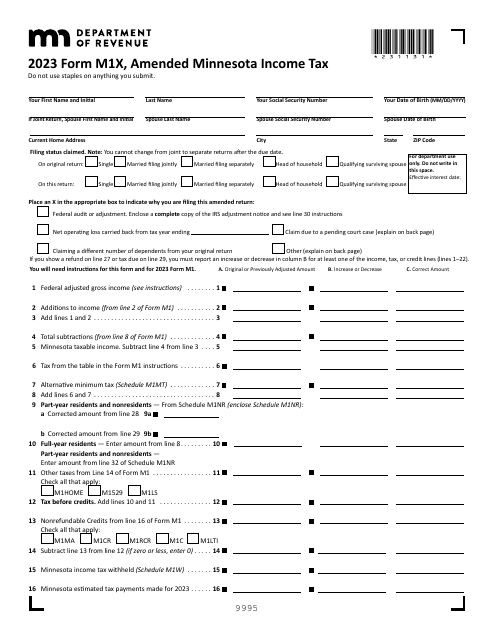

Minnesota Department of Revenue Forms

Documents:

545

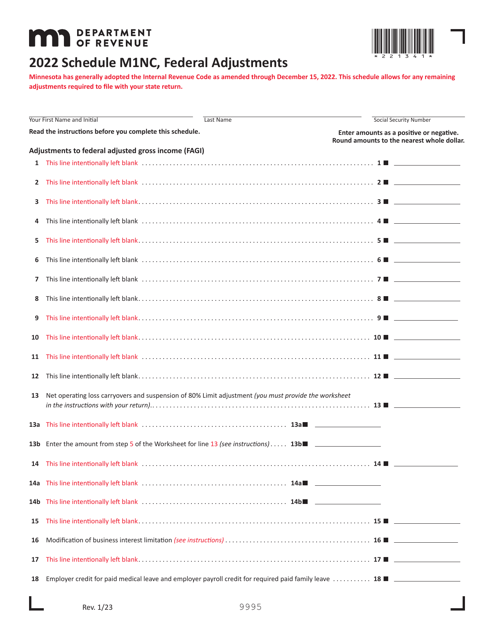

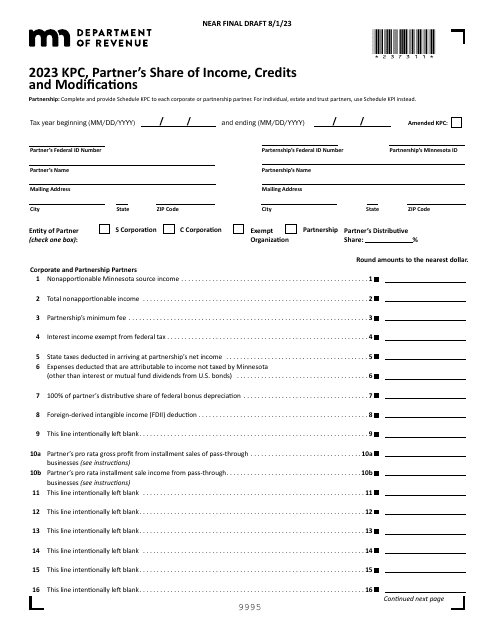

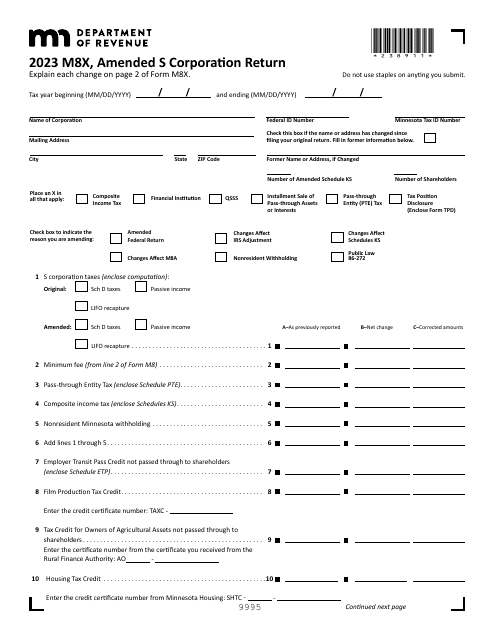

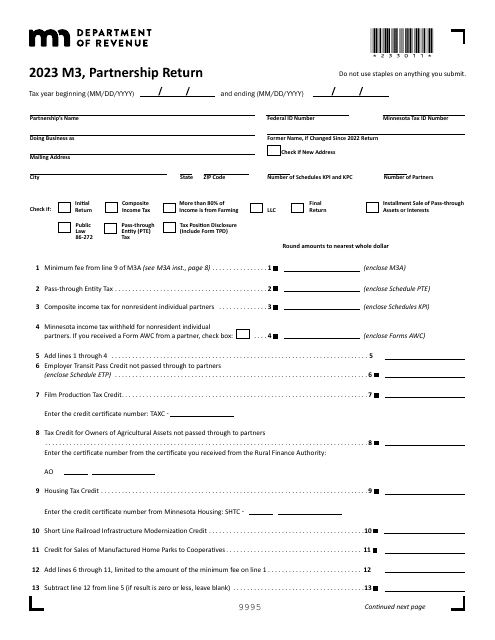

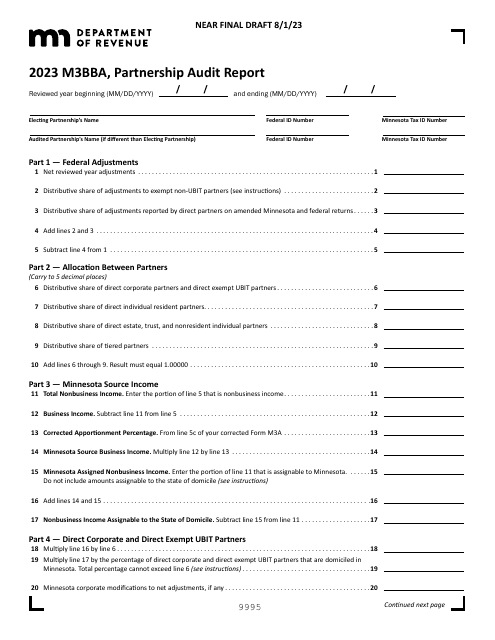

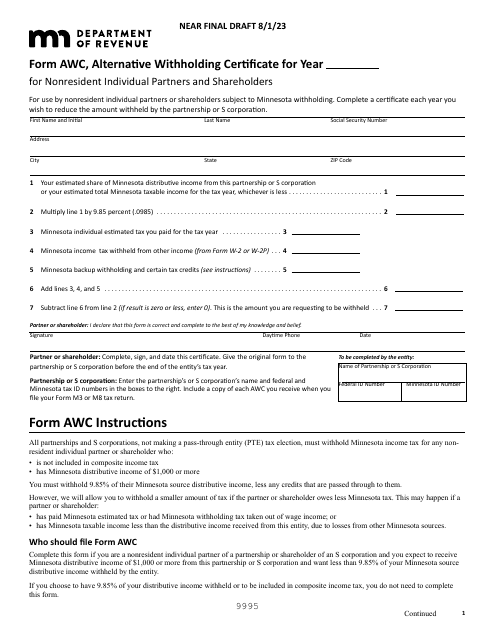

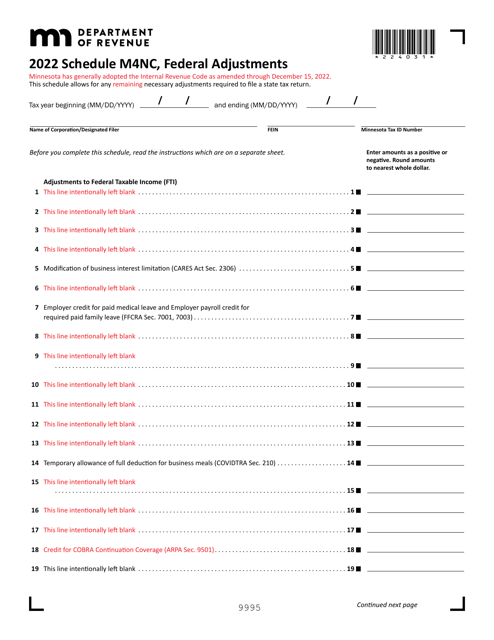

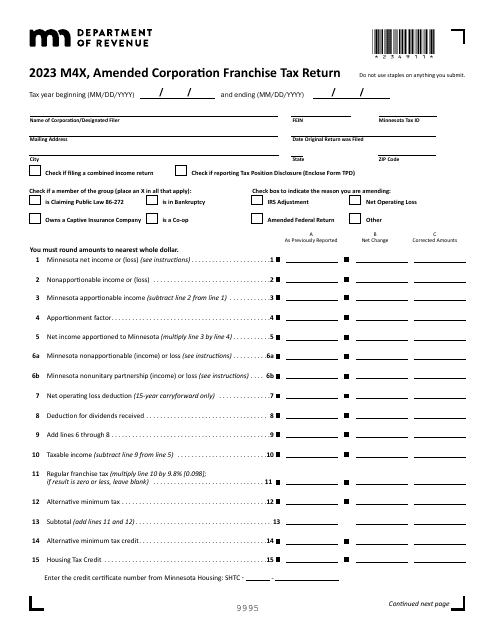

This document is used for reporting federal adjustments made by Minnesota residents for their state tax return.

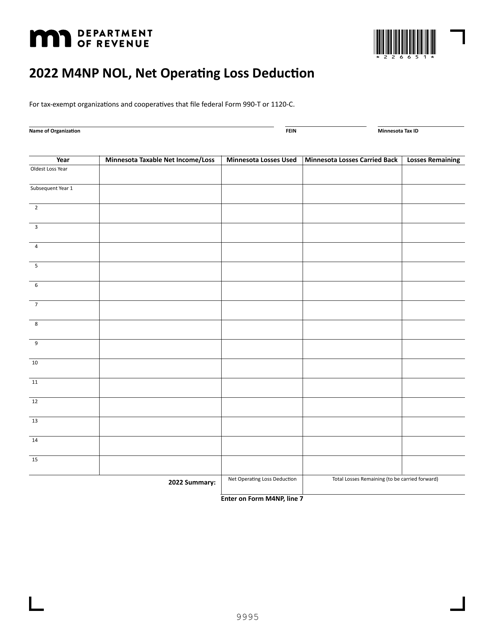

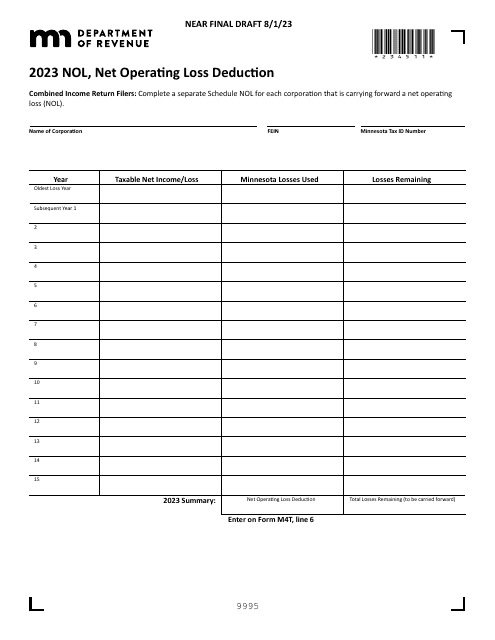

This Form is used for claiming a net operating loss deduction in Minnesota.

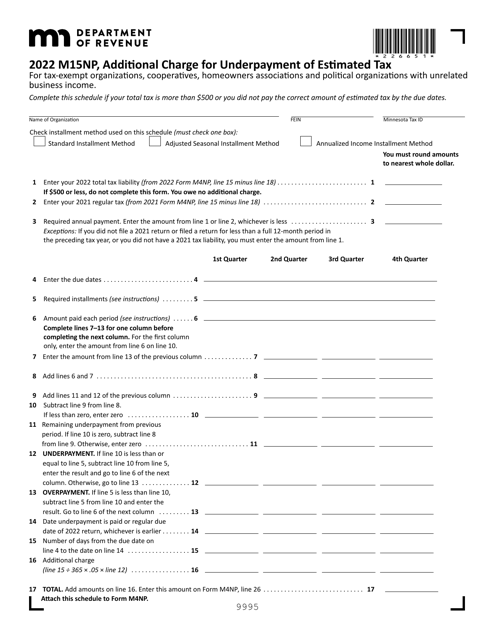

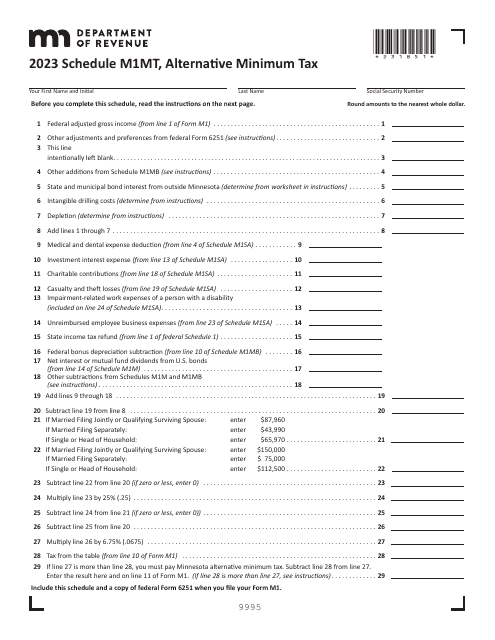

This form is used for reporting and paying an additional charge for underpayment of estimated tax owed to the state of Minnesota.

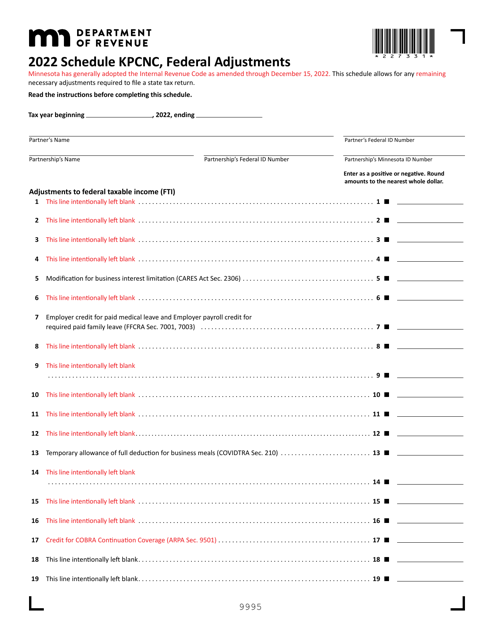

This document is used for reporting federal adjustments specific to Minnesota for Schedule KPCNC.

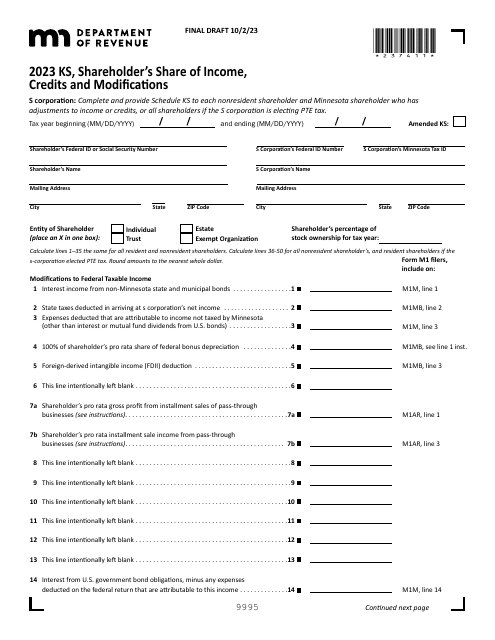

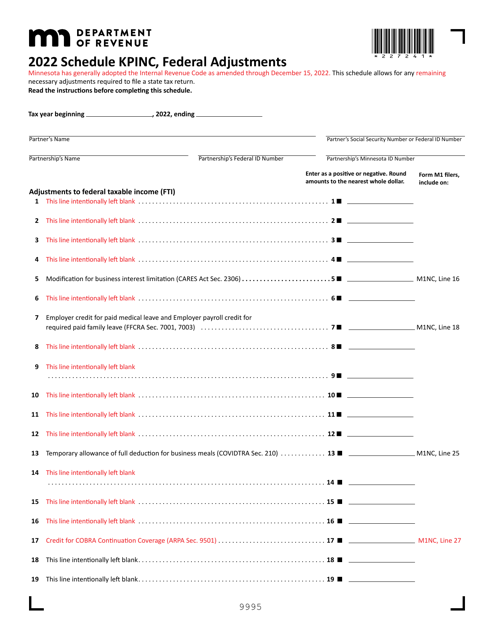

This document is used to schedule federal adjustments for the state of Minnesota as part of the KPINC tax filing process.

This document is used for making federal adjustments to your Minnesota state income tax return. It helps calculate any differences between your federal and state tax obligations in Minnesota.

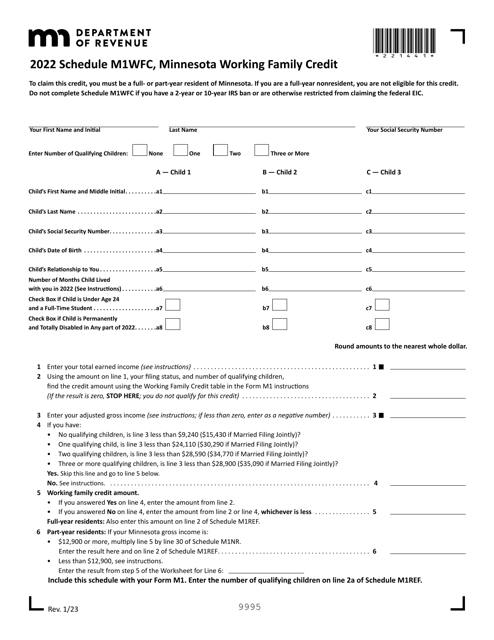

This Form is used for claiming the Minnesota Working Family Credit in the state of Minnesota. It is used to calculate and determine the eligibility for the credit, which provides financial assistance to working families in Minnesota.