New York State Department of Taxation and Finance Forms

Documents:

2566

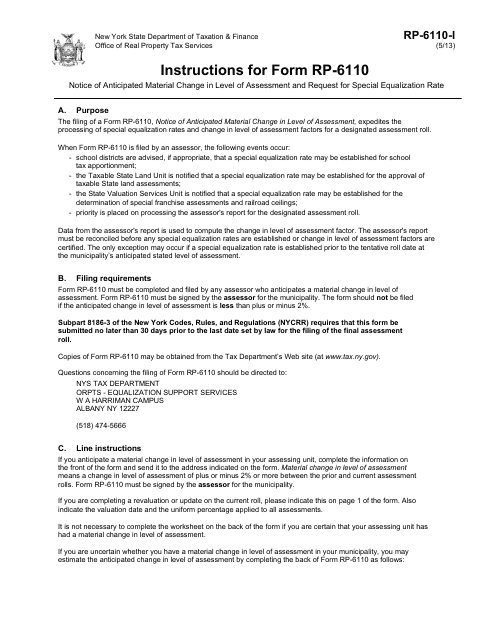

This Form is used for notifying the local assessor in New York about any anticipated material change in the property's assessment level and requesting a special equalization rate.

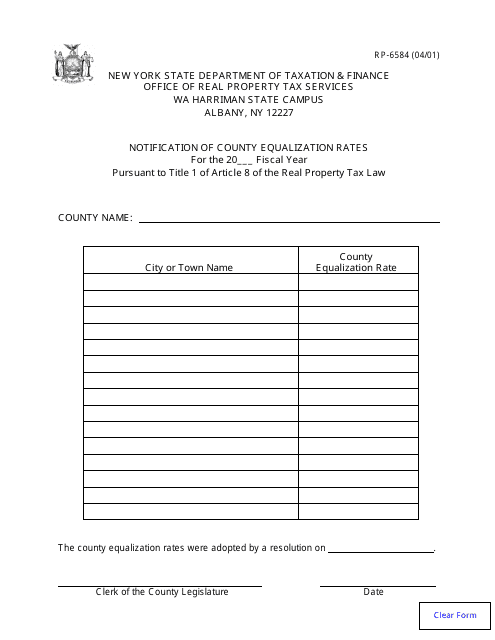

This form is used for notifying individuals of the county equalization rates in New York. It provides information on how property assessments and taxes are calculated, helping residents understand their tax obligations.

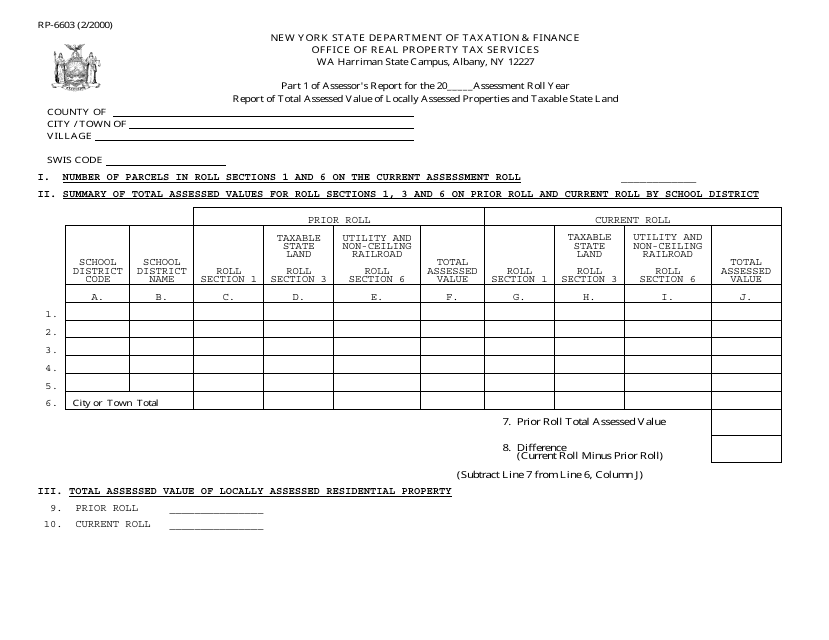

This form is used for reporting the total assessed value of locally assessed properties and taxable state land in New York.

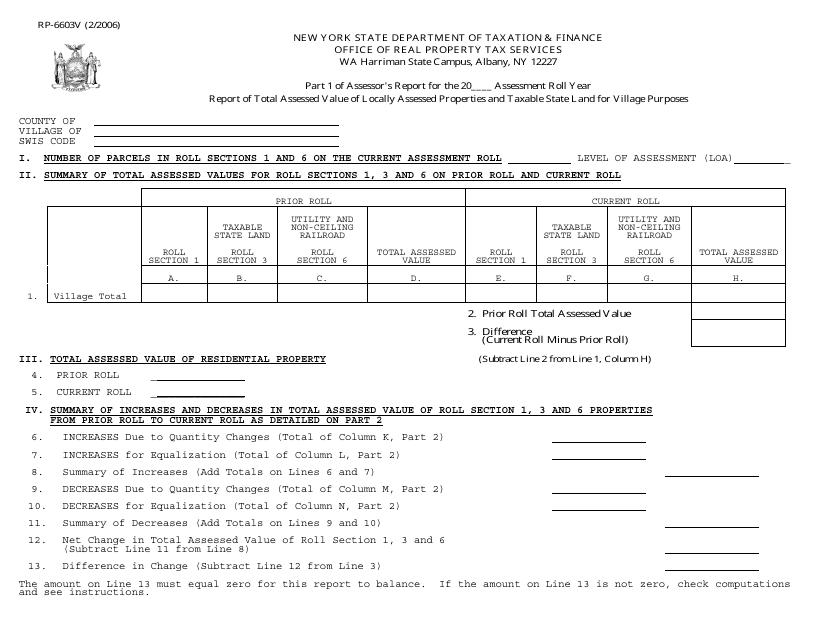

This document is part 1 of the Assessor's Report in the state of New York. It provides information on the total assessed value of locally assessed properties and taxable state land for village purposes.

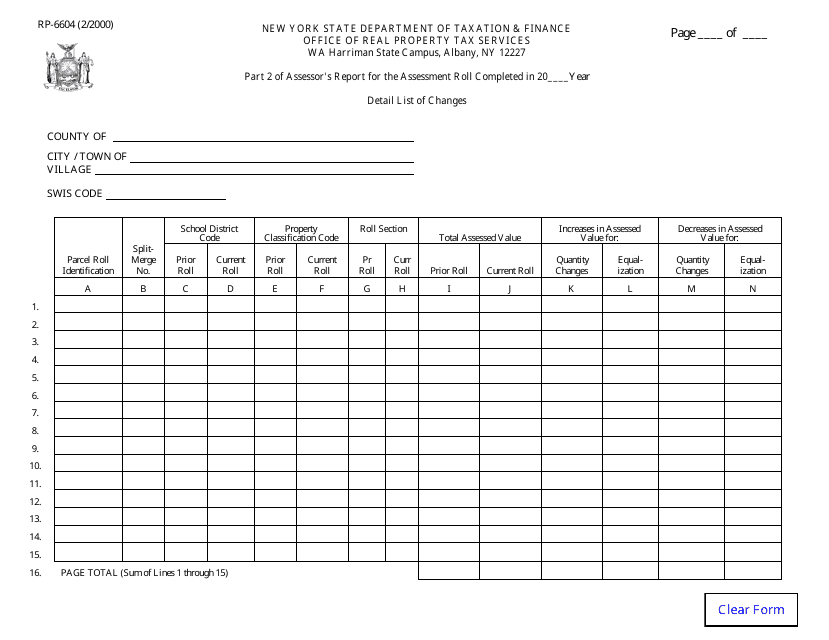

Form RP-6604 Part 2 of Assessor's Report for the Assessment Roll - Detail List of Changes - New York

This Form is used for providing a detailed list of changes to the Assessment Roll in New York. It is part 2 of the Assessor's Report.

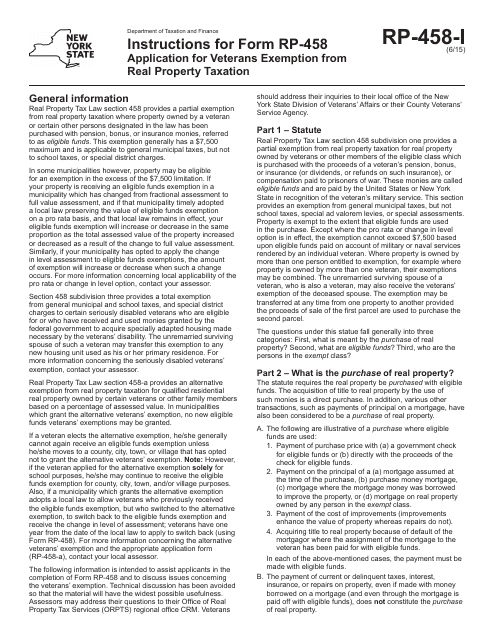

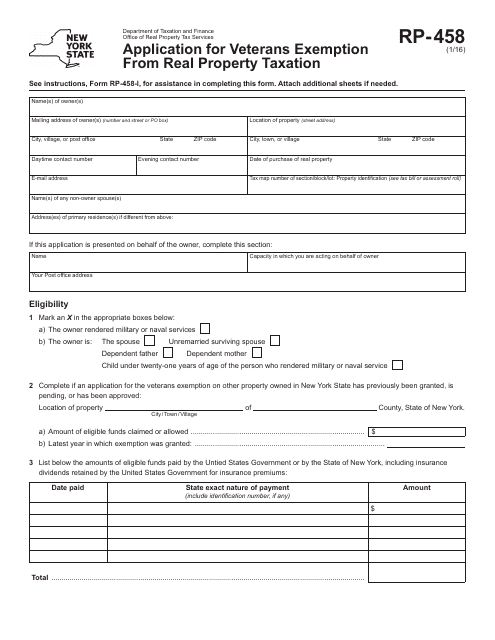

This Form is used for applying for the Veterans Exemption From Real Property Taxation in New York. It provides instructions on how to fill out and submit the application for this tax exemption.

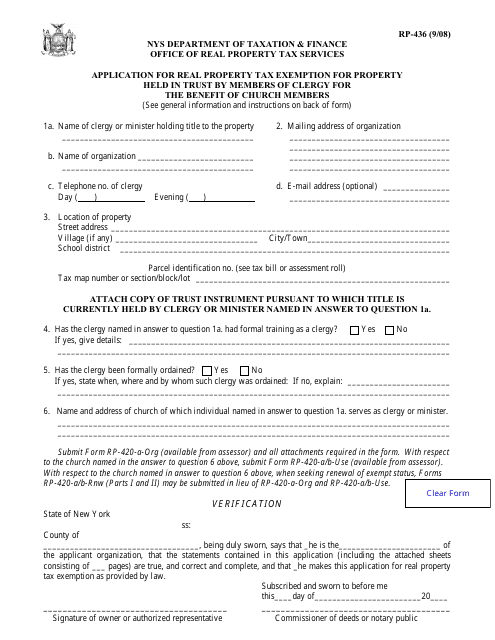

This Form is used for applying for a real property tax exemption in New York for properties held in trust by members of the clergy for the benefit of church members.

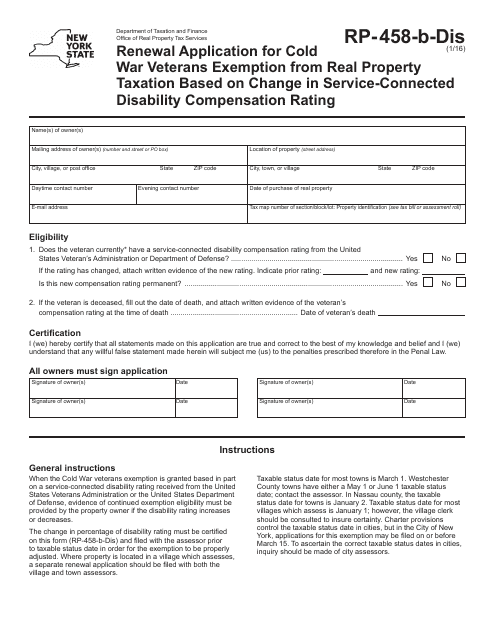

This Form is used for applying for the renewal of the Cold War Veterans Exemption from Real Property Taxation in New York based on a change in the service-connected disability compensation rating.

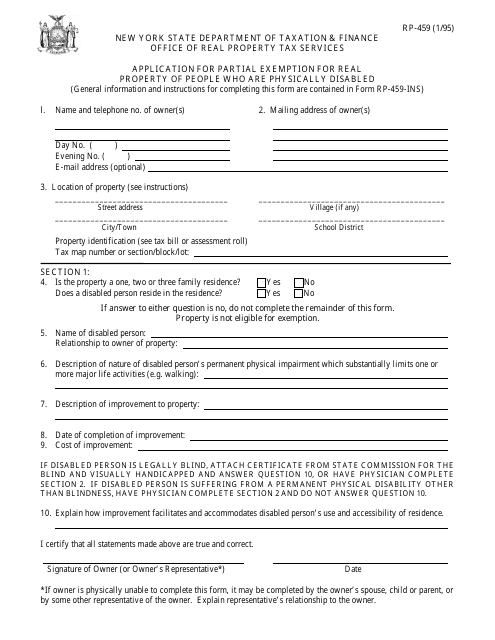

This form is used for applying for a partial exemption on real property taxes for individuals who are physically disabled in the state of New York.

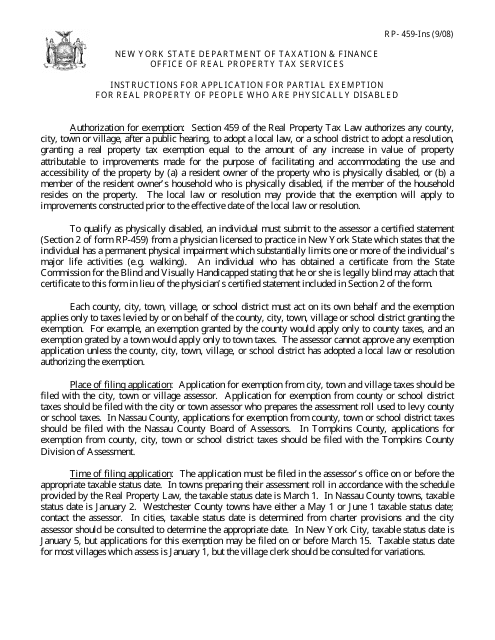

This Form is used for applying for a partial exemption for real property in New York for individuals who are physically disabled. It provides instructions on how to complete the application process.

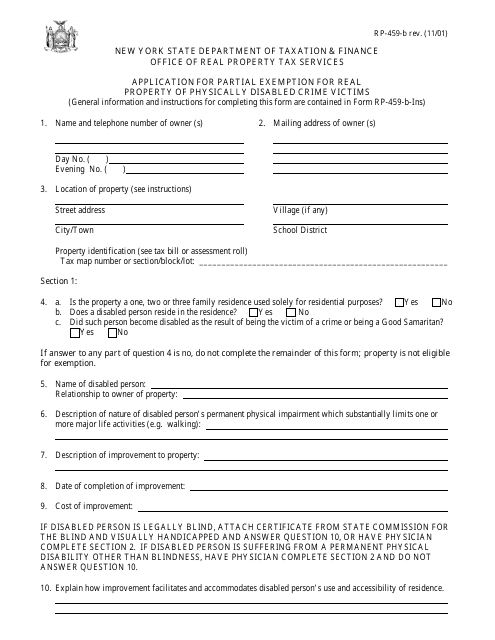

This form is used for applying for a partial exemption on real property taxes for physically disabled crime victims in New York.

This form is used for applying for the Veterans Exemption from real property taxation in New York. Eligible veterans can use this form to claim a tax exemption on their property.

This form is used for applying for a partial exemption on real property tax for physically disabled crime victims in New York. It provides instructions on how to complete the form accurately.

This document is used for applying for a volunteer firefighters/ambulance workers exemption in Rockland or Steuben County, New York.

This form is used for reporting enrolled members of volunteer fire companies, fire departments, or ambulance services in Suffolk County, New York.

This Form is used for applying for a volunteer firefighters/ambulance workers exemption in Chautauqua or Oswego County, New York.

This application form is used for individuals who want to apply for the Volunteer Firefighters / Ambulance Workers Exemption in Wyoming County, New York. It is specific to this county and is intended for those who wish to serve as volunteers in emergency services.

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption for residents of Cattaraugus County, New York.

This document is used for applying for a Volunteer Firefighters / Ambulance Workers Exemption in Dutchess County, New York.

This form is used for applying for the volunteer firefighters/ambulance workers exemption in Erie County, New York.

This Form is used for applying for the Volunteer Firefighters/Ambulance Workers Exemption in Nassau County, New York.

This form is used for applying for a volunteer firefighters/ambulance workers exemption in Columbia County, New York.

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption in Oneida County, New York.

This Form is used for applying for a volunteer firefighter/ambulance worker exemption in Niagara County, New York.

This form is used for applying for a volunteer firefighters/volunteer ambulance workers exemption in Schenectady County, New York.

This form is used for applying for a volunteer firefighters/ambulance workers exemption in Orleans County, New York.

This form is used for applying for an exemption for volunteer firefighters and volunteer ambulance workers specifically in Lewis County, New York.

This form is used for applying for a tax exemption specifically for volunteer firefighters and ambulance workers in Saratoga County, New York.

This form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Schoharie County, New York.

This Form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Jefferson and St. Lawrence Counties, New York.

This form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Montgomery County, New York.

This form is used for applying for an exemption for volunteer firefighters and volunteer ambulance workers in Orange County, New York.

This Form is used for applying for a volunteer firefighters/volunteer ambulance workers exemption in Ulster County, New York.

This Form is used for applying for a Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Onondaga County, New York.

This document is an application form specifically for residents of Albany County in New York who wish to apply for an exemption for volunteer firefighters or volunteer ambulance workers. The form, known as Form RP-466-I, must be filled out to request this exemption.

This form is used for applying for a volunteer firefighters/volunteer ambulance workers exemption in Clinton County, New York.

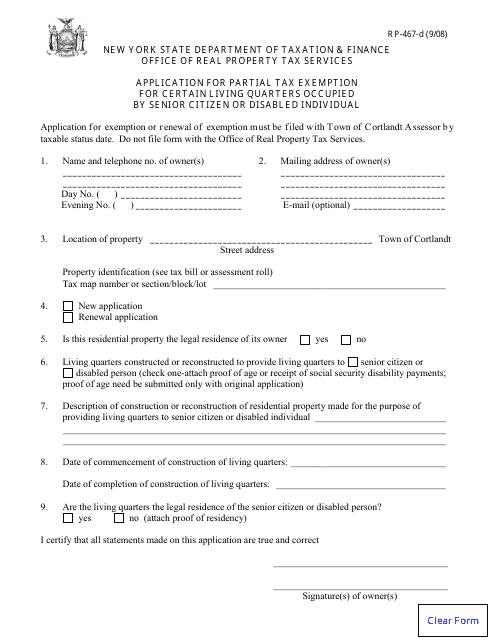

This form is used for applying for a partial tax exemption for certain living quarters in New York that are occupied by a senior citizen or disabled individual.

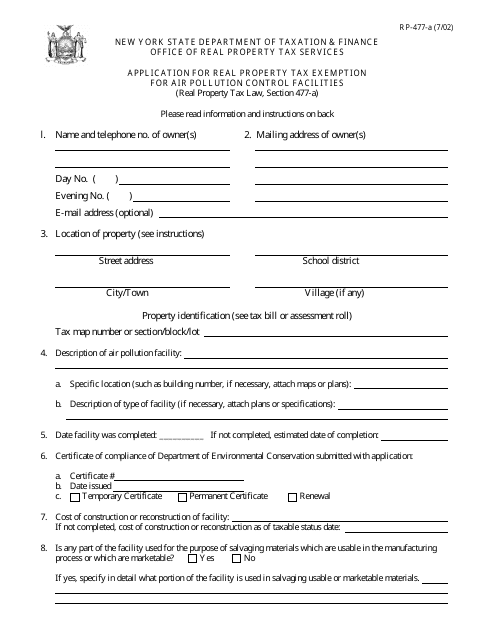

This form is used for applying for a real property tax exemption in New York for air pollution control facilities.

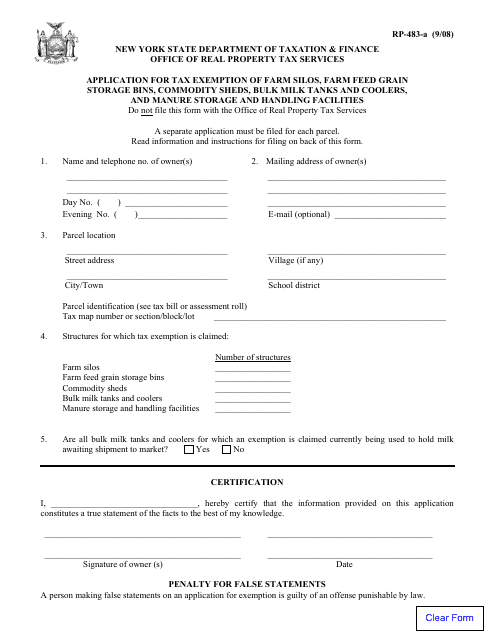

This form is used for applying for tax exemption of various agricultural storage and handling facilities in New York, such as farm silos, feed grain storage bins, commodity sheds, bulk milk tanks and coolers, and manure storage facilities.

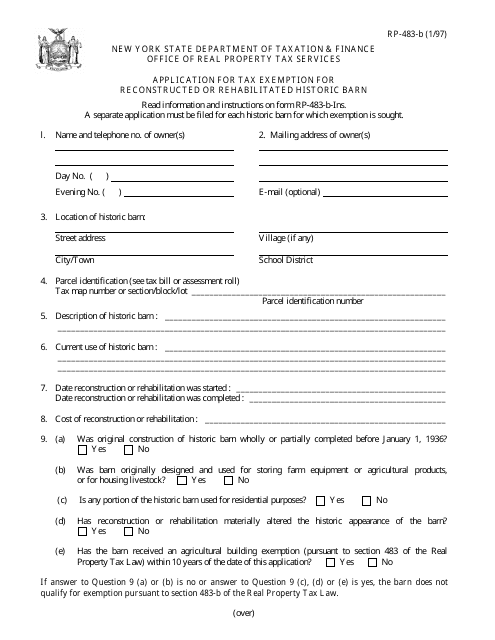

This form is used for applying for tax exemption for reconstructed or rehabilitated historic barns in the state of New York.

![Form RP-466-A [ROCKLAND, STEUBEN] Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Counties (For Use in Rockland or Steuben County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733888/form-rp-466-a-rockland-steuben-application-volunteer-firefighters-ambulance-workers-exemption-in-certain-counties-use-in-rockland-or-steuben-county-only-new-york_big.png)

![Form RP-466-C [SUFFOLK] SUPP Report of Enrolled Member of Volunteer Fire Company, Fire Department or Ambulance Service (For Use in Suffolk County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733889/form-rp-466-c-suffolk-supp-report-enrolled-member-volunteer-fire-company-fire-department-or-ambulance-service-use-in-suffolk-county-only-new-york_big.png)

![Form RP-466-B [CHAUTAUQUA, OSWEGO] Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Additional Counties (For Use in Chautauqua or Oswego County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733890/form-rp-466-b-chautauqua-oswego-application-volunteer-firefighters-ambulance-workers-exemption-in-certain-additional-counties-use-in-chautauqua-or-oswego-county-only-new-york_big.png)

![Form RP-466-C [WYOMING] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Wyoming County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733891/form-rp-466-c-wyoming-application-volunteer-firefighters-ambulance-workers-exemption-use-in-wyoming-county-only-new-york_big.png)

![Form RP-466-C [CATTARAUGUS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Cattaraugus County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733892/form-rp-466-c-cattaraugus-application-volunteer-firefighters-ambulance-workers-exemption-use-in-cattaraugus-county-only-new-york_big.png)

![Form RP-466-C [DUTCHESS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Dutchess County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733893/form-rp-466-c-dutchess-application-volunteer-firefighters-ambulance-workers-exemption-use-in-dutchess-county-only-new-york_big.png)

![Form RP-466-C [ERIE] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Erie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733894/form-rp-466-c-erie-application-volunteer-firefighters-ambulance-workers-exemption-use-in-erie-county-only-new-york_big.png)

![Form RP-466-C [NASSAU] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Nassau County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733895/form-rp-466-c-nassau-application-volunteer-firefighters-ambulance-workers-exemption-use-in-nassau-county-only-new-york_big.png)

![Form RP-466-D [COLUMBIA] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Columbia County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733896/form-rp-466-d-columbia-application-volunteer-firefighters-ambulance-workers-exemption-use-in-columbia-county-only-new-york_big.png)

![Form RP-466-E [ONEIDA] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Oneida County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733897/form-rp-466-e-oneida-application-volunteer-firefighters-ambulance-workers-exemption-use-in-oneida-county-only-new-york_big.png)

![Form RP-466-D [NIAGARA] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Niagara County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733898/form-rp-466-d-niagara-application-volunteer-firefighters-ambulance-workers-exemption-use-in-niagara-county-only-new-york_big.png)

![Form RP-466-E [SCHENECTADY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schenectady County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733899/form-rp-466-e-schenectady-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schenectady-county-only-new-york_big.png)

![Form RP-466-D [ORLEANS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Orleans County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733900/form-rp-466-d-orleans-application-volunteer-firefighters-ambulance-workers-exemption-use-in-orleans-county-only-new-york_big.png)

![Form RP-466-E [LEWIS] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Lewis County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733901/form-rp-466-e-lewis-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-lewis-county-only-new-york_big.png)

![Form RP-466-G [SCHOHARIE] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Saratoga County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733902/form-rp-466-g-schoharie-application-volunteer-firefighters-ambulance-workers-exemption-use-in-saratoga-county-only-new-york_big.png)

![Form RP-466-E [SCHOHARIE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schoharie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733903/form-rp-466-e-schoharie-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schoharie-county-only-new-york_big.png)

![Form RP-466-F [JEFFERSON, ST. LAWRENCE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Jefferson and St. Lawrence Counties Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733904/form-rp-466-f-jefferson-st-lawrence-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-jefferson-and-st-lawrence-counties-only-new-york_big.png)

![Form RP-466-F [MONTGOMERY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Montgomery County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733905/form-rp-466-f-montgomery-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-montgomery-county-only-new-york_big.png)

![Form RP-466-F [ORANGE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Orange County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733906/form-rp-466-f-orange-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-orange-county-only-new-york_big.png)

![Form RP-466-H [ULSTER] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Ulster County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733907/form-rp-466-h-ulster-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-ulster-county-only-new-york_big.png)

![Form RP-466-G [ONONDAGA] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Onondaga County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733908/form-rp-466-g-onondaga-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-onondaga-county-only-new-york_big.png)

![Form RP-466-I [ALBANY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Albany County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733909/form-rp-466-i-albany-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-albany-county-only-new-york_big.png)

![Form RP-466-J [CLINTON] Application for Volunteer Firefighters/ Volunteer Ambulance Workers Exemption (For Use in Clinton County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733910/form-rp-466-j-clinton-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-clinton-county-only-new-york_big.png)