Internal Revenue Service Forms and Templates

Documents:

273

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

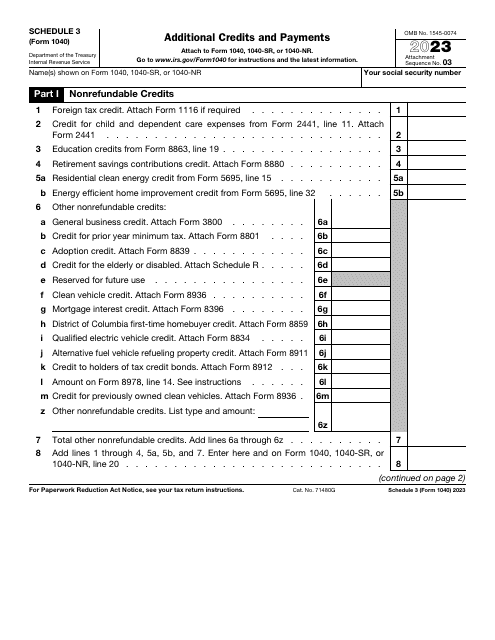

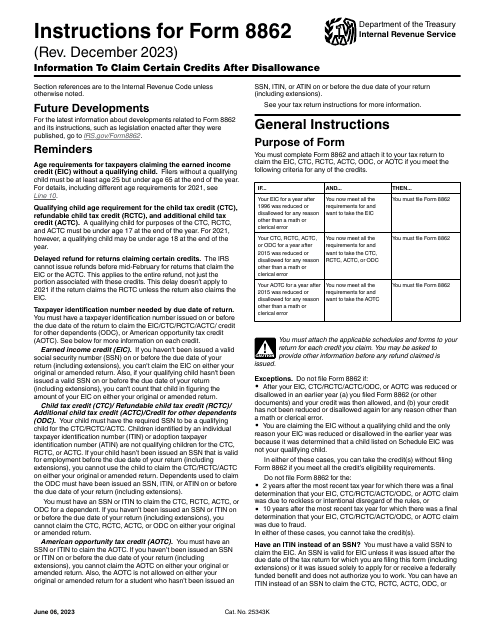

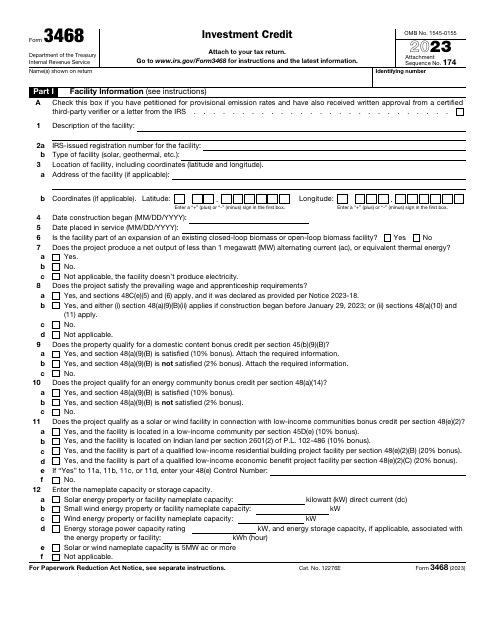

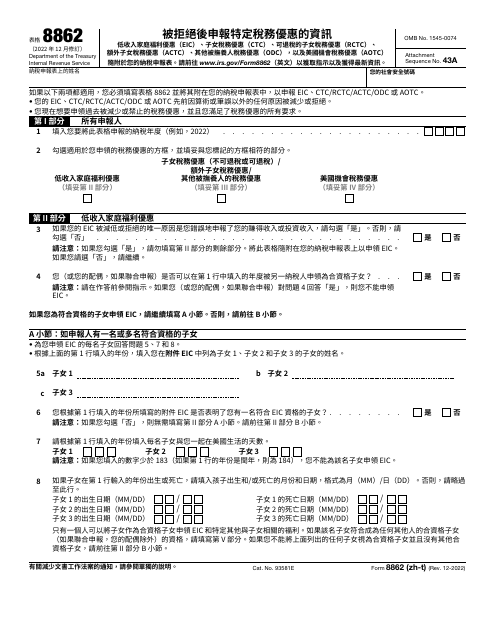

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

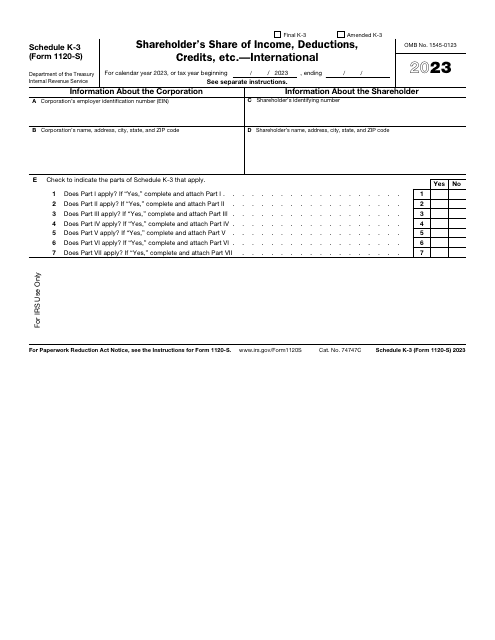

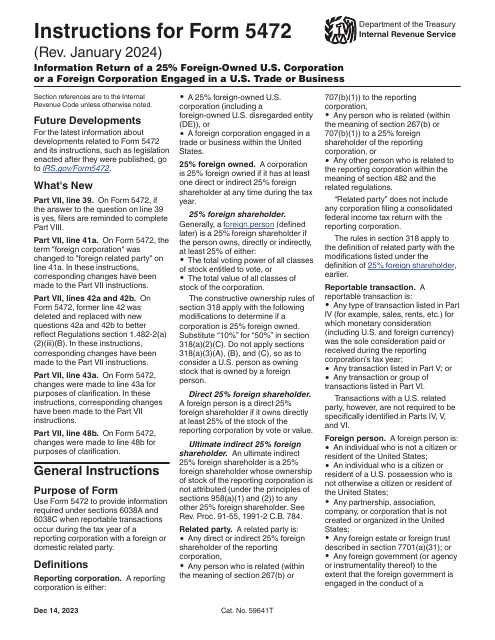

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

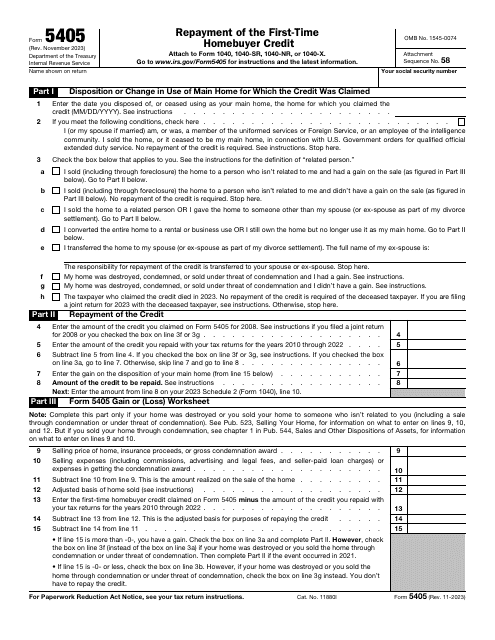

This is a fiscal instrument used by taxpayers who are responsible for computing and repaying the credit they used to purchase residential property in the past.

This is an IRS form that includes the details of an installment sale.

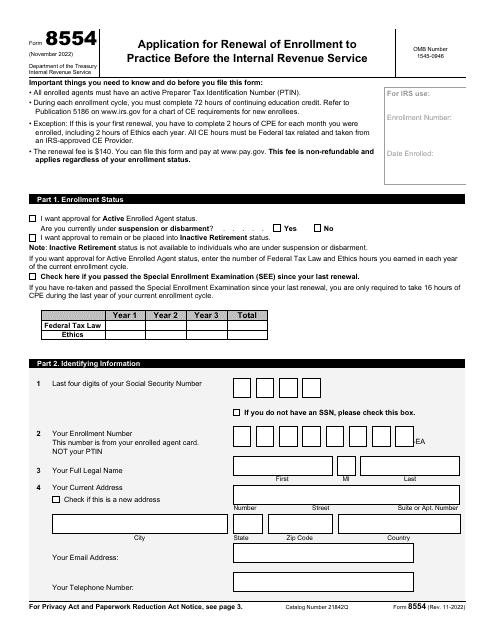

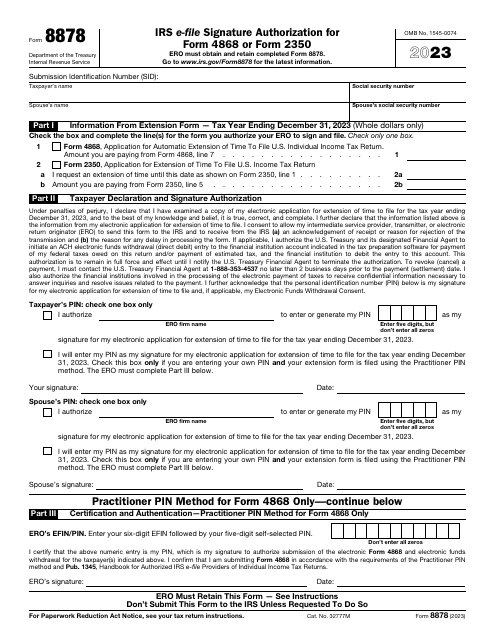

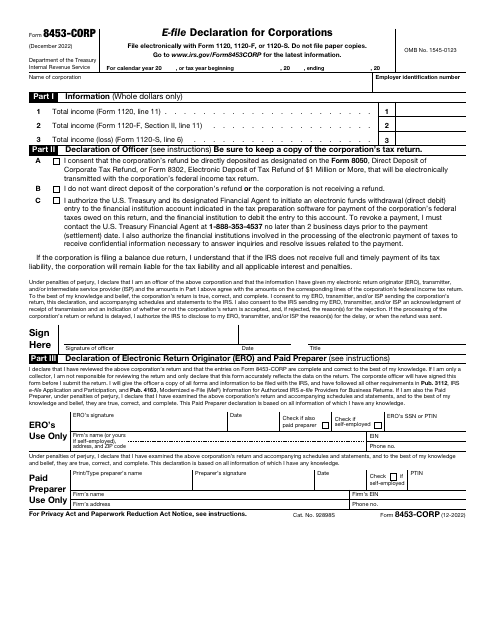

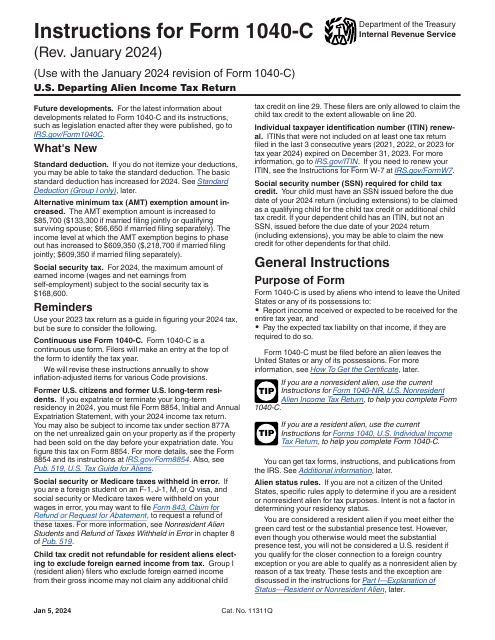

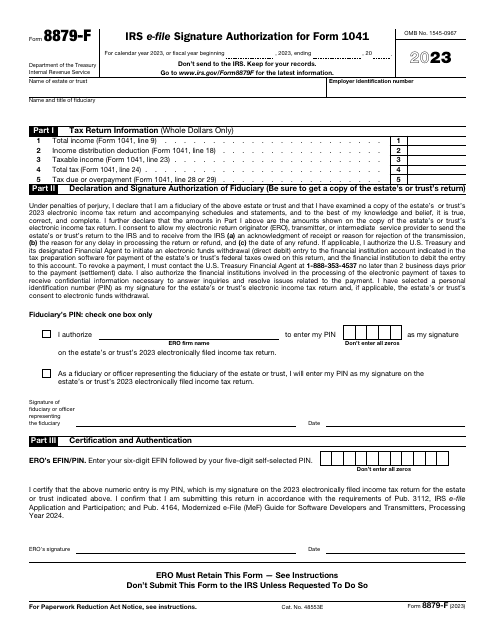

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.

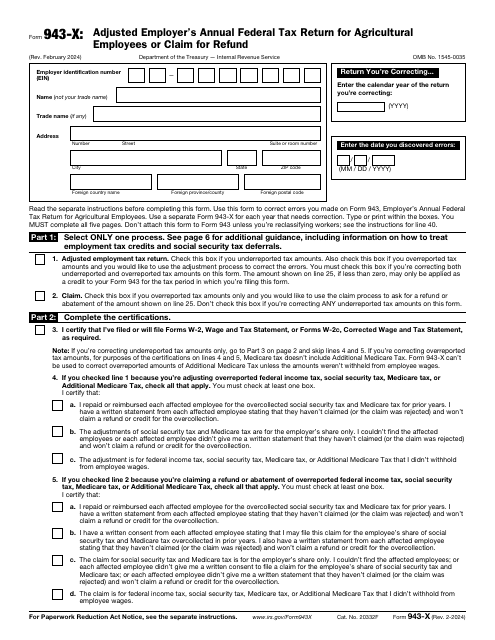

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

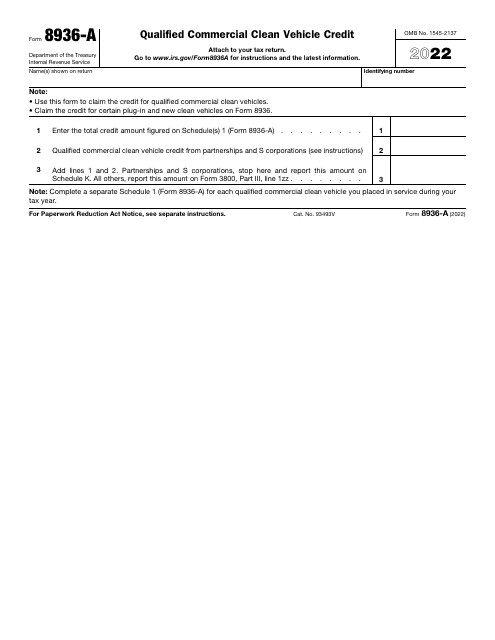

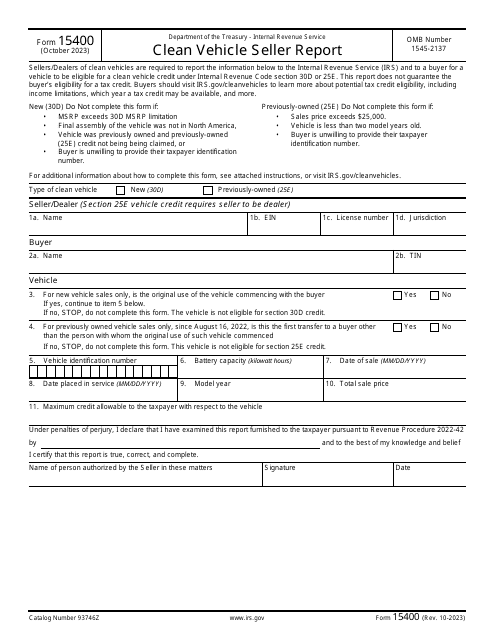

This form is used for claiming a tax credit for the purchase of a qualified commercial clean vehicle.

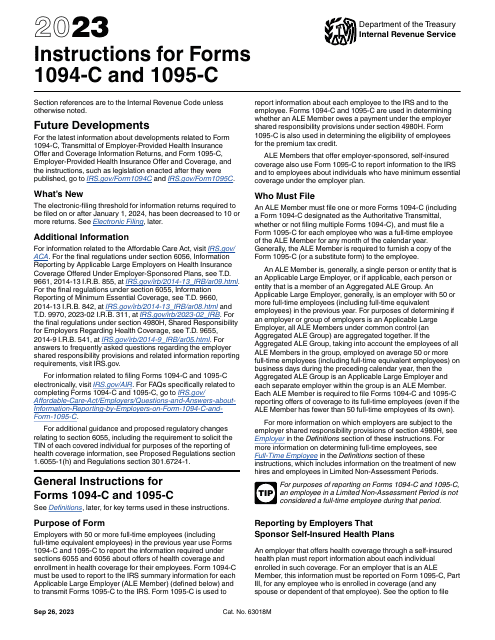

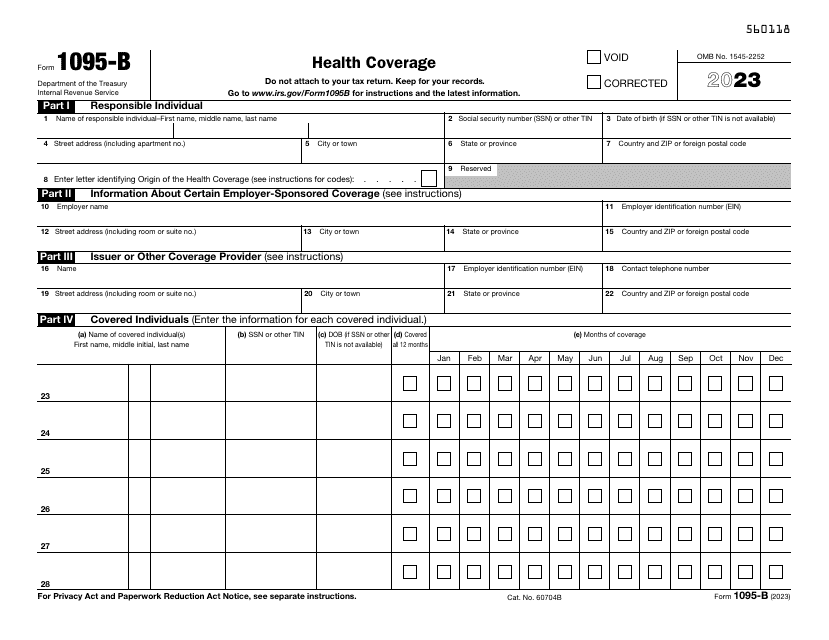

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.