Minnesota Department of Revenue Forms

Documents:

545

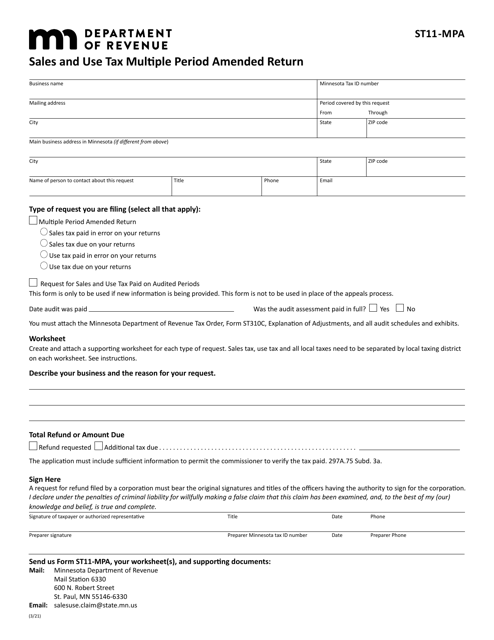

This form is used for filing an amended sales and use tax return for multiple periods in Minnesota.

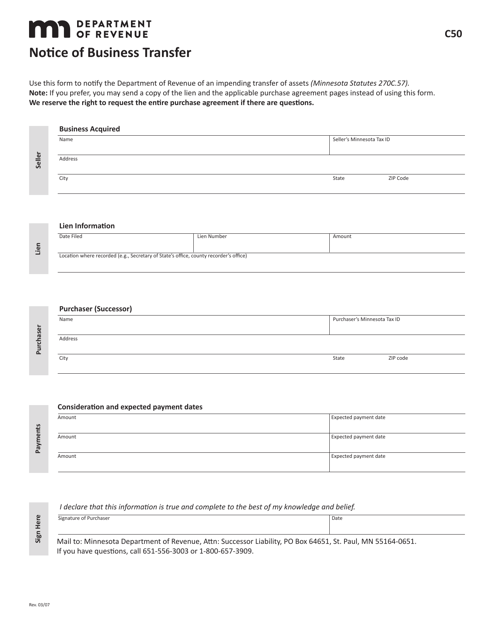

This form is used for providing notice of a business transfer in the state of Minnesota.

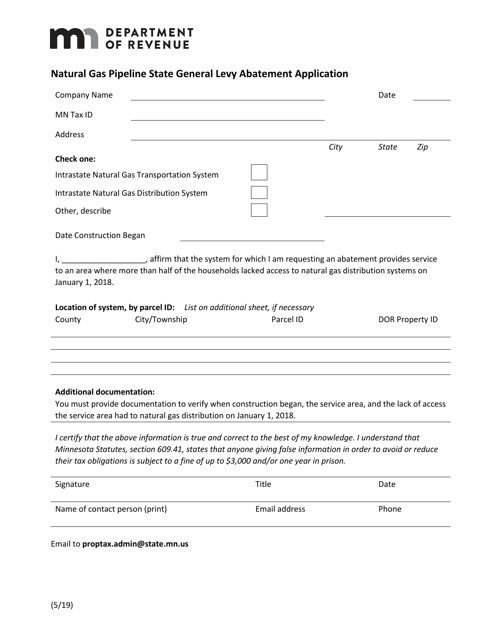

This document is used for applying for a general levy abatement for natural gas pipelines in the state of Minnesota.

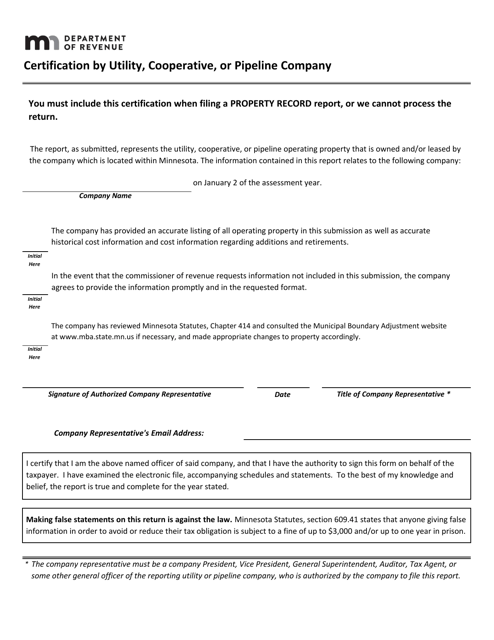

This document certifies the involvement and qualifications of a utility, cooperative, or pipeline company in the state of Minnesota. It ensures that the company has met the necessary requirements and standards to operate within the state.

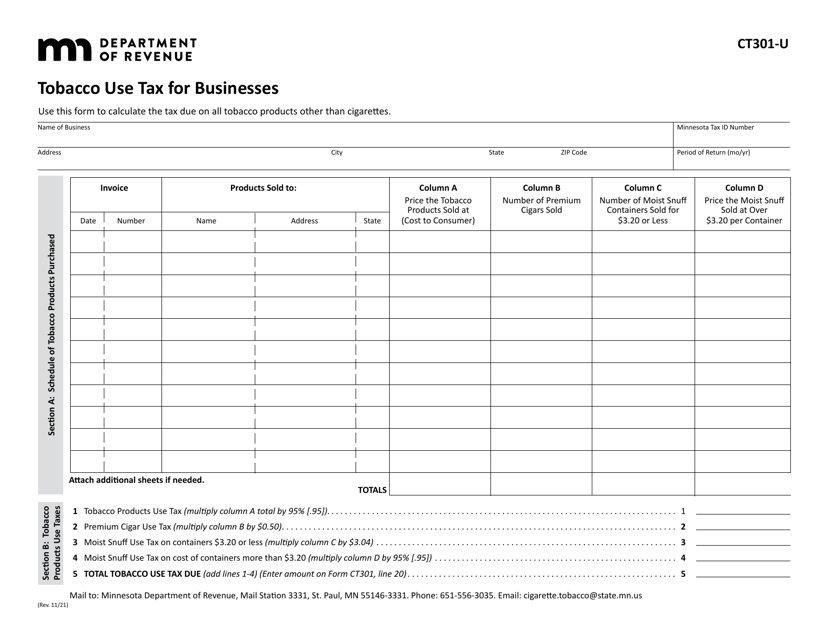

This form is used for businesses in Minnesota to report and pay tobacco use tax.

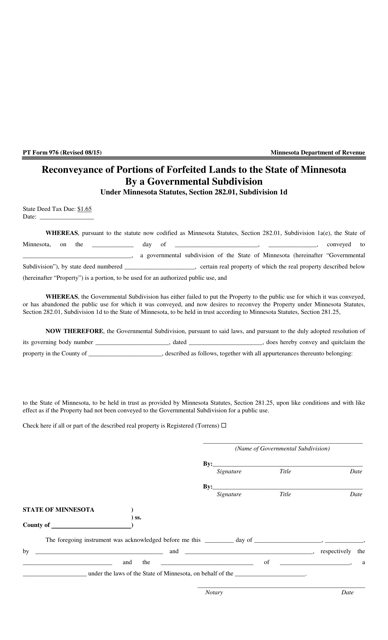

This Form is used for reconveying portions of forfeited lands to the State of Minnesota by a governmental subdivision in Minnesota.

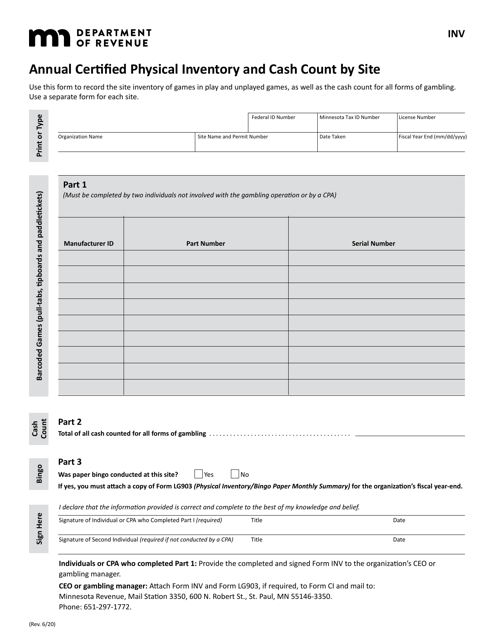

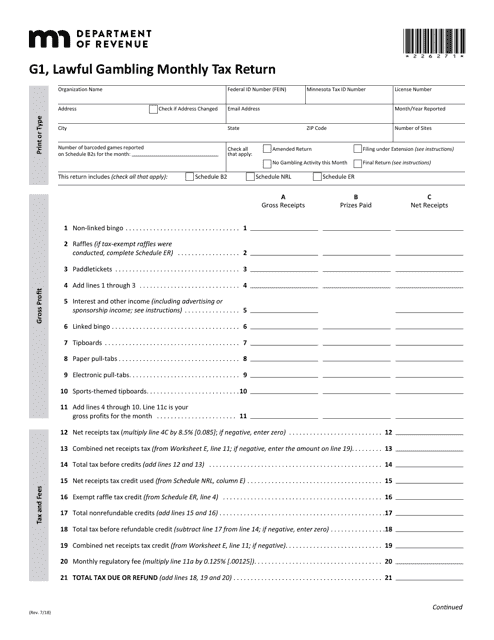

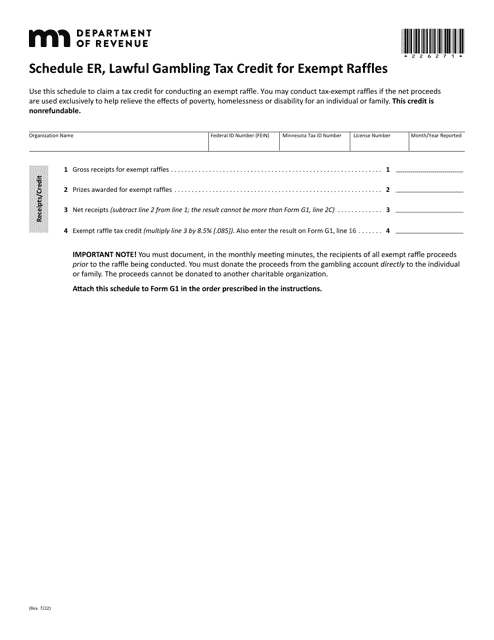

This Form is used for reporting and paying taxes on lawful gambling activities in the state of Minnesota.

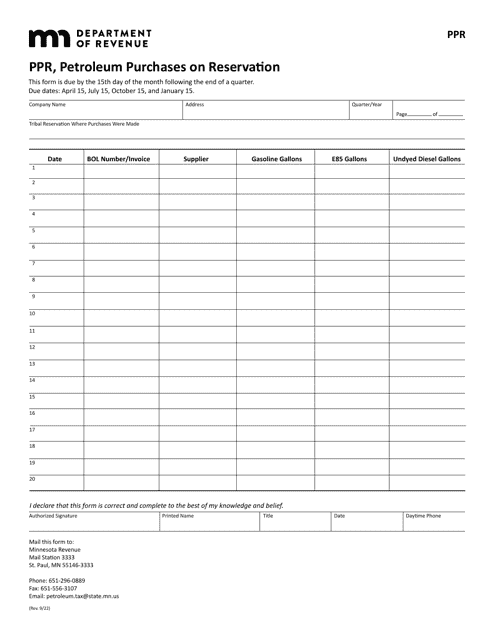

This form is used for reporting petroleum purchases made on reservations in Minnesota.

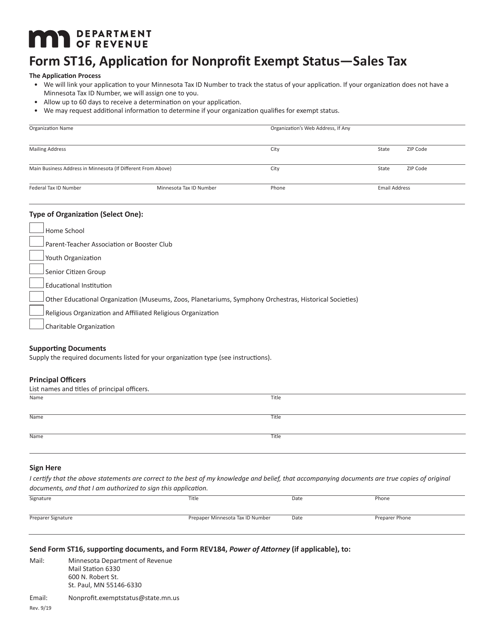

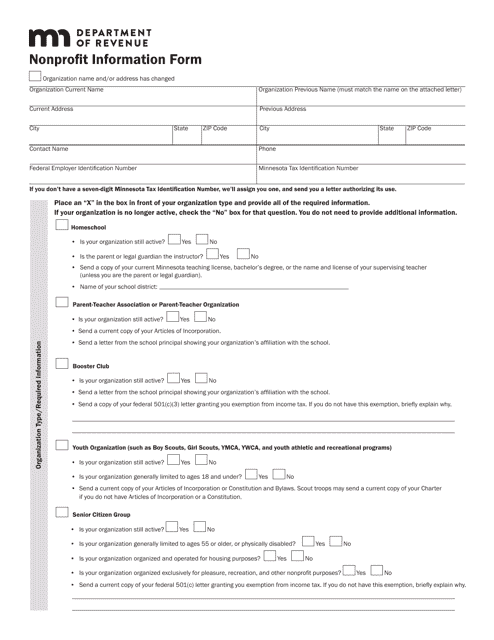

This form is used for collecting information about nonprofit organizations in the state of Minnesota. It is a required document for nonprofits to provide relevant information to the authorities.

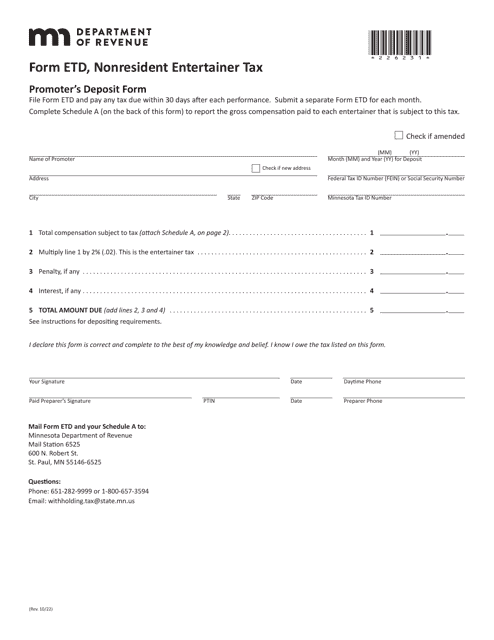

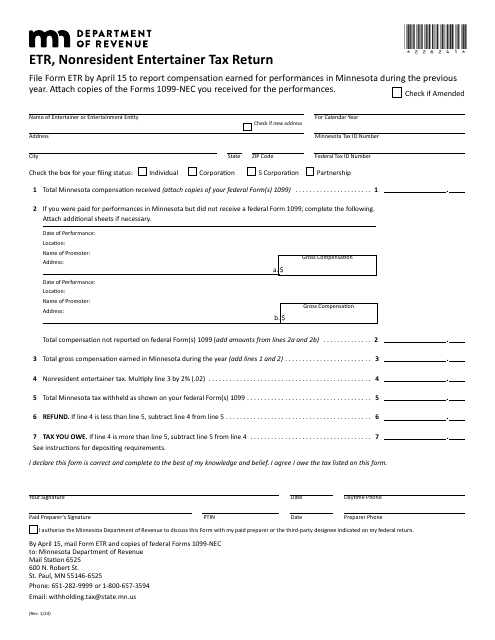

This Form is used for reporting and paying taxes for nonresident entertainers in the state of Minnesota.

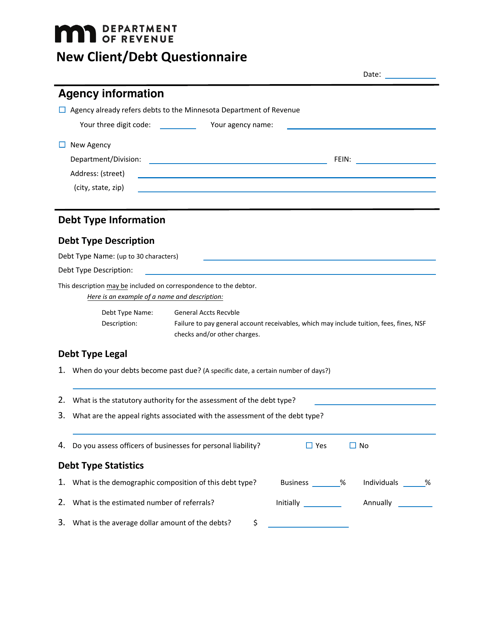

This Form is used for gathering information from new clients or debtors in Minnesota.

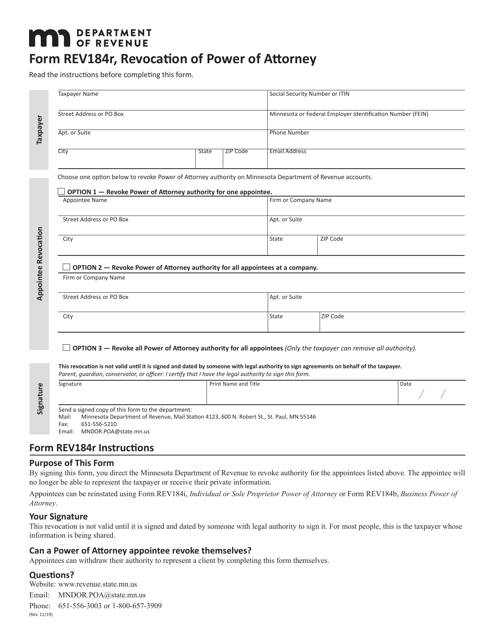

This form is used for revoking a Power of Attorney in Minnesota.

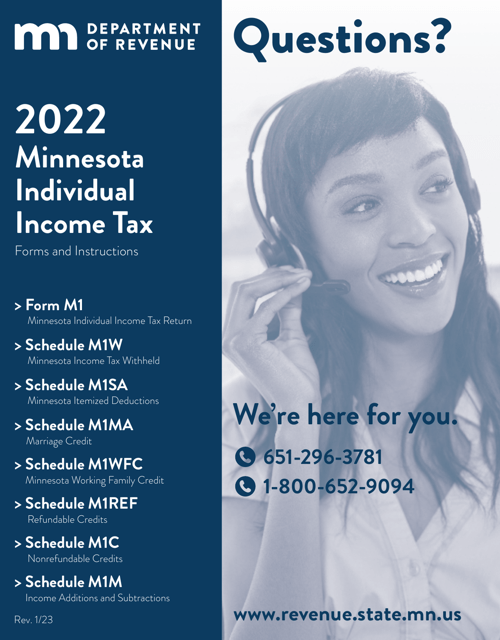

This document provides instructions for various schedules/forms used in Minnesota state tax filing. It includes M1 Schedule M1M, M1MA, M1REF, M1SA, M1W, and M1WFC.