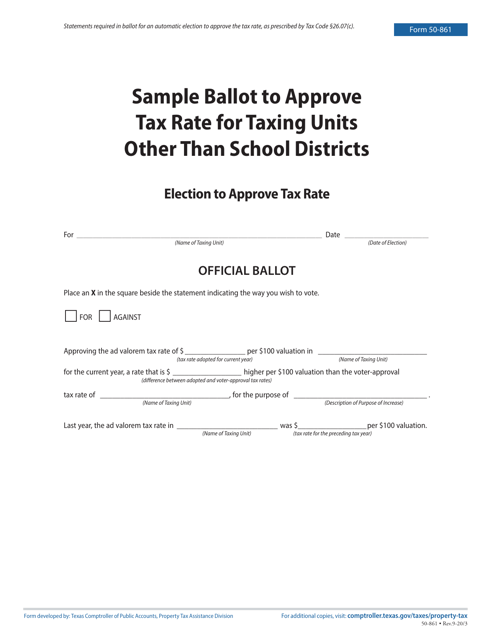

Property Tax Form Templates

Documents:

720

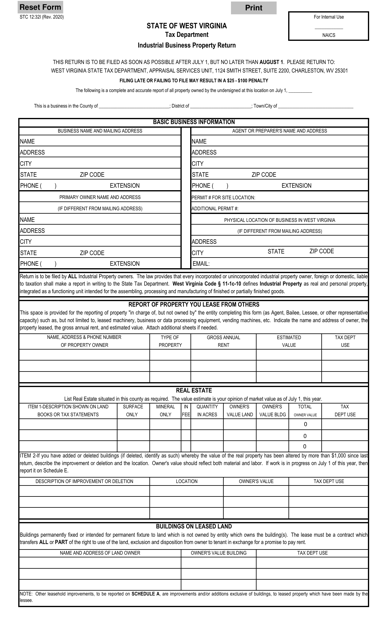

This form is used for reporting industrial business property in West Virginia. It must be filled out by property owners to provide information about their industrial assets for tax purposes.

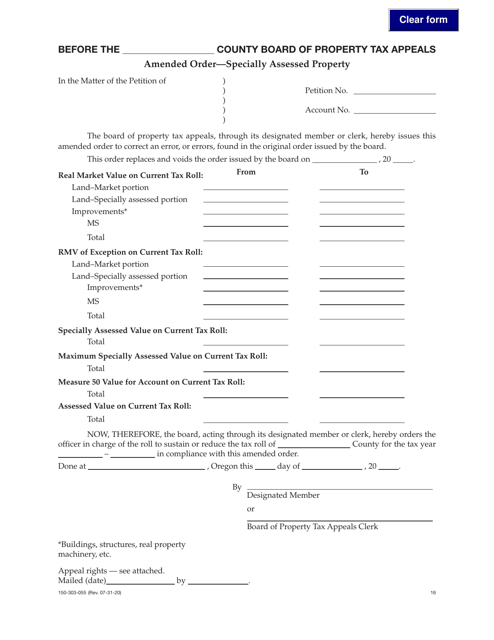

This Form is used for making an amended order for specially assessed property in Oregon.

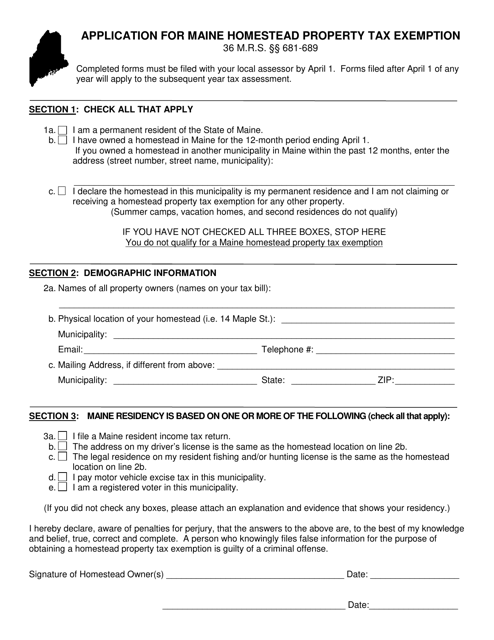

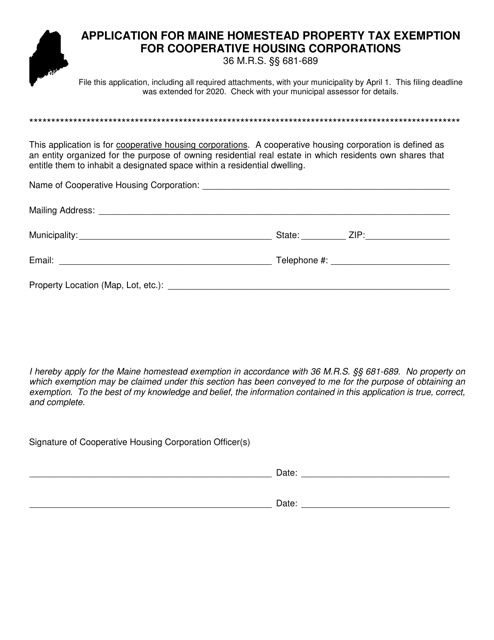

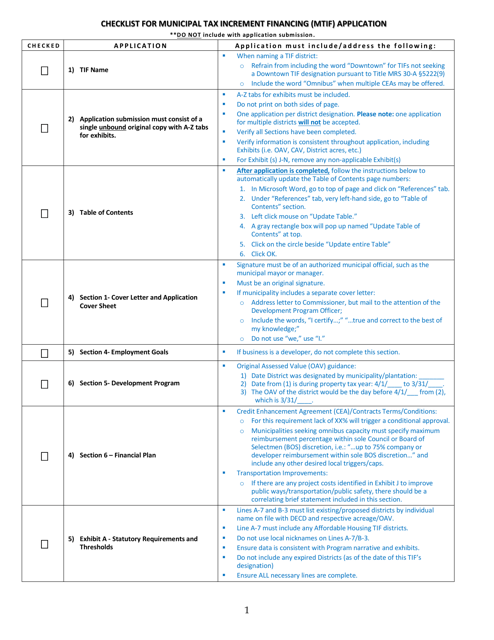

This document provides a checklist for the Municipal Tax Increment Financing (MTIF) application process in Maine. It outlines the necessary steps and requirements for applying for tax increment financing in municipalities.

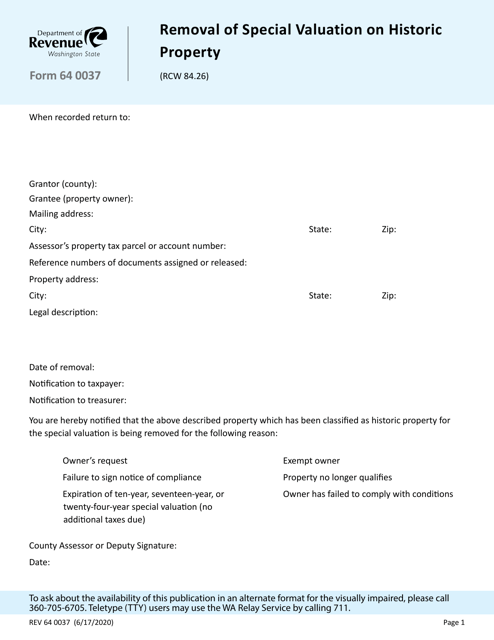

This Form is used for requesting the removal of special valuation on a historic property in Washington state.

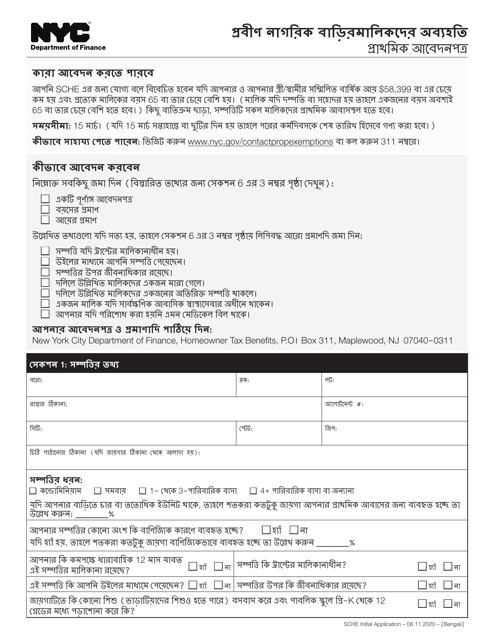

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

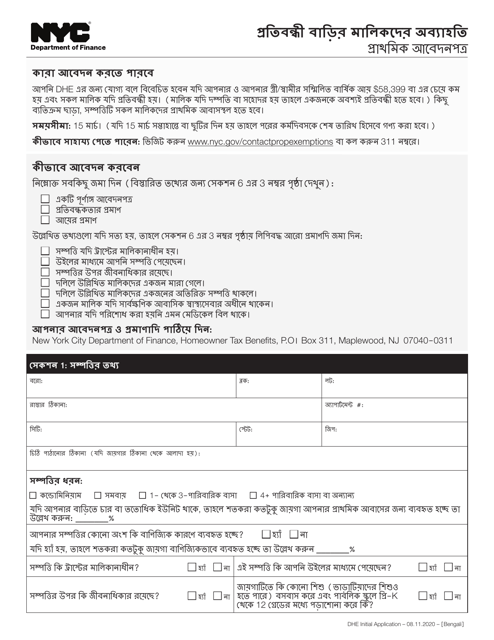

This document is for disabled homeowners in New York City who want to apply for an initial exemption. It is available in Bengali.

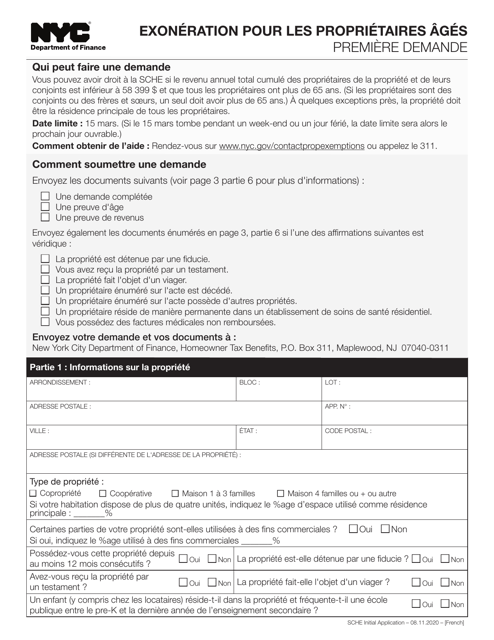

This document is used for applying for the Senior Citizen Homeowners' Exemption in New York City. It is available in French.

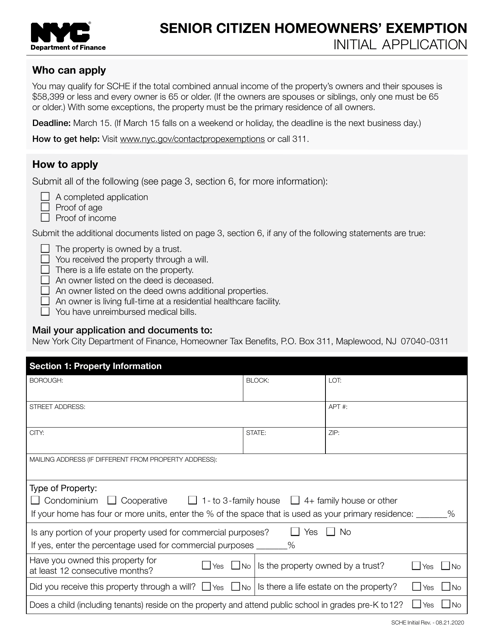

This document is for senior citizens in New York City who own a home and want to apply for a tax exemption. It is the initial application for the Senior Citizen Homeowners' Exemption.

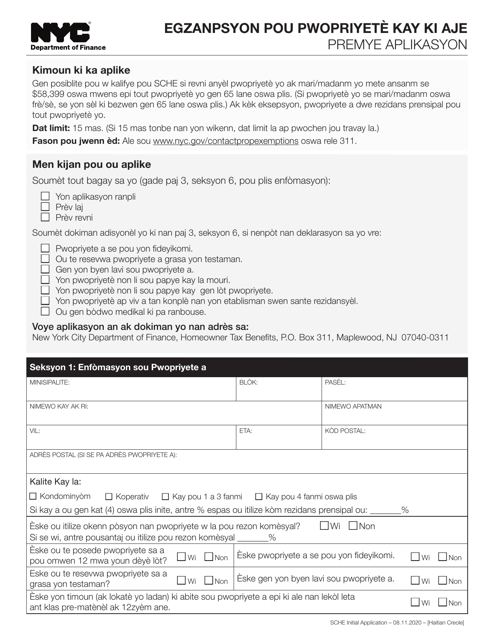

This Form is used for applying for the Senior Citizen Homeowners' Exemption in New York City, and is available in Haitian Creole.

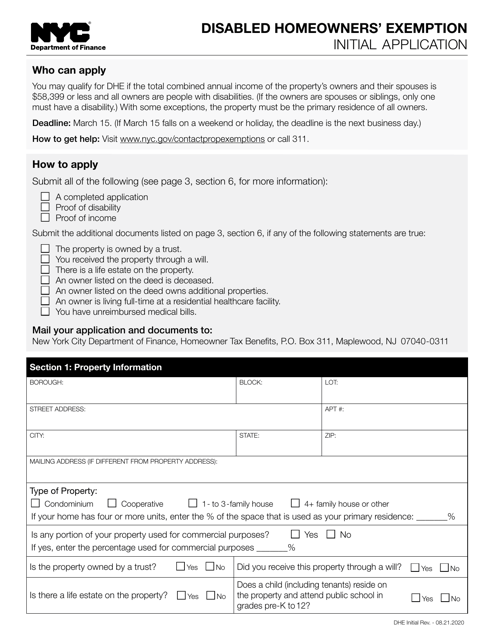

This document is for disabled homeowners in New York City who are applying for the initial exemption.

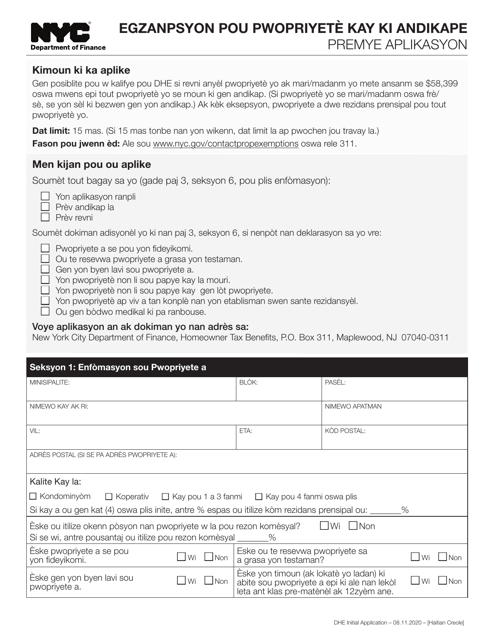

This type of document is used for disabled homeowners in New York City who are applying for the initial exemption. It is available in Haitian Creole language.

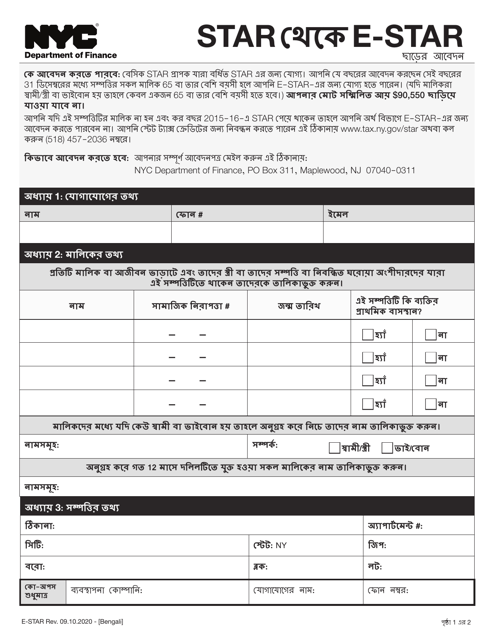

This document is for applying for the Star to E-Star Exemption in New York City. It is available in Bengali.

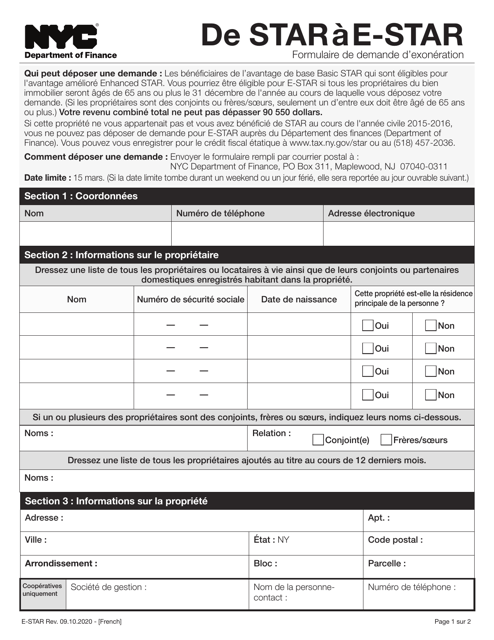

This document is for applying for the Star to E-Star exemption in New York City. It is available in French.

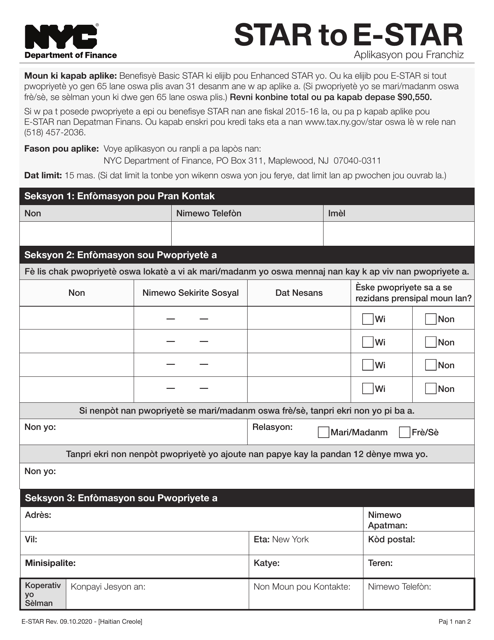

This document is used for applying for the Star to E-Star exemption in New York City. It is available in Haitian Creole language.

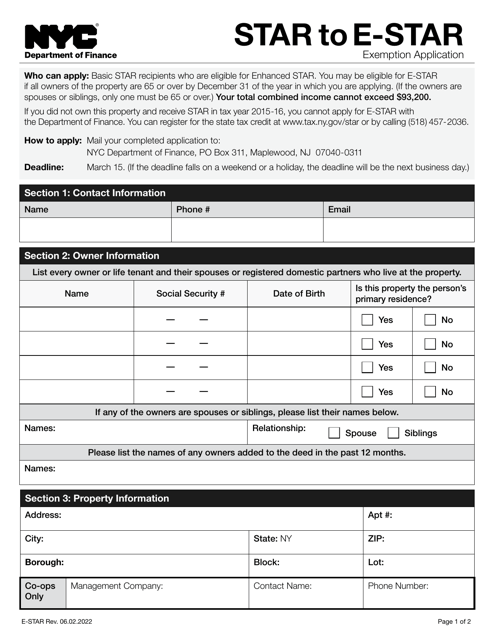

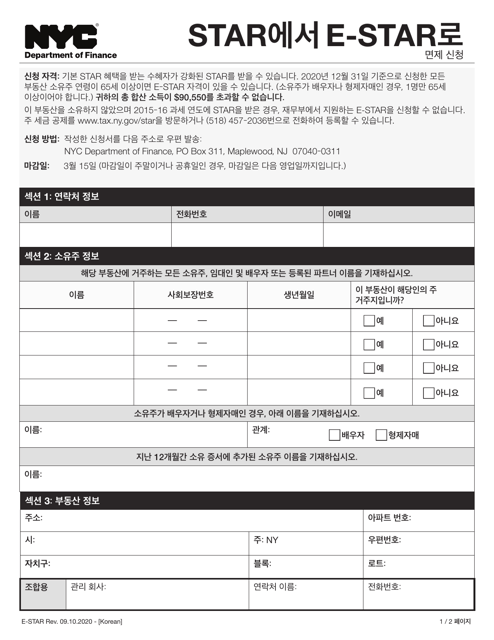

This document is an application form for the Star to E-Star Exemption in New York City, specifically for Korean speakers. The E-Star Exemption provides property tax relief for eligible homeowners.

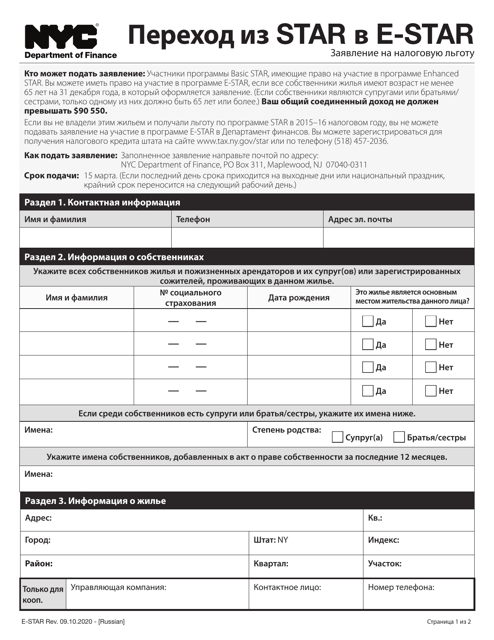

This document is an application for the Star to E-Star exemption in New York City, written in Russian.

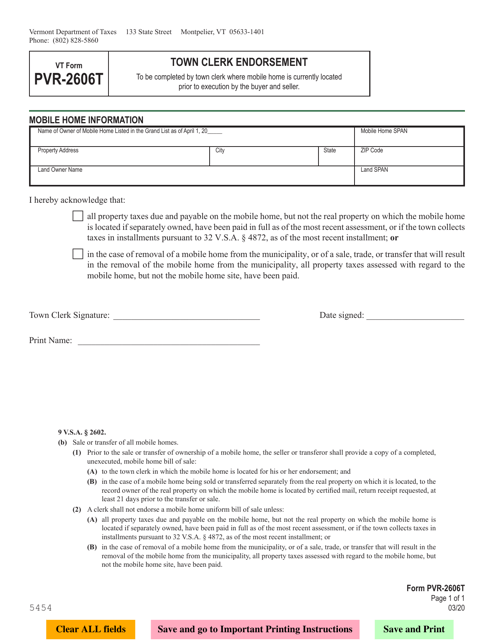

This form is used for obtaining the Town Clerk Endorsement in Vermont.

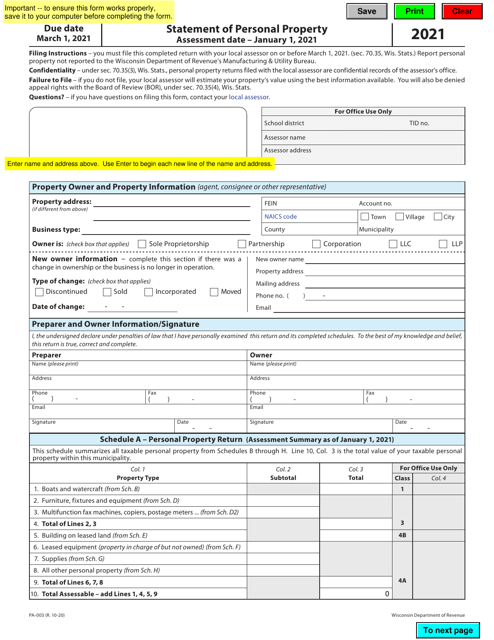

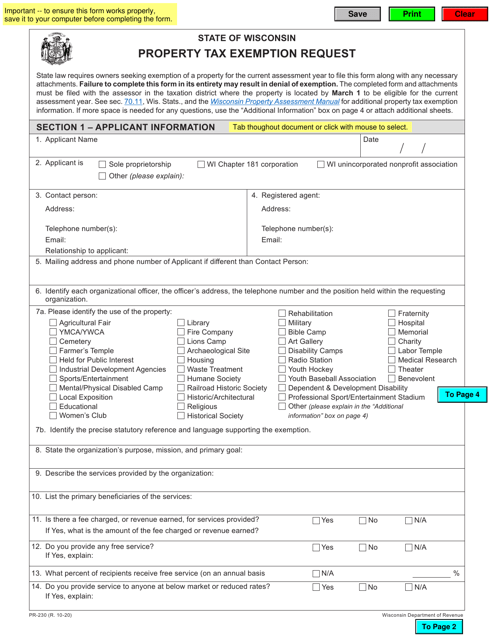

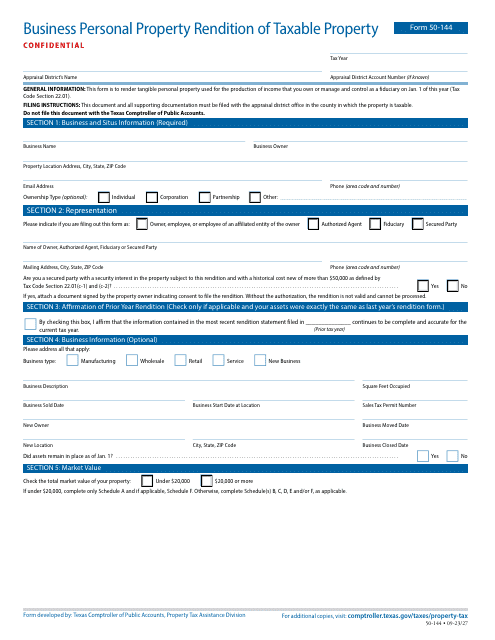

This Form is used for reporting personal property in the state of Wisconsin. It is used to provide information on items such as furniture, equipment, and vehicles owned by individuals or businesses.

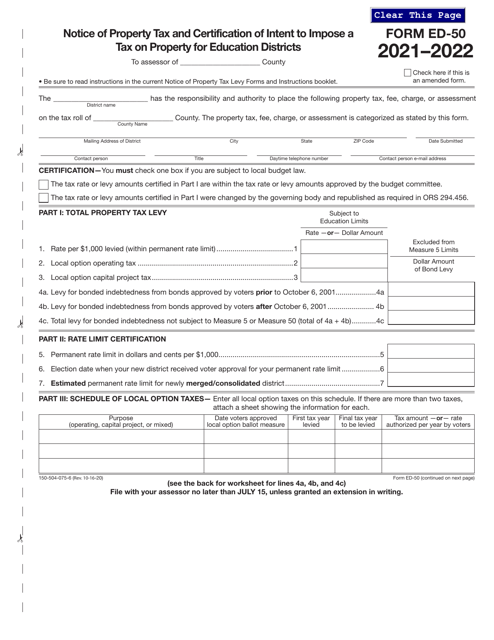

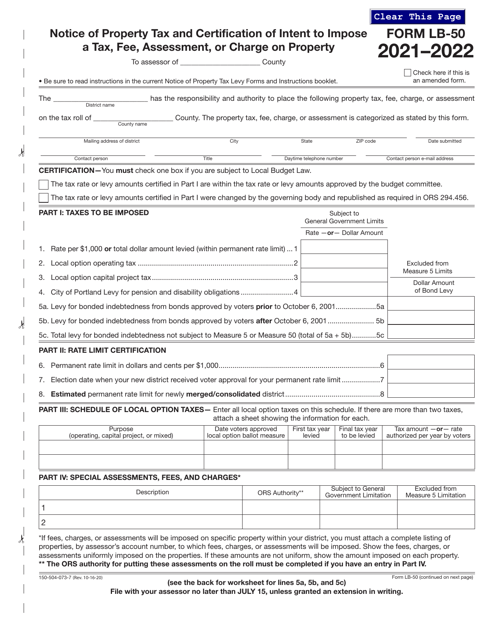

This document is used for providing notice of property tax and certification of intent to impose a tax, fee, assessment, or charge on property in Oregon.

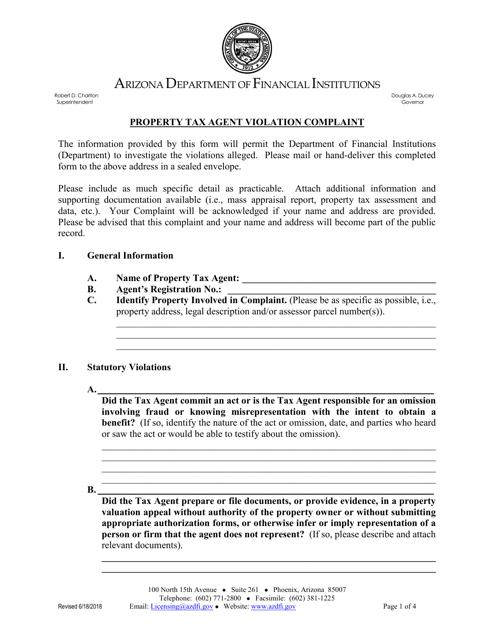

This document is used for filing a complaint against a property tax agent for a violation in Arizona.

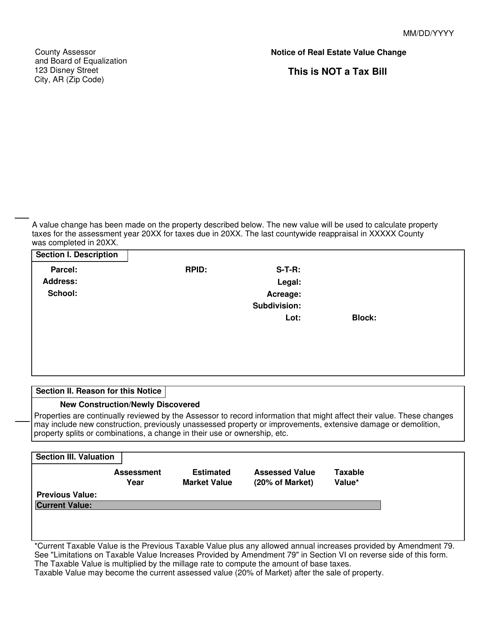

This document notifies property owners in Arkansas of a change in the value of their real estate. It provides important information regarding the updated value assessment of the property.

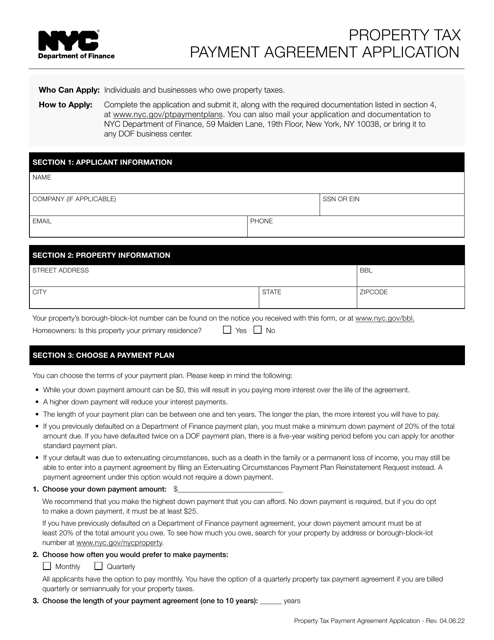

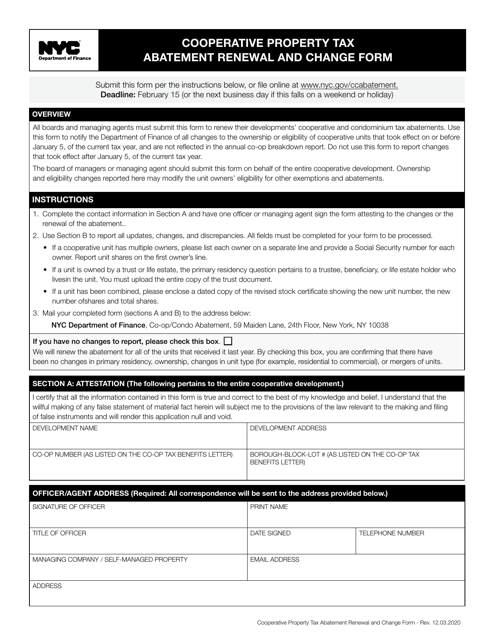

This document is used for renewing and making changes to the property tax abatement program for cooperative properties in New York City.