Illinois Department of Revenue Forms

Documents:

857

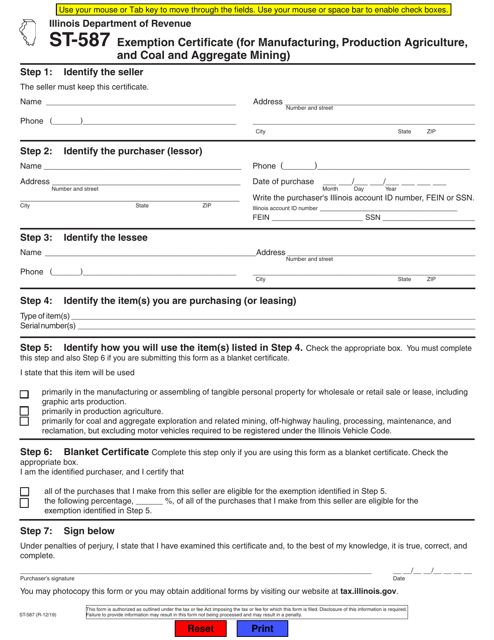

This document is used for obtaining an exemption certificate for manufacturing, production agriculture, and coal and aggregate mining in the state of Illinois.

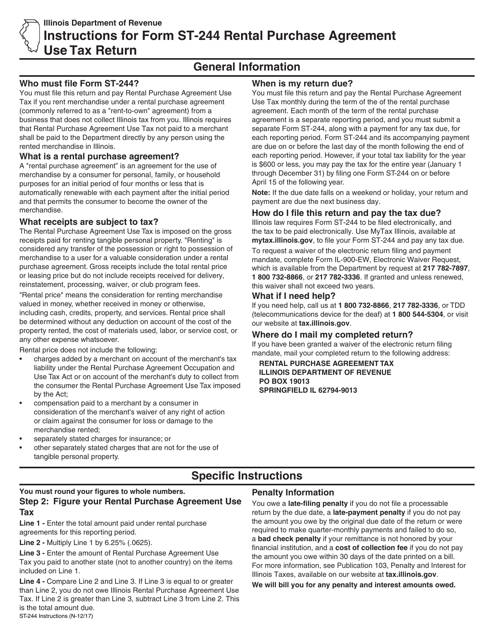

This document is used for reporting and paying use tax on rental purchase agreements in the state of Illinois.

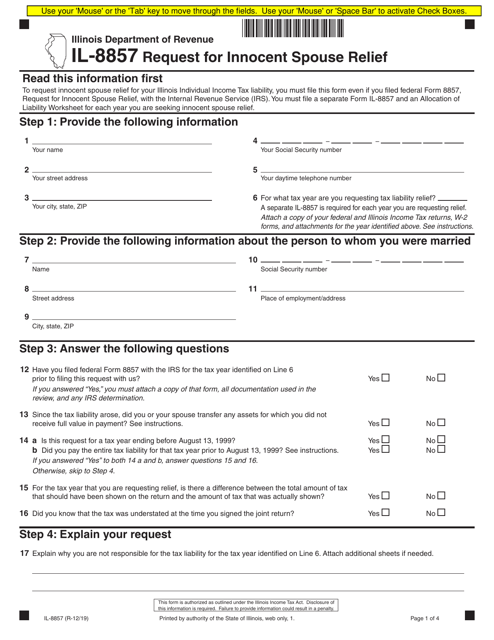

This document is used for requesting innocent spouse relief in the state of Illinois.

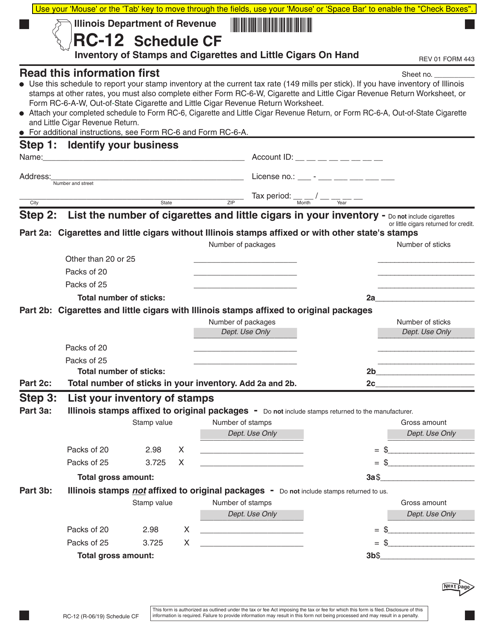

Form RC-12 (443) Schedule CF Inventory of Stamps and Cigarettes and Little Cigars on Hand - Illinois

This document is used for reporting the inventory of stamps, cigarettes, and little cigars that a person or business in Illinois has on hand.

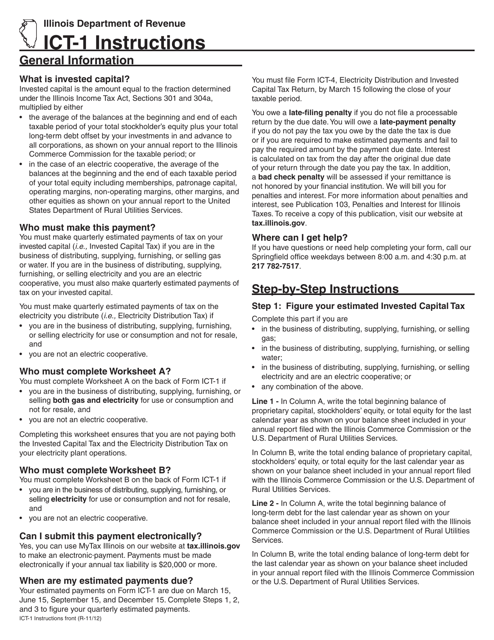

This document provides instructions for individuals in Illinois to make estimated payments for Electricity Distribution and Invested Capital Tax using Form ICT-1.

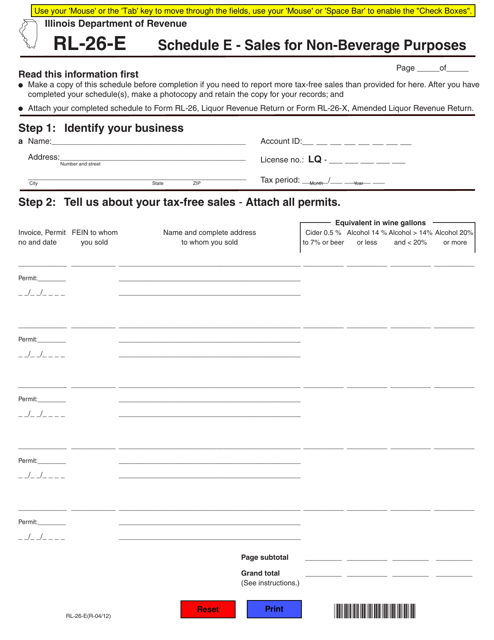

This form is used for reporting sales of non-beverage items in Illinois. It is specifically for Schedule E of Form RL-26-E.

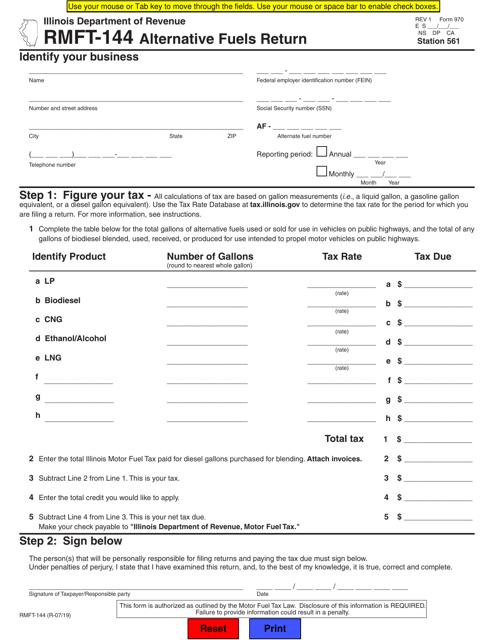

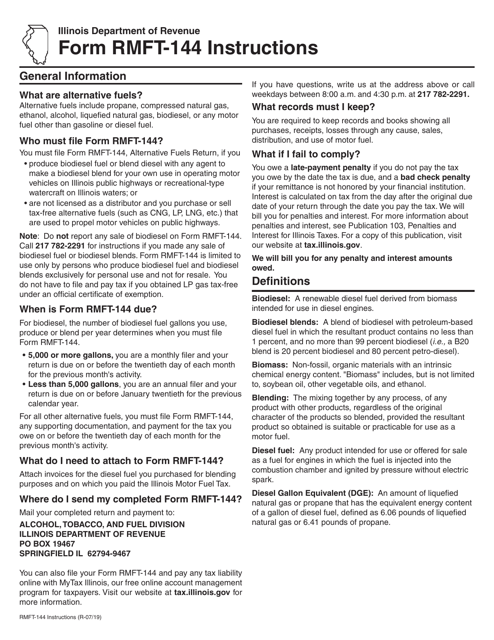

This Form is used for reporting alternative fuels usage in Illinois.

This Form is used for reporting alternative fuels usage and related information for tax purposes in the state of Illinois.

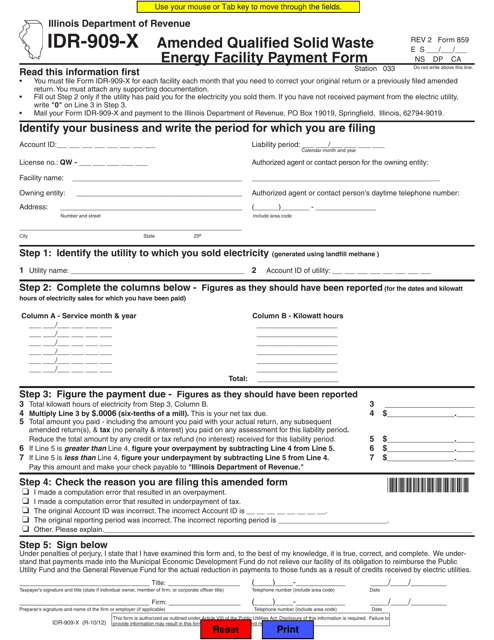

This Form is used for making an amendment to the Qualified Solid Waste Energy Facility Payment Form in the state of Illinois.

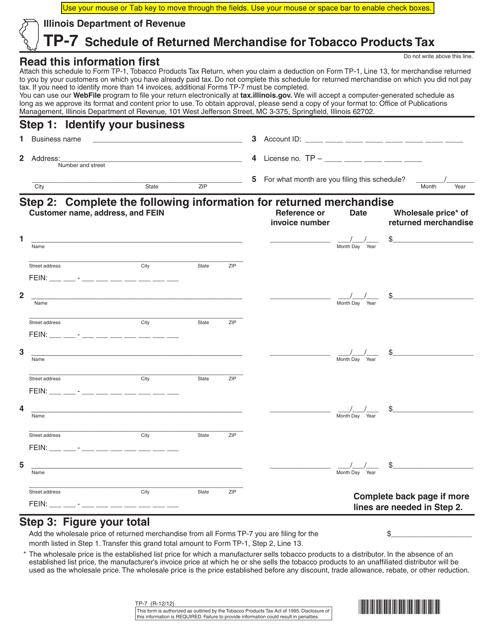

This document is for reporting returned merchandise related to tobacco products tax in Illinois.

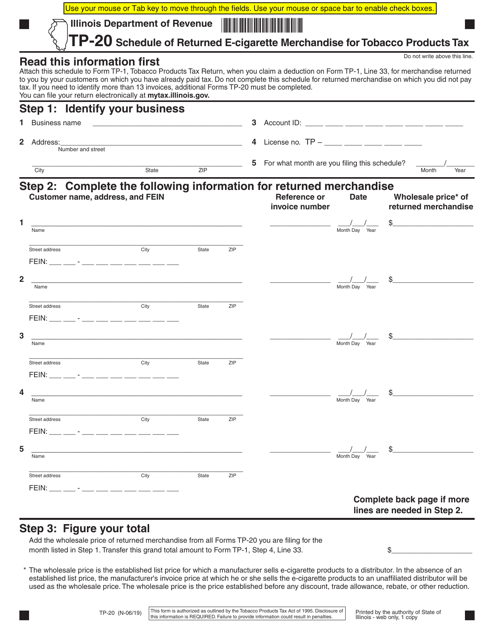

This form is used for reporting and documenting returned e-cigarette merchandise for the purpose of paying tobacco products tax in the state of Illinois.

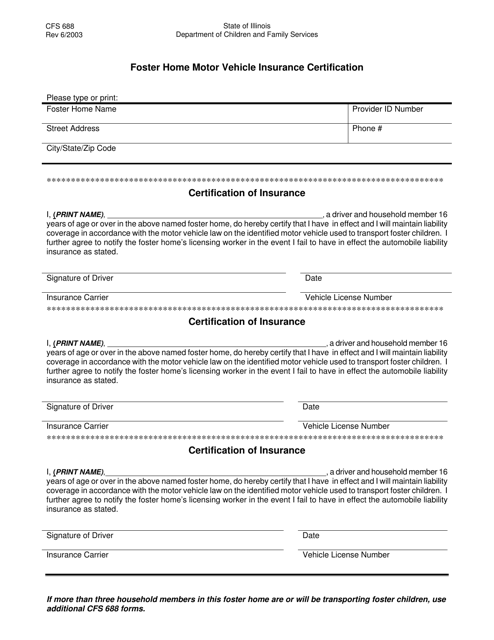

This form is used for certifying the motor vehicle insurance coverage for foster homes in the state of Illinois.

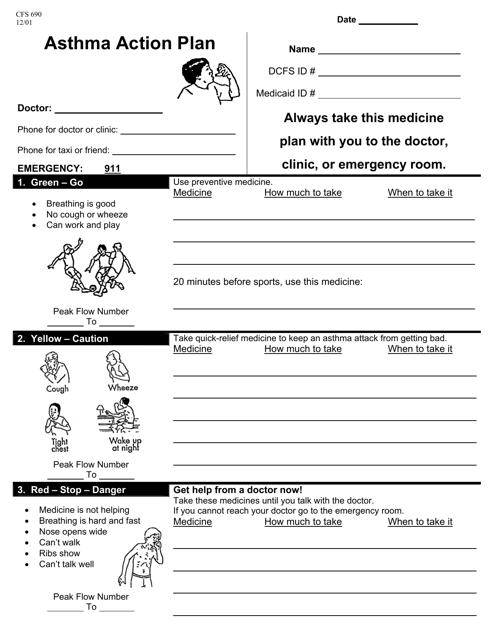

This document is a form used for creating an asthma action plan in the state of Illinois. It helps individuals with asthma and their healthcare providers develop a personalized plan to manage and control their asthma symptoms.

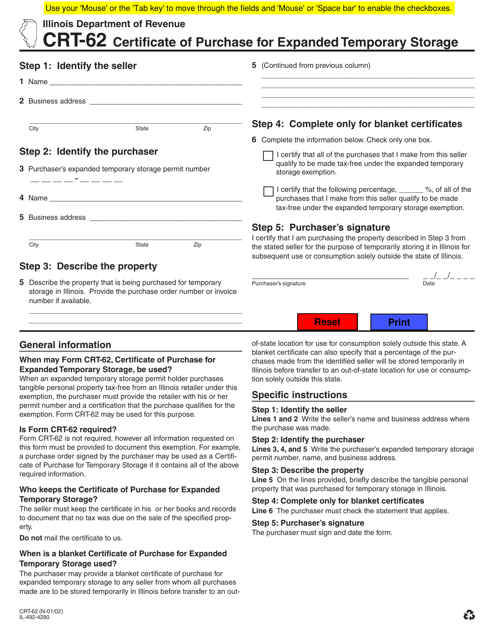

This form is used for certifying the purchase of expanded temporary storage in Illinois. It helps businesses comply with storage regulations and maintain proper documentation.

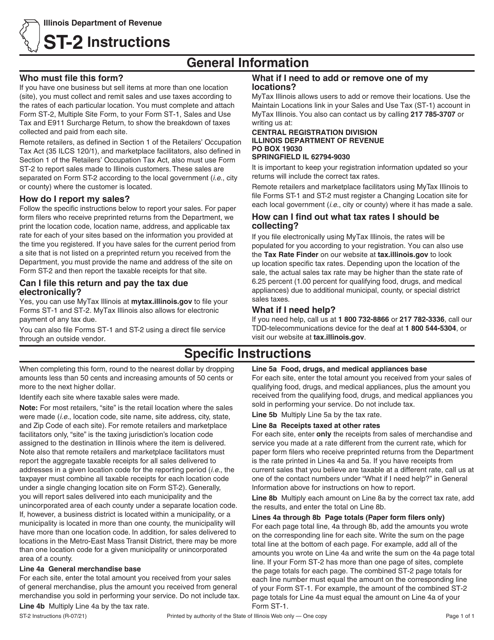

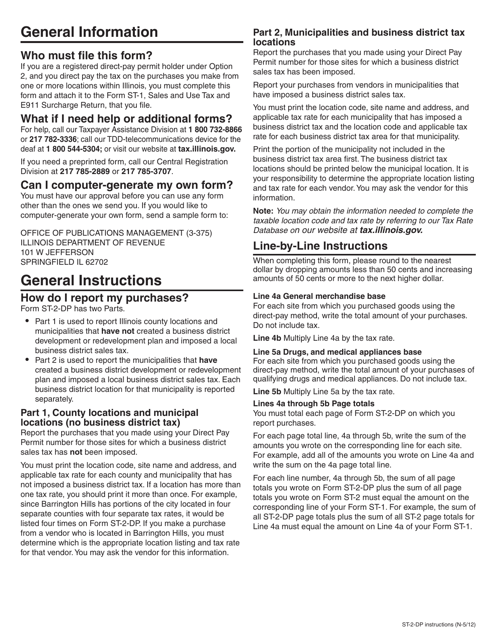

This Form is used for direct pay and reporting multiple sites in Illinois. It provides instructions for filling out Form ST-2-DP.

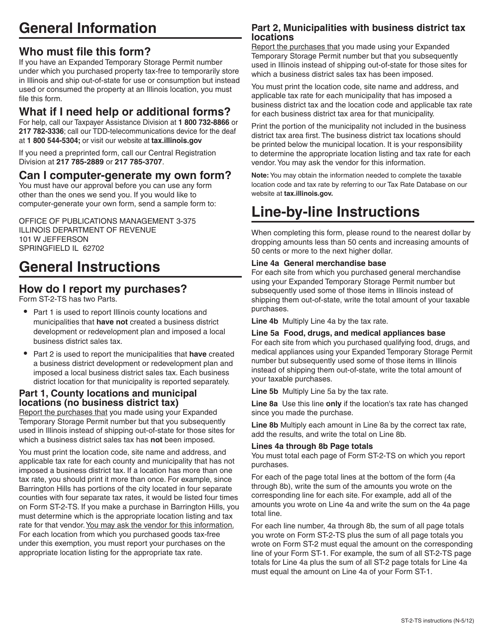

This Form is used for reporting expanded temporary storage at multiple sites in Illinois. It provides instructions for completing the Form ST-2-TS, 009.

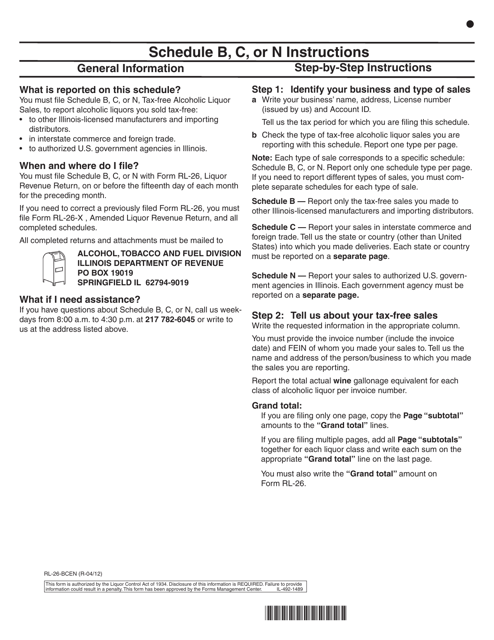

This Form is used for reporting tax-free sales of alcoholic liquor in Illinois. It includes Schedule B, C, and N for specific types of sales.

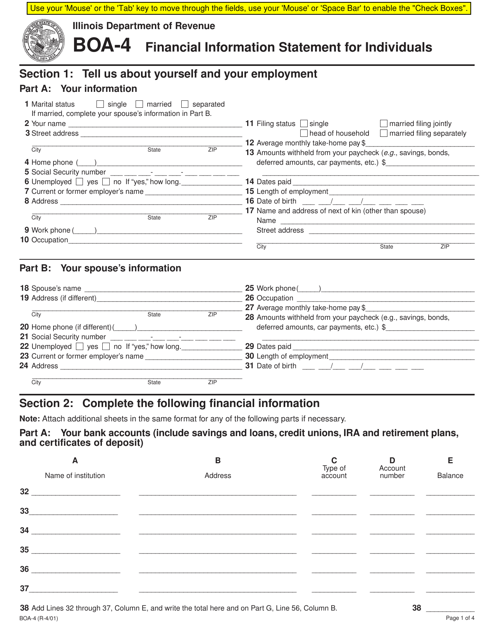

This document is used for providing financial information for individuals in Illinois, such as income, expenses, and assets. It is often required in legal and financial proceedings, such as divorce cases or loan applications.

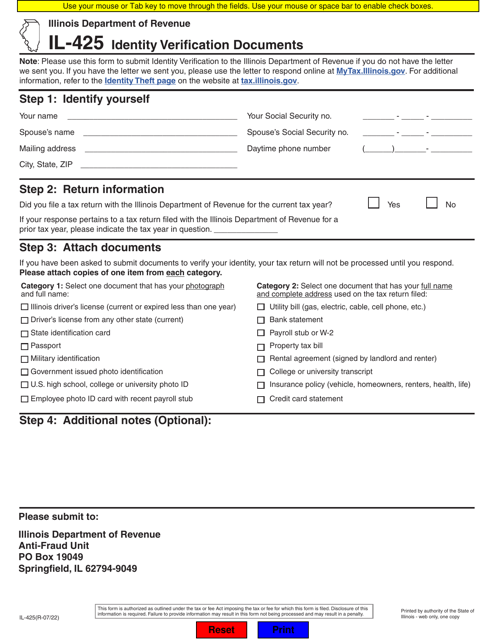

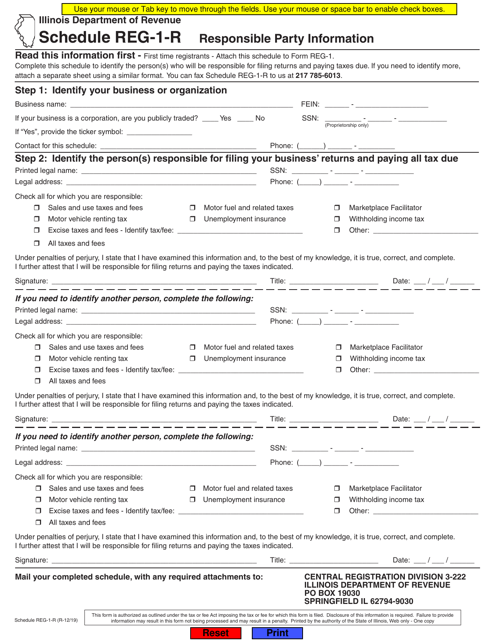

This form is used for providing information about the responsible party for businesses in Illinois.

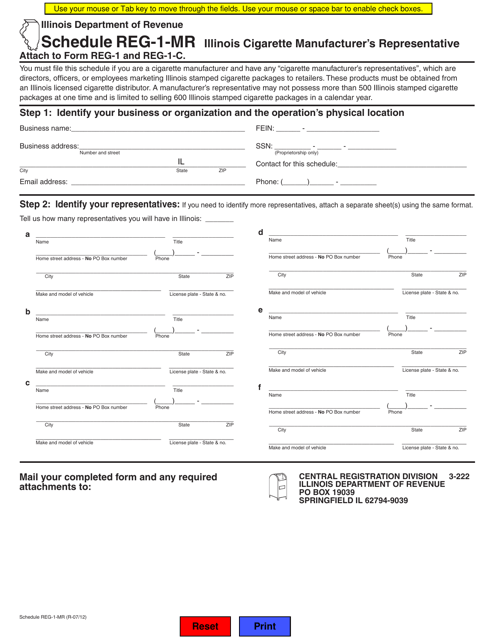

This type of document is used for scheduling the REG-1-MR Illinois Cigarette Manufacturer's Representative required in Illinois.

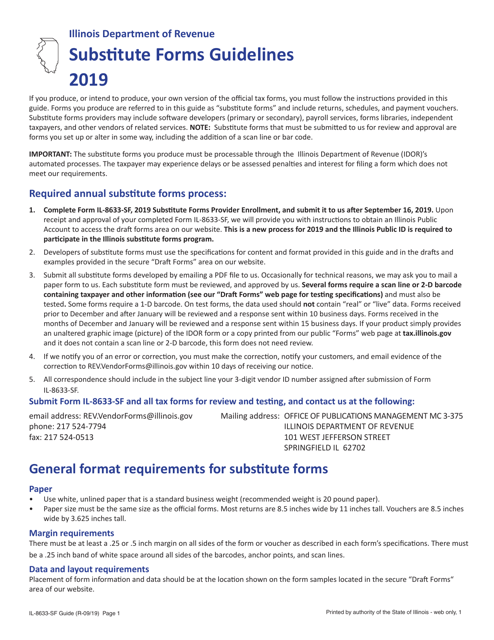

This form is used for annual enrollment as a substitute forms provider in Illinois.

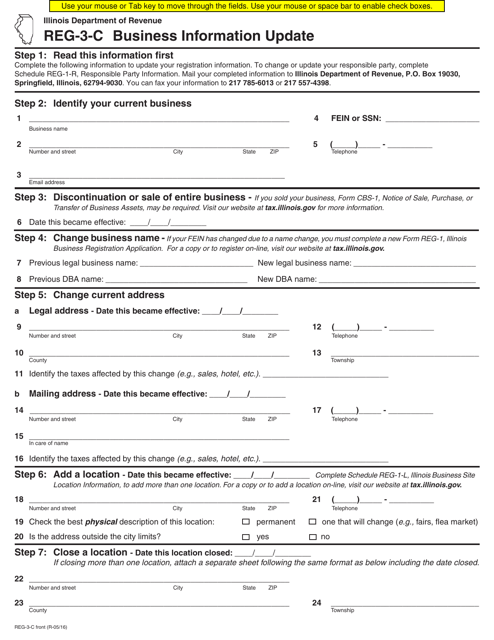

This Form is used for updating business information in the state of Illinois.

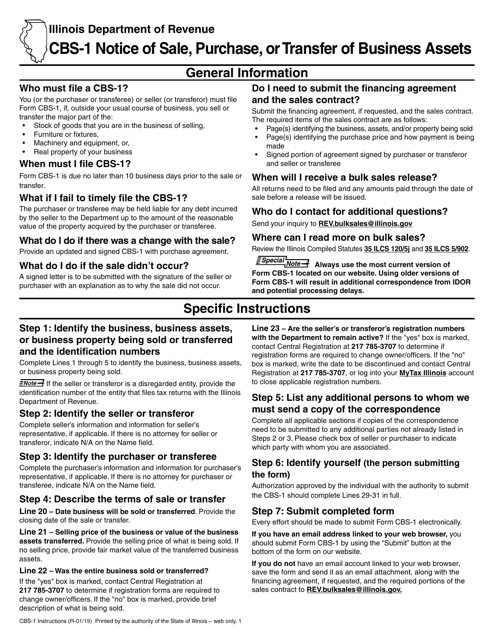

This document provides instructions for completing Form CBS-1, which is used to notify the state of Illinois about the sale, purchase, or transfer of business assets.

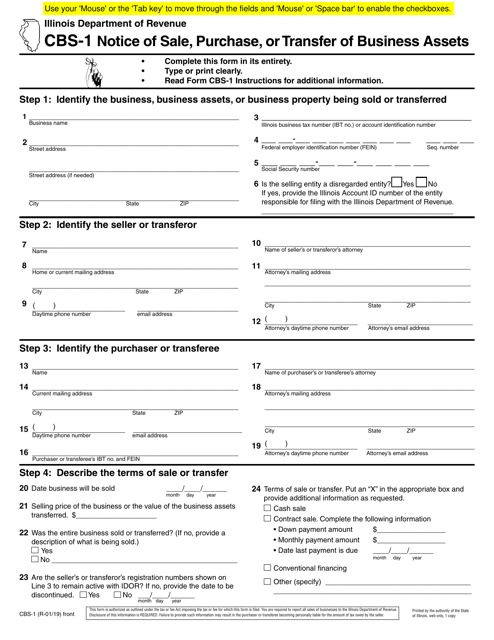

This form is used for notifying the Illinois government about the sale, purchase, or transfer of business assets. It is important for businesses to inform the state when such transactions occur.