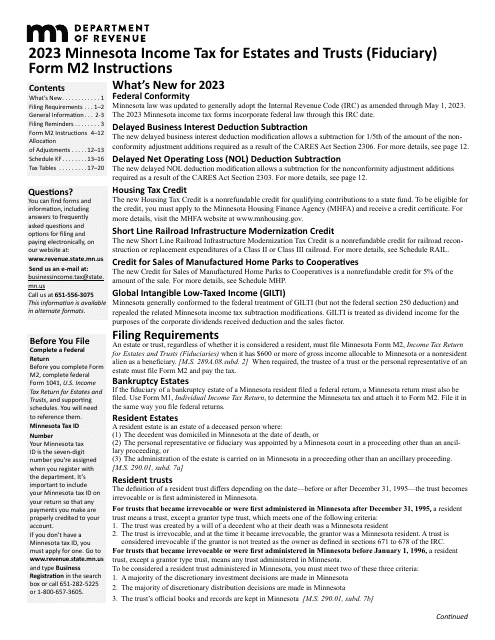

Minnesota Department of Revenue Forms

Documents:

545

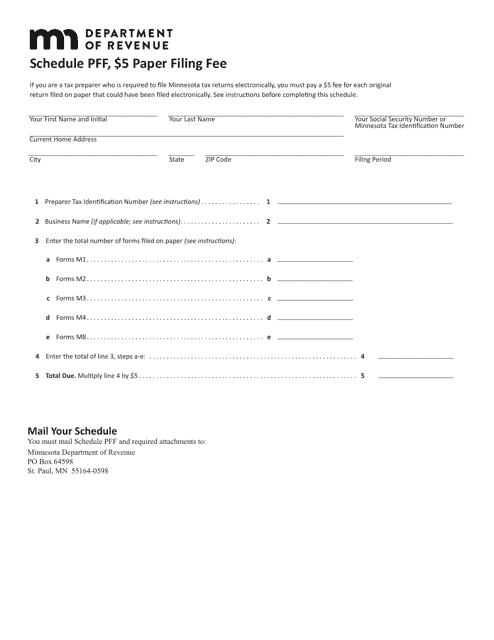

This document is used for filing a paper Schedule PFF and paying a $5 fee in the state of Minnesota.

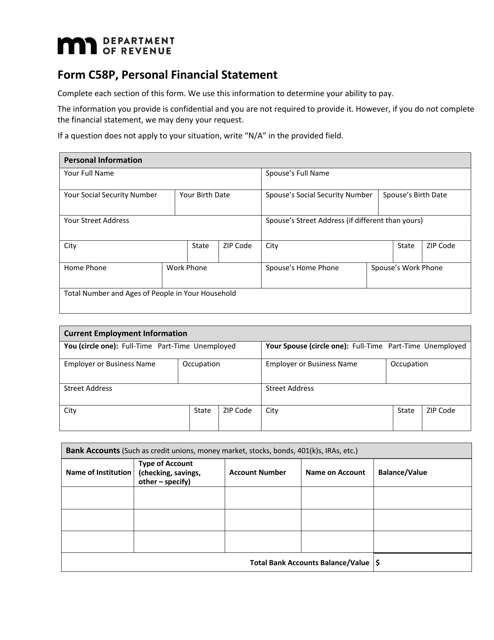

This document is used for disclosing personal financial information in the state of Minnesota. It provides a comprehensive snapshot of an individual's assets, liabilities, income, and expenses.

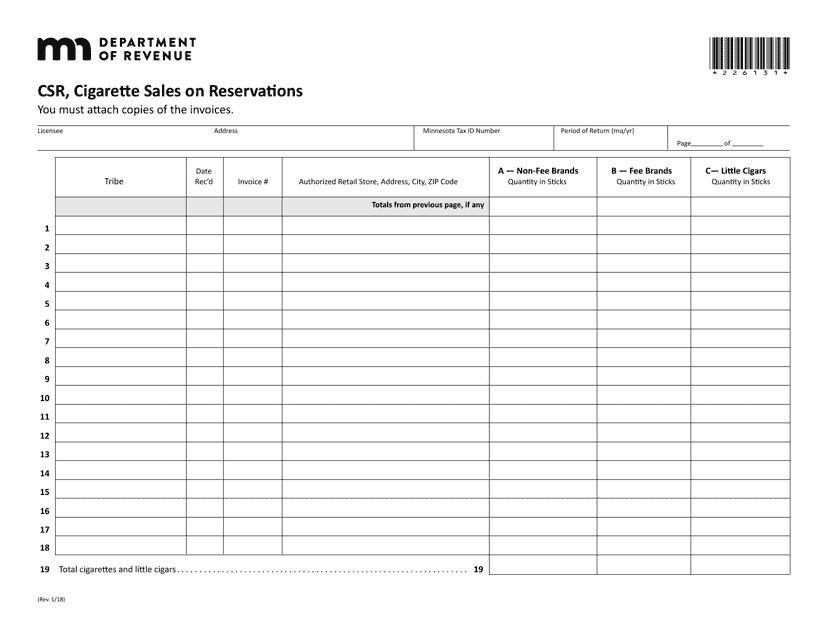

This form is used for reporting cigarette sales made on reservations in Minnesota.

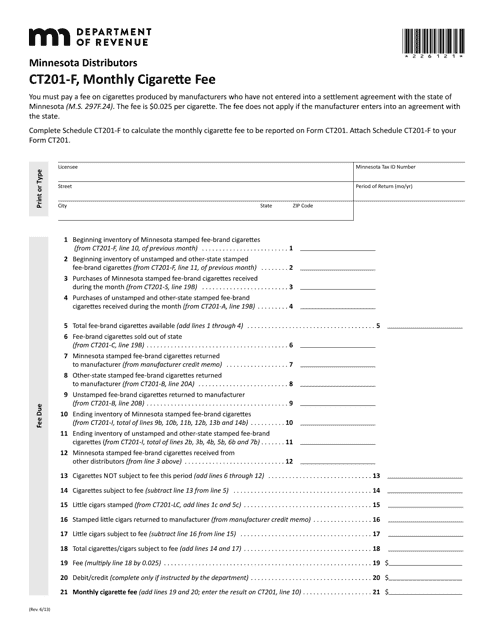

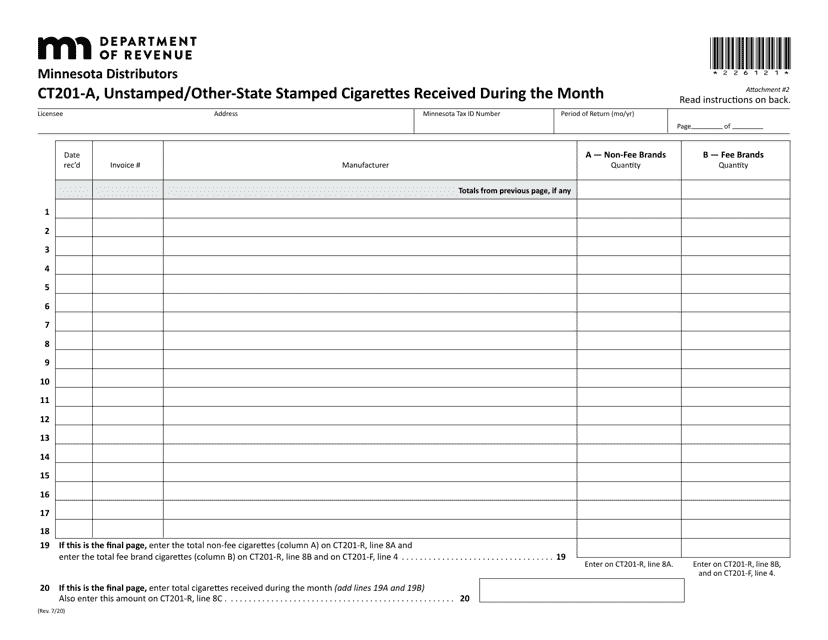

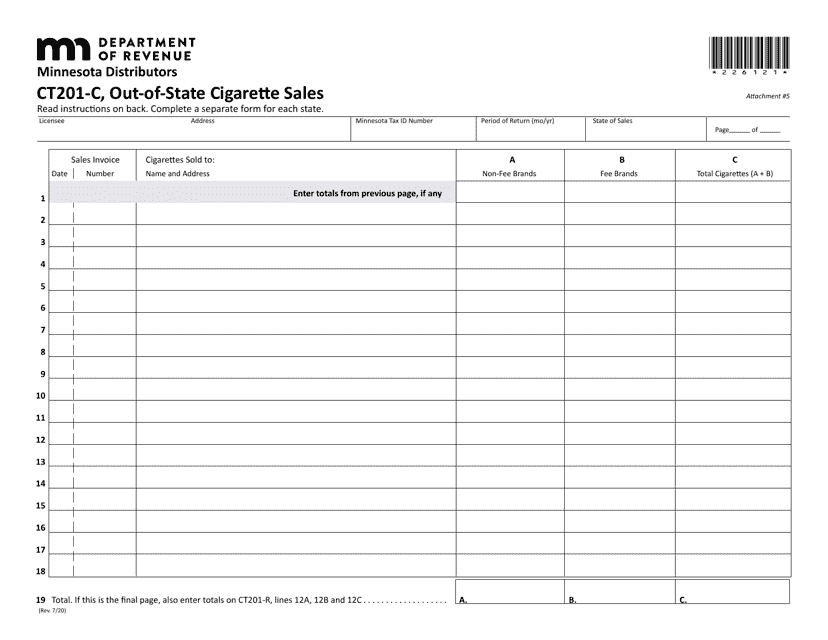

This form is used for Minnesota cigarette distributors to report and pay their monthly cigarette fee to the state of Minnesota.

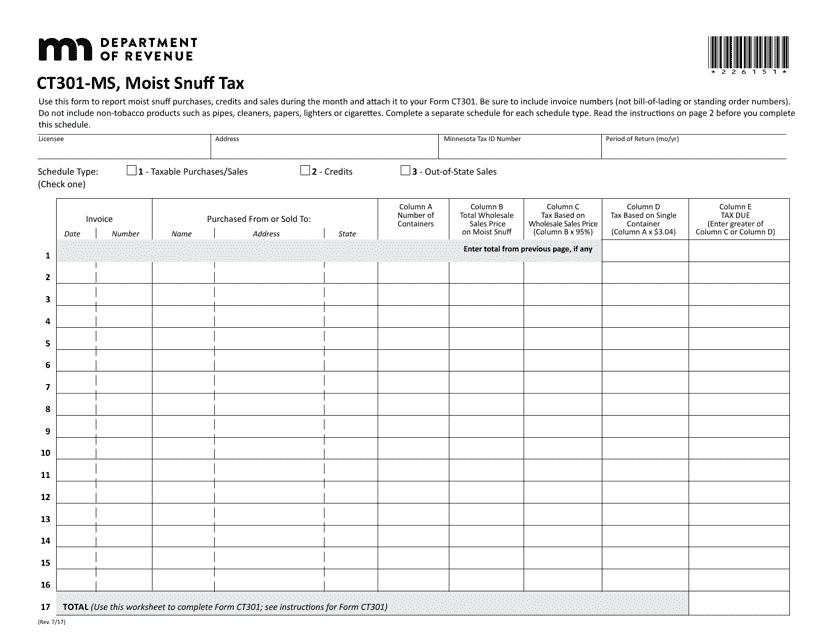

This form is used for reporting and paying the moist snuff tobacco tax in the state of Minnesota.

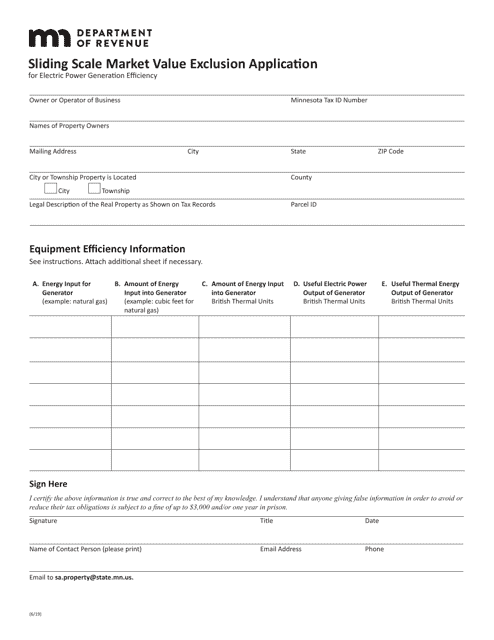

This document is used for applying for a market value exclusion for electric power generation efficiency in Minnesota.

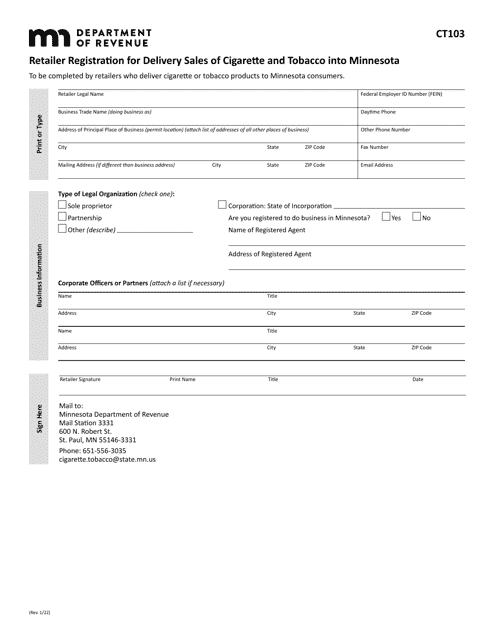

This form is used for retailers who want to register for delivery sales of cigarettes and tobacco into Minnesota.

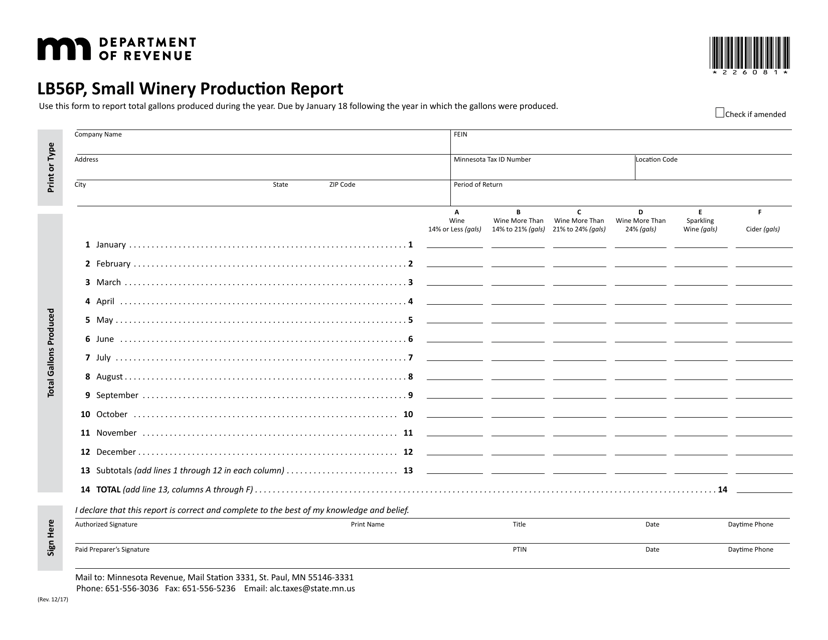

This form is used for small wineries in Minnesota to report their production. It helps track and monitor the volume of wine produced by these wineries.

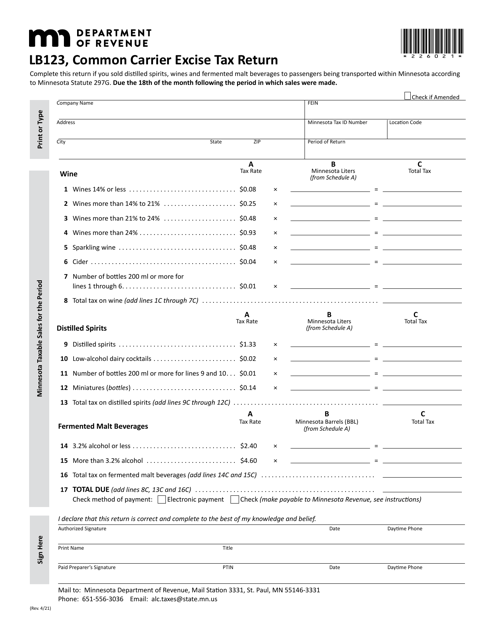

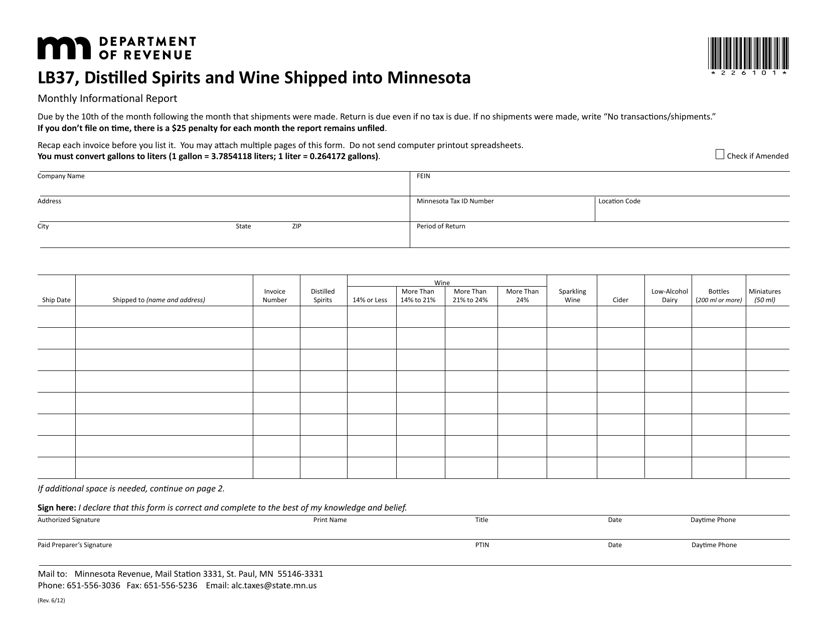

This form is used for documenting the shipment of distilled spirits and wine into Minnesota. It helps to ensure compliance with Minnesota's regulations for the importation and distribution of alcoholic beverages.

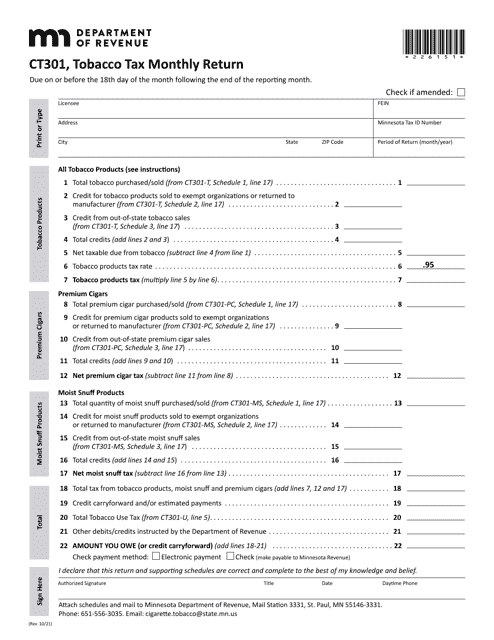

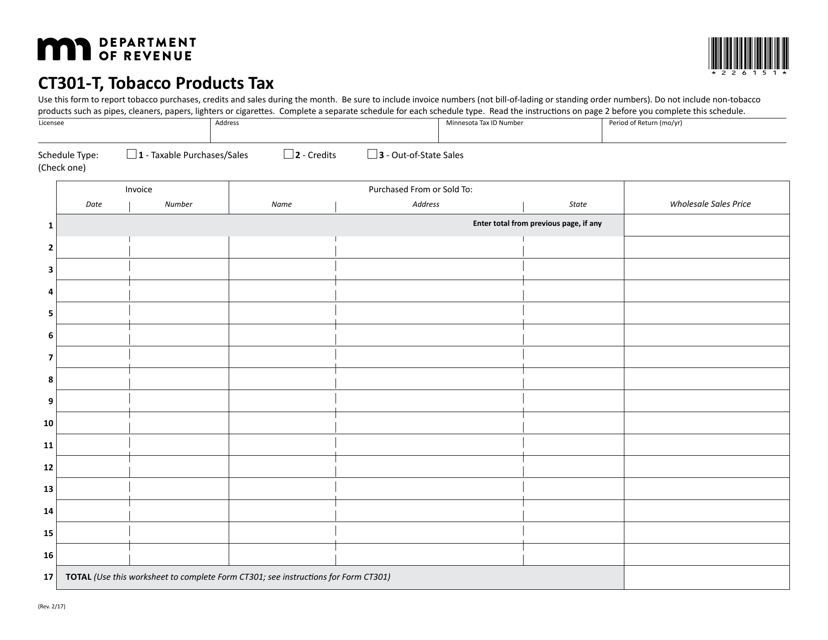

This form is used for filing tobacco products tax in the state of Minnesota. It is used by individuals or businesses engaged in the sale of tobacco products to report and pay the tax owed to the state.