New York State Department of Taxation and Finance Forms

Documents:

2566

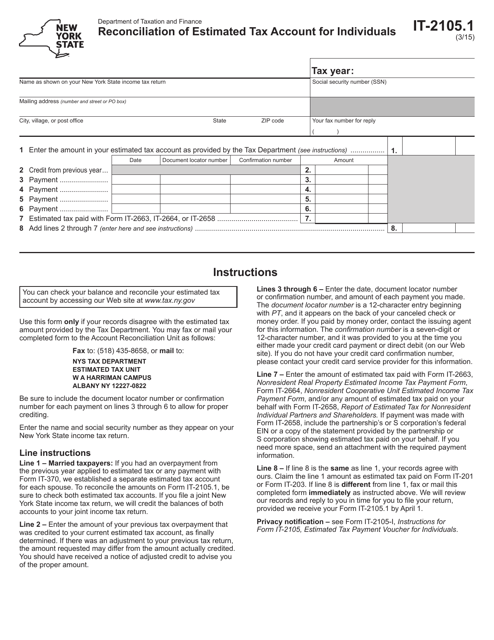

This form is used for reconciling the estimated tax account for individual taxpayers in New York.

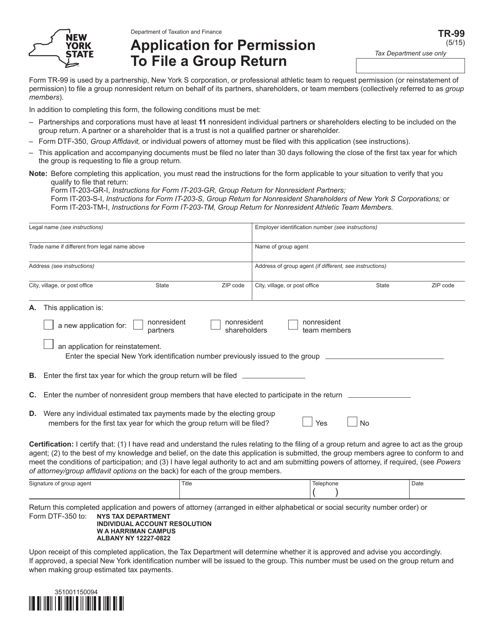

This form is used for applying for permission to file a group return in the state of New York.

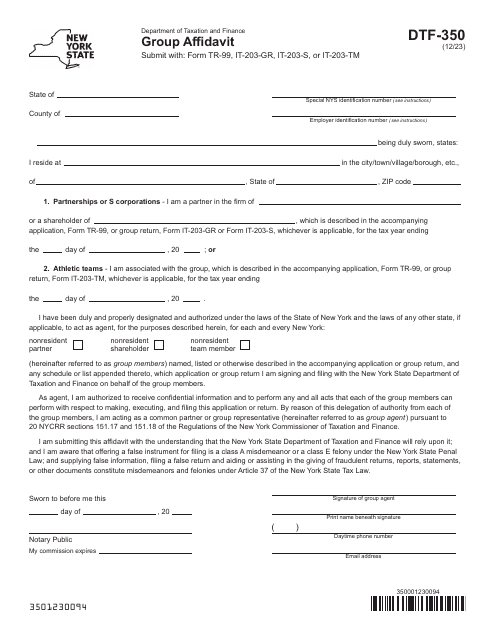

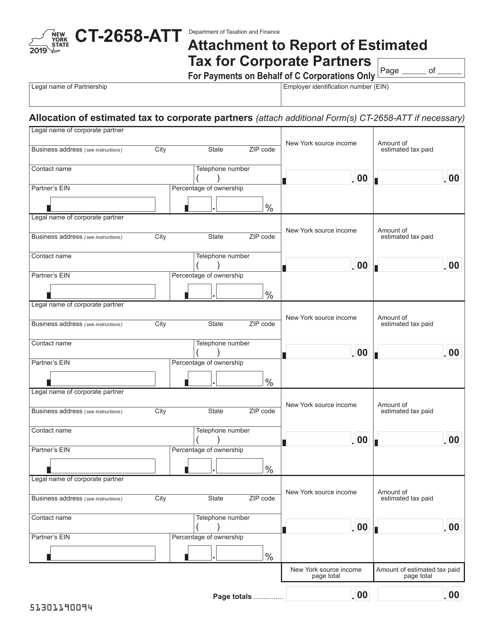

This document is an attachment form to be used by corporate partners in New York when reporting estimated taxes.

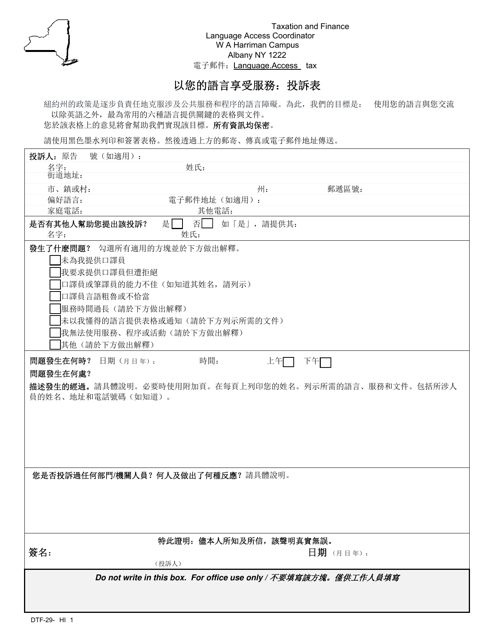

This document is a form called DTF-29-CHI Access to Services in Your Language: Complaint Form, specifically for the state of New York. It is designed to be used by individuals who speak Chinese and have a complaint regarding access to services in their language.

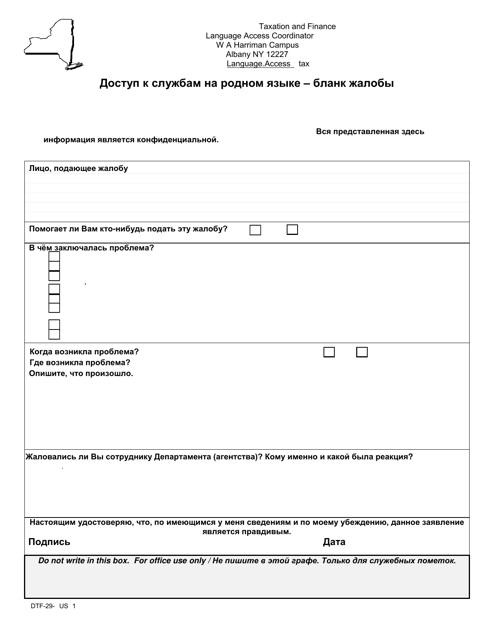

This form is used for filing a complaint regarding access to services in your language in New York. It specifically targets Russian-speaking individuals.

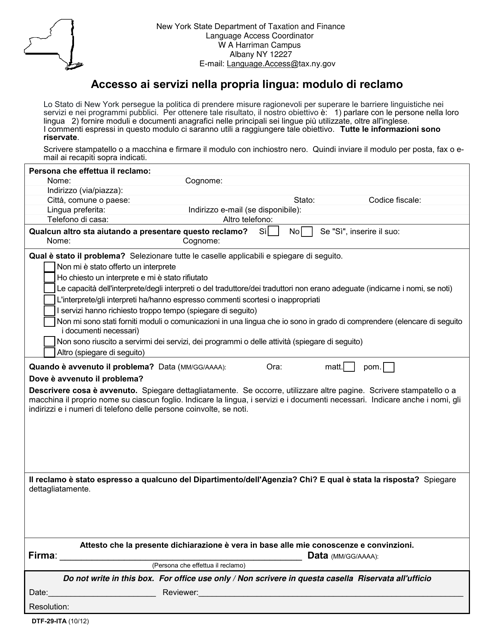

This form is used for filing a complaint regarding access to services in your language in New York. It specifically caters to Italian-speaking individuals.

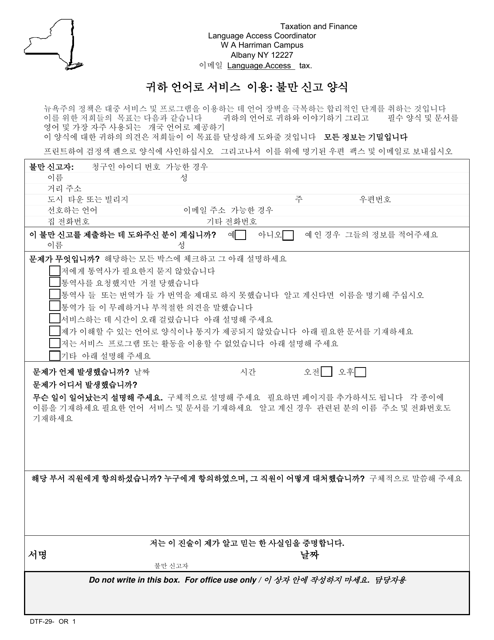

This document provides a complaint form in Korean for individuals in New York who need access to services in their language.

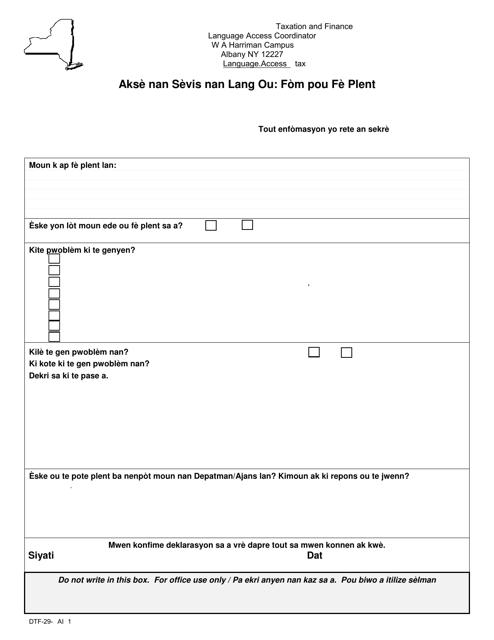

This Form is used to file a complaint regarding access to services in Haitian Creole language in New York.

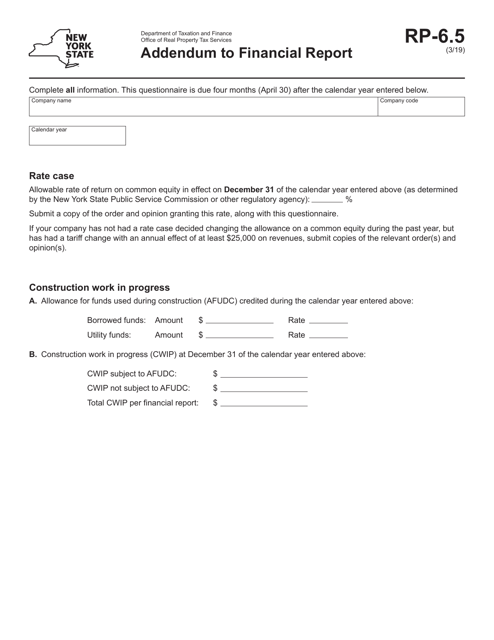

This form is used in New York as an addendum to a financial report.

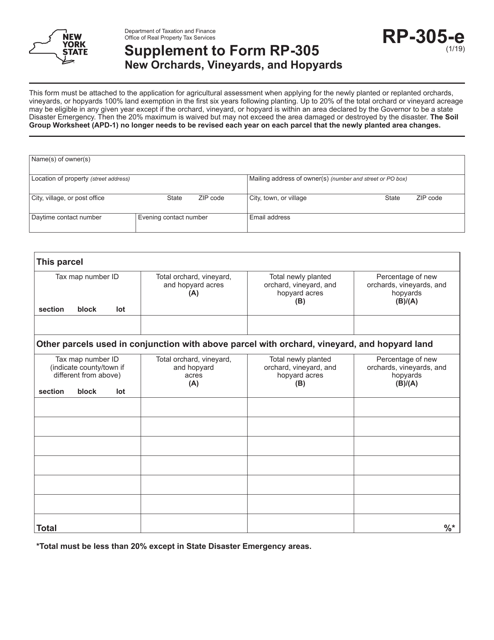

This form is used as a supplement to Form RP-305 for reporting new orchards, vineyards, and hopyards in New York.

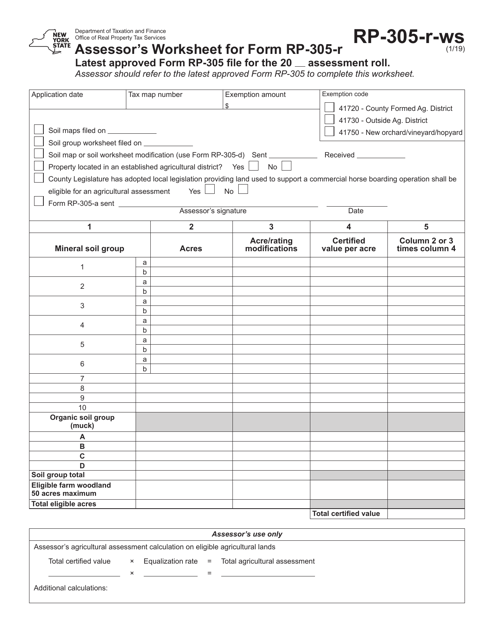

This Form is used by assessors in New York to complete the worksheet for Form RP-305-R. It helps in assessing property values in the state.

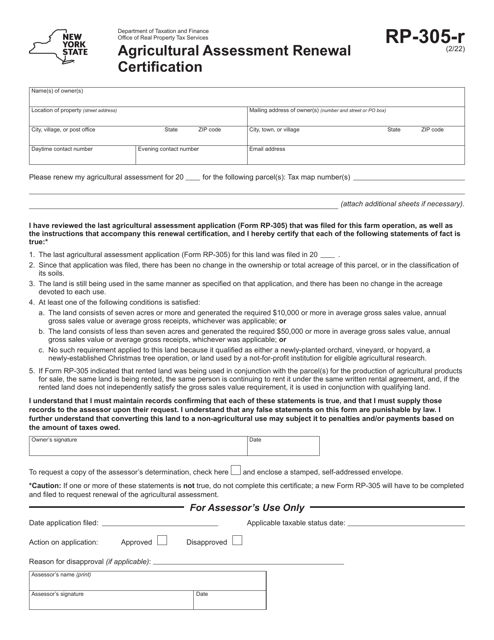

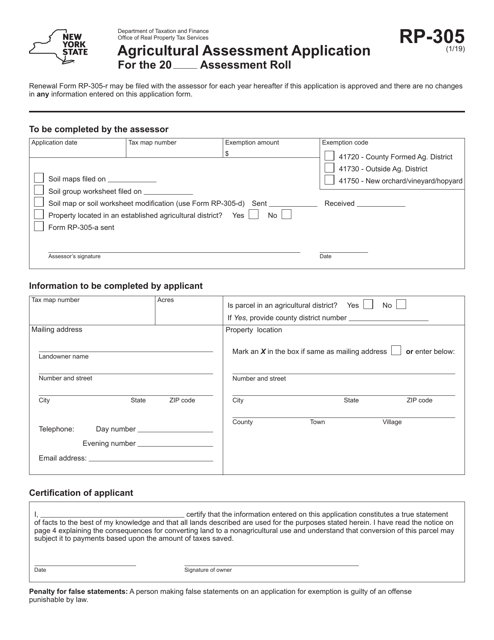

This form is used for applying for agricultural assessment in New York. It helps property owners receive tax benefits for qualifying agricultural land.

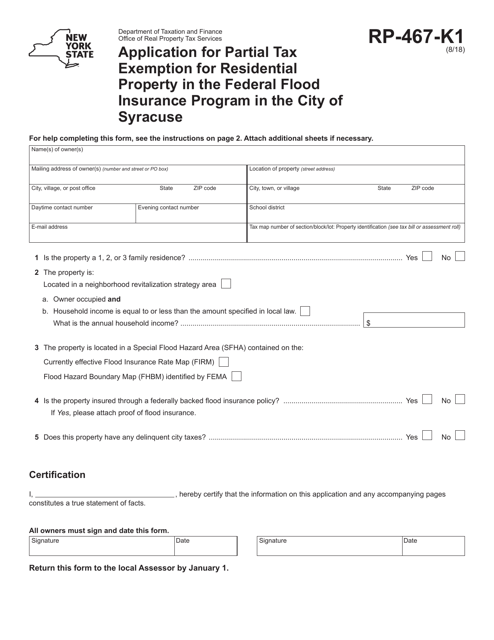

This form is used for applying for a partial tax exemption for residential property located in the City of Syracuse, New York, that is participating in the Federal Flood Insurance Program.

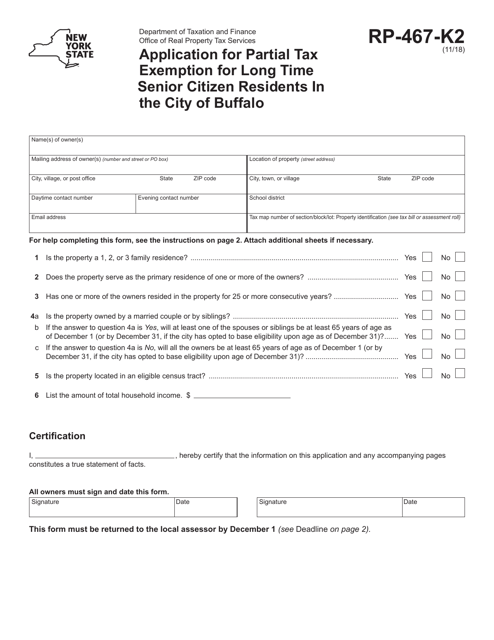

This form is used for applying for a partial tax exemption for long-time senior citizen residents in the city of Buffalo, New York.

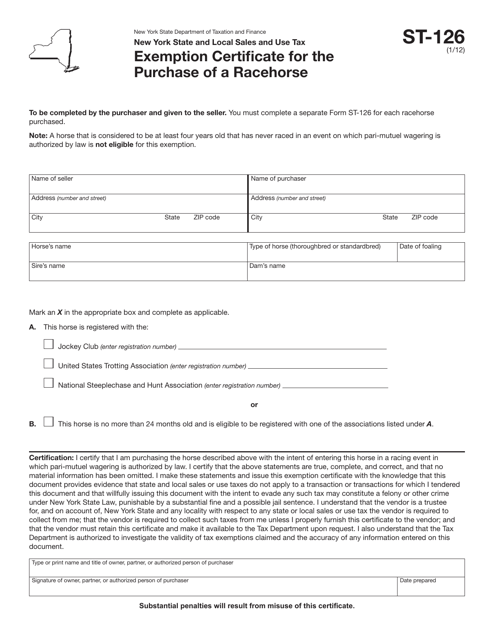

This form is used for obtaining an exemption certificate in New York for the purchase of a racehorse.

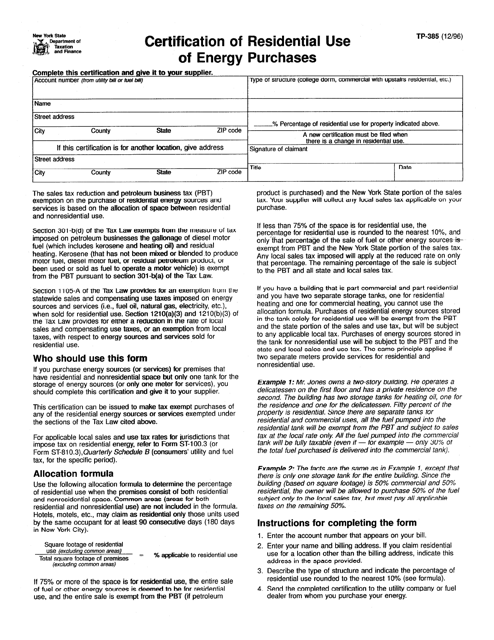

This form is used for certifying the residential use of energy purchases in the state of New York.

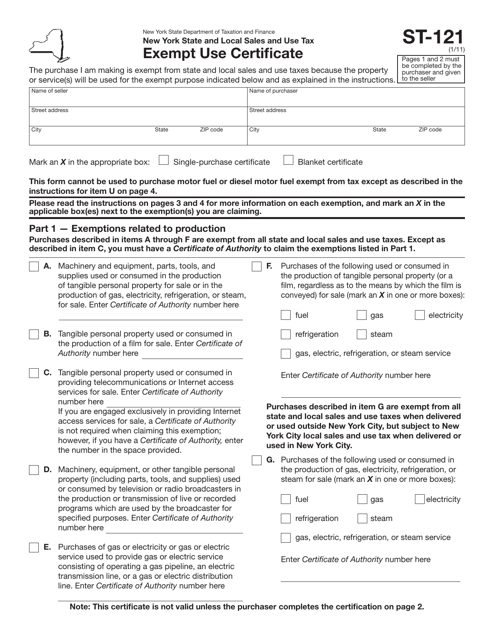

This form is used for claiming exemption from sales tax in the state of New York.

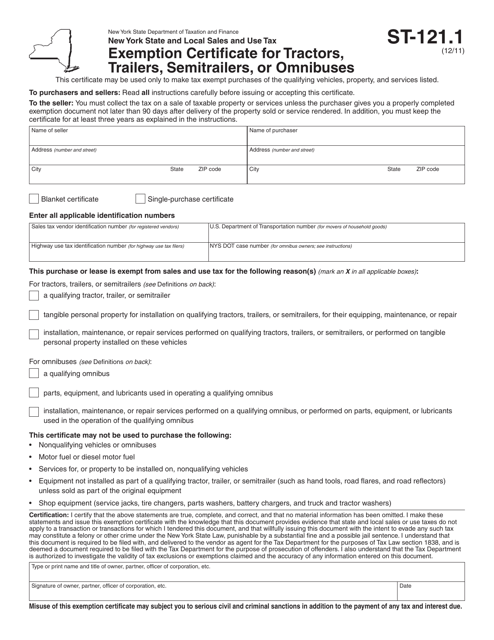

This Form is used for claiming an exemption from sales tax for tractors, trailers, semitrailers, or omnibuses in the state of New York.

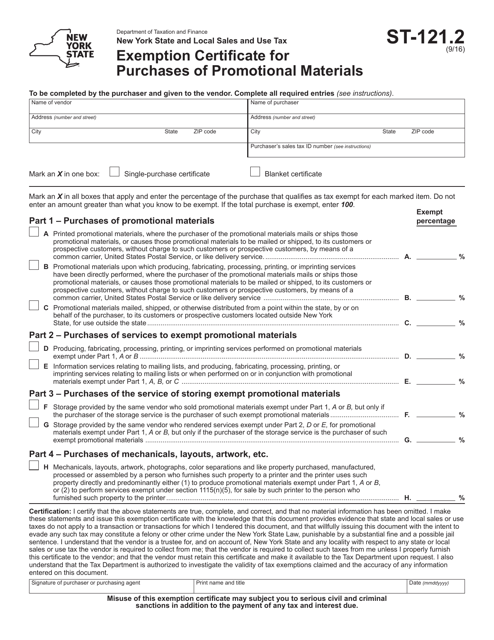

This form is used for requesting an exemption from sales tax when purchasing promotional materials in New York.

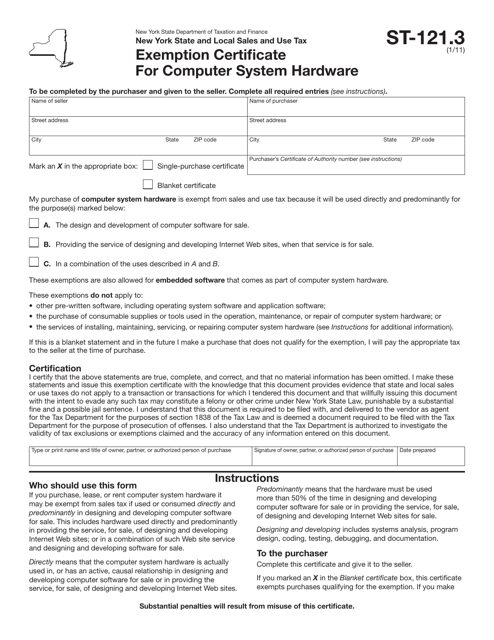

This form is used for applying for an exemption from sales tax on computer system hardware in the state of New York.

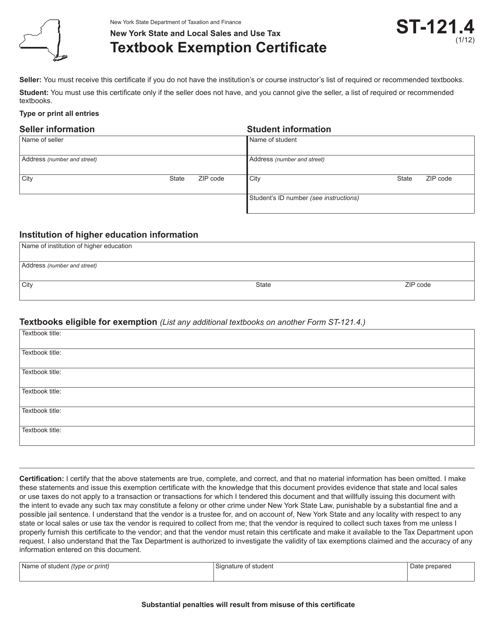

This form is used for claiming a sales tax exemption for textbooks in the state of New York.

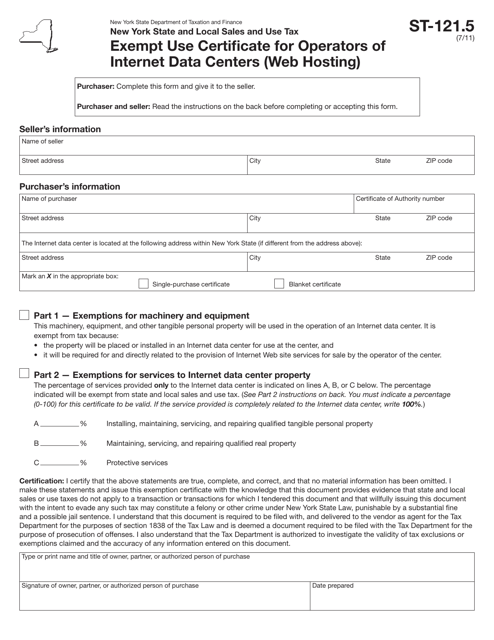

Form ST-121.5 Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting) - New York

This Form is used for operators of internet data centers (web hosting) in New York to claim exemption from certain taxes.

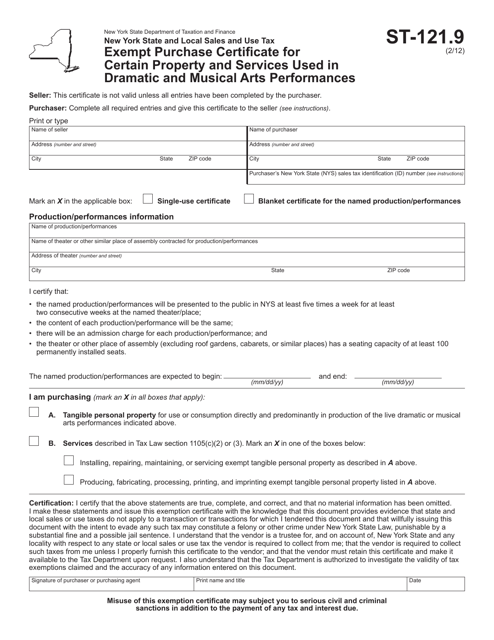

This form is used for claiming an exemption on certain property and services used in dramatic and musical arts performances in New York.

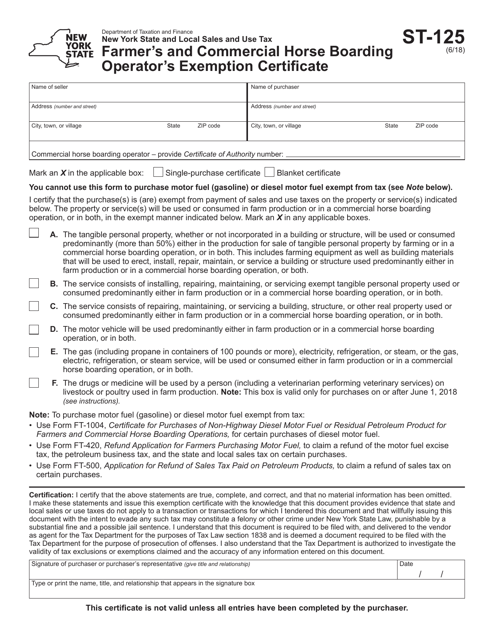

This form is used for farmers and commercial horse boarding operators in New York to claim an exemption from certain taxes.

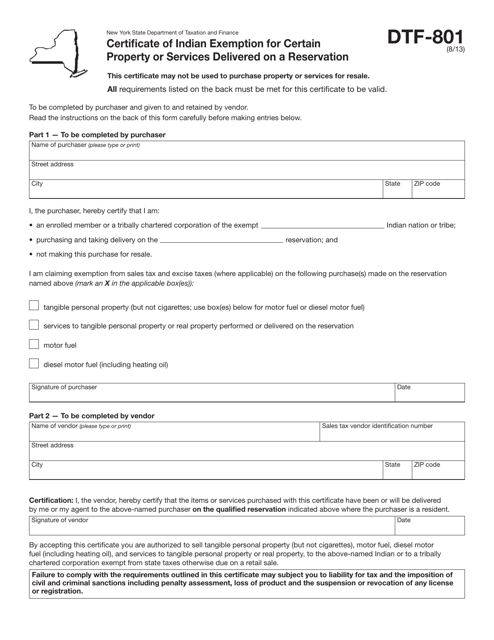

This form is used for declaring Indian exemption for certain property or services delivered on a reservation in New York.

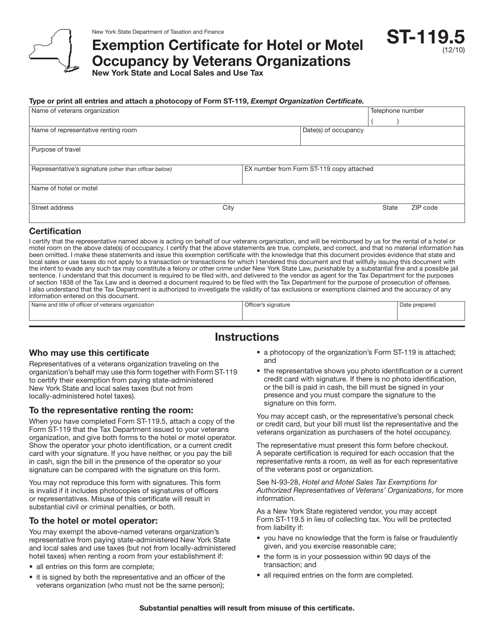

This Form is used for Veterans Organizations in New York to claim exemption from taxes for hotel or motel occupancy.

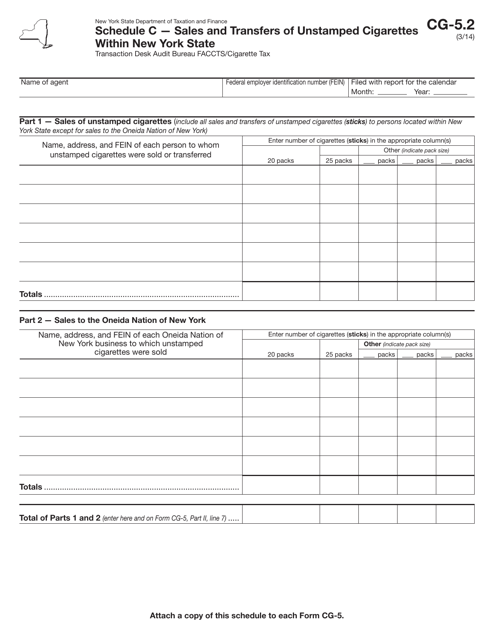

This form is used for reporting sales and transfers of unstamped cigarettes within New York State.

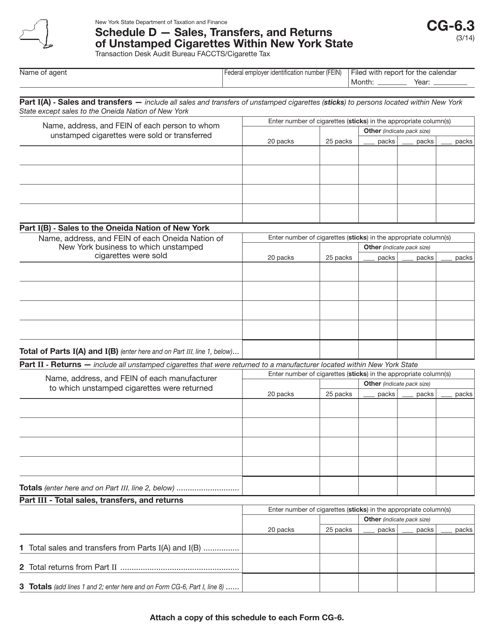

This form is used for reporting sales, transfers, and returns of unstamped cigarettes within New York State.

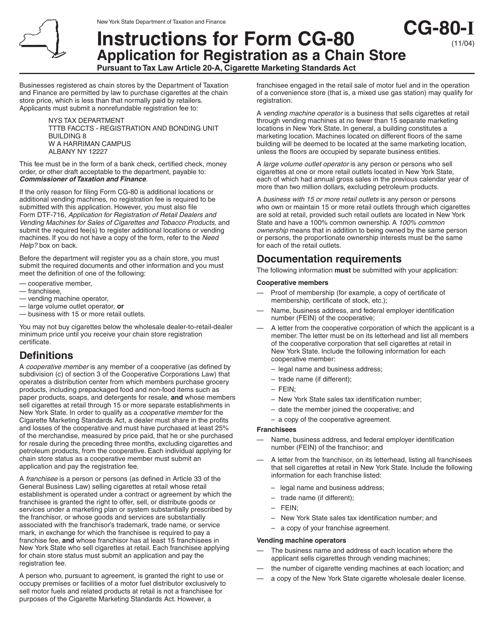

This document is an application form for registering as a chain store in New York. It provides instructions on how to fill out the form and submit it.

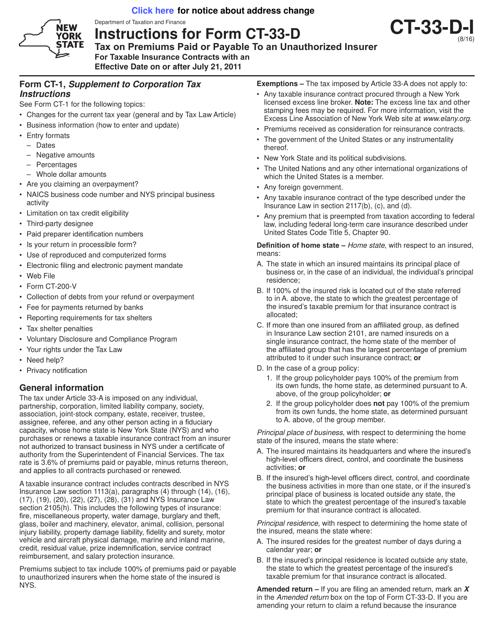

This Form is used for reporting and paying tax on premiums paid to unauthorized insurers for taxable insurance contracts in New York that have an effective date on or after July 21, 2011.

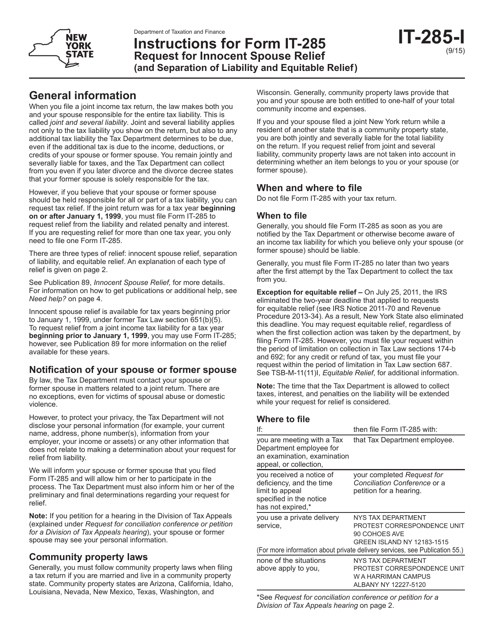

This Form is used for requesting innocent spouse relief, separation of liability, and equitable relief in the state of New York.