Minnesota Department of Revenue Forms

Documents:

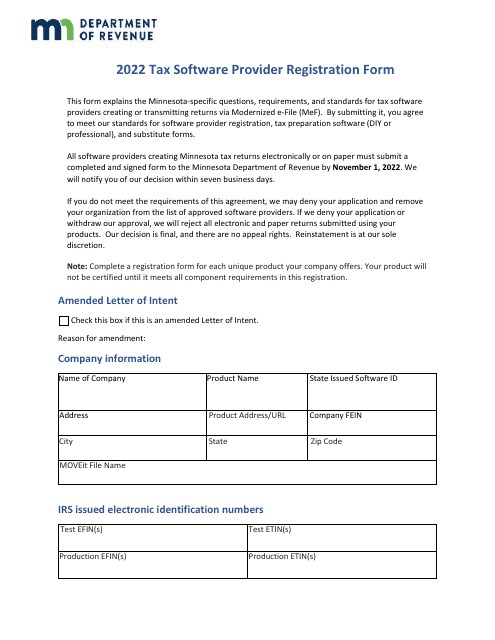

545

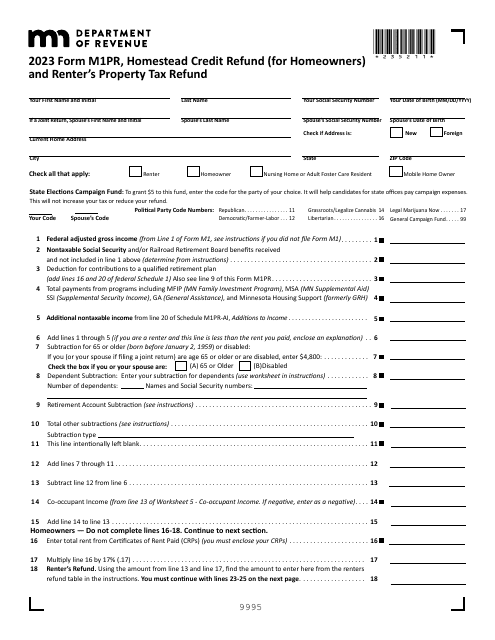

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.

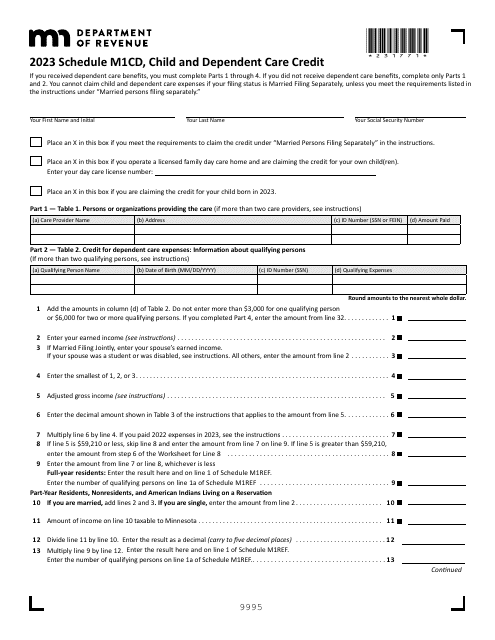

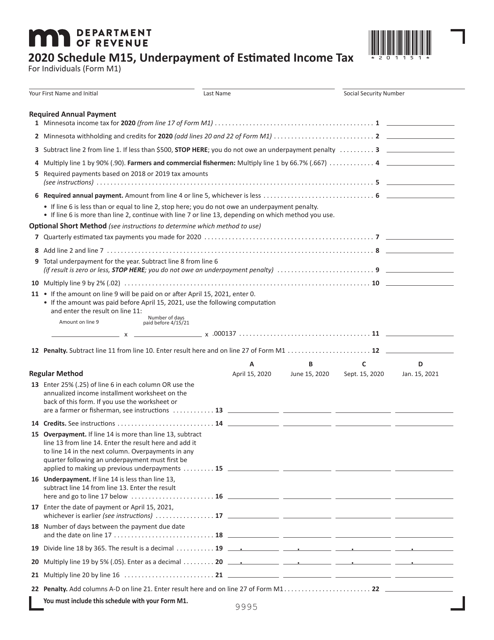

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

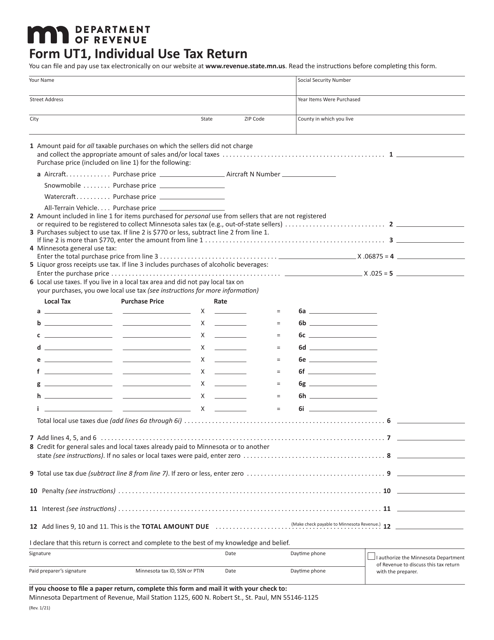

This form is used for reporting and paying individual use tax in the state of Minnesota.

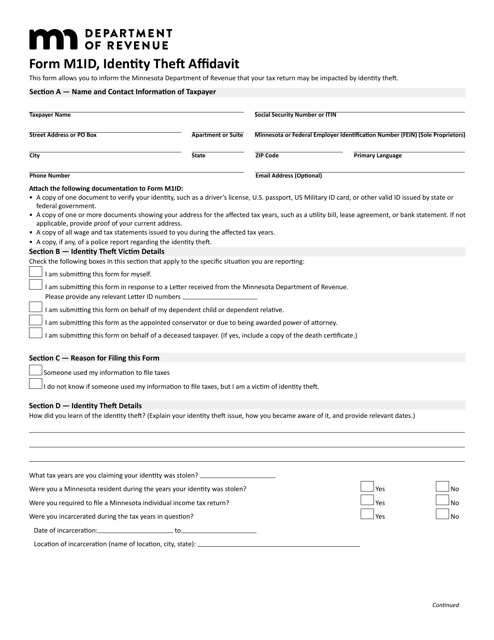

This form is used for reporting identity theft and submitting a sworn statement in Minnesota.

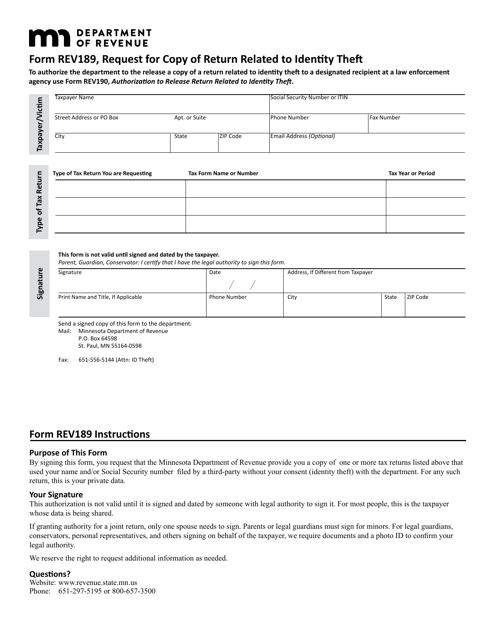

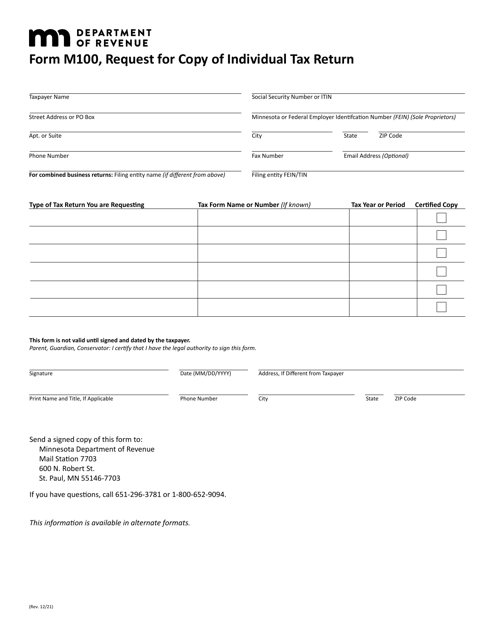

This form is used to request a copy of a return that is related to identity theft in the state of Minnesota.

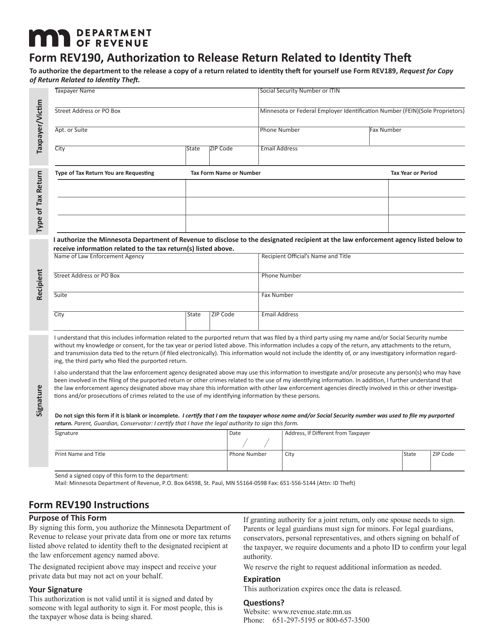

This Form is used for authorizing the release of a return related to identity theft in Minnesota.

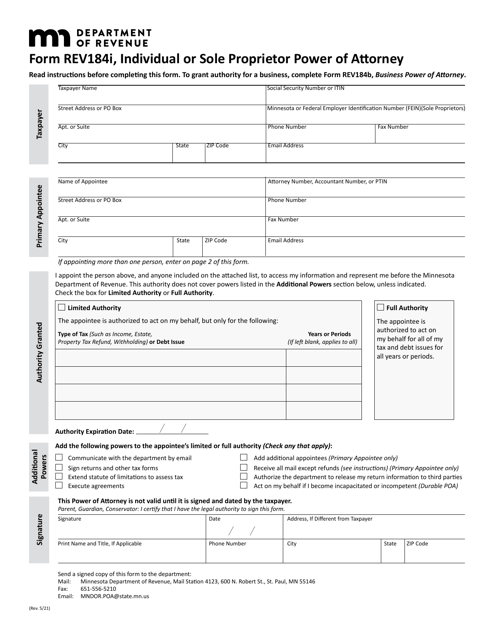

This Form is used for appointing an individual or sole proprietor as a power of attorney in the state of Minnesota. It allows them to act on behalf of the person granting the power of attorney in legal and financial matters.

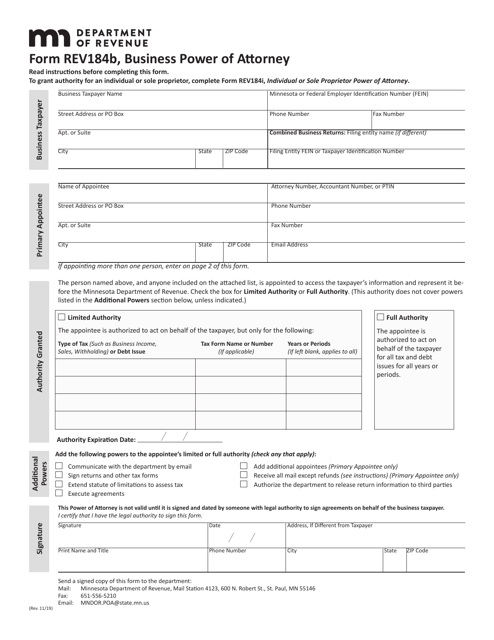

This form is used for appointing someone as a power of attorney for a business in the state of Minnesota.

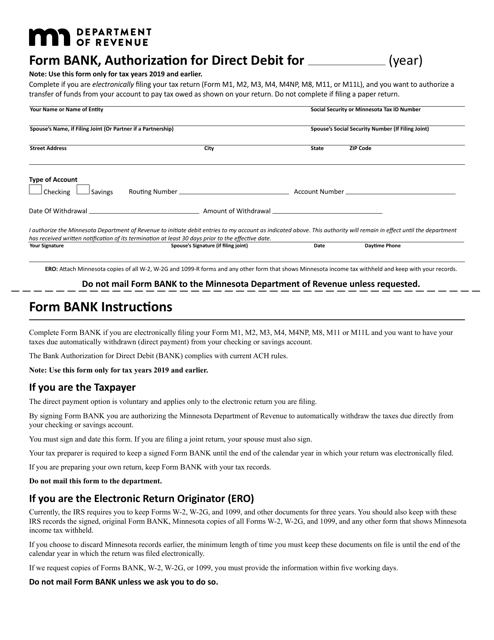

This Form is used for authorizing a bank to make direct debit transactions in Minnesota.

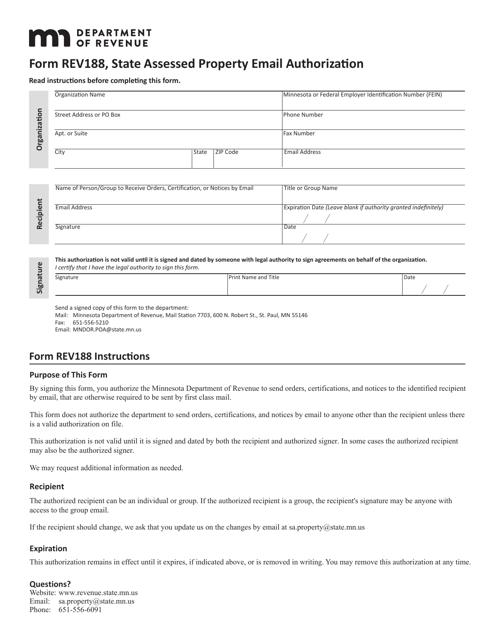

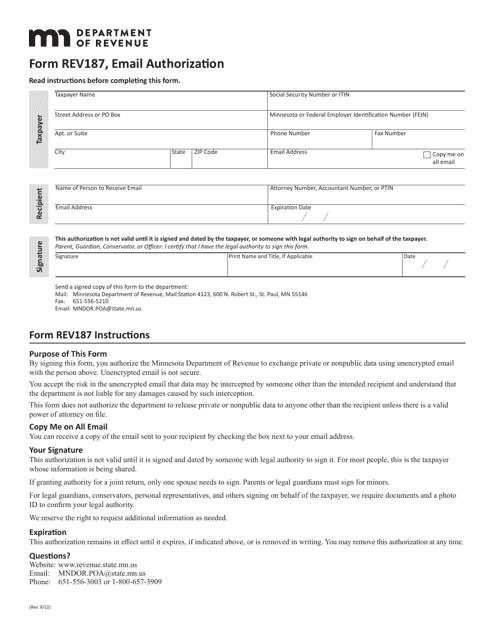

This Form is used for authorizing the state of Minnesota to send property assessment information via email.

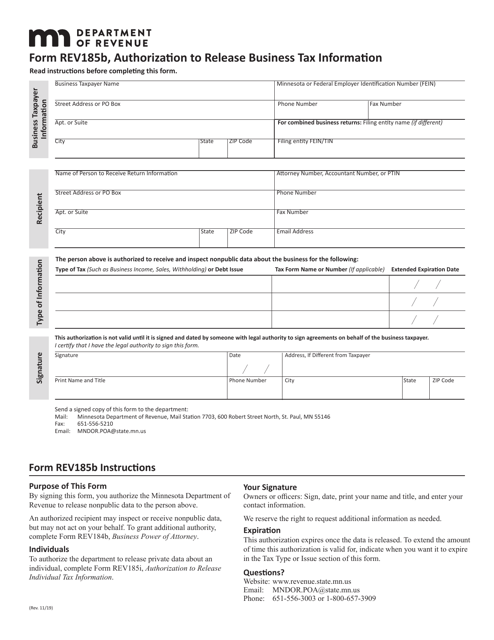

This form is used for authorizing the release of business tax information in the state of Minnesota.

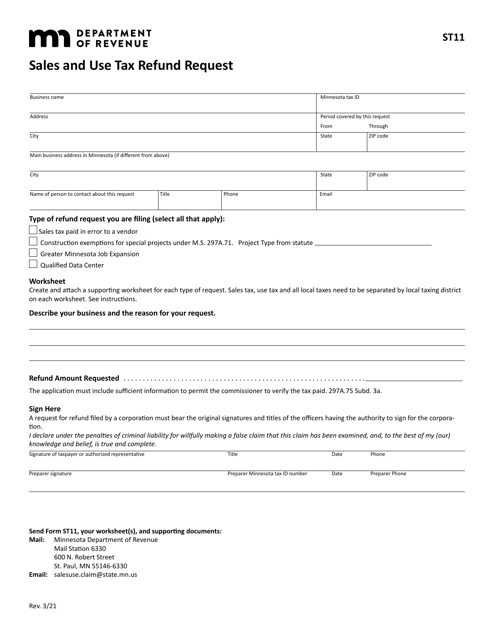

This form is used for requesting a refund of sales and use tax in the state of Minnesota.