New York State Department of Taxation and Finance Forms

Documents:

2566

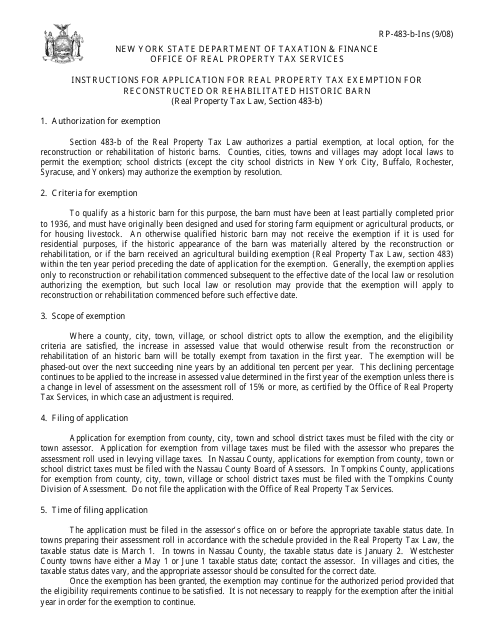

This Form is used for applying for real property tax exemption for reconstructed or rehabilitated historic barn in New York.

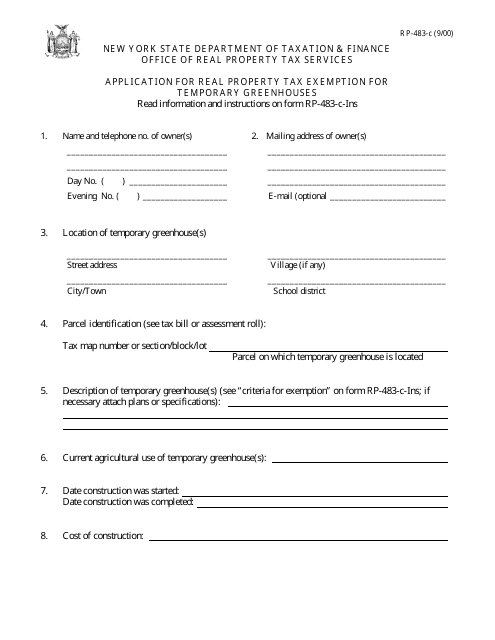

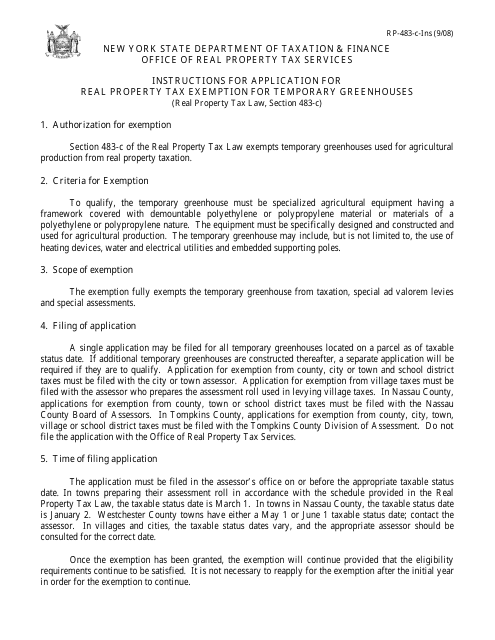

This form is used for applying for a real property tax exemption for temporary greenhouses in New York.

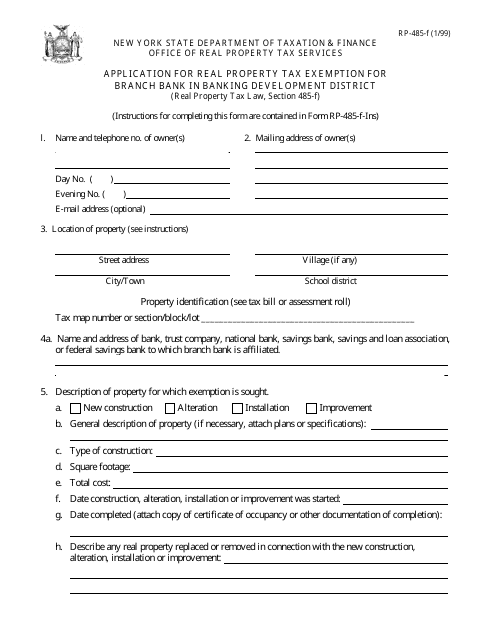

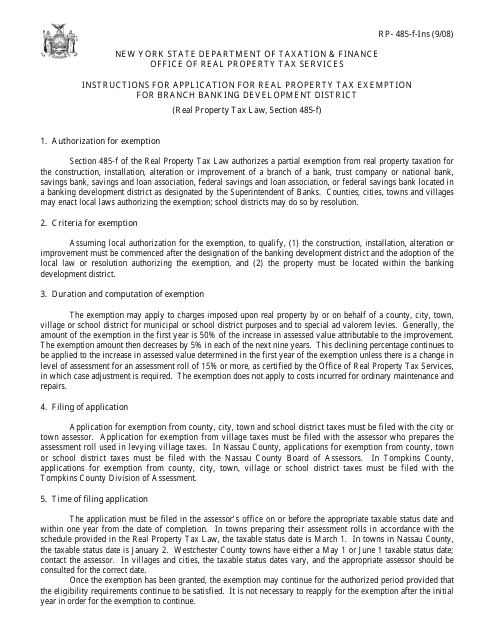

This form is used for applying for a real property tax exemption for a branch bank located in a banking development district in New York.

This Form is used for applying for a real property tax exemption for temporary greenhouses in New York.

This form is used for applying for a real property tax exemption for branch banking development districts in New York.

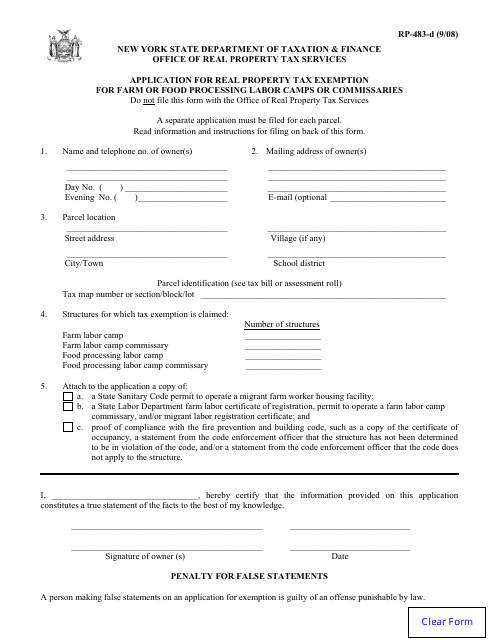

This form is used for applying for a real property tax exemption specifically for farm or food processing labor camps or commissaries in the state of New York.

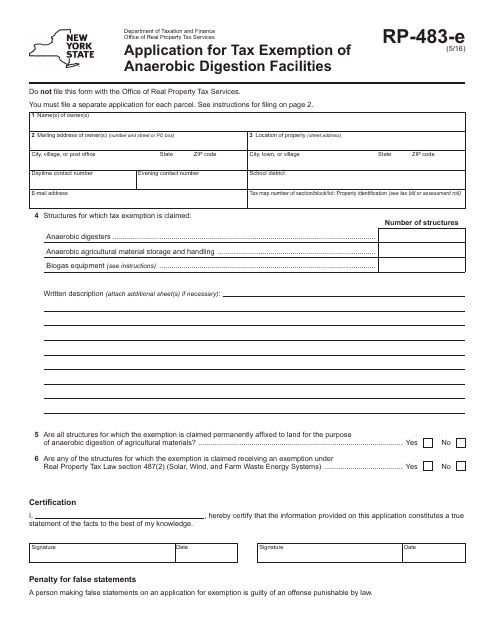

This form is used for applying for tax exemption for anaerobic digestion facilities in New York.

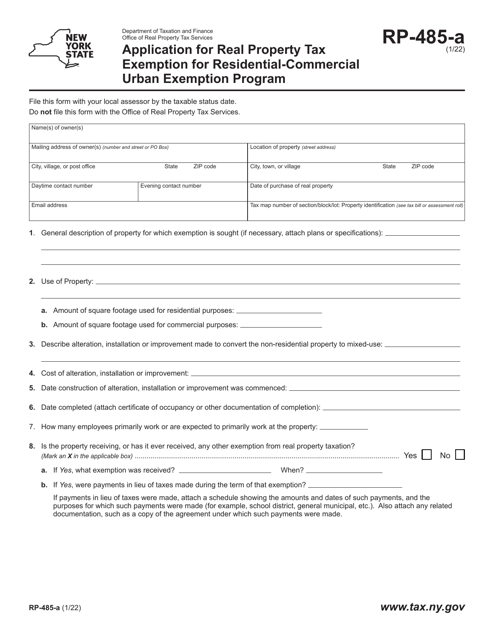

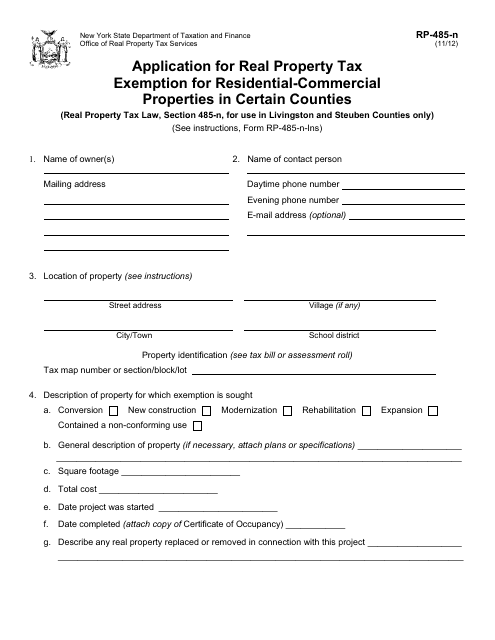

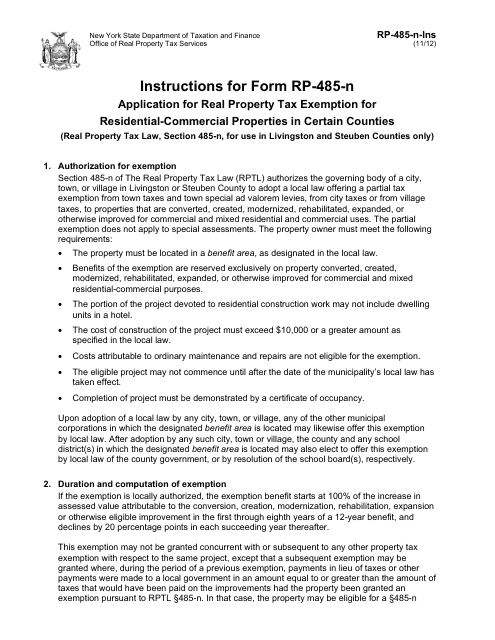

This form is used for applying for a real property tax exemption for residential-commercial properties in certain counties in New York.

This Form is used for applying for a tax exemption on residential-commercial properties in certain counties in New York. It provides instructions for completing the application process.

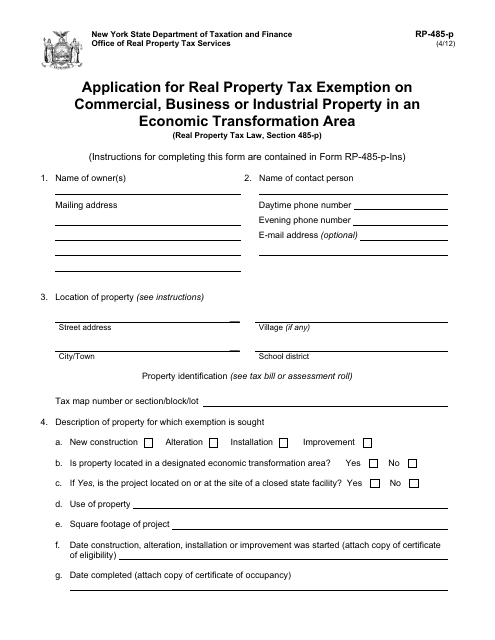

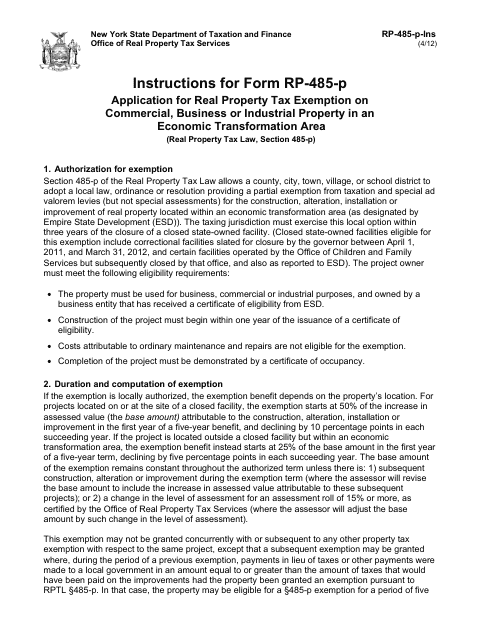

This Form is used for applying for a tax exemption on commercial, business, or industrial property located in an Economic Transformation Area in New York.

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

This form is used for applying for residential property improvement in certain towns in New York, specifically in Amherst.

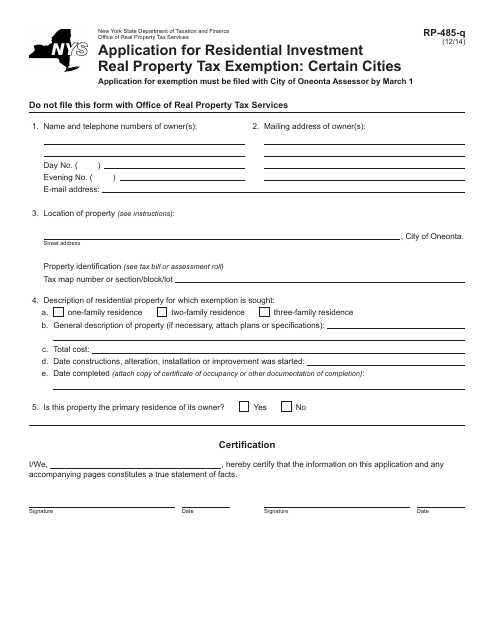

This Form is used for applying for a residential investment real property tax exemption in certain cities in New York.

This form is used for applying for a residential investment real property tax exemption in certain school districts in New York.

This form is used for applying for a tax exemption on residential investment properties in certain school districts in New York.

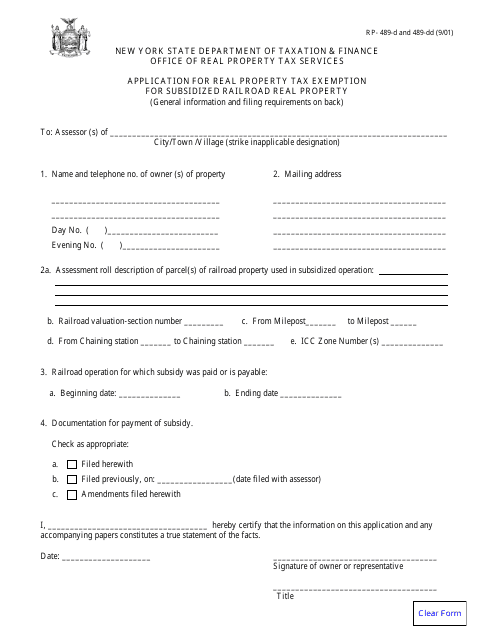

This Form is used for applying for a real property tax exemption for subsidized railroad real property in New York.

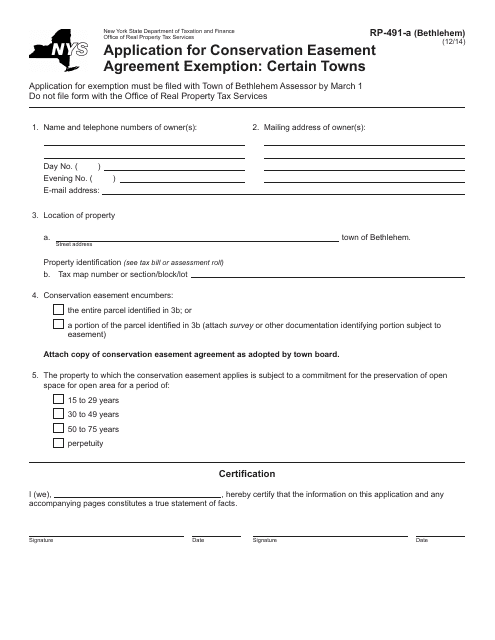

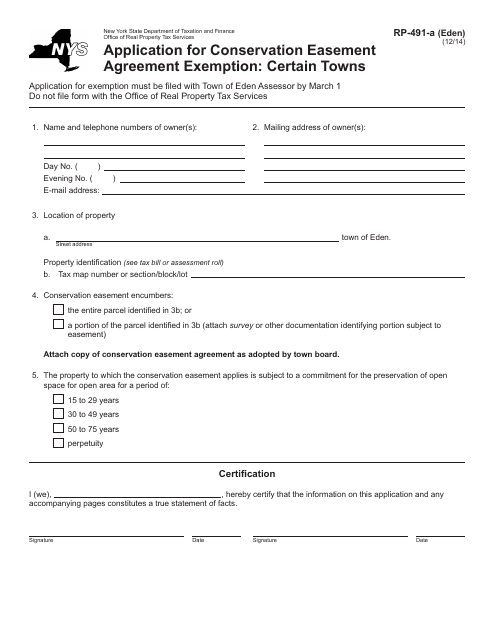

This form is used for applying for a conservation easement agreement exemption in certain towns in New York.

This Form is used for applying for an exemption on a Conservation Easement Agreement in certain towns in New York.

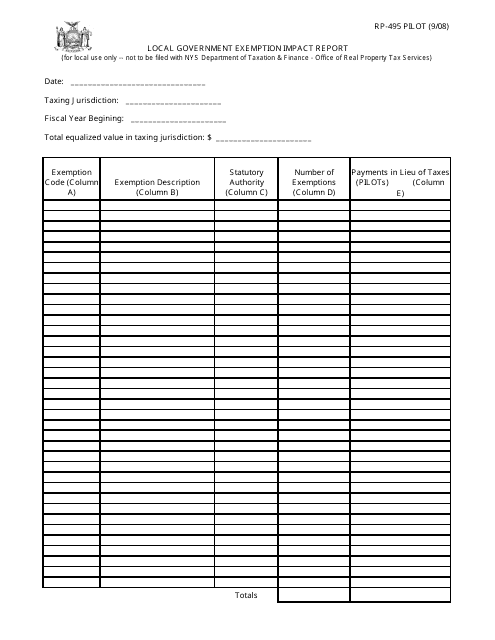

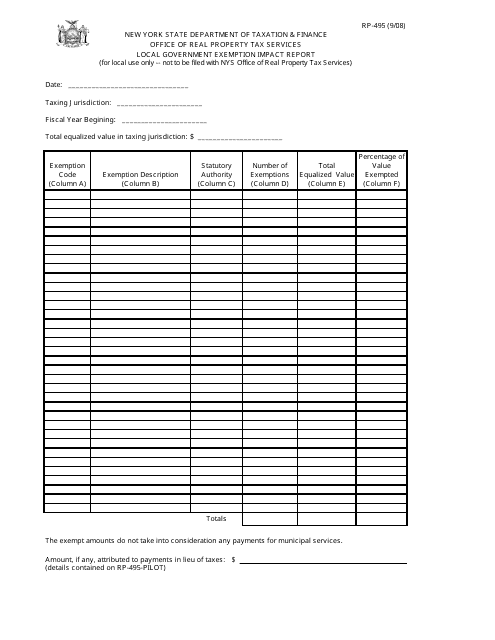

This form is used for reporting the impact of local government exemptions in New York. It helps assess the financial impact of these exemptions on the local government.

This Form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Orchard Park. It allows individuals to request an exemption from certain requirements for conservation easements.

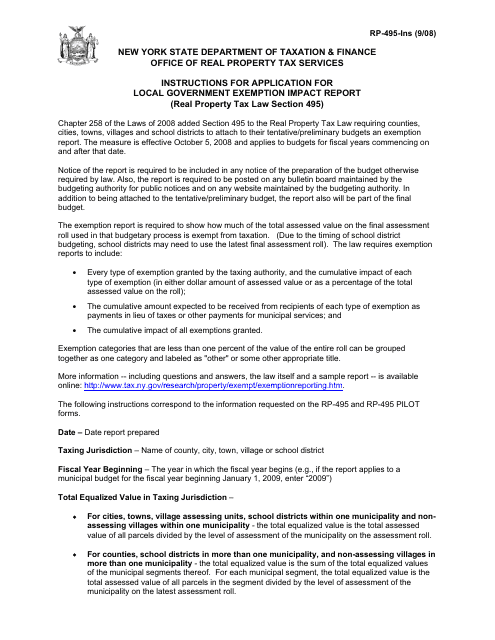

This document is used for applying for a local government exemption impact report in New York. It provides instructions on how to complete the Form RP-495.

This form is used for applying for a conservation easement agreement exemption in certain towns in New York, specifically Bethlehem.

This form is used for reporting the impact of local government exemptions for the pilot program in New York.

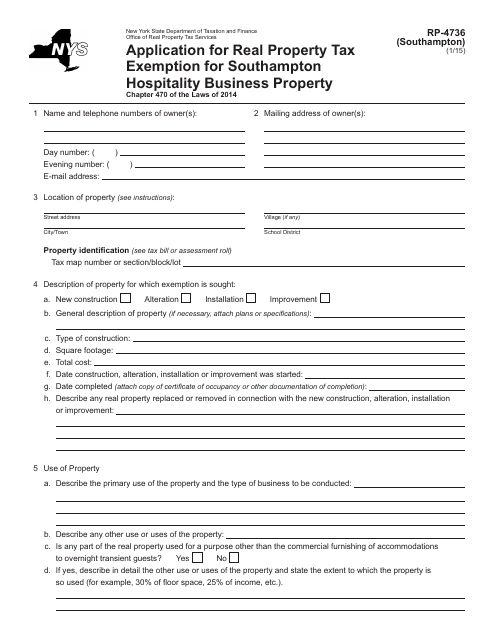

This form is used for applying for a real property tax exemption for hospitality businesses in Southampton, New York.

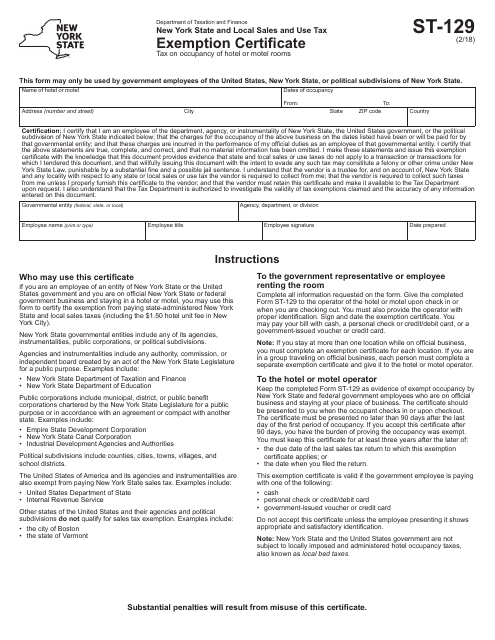

This Form is used for claiming a sales tax exemption in the state of New York.

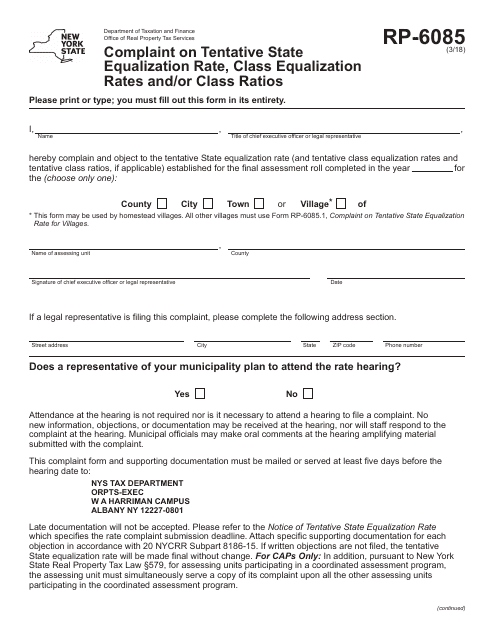

This form is used for filing a complaint regarding the tentative state equalization rate, class equalization rates, and/or class ratios in New York.

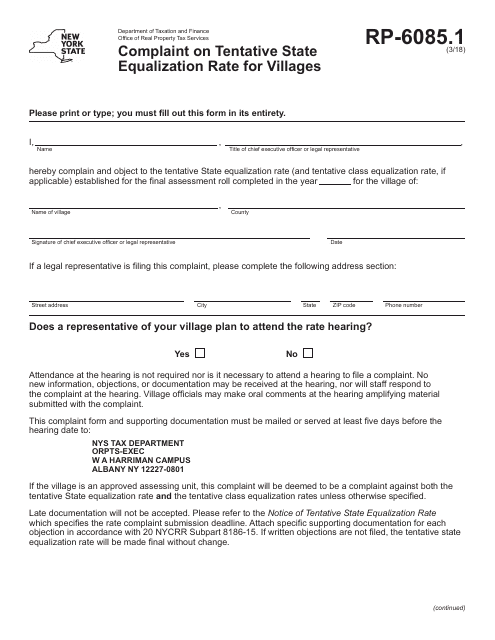

This form is used for filing a complaint regarding the tentative state equalization rate for villages in New York.

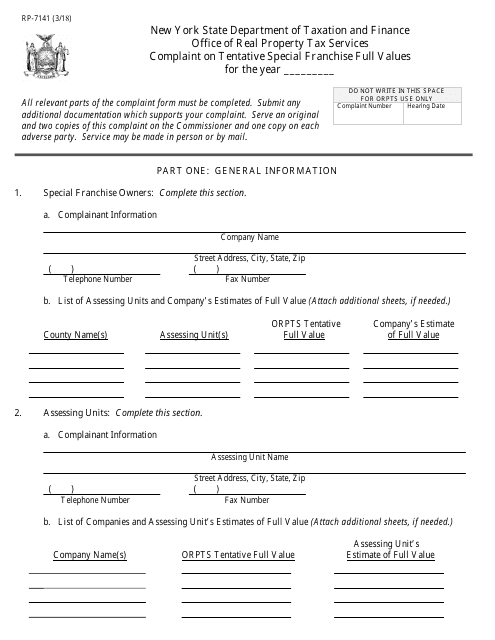

This form is used for filing a complaint about the tentative special franchise full values in New York. It allows individuals to contest the assessed values assigned to special franchises.

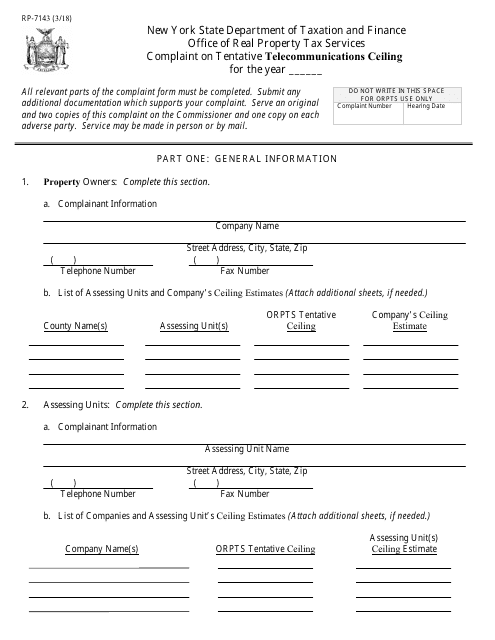

This Form is used for filing a complaint regarding a tentative telecommunications ceiling in New York.

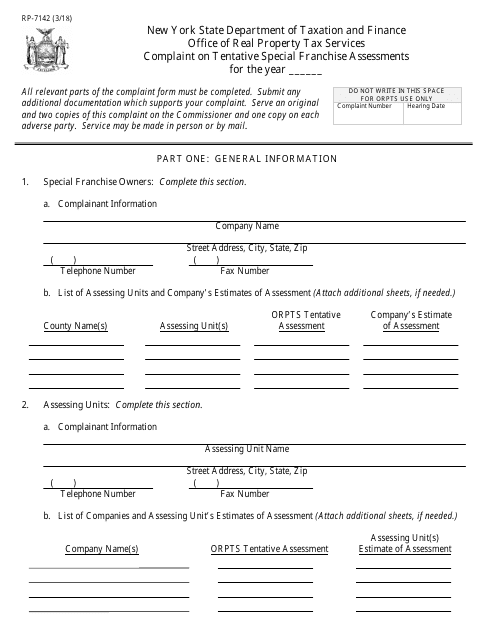

This form is used for filing a complaint regarding preliminary special franchise assessments in New York. It allows individuals to contest the estimated value and determine the proper assessment for their special franchise.

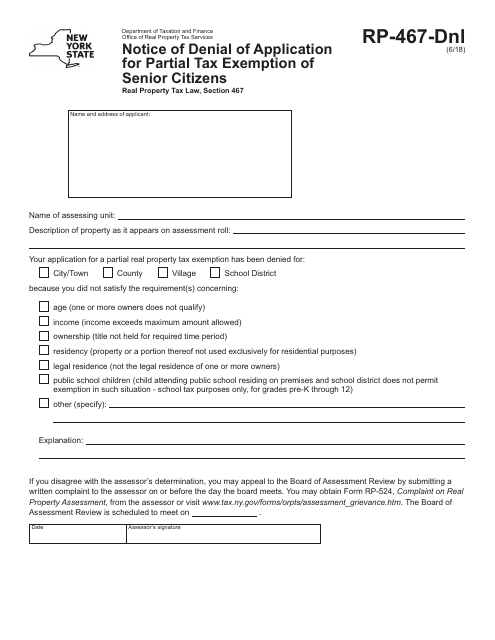

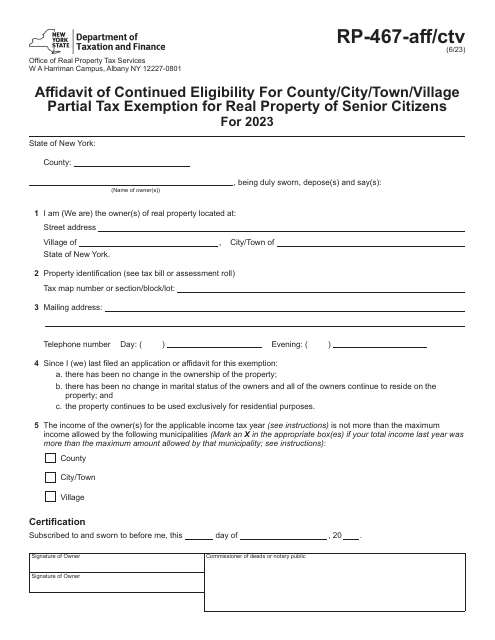

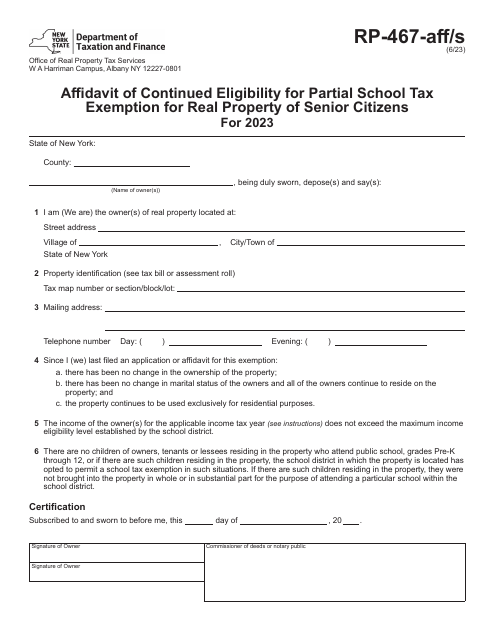

This form is used for notifying senior citizens in New York about the denial of their application for partial tax exemption.

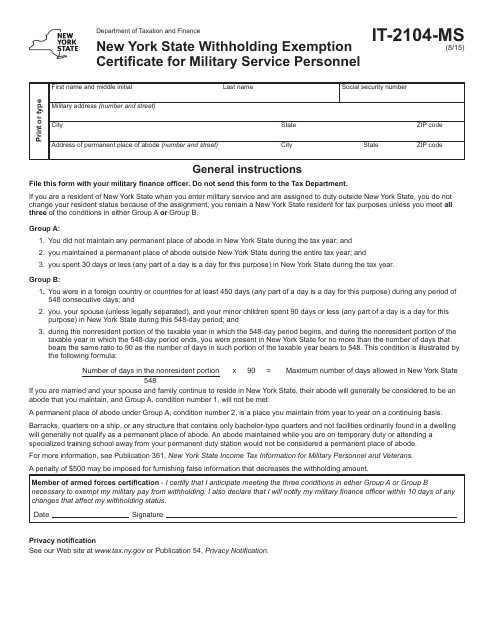

This Form is used for military service personnel in New York to claim withholding exemption from their income tax.

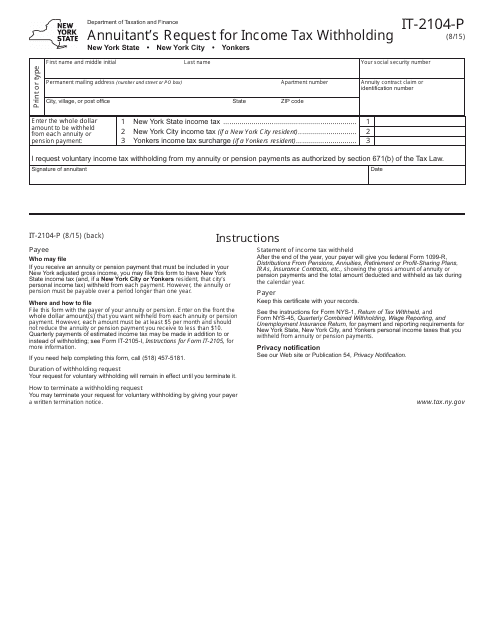

This form is used for annuitants in New York to request income tax withholding.

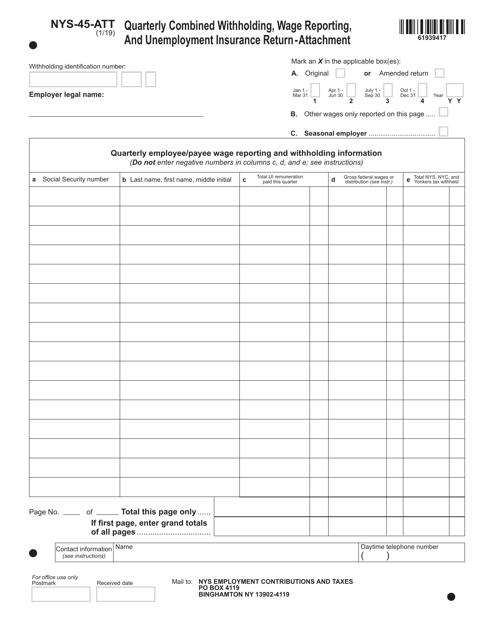

This document provides instructions for Form NYS-45-ATT, which is used for quarterly combined withholding, wage reporting, and unemployment insurance return in New York.

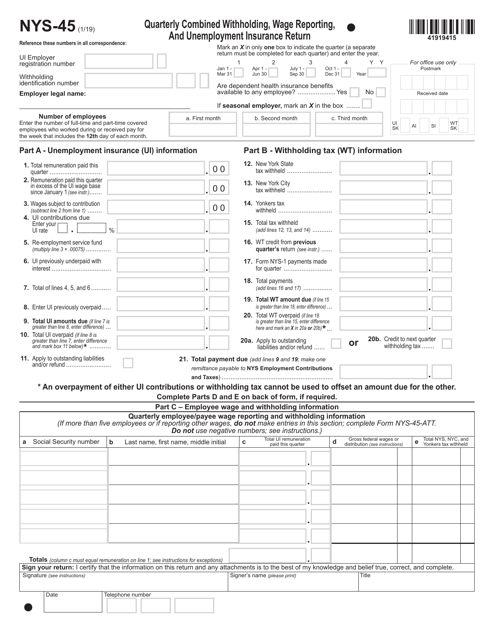

This form is used for quarterly reporting and payment of withholding taxes, wage information, and unemployment insurance in the state of New York.

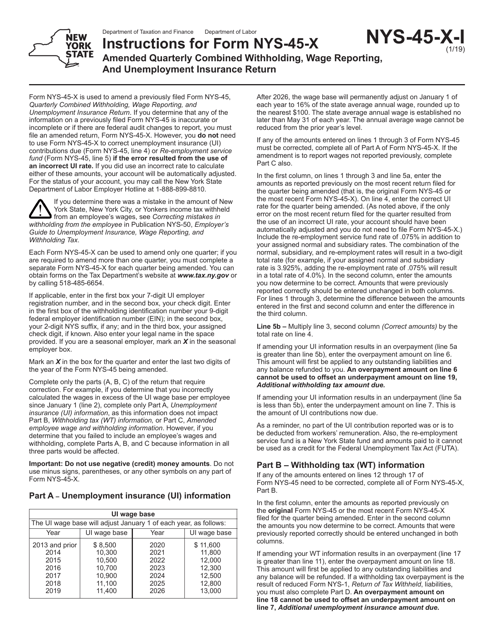

This form is used for amending the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return in the state of New York. It provides instructions for how to correctly complete and submit the amended return.

![Form RP-485-L [AMHERST] Application for Residential Property Improvement; Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733926/form-rp-485-l-amherst-application-residential-property-improvement-certain-towns-new-york_big.png)

![Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)

![Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york_big.png)