Internal Revenue Service Forms and Templates

Documents:

273

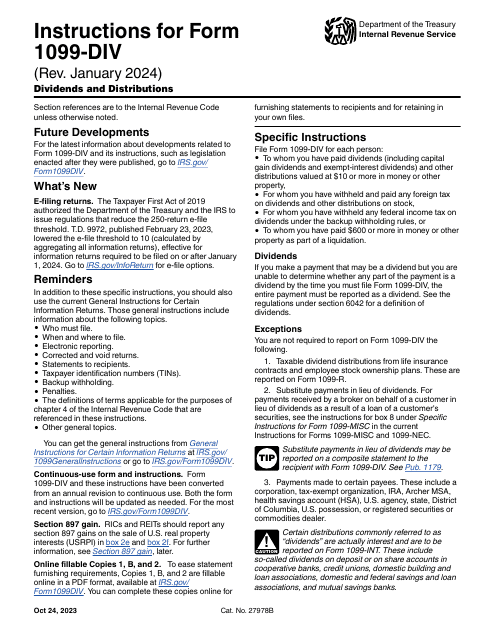

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

This Form is used for reporting information related to Build America Bonds and Recovery Zone Economic Development Bonds to the IRS. It provides instructions on how to fill out and submit Form 8038-B.

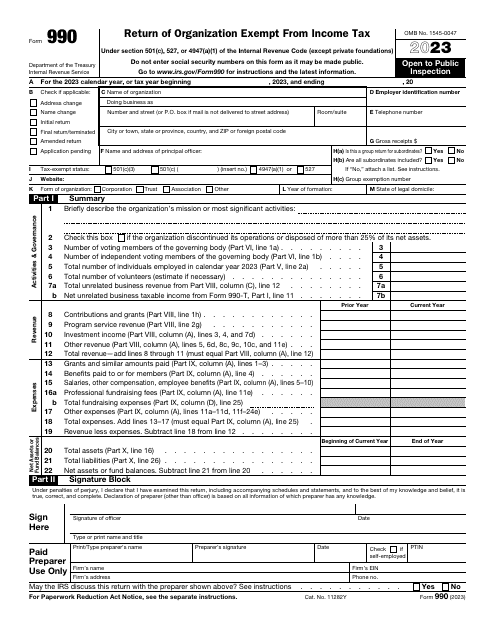

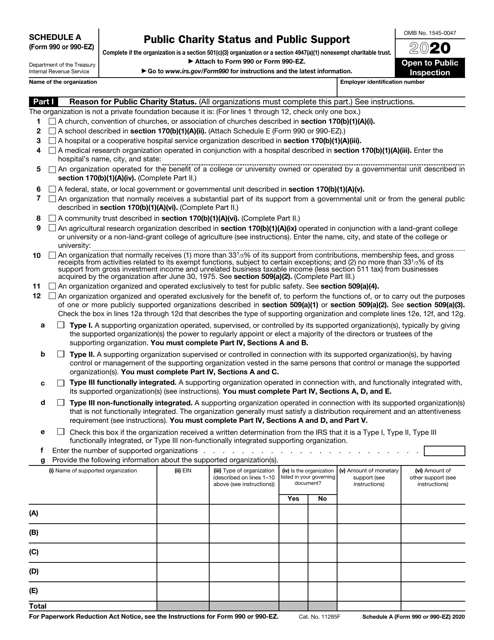

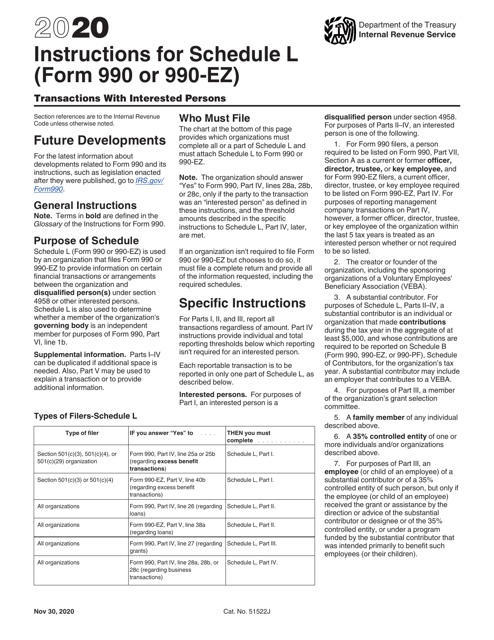

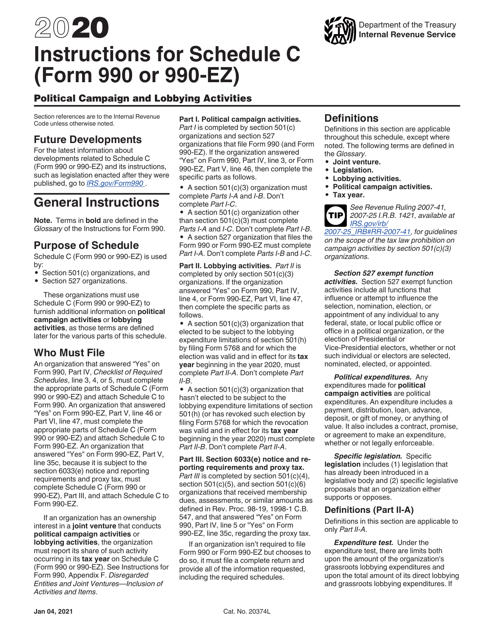

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

This Form is used for requesting a Certificate of Residency.

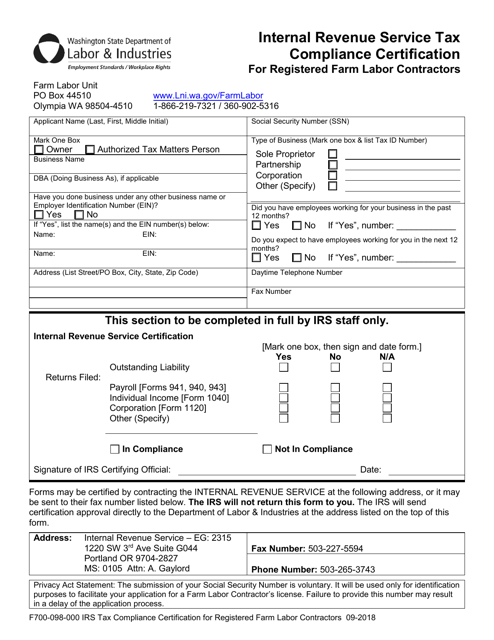

This form is used for tax compliance certification for registered farm labor contractors in Washington state.

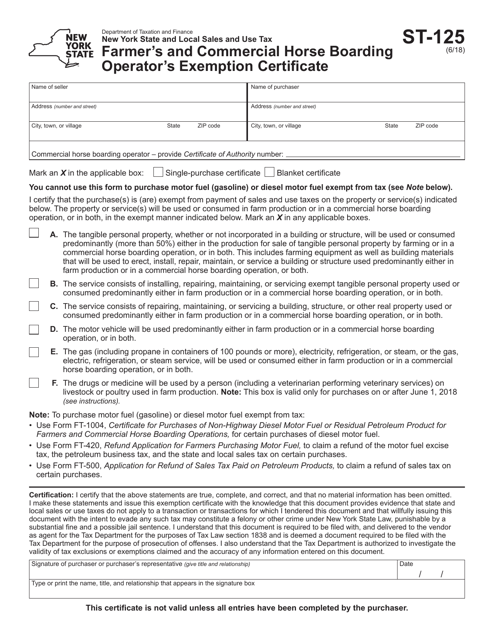

This form is used for farmers and commercial horse boarding operators in New York to claim an exemption from certain taxes.

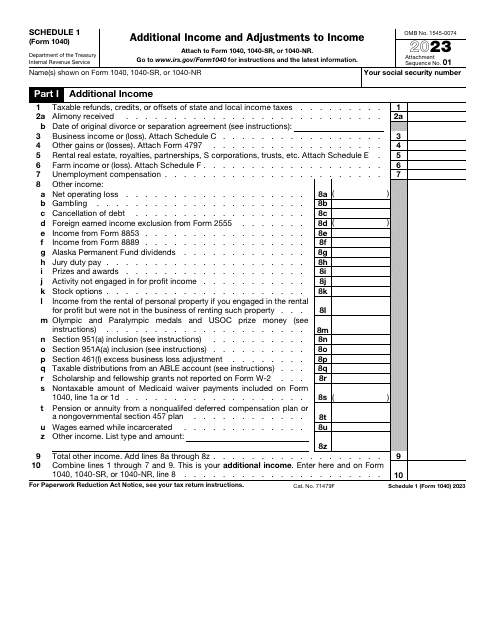

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

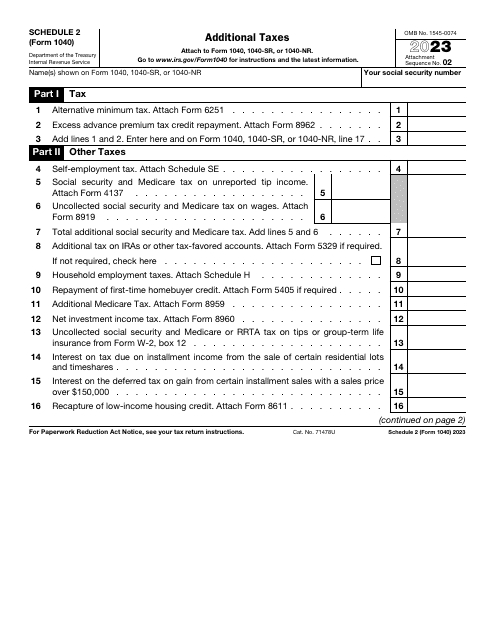

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

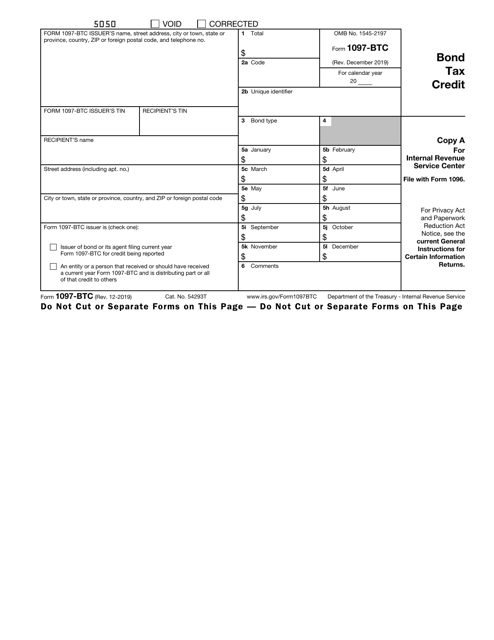

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

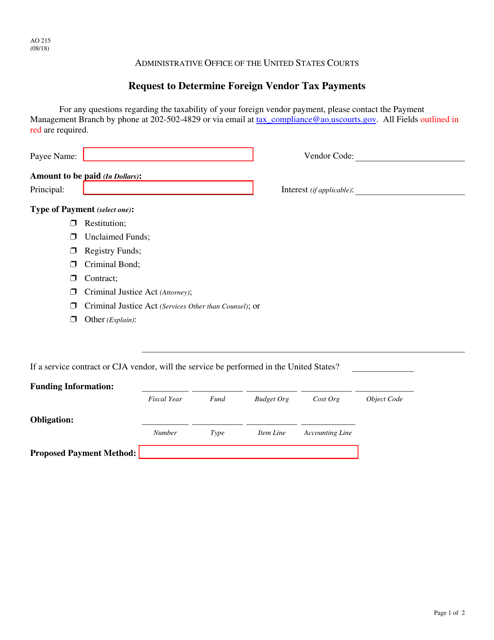

This form is used for requesting the determination of tax payments made by a foreign vendor.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.