Canadian Federal Legal Forms and Templates

Documents:

5112

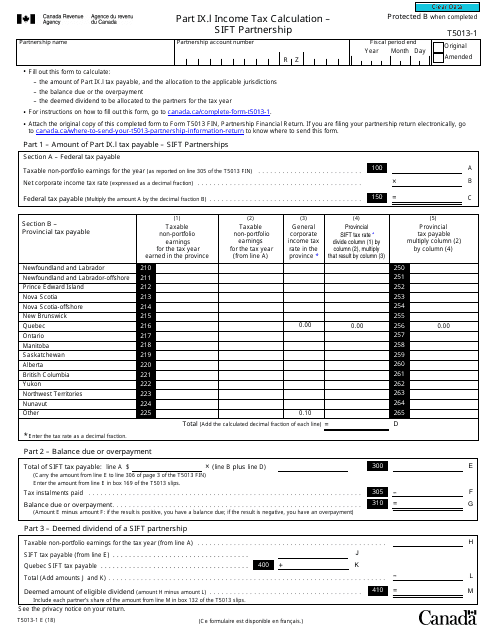

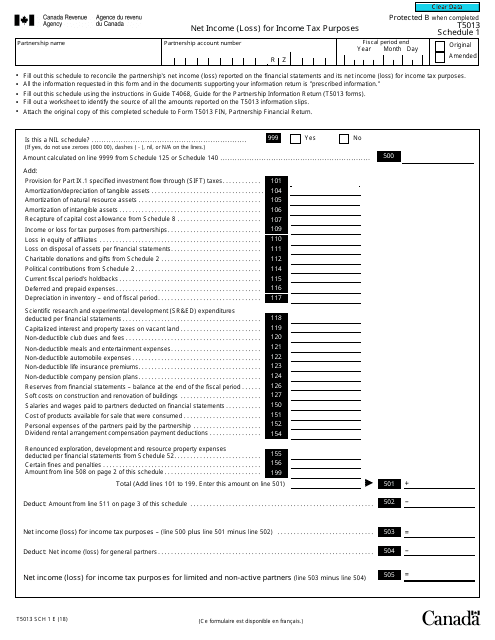

This form is used for calculating the income tax for a Sift Partnership in Canada.

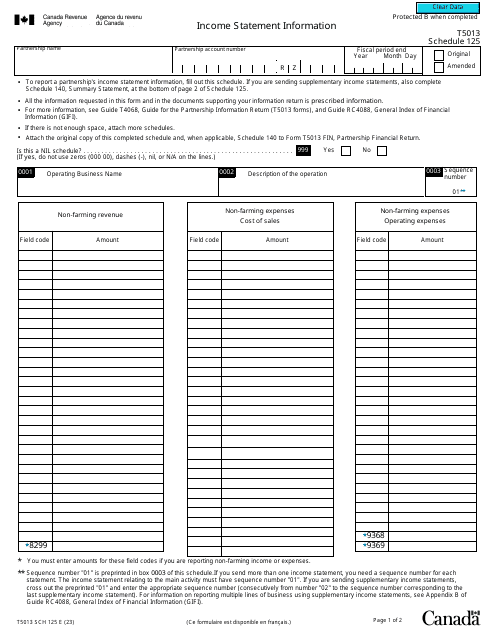

This Form is used for reporting the net income or loss for income tax purposes in Canada.

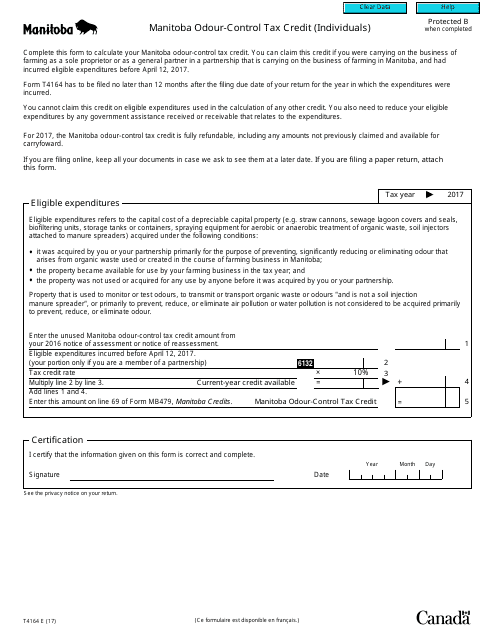

This form is used for claiming the Manitoba Odour-Control Tax Credit as an individual in Canada.

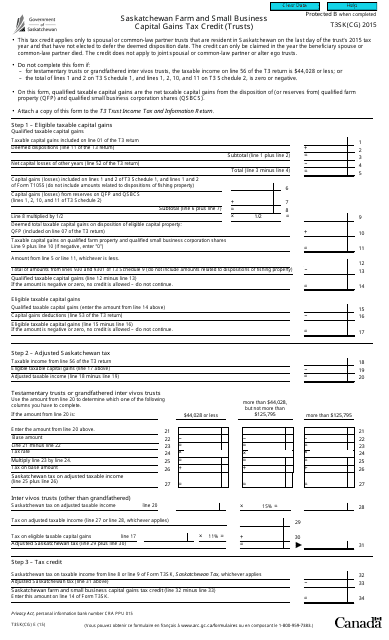

This form is used for applying for the Saskatchewan Farm and Small Business Capital Gains Tax Credit for trusts in Canada. It provides tax benefits for trusts that have capital gains from selling a qualifying farm or small business property in Saskatchewan.

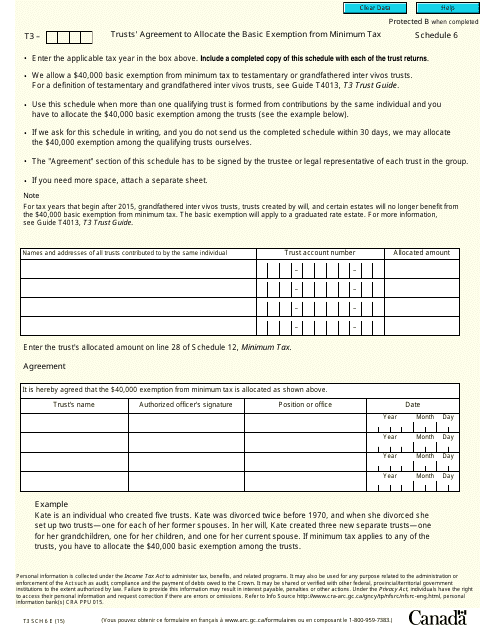

This Form is used for trusts in Canada to allocate the basic exemption from minimum tax.

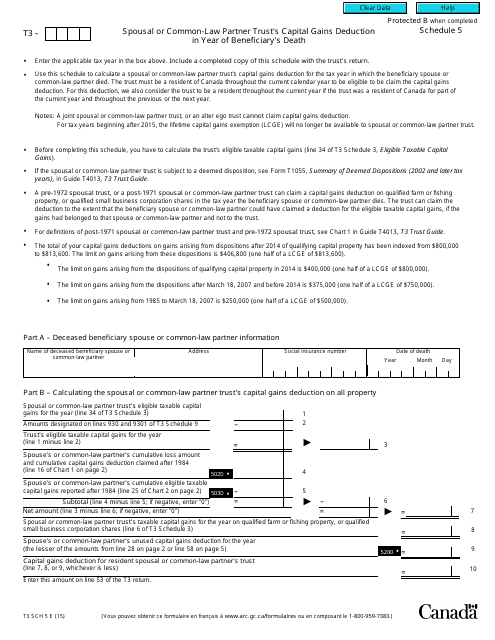

This form is used for claiming the capital gains deduction for a spousal or common-law partner trust in the year when the beneficiary dies in Canada.

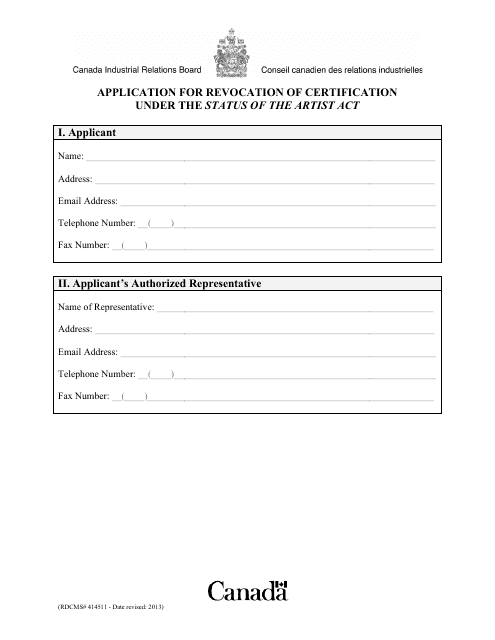

This form is used for applying to revoke certification under the Status of the Artist Act in Canada.

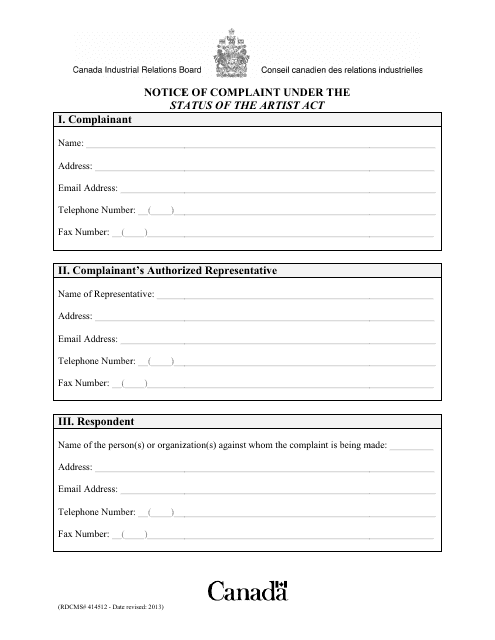

This document is a notice of a complaint made under the Status of the Artist Act in Canada. It is used to formally raise concerns or grievances related to artists' rights and protections.

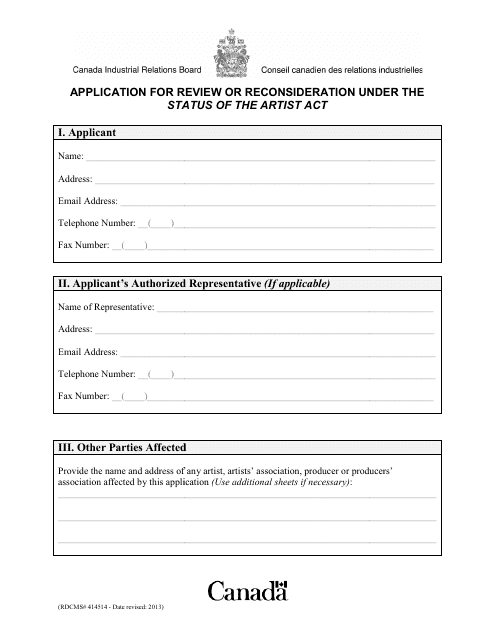

This form is used for submitting a request for review or reconsideration under the Status of the Artist Act in Canada. It allows artists to seek a re-evaluation of their artistic status and related benefits.

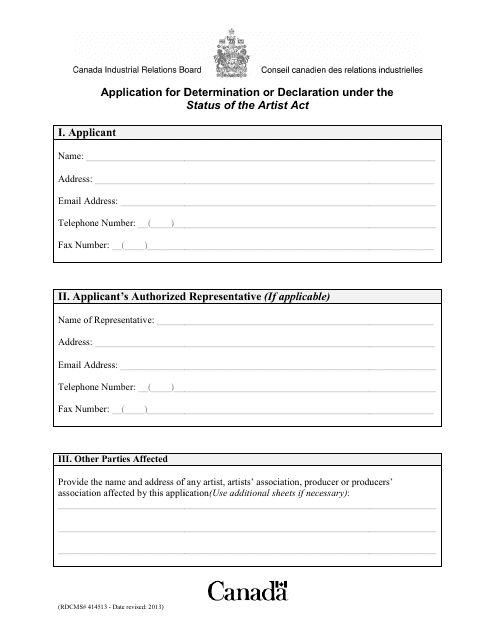

This Form is used for applying for determination or declaration of artist status under the Status of the Artist Act in Canada. It helps individuals in the artistic field to seek recognition and benefits as an artist.

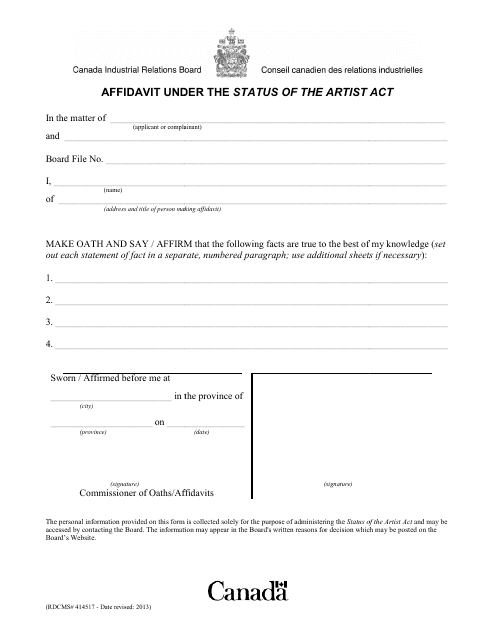

This document is used for declaring oneself as an artist under the Status of the Artist Act in Canada.

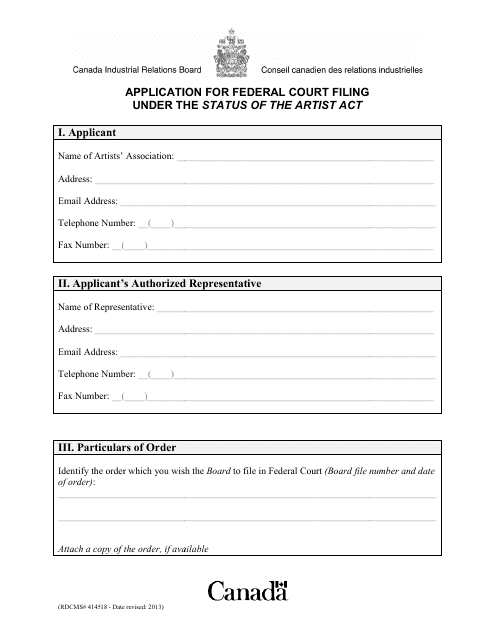

This document is for artists in Canada who want to file an application in the Federal Court under the Status of the Artist Act. It allows artists to seek legal remedies or resolve disputes related to their rights and status.

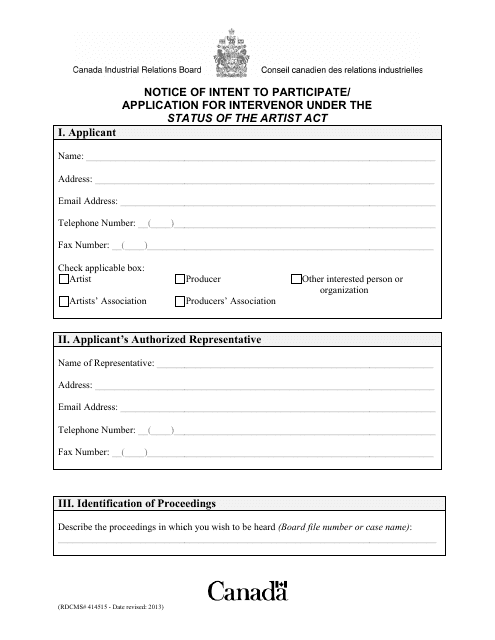

This document is used for submitting a notice of intent to participate or an application for intervenor under the Status of the Artist Act in Canada. It is a form that artists can use to express their intention to participate or seek intervention in matters related to their rights and protections under the Act.

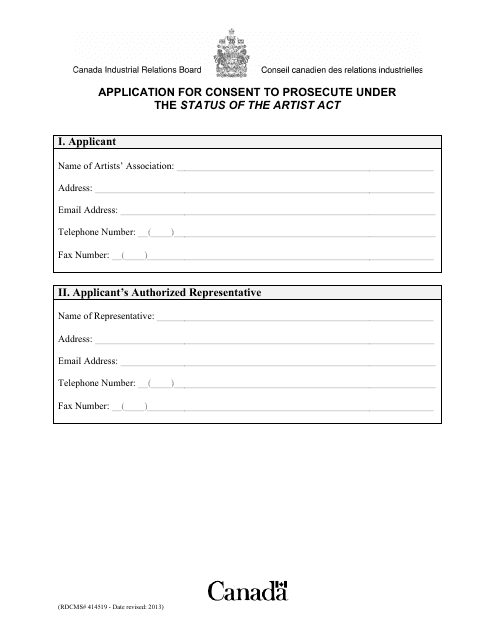

This document is used for applying for consent to prosecute under the Status of the Artist Act in Canada.

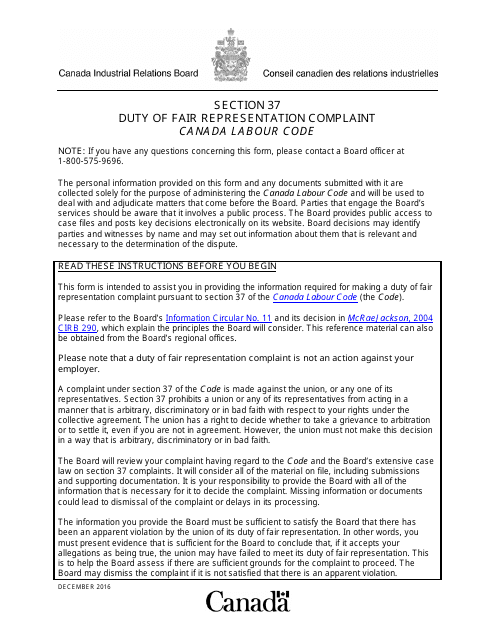

This document is for filing a complaint against a labor union in Canada for failing to fairly represent workers.

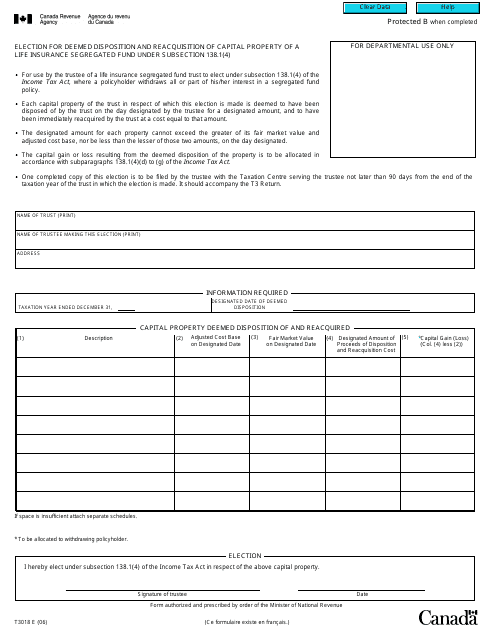

This Form is used for making an election under subsection 138.1(4) of the deemed disposition of capital property of a life insurance segregated fund in Canada.

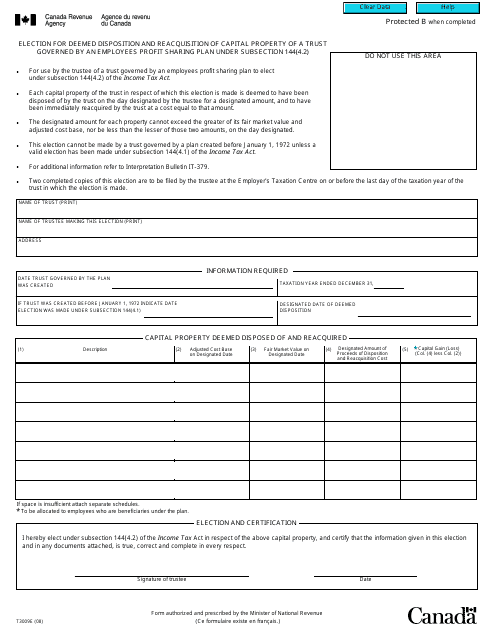

This form is used for electing the deemed disposition and reacquisition of any capital property of an employee's profit sharing plan under subsection 144.(4.2) in Canada.

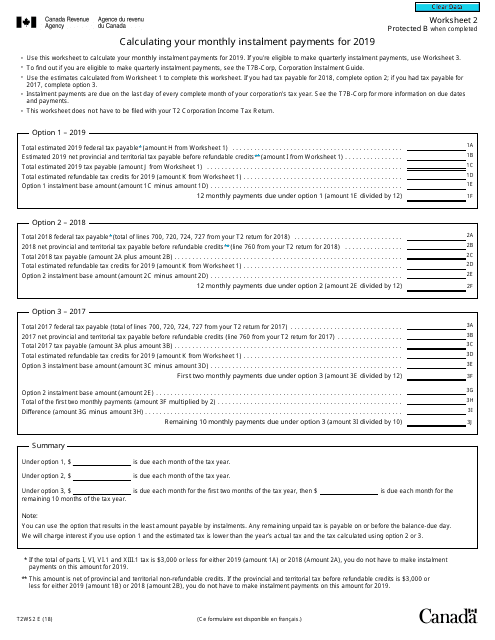

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

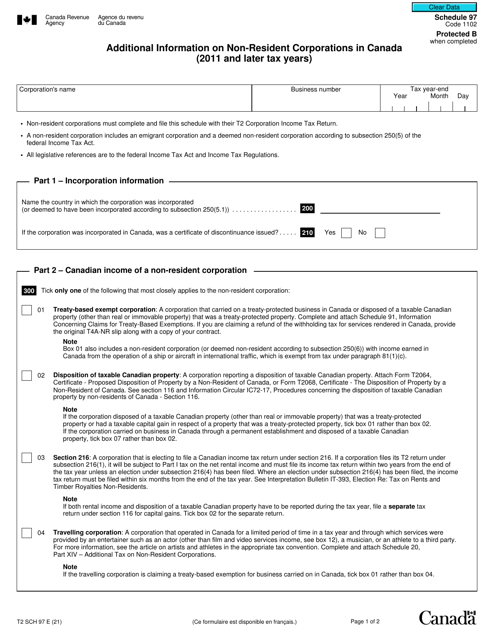

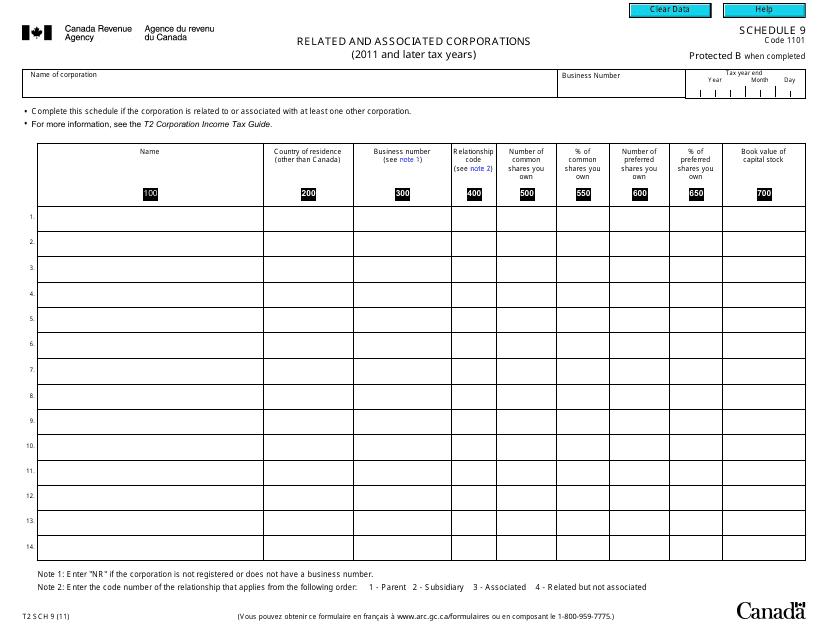

This form is used for reporting related and associated corporations for tax years 2011 and later in Canada.

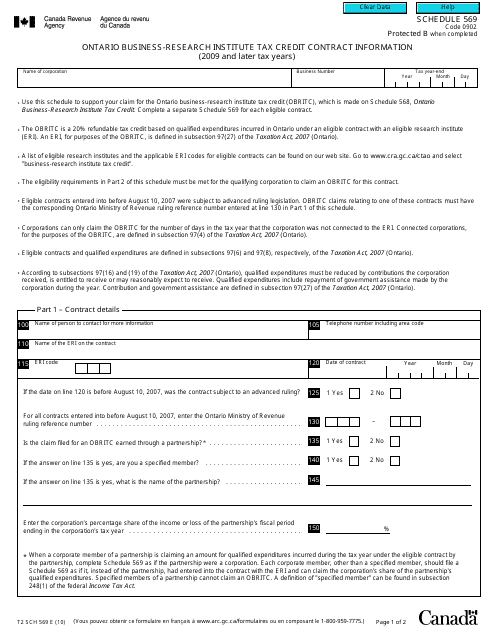

This form is used for providing contract information for claiming the Ontario Business-Research Institute Tax Credit for tax years 2009 and later in Canada.

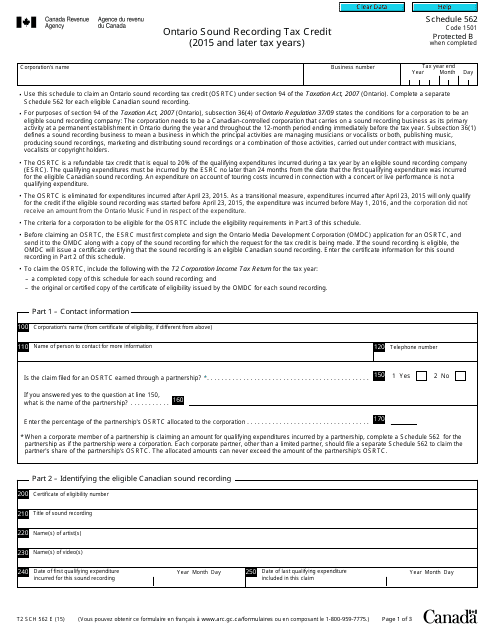

This form is used for claiming the Ontario Sound Recording Tax Credit in Canada for the tax years 2015 and later.

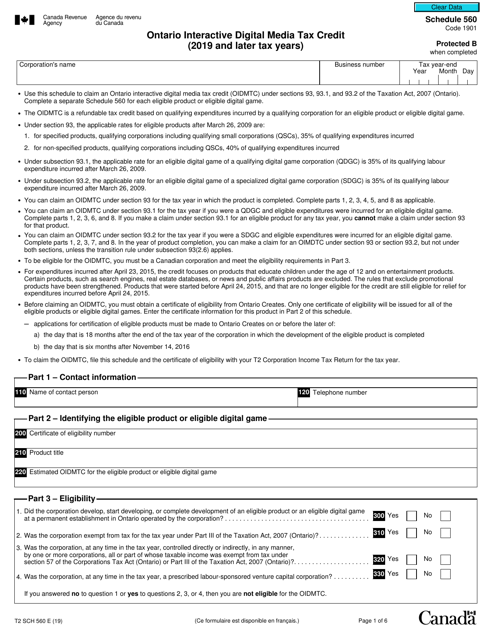

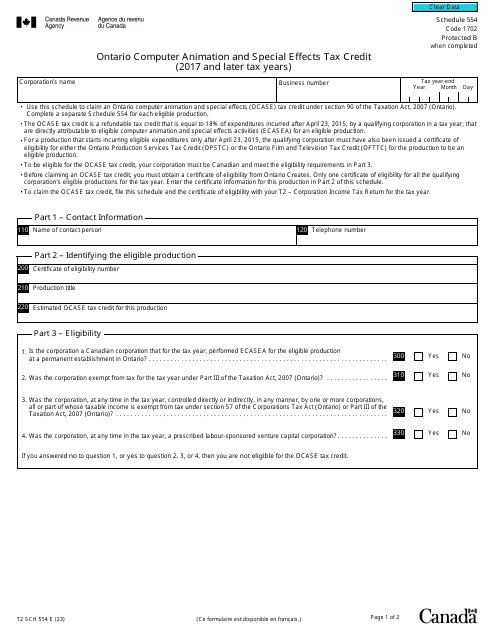

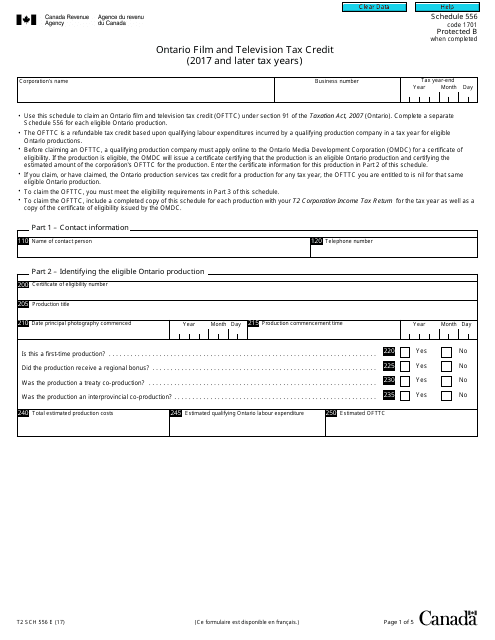

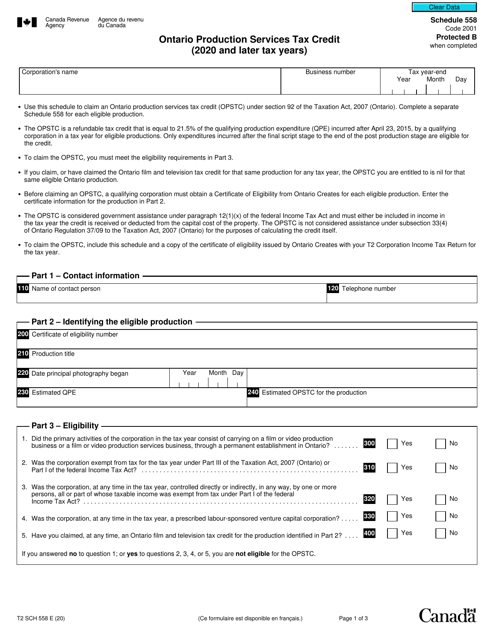

This form is used for claiming the Ontario Film and Television Tax Credit in Canada for the tax years 2017 and onwards.

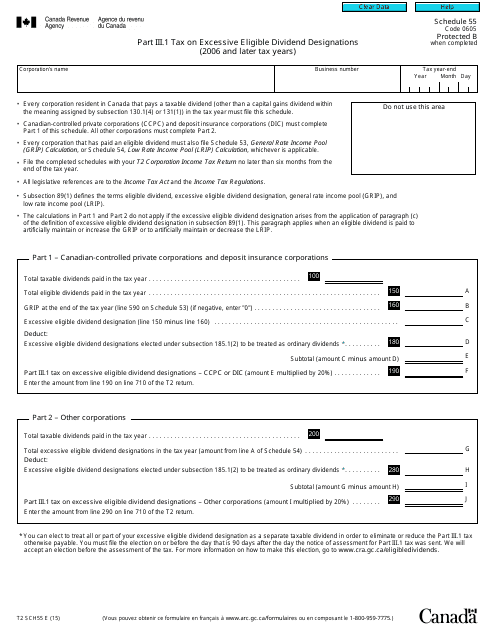

This form is used for reporting and paying tax on excessive eligible dividend designations for the 2006 tax year and later in Canada.

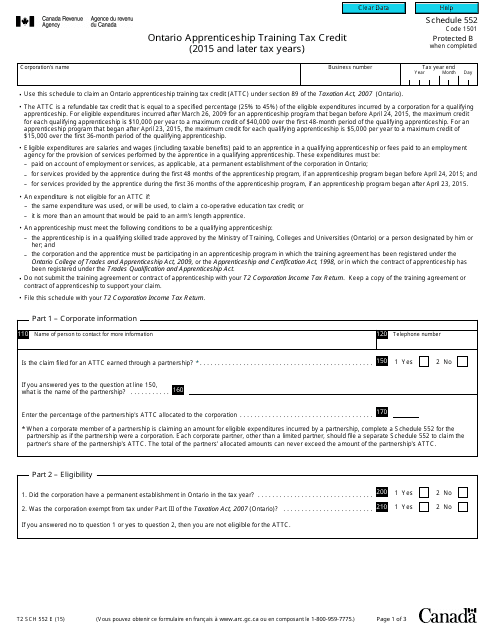

This form is used for claiming the Ontario Apprenticeship Training Tax Credit for tax years 2015 and later in Canada.

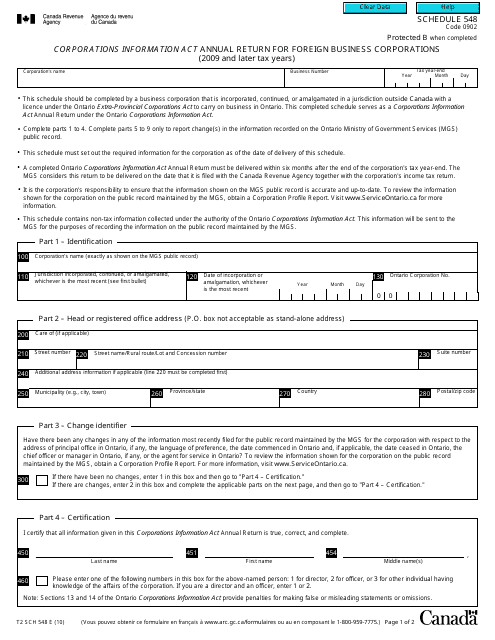

This form is used for foreign business corporations to file their annual return under the Corporations Information Act in Canada.

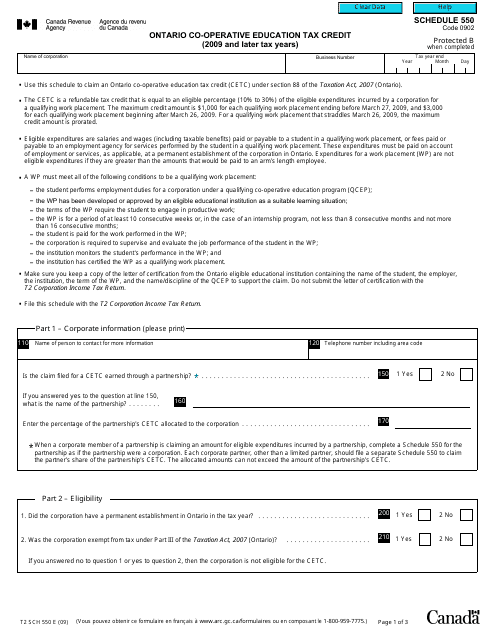

This form is used for claiming the Ontario Co-operative Education Tax Credit for tax years 2009 and later in Canada.

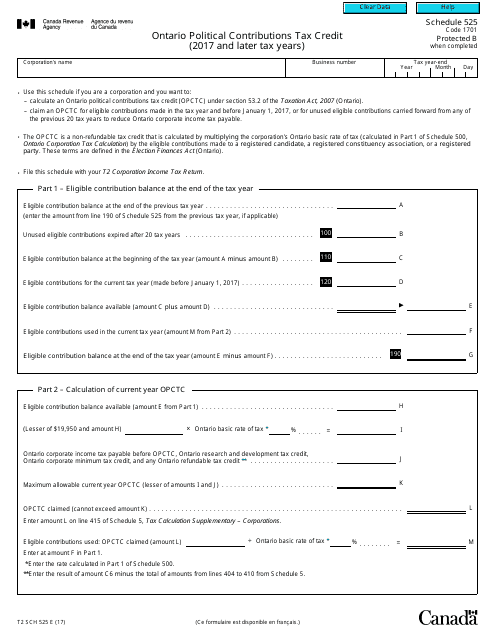

This Form is used for reporting and claiming the Ontario Political Contributions Tax Credit on your Canadian tax return.

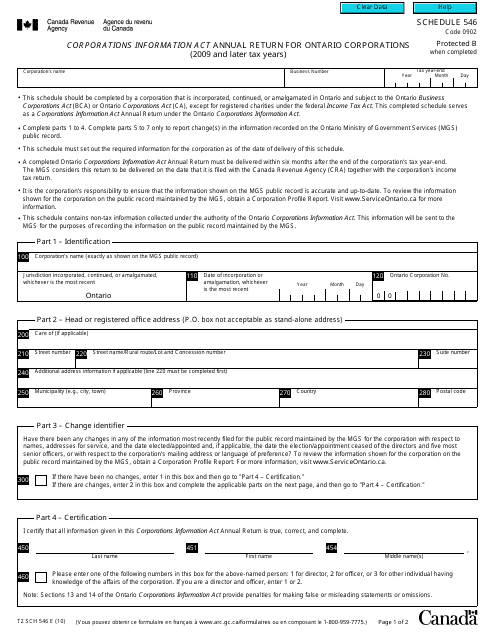

This form is used for Ontario corporations in Canada to file their annual return under the Corporations Information Act for the tax years 2009 and onwards.