New York State Department of Taxation and Finance Forms

Documents:

2566

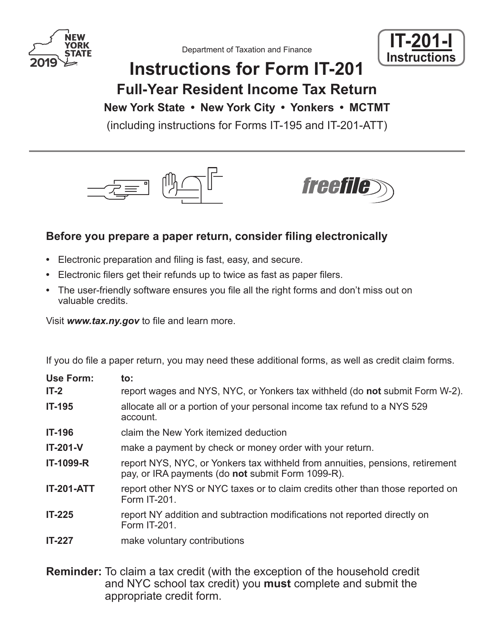

This form contains official instructions for Form IT-201, along with Forms IT-195 and IT-201-ATT.

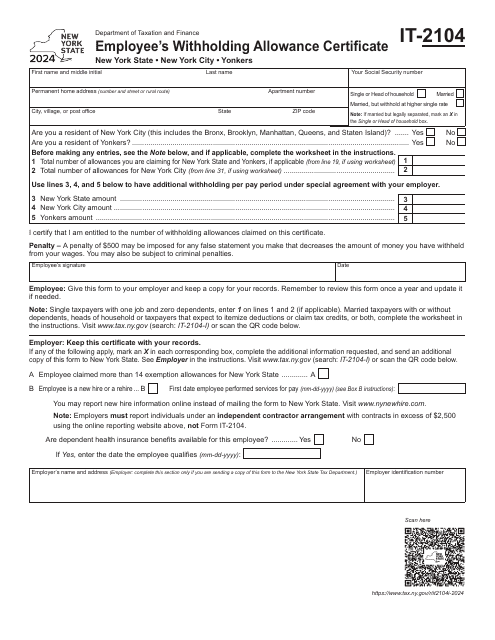

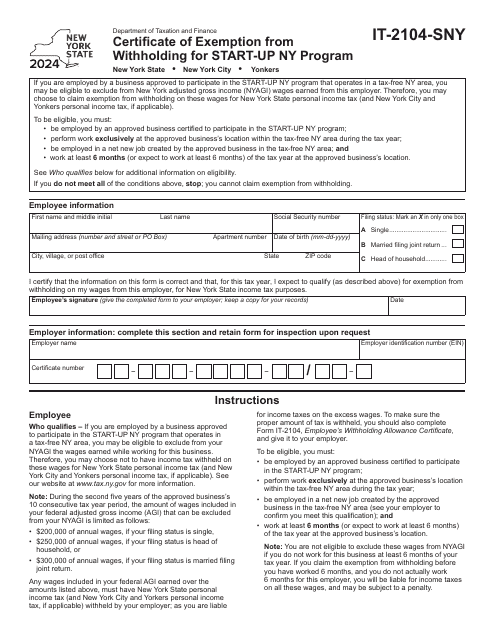

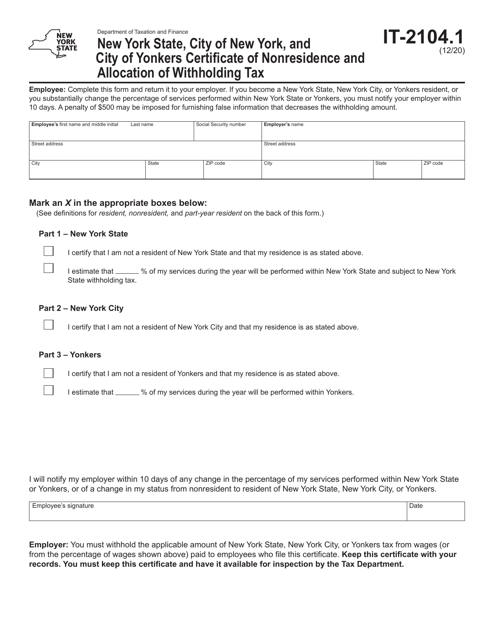

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

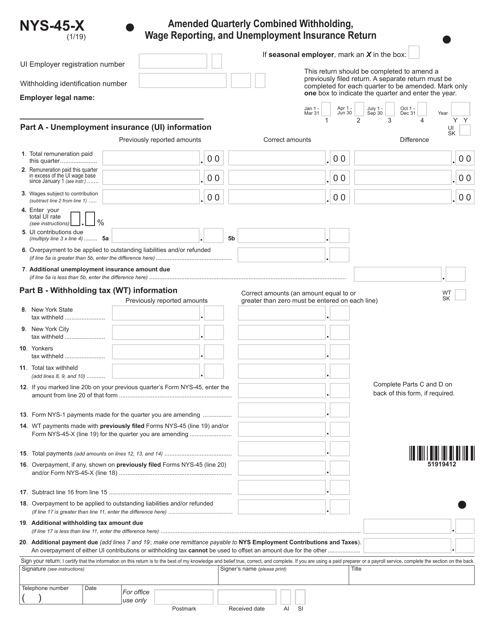

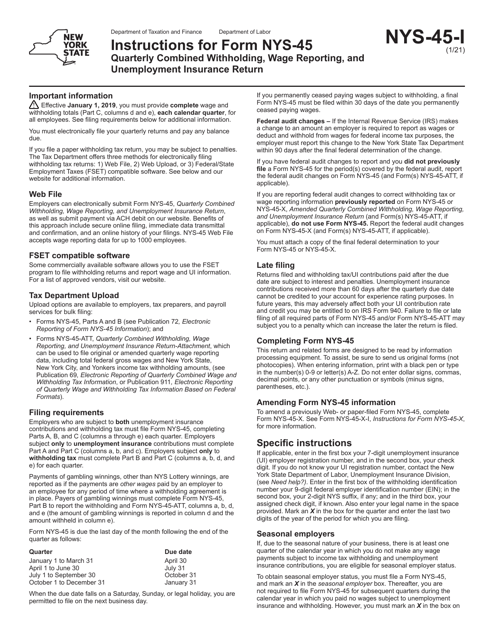

This form is used for submitting an amended quarterly report for withholding taxes, wage reporting, and unemployment insurance in the state of New York.

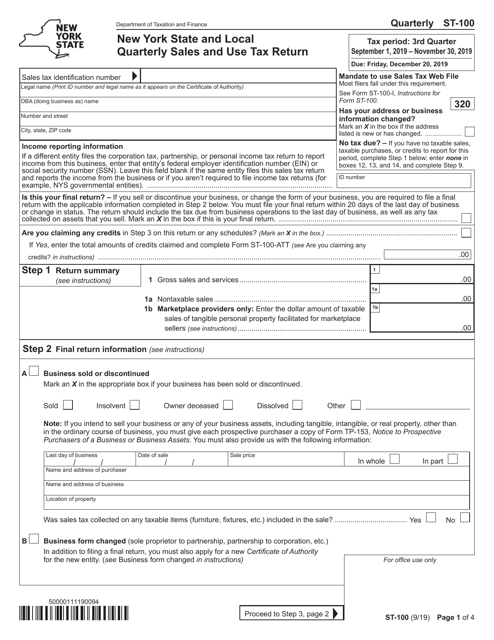

This is a tax return used by New York-based companies to notify the authorities about the total amount of sales of goods, purchases, and credits every quarter of the year.

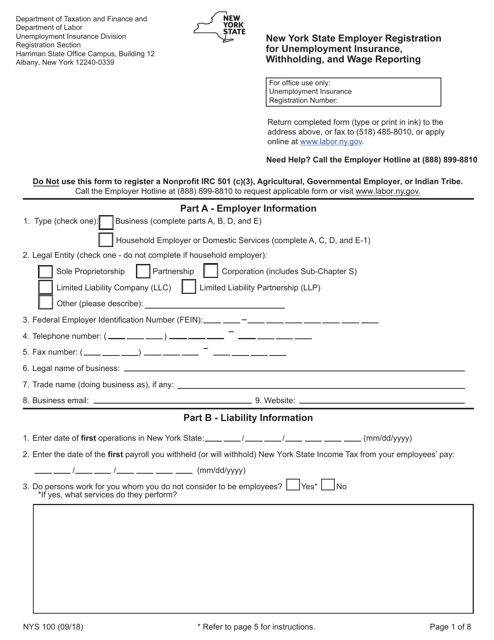

This is a form that should be completed by business employers or household employers of domestic services to register for Unemployment Insurance.

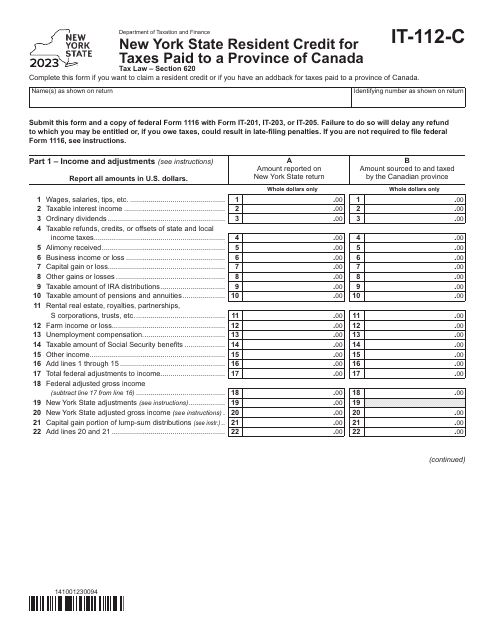

Form IT-112-C New York State Resident Credit for Taxes Paid to a Province of Canada - New York, 2023

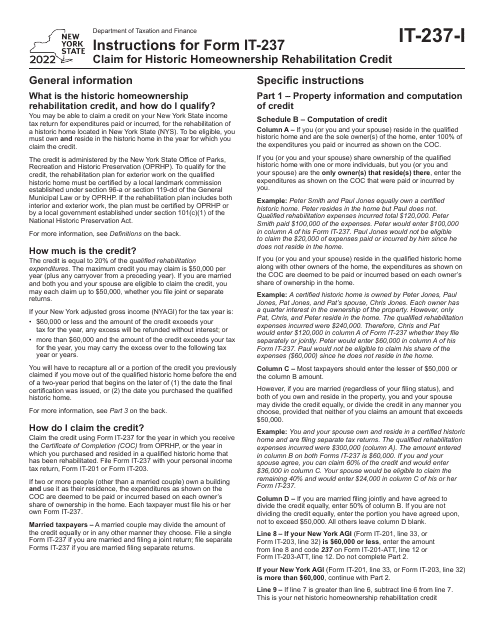

Instructions for Form IT-237 Claim for Historic Homeownership Rehabilitation Credit - New York, 2022

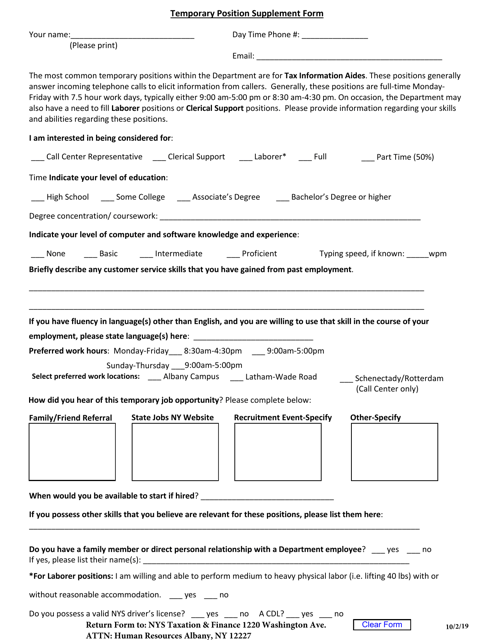

This Form is used for supplementing a temporary position in New York.

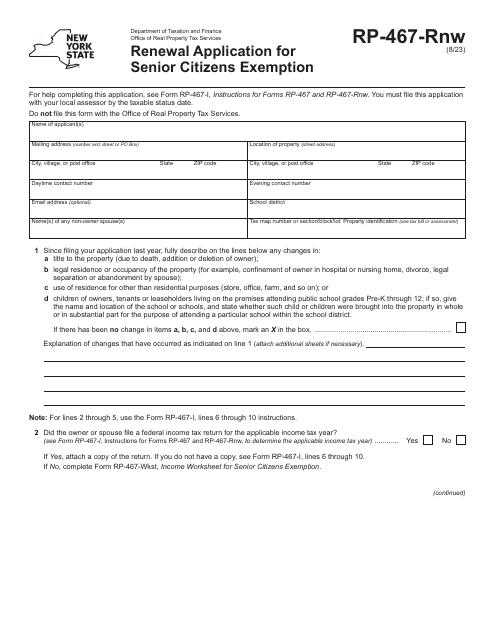

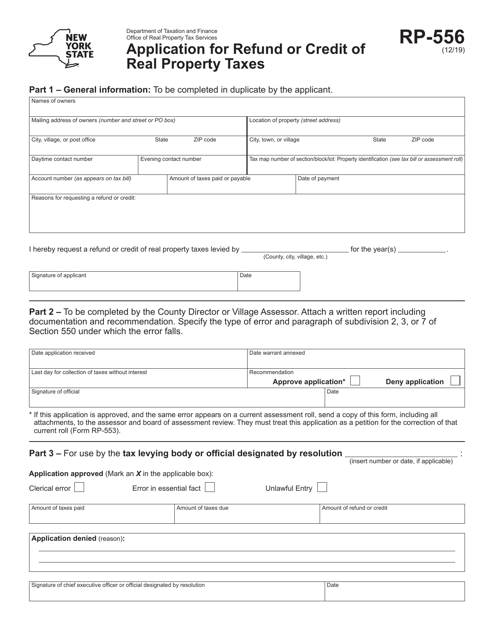

This form is used for applying for a refund or credit for the payment of real property taxes in the state of New York.