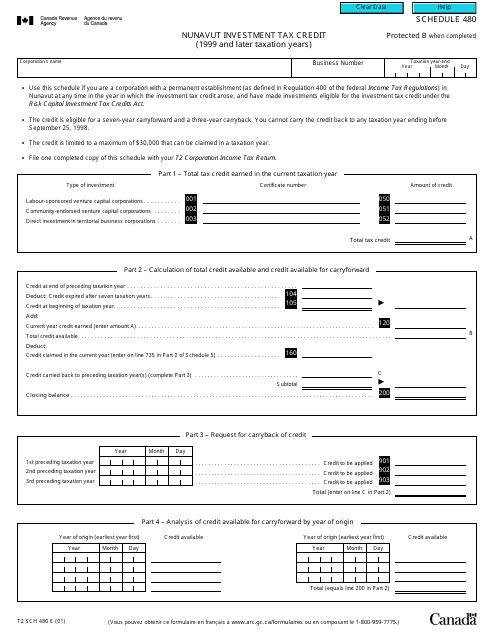

This form is used for claiming the Nunavut Investment Tax Credit in Canada for taxation years 1999 and later.

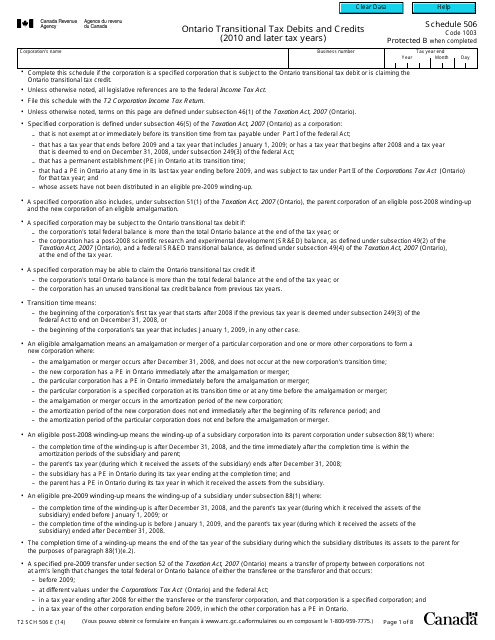

Form T2 Schedule 506 Ontario Transitional Tax Debits and Credits (2010 and Later Tax Years) - Canada

This document is a form used in Canada for reporting transitional tax debits and credits in Ontario for tax years 2010 and later.

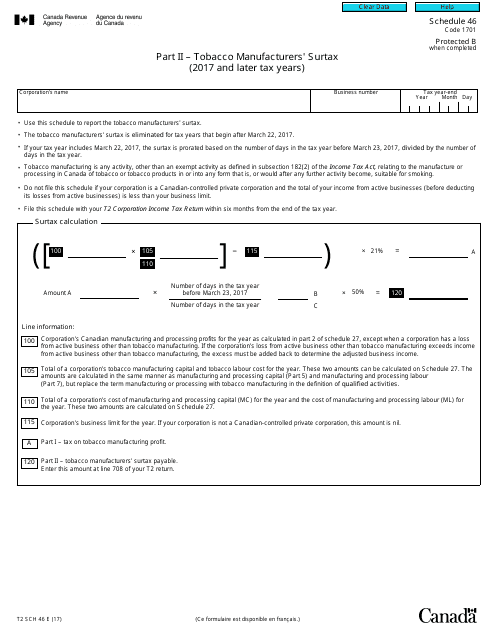

Form T2 Schedule 46 Part II - Tobacco Manufacturers' Surtax (2017 and Later Taxation Years) - Canada

This form is used for reporting tobacco manufacturers' surtax for the tax years 2017 and later in Canada.

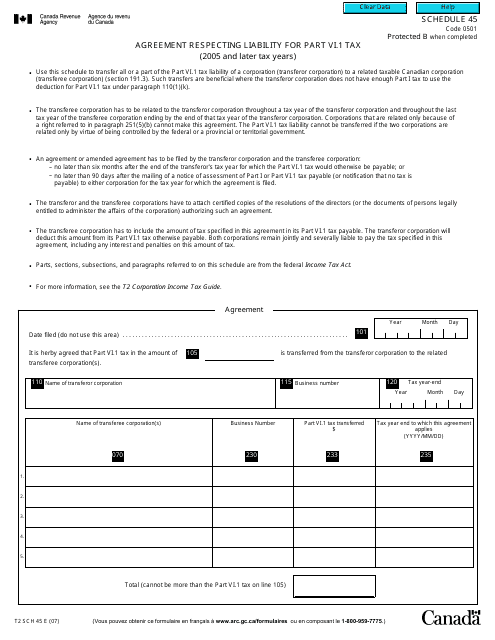

This form is used in Canada for reporting agreements related to liability for Part VI.1 tax for tax years 2005 and later. It is used to document the details of the agreement between the taxpayer and the tax administration.

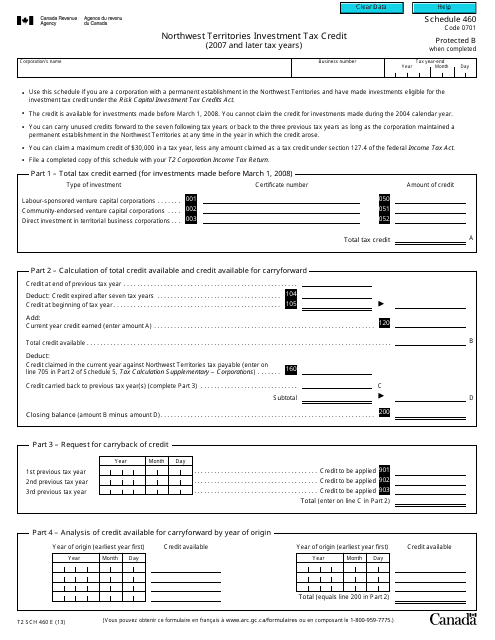

Form T2 Schedule 460 Northwest Territories Investment Tax Credit (2007 and Later Tax Years) - Canada

This form is used for claiming the Northwest Territories Investment Tax Credit on your Canadian tax return for the years 2007 and later.

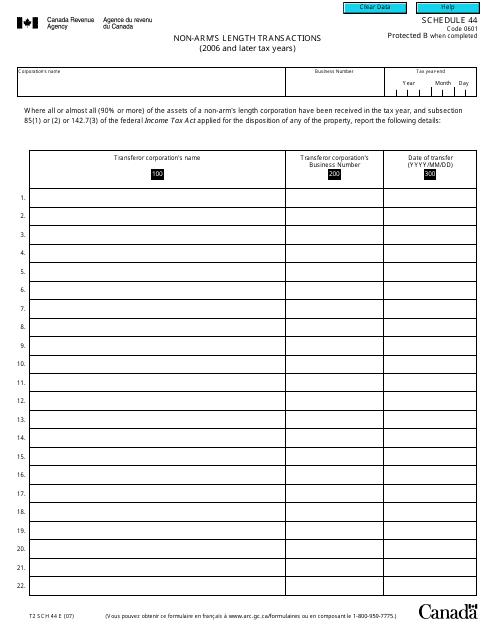

This form is used for reporting non-arm's length transactions for tax years 2006 and later in Canada. It helps ensure proper reporting of transactions between related parties.

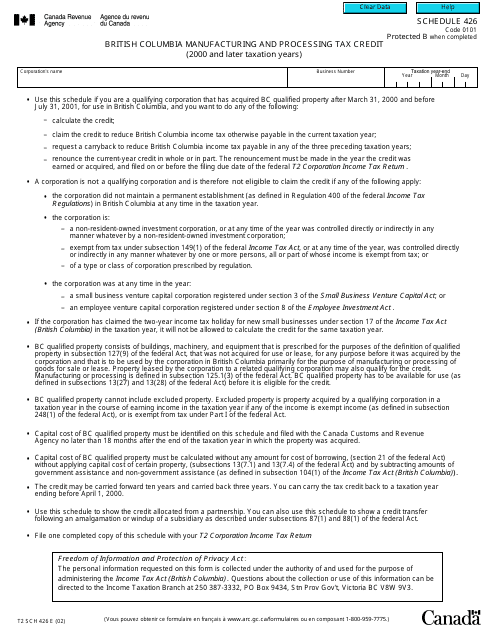

This form is used for claiming the British Columbia Manufacturing and Processing Tax Credit for tax years 2000 and later in Canada.

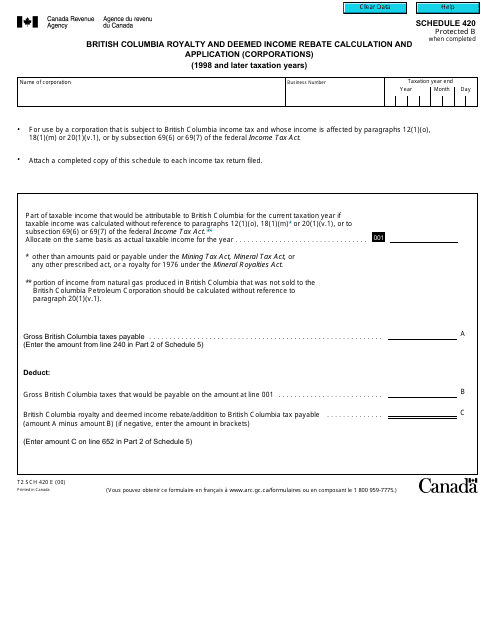

This form is used for calculating and applying for the British Columbia Royalty and Deemed Income Rebate for corporations in Canada, for tax years 1998 and later.

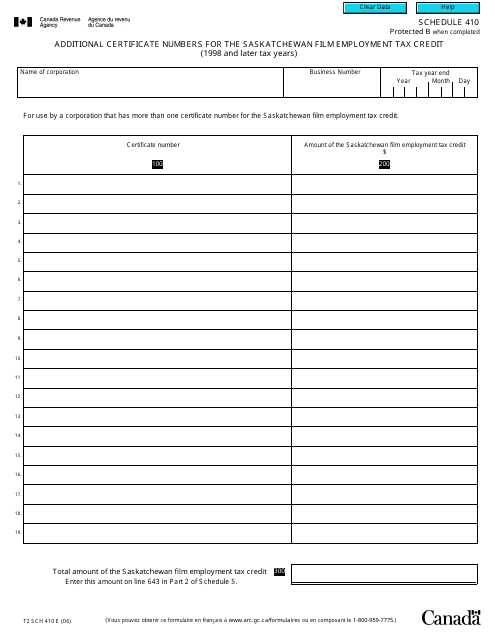

This form is used in Canada to provide additional certificate numbers for the Saskatchewan Film Employment Tax Credit for tax years 1998 and later.

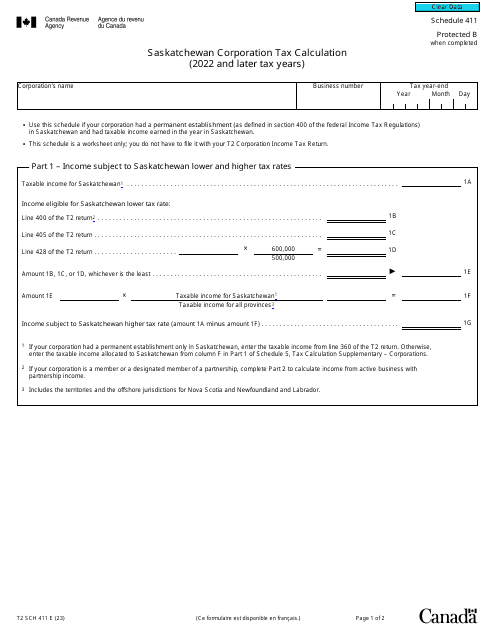

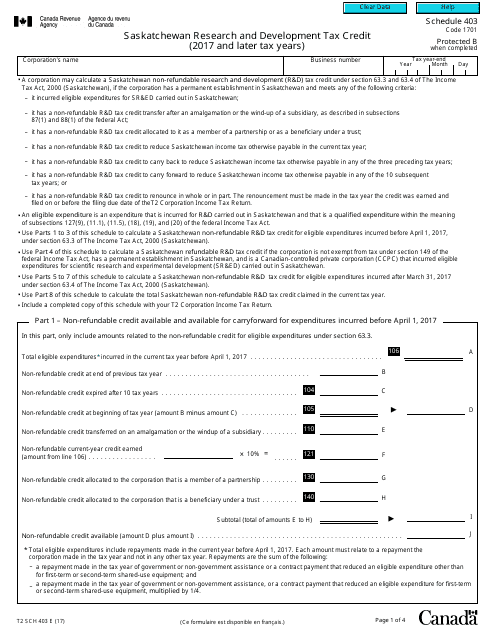

This form is used for claiming the Saskatchewan Research and Development Tax Credit in Canada for tax years 2017 and later.

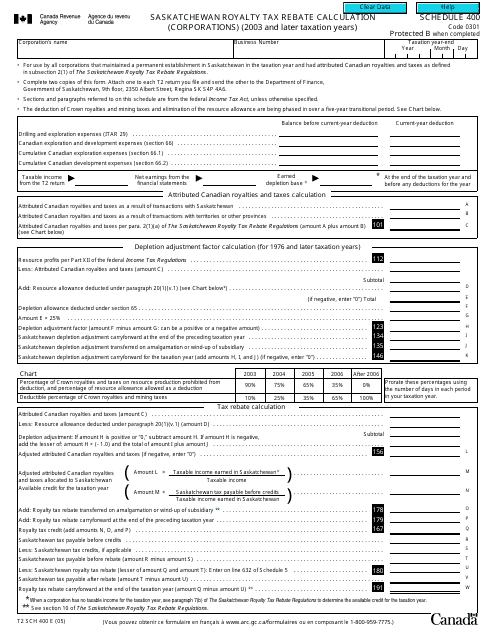

This form is used for calculating the Saskatchewan royalty tax rebate for corporations in Canada for the taxation years 2003 and later.

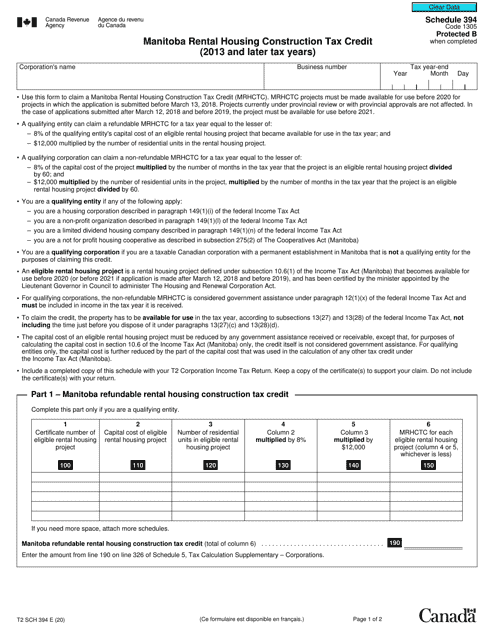

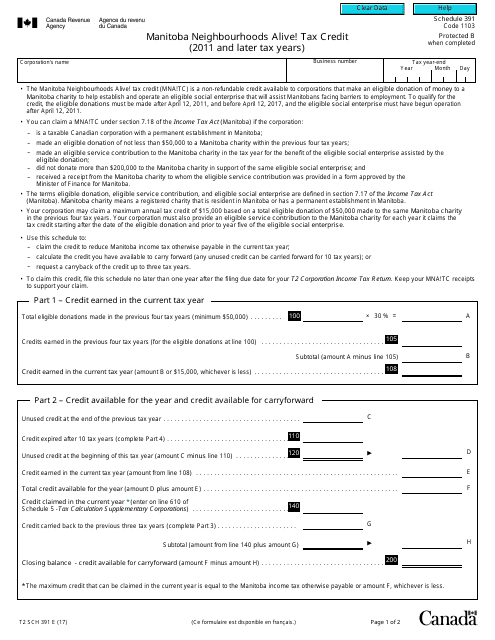

This form is used for claiming the Manitoba Neighbourhoods Alive! Tax Credit for tax years 2011 and later in Canada. It is specific to the province of Manitoba and provides a tax credit for investments made in eligible projects in designated neighbourhoods.

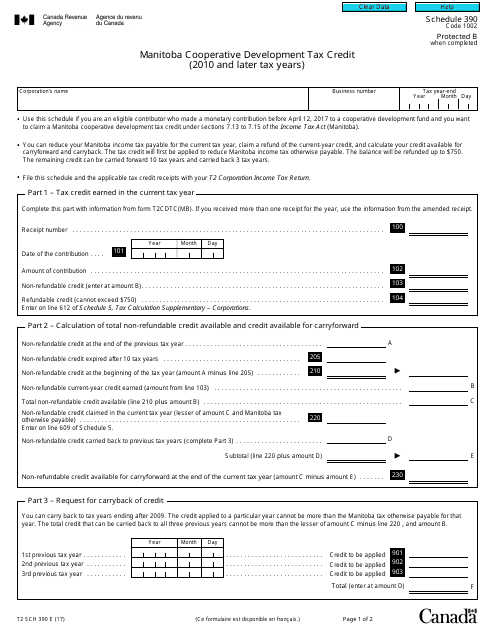

Form T2 Schedule 390 Manitoba Cooperative Development Tax Credit (2010 and Later Tax Years) - Canada

This form is used for claiming the Manitoba Cooperative Development Tax Credit in Canada for tax years 2010 and later.

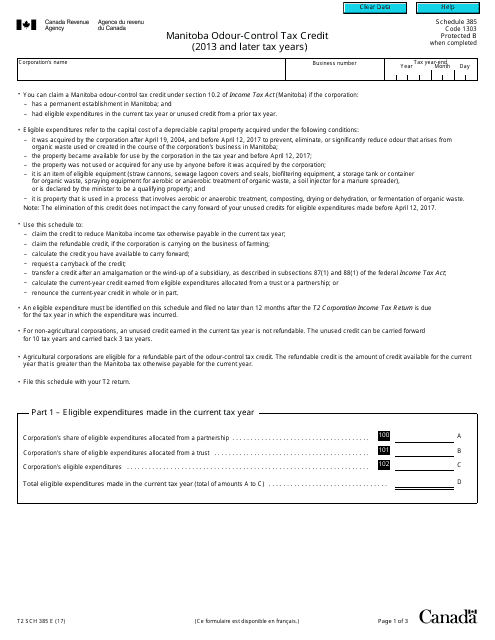

This form is used for claiming the Manitoba Odour-Control Tax Credit in Canada for tax years 2013 and later.