New York State Department of Taxation and Finance Forms

Documents:

2566

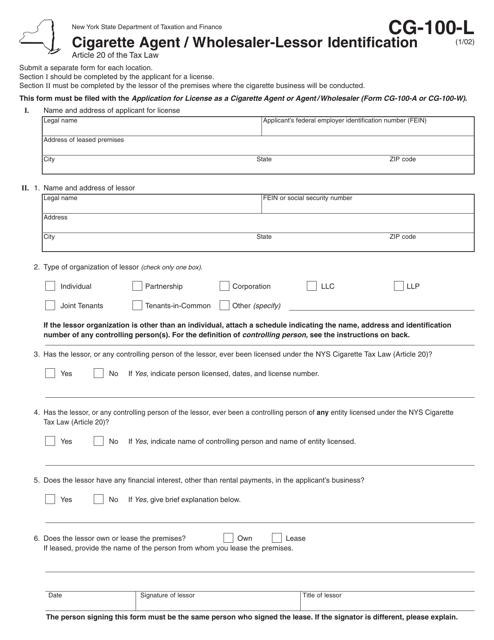

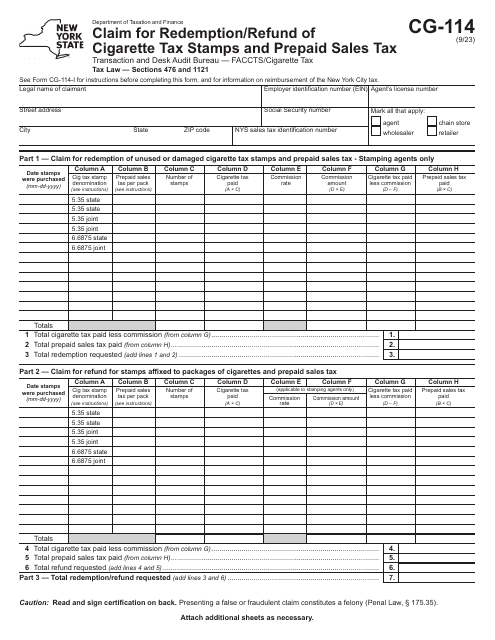

This Form is used for identifying and registering cigarette agents, wholesalers, and lessors in the state of New York.

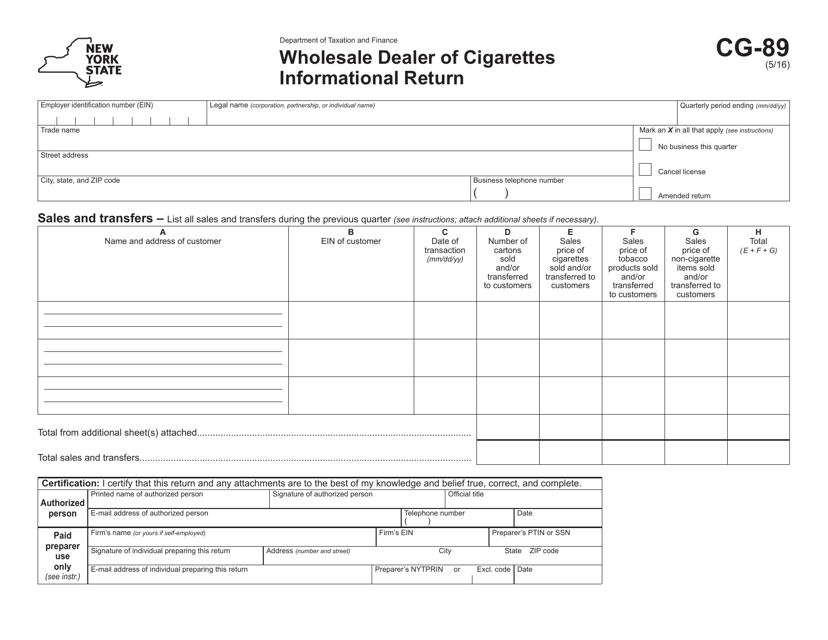

This form is used for wholesale dealers of cigarettes in New York to provide information about their business activities.

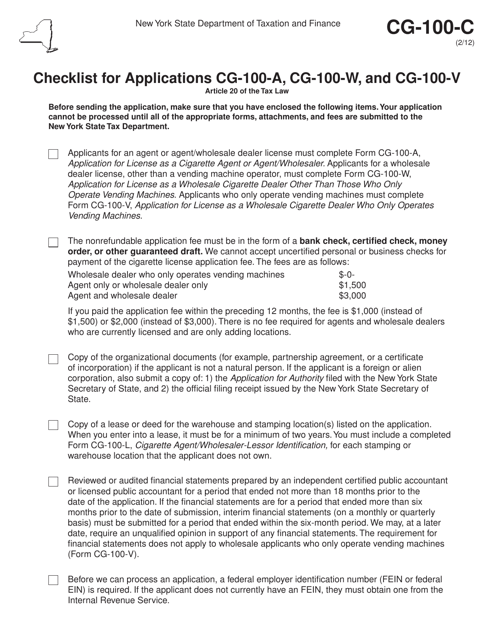

This form is used as a checklist for applications CG-100-A, CG-100-W, and CG-100-V in the state of New York. It helps to ensure that all required documents and information are provided when submitting these applications.

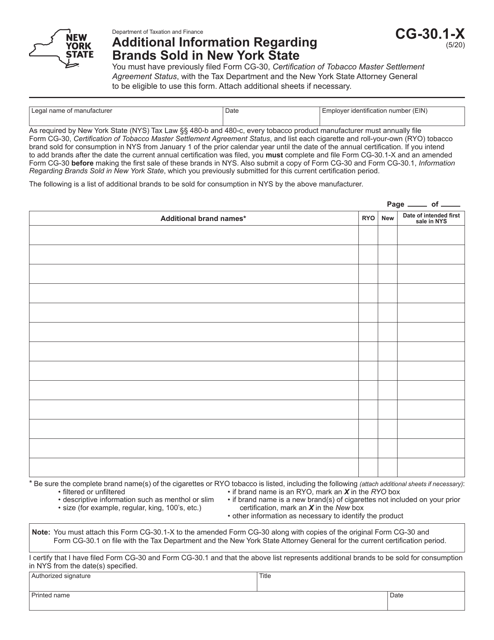

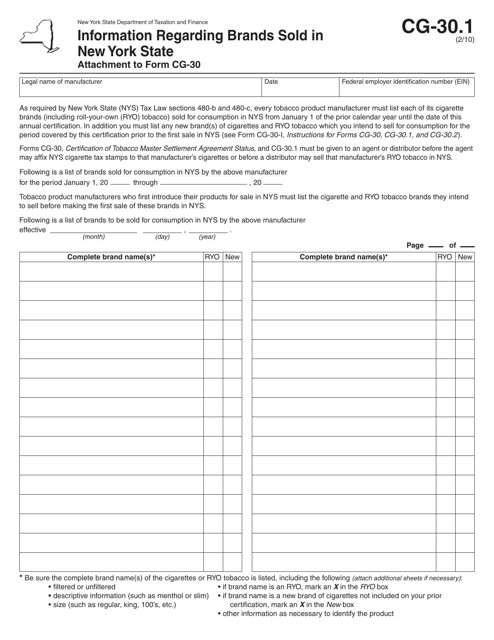

This form is used for providing information about the brands that are sold in New York State.

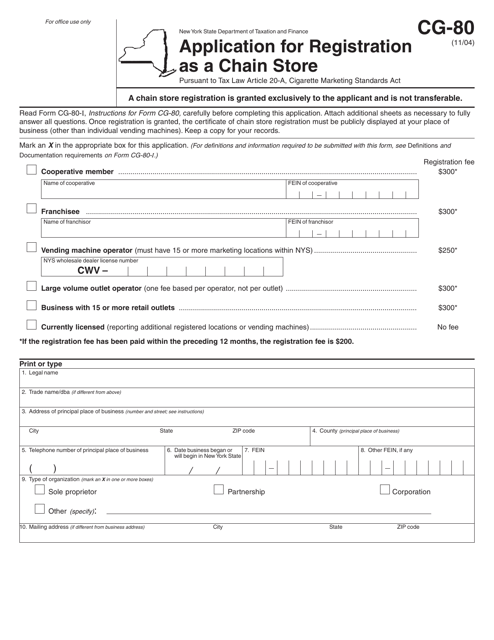

This Form is used for applying to register as a chain store in the state of New York.

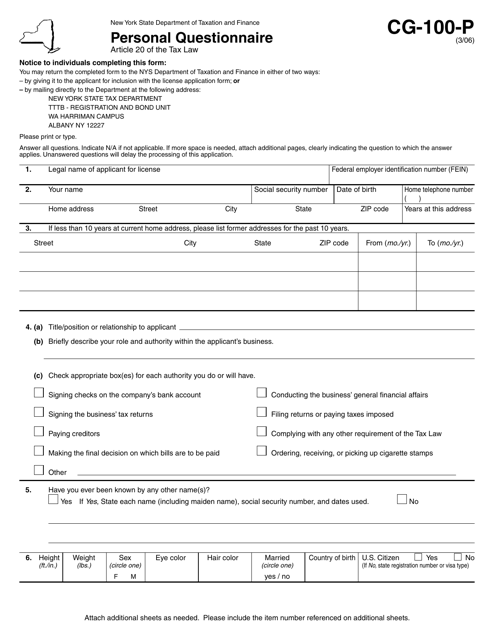

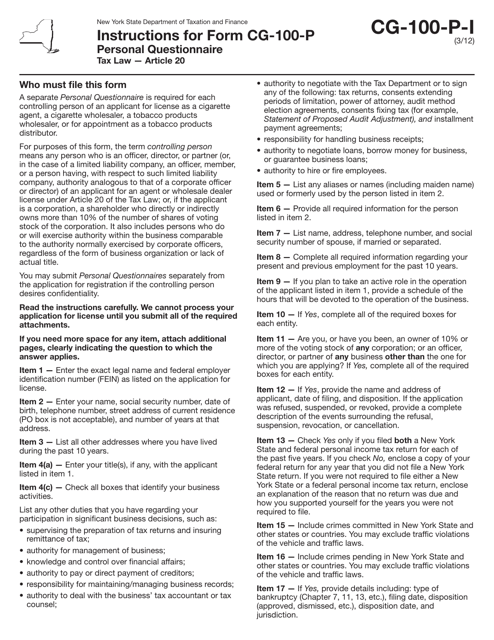

This Form is used for completing a personal questionnaire in New York. It collects basic information about an individual for various purposes, such as employment, insurance, or legal proceedings.

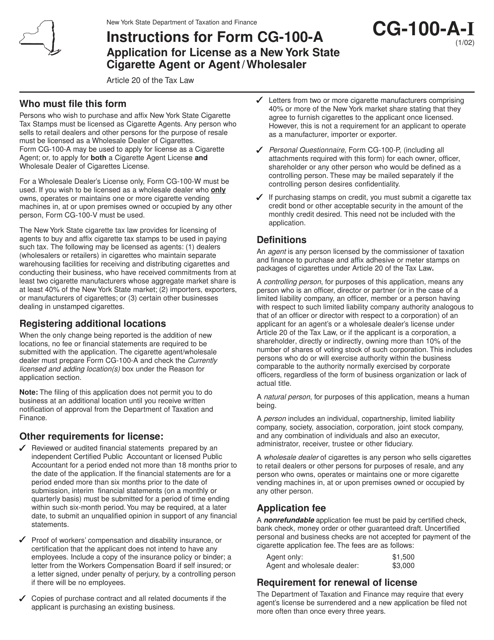

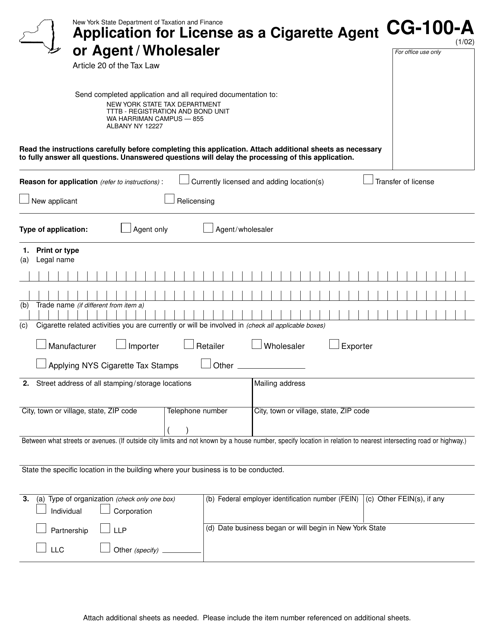

This document is for individuals or businesses in New York who want to apply for a license to become a cigarette agent or agent/wholesaler. It provides instructions on how to complete Form CG-100-A.

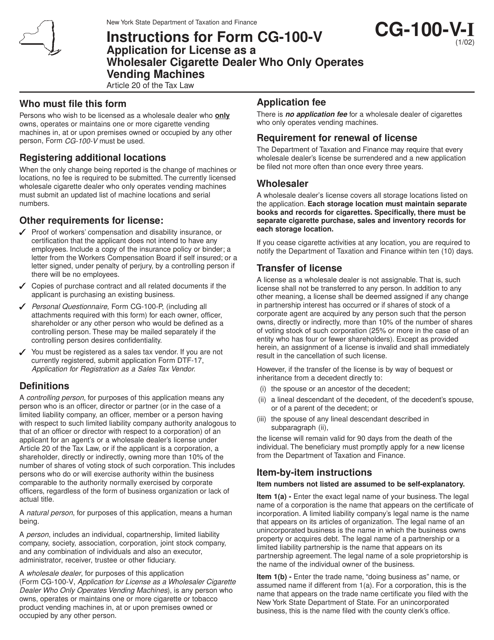

This document is used for applying for a license as a wholesaler cigarette dealer who only operates vending machines in the state of New York. The form provides instructions on how to fill out the application.

This Form is used for completing a personal questionnaire specific to the state of New York. It provides instructions on how to fill out the form accurately and contains important information for individuals to provide the required personal details.

This form is used for applying for a license as a cigarette agent or agent/wholesaler in New York.

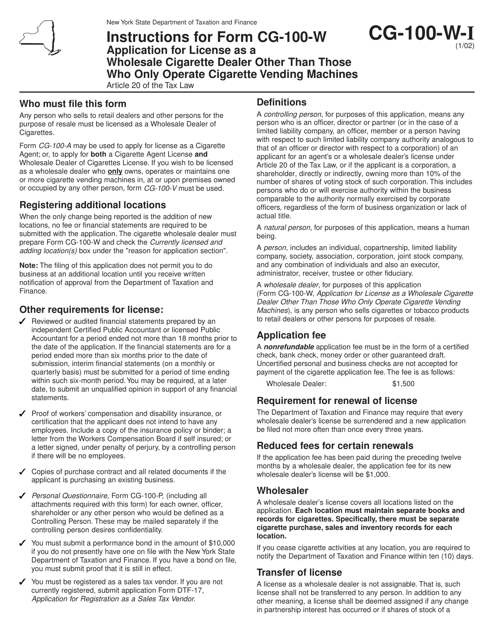

This document is used for applying for a license as a wholesale cigarette dealer in New York, except for those who only operate cigarette vending machines. It provides instructions on how to fill out Form CG-100-W.

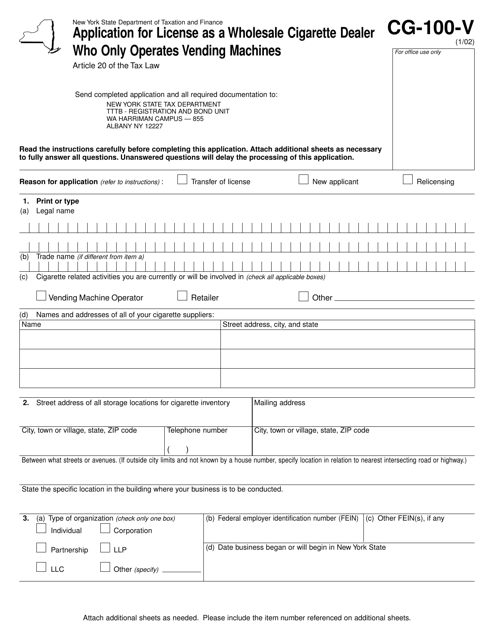

This form is used for applying for a license as a wholesale cigarette dealer who only operates vending machines in New York.

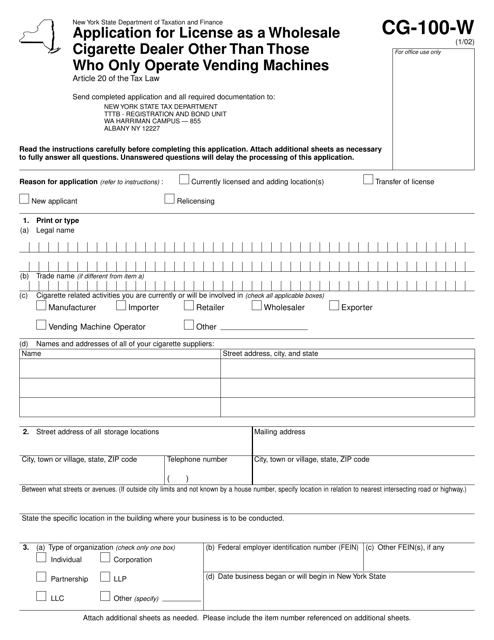

This form is used for applying for a wholesale cigarette dealer license in New York for businesses that do not only operate vending machines.

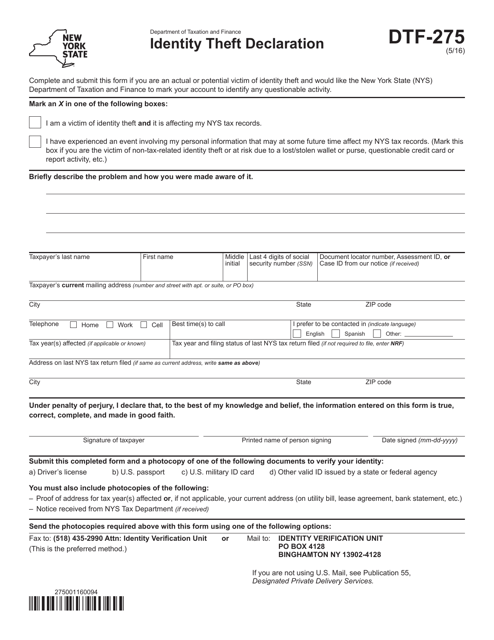

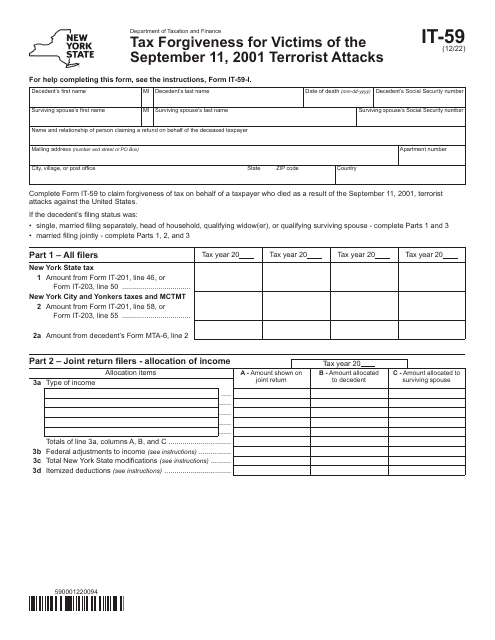

This form is used for declaring identity theft in the state of New York.

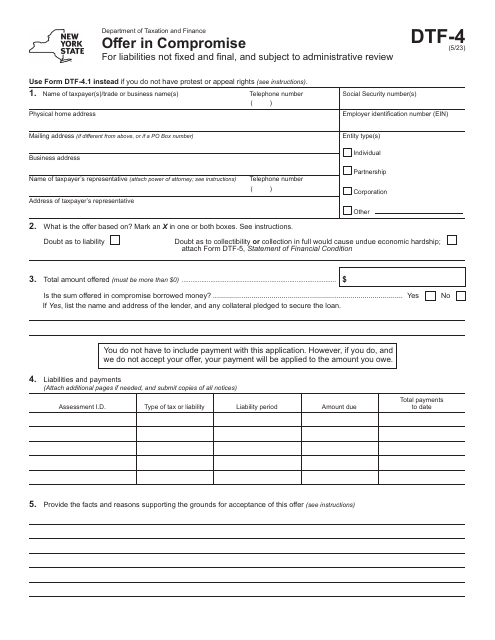

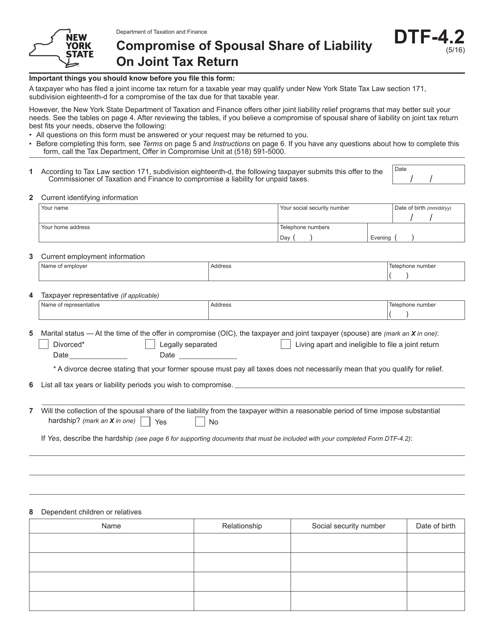

This form is used for compromising the spousal share of liability on a joint tax return in New York.

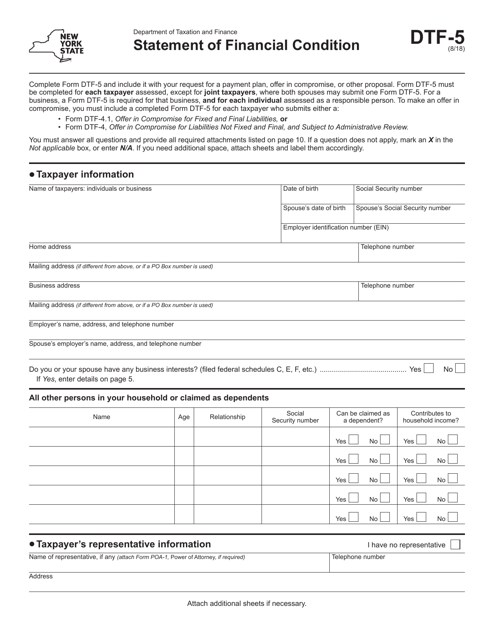

This Form is used for reporting financial condition in the state of New York.

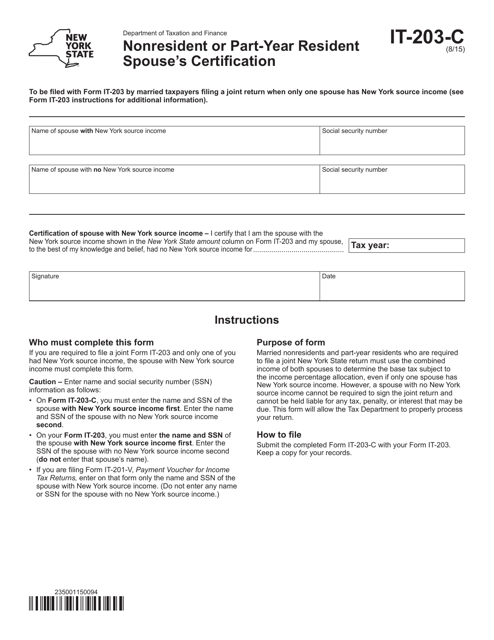

This form is used for nonresident or part-year resident spouses in New York to certify their residency status.

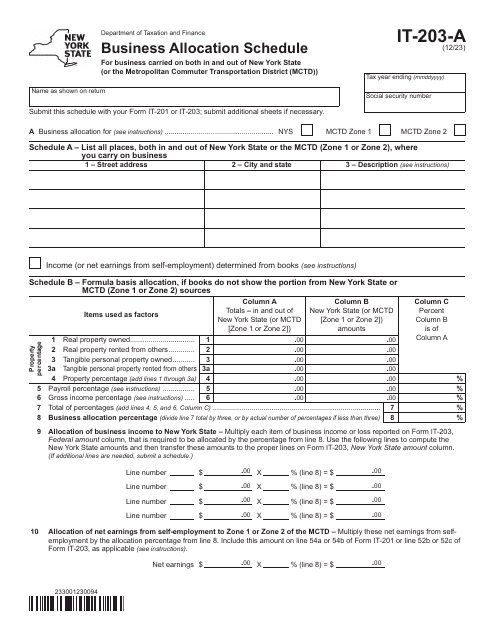

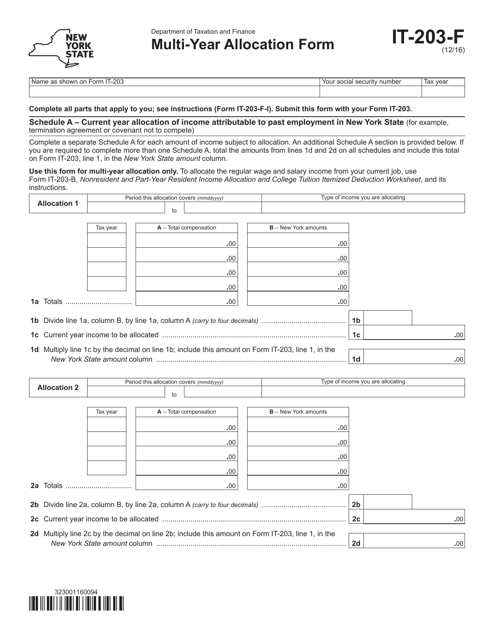

This Form is used for allocating income and deductions for multiple years in New York.

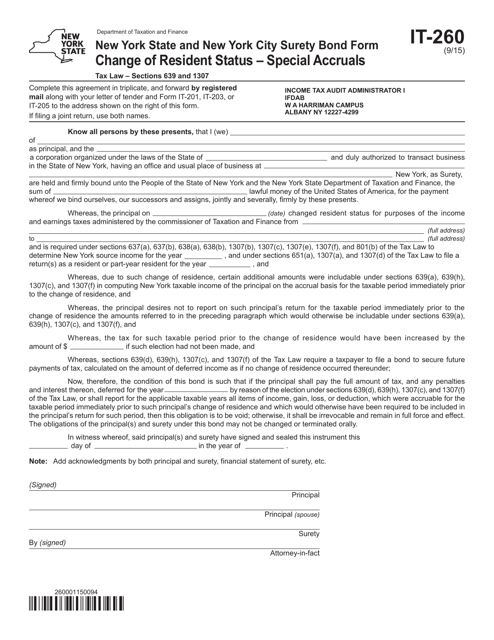

This Form is used for residents of New York State and New York City to change their resident status and report any special accruals in New York. It also includes a Surety Bond Form.

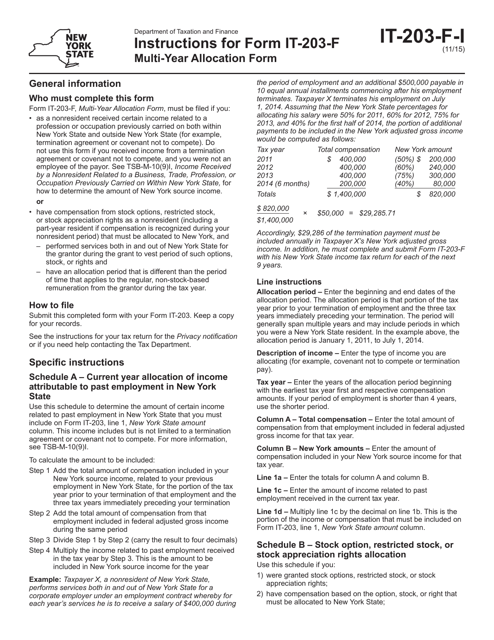

This document is used to provide instructions for completing Form IT-203-F Multi-Year Allocation Form in New York. It guides taxpayers on how to properly allocate income, deductions, and credits over multiple tax years.

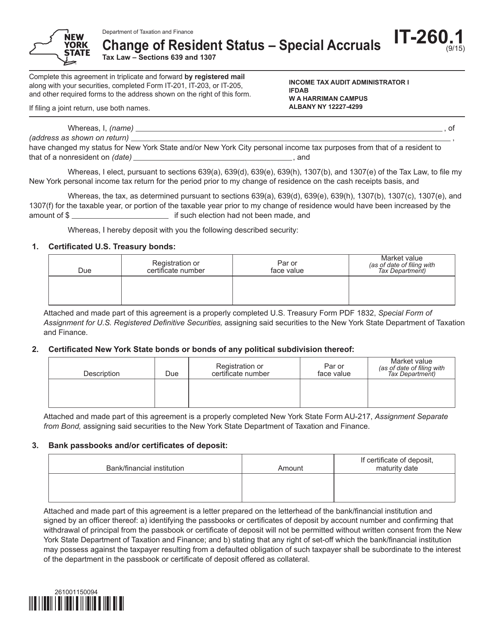

This form is used for reporting changes in resident status and special accruals in New York.

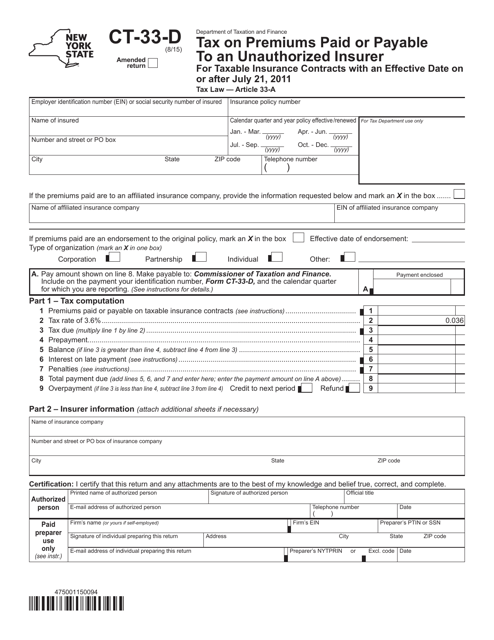

This form is used for reporting and paying taxes on premiums paid to unauthorized insurers in the state of New York. It is required by the New York State Department of Taxation and Finance.

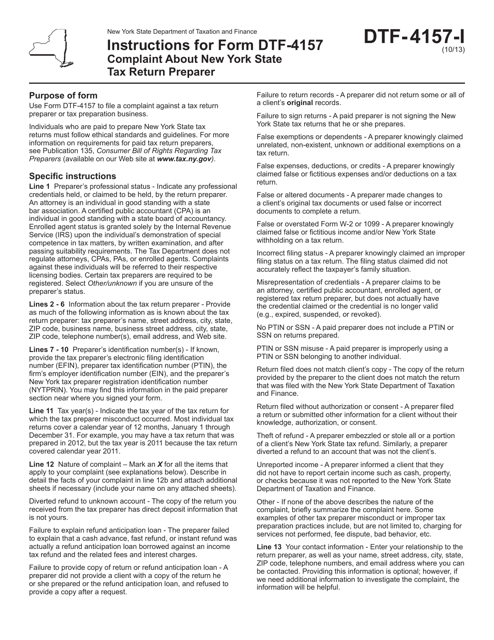

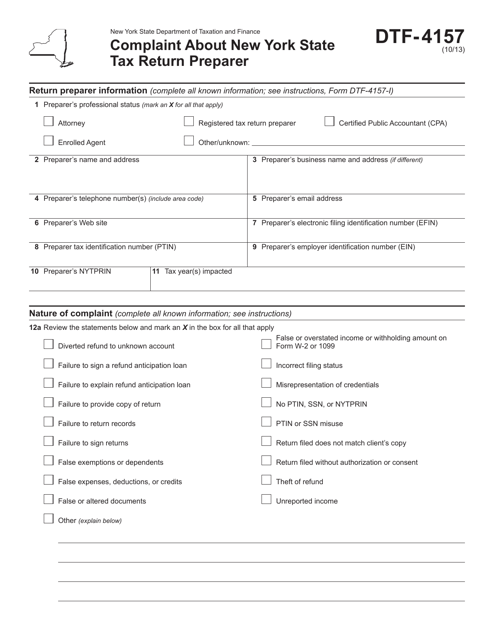

This Form is used for filing a complaint about a New York State tax return preparer.

This form is used for filing a complaint about a New York State tax return preparer in New York.

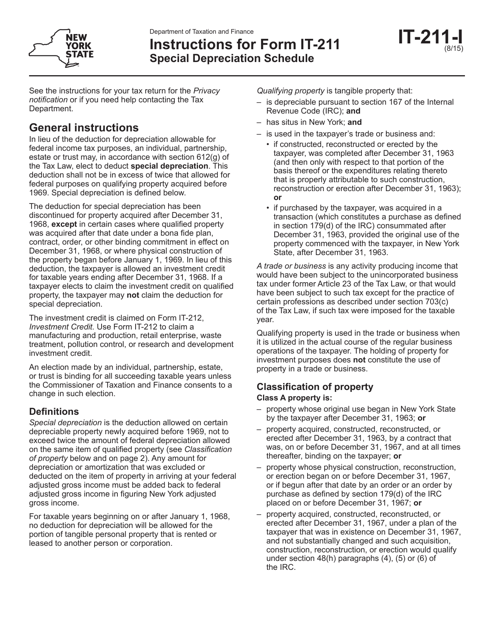

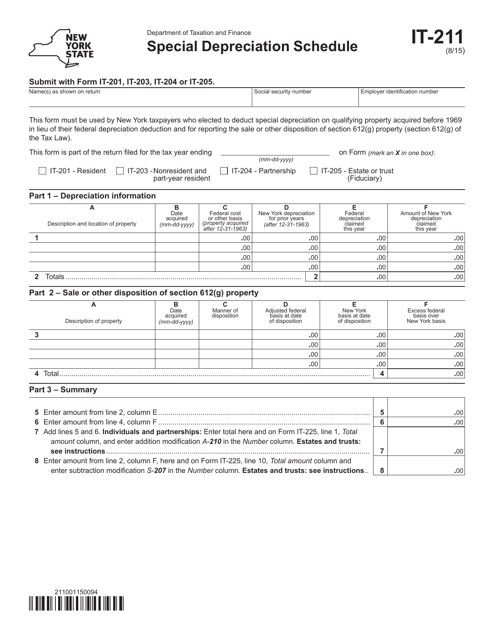

This form is used for providing instructions on how to complete Form IT-211, which is the Special Depreciation Schedule required for taxpayers in New York. It helps taxpayers accurately calculate and report their special depreciation deductions.

This form is used for reporting special depreciation for businesses in New York. It helps businesses calculate and claim deductions for depreciating assets.

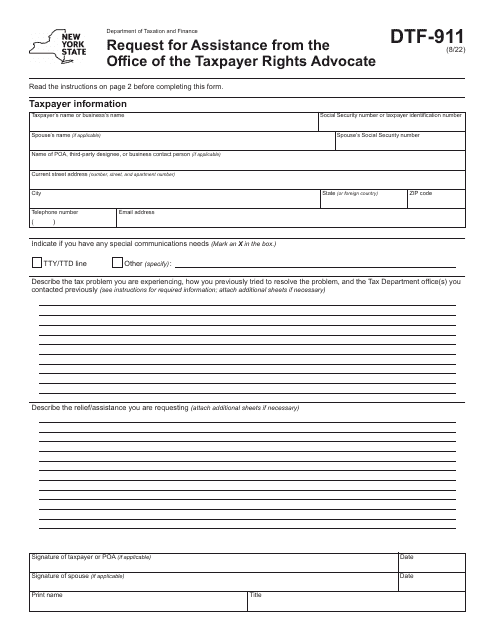

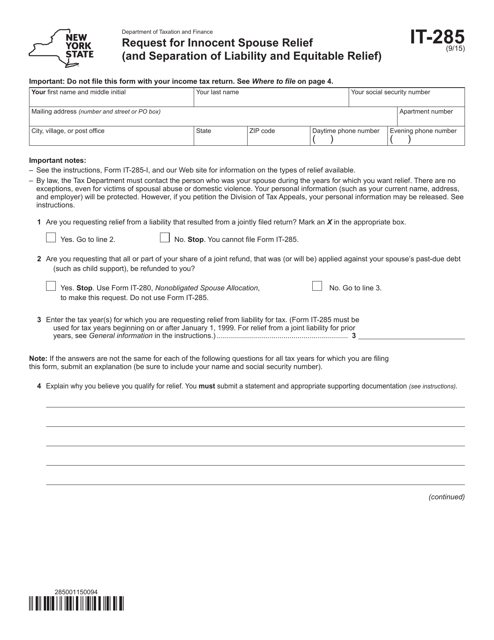

This form is used for residents of New York who are seeking innocent spouse relief, as well as separation of liability and equitable relief. It allows taxpayers to request relief from certain tax liabilities that were caused by their spouse or former spouse.

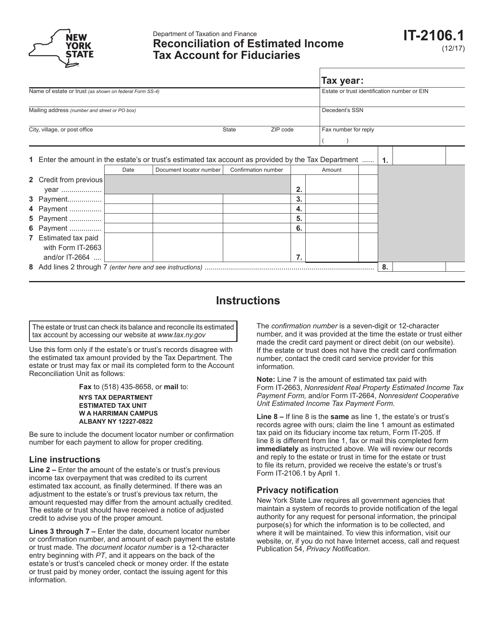

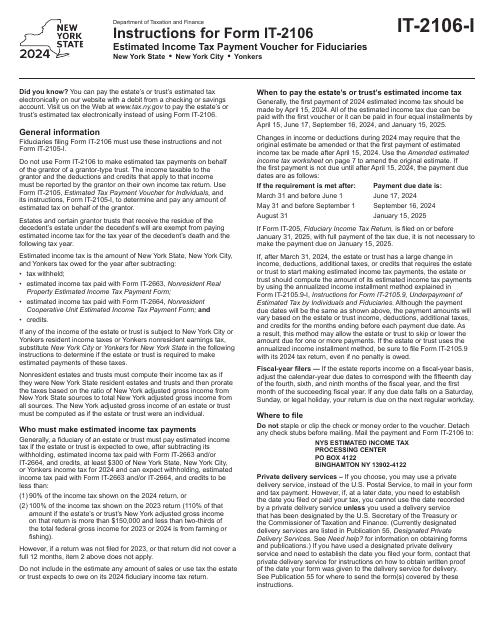

This form is used for reconciling the estimated income tax account for fiduciaries in the state of New York.

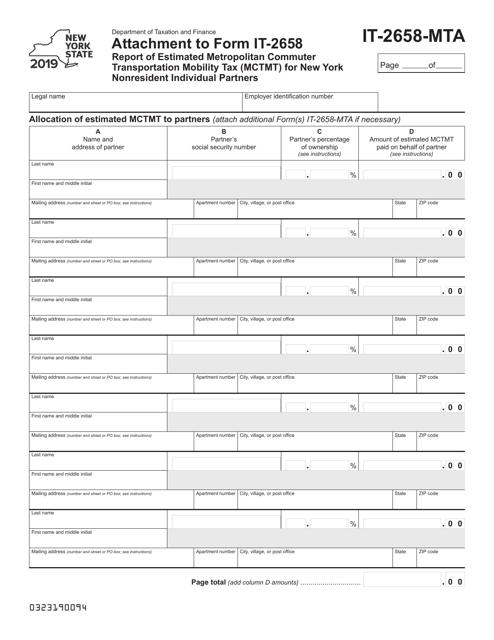

This document is used for reporting the estimated Metropolitan Commuter Transportation Mobility Tax (MCTMT) for nonresident individual partners in New York who are not residents of the state. It is an attachment to Form IT-2658.

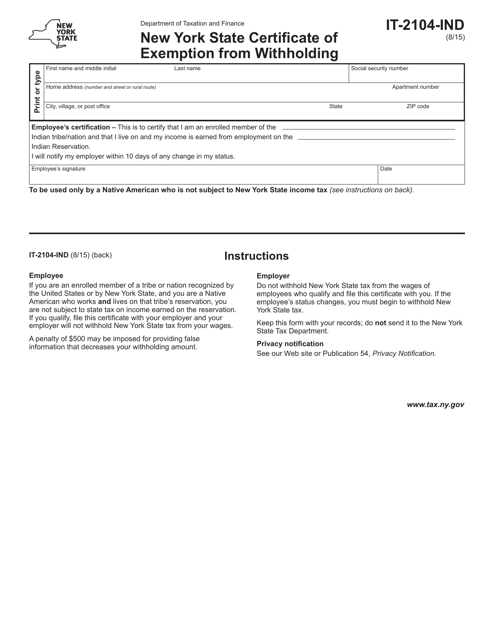

This Form is used for exempting individuals in New York State from income tax withholding. Individuals can use this form to claim an exemption from having taxes withheld from their wages.