Minnesota Department of Revenue Forms

Documents:

545

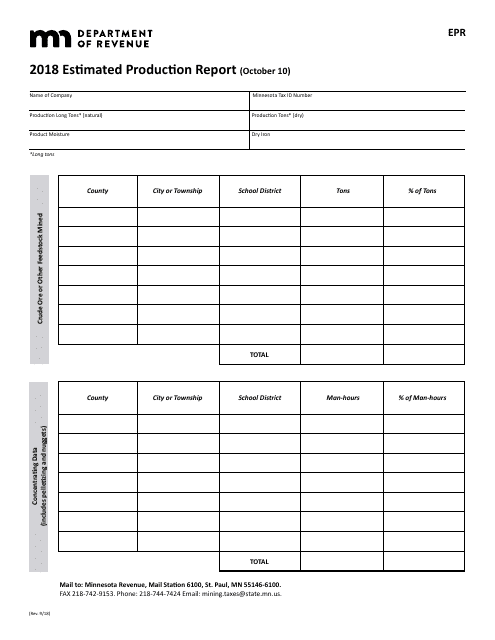

This form is used for reporting the estimated production data in the state of Minnesota. It provides information on the estimated production quantities and rates for various products or commodities.

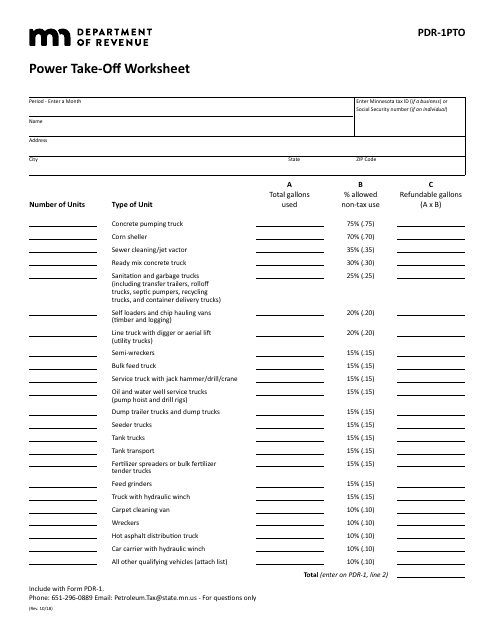

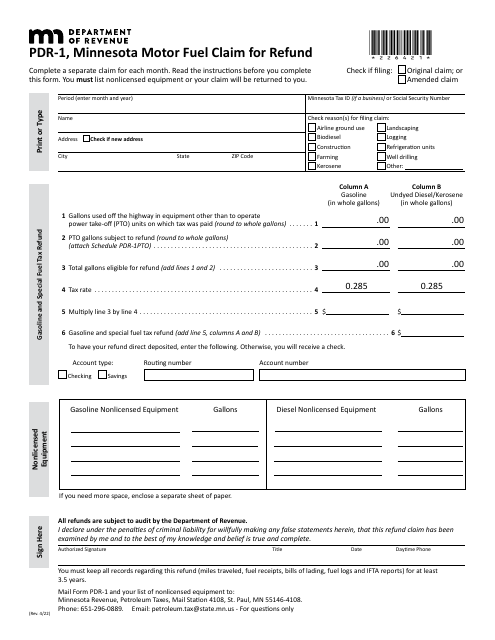

This Form is used for completing a Power Take-Off Worksheet in the state of Minnesota.

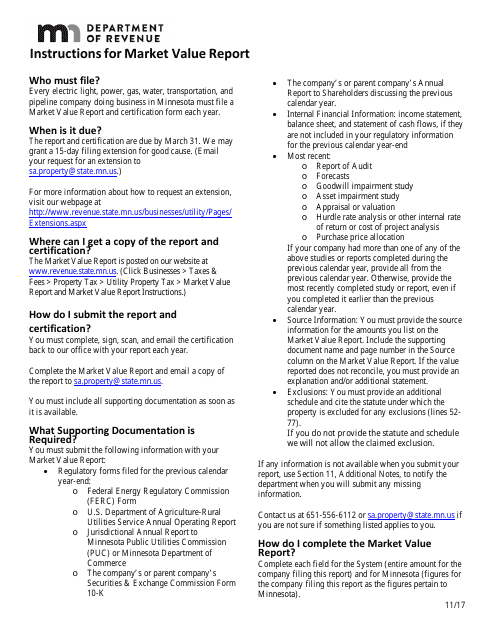

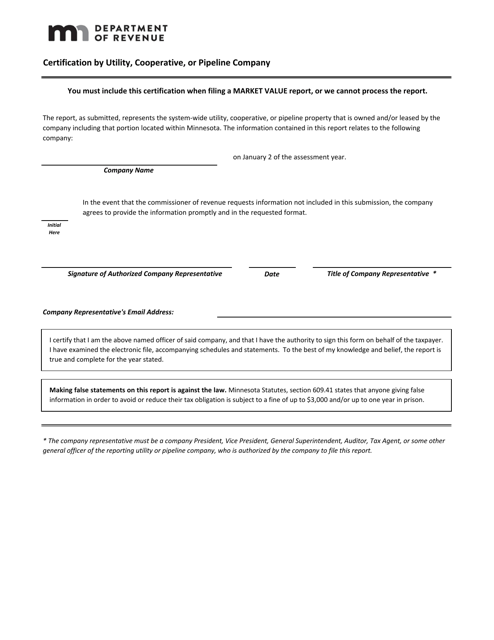

This form is used for reporting the market value of a property in Minnesota. It provides instructions on how to properly fill out the report and submit it to the relevant authorities.

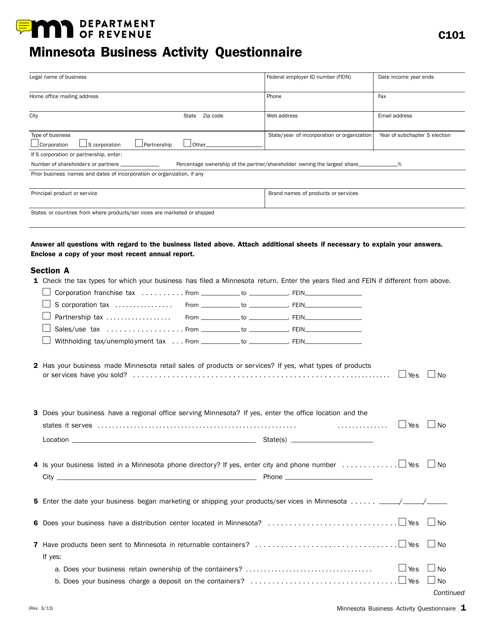

This form is used for completing a Business Activity Questionnaire in the state of Minnesota. It is necessary for businesses to provide information about their activities to the state government.

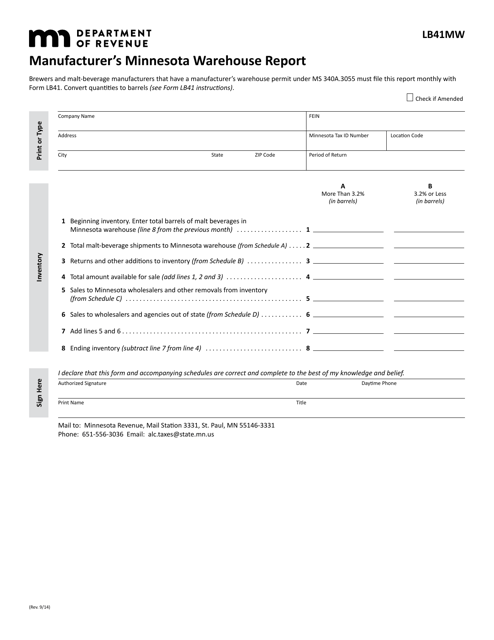

This Form is used for reporting manufacturer's warehouse inventory in Minnesota.

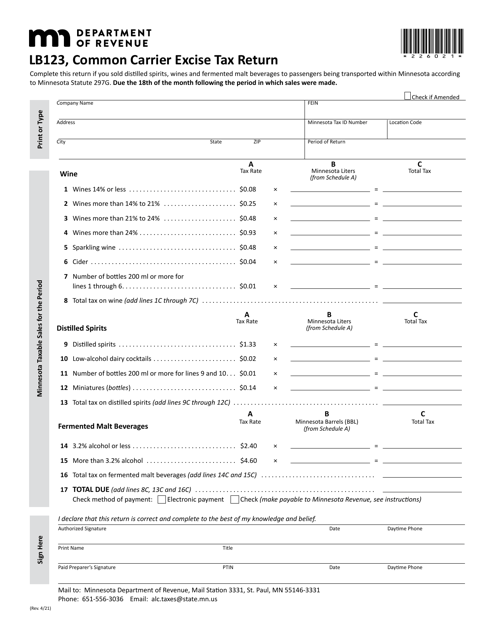

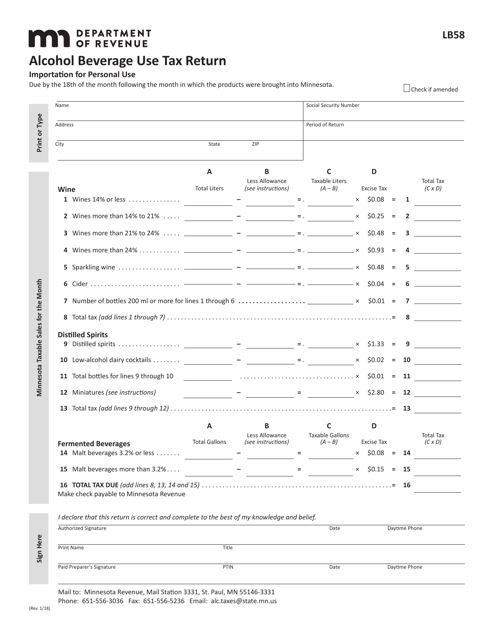

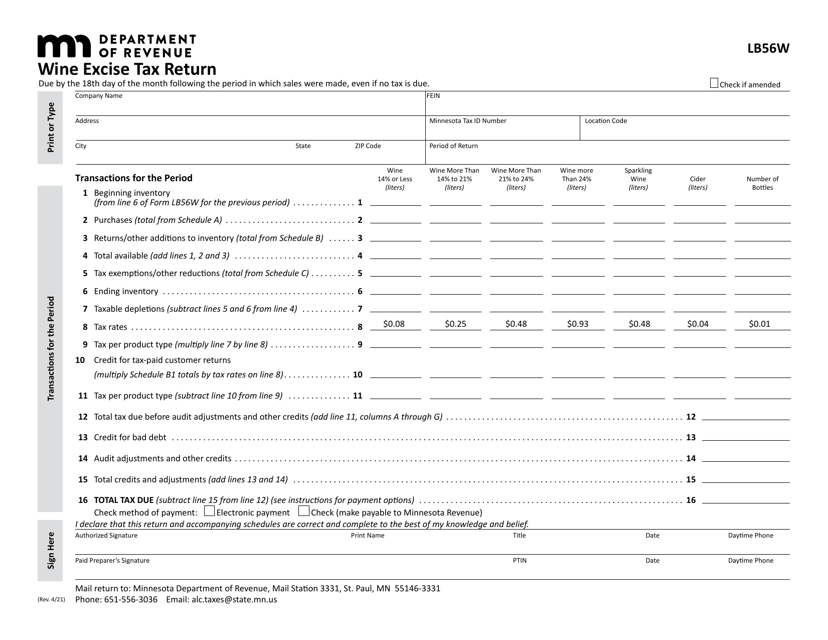

This form is used for reporting and paying the alcohol beverage use tax in Minnesota. It is required for businesses that sell or distribute alcohol beverages in the state.

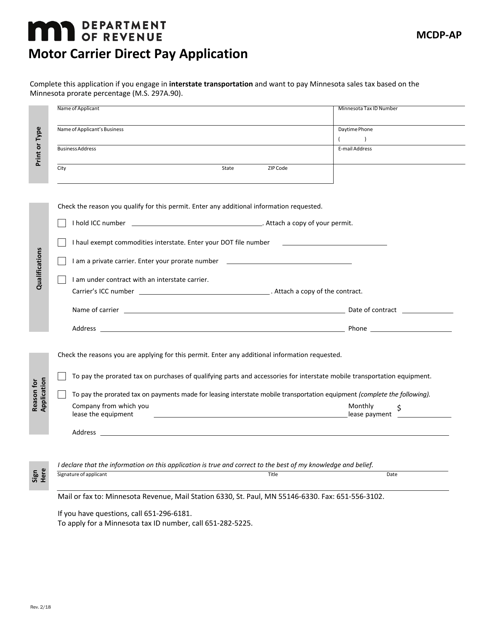

This form is used for motor carriers in Minnesota who want to apply for the Direct Pay Program, which allows them to pay sales and use taxes directly to the Department of Revenue instead of collecting them from customers.

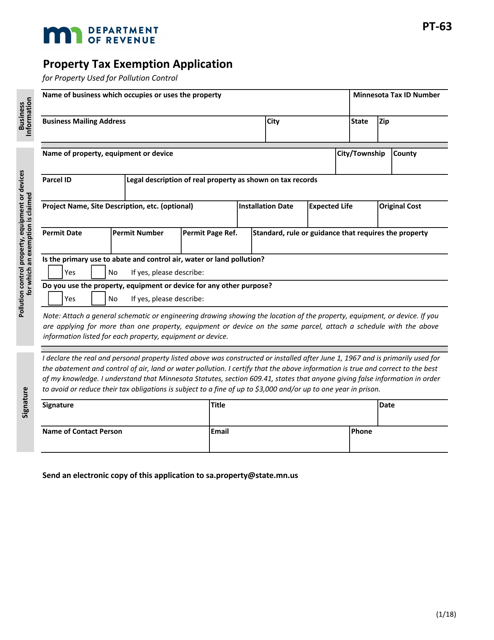

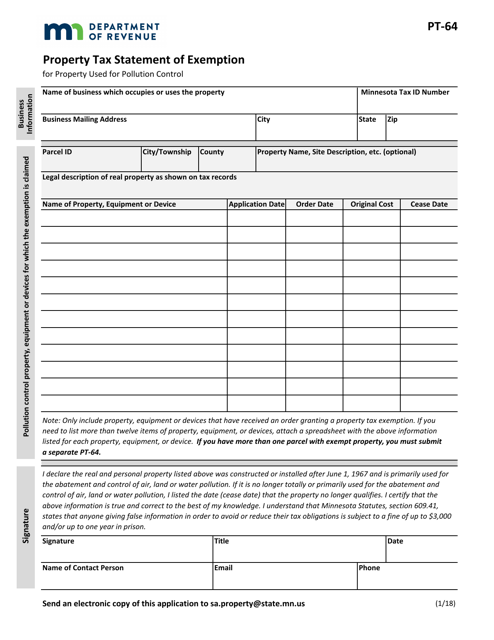

This document is used for applying for a property tax exemption in Minnesota.

This form is used for property owners in Minnesota to apply for an exemption from property tax for pollution control purposes.

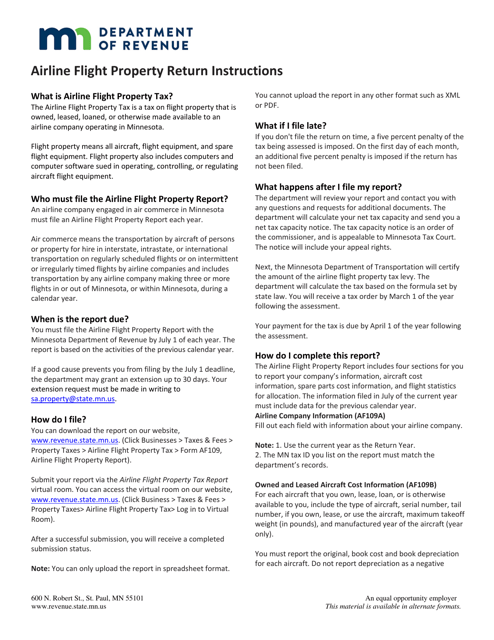

This type of document provides instructions for passengers to reclaim lost or damaged property from an airline flight in Minnesota.

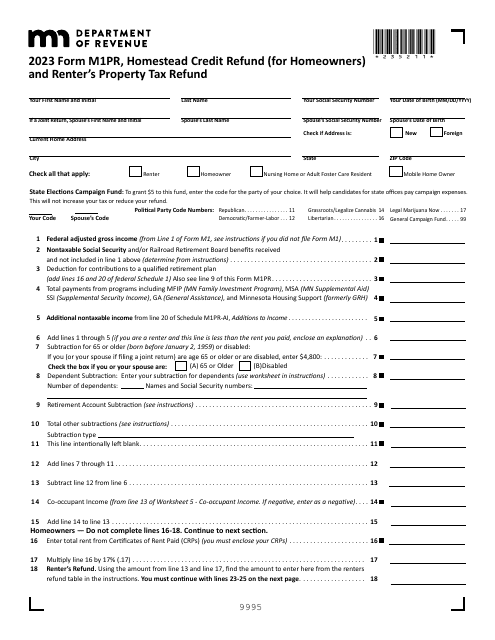

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.

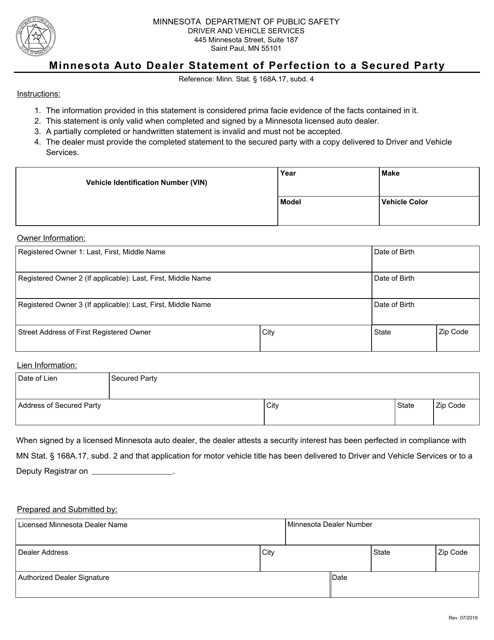

This document is used by auto dealers in Minnesota to declare their perfection of a security interest to a secured party. It is an important form for ensuring proper documentation of transactions involving vehicles.

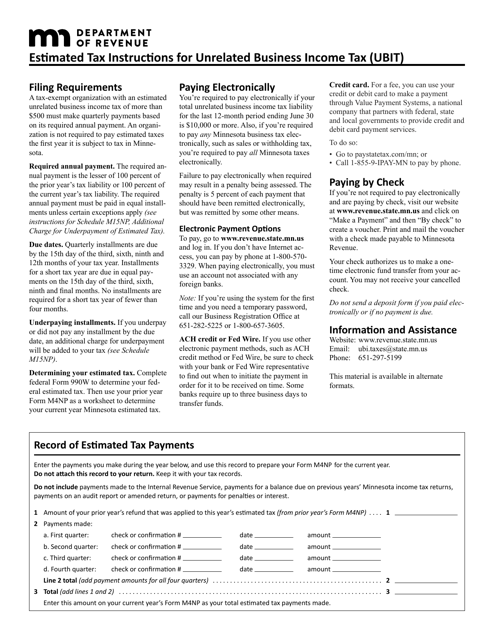

This document provides instructions for estimating and paying unrelated business income tax (UBIT) in the state of Minnesota. It is a guide for organizations that engage in activities unrelated to their exempt purpose and need to report and pay taxes on that income.

This report provides an assessment of the market value of utilities and pipelines in Minnesota. It analyzes the current status and projections for growth in the industry.

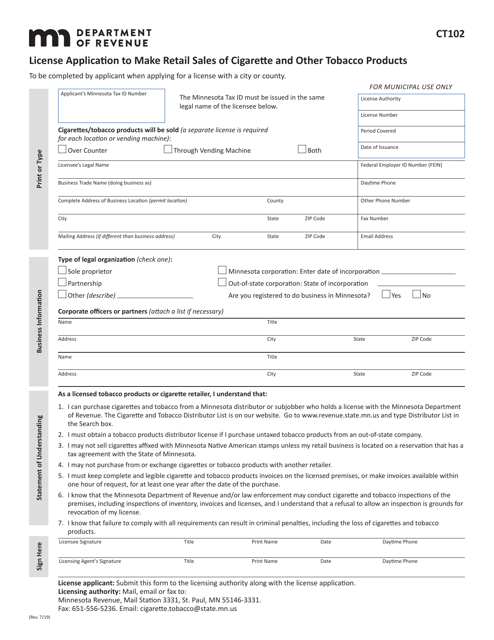

This form is used for applying for a license to sell cigarettes and other tobacco products at retail in the state of Minnesota.

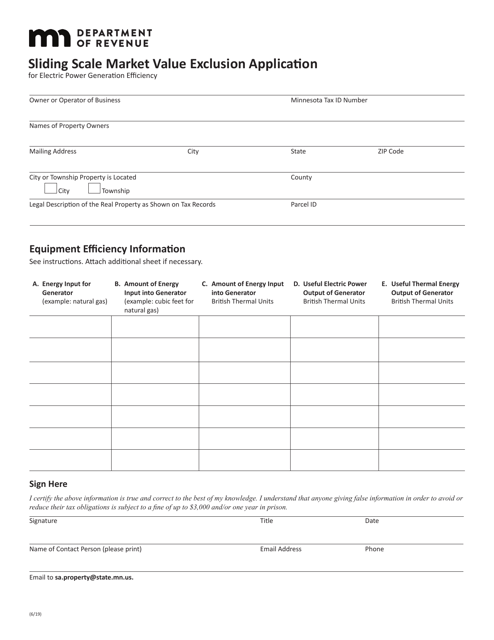

This form is used to apply for the sliding scale market value exclusion in Minnesota.

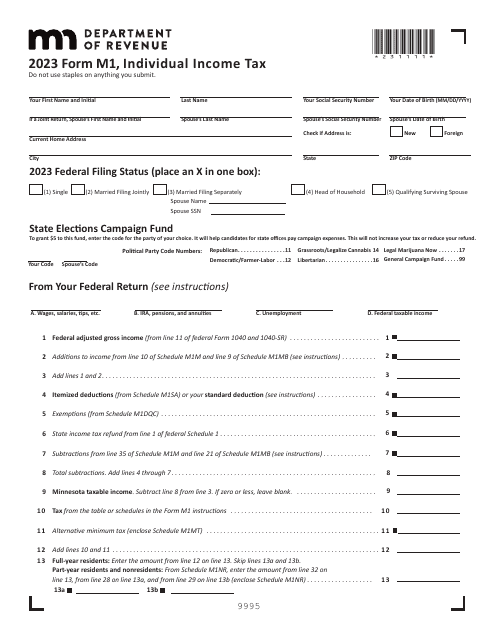

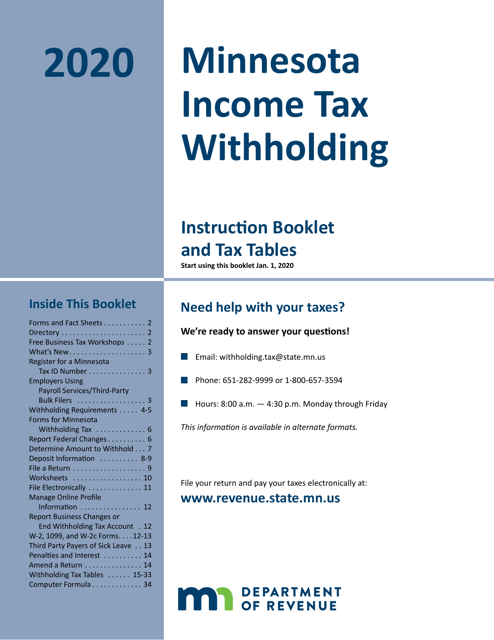

This type of document is the Minnesota Income Tax Withholding form, which is used to determine the amount of state income tax that employers should withhold from employees' paychecks in Minnesota.