Minnesota Department of Revenue Forms

Documents:

545

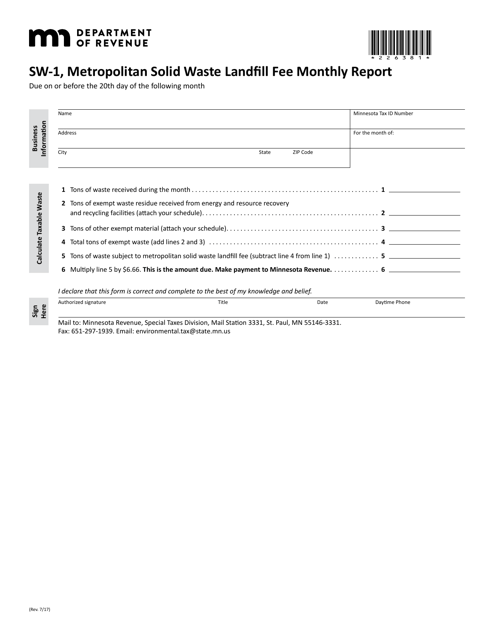

This Form is used for reporting the monthly fees for metropolitan solid waste landfills in Minnesota.

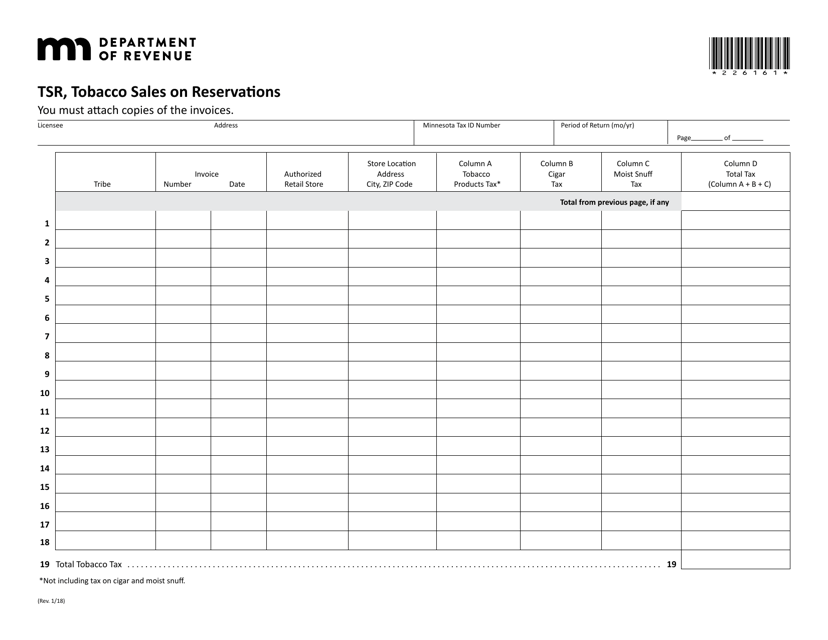

This form is used for reporting tobacco sales on reservations in Minnesota.

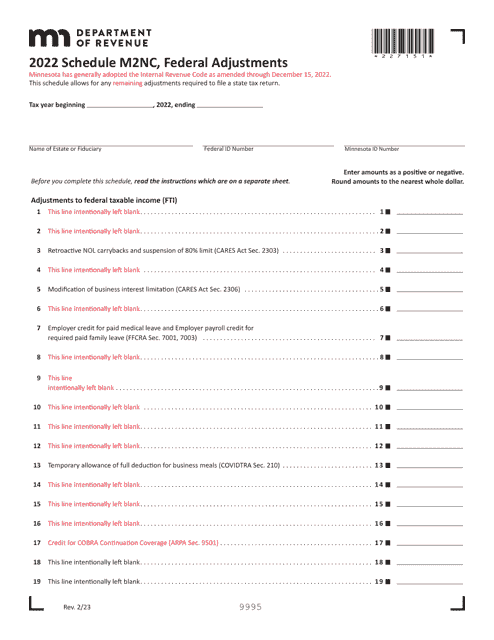

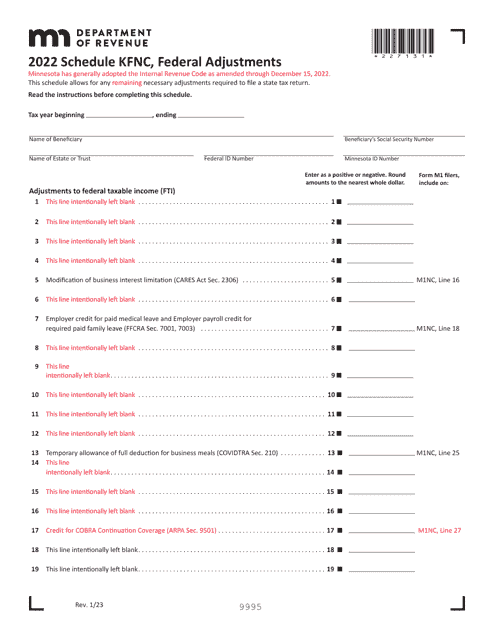

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.

This document is used for reporting federal adjustments for Minnesota state taxes. It is used by taxpayers who have made modifications to their federal tax return that affect their state tax liabilities in Minnesota.

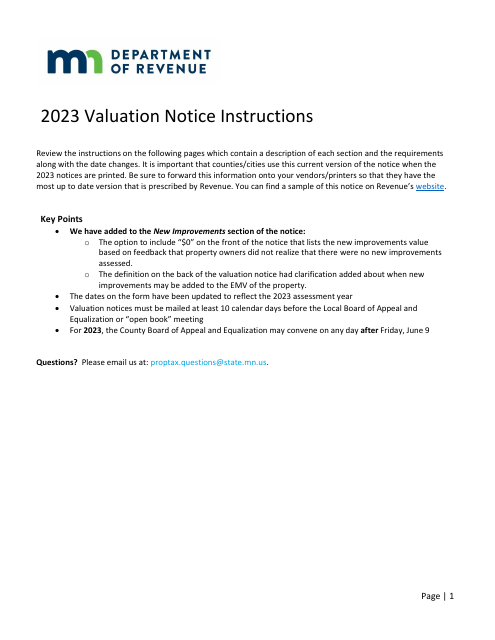

This document provides instructions for completing the Local Board of Appeal and Equalization Meeting and Certification Form in Minnesota. It outlines the steps to follow and the information required to ensure accurate completion of the form.

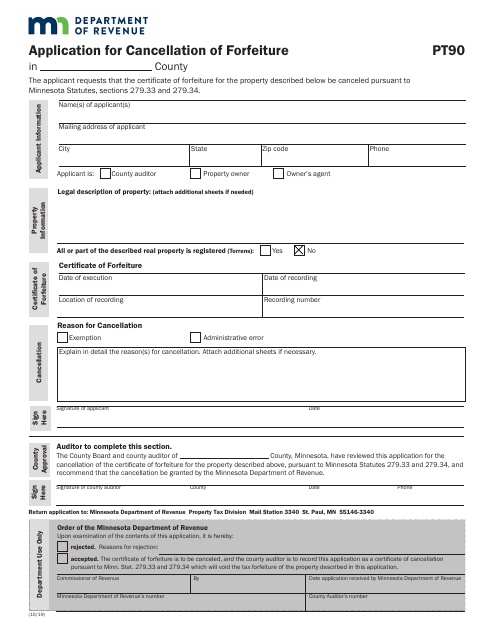

This form is used for applying to cancel a forfeiture in the state of Minnesota.

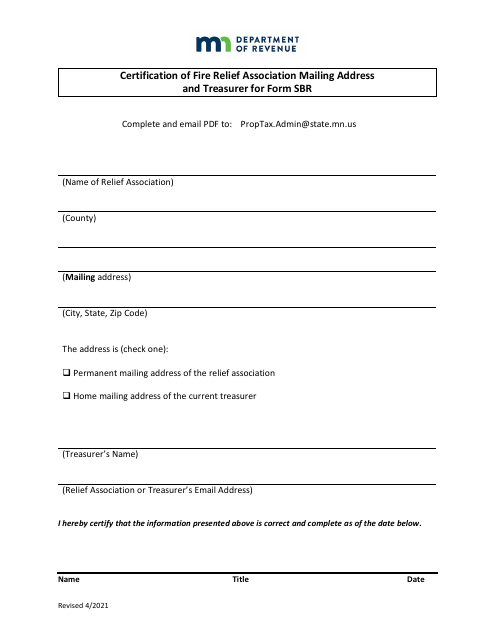

This document is used to certify the mailing address and treasurer for the Fire Relief Association in Minnesota.

This document provides instructions on how to complete the Railroad Market Value Report for the state of Minnesota. It outlines the required information and steps for accurately assessing the market value of railroads in the state.

This document provides instructions for generating a market value report for utility and pipeline companies operating in Minnesota. It contains guidelines for collecting relevant data and calculating the market value of these companies.

This document provides instructions for understanding and responding to a Valuation Notice in the state of Minnesota. It guides property owners on how to interpret the notice and how to take appropriate action, such as filing an appeal if necessary.