Property Tax Form Templates

Documents:

720

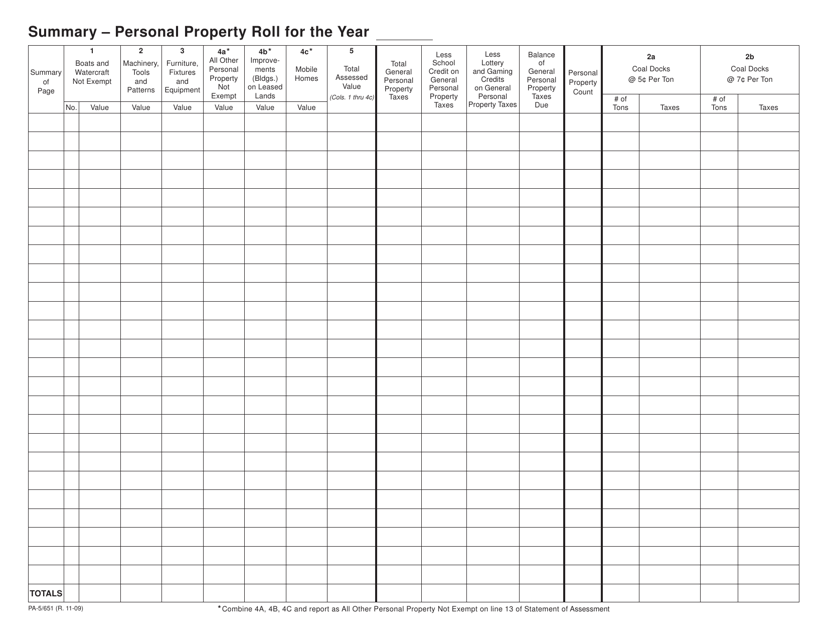

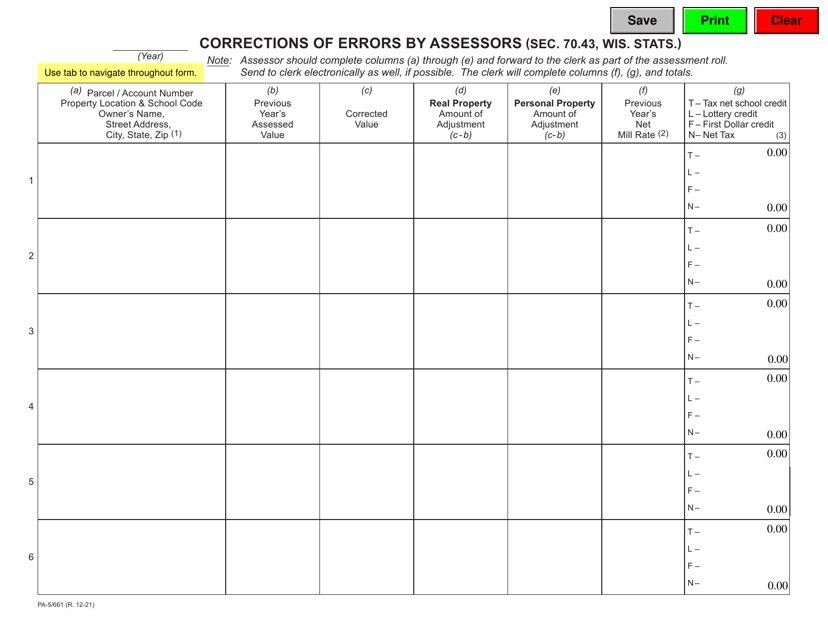

This Form PA-5/651 is used for reporting personal property in Wisconsin. It is used to create a personal property roll for tax assessment purposes.

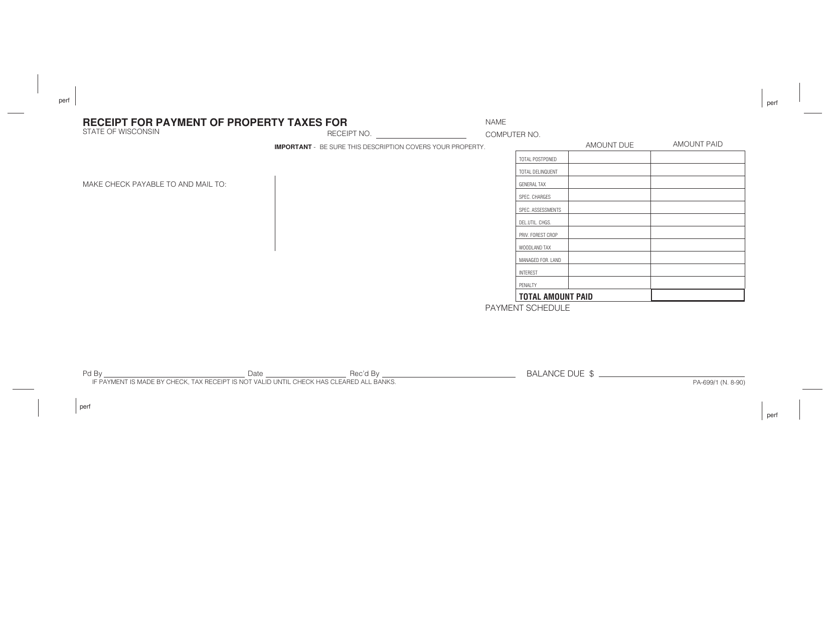

This form is used for providing a receipt for payment of property taxes in Wisconsin.

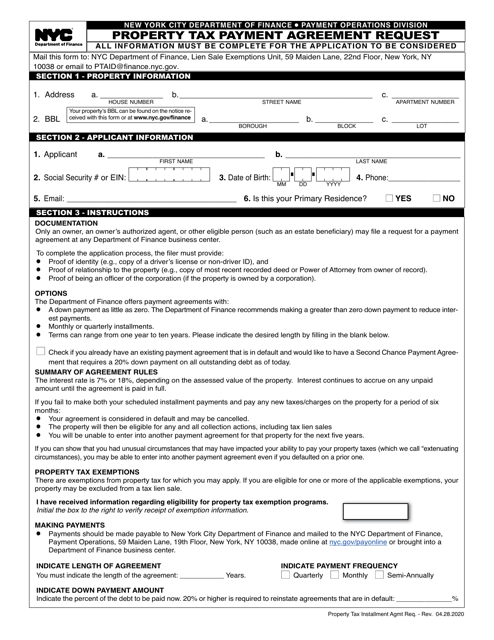

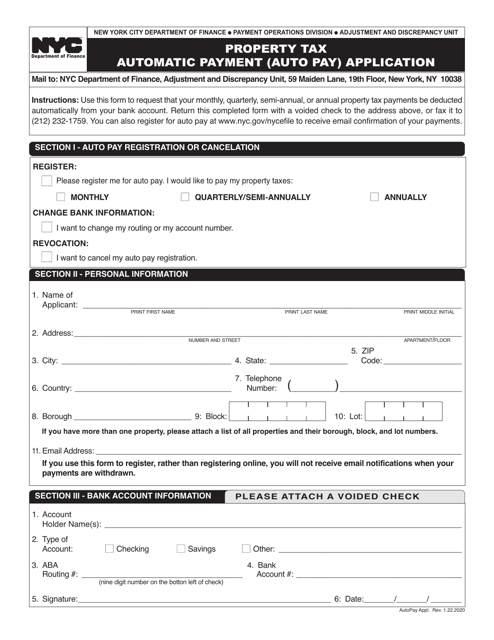

This document allows New York City residents to apply for automatic payment of their property tax.

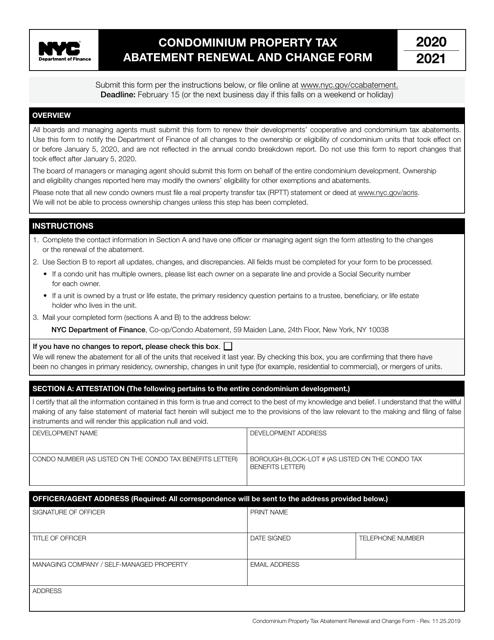

This form is used for renewing and changing the property tax abatement for condominiums in New York City.

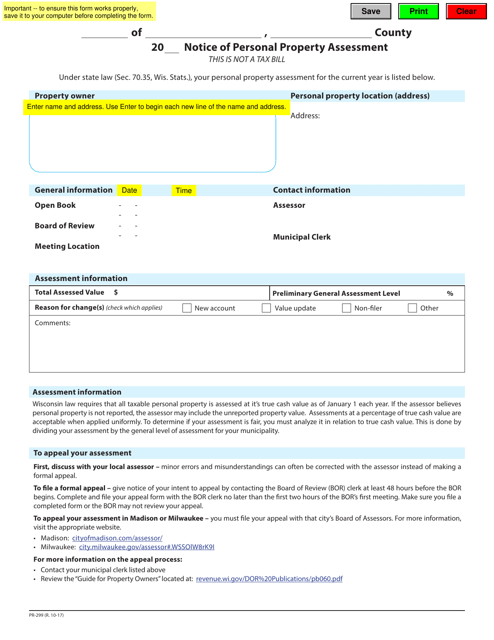

This type of document, Form PR-299, is used for providing a notice of personal property assessment in the state of Wisconsin.

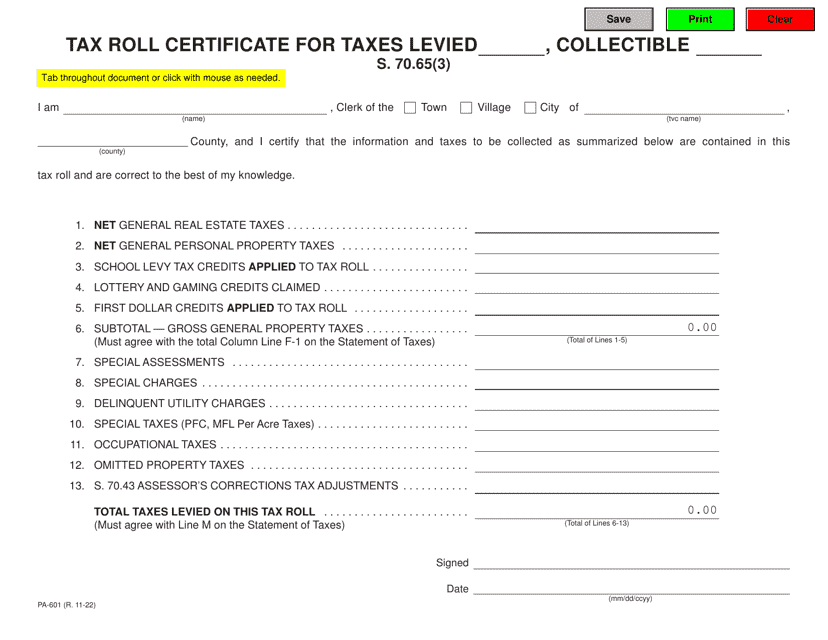

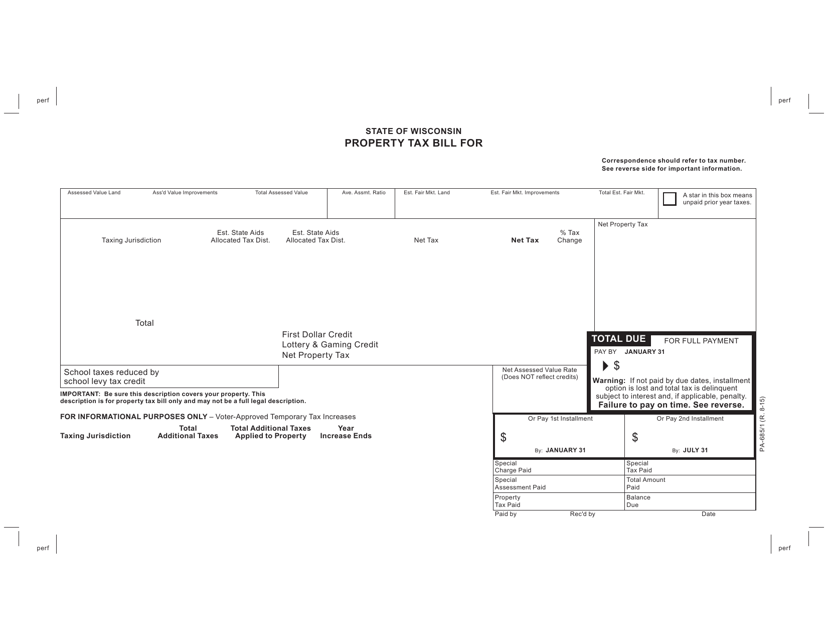

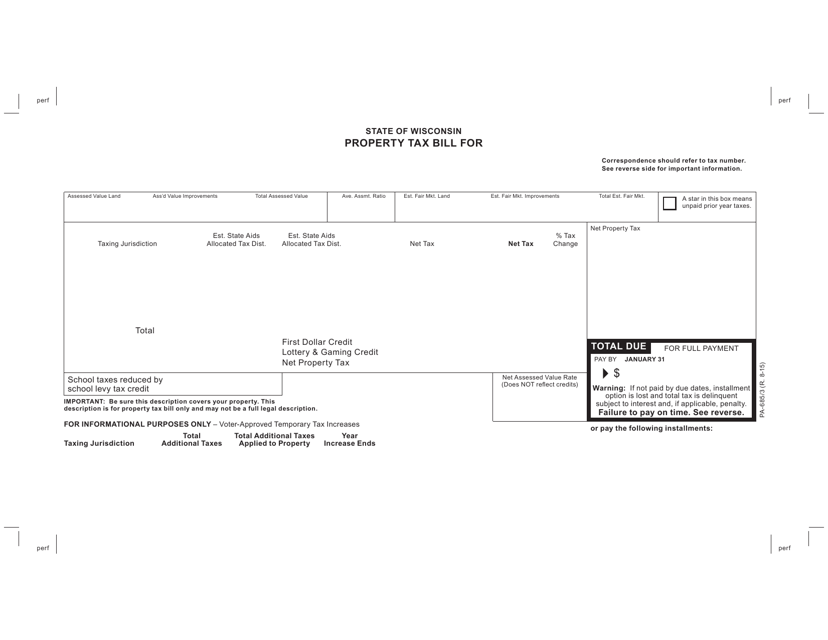

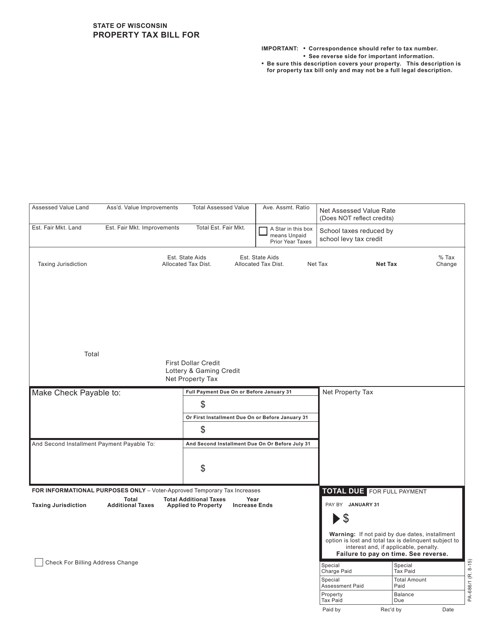

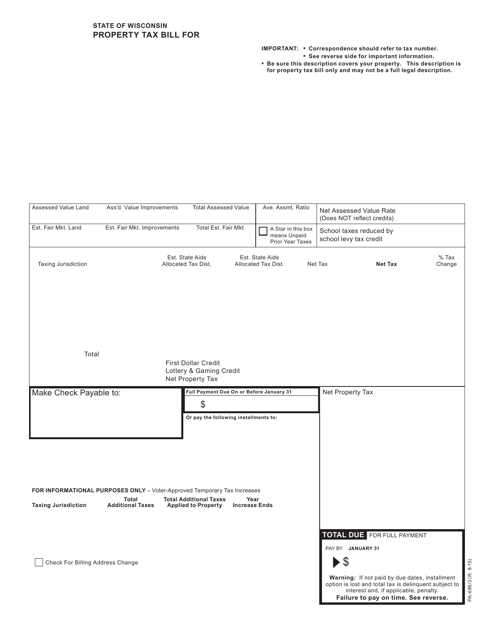

This Form is used for receiving and paying property tax bills in Wisconsin.

This form is used for paying property taxes in Wisconsin. It is the bill that homeowners receive to calculate and submit their property tax payments.

This form is used to send property tax bills to residents in Wisconsin.

This form is used for paying property tax bills in the state of Wisconsin.

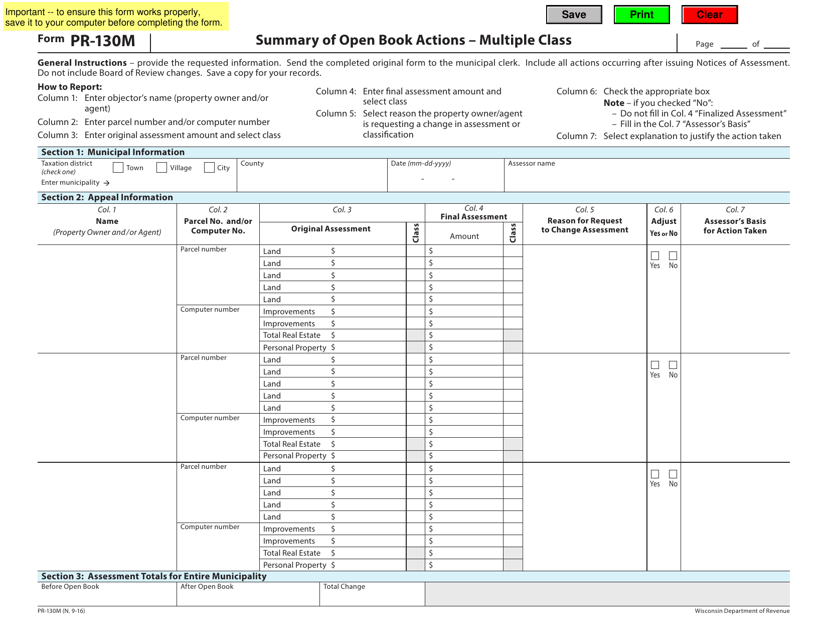

This form is used for providing a summary of open book actions for multiple classes in the state of Wisconsin.

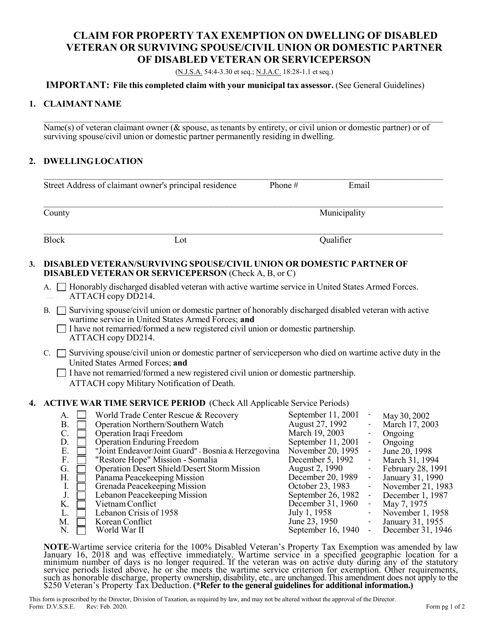

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

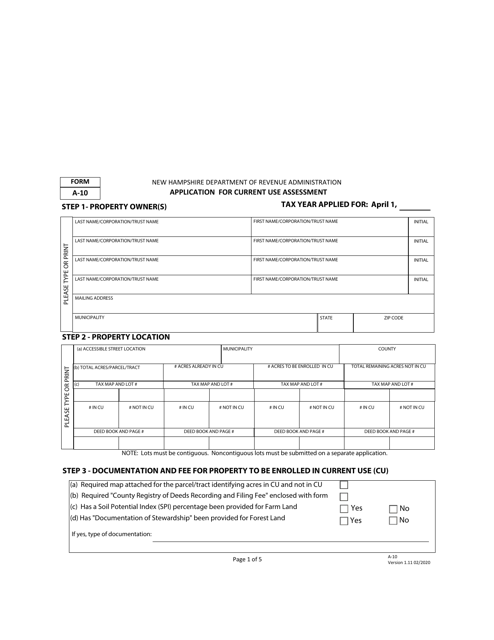

This form is used for applying for current use assessment in the state of New Hampshire. Current use assessment is a program that allows qualifying property owners to have their land assessed at its current use value, rather than its market value, for property tax purposes.

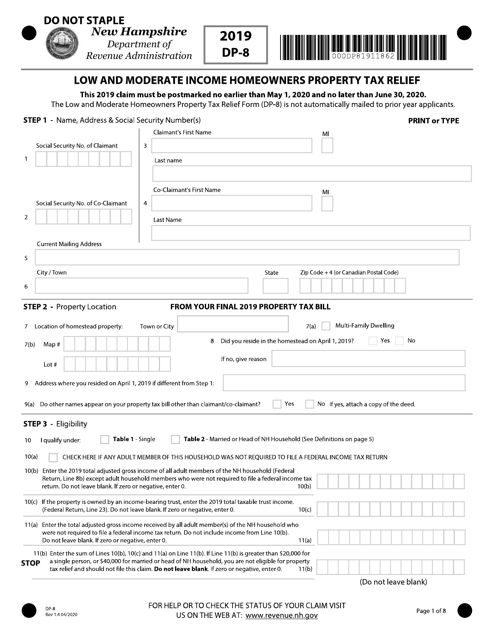

This form is used for applying for low and moderate income homeowners property tax relief in the state of New Hampshire.

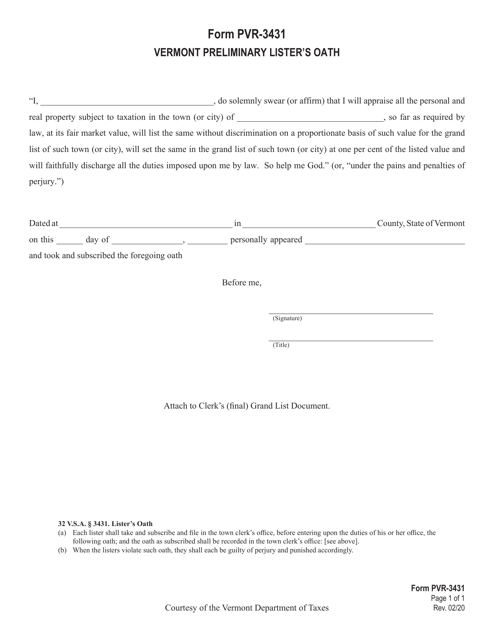

This form is used for the Vermont Preliminary Lister's Oath.

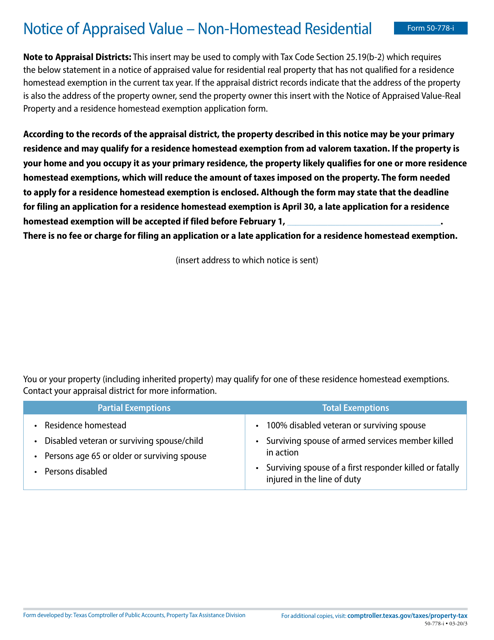

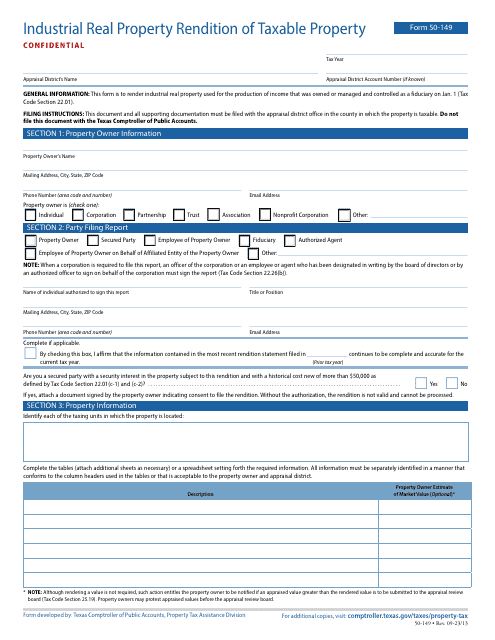

This Form is used for notifying property owners in Texas about the appraised value of their non-homestead residential property.

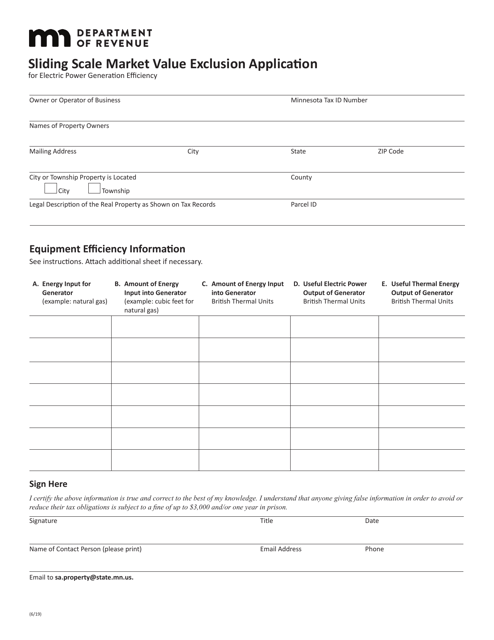

This form is used to apply for the sliding scale market value exclusion in Minnesota.

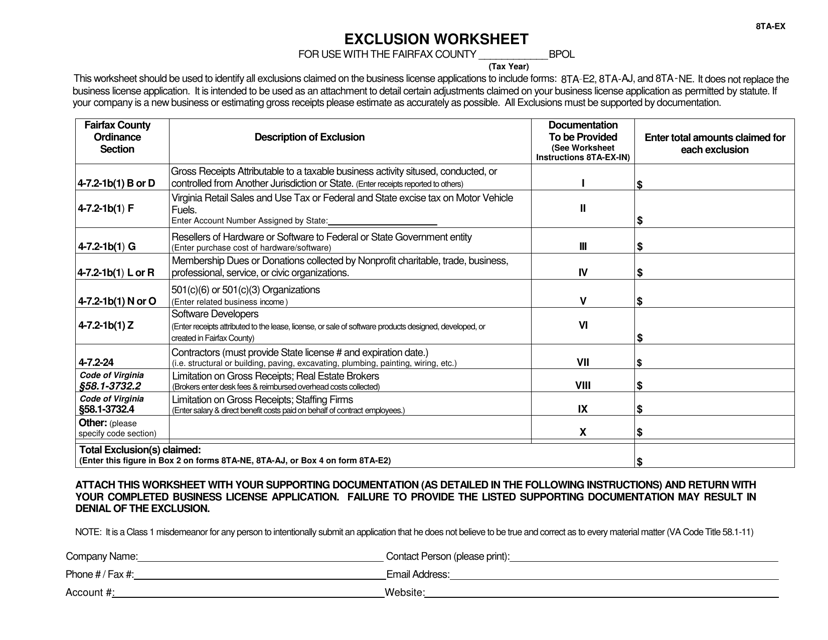

This form is used for calculating exclusions on real property taxes in Fairfax County, Virginia.

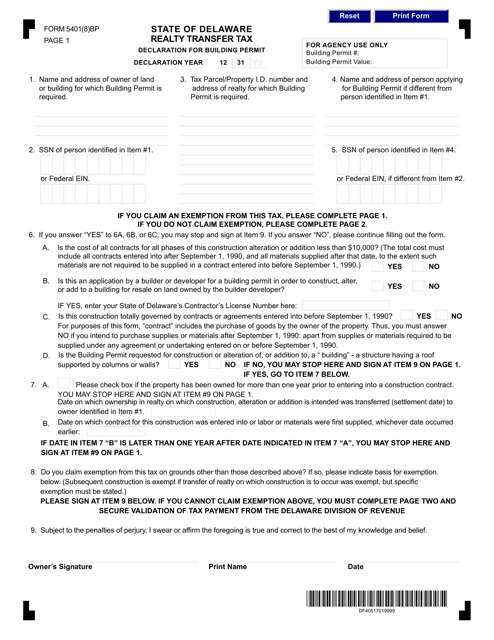

This document is used for declaring the realty transfer tax for building permits in the state of Delaware.