Internal Revenue Service Forms and Templates

Documents:

273

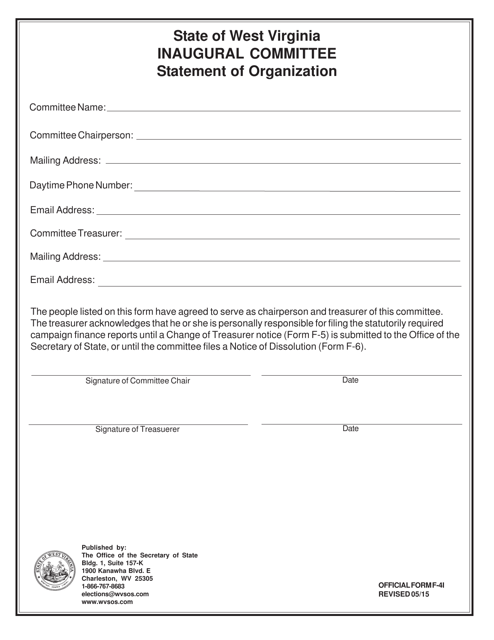

This form is used for filing a Statement of Organization for an Inaugural Committee in West Virginia. It is an official document that provides details about the organization and its purpose.

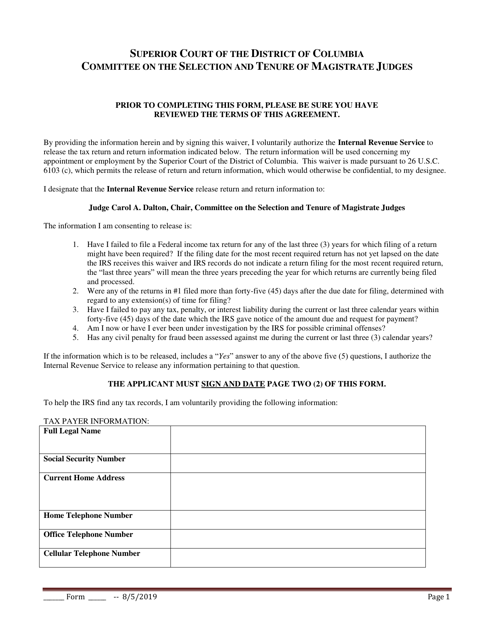

This document is used for requesting a waiver of taxes in Washington, D.C.

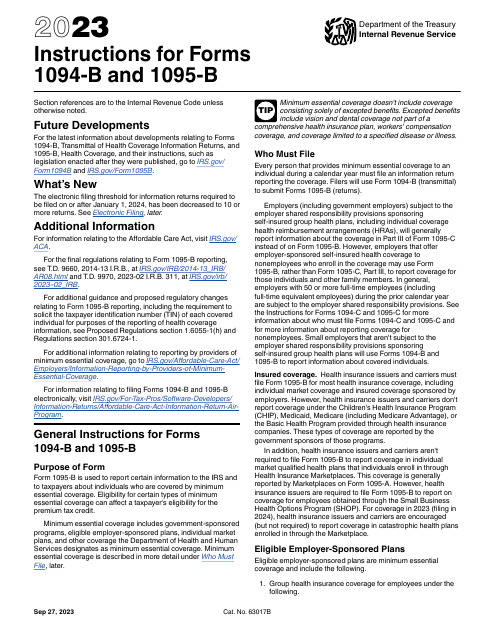

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

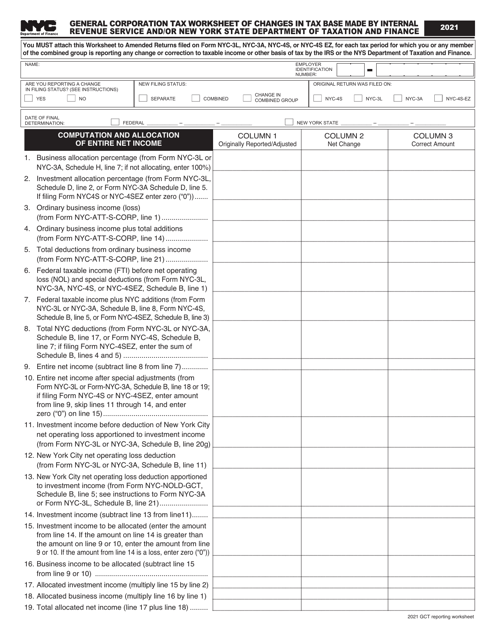

This document provides a worksheet for calculating changes in tax base made by the Internal Revenue Service (IRS) and/or the New York State Department of Taxation and Finance for general corporation tax in New York City.

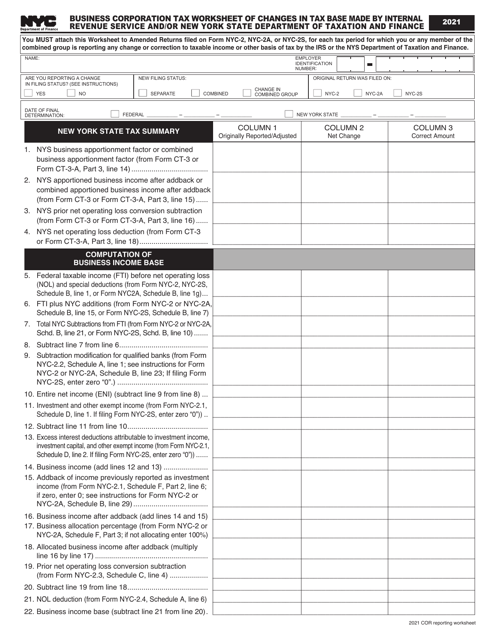

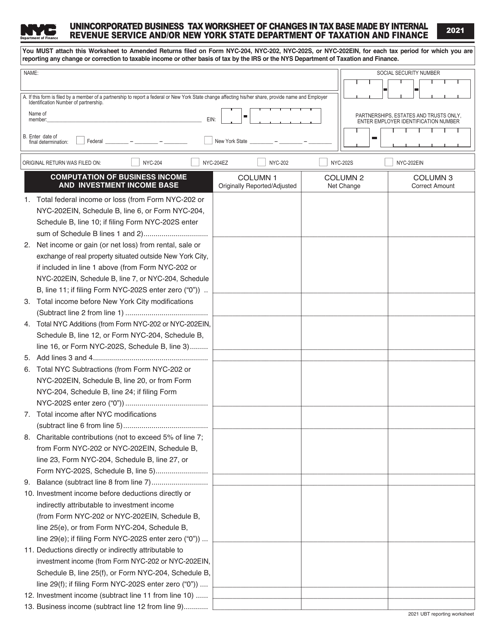

This document provides a worksheet to calculate changes in tax base made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance for businesses in New York City. It helps businesses track and calculate any adjustments to their tax obligations.

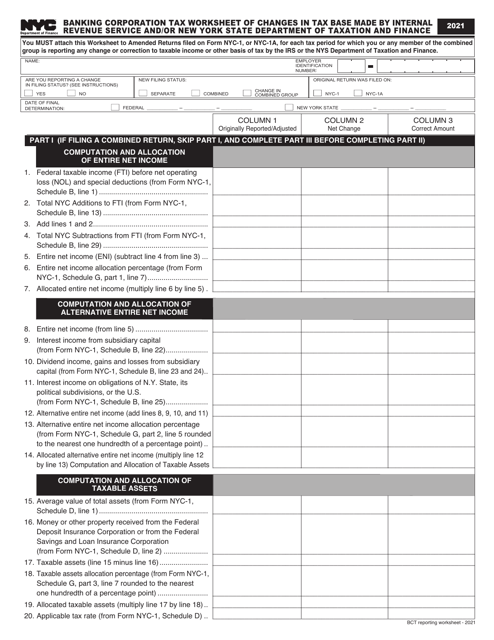

This document provides a worksheet for a banking corporation in New York City to track changes in their tax base made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance.

This document is used for calculating the changes in tax base for unincorporated businesses in New York City due to updates made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance.

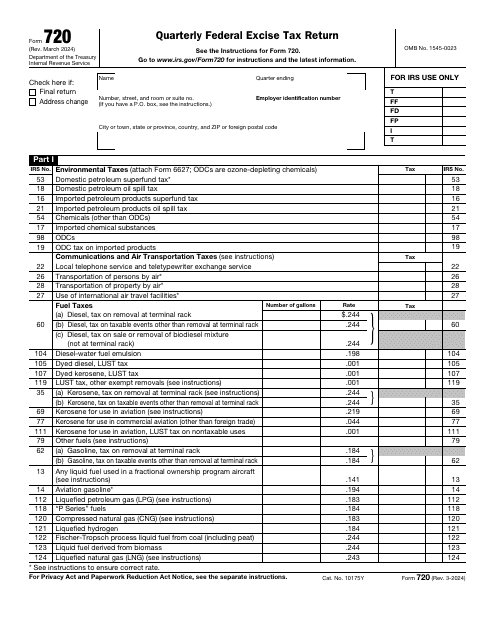

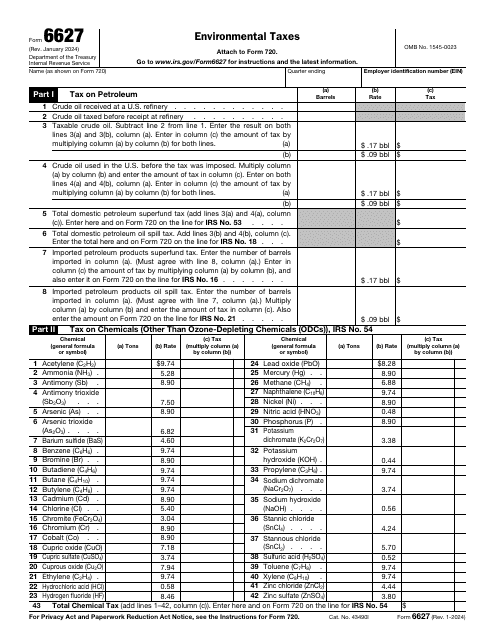

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

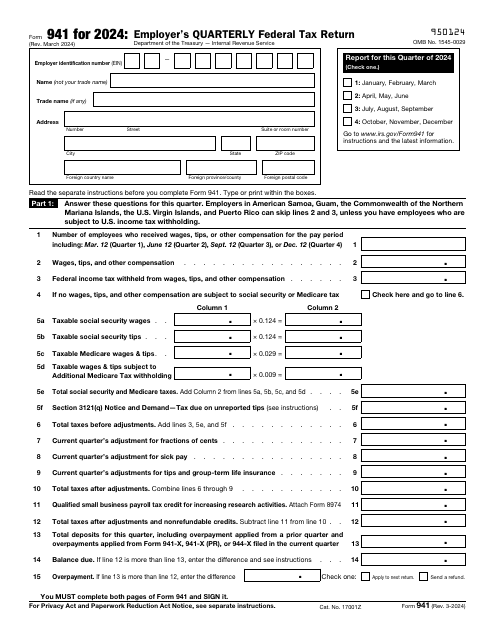

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

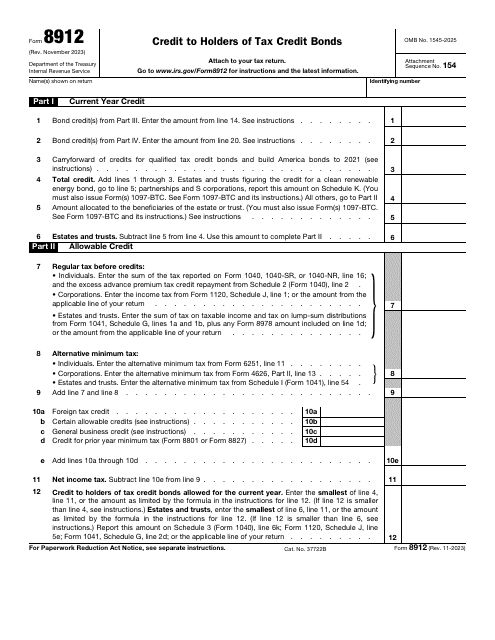

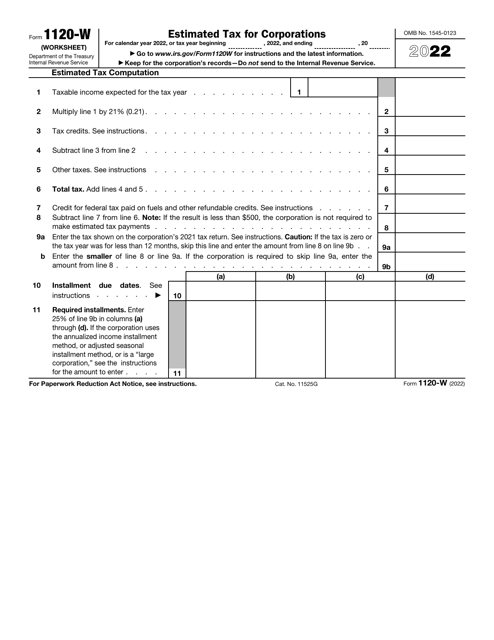

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

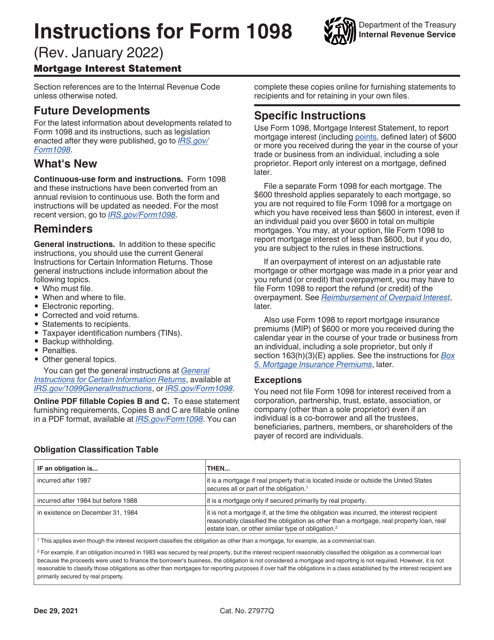

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

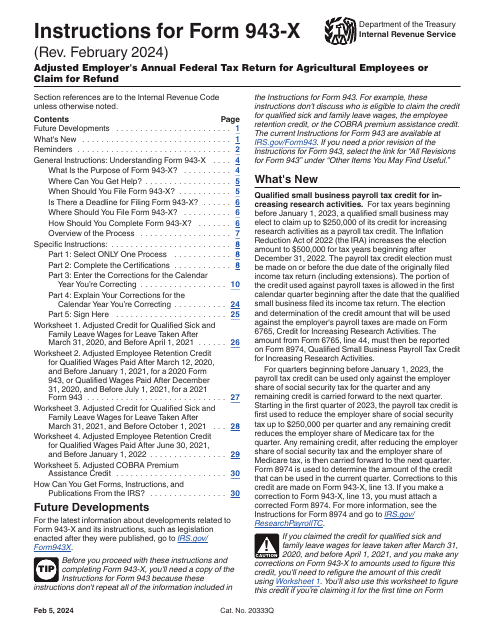

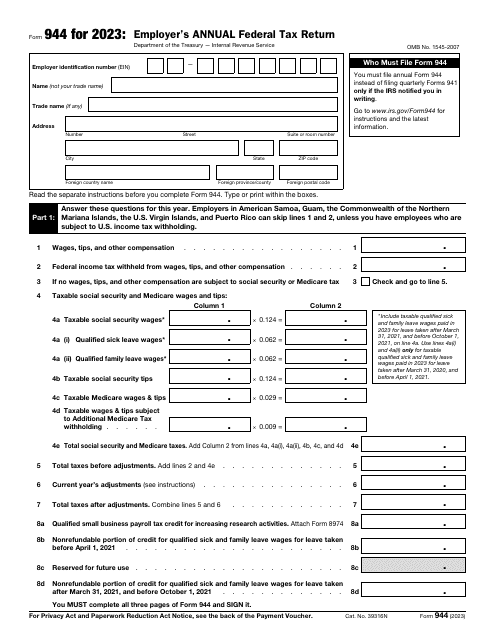

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

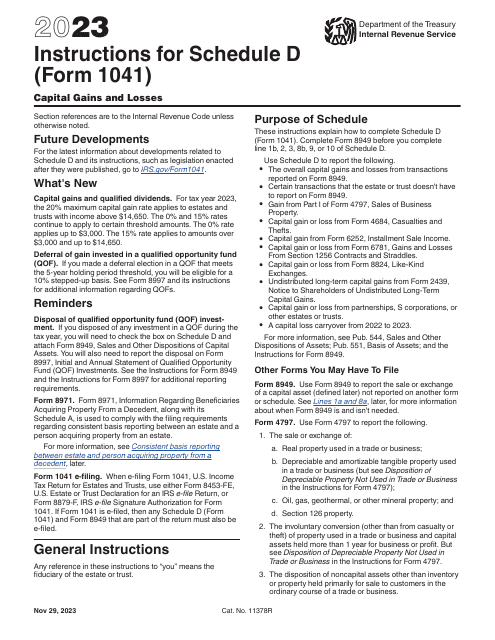

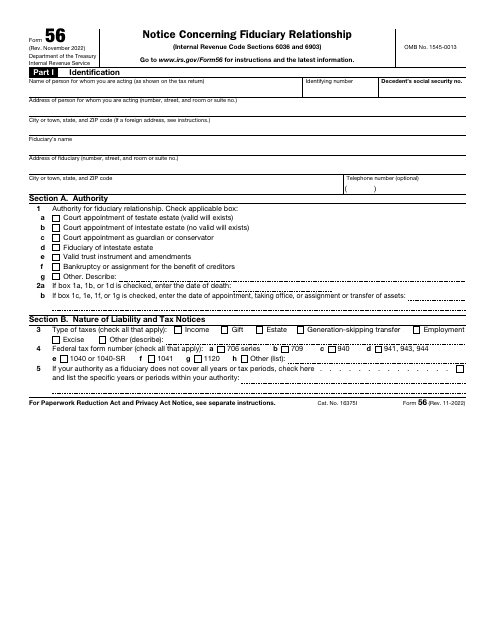

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.