Illinois Department of Revenue Forms

Documents:

857

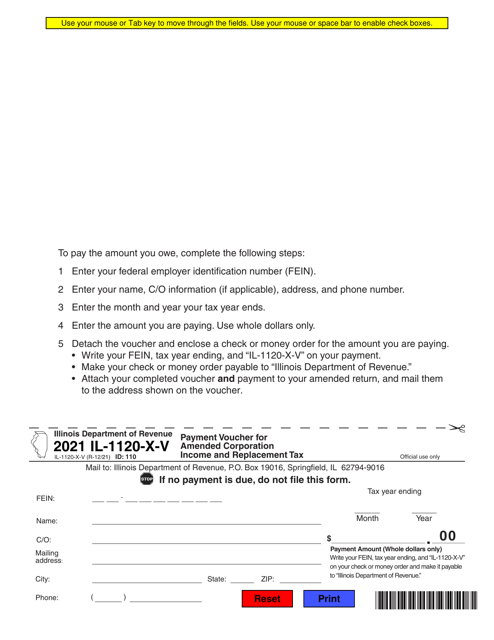

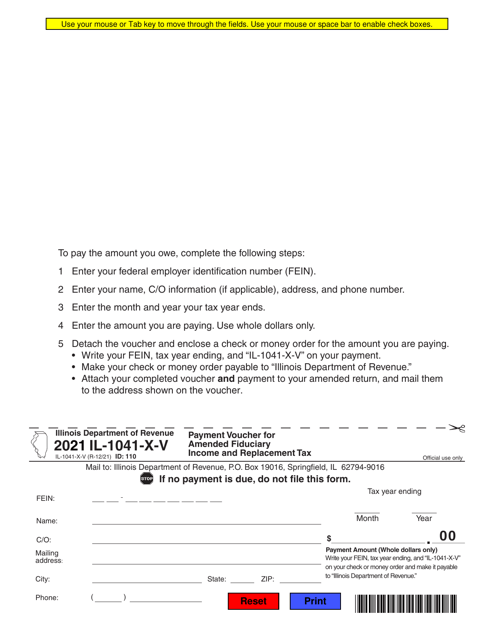

Form IL-1120-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

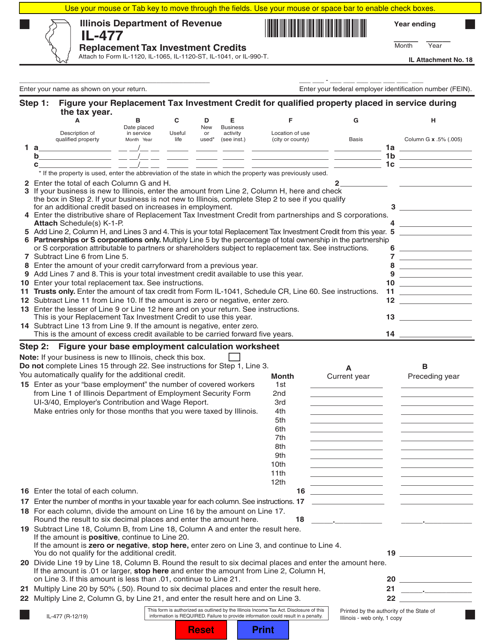

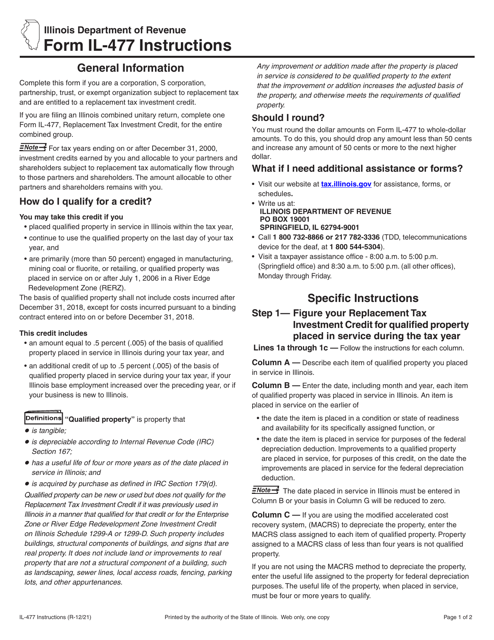

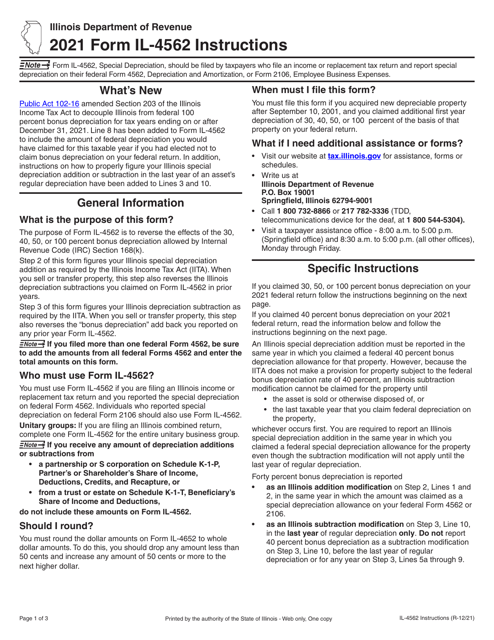

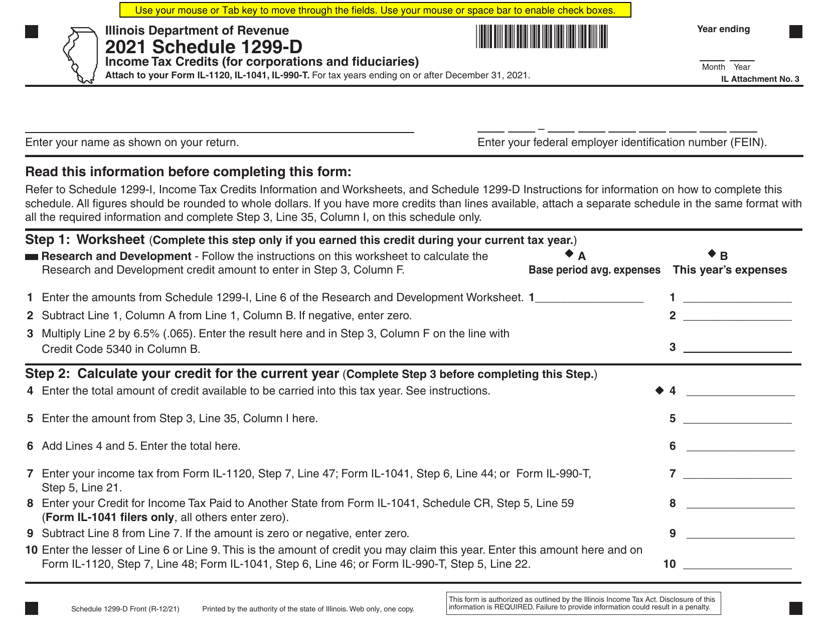

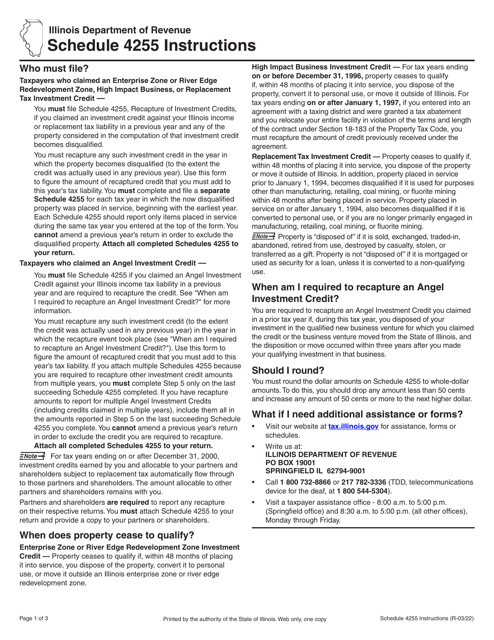

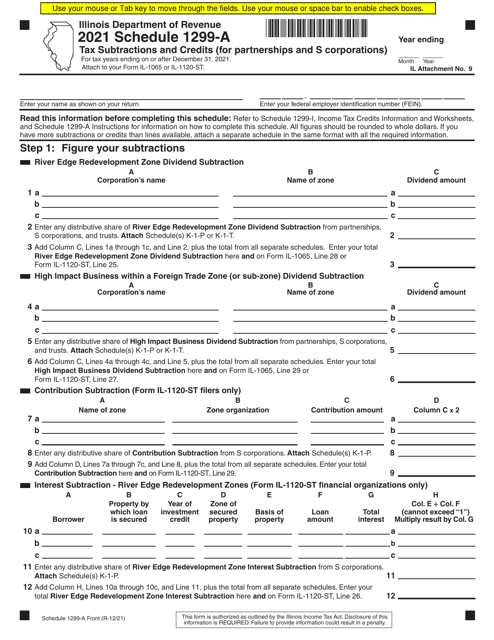

This Form is used for claiming replacement tax investment credits in the state of Illinois.

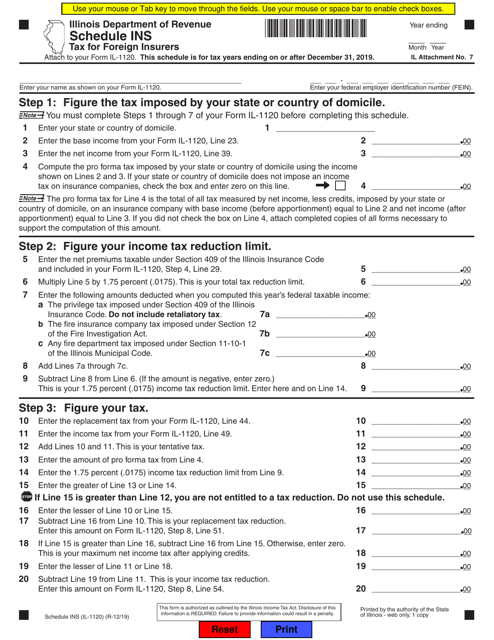

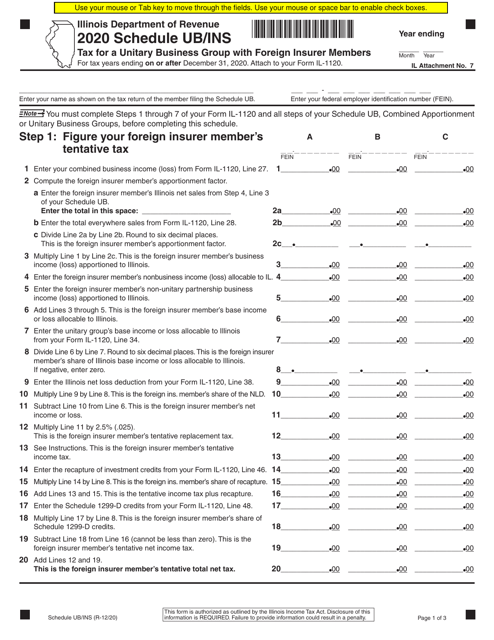

This form is used by foreign insurance companies operating in Illinois to report their taxable income and calculate their tax liability in the state.

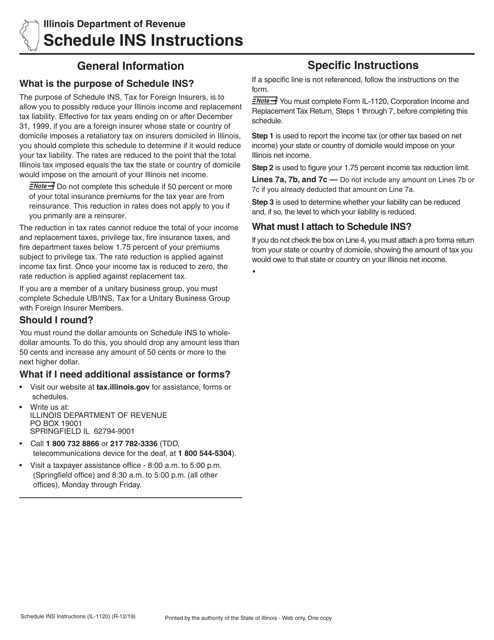

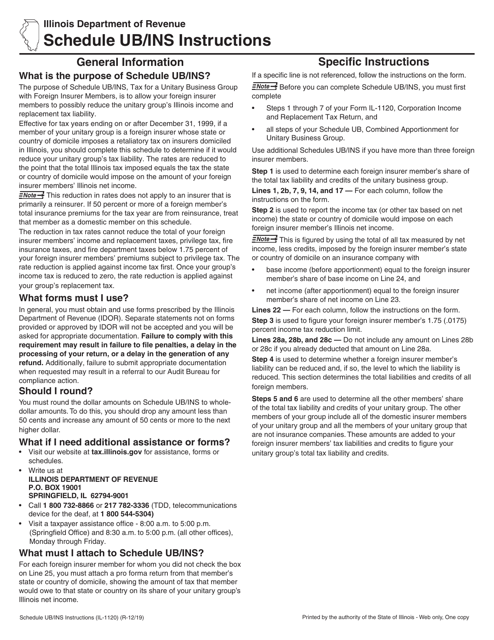

This Form is used for foreign insurers in Illinois to report and pay their tax obligations. It provides instructions for completing Schedule INS of Form IL-1120.

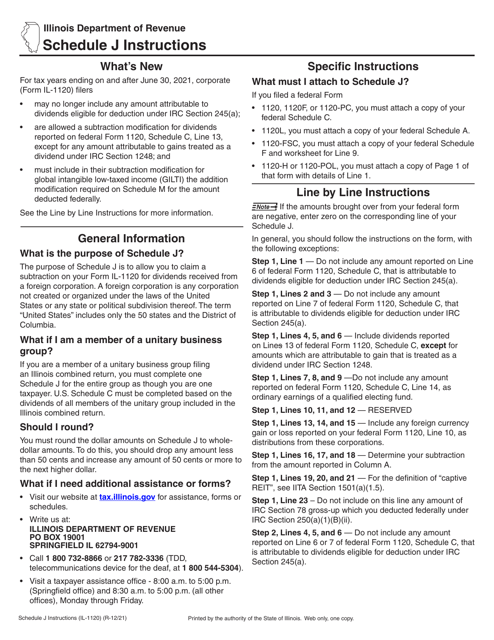

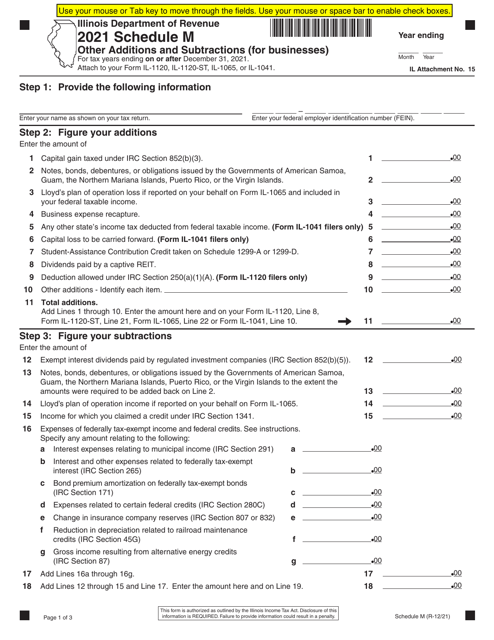

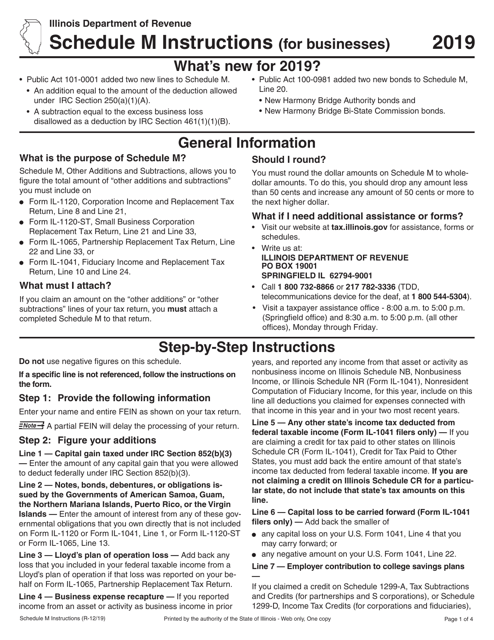

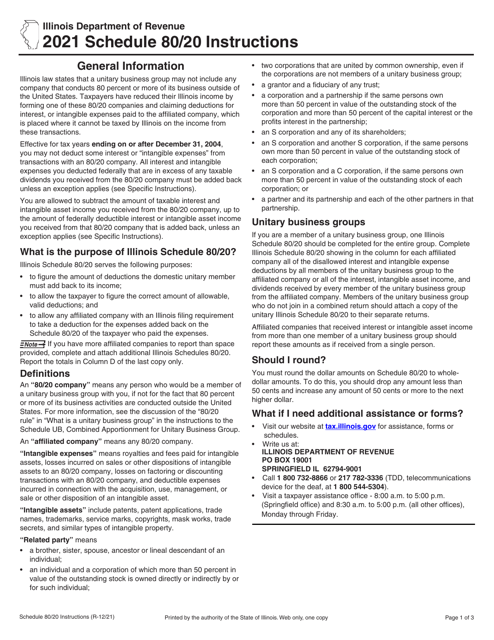

This document provides instructions for completing Form IL-1040 Schedule M, which is used for reporting other additions and subtractions for businesses in the state of Illinois.

This document provides instructions for Form IL-1120 Schedule UB/INS Tax, which is used for calculating tax for a unitary business group with foreign insurer members in the state of Illinois. The instructions guide taxpayers on how to properly complete the form and report their tax liability.

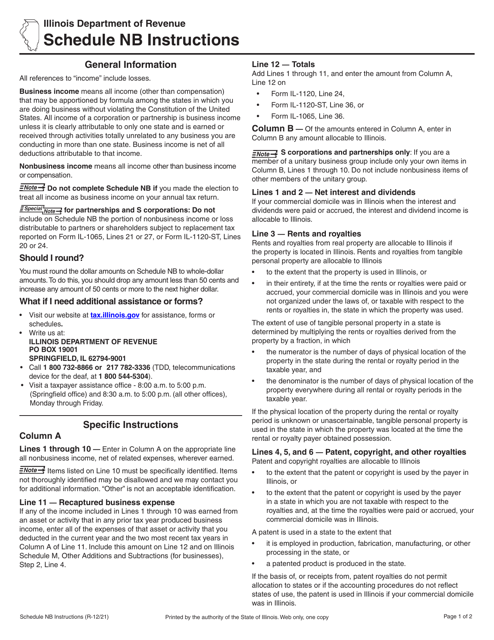

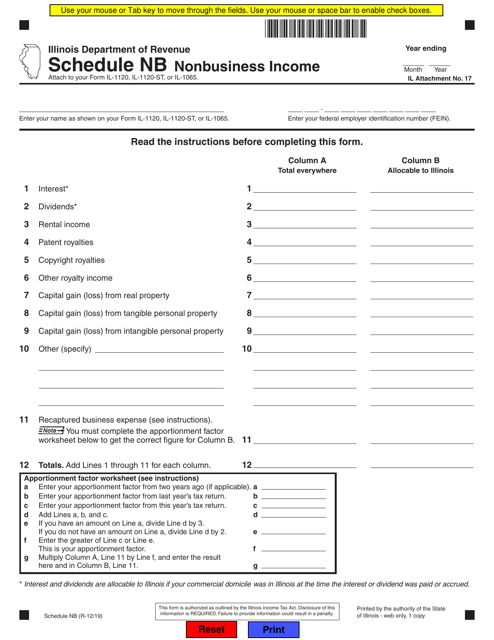

This document is for reporting nonbusiness income in the state of Illinois for individual taxpayers. It is used to schedule the income that is not derived from business activities.

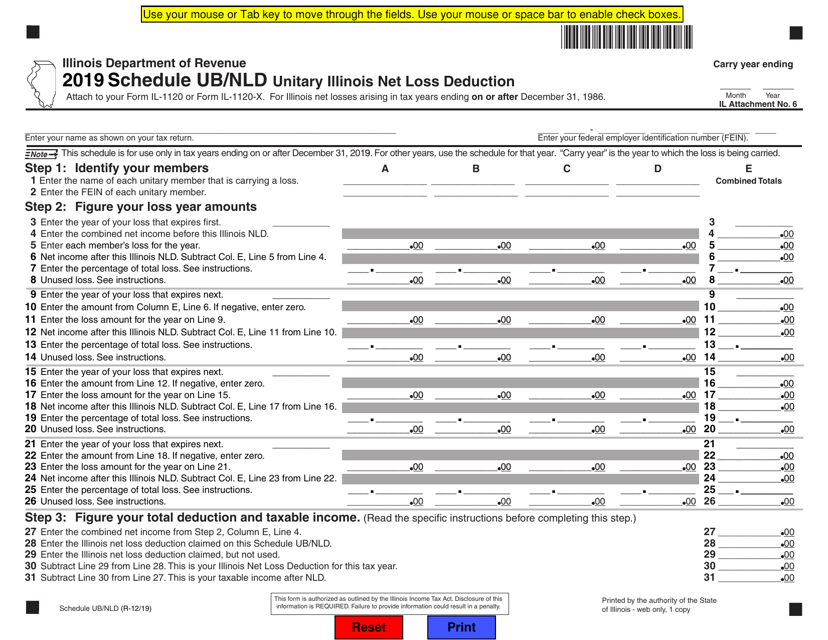

This document is for claiming the Unitary Illinois Net Loss Deduction in the state of Illinois. This deduction allows businesses to offset their net losses against their income.

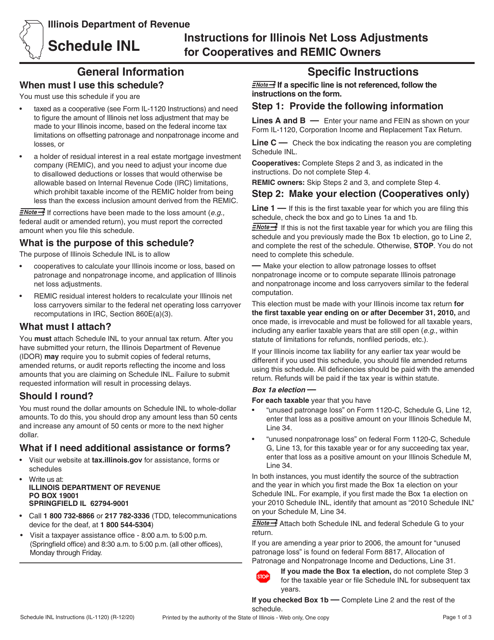

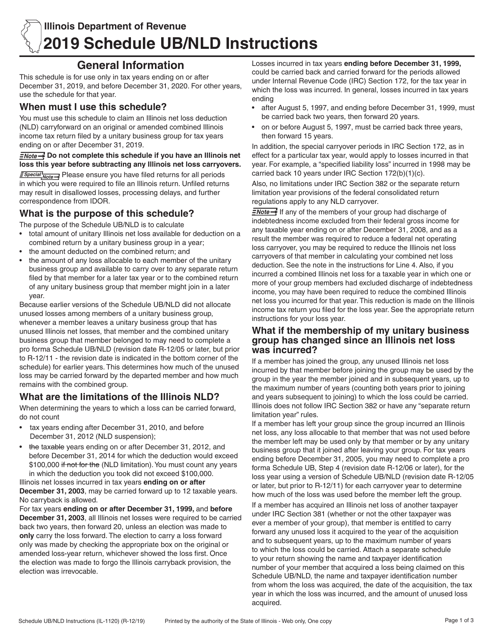

This form is used for claiming the Unitary Illinois Net Loss Deduction for businesses in Illinois. It provides instructions on how to calculate and report the net loss deduction on your Illinois business tax return.

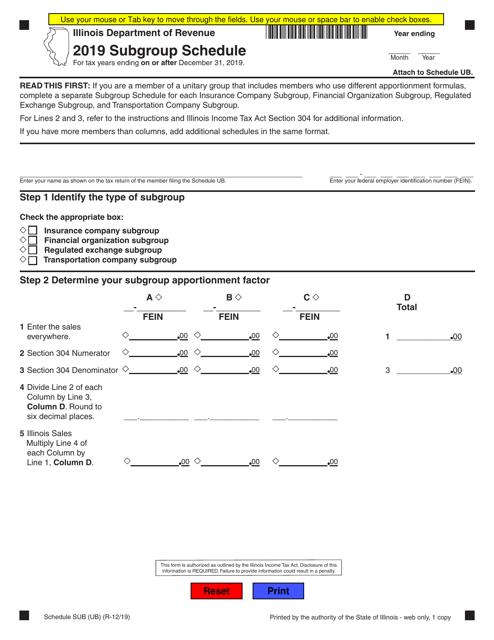

This document is used for scheduling subgroup activities in Illinois.

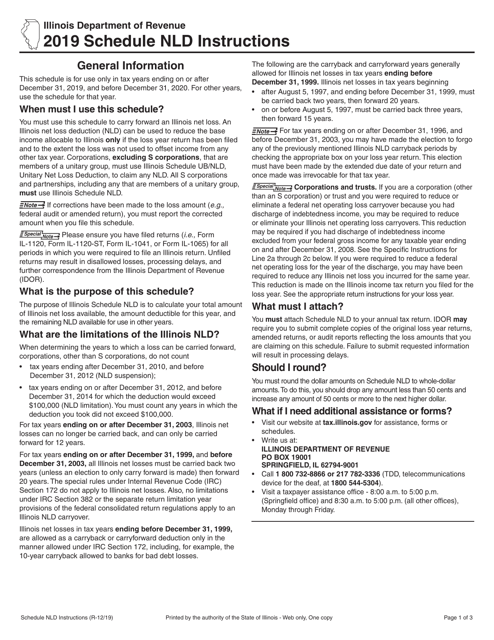

This type of document provides instructions for claiming a net loss deduction in Illinois when filing taxes.

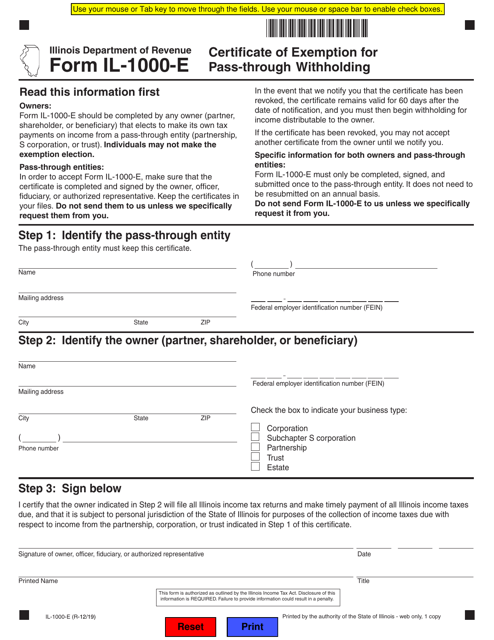

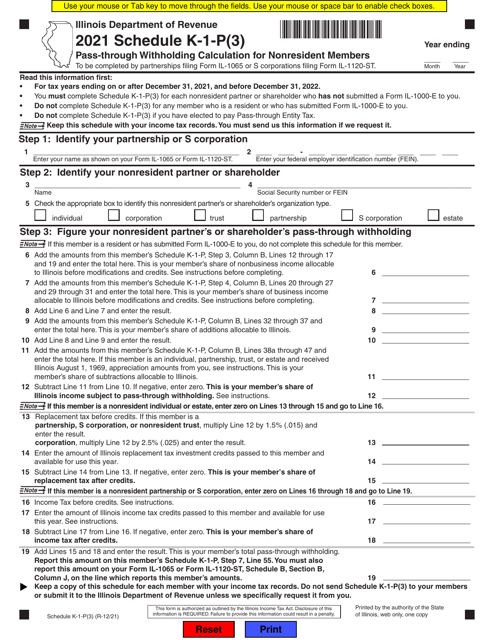

This Form is used for obtaining a certificate of exemption from pass-through withholding in the state of Illinois.

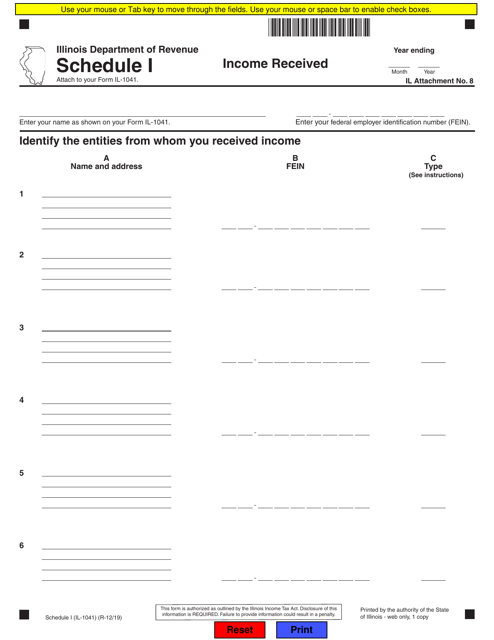

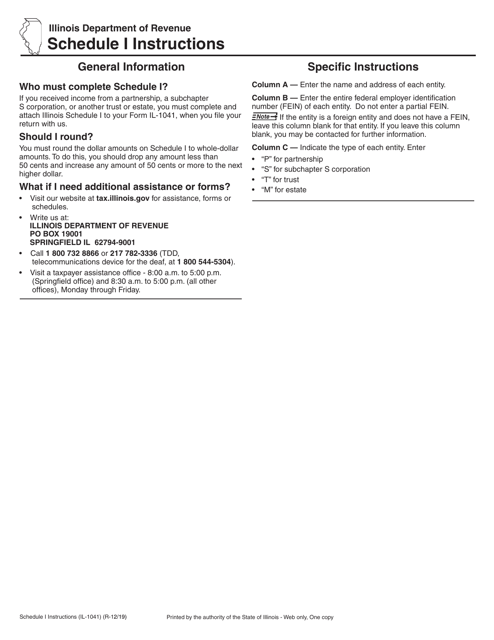

This form is used for reporting income received in the state of Illinois for Form IL-1041.

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

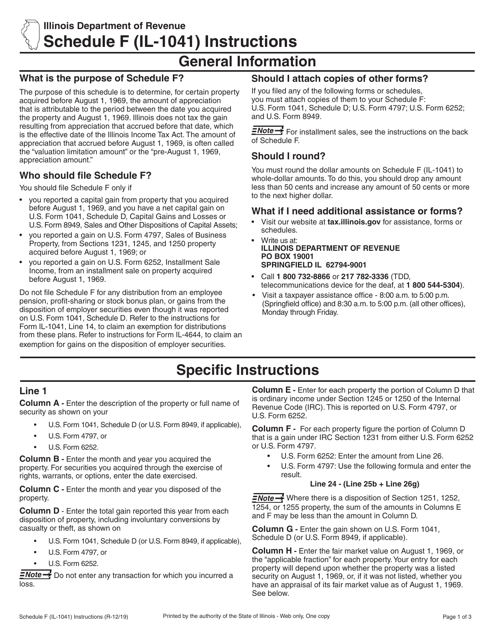

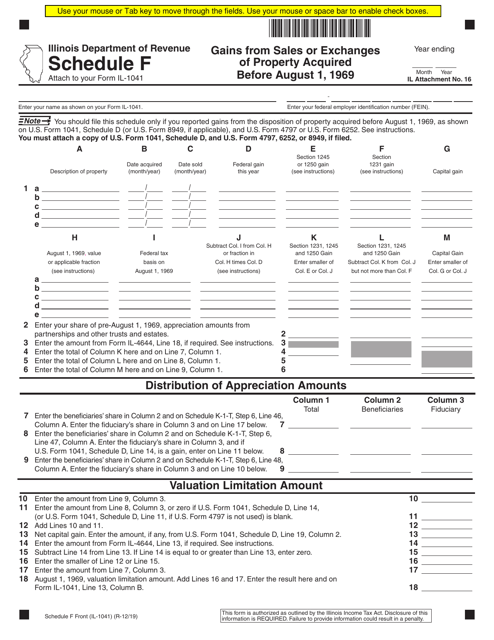

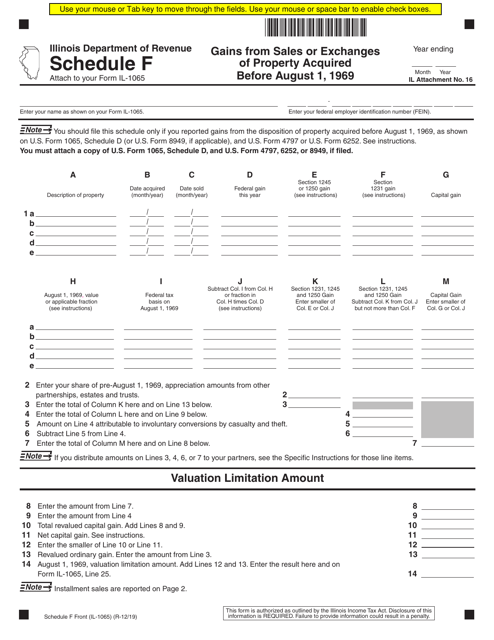

This Form is used for reporting gains from the sale or exchange of property that was acquired before August 1, 1969 in the state of Illinois. It provides instructions on how to report these gains on Form IL-1041 Schedule F.

This form is used for reporting gains from the sales or exchanges of property acquired before August 1, 1969 in the state of Illinois.

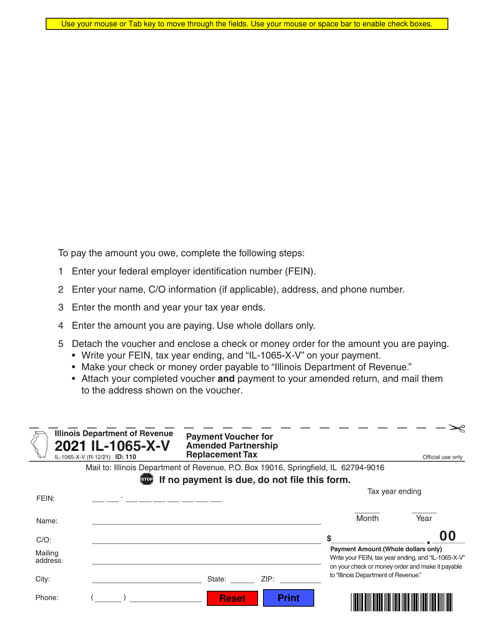

Form IL-1065-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

This Form is used for reporting gains from sales or exchanges of property acquired before August 1, 1969 in the state of Illinois.