Internal Revenue Service Forms and Templates

Documents:

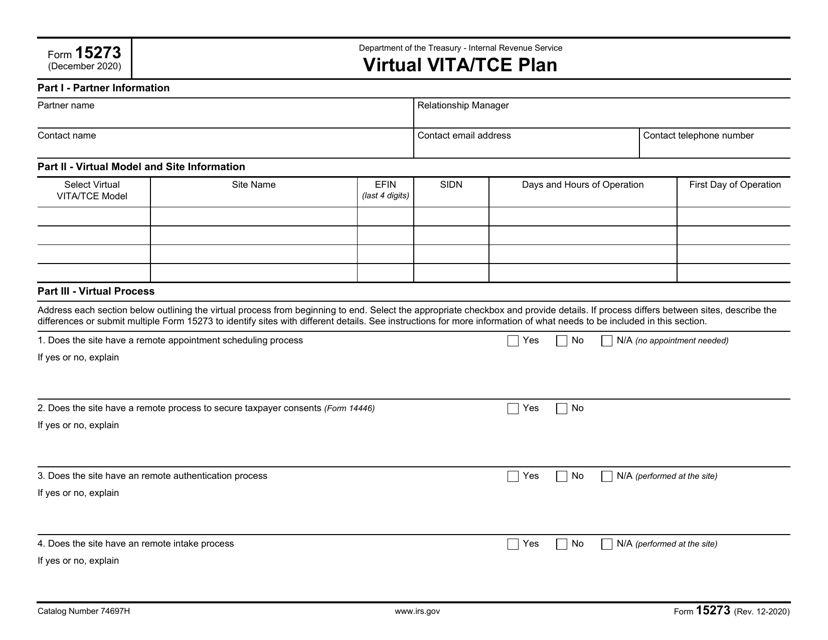

273

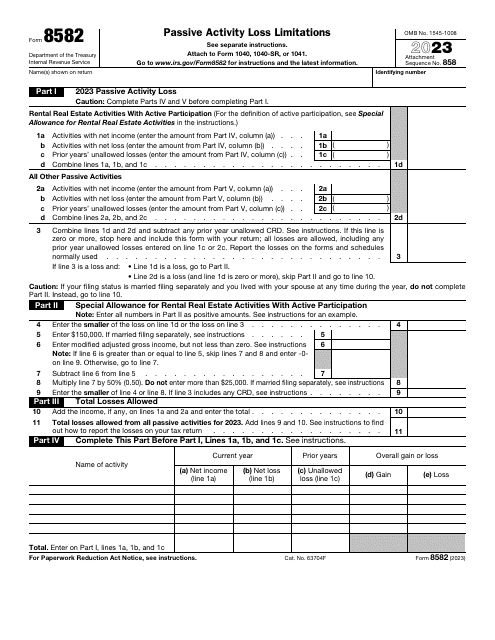

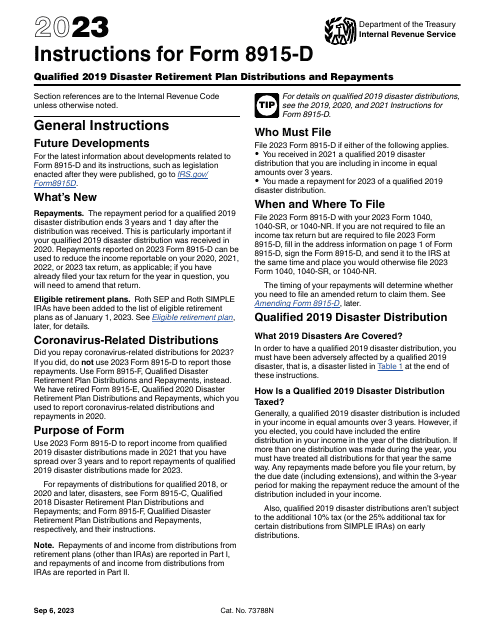

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

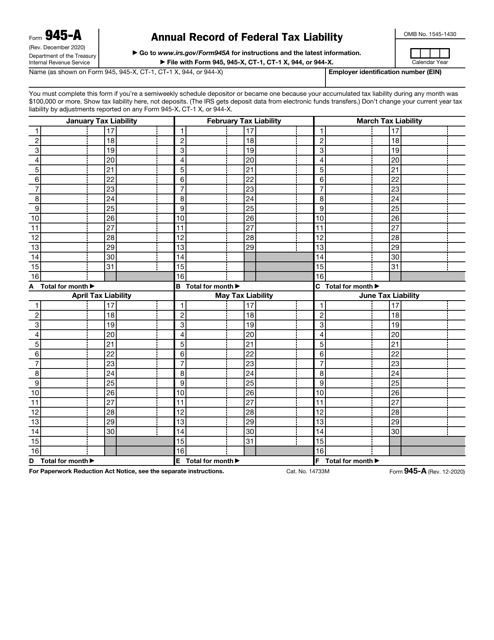

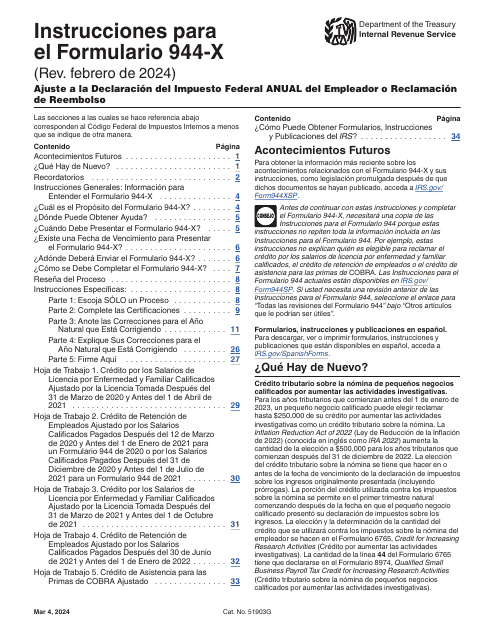

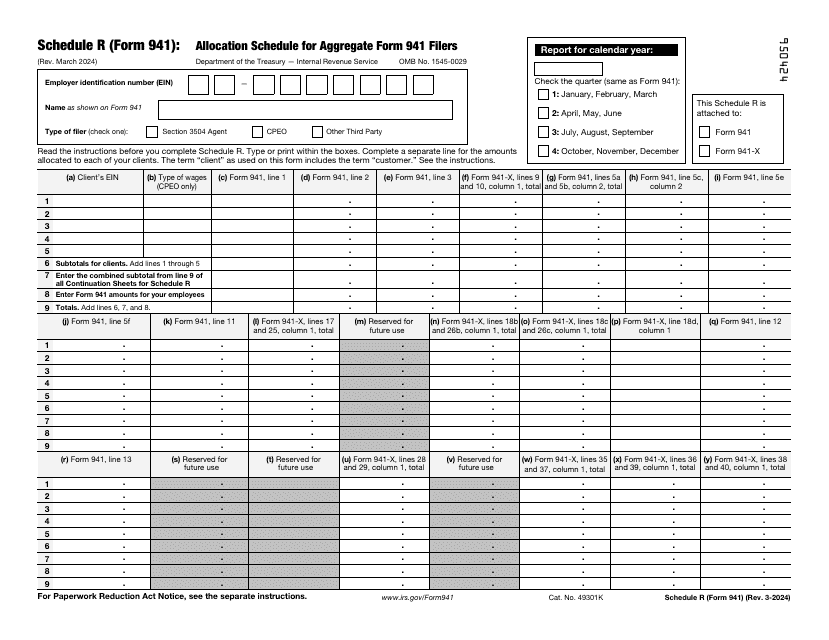

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

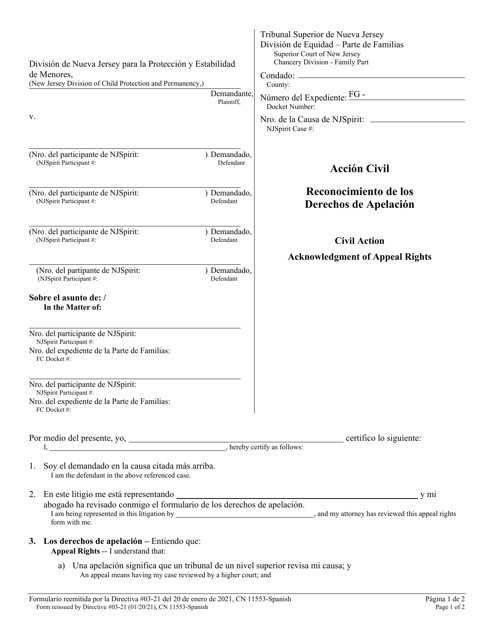

This document is used for acknowledging the appeal rights in New Jersey. It is available in both English and Spanish.

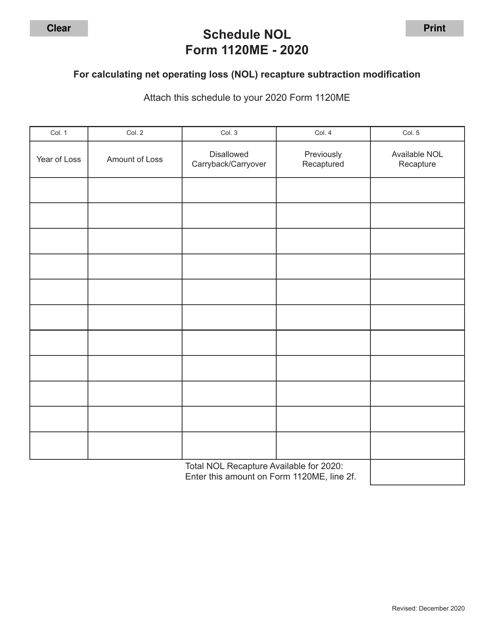

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

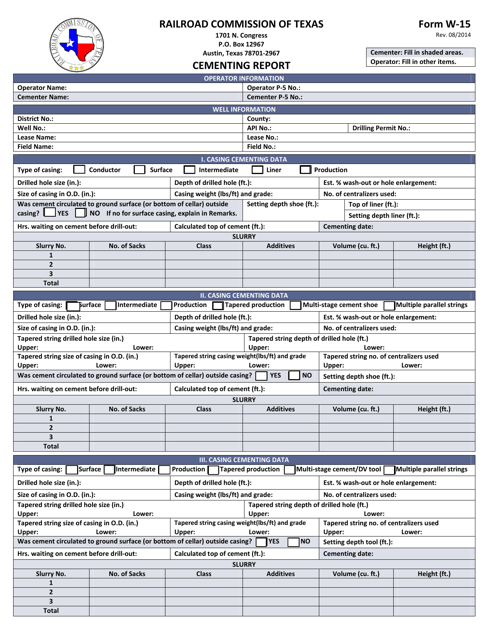

This Form is used for submitting a cementing report in the state of Texas. It provides information about the cementing process for oil and gas wells.

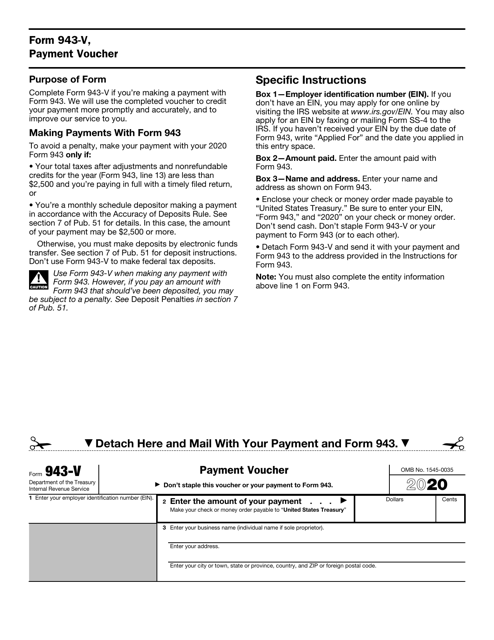

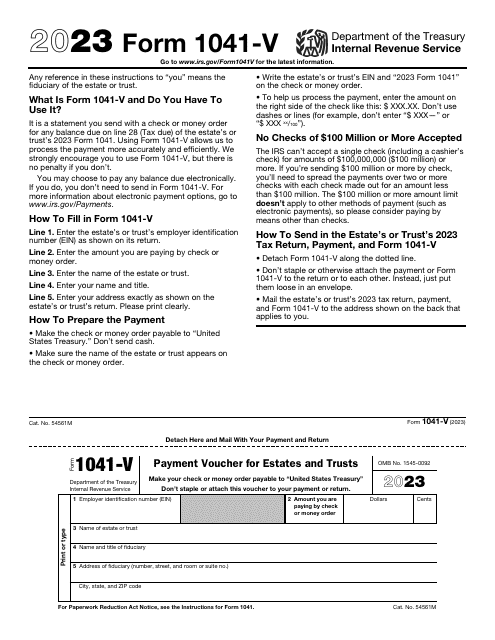

This form is used for making payment vouchers for IRS Form 943.

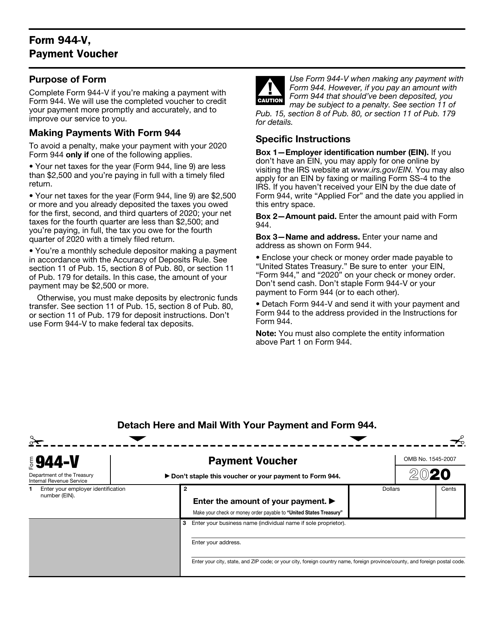

This Form is used for making payments to the IRS for certain small employers. It serves as a payment voucher when submitting payments with Form 944.

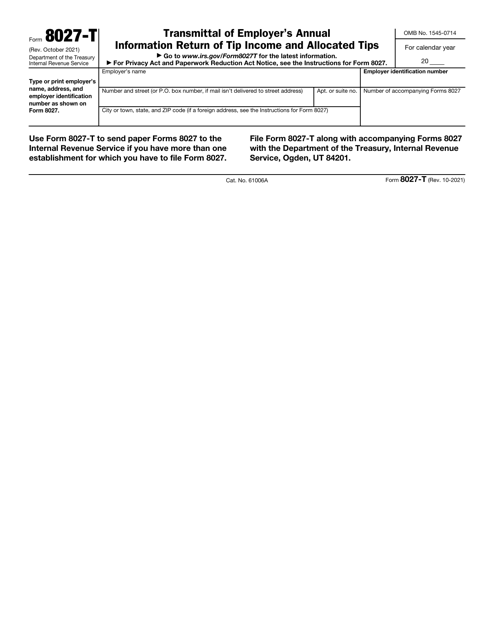

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

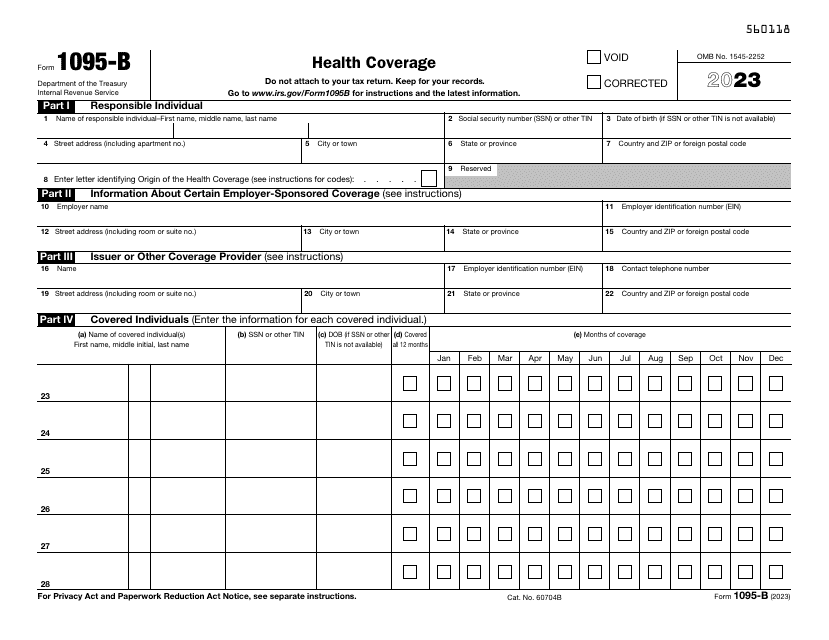

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.