Property Tax Form Templates

Documents:

720

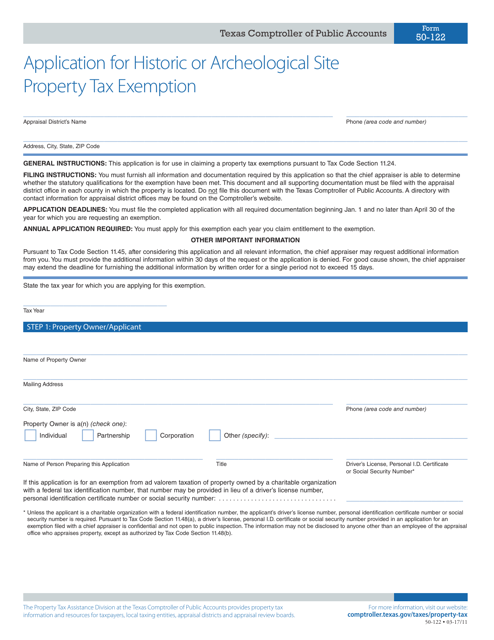

This Form is used for applying for a property tax exemption for historic or archaeological sites in Texas.

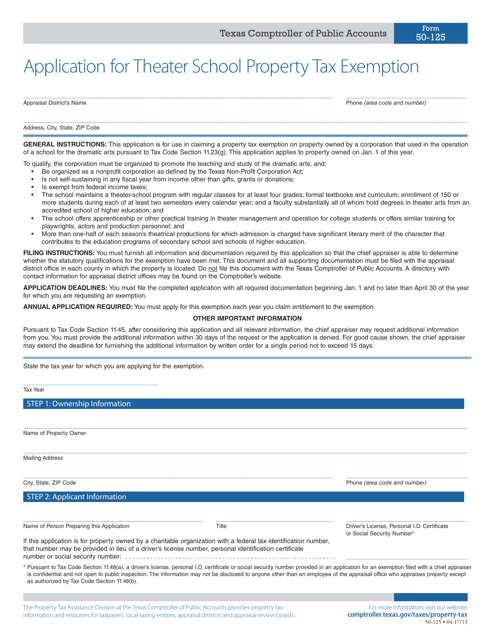

This document is used for applying for a property tax exemption for theater schools in Texas.

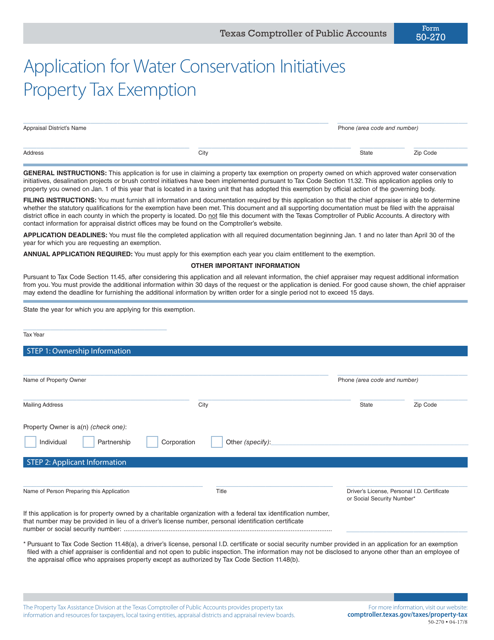

This form is used for applying for a property tax exemption in Texas for water conservation initiatives.

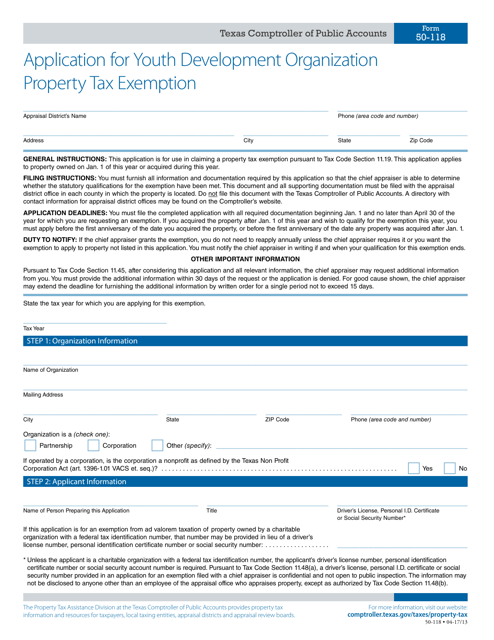

This form is used for applying for a property tax exemption for a youth development organization in Texas.

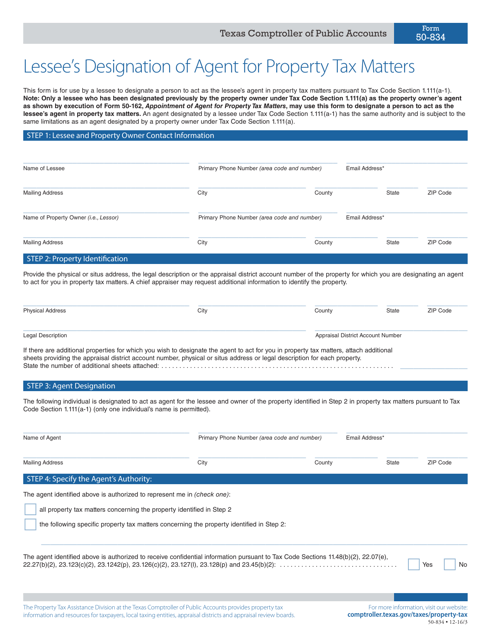

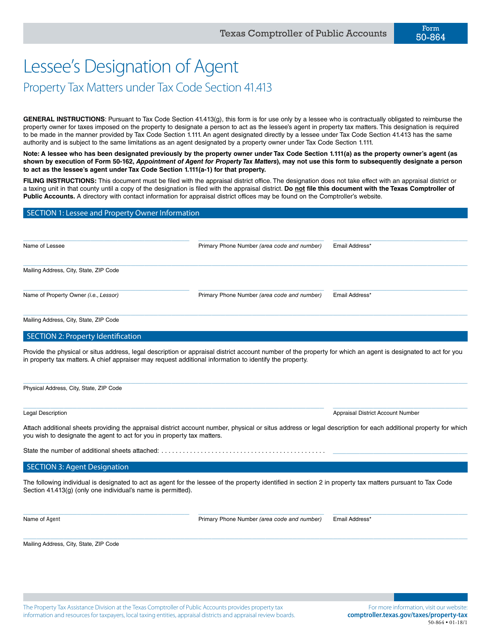

This form is used for a lessee in Texas to designate an agent to handle property tax matters on their behalf.

This form is used for a lessee to designate an agent for property tax matters under Tax Code Section 41.413 in the state of Texas.

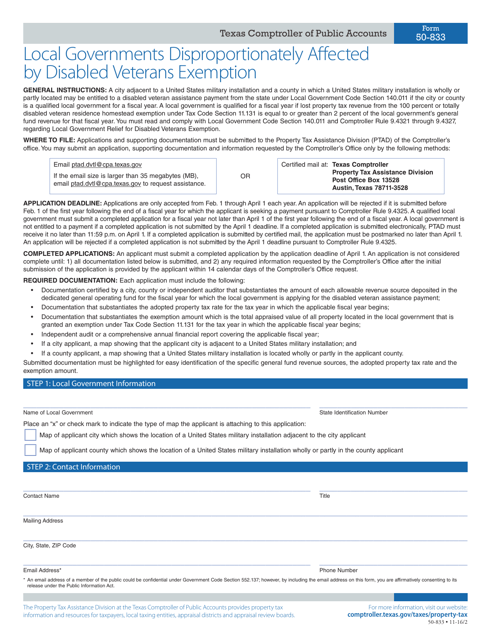

This Form is used for local governments in Texas to report and apply for the Disabled Veterans Exemption. It helps determine the impact of this exemption on local budgets and revenue.

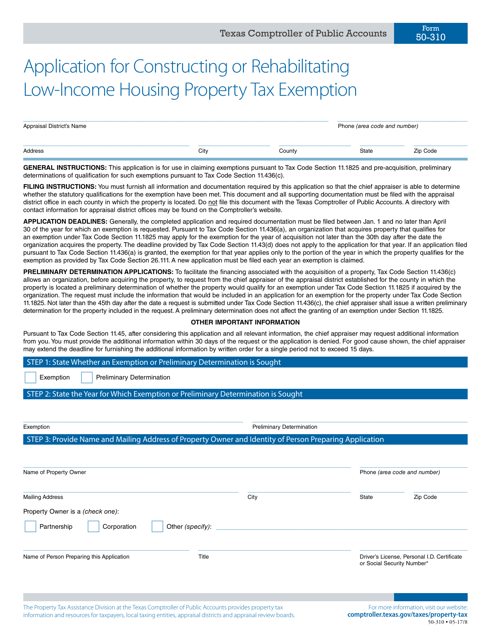

This form is used for applying for a property tax exemption in Texas for constructing or rehabilitating low-income housing.

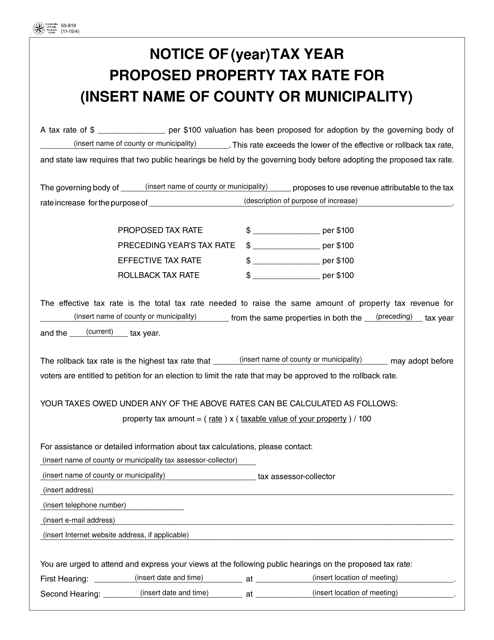

This form is used in Texas to notify residents about the proposed property tax rate for their property.

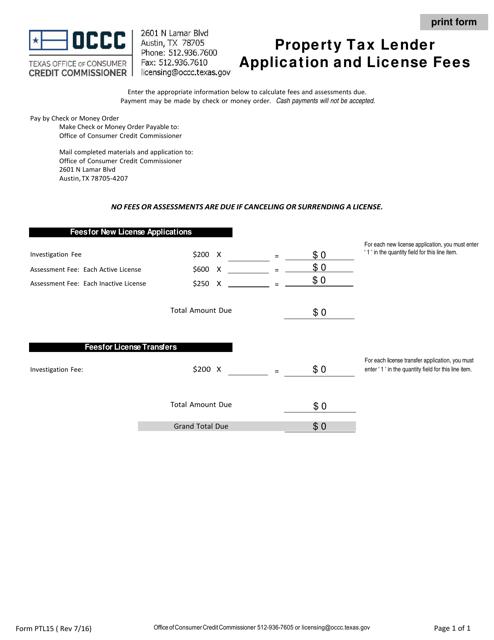

This Form is used for applying for a property tax lender license in Texas and paying the associated license fees.

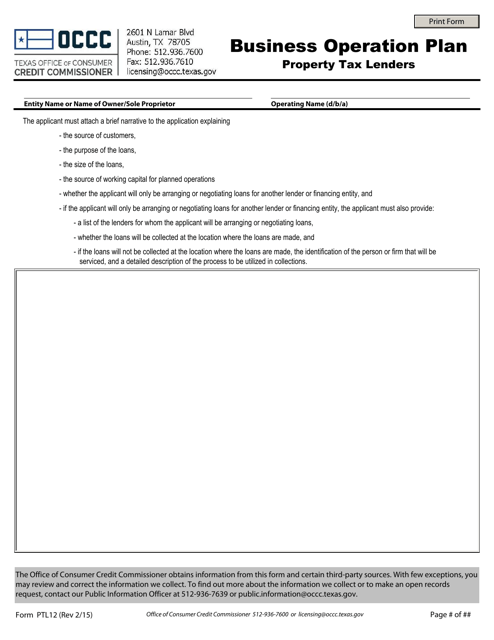

This form is used to create a business operation plan for property tax lenders in Texas. It outlines the details and strategies for operating a property tax lending business in the state.

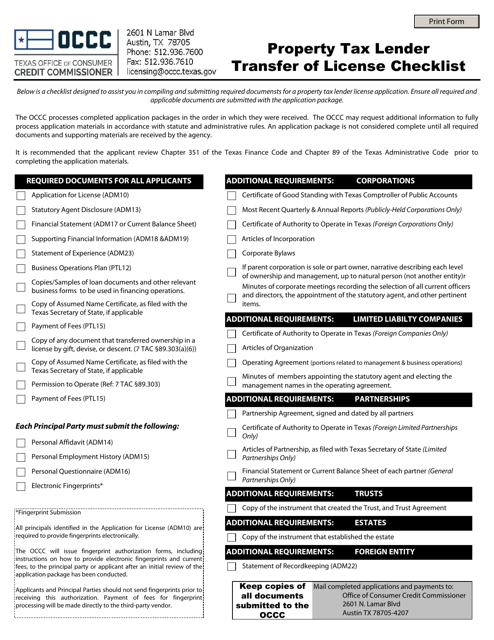

This checklist is used in Texas for transferring a property tax lender license to another individual or entity. It helps ensure that all necessary steps and requirements are met during the transfer process.

This form is used for requesting an exemption for property tax lenders in Texas who have issued five or fewer loans.

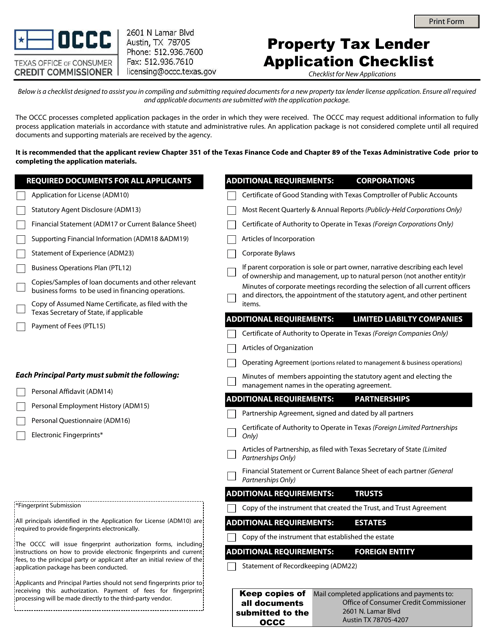

This checklist is used for applying for a property tax lender in Texas.

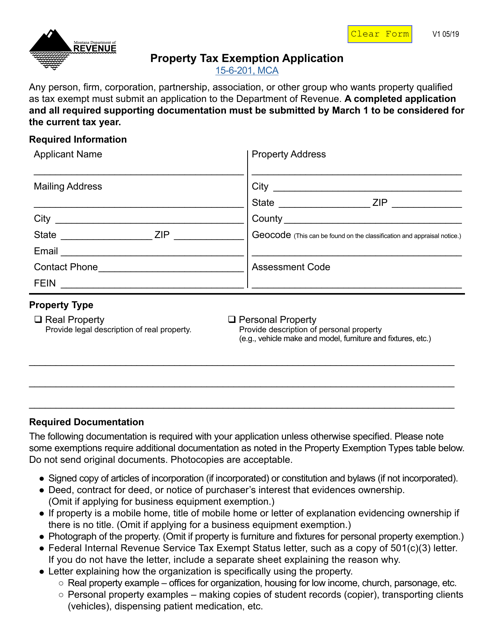

This document is used for applying for a property tax exemption in Montana. It helps eligible individuals or organizations apply for a reduction or exemption from their property taxes.

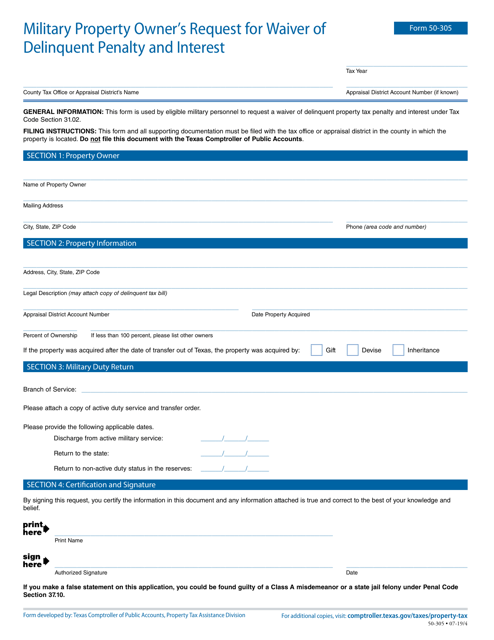

This form is used for military property owners in Texas to request a waiver of delinquent penalty and interest for their property taxes.

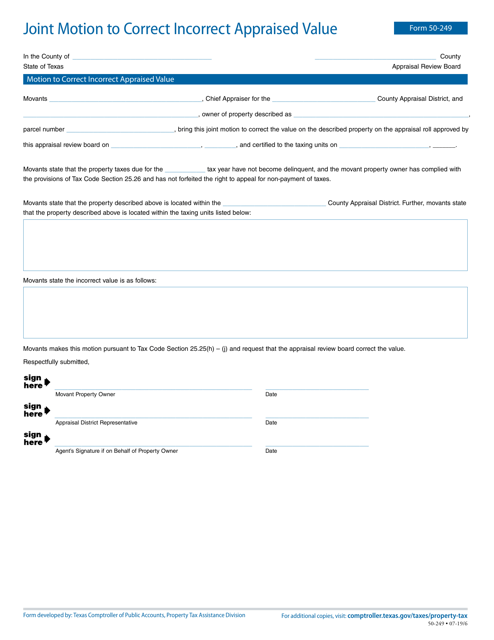

This Form is used for filing a joint motion in Texas to correct an incorrectly appraised value. It allows property owners to dispute the appraisal of their property and request a correction.

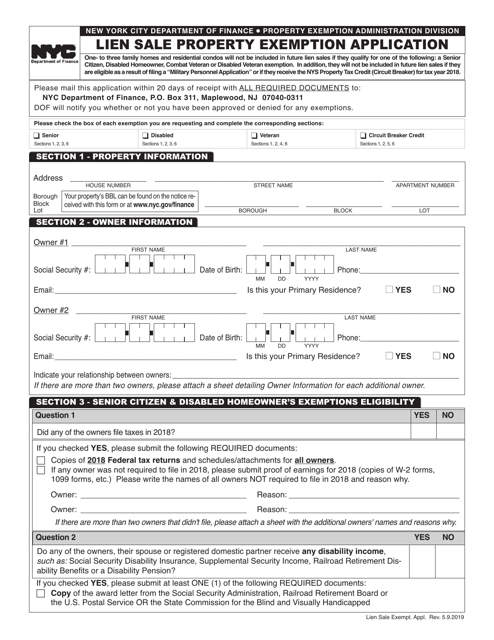

This document is for applying for an exemption on a property being sold through a lien sale in New York City.