Illinois Department of Revenue Forms

Documents:

857

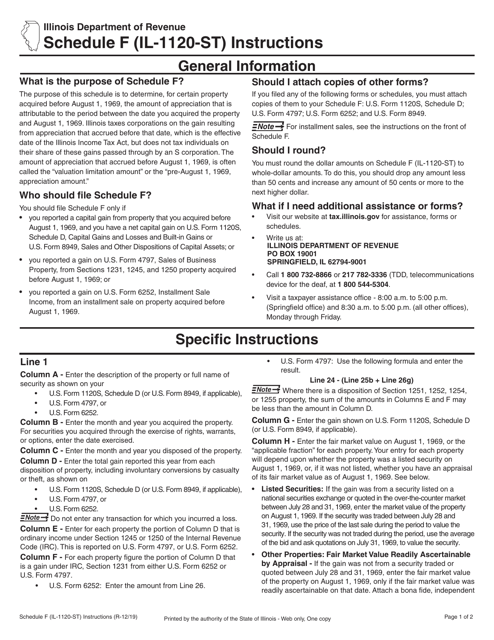

This document provides instructions for reporting gains from sales or exchanges of property acquired before August 1, 1969 on Form IL-1120-ST Schedule F. These instructions help businesses in Illinois accurately report their taxable gains to the state.

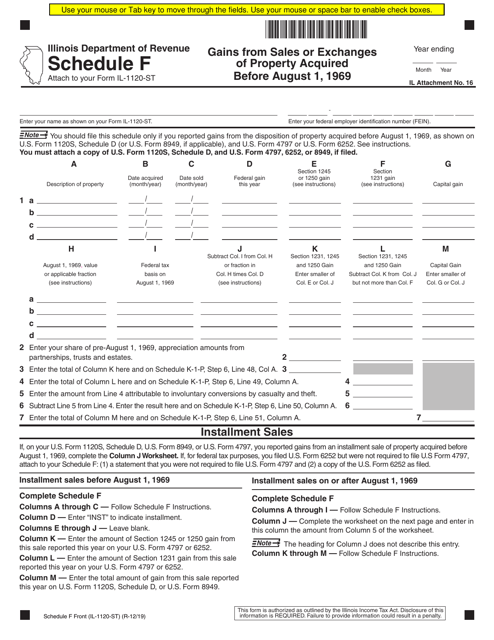

This document is used for reporting gains from the sale or exchange of property acquired before August 1, 1969 in the state of Illinois. It is a required schedule for Form IL-1120-ST.

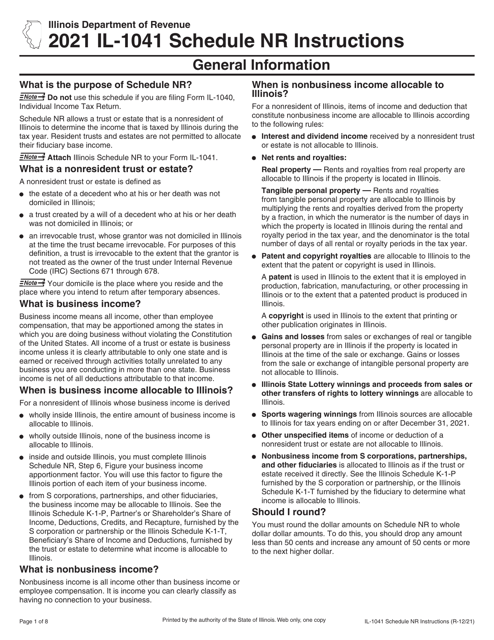

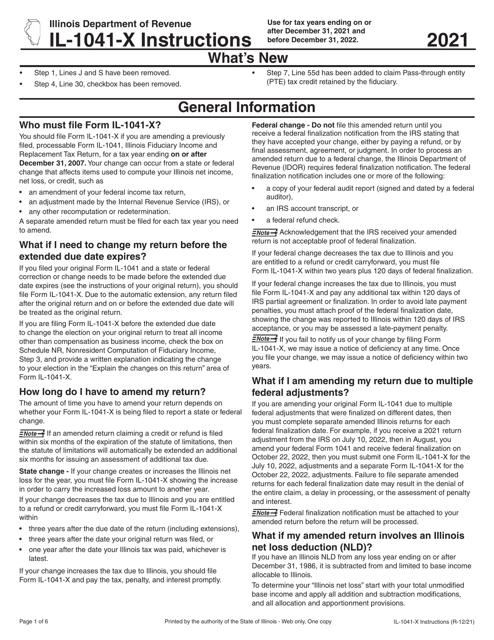

Instructions for Form IL-1041-X Amended Fiduciary Income and Replacement Tax Return - Illinois, 2021

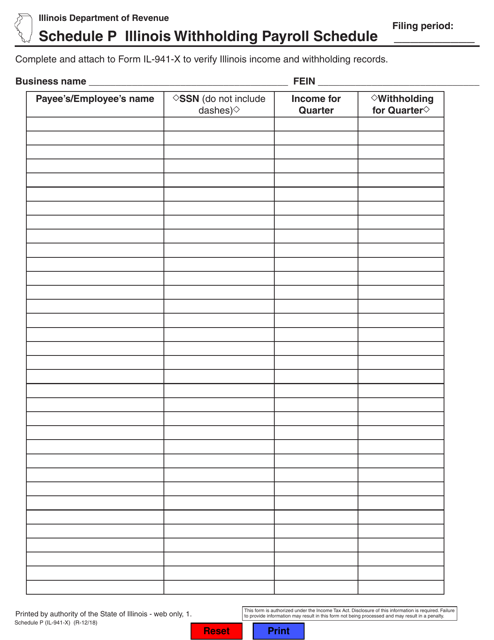

This document is a schedule used in Illinois for reporting and adjusting payroll withholding taxes. It is specifically for Form IL-941-X.

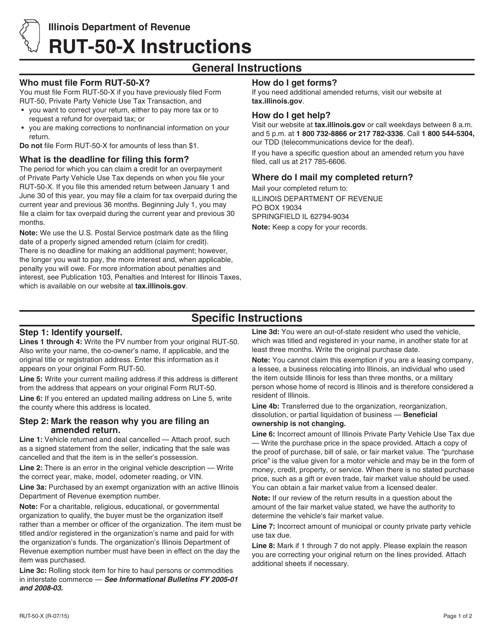

This Form is used for amending a private party vehicle tax transaction return in Illinois. It provides instructions on how to make changes to a previously filed Form RUT-50.

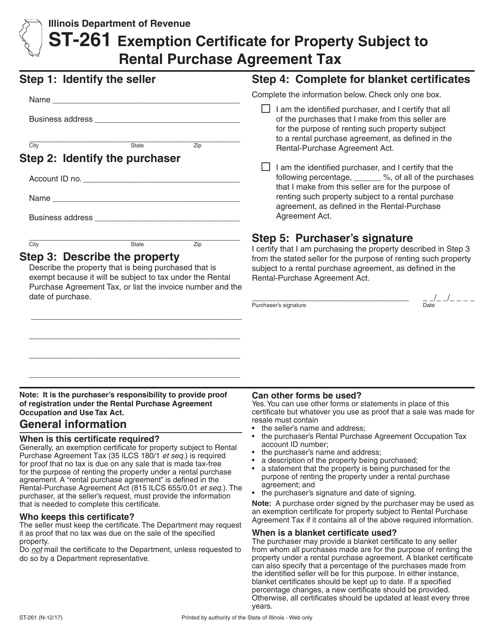

This form is used for claiming exemption from the rental purchase agreement tax on property in Illinois.

This Form is used for filing an amended Rental Purchase Agreement Occupation Tax Return in the state of Illinois. It provides instructions on how to make changes to your previously filed return.

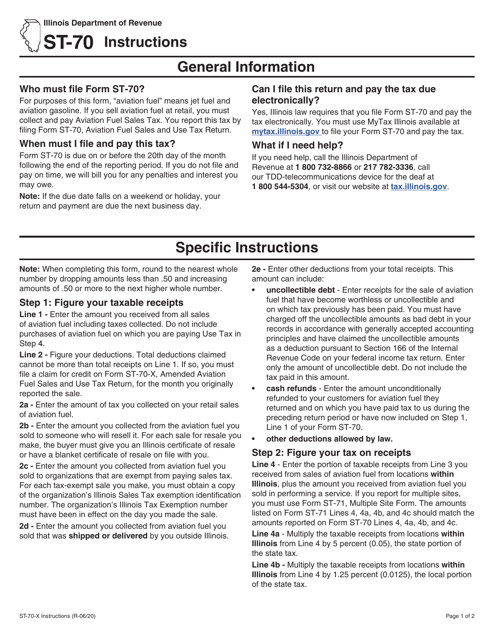

This Form is used for filing the Prepaid Sales Tax Return in the state of Illinois. It provides instructions on how to complete and submit the form accurately.

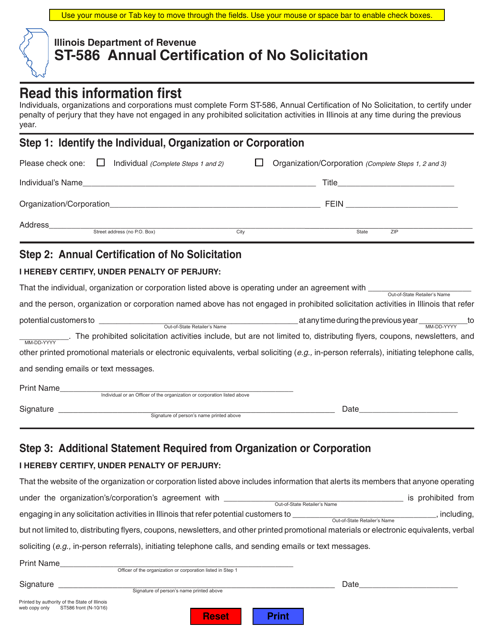

This Form is used for the Annual Certification of No Solicitation in the state of Illinois.

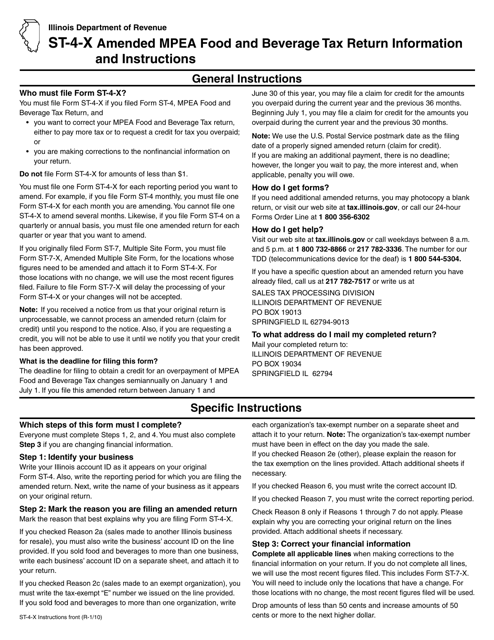

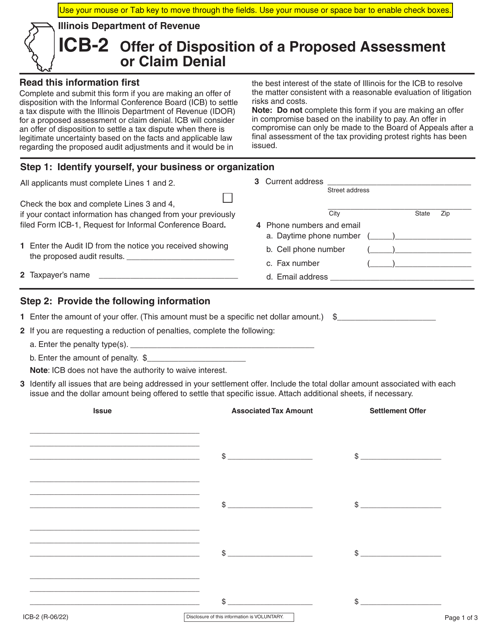

This document is used to provide instructions for filling out Form ST-4-X, which is the Amended Metropolitan Pier and Exposition Authority Food and Beverage Tax Return specific to the state of Illinois. It includes guidance on how to correct any errors or make changes to previously filed tax returns related to food and beverage taxes.

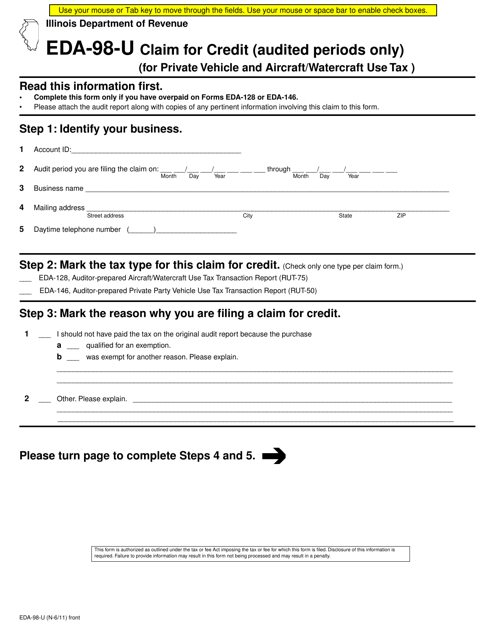

This form is used for claiming a credit for private vehicle and aircraft/watercraft use tax in Illinois.

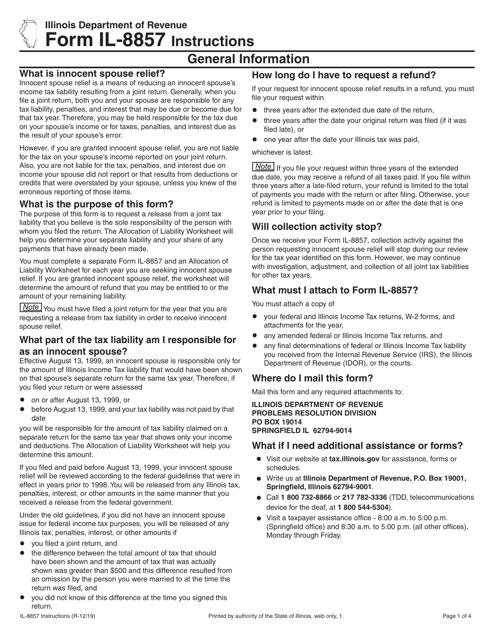

This form is used for requesting innocent spouse relief in the state of Illinois.

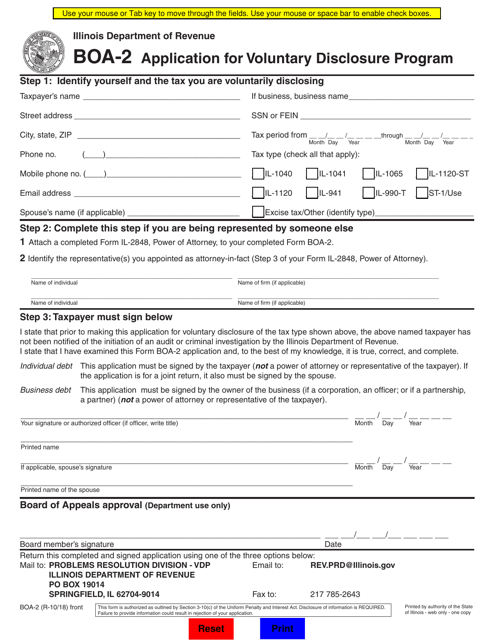

This Form is used for applying to the Voluntary Disclosure Program in the state of Illinois. It allows individuals or businesses to disclose any unpaid taxes and penalties in exchange for reduced penalties and potential immunity from legal action.

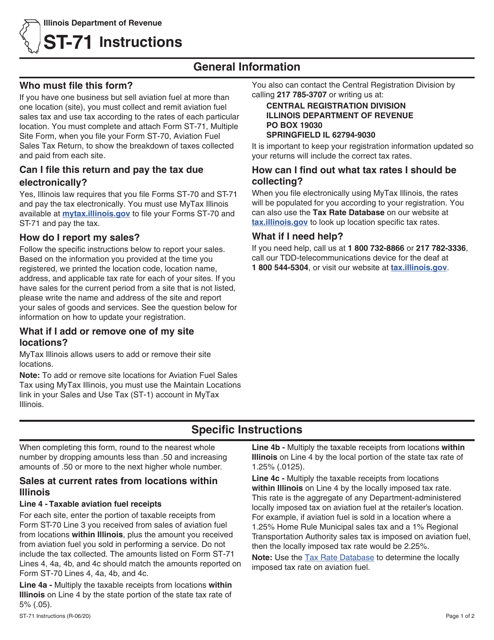

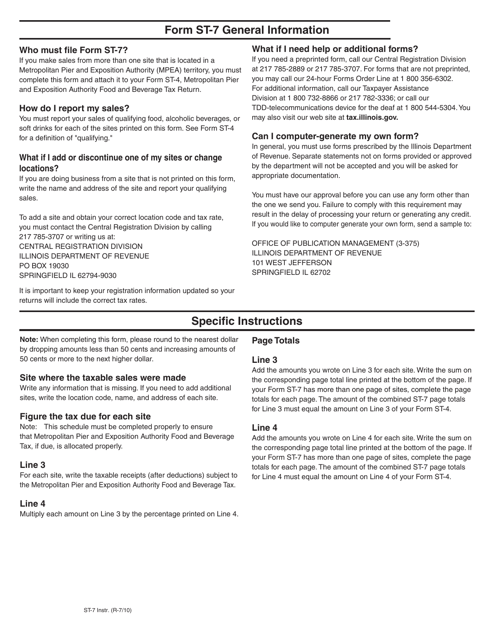

This Form is used for reporting multiple sites in Illinois for sales and use tax purposes. The instructions provide guidance on how to fill out and submit the form correctly.

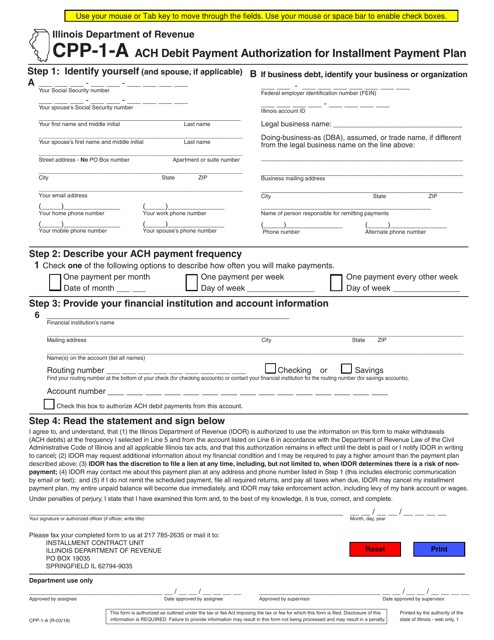

This form is used for authorizing an ACH debit payment for an installment payment plan in the state of Illinois.

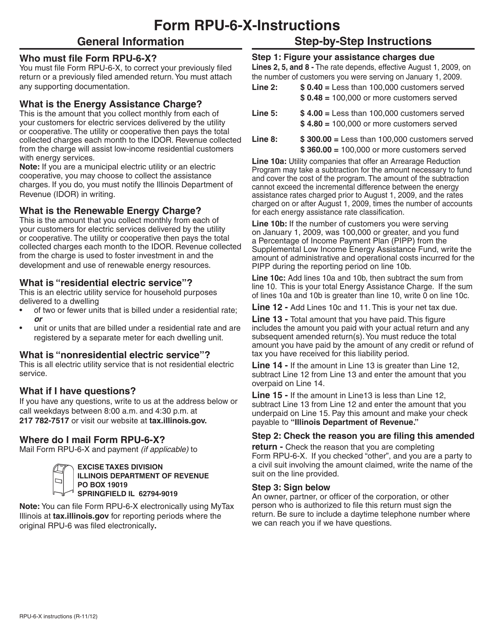

This form is used for filing an amended assistance charges return for electricity distributors in Illinois. It provides instructions for completing the Form RPU-6-X, which allows distributors to make corrections or updates to their original return.

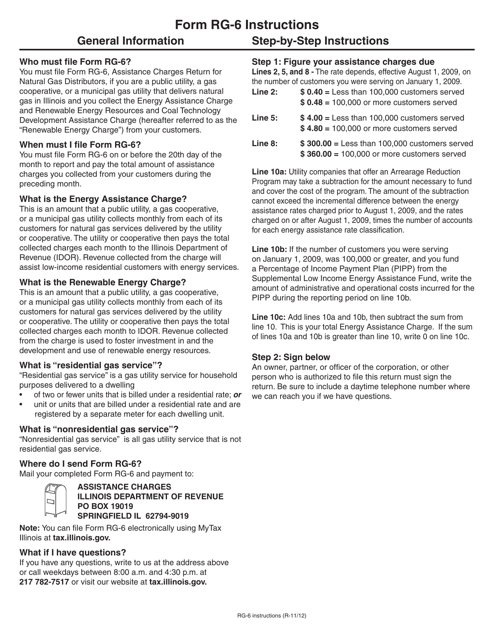

This form is used for natural gas distributors in Illinois to report and pay assistance charges.

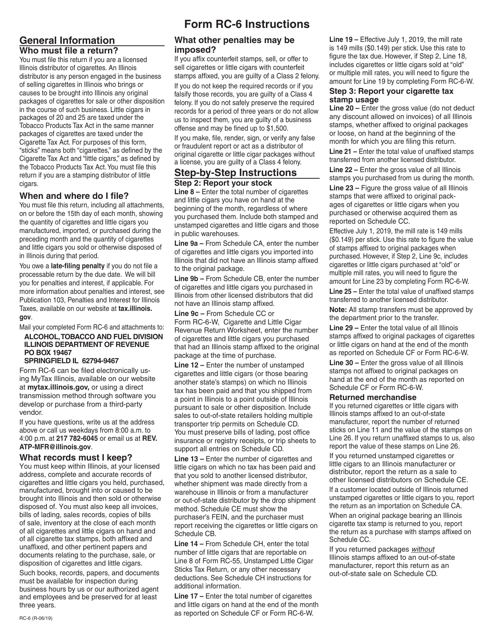

This Form is used for reporting and paying cigarette and little cigar revenue in the state of Illinois.

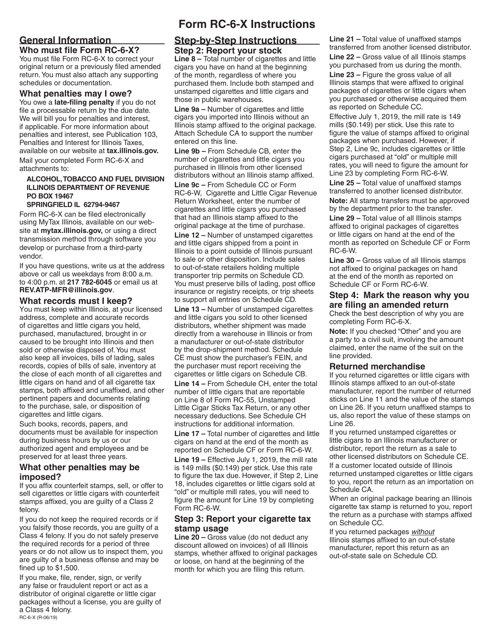

This document provides instructions for filling out Form RC-6-X, which is used to report amended cigarette and little cigar revenue returns in the state of Illinois.

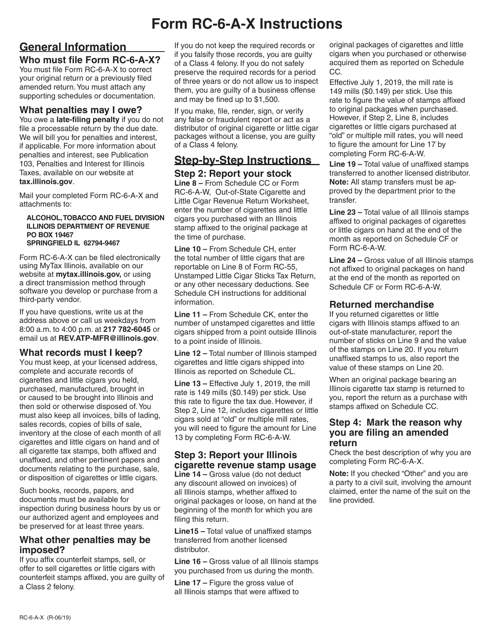

This Form is used for filing an amended out-of-state cigarette and little cigar revenue return for the state of Illinois. It provides instructions on how to report any changes or corrections to the original return.

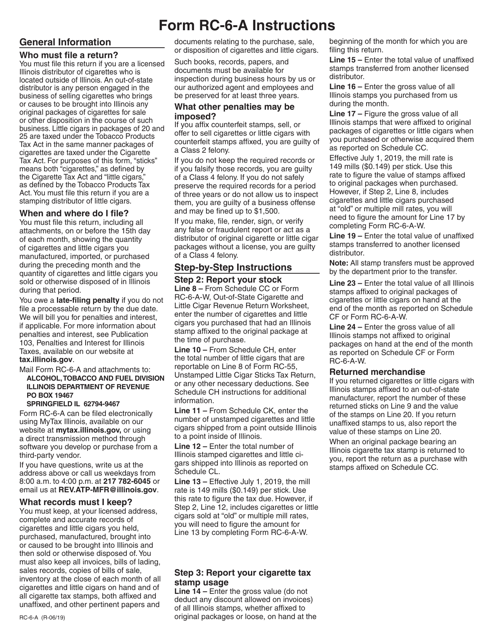

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.