New York State Department of Taxation and Finance Forms

Documents:

2566

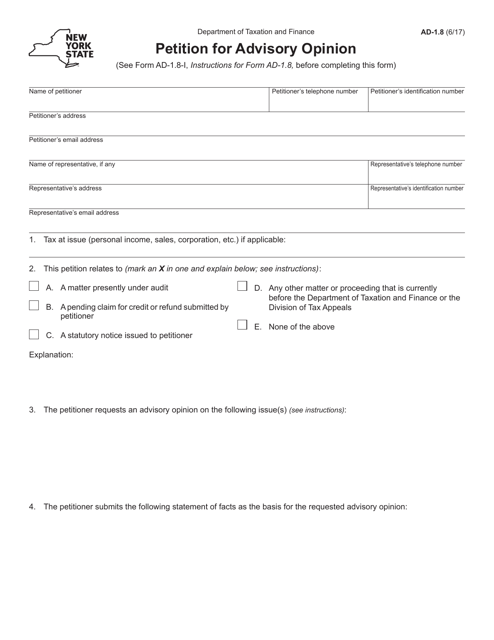

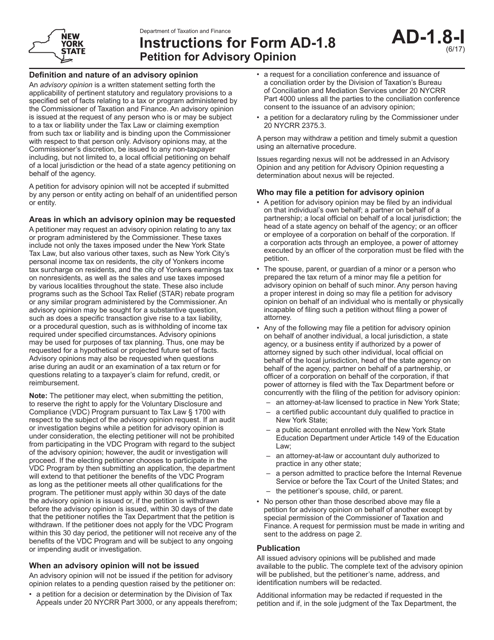

This Form is used for filing a Petition for Advisory Opinion in the state of New York. It is a formal request for legal advice or guidance from a government agency.

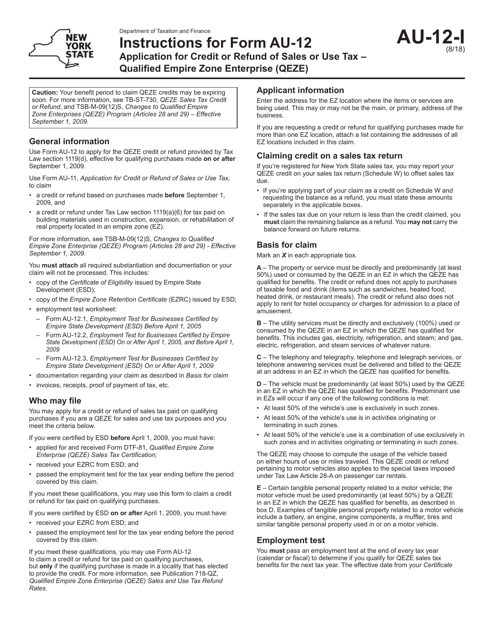

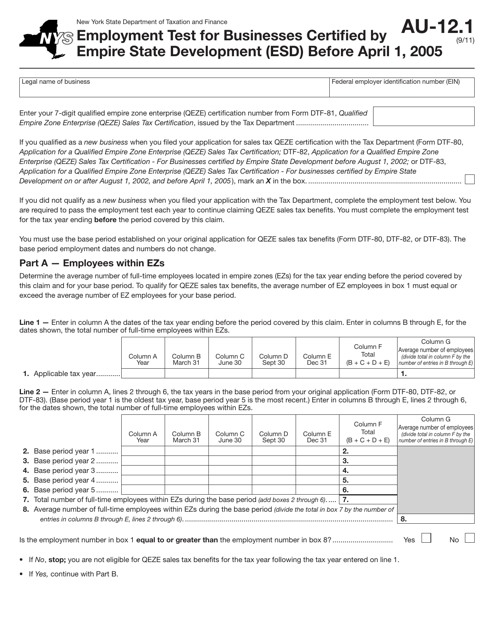

This document is for individuals or businesses in New York who want to apply for a credit or refund of sales or use tax for being a Qualified Empire Zone Enterprise (QEZE). It provides instructions on how to complete the application process.

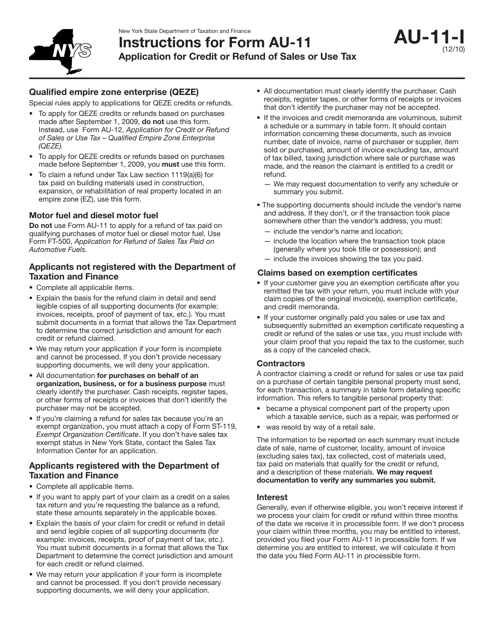

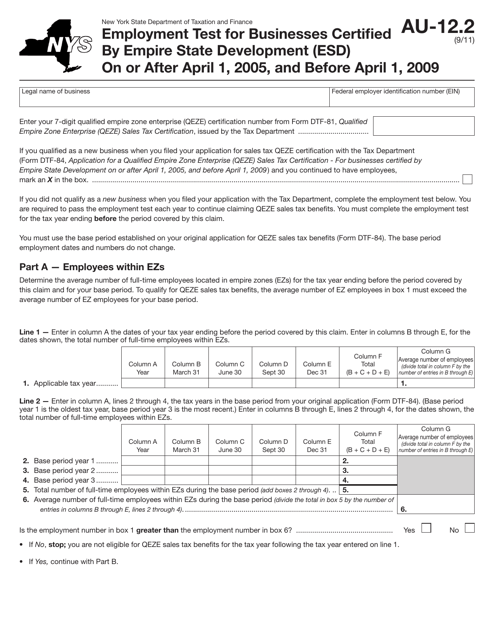

This Form is used for applying for a credit or refund of sales or use tax in the state of New York. It provides instructions on how to complete and submit the application.

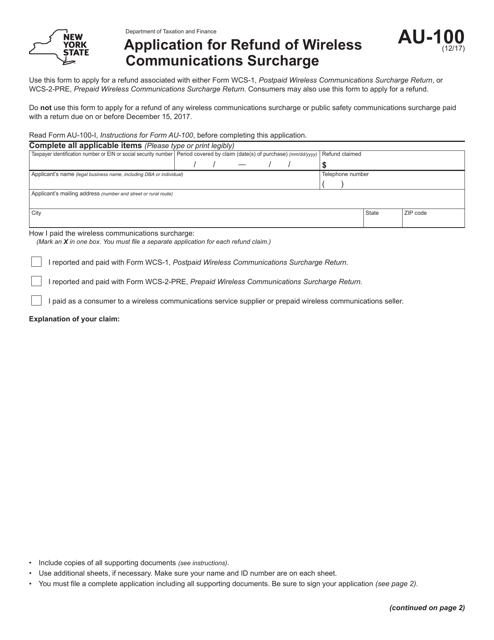

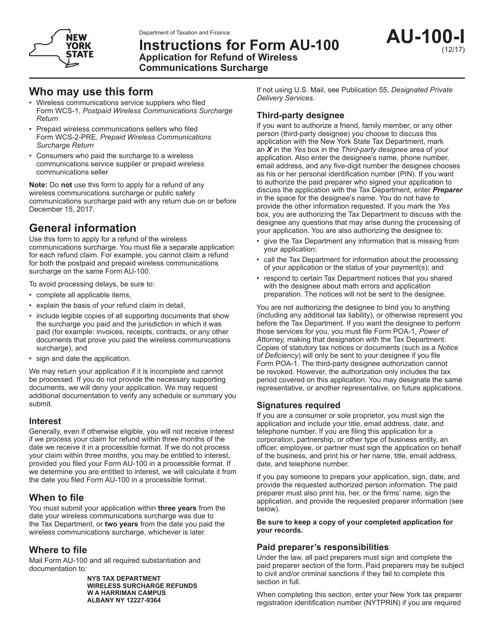

This form is used for applying for a refund of the wireless communications surcharge in New York.

This form is used for submitting a petition for an advisory opinion in New York. It provides instructions on how to complete the form and where to submit it.

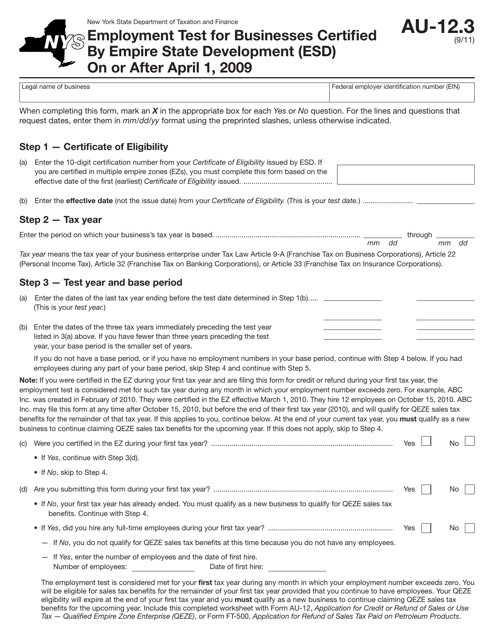

This document is a form that was used for conducting employment tests for businesses certified by Empire State Development (ESD) in New York before April 1, 2005.

This Form is used for applying for a refund of the Wireless Communications Surcharge in New York. It provides instructions on how to submit your application and get a refund if you are eligible.

This document is a form for businesses certified by Empire State Development (ESD) in New York between April 1, 2005, and April 1, 2009. It is used for employment testing purposes.

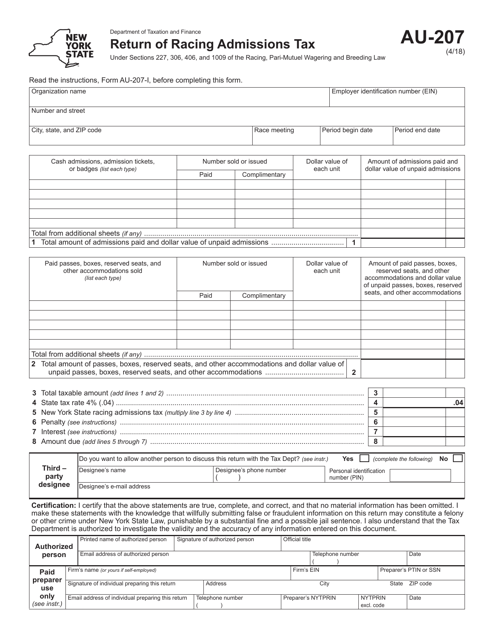

This form is used for reporting and paying the Racing Admissions Tax in New York.

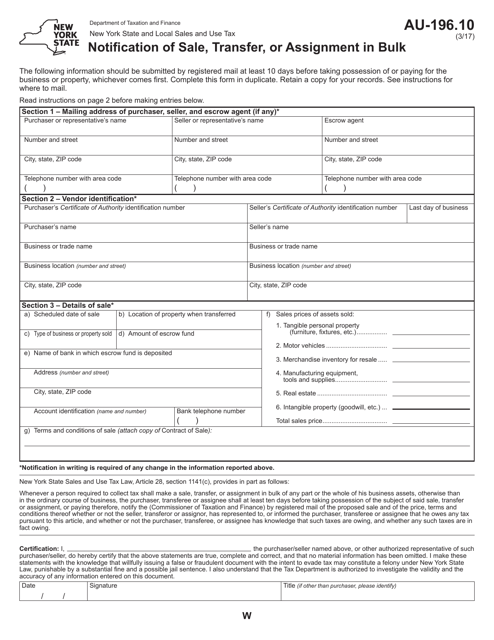

This form is used for notifying the state of New York about a sale, transfer, or assignment of assets in bulk.

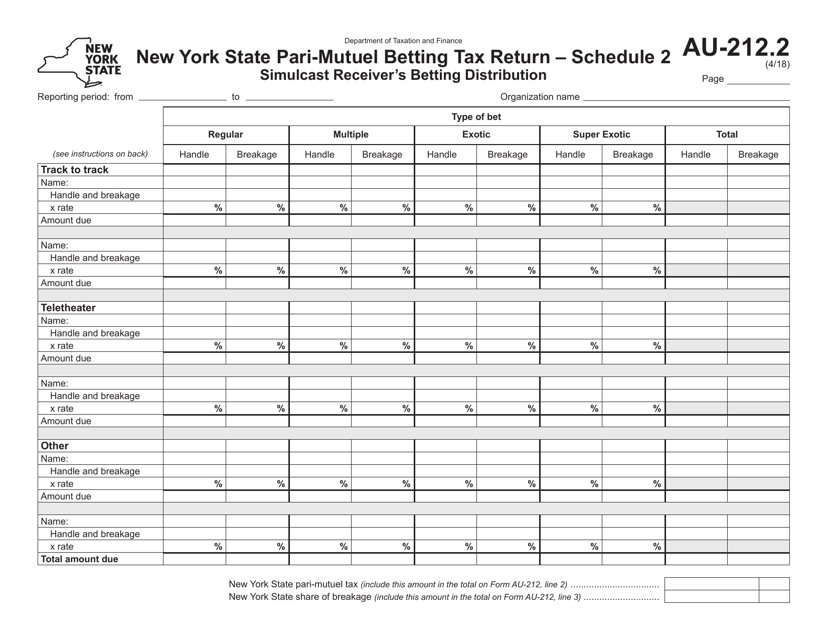

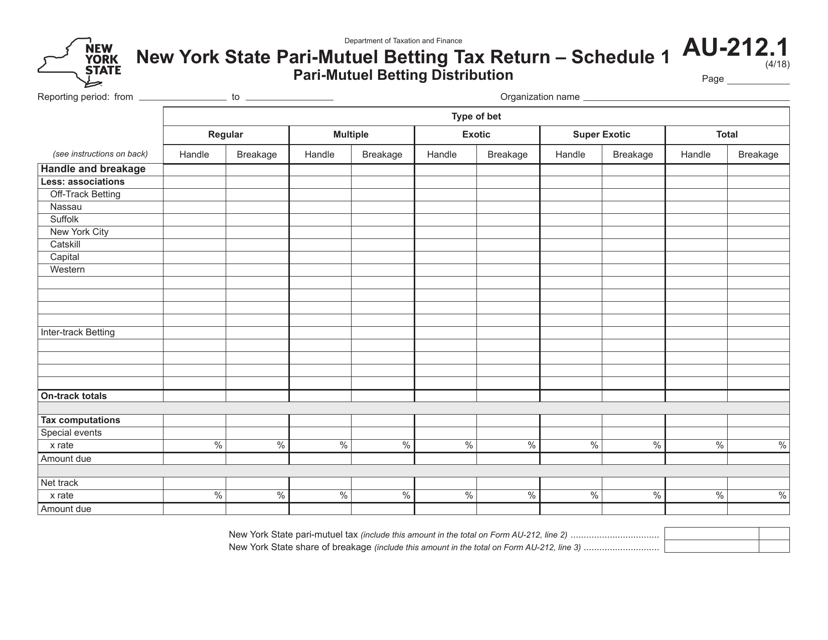

This form is used for reporting the betting distribution from simulcast receivers in New York.

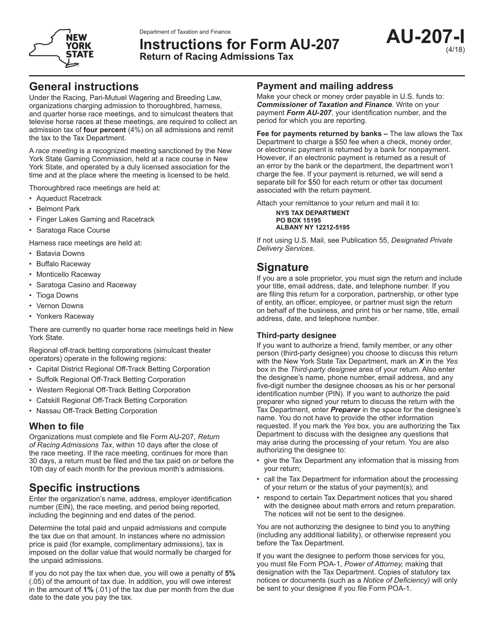

This document provides instructions for filing Form AU-207, which is used to report and pay the racing admissions tax in the state of New York. The form is required for businesses involved in racing events and provides guidance on how to accurately report and remit the tax.

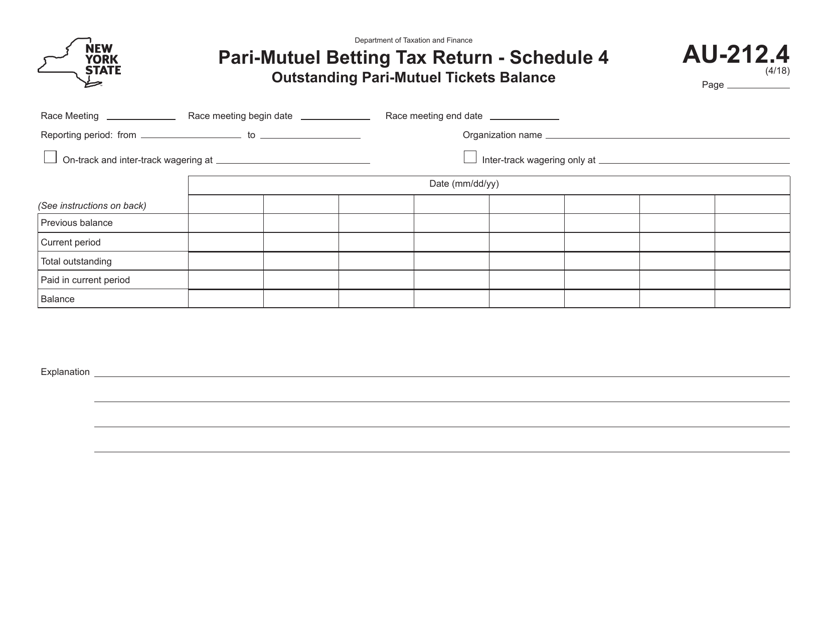

This form is used for reporting the outstanding balance of pari-mutuel tickets in the state of New York.

This form is used for businesses certified by Empire State Development (ESD) on or after April 1, 2009, in New York to test employment eligibility.

This Form is used for reporting the distribution of funds from pari-mutuel betting in New York.

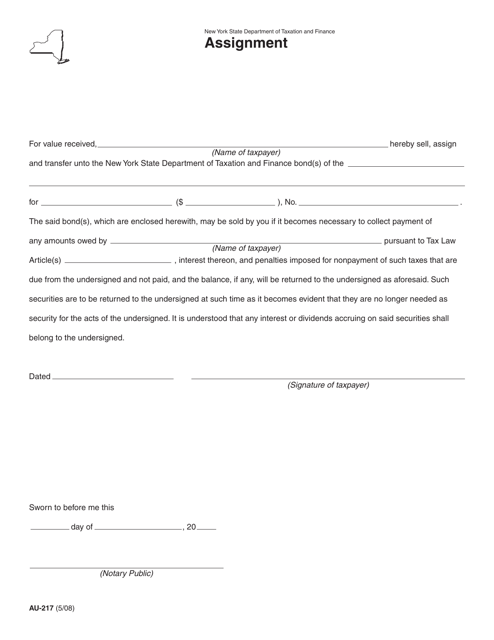

This document is used for assigning a tax lien certificate in New York.

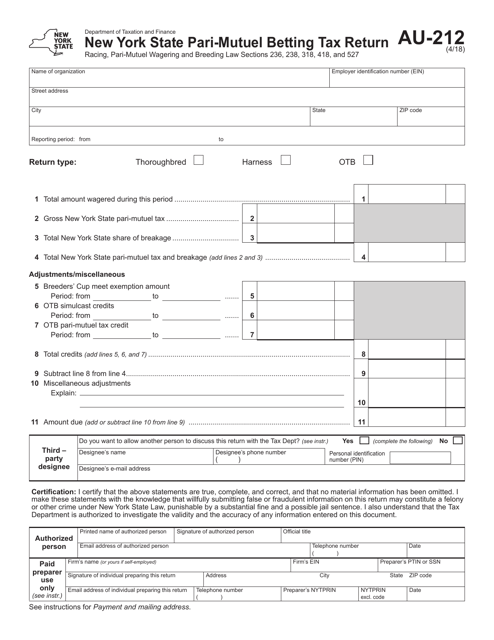

This form is used for reporting and paying the New York State Pari-Mutuel Betting Tax.

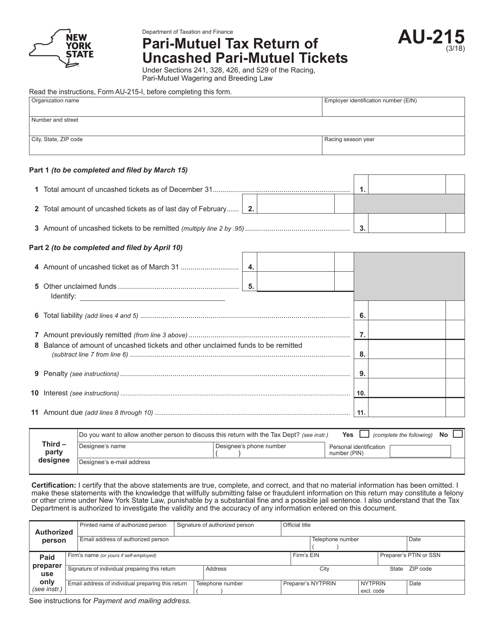

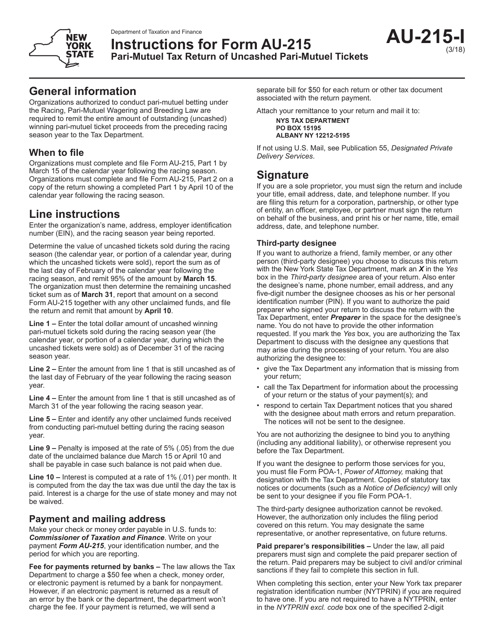

This Form is used for reporting and filing the Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets in the state of New York.

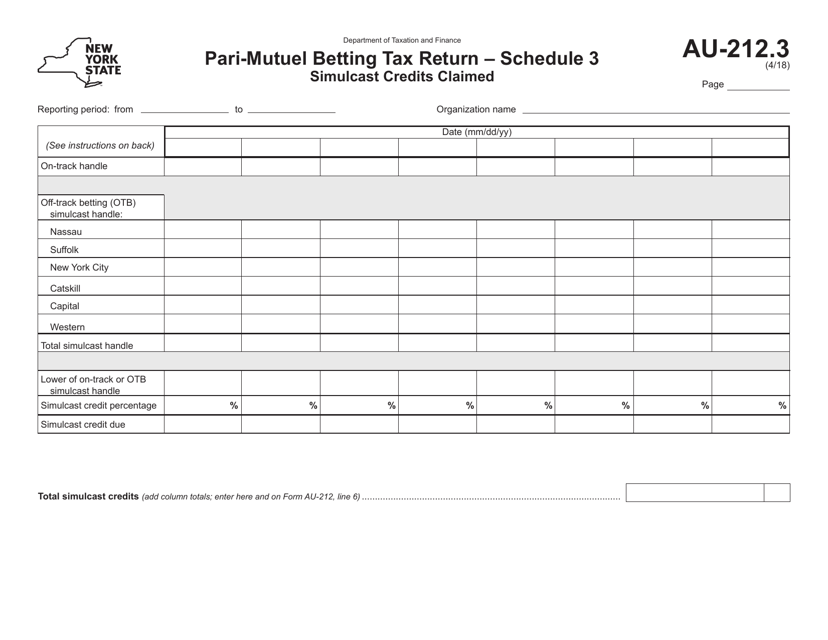

This form is used for claiming simulcast credits in New York.

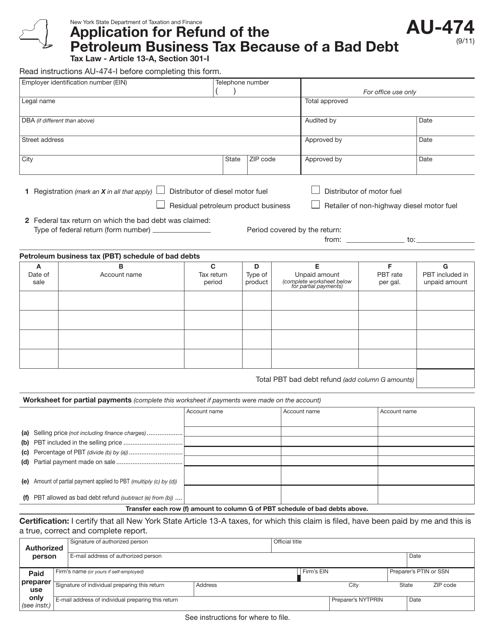

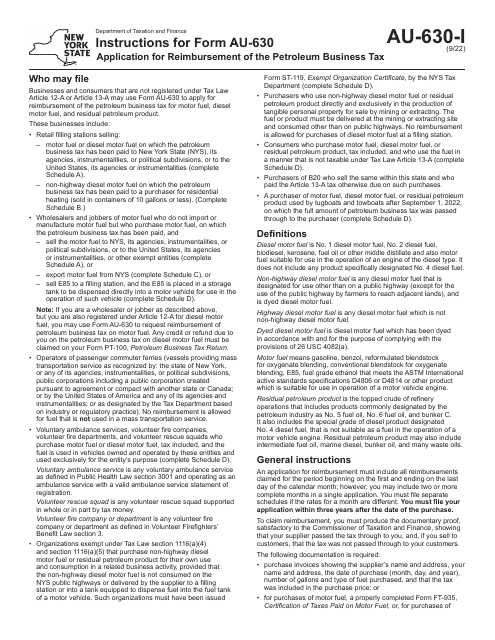

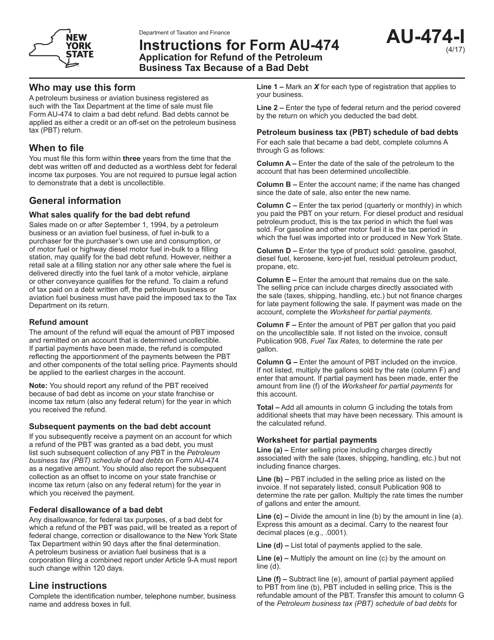

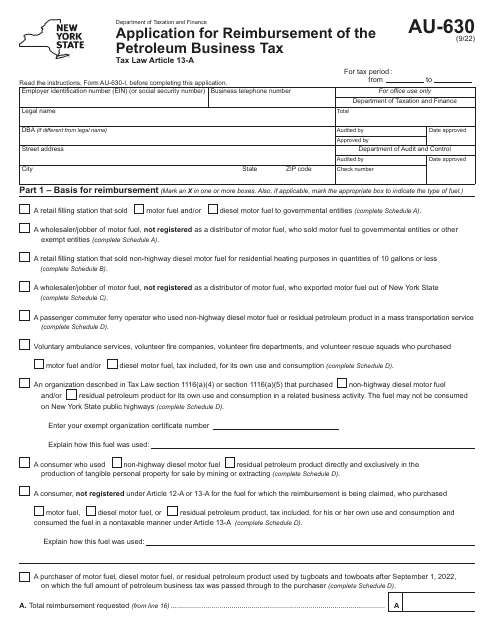

This form is used for applying for a refund of the petroleum business tax in New York due to a bad debt.

This Form is used for reporting and filing the Pari-Mutuel Tax Return of Uncashed Pari-Mutuel Tickets in the state of New York. It provides instructions on how to accurately fill out and file the form.

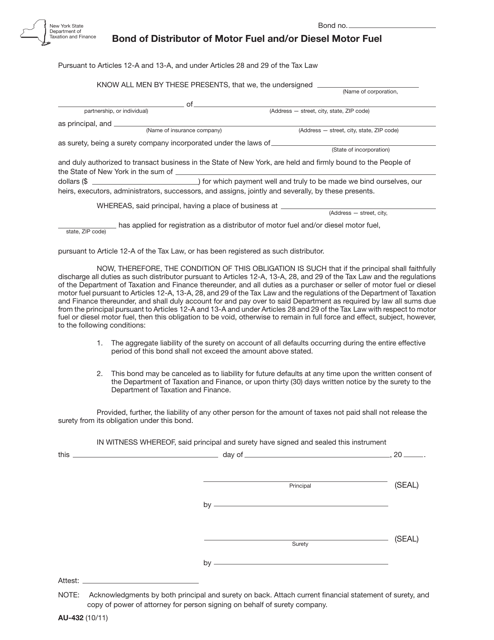

This form is used for distributors of motor fuel and/or diesel motor fuel in New York to submit a bond. It is required by the state to ensure compliance with tax obligations related to fuel distribution.

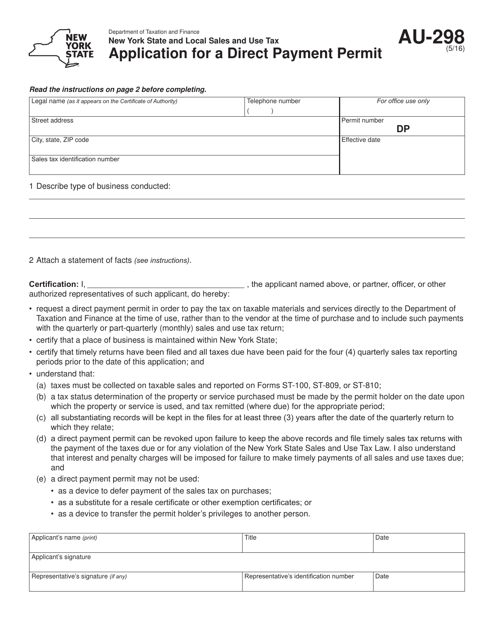

This form is used for applying for a Direct Payment Permit in New York. It allows businesses to directly pay sales tax rather than collecting it from customers.

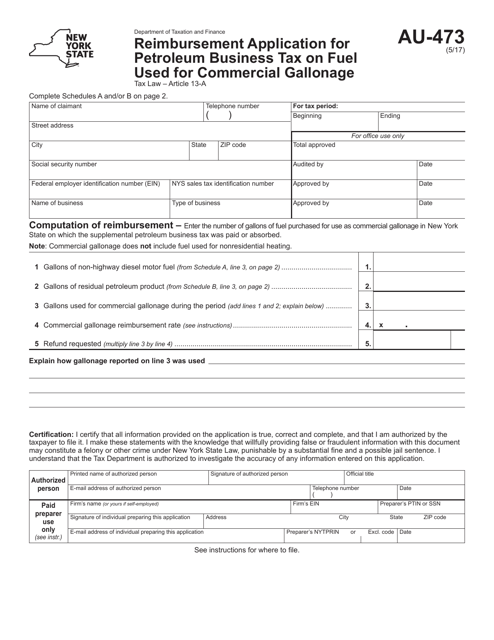

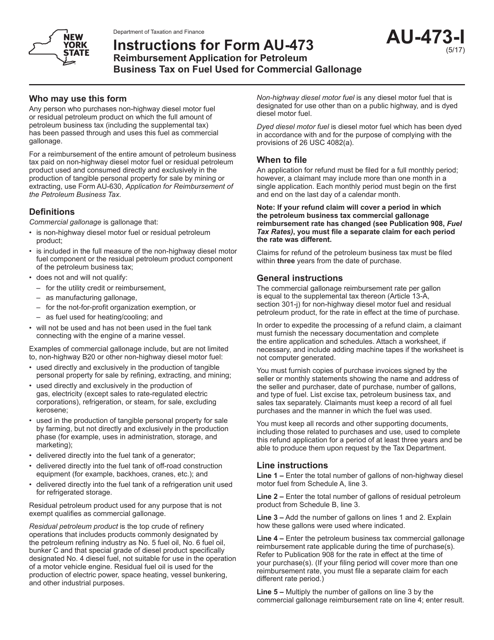

This form is used for applying for reimbursement of the petroleum business tax on fuel used for commercial gallonage in New York.

This Form is used for reimbursement of Petroleum Business Tax on fuel used for commercial gallonage in New York. It provides instructions on how to complete the reimbursement application.

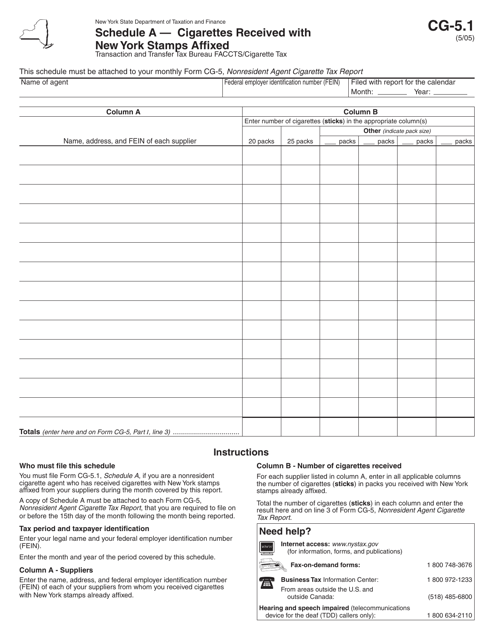

This Form is used for reporting the receipt of cigarettes with New York stamps affixed in the state of New York.

This form is used for filing an application for a refund of the petroleum business tax in New York due to a bad debt. It provides instructions on how to complete the form and apply for the refund.

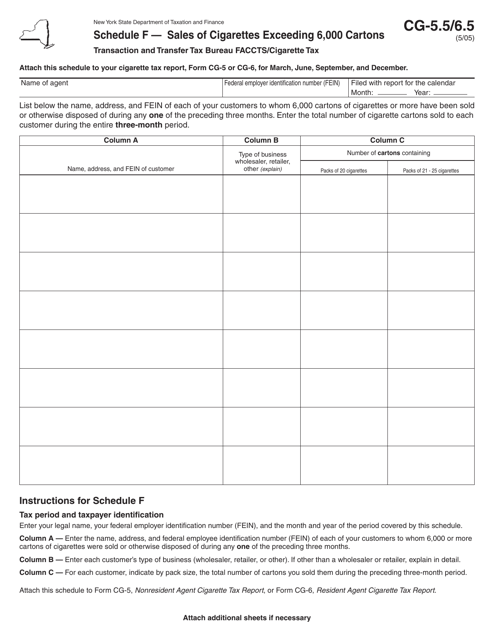

This form is used for reporting the sales of cigarettes exceeding 6,000 cartons in the state of New York.

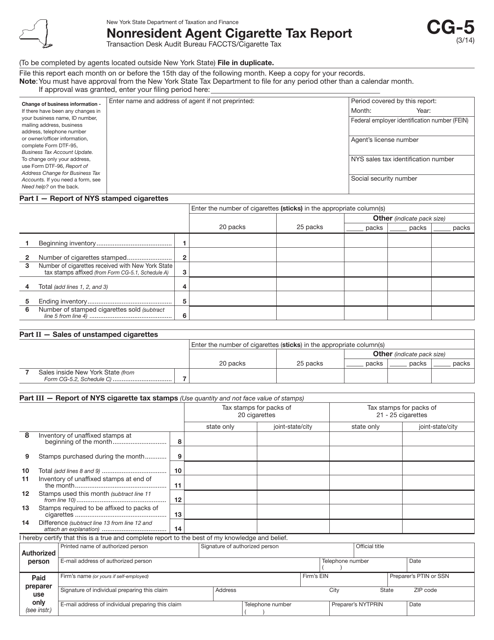

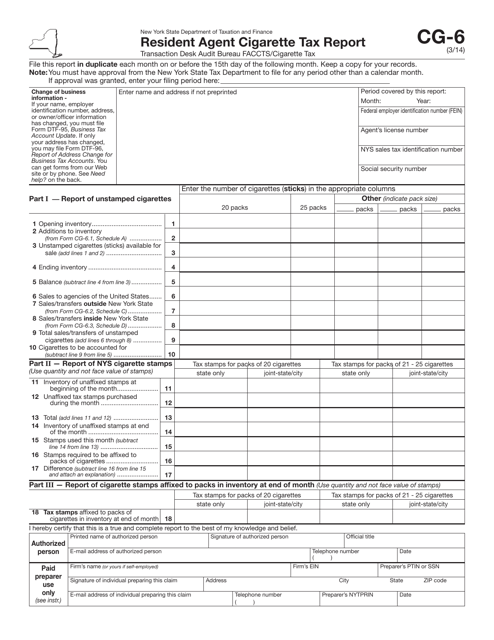

This Form is used for reporting cigarette taxes by nonresident agents in New York.

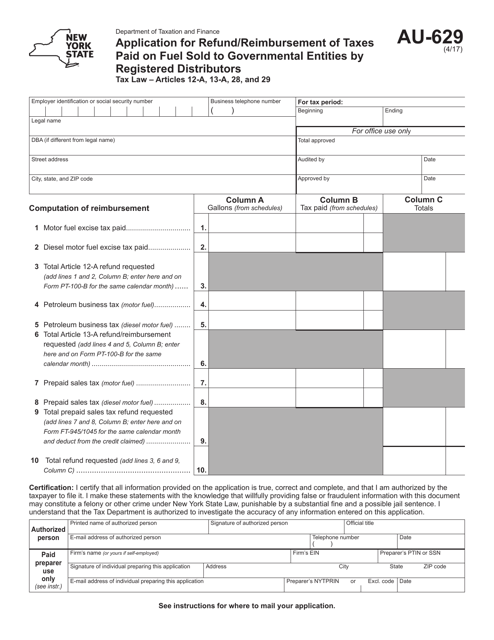

This form is used for applying for a refund or reimbursement of taxes paid on fuel sold to governmental entities by registered distributors in New York.

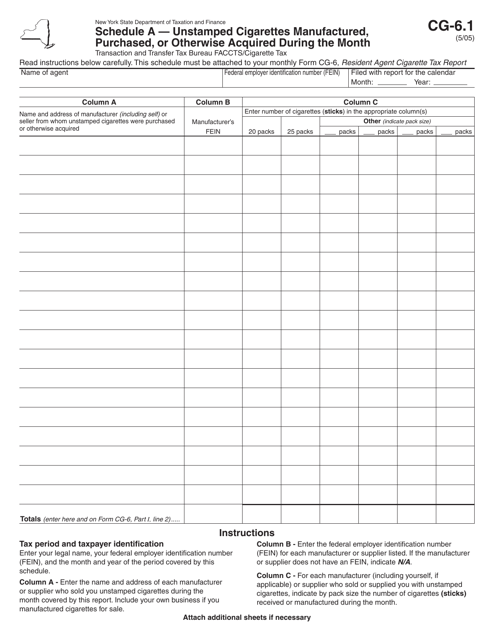

This Form is used for reporting information about the manufacturing, purchasing, or acquisition of unstamped cigarettes in New York during a specific month.

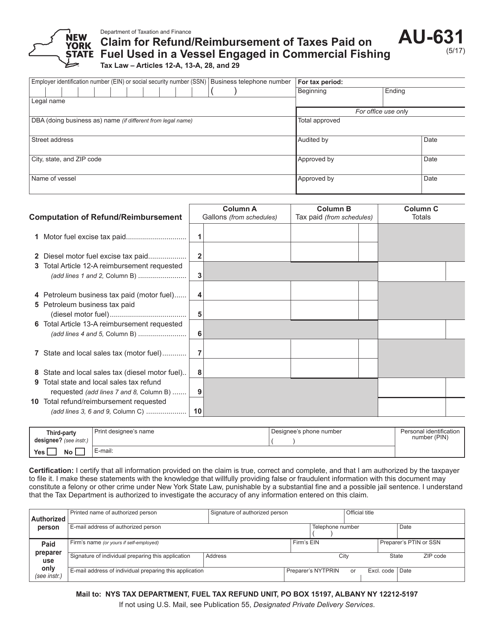

This form is used for claiming a refund or reimbursement of taxes paid on fuel used in a commercial fishing vessel in New York.

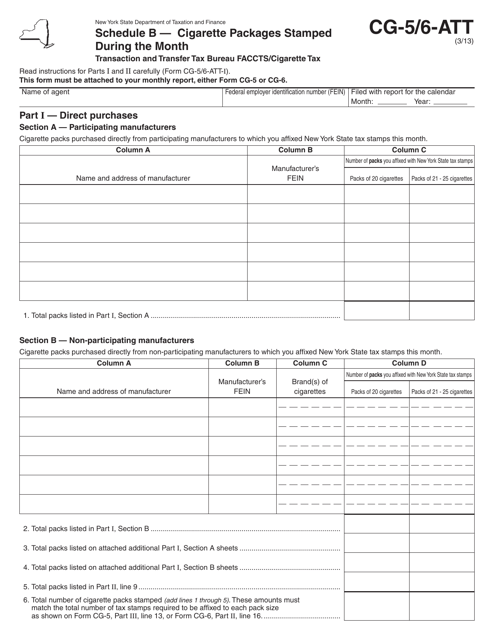

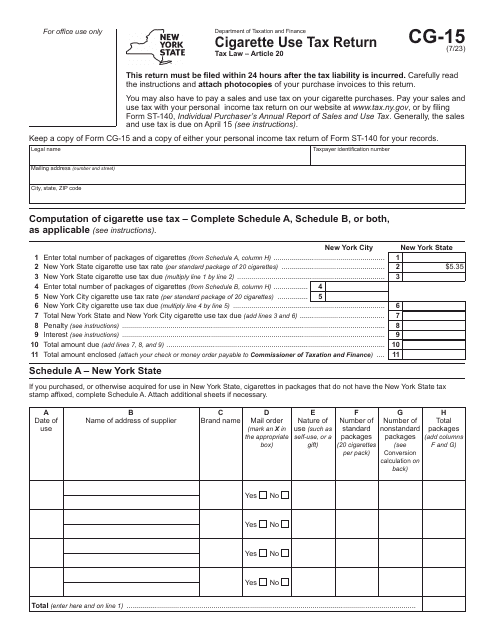

This document is a form used for reporting the number of cigarette packages stamped in the state of New York during a specific month.

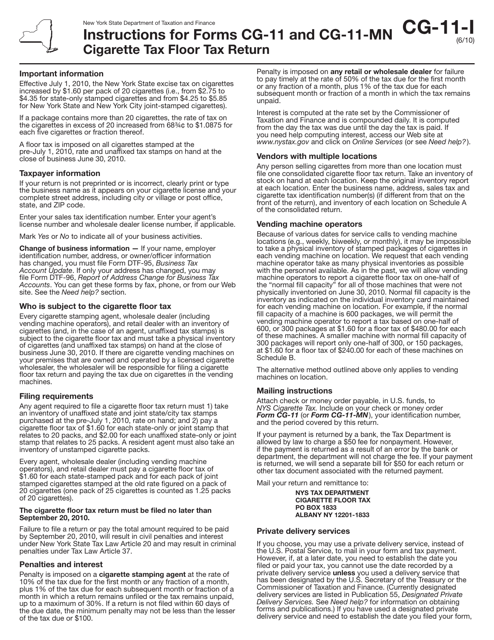

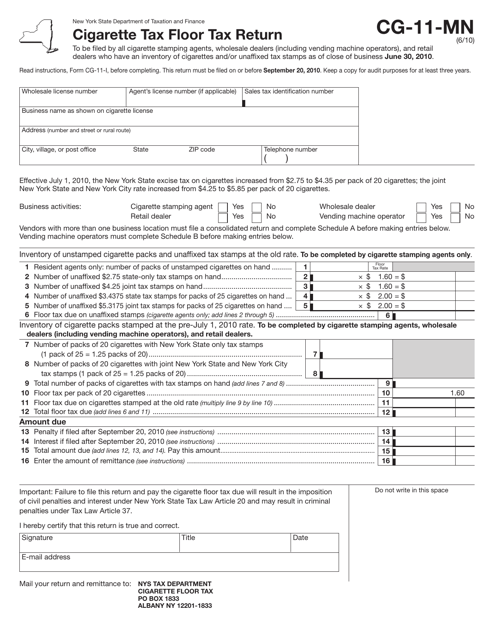

This form is used for filing the Cigarette Tax Floor Tax Return in the state of New York. It provides instructions on how to accurately report and calculate the tax owed on cigarettes.

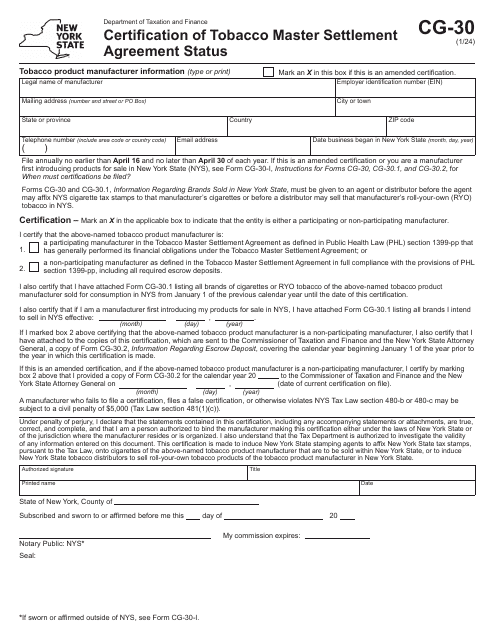

This form is used for reporting and paying the floor tax on cigarettes in New York.

This form is used for reporting cigarette tax payments and sales made by resident agents in the state of New York.