Internal Revenue Service Forms and Templates

Documents:

273

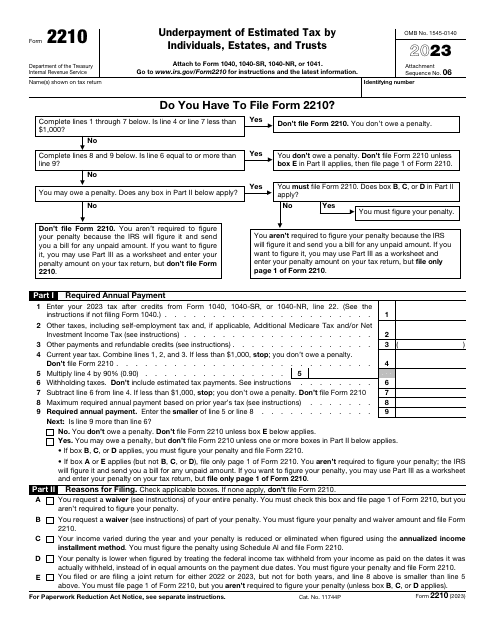

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

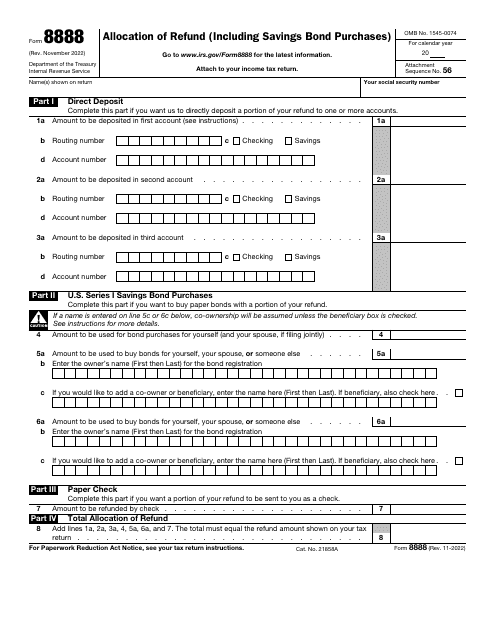

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

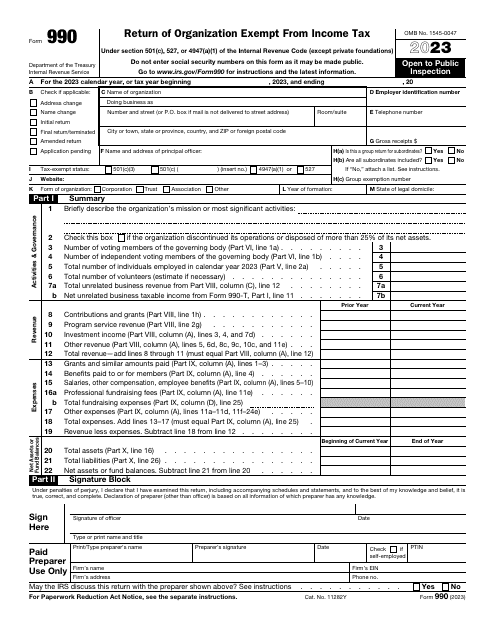

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

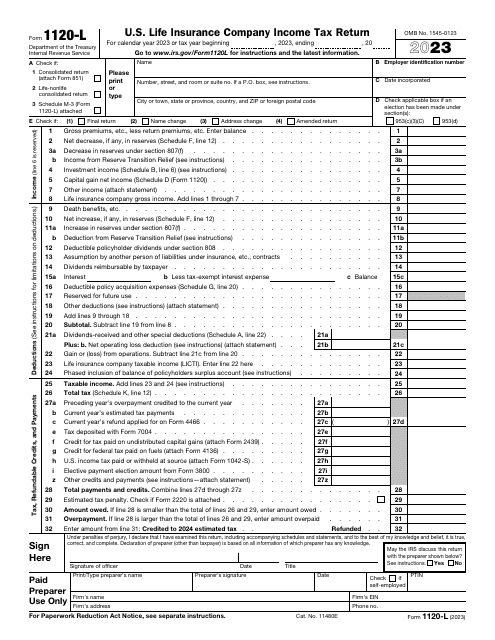

File this form if you are the owner of a domestic life insurance company to report to the IRS on your income, deductions, and credits for the tax year, and to figure your income tax liability.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

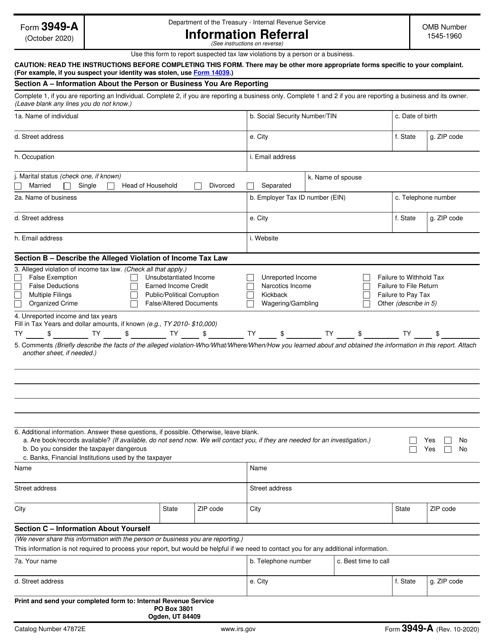

This is a fiscal IRS form any individual is free to use to report an alleged tax violation.

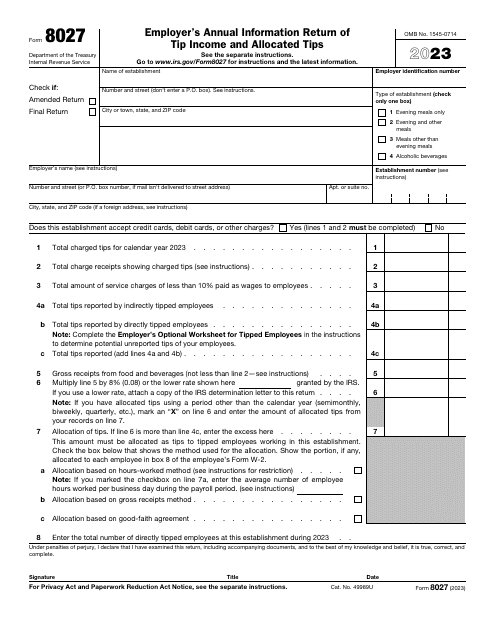

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

This is a formal IRS document that outlines the details of a property foreclosure.