Illinois Department of Revenue Forms

Documents:

857

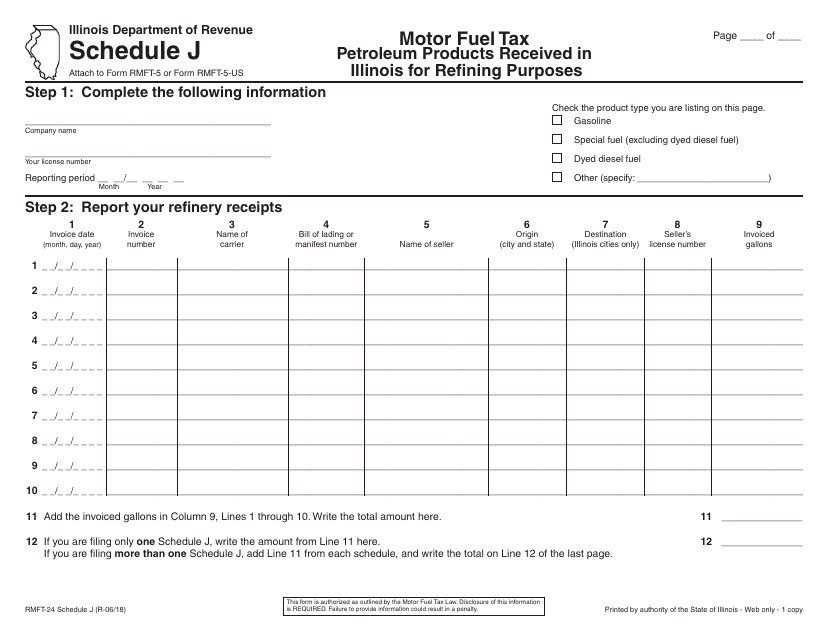

This form is used in Illinois to report the quantity of petroleum products received for refining purposes.

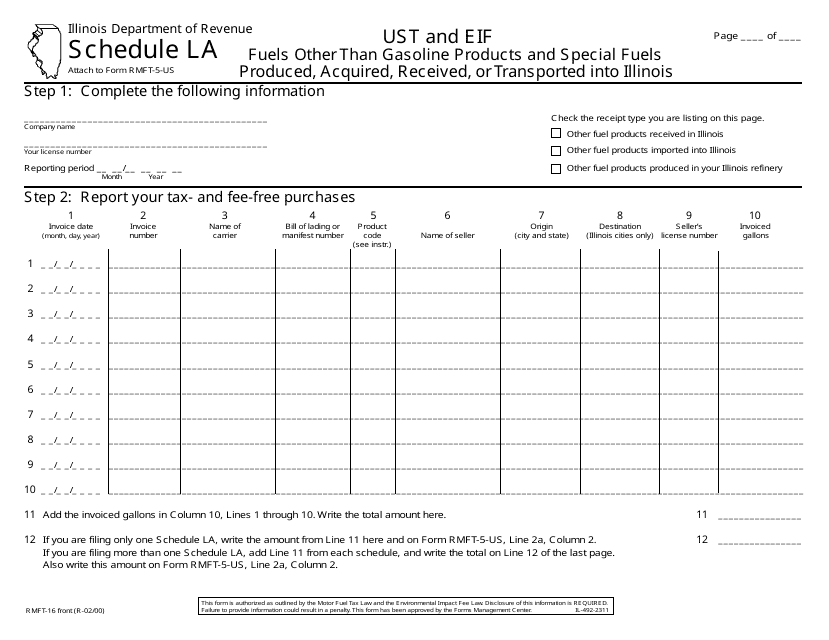

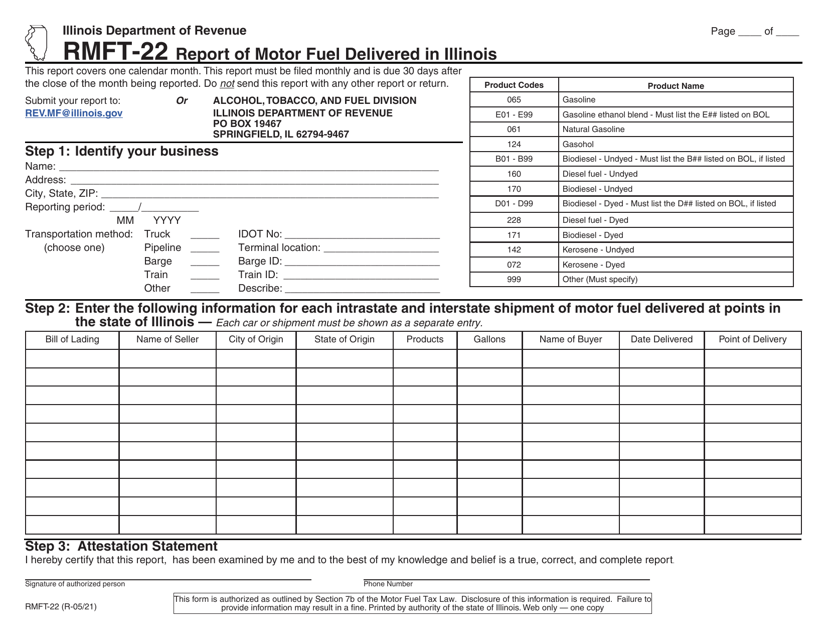

This form is used for reporting fuels other than gasoline products and special fuels that are produced, acquired, received, or transported into Illinois. It is specifically for use in the state of Illinois.

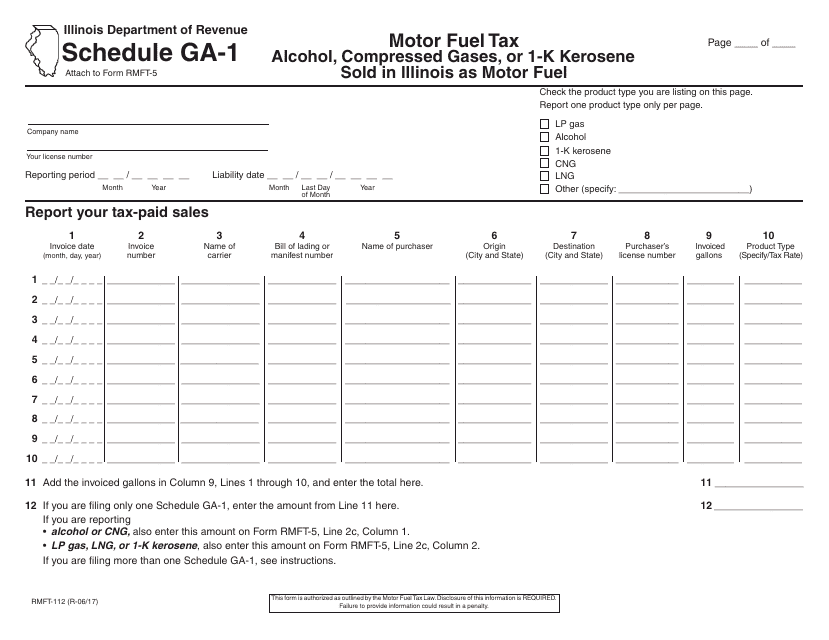

This form is used for reporting the sale of alcohol, compressed gases, or 1-k Kerosene in Illinois as motor fuel.

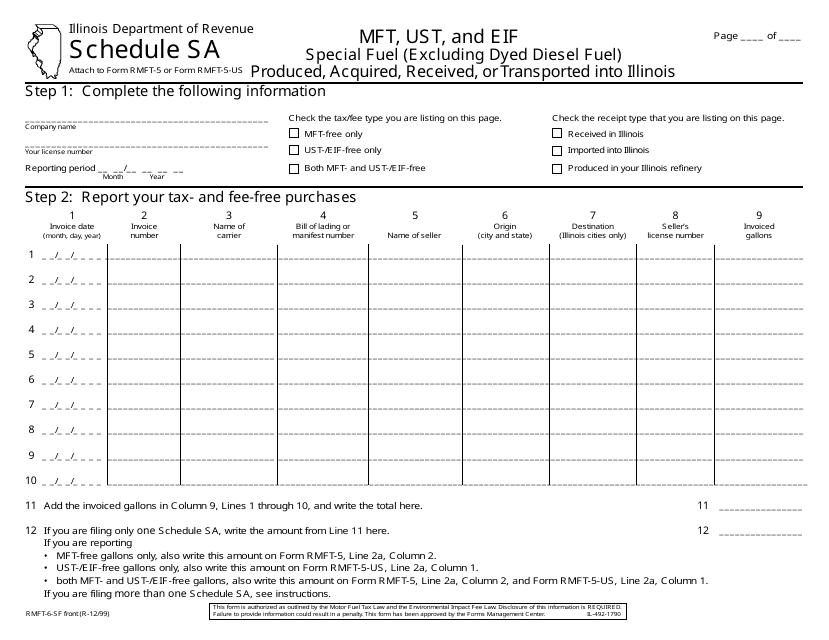

This form is used for reporting the production, acquisition, receipt, or transportation of special fuel (excluding dyed diesel fuel) into Illinois.

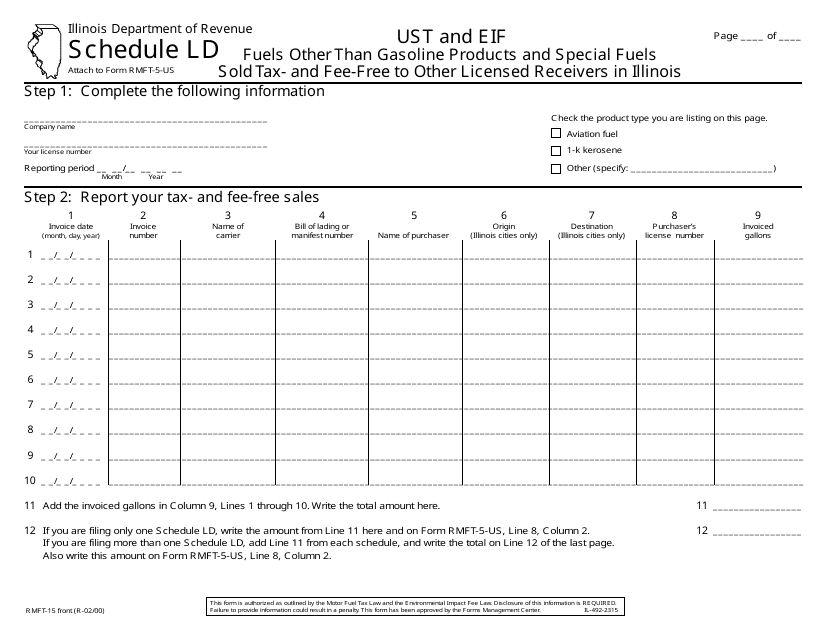

This form is used for reporting and documenting the sales of fuels other than gasoline products and special fuels that are sold tax- and fee-free to other licensed receivers in Illinois.

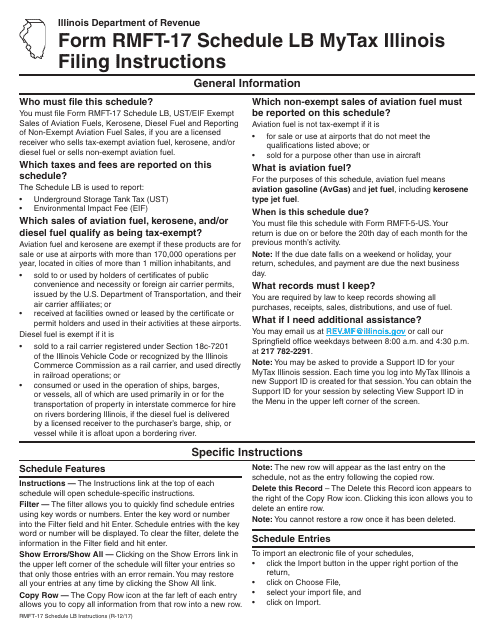

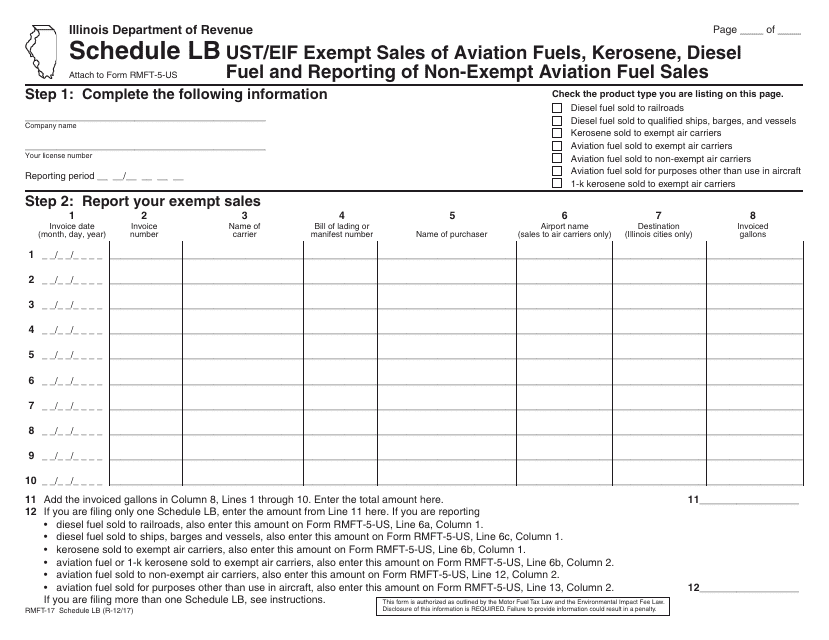

This Form is used for reporting exempt and non-exempt sales of aviation fuels in Illinois. It provides instructions for filling out Schedule LB of Form RMFT-17.

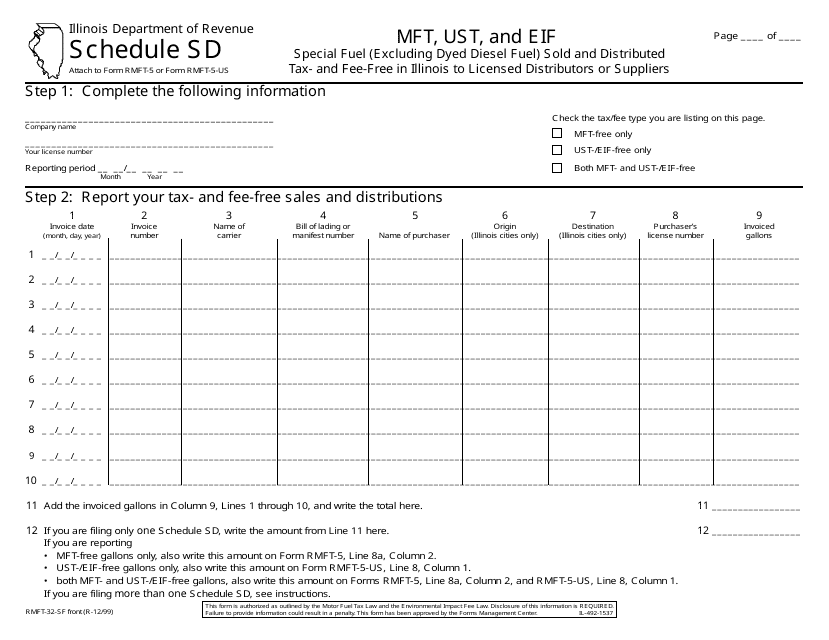

This Form is used for reporting special fuel sales in Illinois that are tax- and fee-free. It is specifically for licensed distributors or suppliers and excludes dyed diesel fuel.

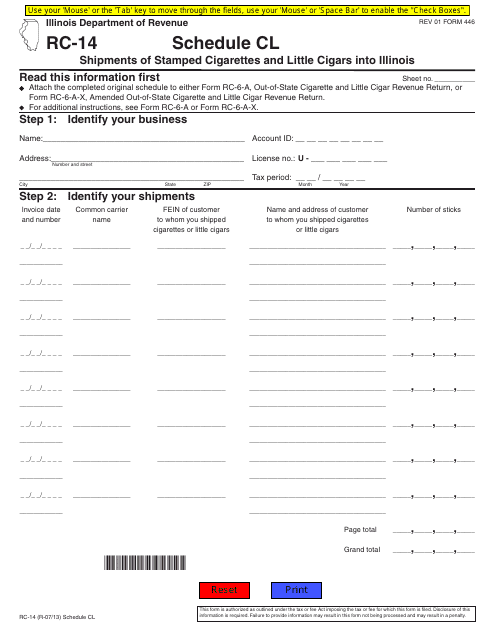

This document is for reporting shipments of stamped cigarettes and little cigars into Illinois.

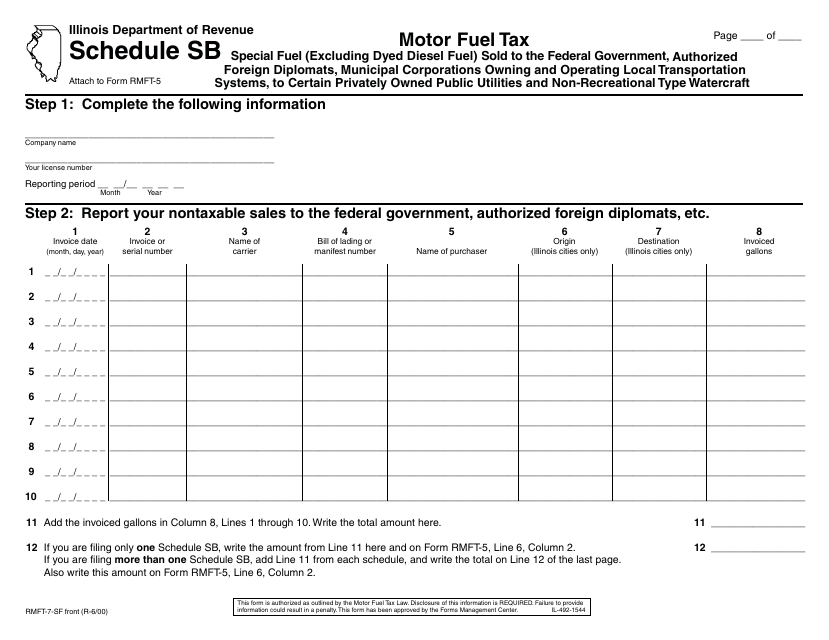

This form is used for reporting the sales of special fuel (excluding dyed diesel fuel) to the Federal Government, authorized foreign diplomats, municipal corporations owning and operating local transportation systems, certain privately owned public utilities, and non-recreational type watercraft in Illinois.

This form is used for reporting the exempt sales of aviation fuels, kerosene, and diesel fuel, as well as reporting non-exempt aviation fuel sales in Illinois.

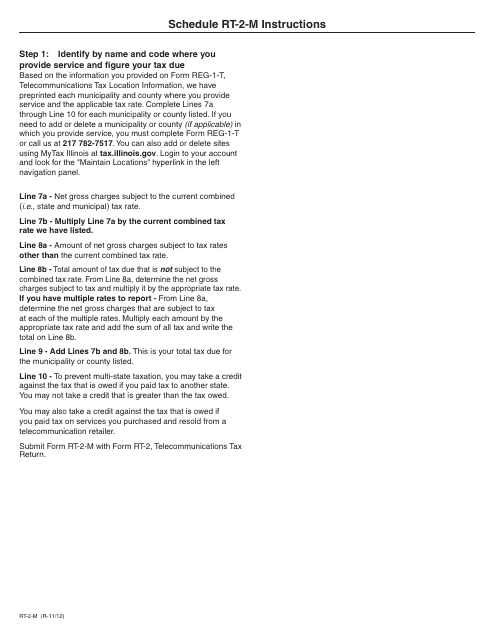

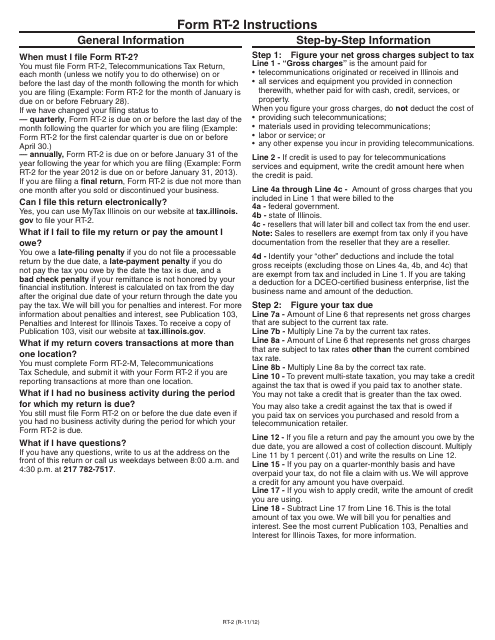

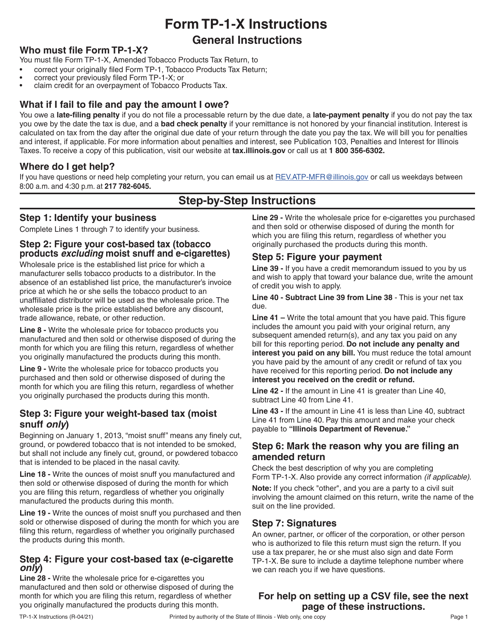

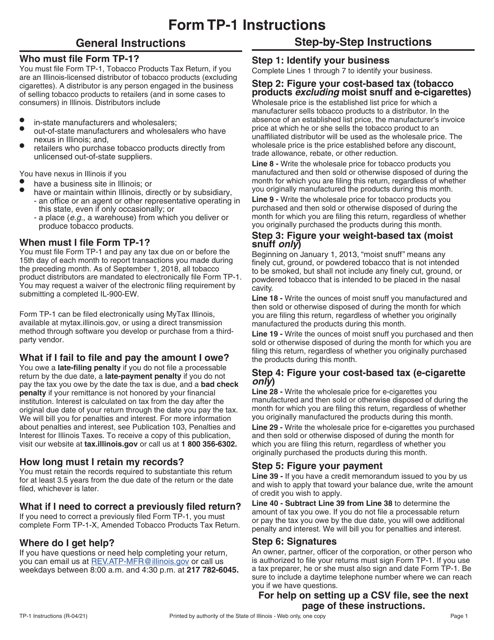

This document provides instructions for completing Form RT-2-M, which is used to report and calculate telecommunications tax in the state of Illinois. It provides step-by-step guidance on how to fill out the form accurately and correctly.

This Form is used for filing the Telecommunications Tax Return in the state of Illinois. It provides instructions on how to complete and submit Form RT-12 and Form RT-2.

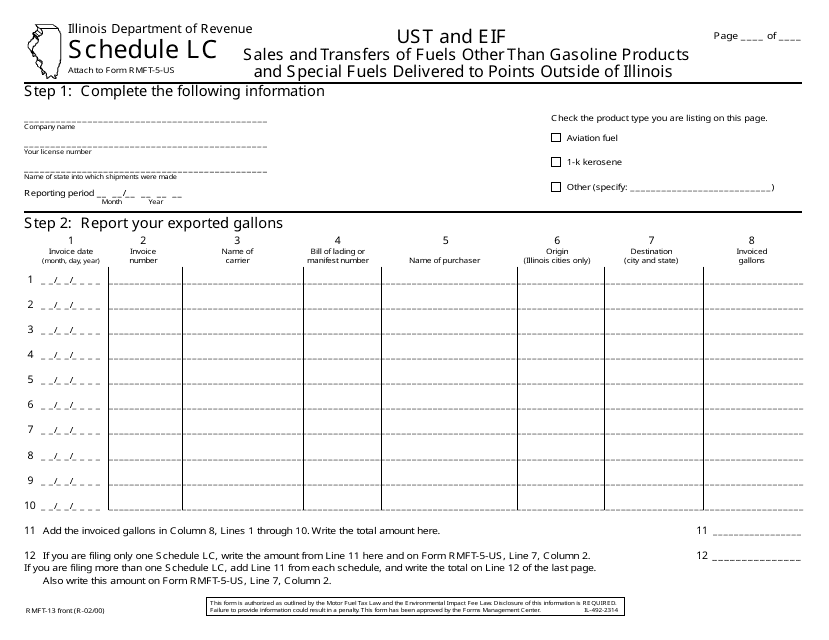

This form is used for reporting sales and transfers of fuels other than gasoline products and special fuels that are delivered to points outside of Illinois.

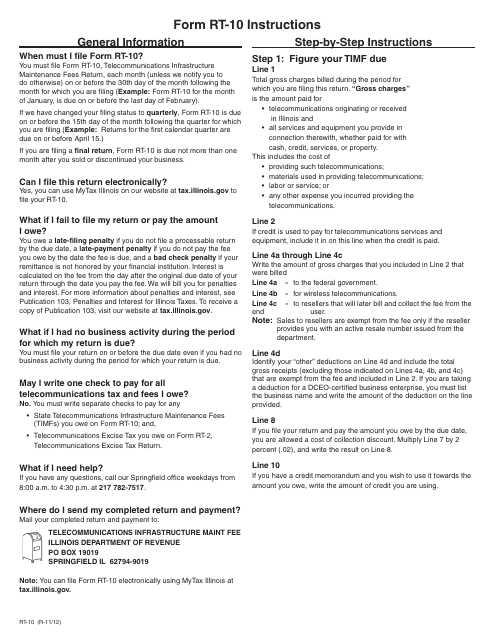

This document provides instructions for completing Form RT-10 Telecommunications Infrastructure Maintenance Fee (TIMF) Return in the state of Illinois. The form is used by telecommunications companies to report and pay the TIMF fee. It outlines the various sections of the form and provides guidance on how to accurately fill it out.

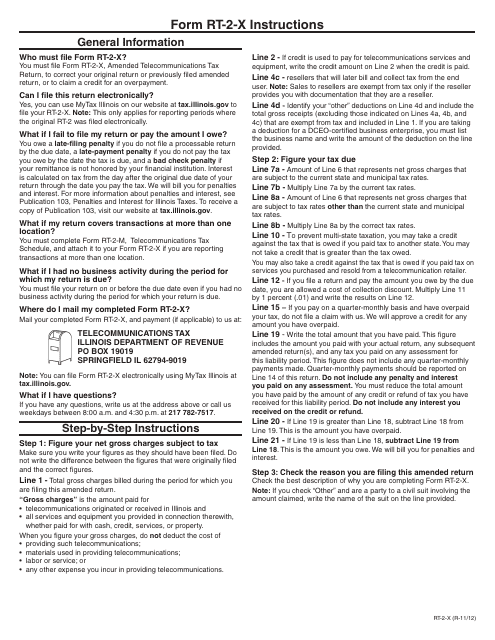

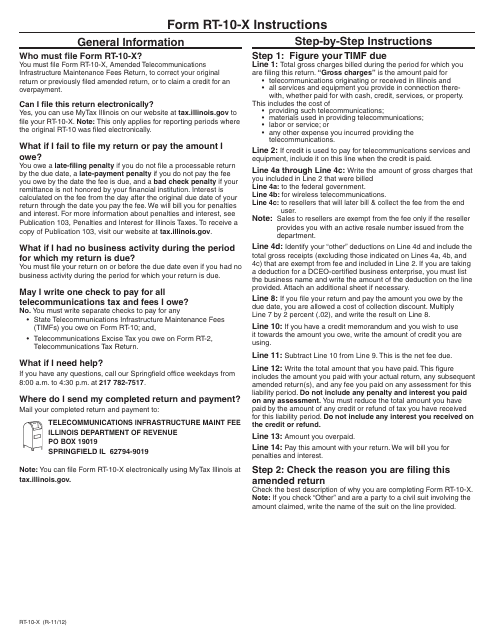

This Form is used for filing an amended telecommunications tax return in the state of Illinois. It provides instructions on how to correct any errors or make changes to a previously filed return.

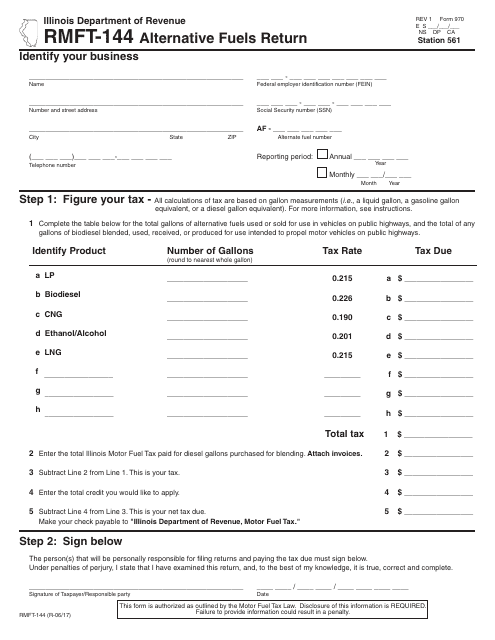

This form is used for reporting and paying Alternative Fuels Tax in the state of Illinois.

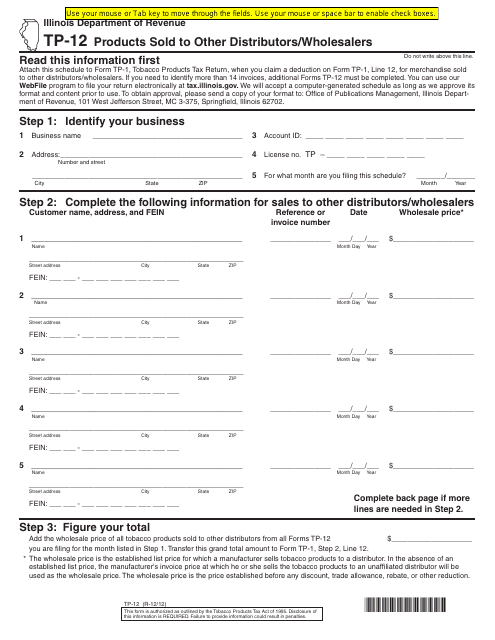

This form is used for reporting the products sold to other distributors or wholesalers in the state of Illinois. It is used for tax purposes and allows businesses to accurately report their sales.

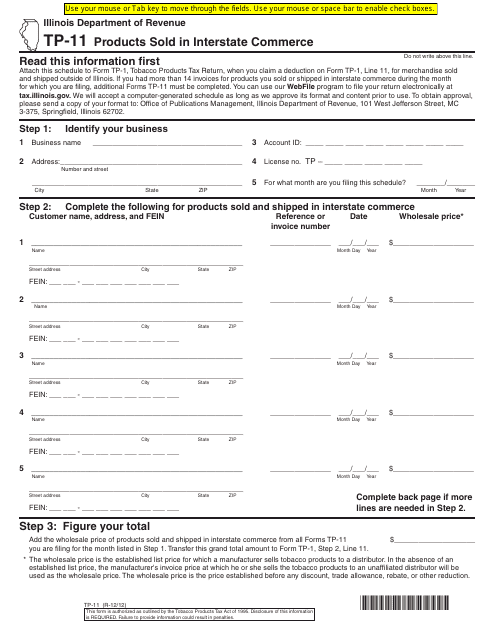

This Form is used for reporting products sold in interstate commerce in the state of Illinois.

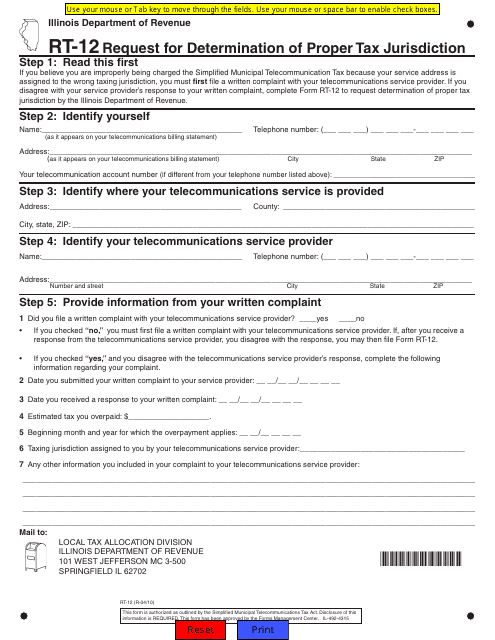

This form is used for requesting a determination of the proper tax jurisdiction in the state of Illinois.

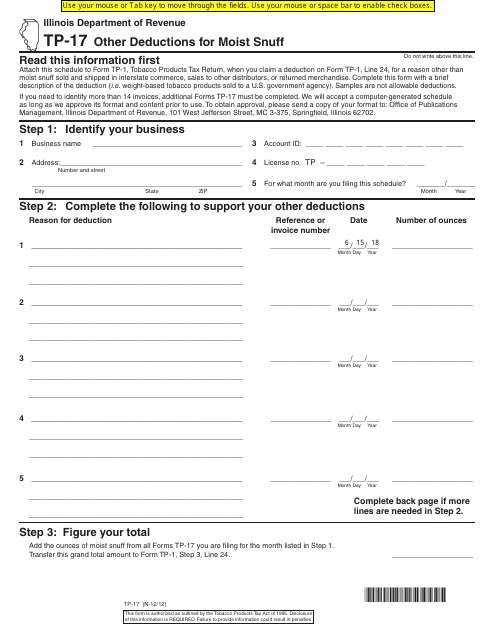

This Form is used for reporting other deductions related to the purchase of moist snuff in the state of Illinois.

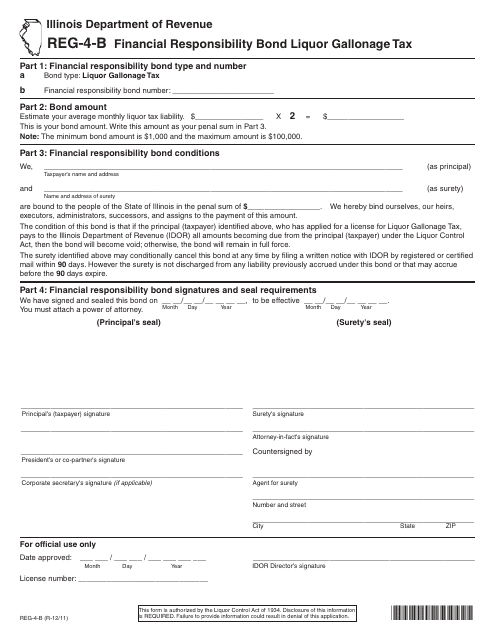

This form is used for obtaining a financial responsibility bond for paying the liquor gallonage tax in the state of Illinois.

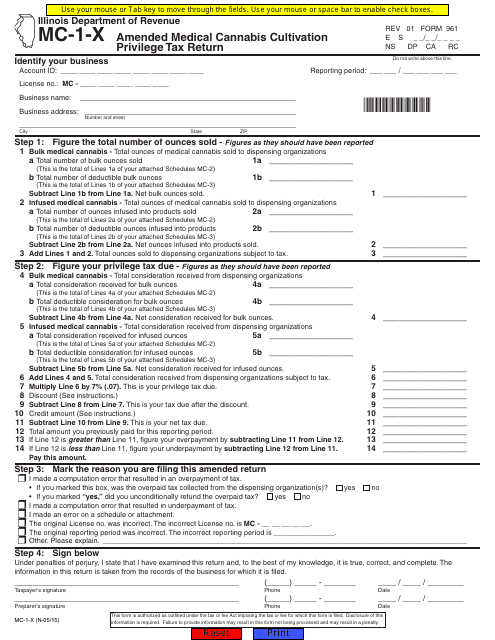

This form is used for filing an amended tax return for the cultivation of medical cannabis in Illinois.

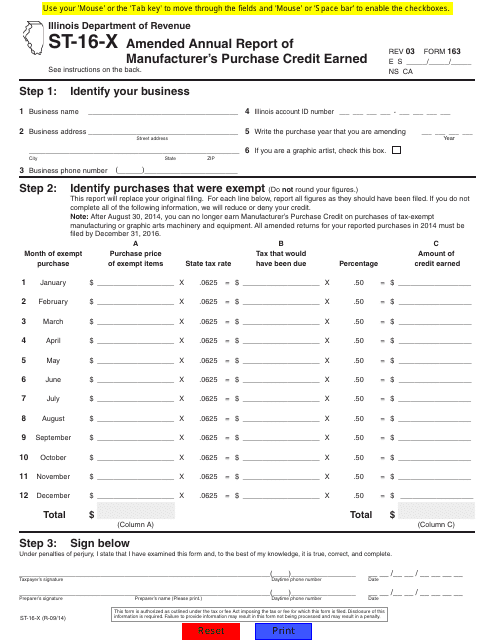

This Form is used for filing an amended annual report of manufacturer's purchase credit earned in the state of Illinois.

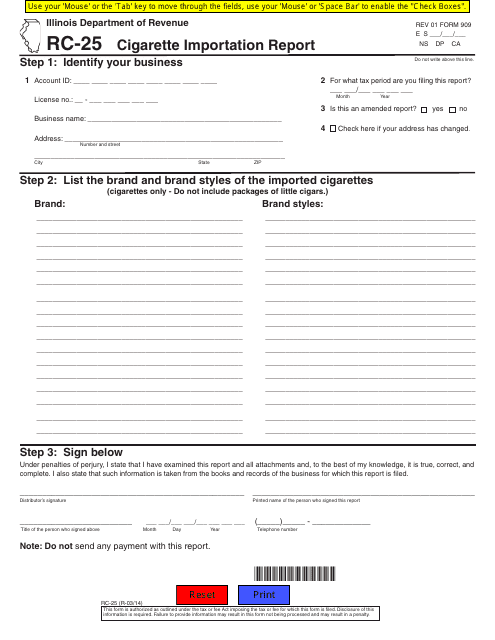

This form is used for reporting the importation of cigarettes in the state of Illinois.

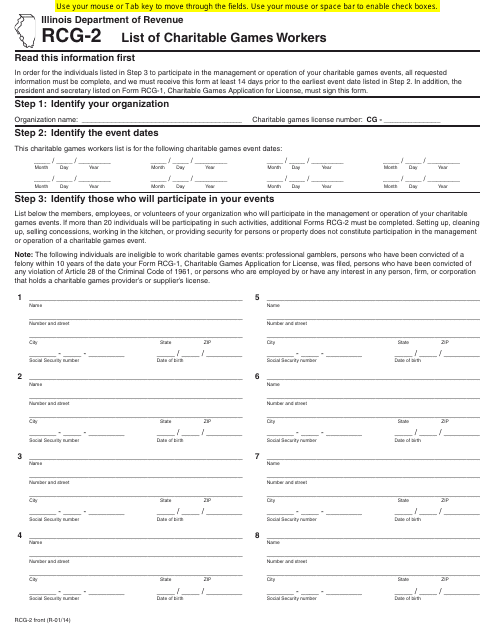

This form is used for listing the workers involved in charitable games in Illinois.

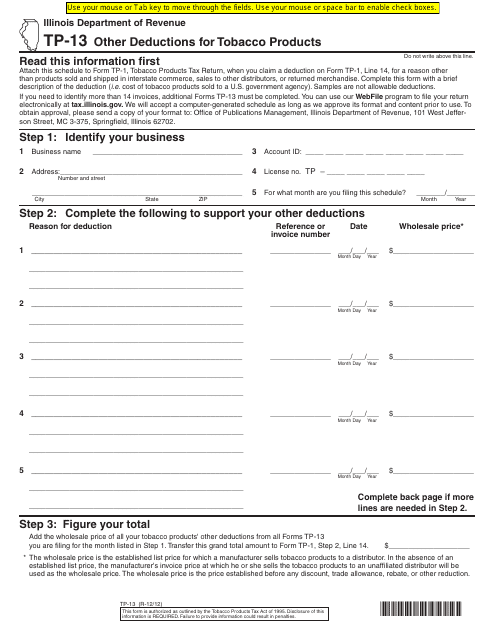

This form is used for reporting and claiming deductions for other tobacco products in the state of Illinois.

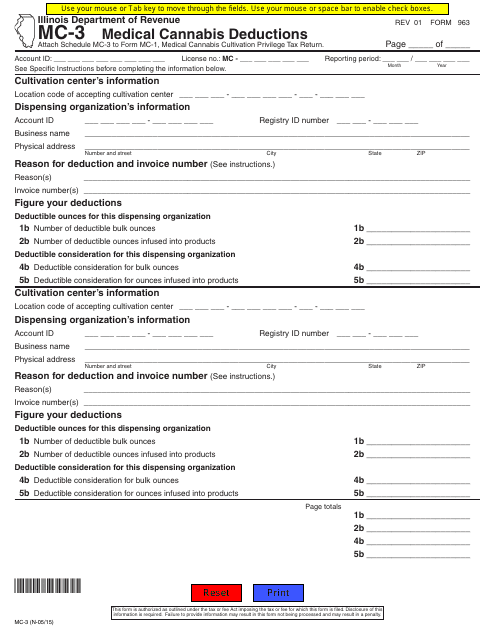

This form is used for claiming medical cannabis deductions in Illinois.

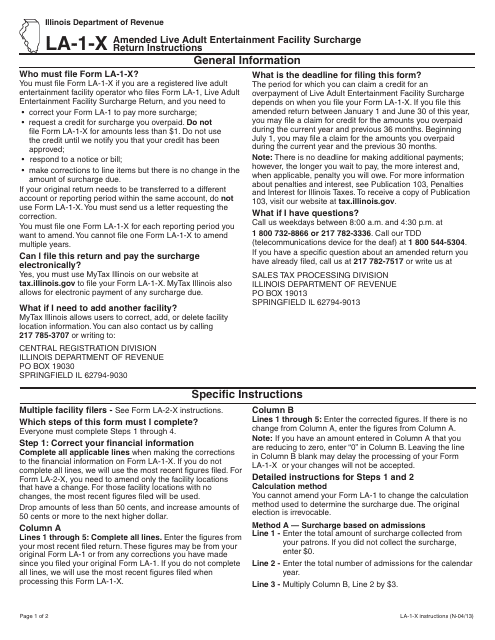

This Form is used for filing an amended return for the Live Adult Entertainment Facility Surcharge in Illinois. It provides instructions on how to correctly report any changes or corrections to the original return filed.

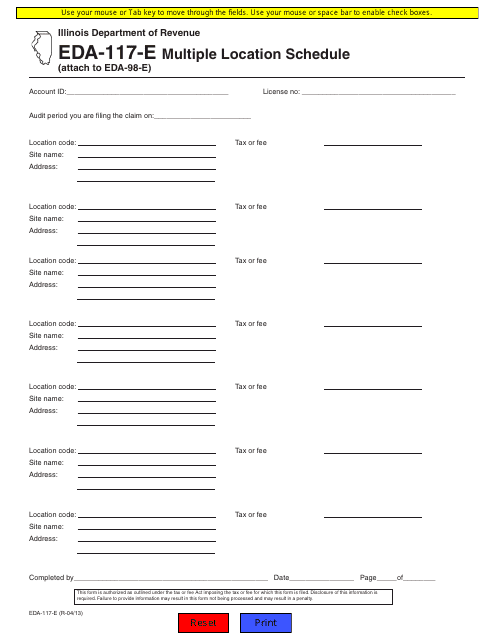

This form is used for reporting multiple locations for the state of Illinois.

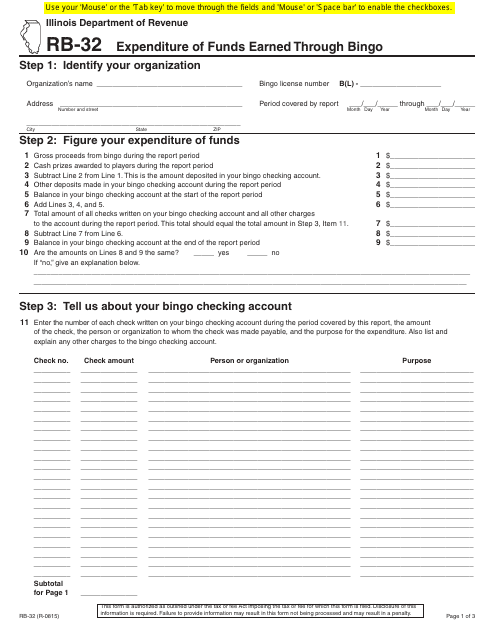

This document is used for reporting the expenditure of funds earned through bingo in the state of Illinois.

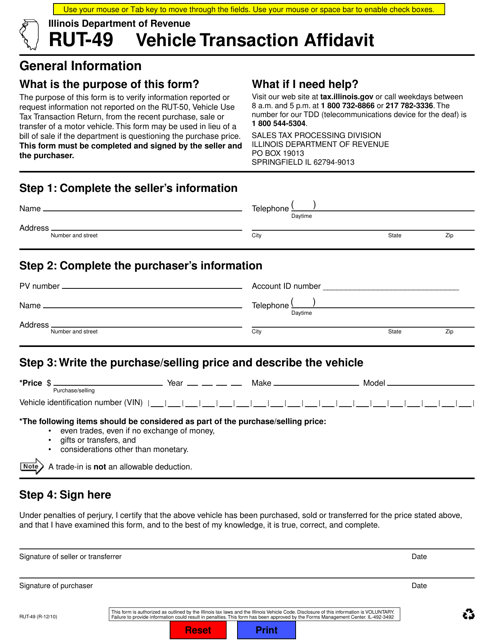

This form is used for recording vehicle transactions in the state of Illinois. It serves as an affidavit and must be completed and submitted when certain transactions occur, such as transferring ownership or changing vehicle details.

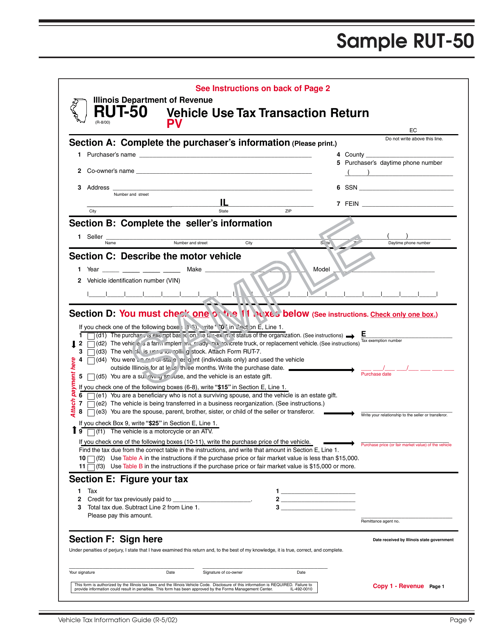

Use this form as a legal document completed by Illinois residents who purchased or acquired by transfer or gift a motor vehicle from a private party in the state of Illinois.

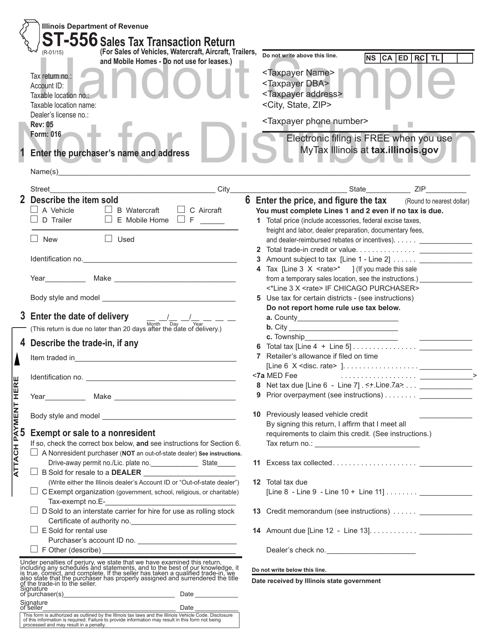

This is a form that is used to register a vehicle title with the State of Illinois government agency.