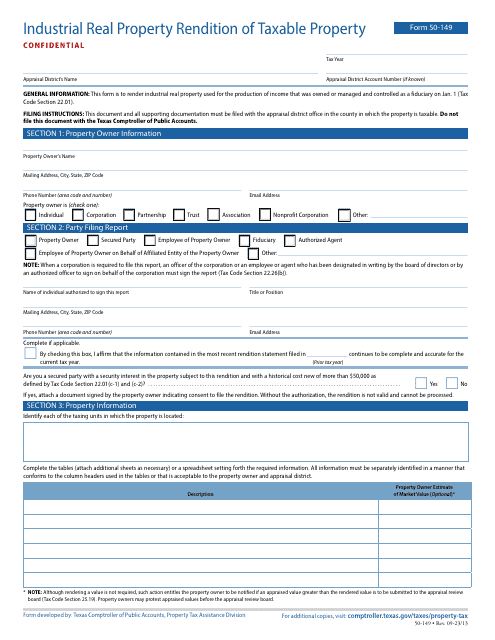

Property Tax Form Templates

Documents:

720

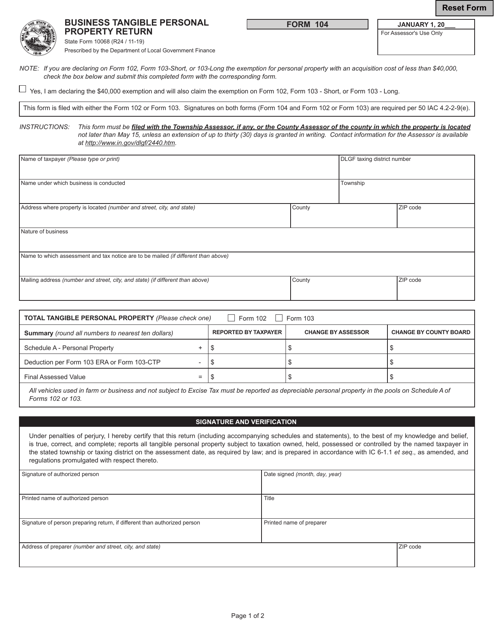

This document is used for filing the Business Tangible Personal Property Return in the state of Indiana. It is a form that businesses must complete and submit to report their personal property holdings.

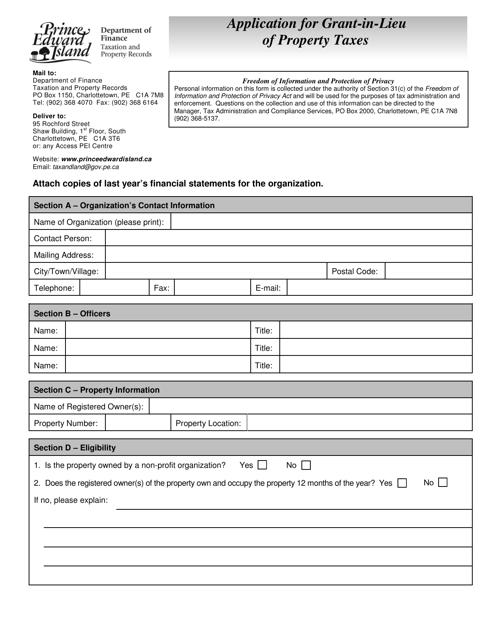

This form is used for applying for a grant-in-lieu of property taxes in Prince Edward Island, Canada.

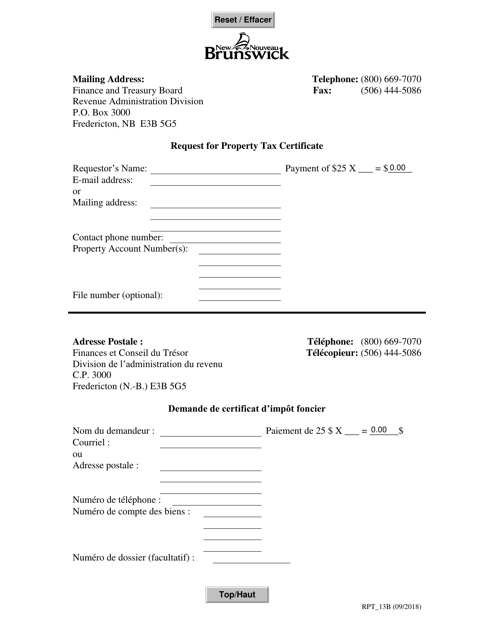

This form is used for requesting a Property Tax Certificate in New Brunswick, Canada. It is used to obtain information regarding the property's tax status and any outstanding taxes or liens.

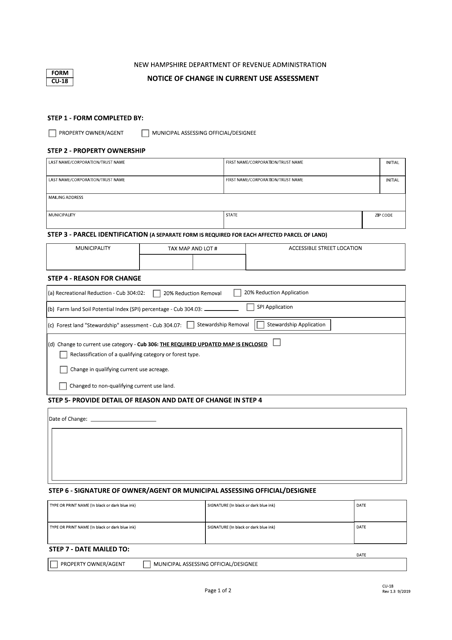

This form is used for notifying a change in the current use assessment in New Hampshire. It is used by property owners to inform the authorities about any changes in the use of their land for tax assessment purposes.

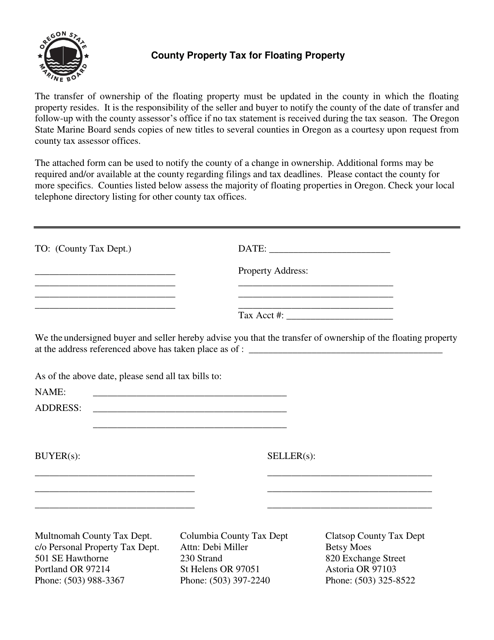

This document explains the process for calculating and paying property tax on floating properties in Oregon. It provides information on the assessment methods and payment options available.

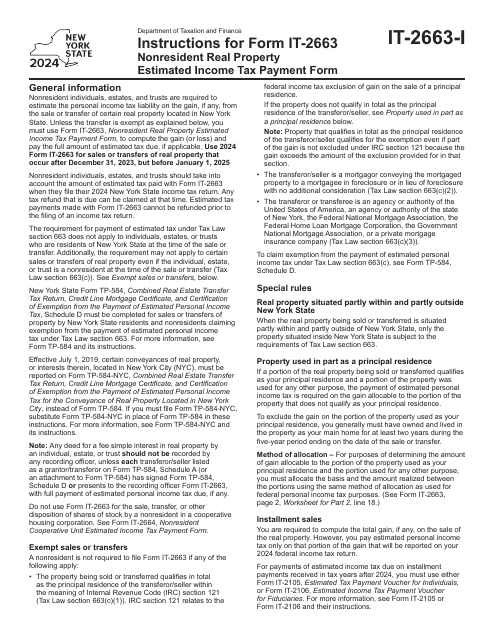

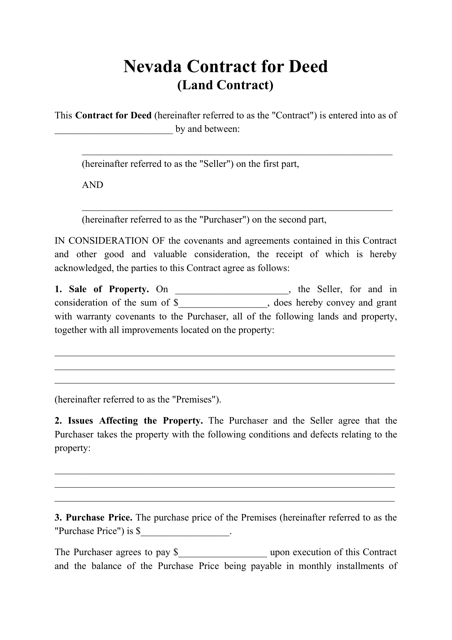

This document is a legally binding contract used in Nevada for the sale of land. It allows the buyer to make installment payments and take possession of the property while the seller retains legal ownership until the full purchase price is paid.

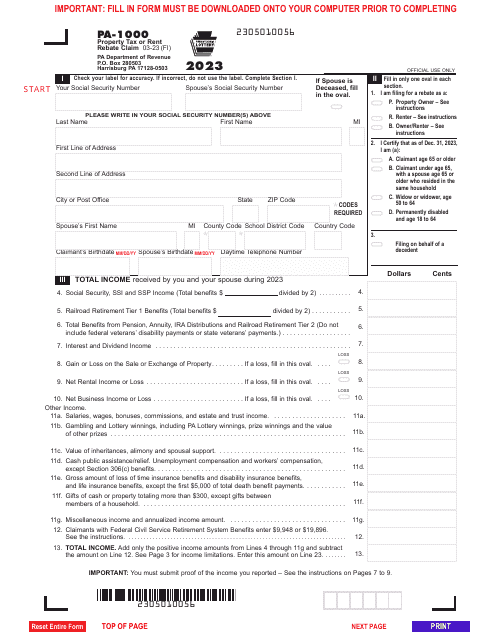

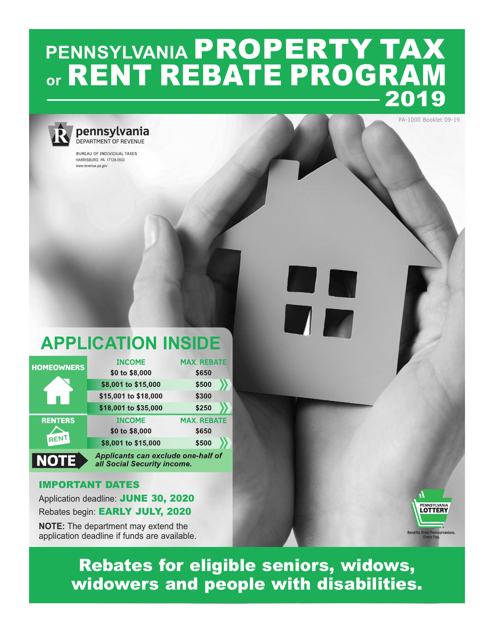

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

This guide provides instructions for preparing the Property Tax/Rent Rebate application in Pennsylvania. It explains the eligibility criteria and necessary documentation required for the rebate.

This Form is used for filing a property tax or rent rebate claim in Pennsylvania. It provides instructions on how to complete the application and claim a rebate for property taxes paid or rent paid for a principal residence.

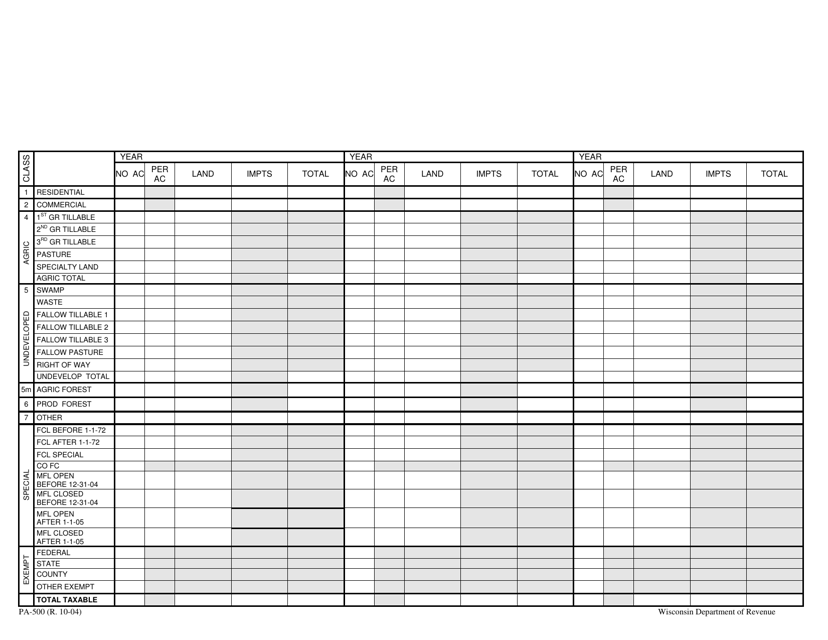

This form is used for recording residential property details in the state of Wisconsin. It allows property owners to provide information such as property address, size, and value to the relevant authorities.