Canadian Federal Legal Forms and Templates

Documents:

5112

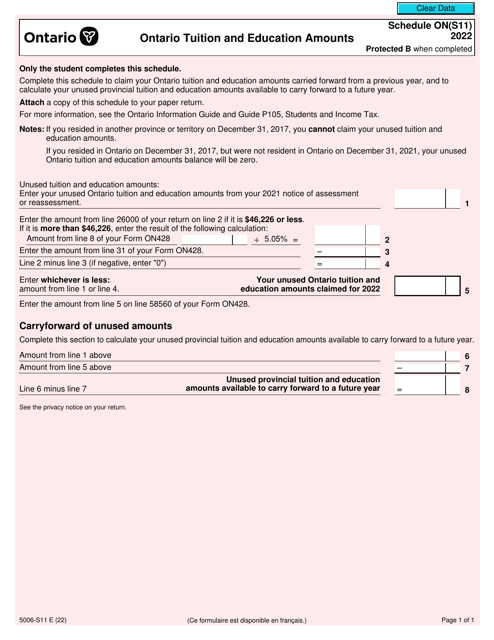

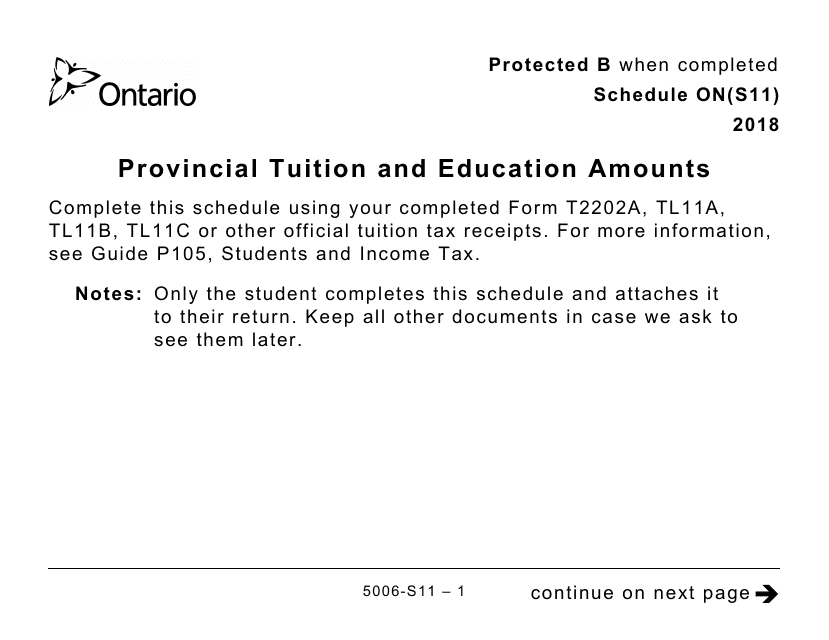

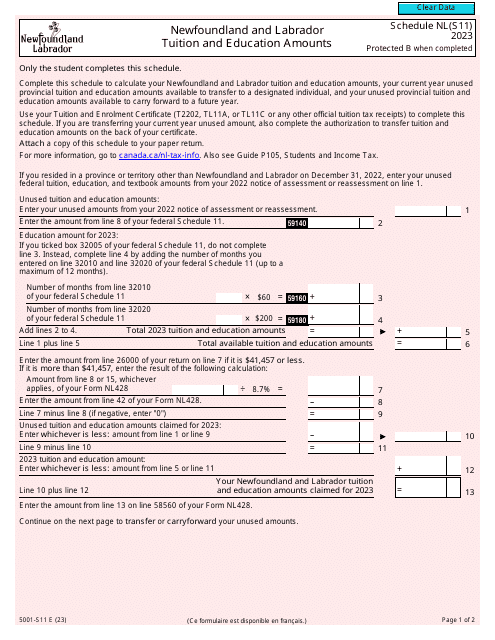

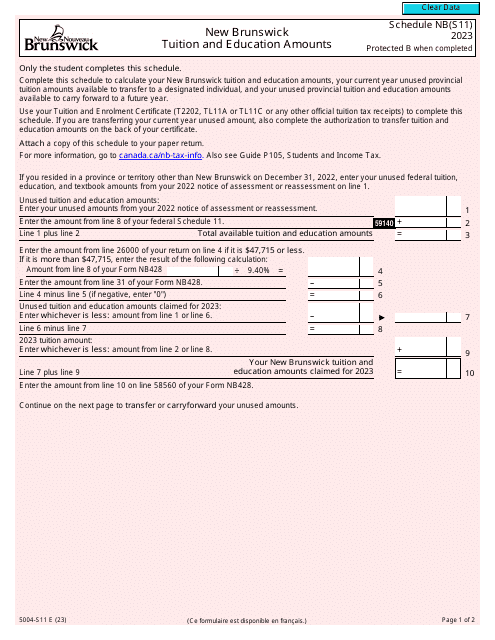

Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2018

This document is for reporting provincial tuition and education amounts in Canada. It is a large print version of Schedule ON(S11) for Form 5006-S11.

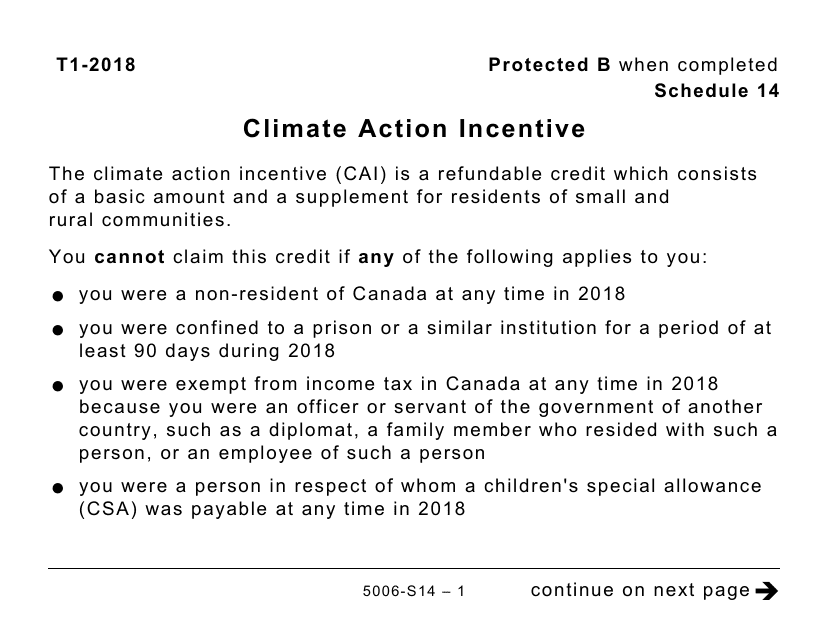

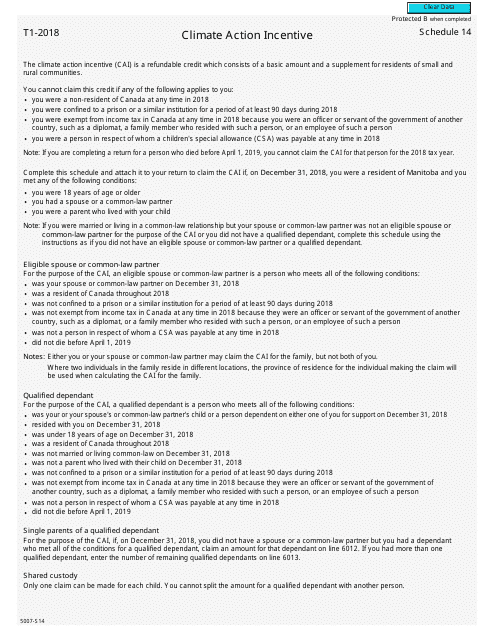

This Form is used for reporting and claiming the Climate Action Incentive in Canada in a large print format.

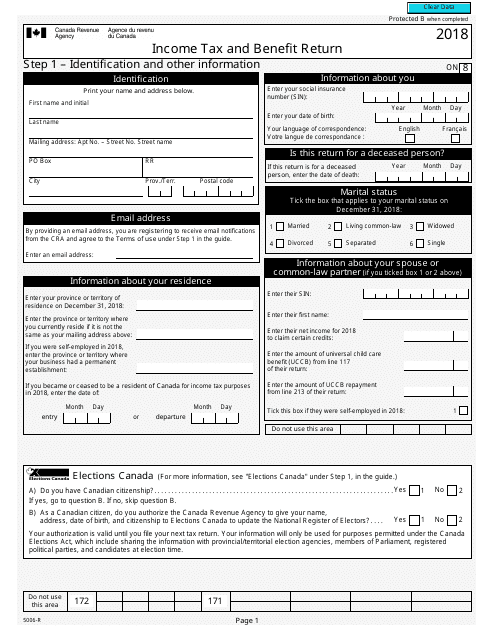

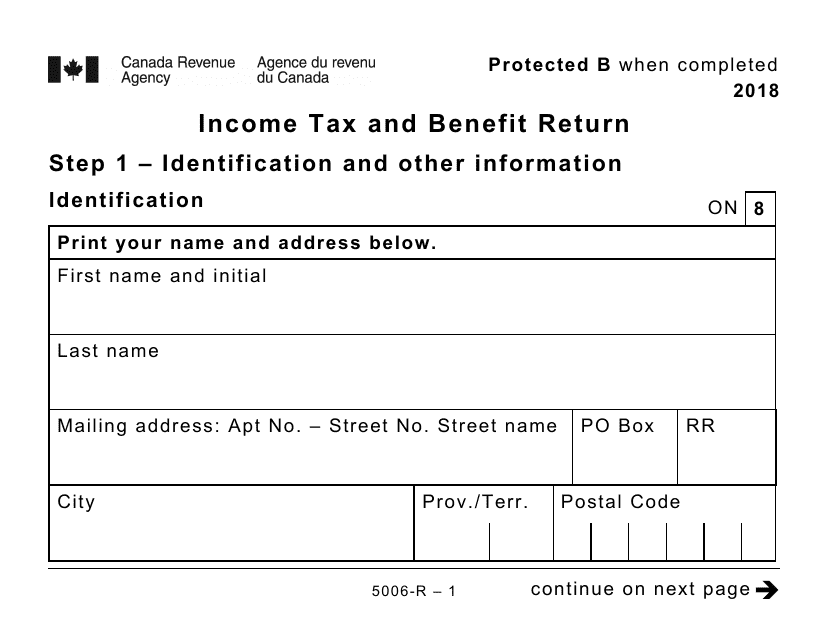

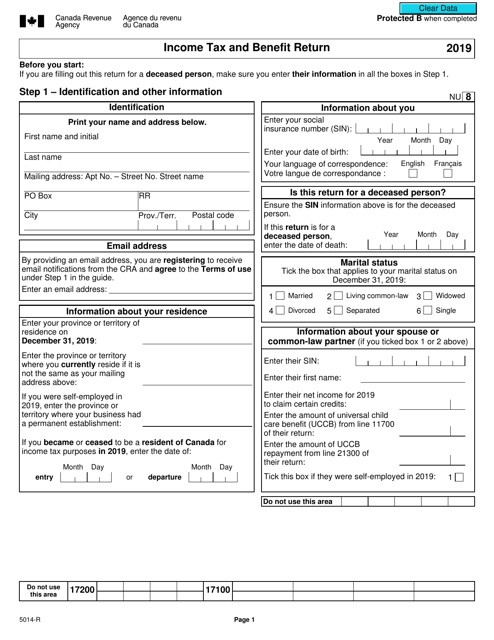

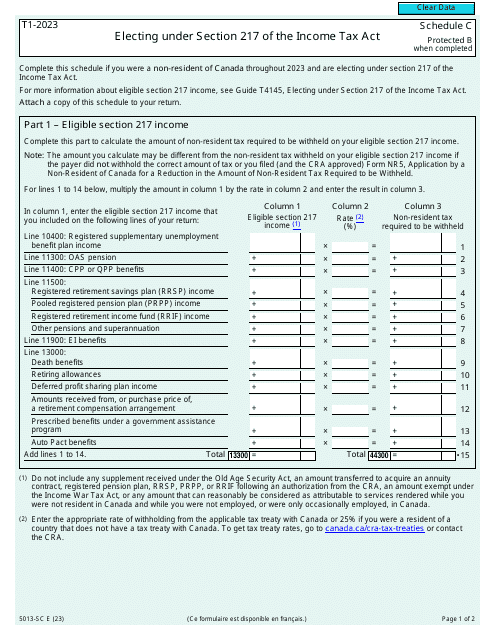

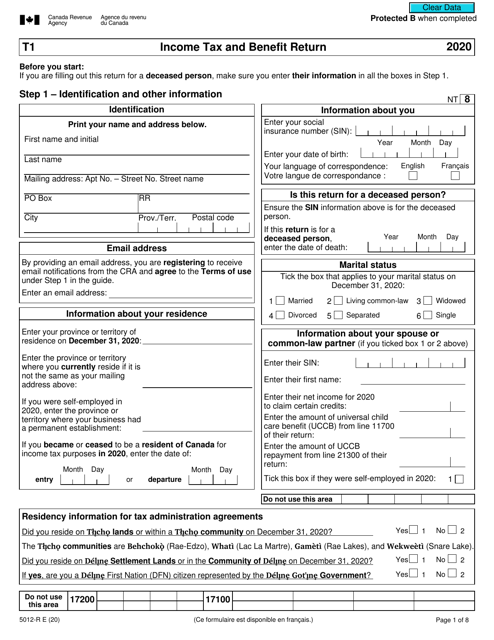

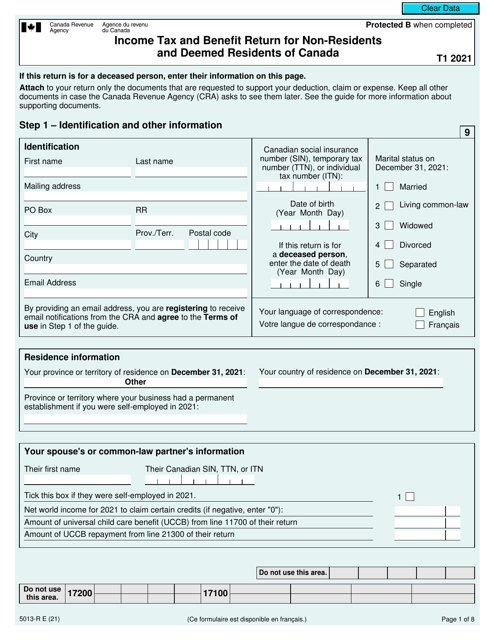

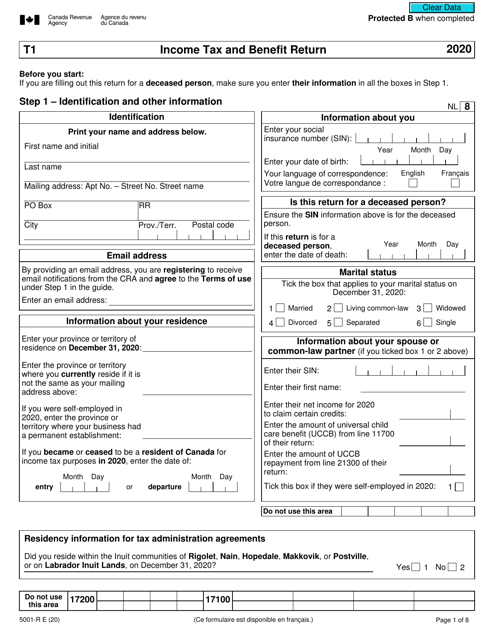

This form is used for filing income tax and benefit returns in Canada. It is used to report your income, deductions, credits, and other information that is necessary for calculating your tax liability or claiming any benefits you may be eligible for.

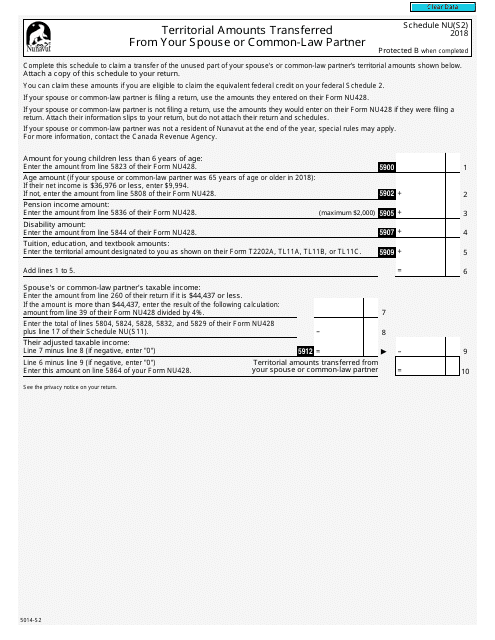

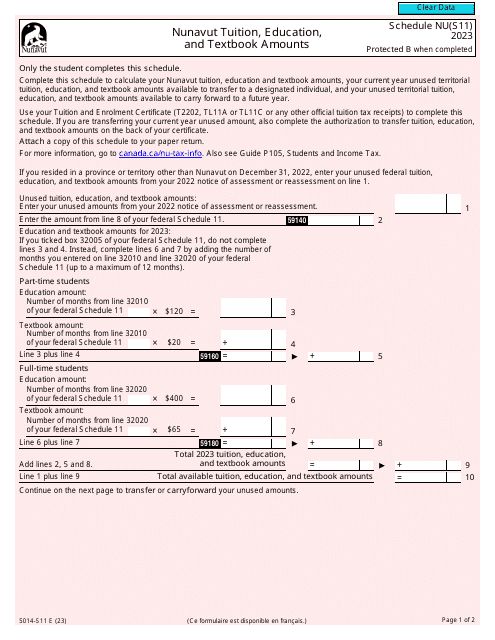

This form is used for reporting the territorial amounts transferred from your spouse or common-law partner on Schedule NU(S2) in Canada.

This Form is used for reporting income, claiming deductions and credits, and calculating tax liability for individuals in Canada. It is specifically designed for those who require a large print format.

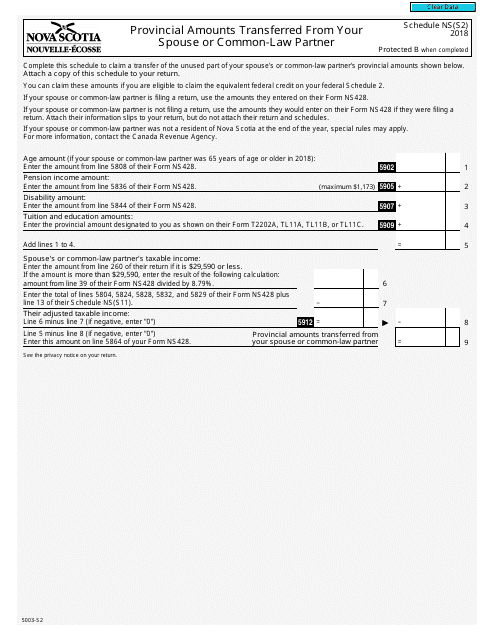

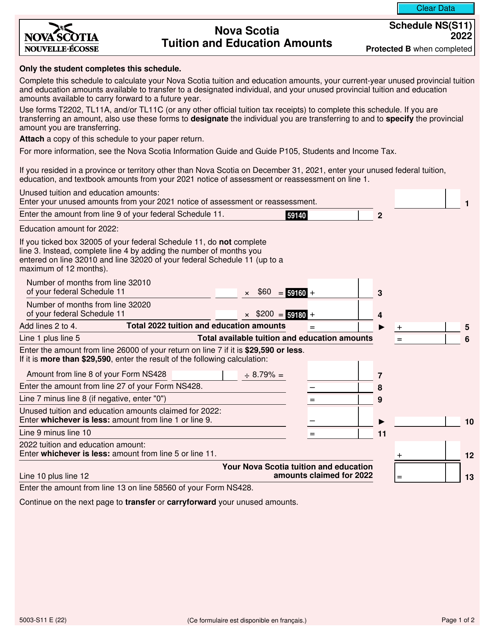

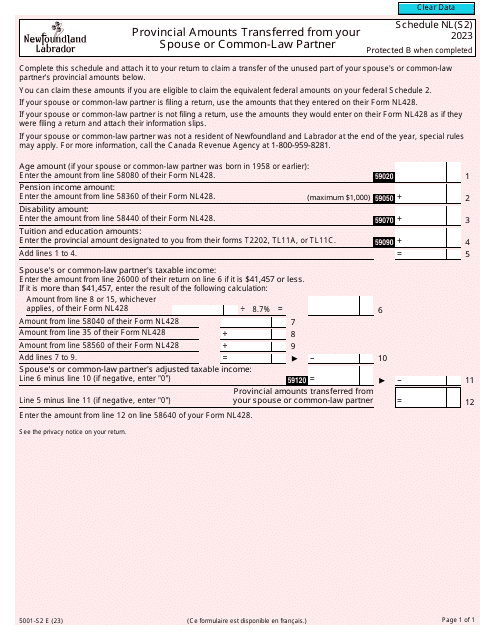

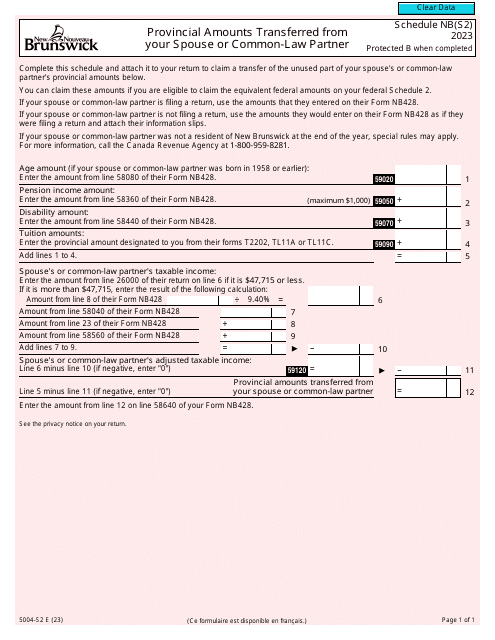

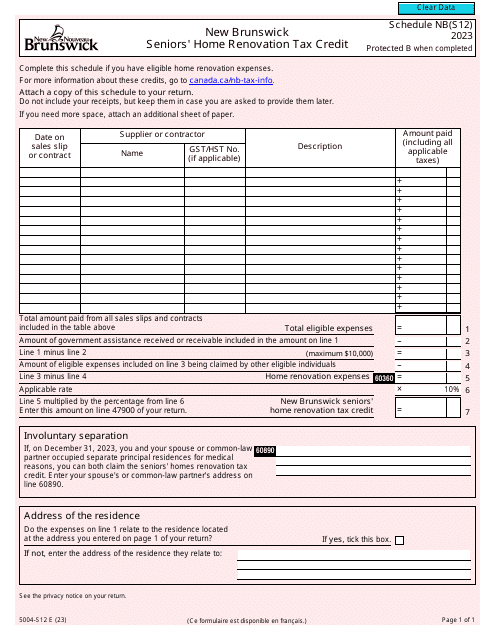

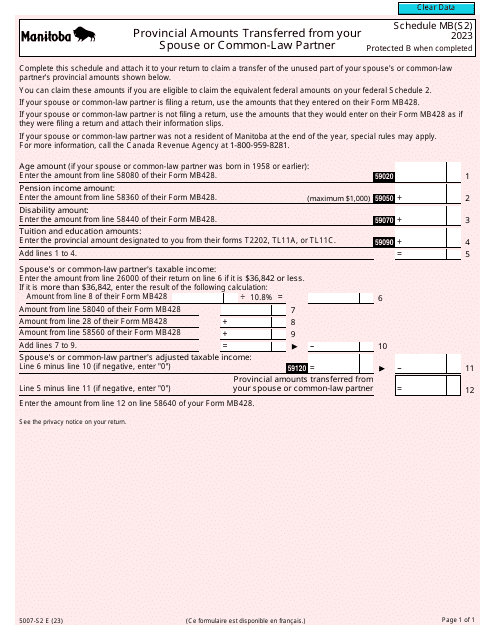

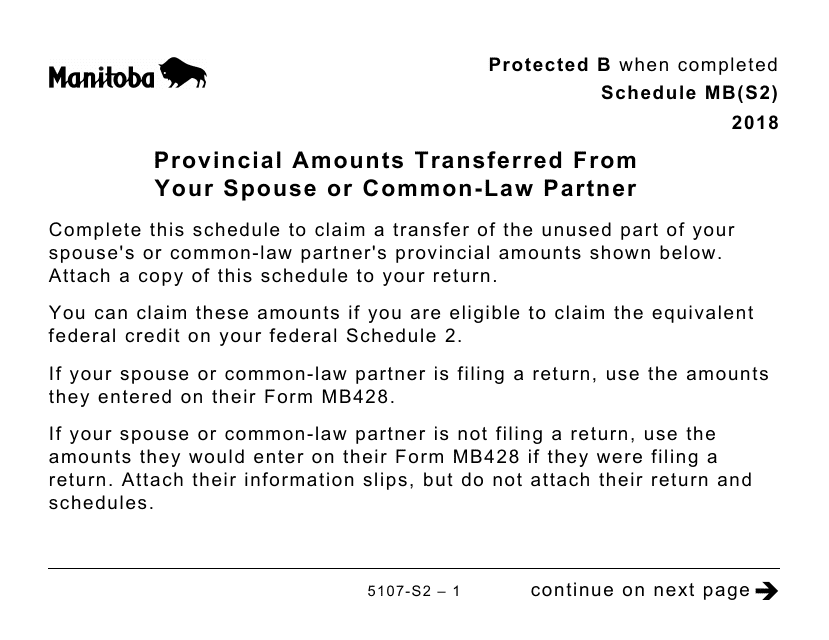

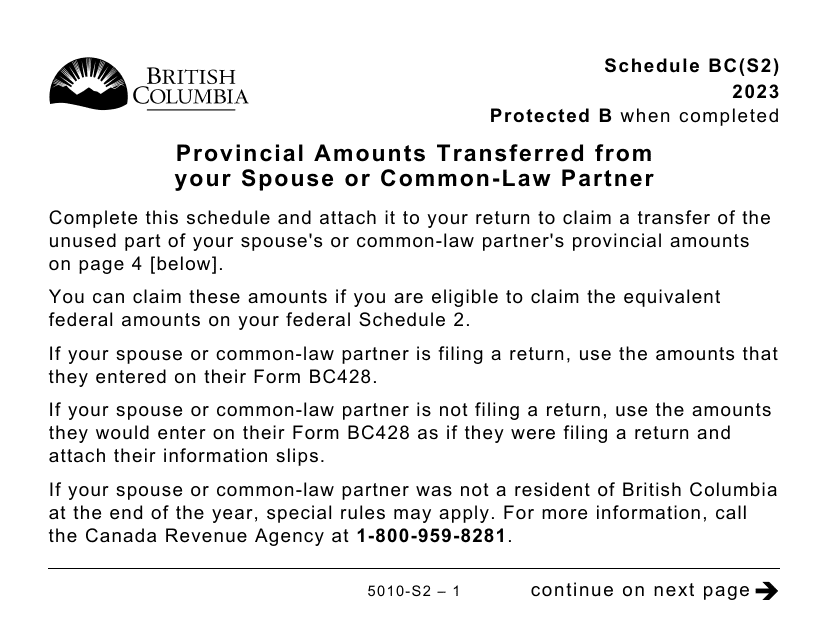

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner in Canada.

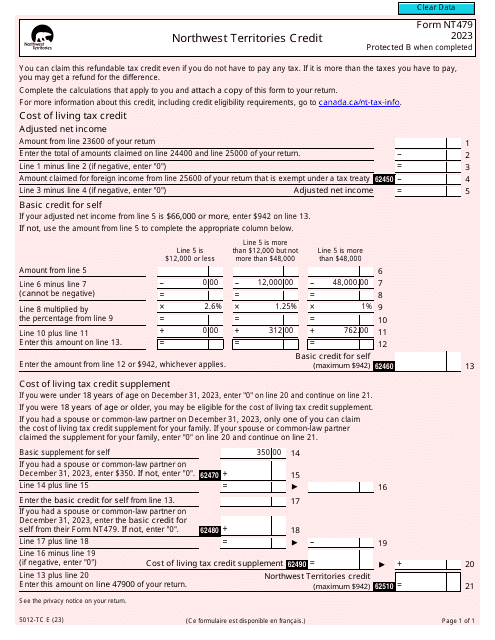

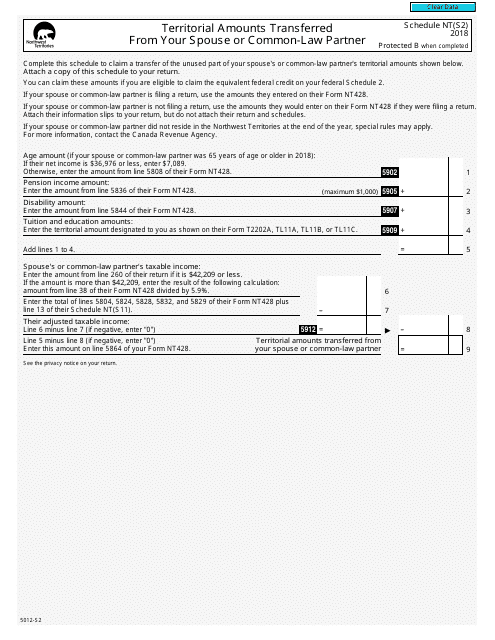

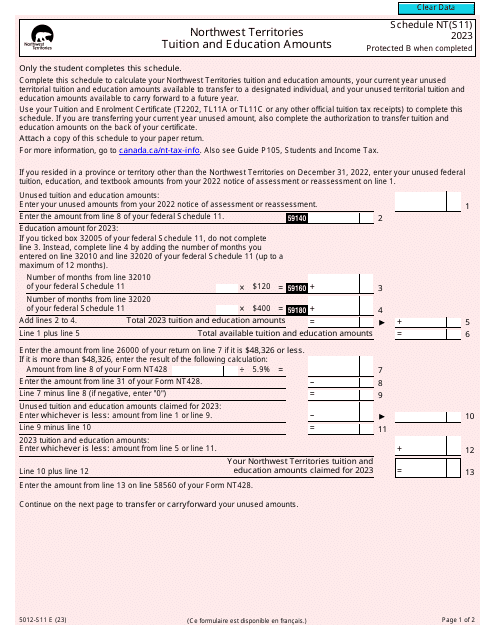

This form is used in Canada to report the territorial amounts transferred from your spouse or common-law partner on Schedule NT(S2).

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on your Canadian tax return. It is in large print format for easier reading.

This form is used for reporting and claiming the Climate Action Incentive in Canada. It helps individuals calculate and document their eligible expenses related to energy-efficient products and home improvements.

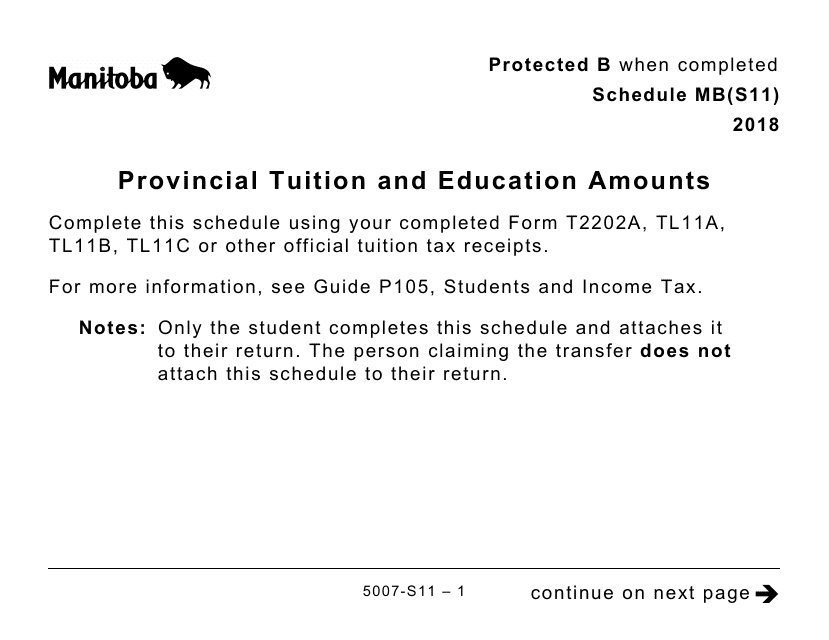

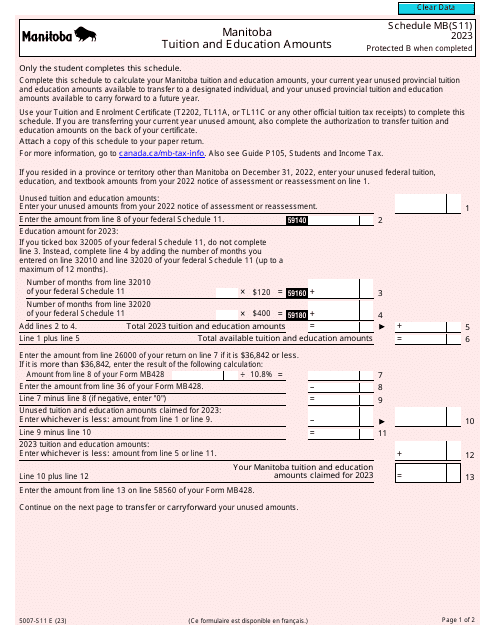

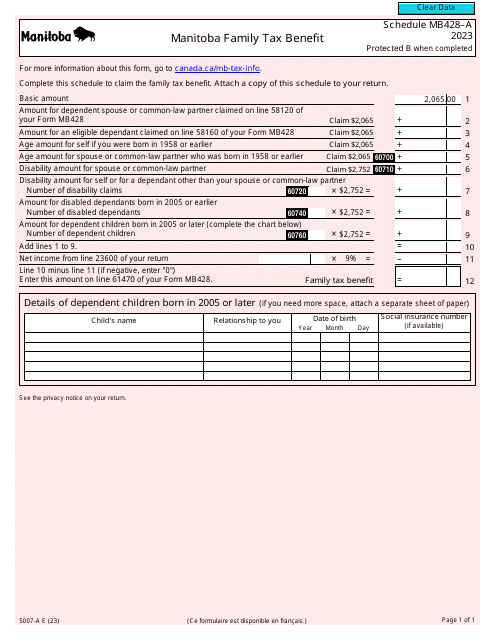

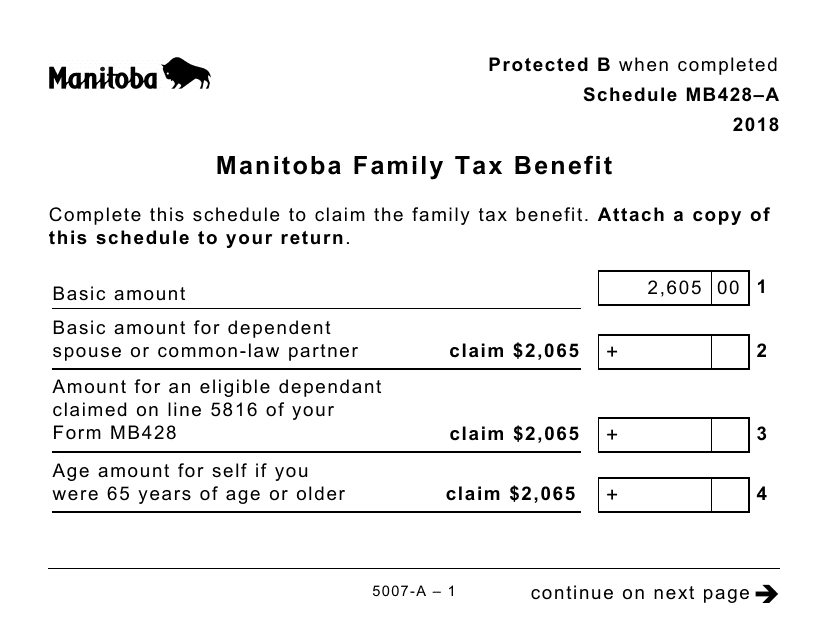

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts (Large Print) - Canada, 2018

This form is used for reporting provincial tuition and education amounts in a large print format in Canada.

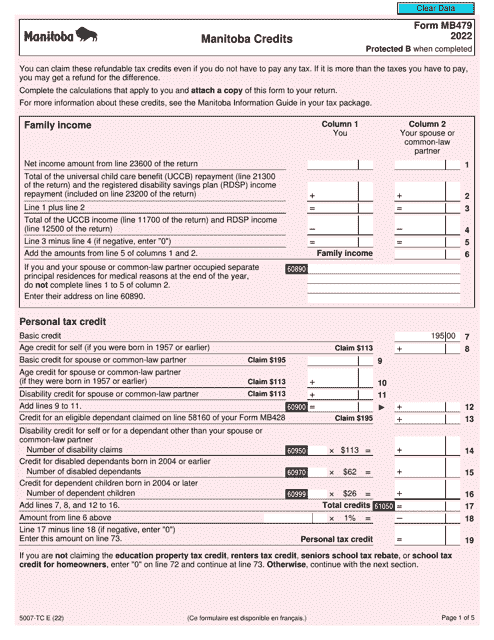

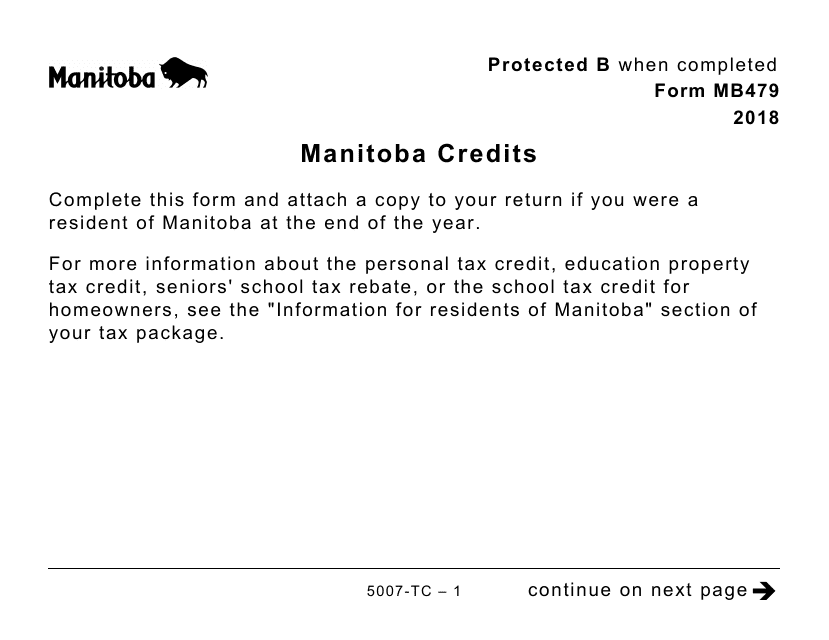

This form is used for claiming Manitoba credits in Canada. It is a large print version of Form 5007-TC (MB479).

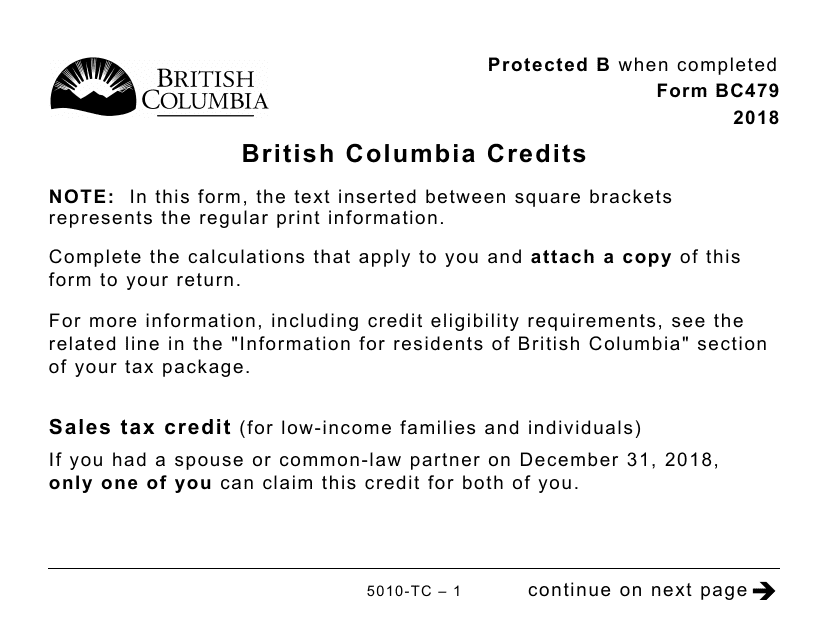

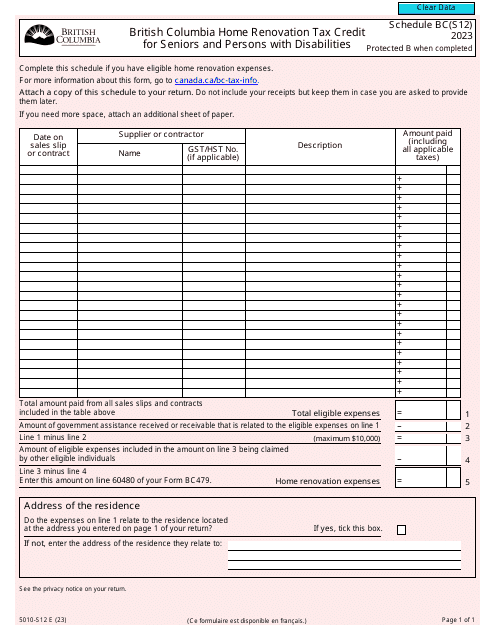

This form is used for claiming credits in the province of British Columbia in Canada. It is available in a large print format for easy reading.

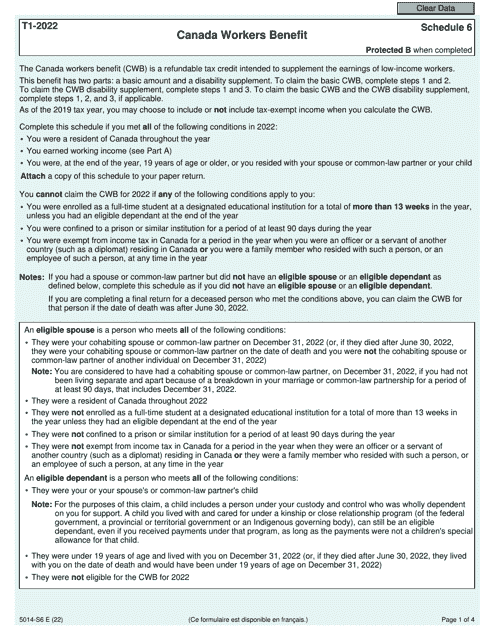

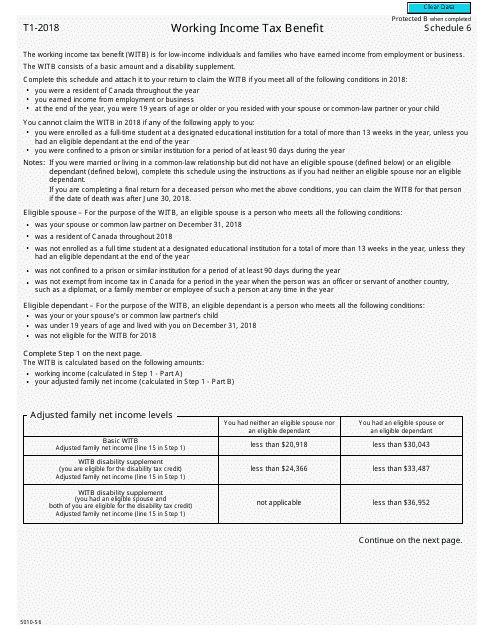

This form is used for reporting the Working Income Tax Benefit in Canada.