Canadian Federal Legal Forms and Templates

Documents:

5112

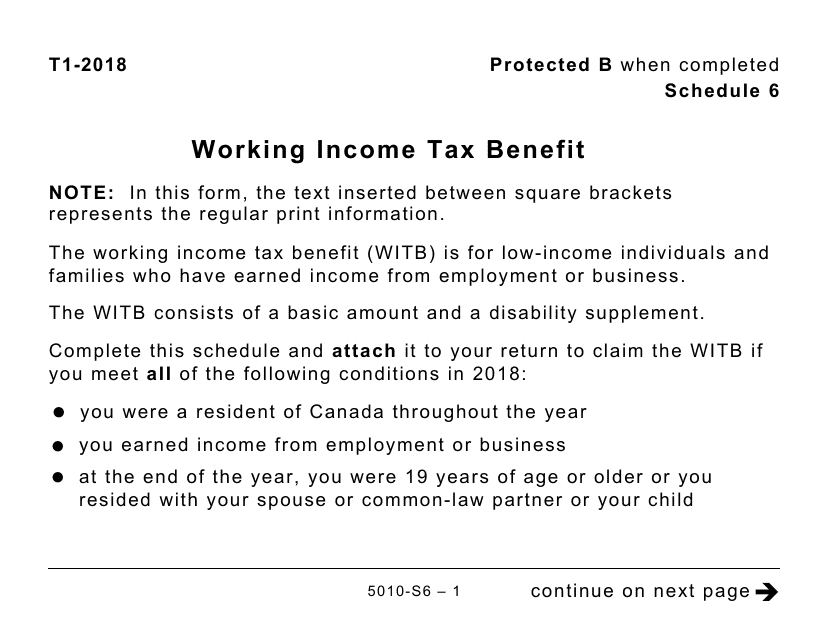

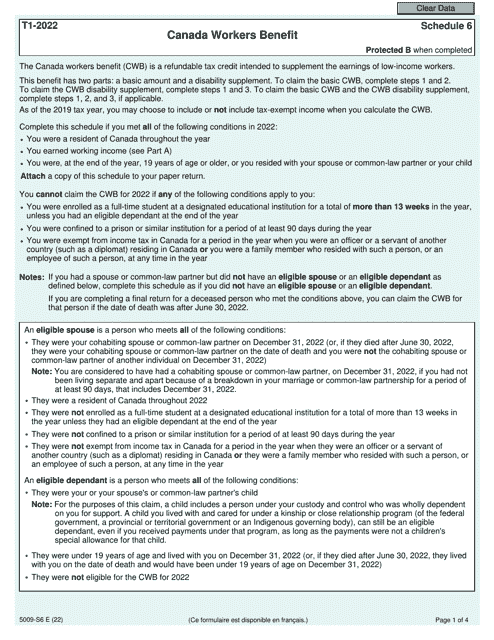

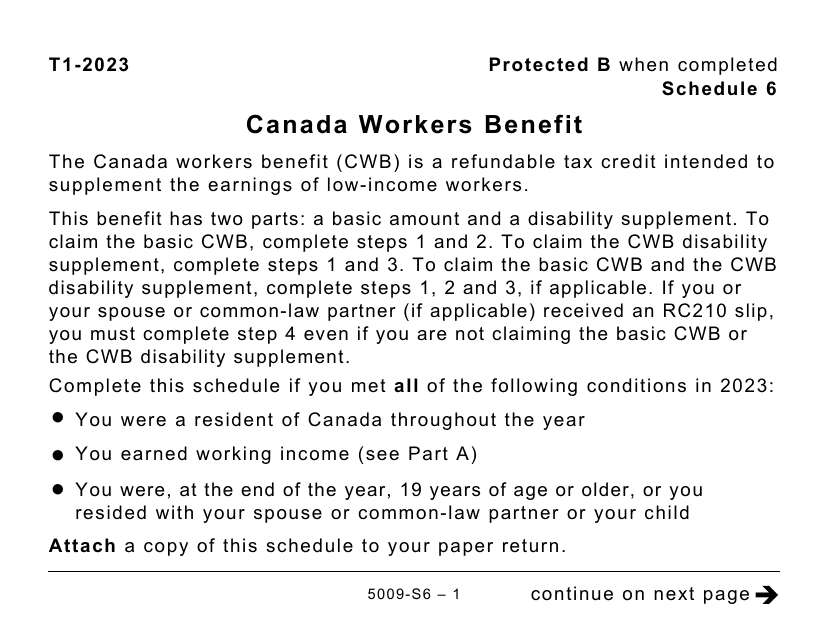

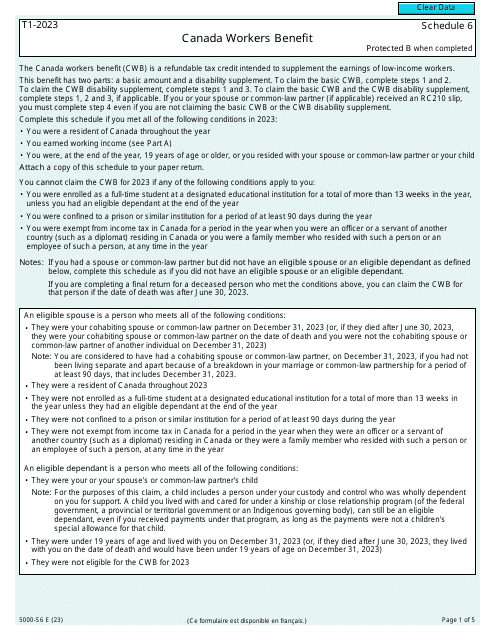

This form is used for reporting the Working Income Tax Benefit in Canada. It is specifically designed for individuals who prefer a large print version.

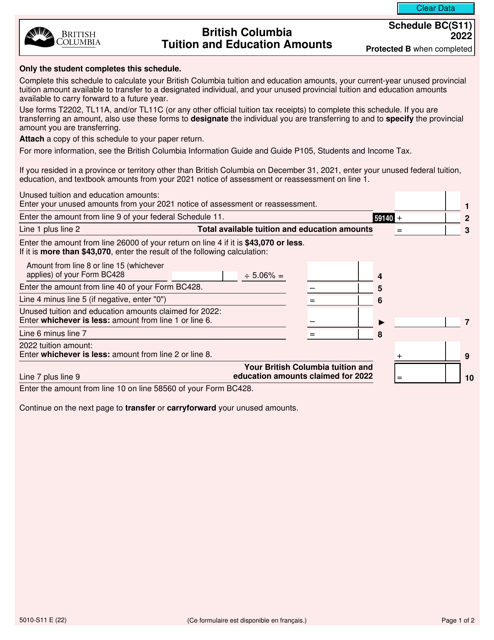

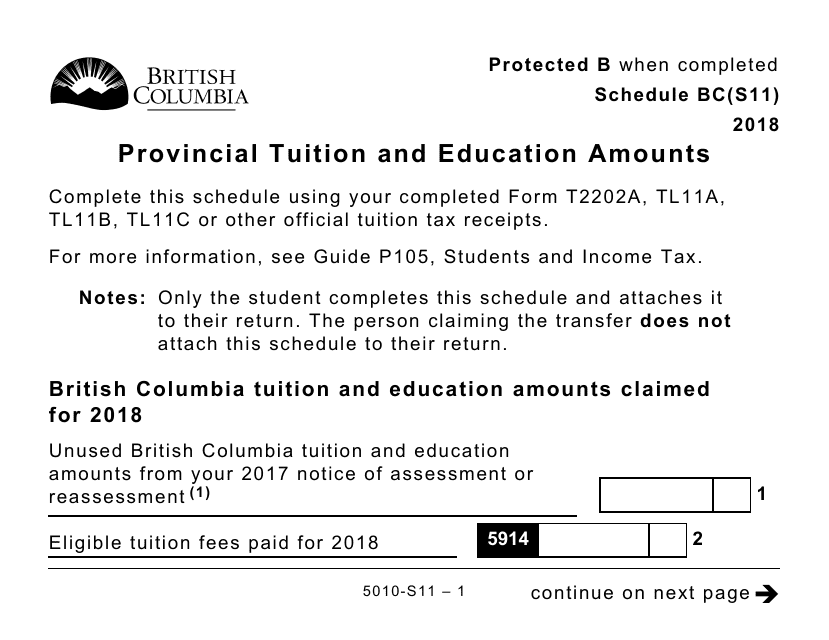

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2018

This form is used for reporting provincial tuition and education amounts in a large print format in Canada.

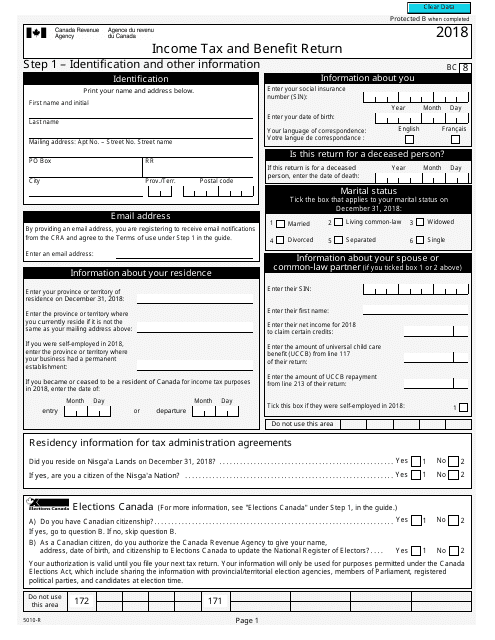

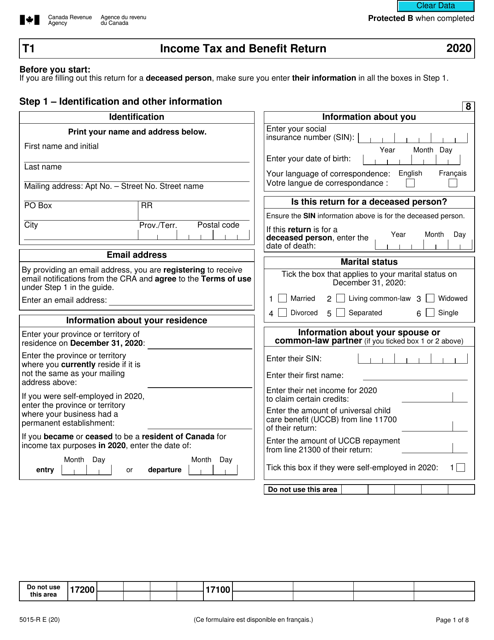

This form is used for filing income taxes and reporting benefits in Canada.

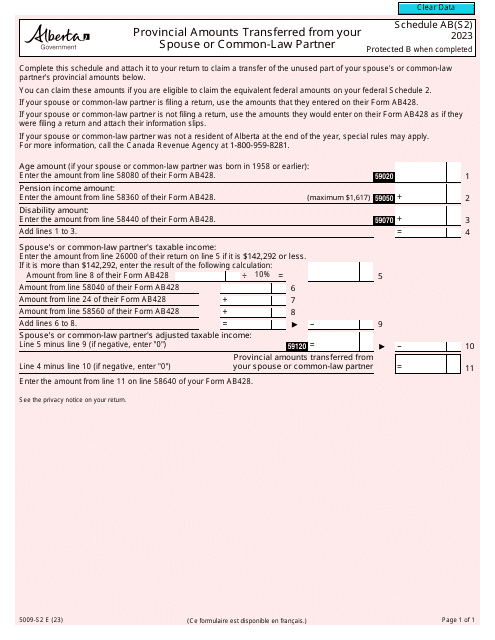

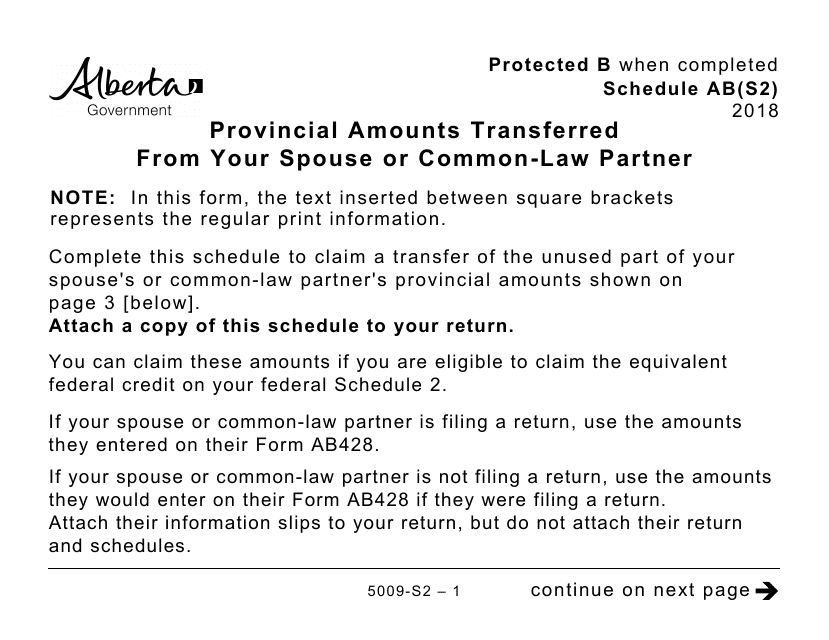

This form is used for reporting provincial amounts that have been transferred from your spouse or common-law partner on Schedule AB(S2). It is available in a large print format.

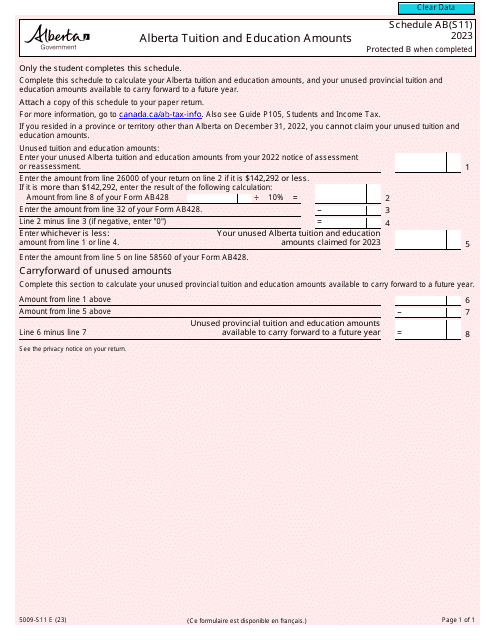

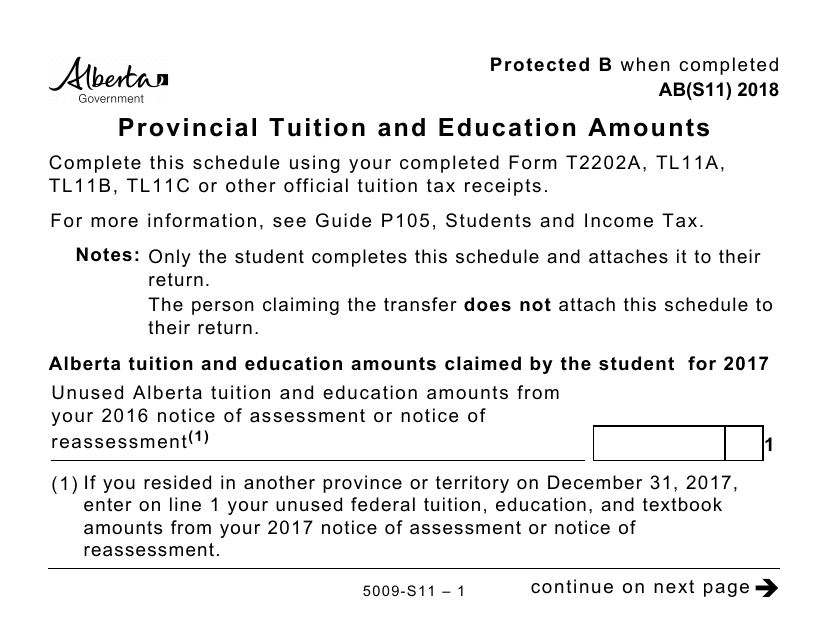

Form 5009-S11 Schedule AB(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2018

This form is used for reporting provincial tuition and education amounts for tax purposes in Canada. It is specifically designed in a large print format for ease of reading.

This Form is used for filing income tax and benefit return in large print format in Canada.

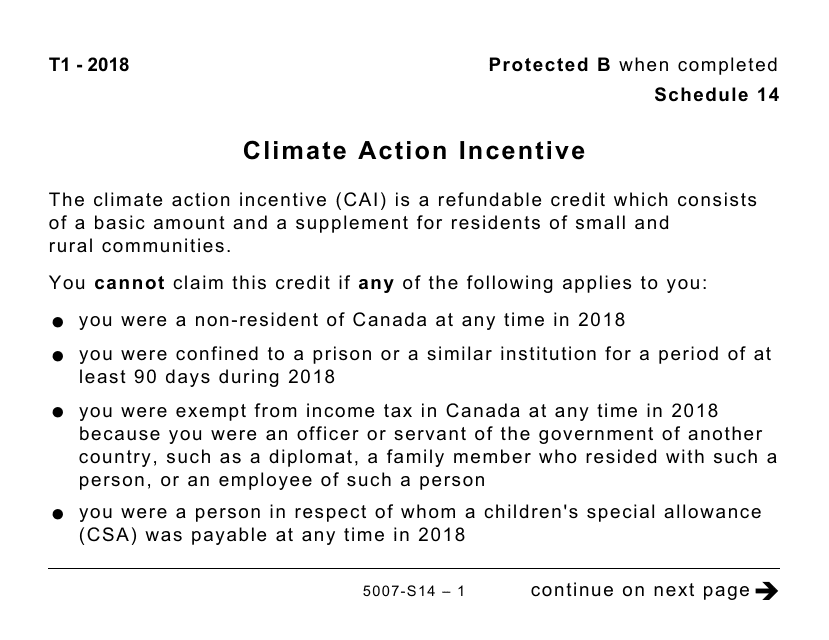

This form is used for reporting and claiming the Climate Action Incentive in Canada. It is a large print version of Schedule 14.

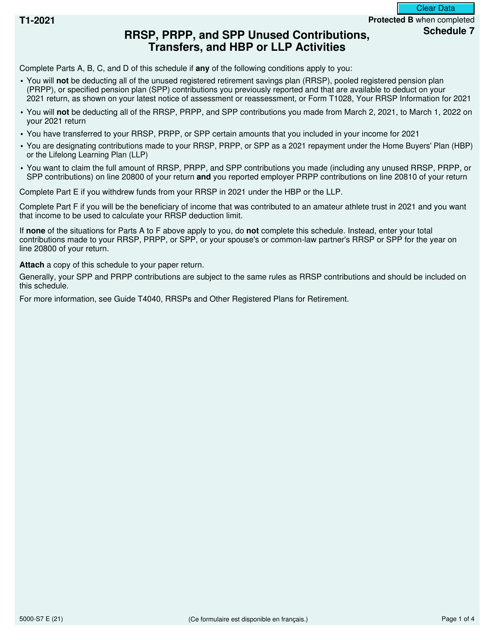

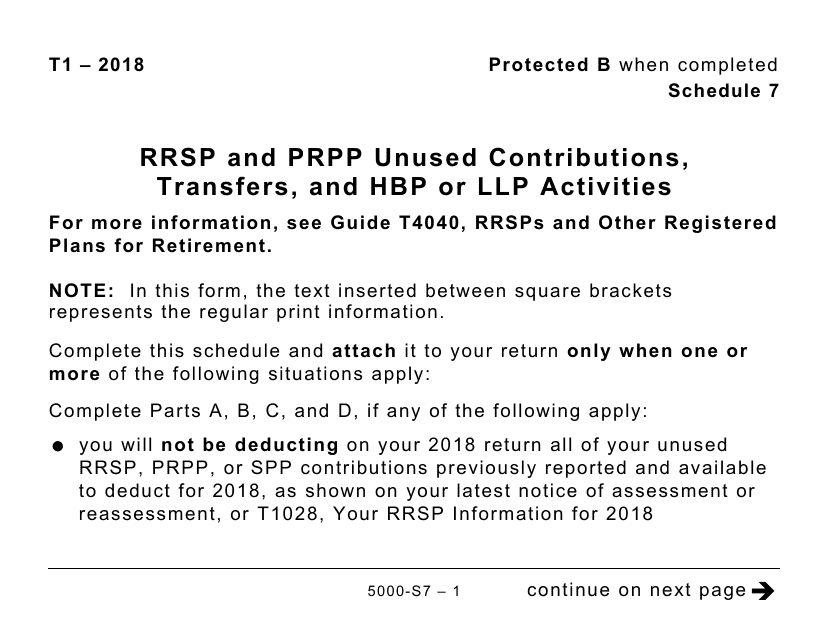

This form is used for reporting the unused contributions, transfers, and activities related to RRSP, PRPP, HBP or LLP in Canada. The large print version is available for visually impaired individuals.

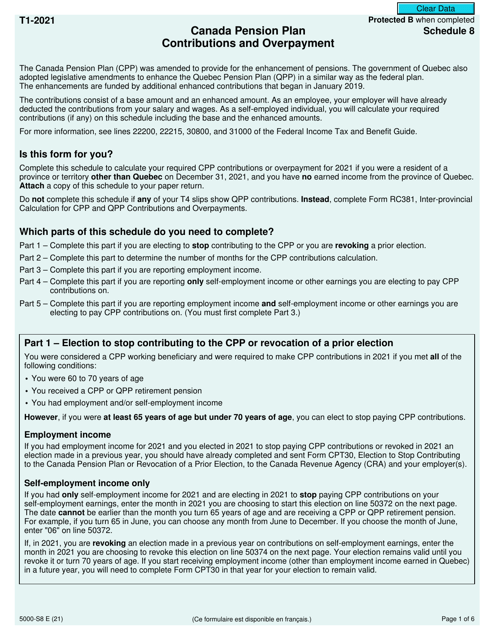

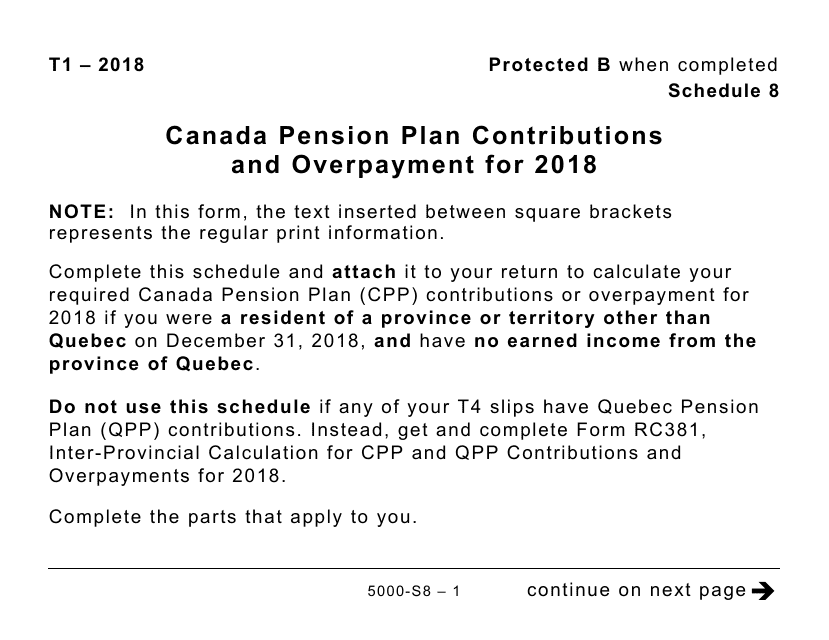

This form is used for reporting Canada Pension Plan contributions and overpayment in a large print format.

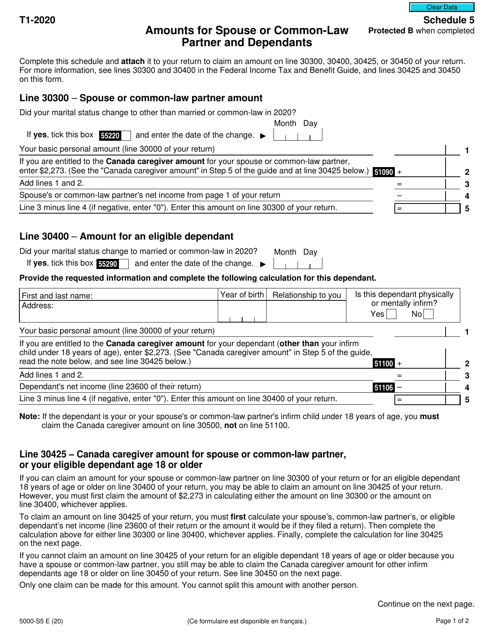

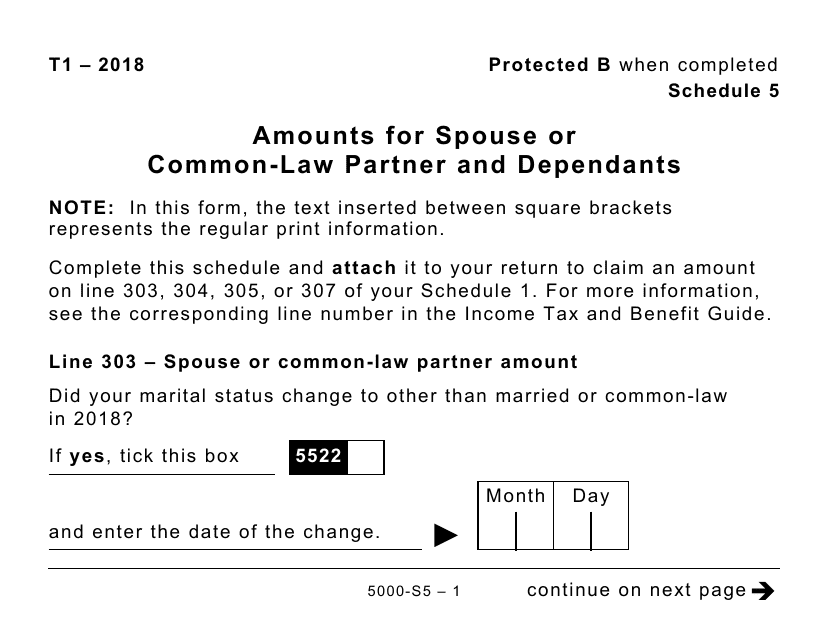

This form is used to report the amounts for a spouse or common-law partner and dependants in a larger print format. It is specifically for Canadian taxpayers.

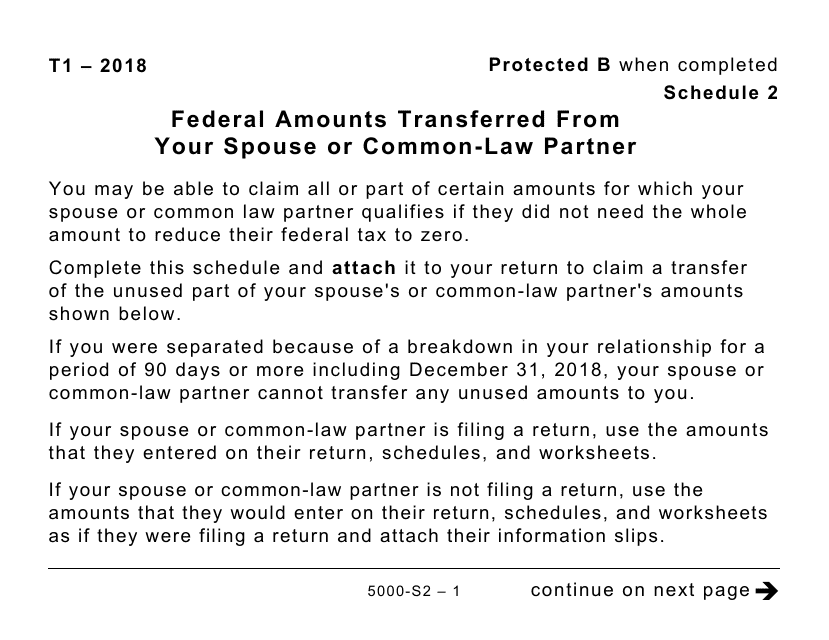

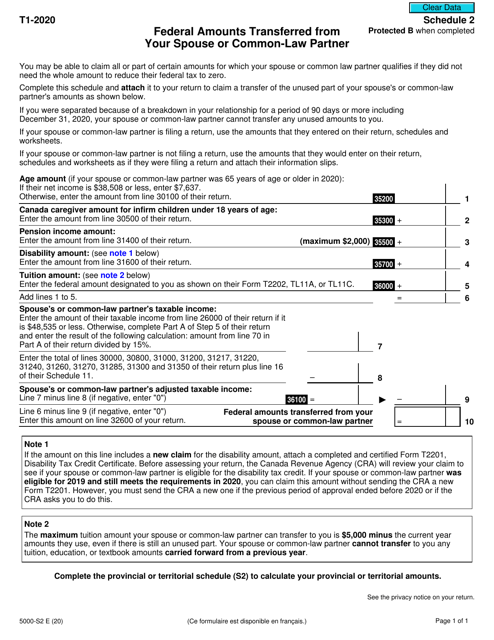

This type of document is used in Canada to report federal amounts transferred from a spouse or common-law partner. It is available in large print format.

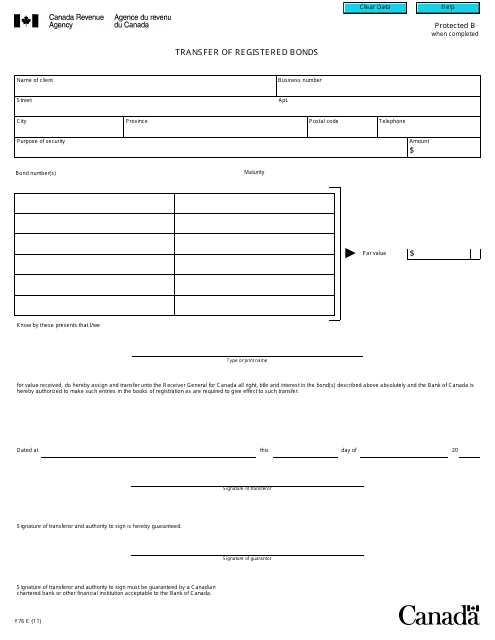

This form is used for transferring registered bonds in Canada. It is used to change the ownership of the bonds from one party to another.

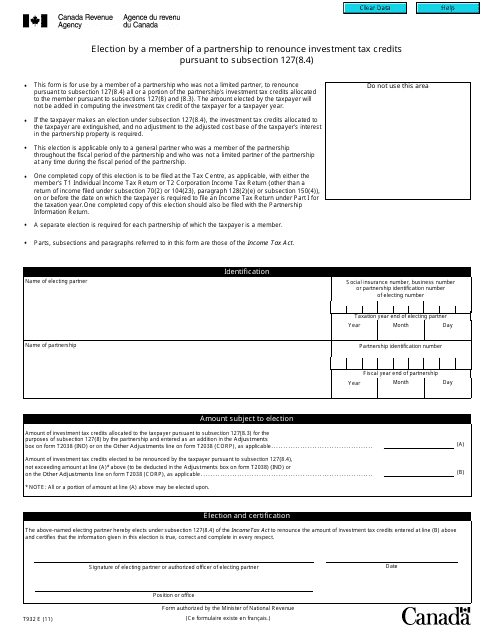

This form is used for a member of a partnership in Canada to renounce investment tax credits as per subsection 127(8.4).

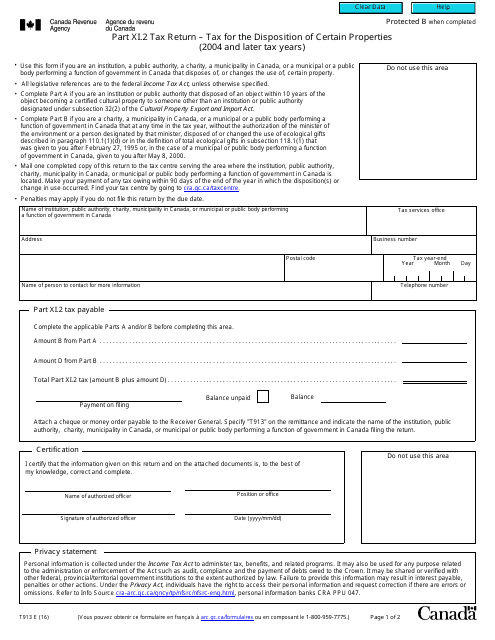

This Form is used for reporting tax on the sale of certain properties in Canada for the tax years 2004 and later.

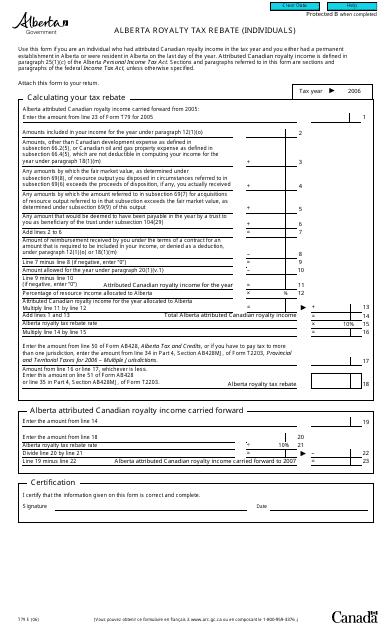

This form is used for individuals in Alberta, Canada to apply for a royalty tax rebate. It allows eligible individuals to claim a refund on the taxes paid on royalties received.

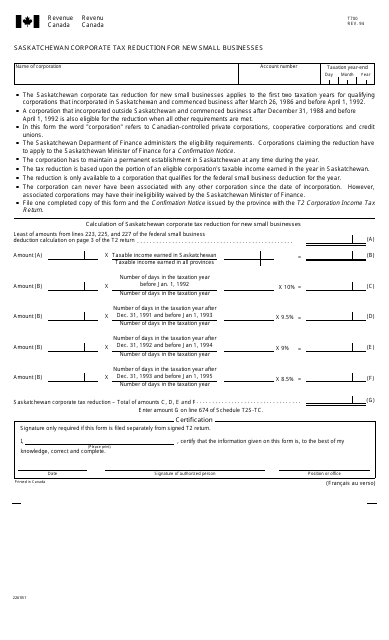

This form is used for applying for the Saskatchewan Corporate Tax Reduction for New Small Businesses in Canada. It helps eligible small businesses reduce their corporate tax obligations in the province of Saskatchewan.

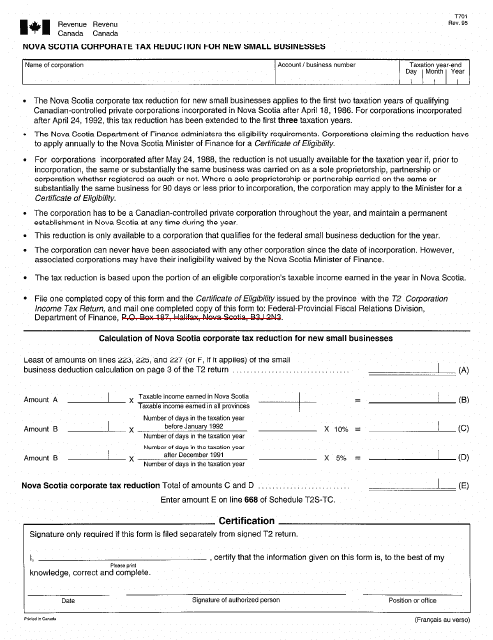

This form is used for claiming a tax reduction for new small businesses in Nova Scotia, Canada.

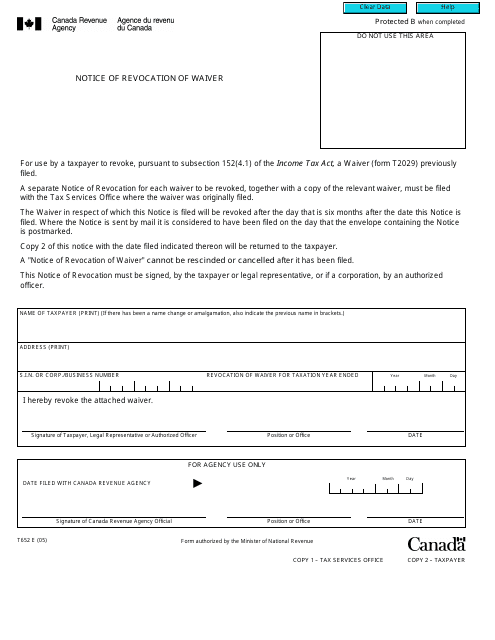

This form is used for notifying the revocation of a waiver in Canada.

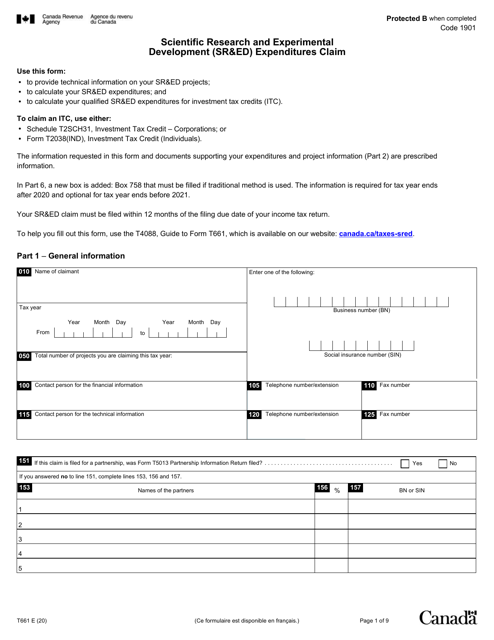

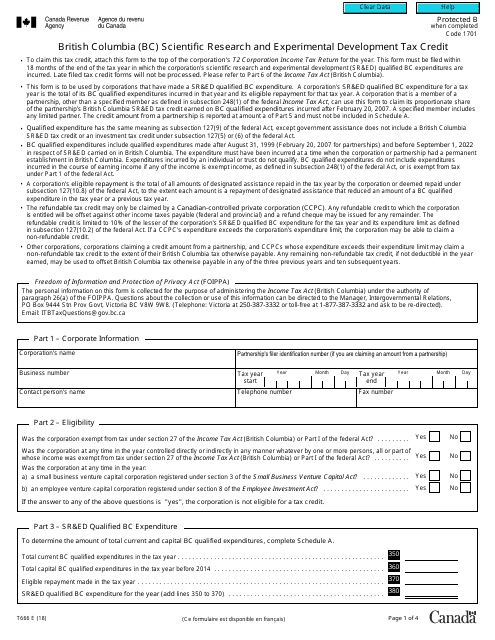

Form T666 British Columbia (Bc) Scientific Research and Experimental Development Tax Credit - Canada

This form is used for claiming the British Columbia (BC) Scientific Research and Experimental Development Tax Credit in Canada.

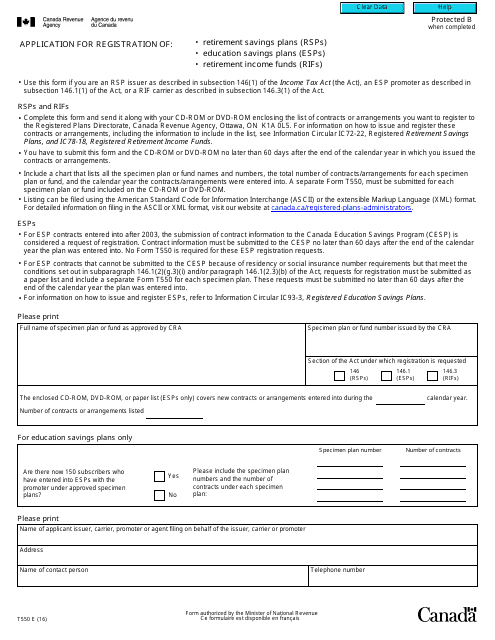

This form is used for applying to register RSPs, ESPs, or RIFs under specific sections of the Canadian Income Tax Act.

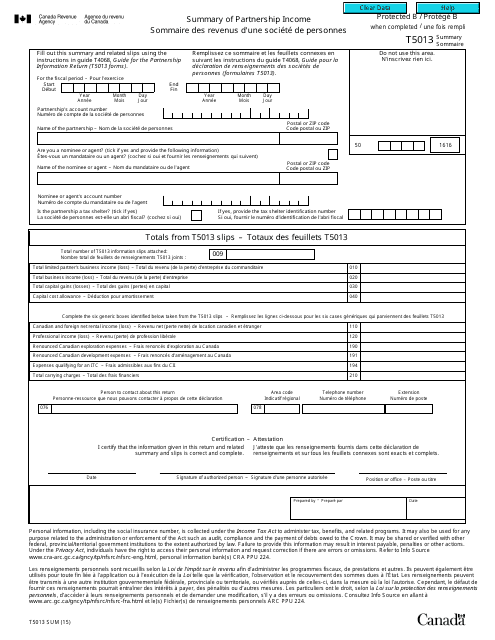

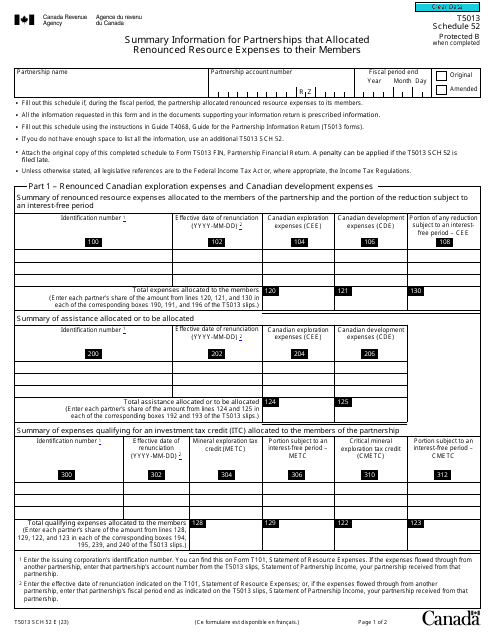

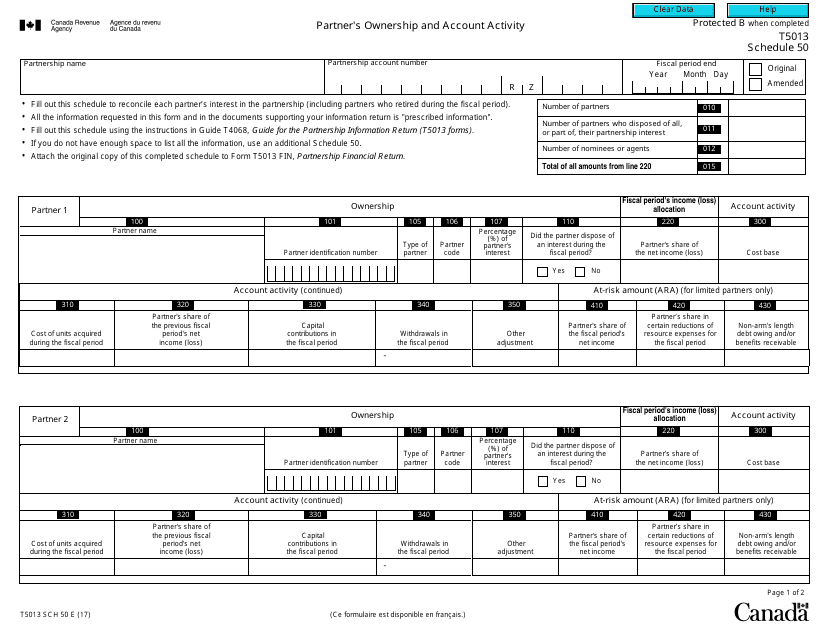

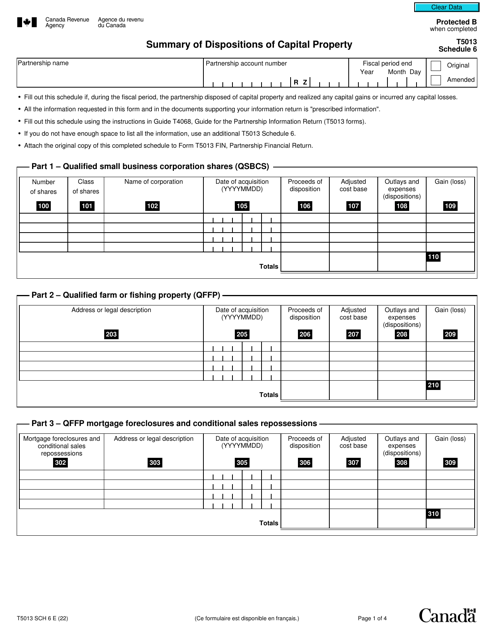

This form is used for reporting partnership income in Canada. It provides a summary of partnership income and is available in both English and French.

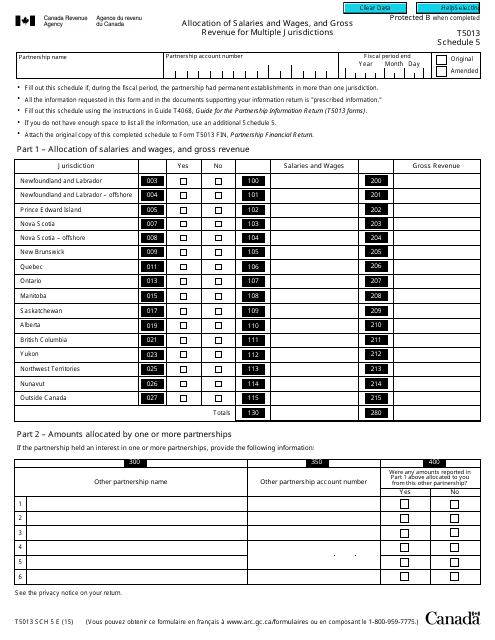

This form is used for allocating salaries, wages, and gross revenue for multiple jurisdictions in Canada.