Illinois Department of Revenue Forms

Documents:

857

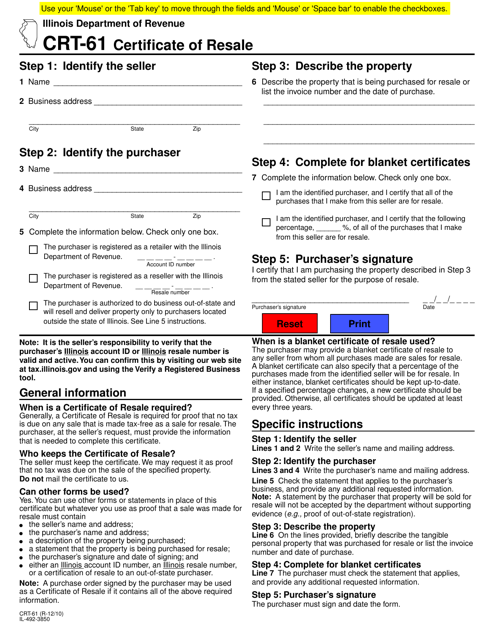

Use this Illinois form as proof to a seller that no tax is due on a tax-free sale made as a sale for resale.

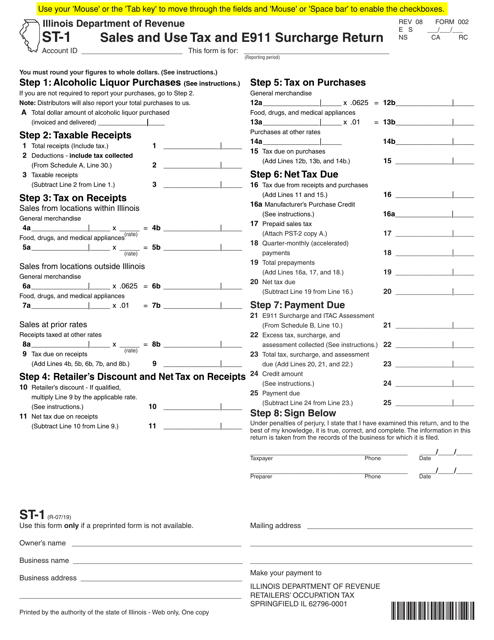

This form is used for filing sales and use tax, as well as E911 surcharge, in the state of Illinois.

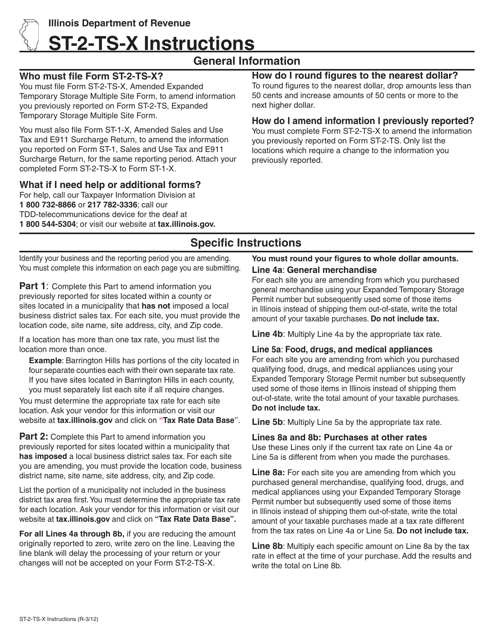

This Form is used for amending the Expanded Temporary Storage Multiple Site Form in Illinois.

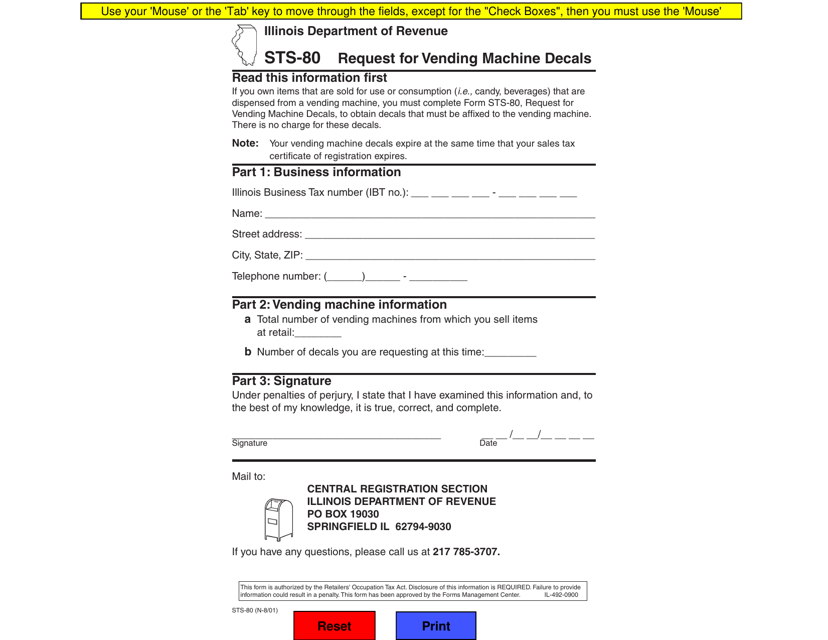

This form is used for requesting vending machine decals in the state of Illinois.

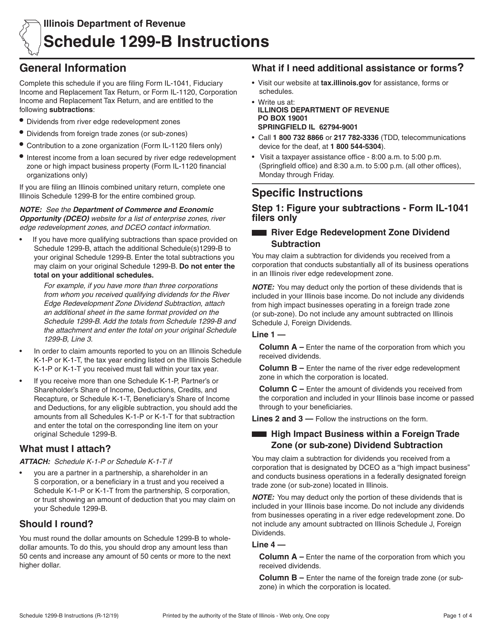

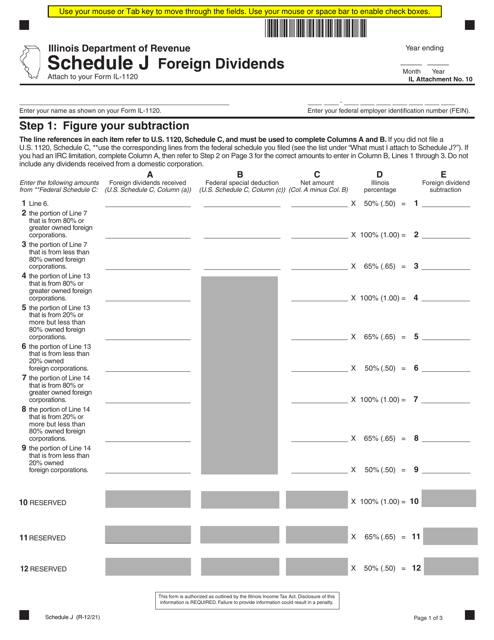

This form is used for corporations and fiduciaries in Illinois to report and claim deductions for activities related to River Edge Redevelopment Zones or Foreign Trade Zones. It provides instructions on how to accurately calculate and report these subtractions for tax purposes.

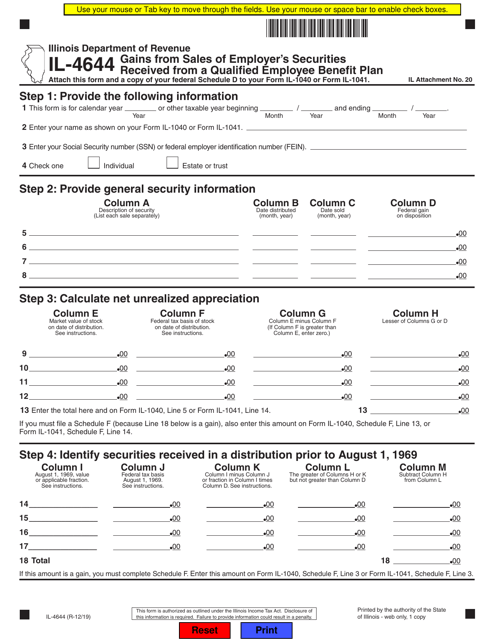

This form is used for reporting gains from the sales of employer's securities received from a qualified employee benefit plan in the state of Illinois.

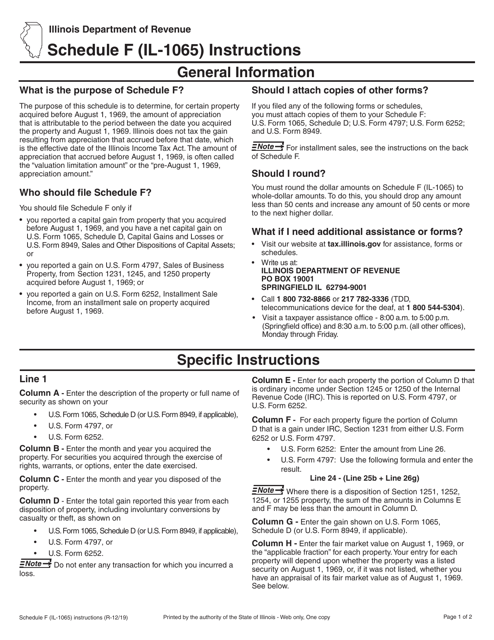

This Form is used for reporting gains from the sales or exchanges of property acquired before August 1, 1969 in the state of Illinois.

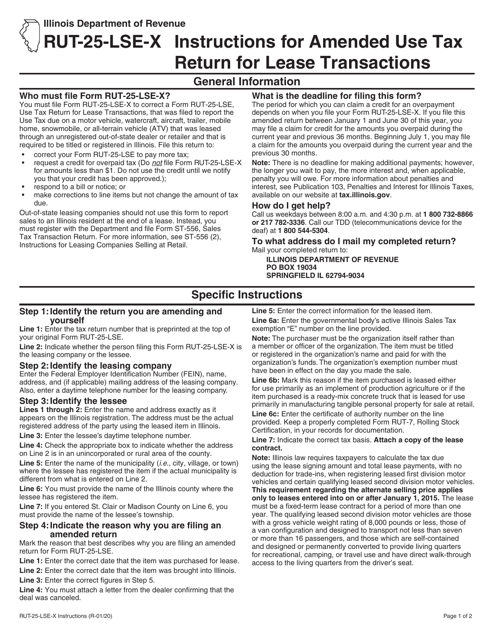

This document is a set of instructions for completing Form RUT-25-LSE-X, which is used to file an amended use tax return for lease transactions in Illinois.

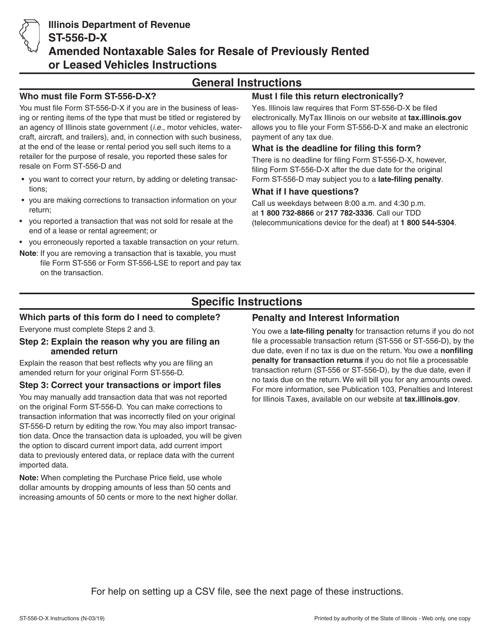

This Form is used for reporting amended nontaxable sales for resale of previously rented or leased vehicles in the state of Illinois. It provides instructions on how to accurately fill out the form and submit the necessary information to the Illinois Department of Revenue.

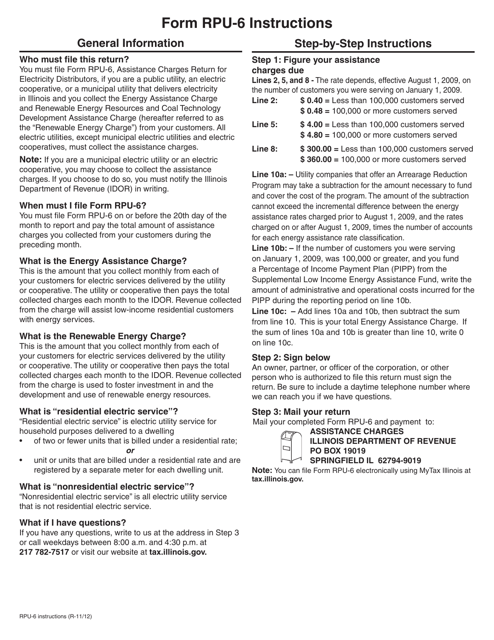

This Form is used for reporting assistance charges by electricity distributors in Illinois.

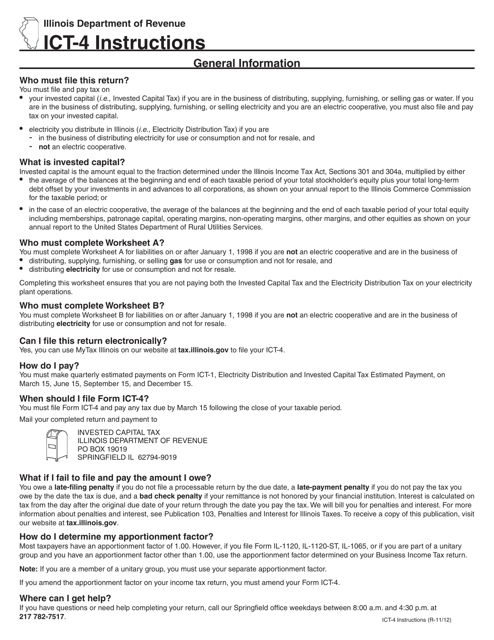

Instructions for Form ICT-4, 491 Electricity Distribution and Invested Capital Tax Return - Illinois

This document is used for filing the Electricity Distribution and Invested Capital Tax Return in Illinois. It provides instructions on how to complete Form ICT-4, 491.

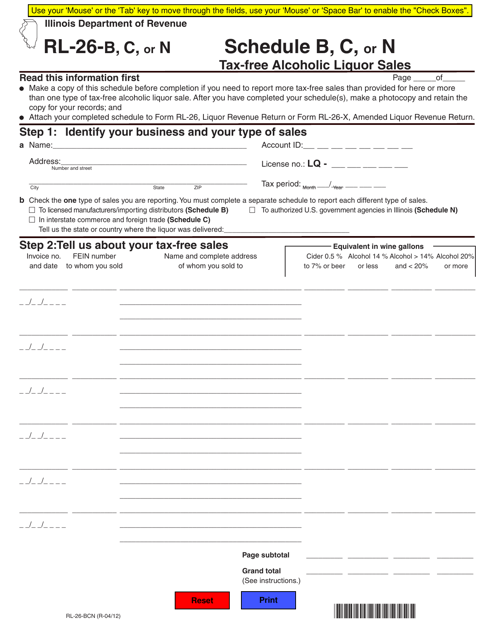

This document is for reporting tax-free sales of alcoholic liquor in Illinois. It includes schedules B, C, and N.

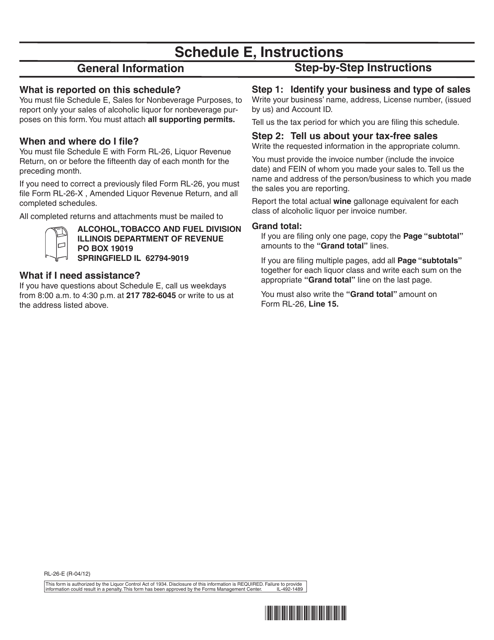

This document is used to report sales for non-beverage purposes in Illinois. It provides instructions for completing Form RL-26-E Schedule E.

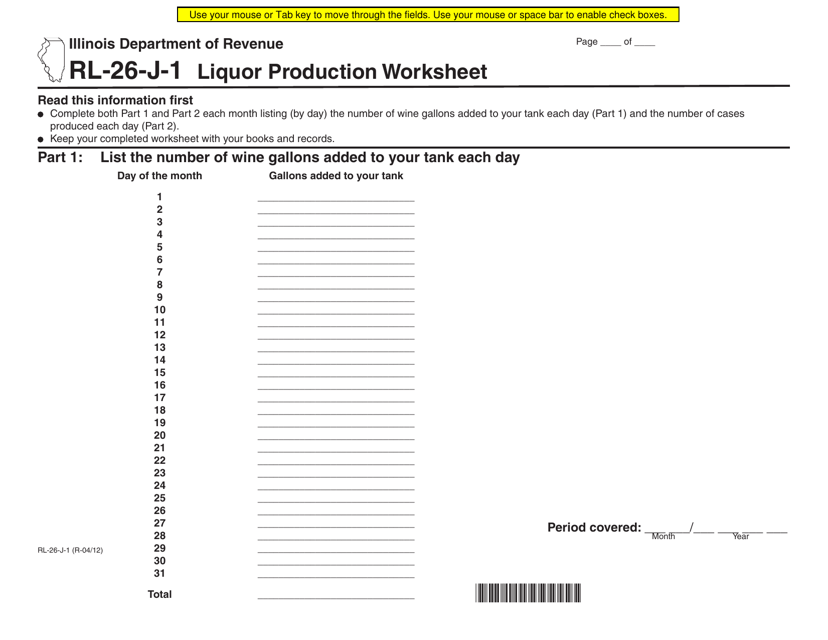

This form is used for recording and reporting liquor production in the state of Illinois. It helps businesses comply with state regulations and accurately calculate production quantities.

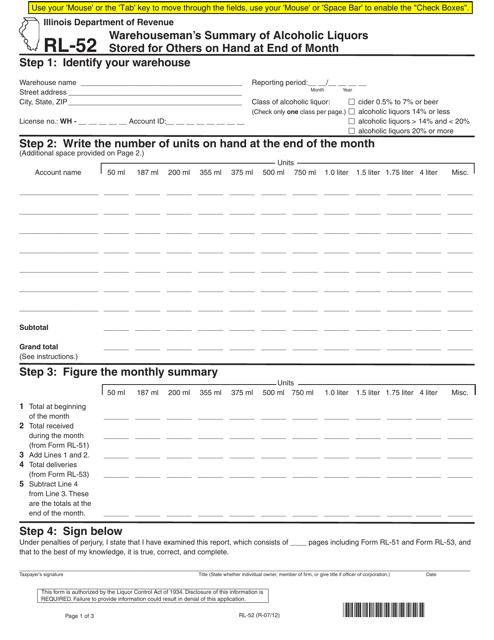

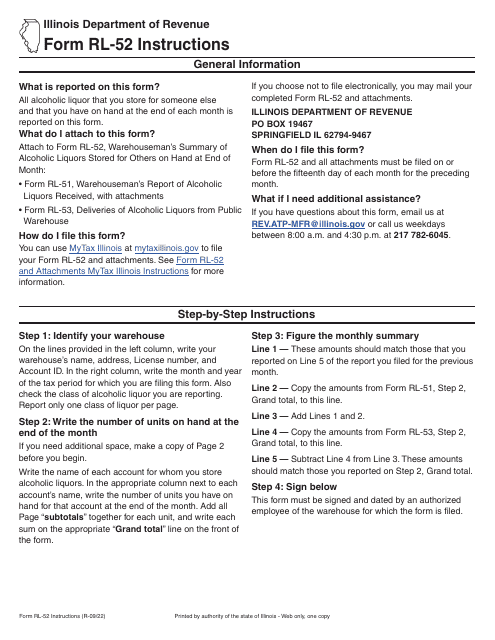

This form is used for warehousemen in Illinois to report a summary of alcoholic liquors stored for others at the end of the month.

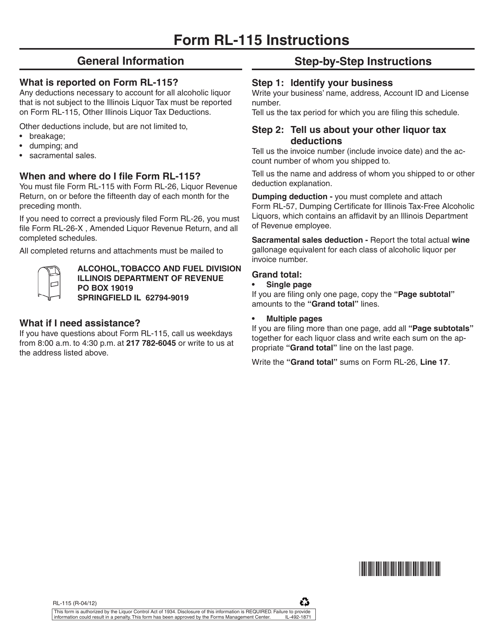

This form is used for claiming other liquor tax deductions in the state of Illinois.

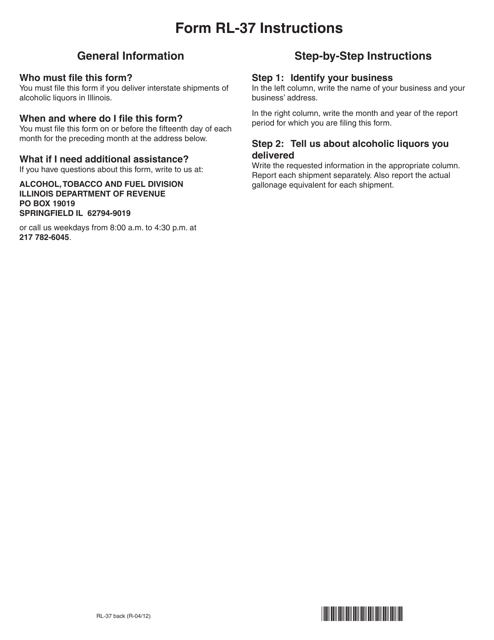

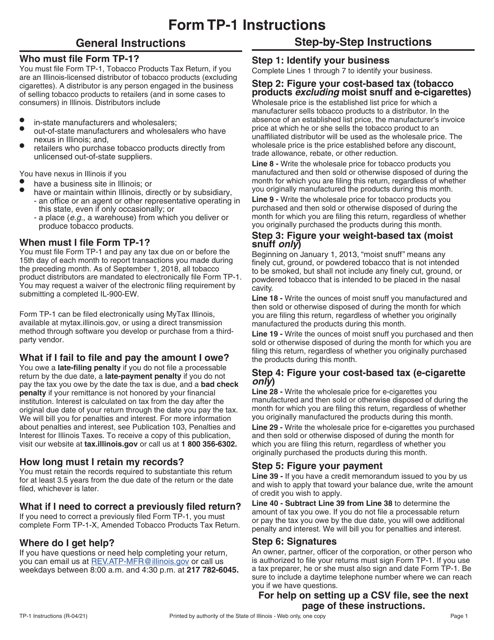

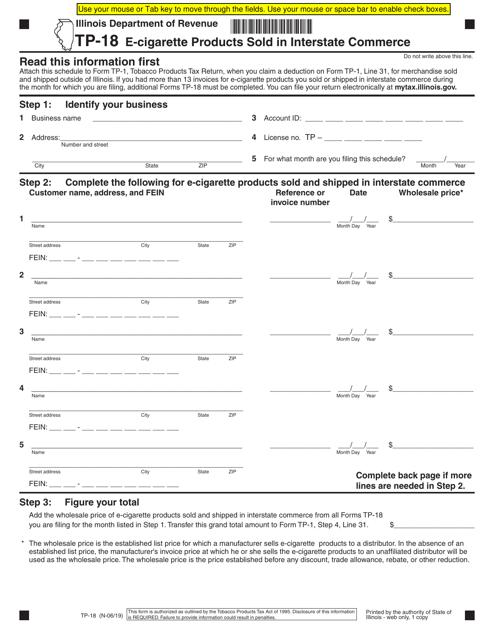

This form is used for reporting the sale of e-cigarette products that are sold in interstate commerce in the state of Illinois.

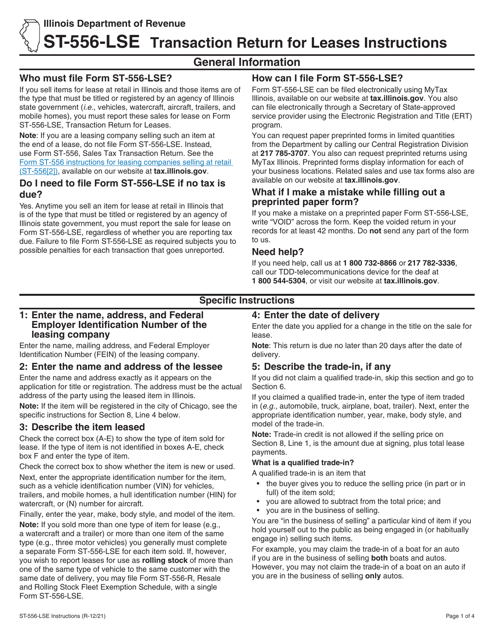

This Form is used for providing original lease information in Illinois.

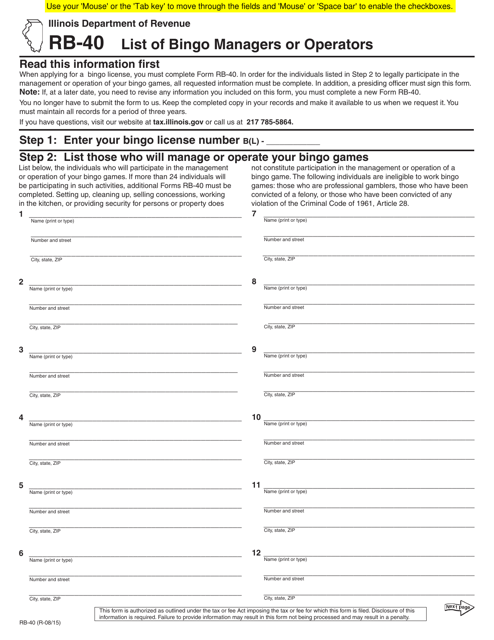

This document is a list of Bingo Managers or Operators in the state of Illinois. It is used for keeping track of those responsible for managing or operating bingo events.

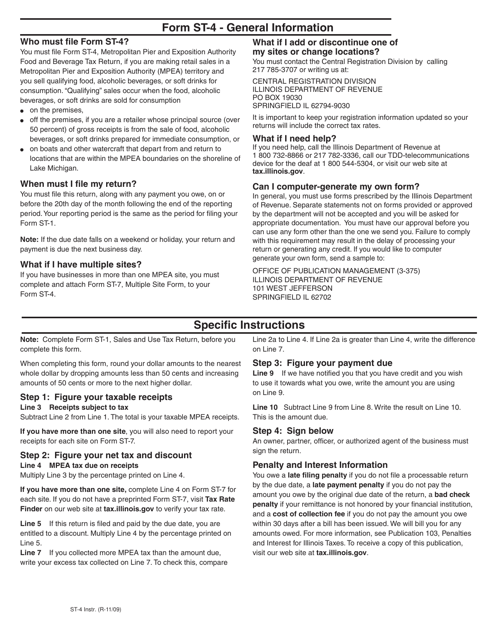

This document provides instructions for completing the Form ST-4, which is used for filing the Metropolitan Pier and Exposition Authority Food and Beverage Tax Return in Illinois. This type of document is helpful for business owners who are responsible for collecting and remitting food and beverage taxes in the designated area.

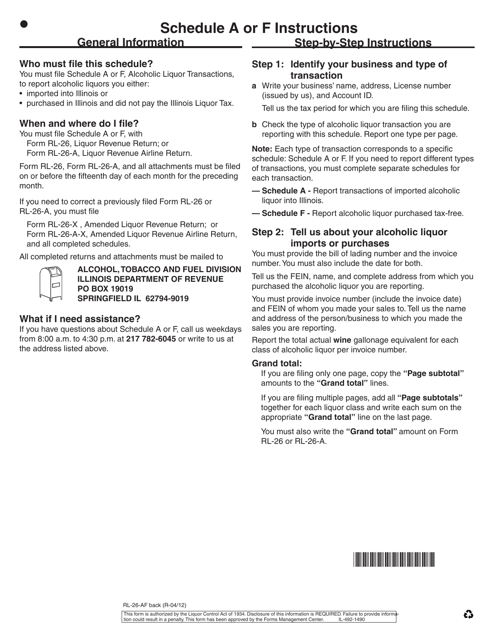

This document is for reporting alcoholic liquor transactions in Illinois. It provides instructions for completing Schedule A and Schedule F of Form RL-26-AF.

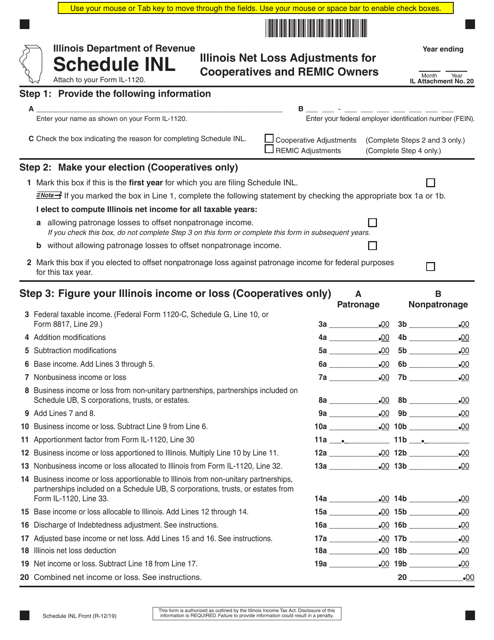

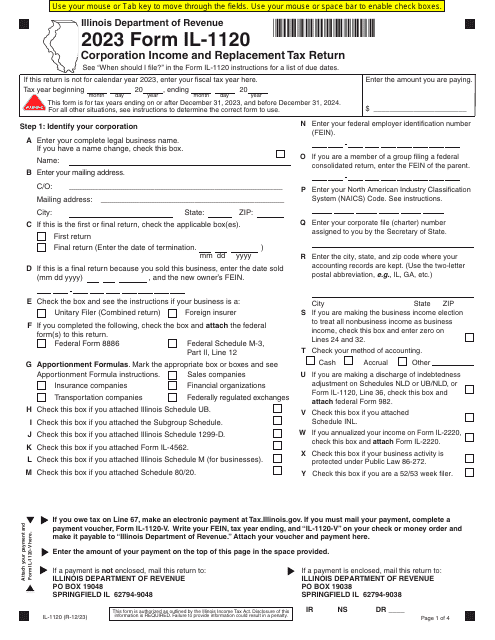

This form is used for scheduling net loss adjustments for cooperatives and REMIC owners in Illinois.

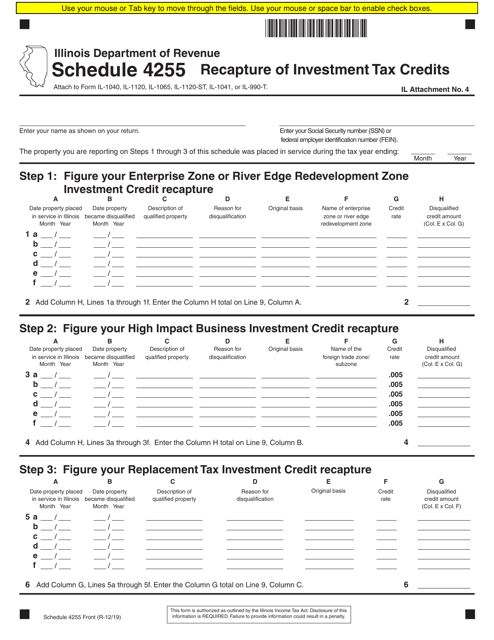

This Form is used for the recapture of investment tax credits in the state of Illinois.