Property Tax Form Templates

Documents:

720

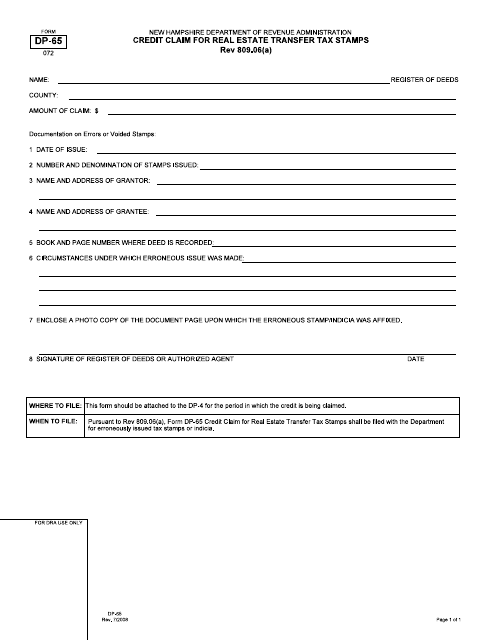

This form is used for claiming credit for real estate transfer tax stamps in New Hampshire.

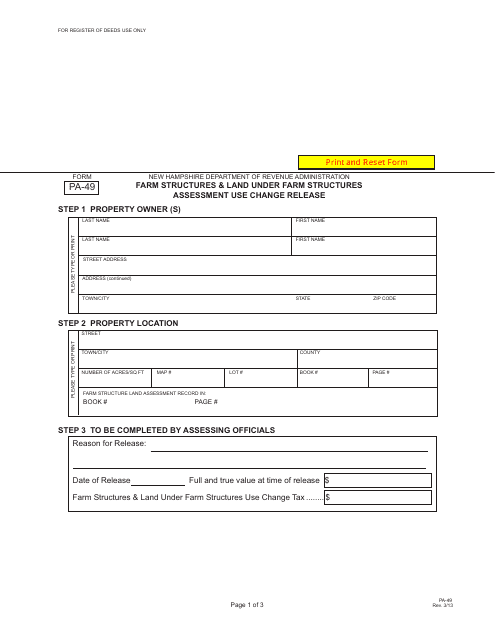

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

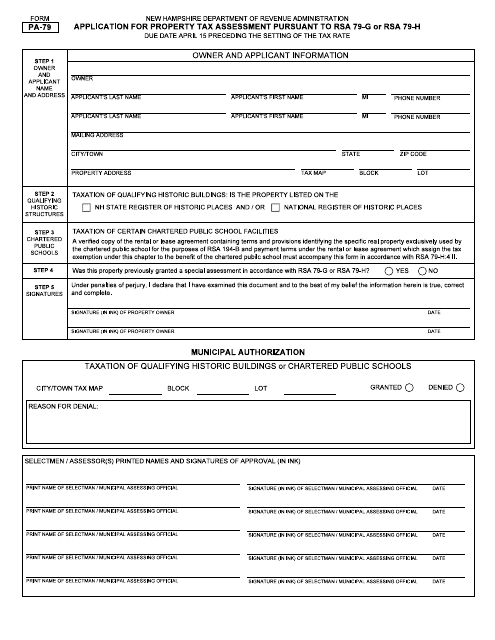

This form is used for applying for a property tax assessment in New Hampshire under RSA 79-G or RSA 79-H.

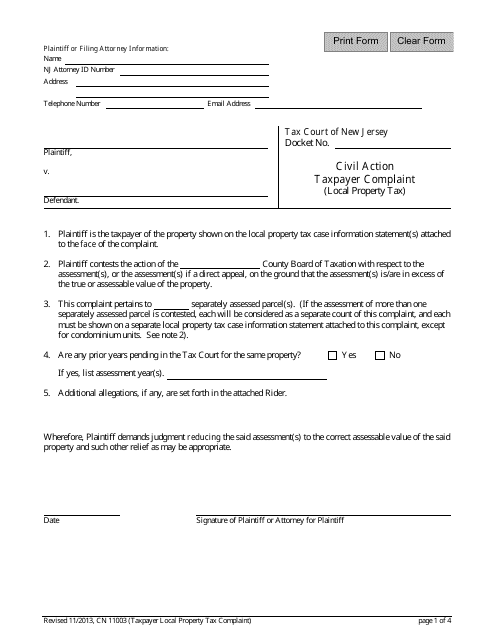

This Form is used for filing a complaint regarding local property tax issues in New Jersey.

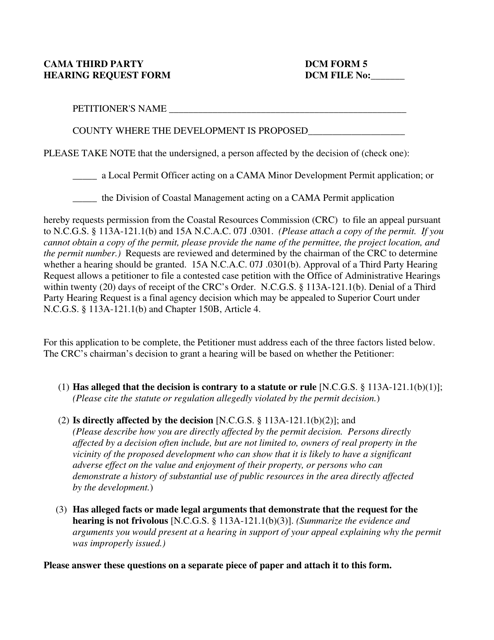

This form is used for requesting a third party hearing related to the DCM Form 5 CAMA in North Carolina.

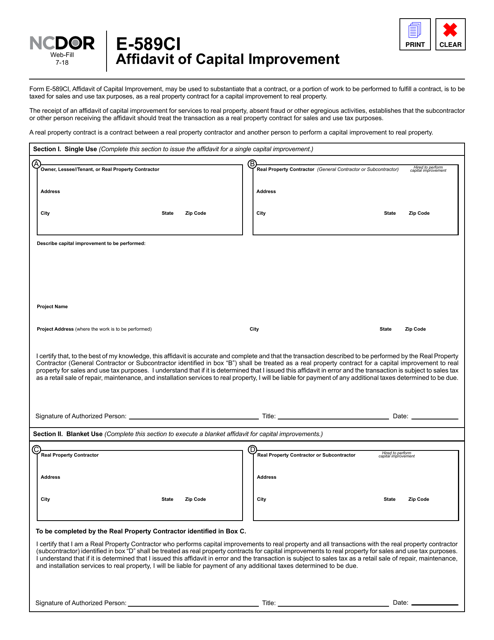

This form is used for filing an Affidavit of Capital Improvement in North Carolina. It is used to certify that certain construction or improvements have been made to a property in order to claim an exclusion or deferment from property taxes.

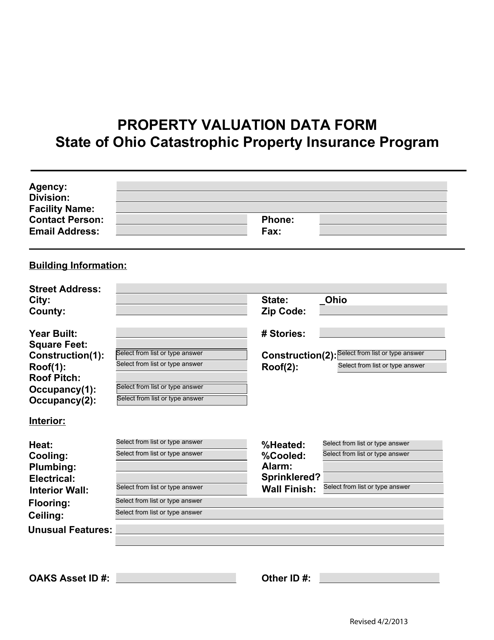

This Form is used for obtaining property valuation data in the state of Ohio.

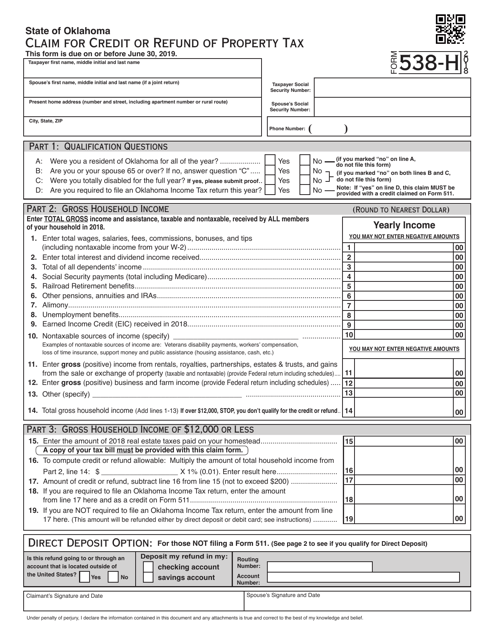

This form is used for claiming a credit or refund of property tax in Oklahoma. It is an OTC Form 538-H.

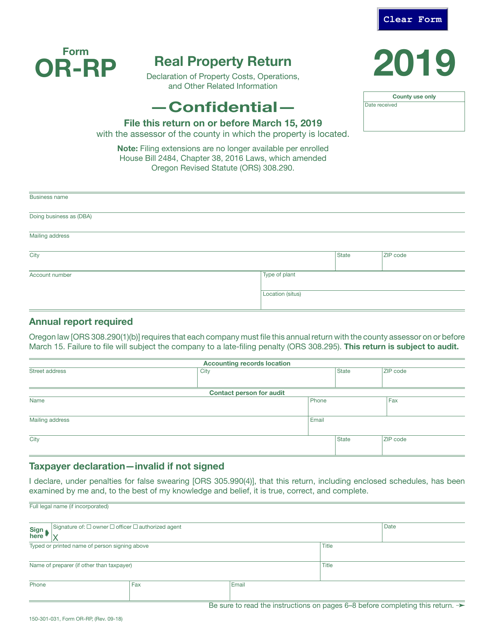

This form is used for filing a real property return in the state of Oregon. It is required by the Oregon Department of Revenue and must be completed by property owners to report their real estate holdings.

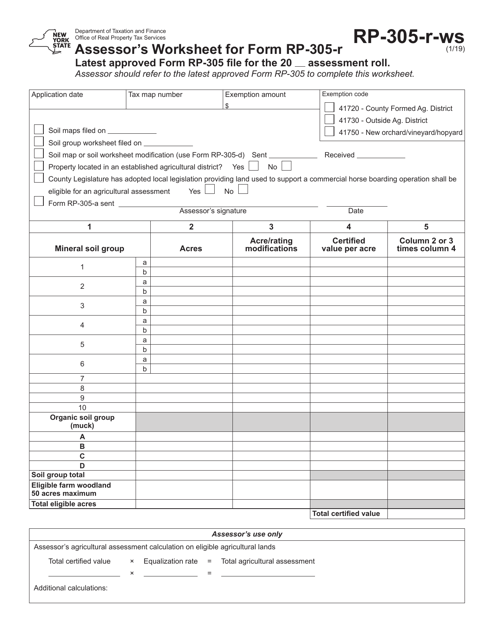

This Form is used by assessors in New York to complete the worksheet for Form RP-305-R. It helps in assessing property values in the state.

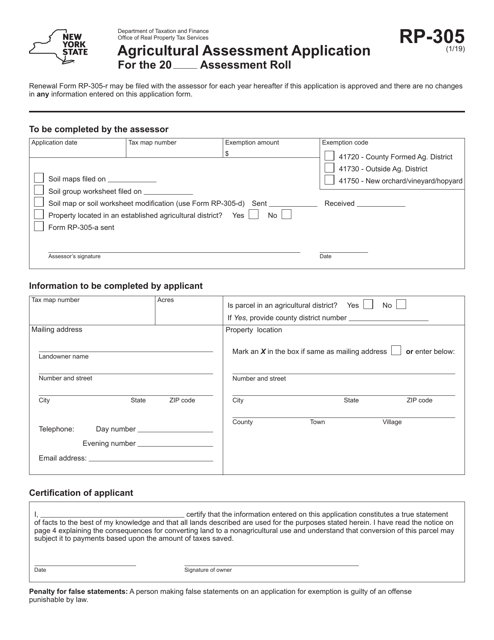

This form is used for applying for agricultural assessment in New York. It helps property owners receive tax benefits for qualifying agricultural land.

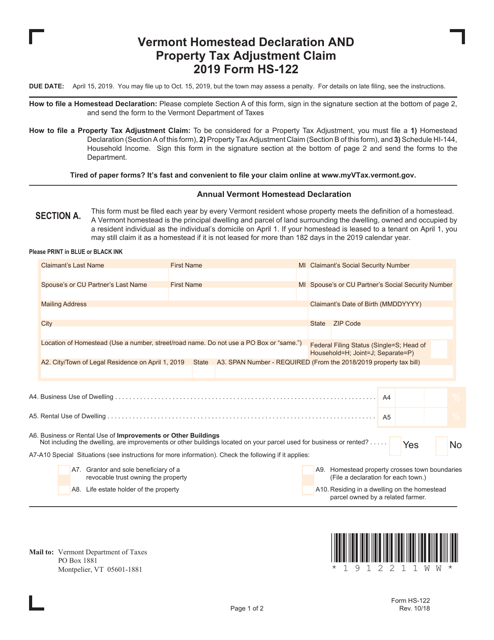

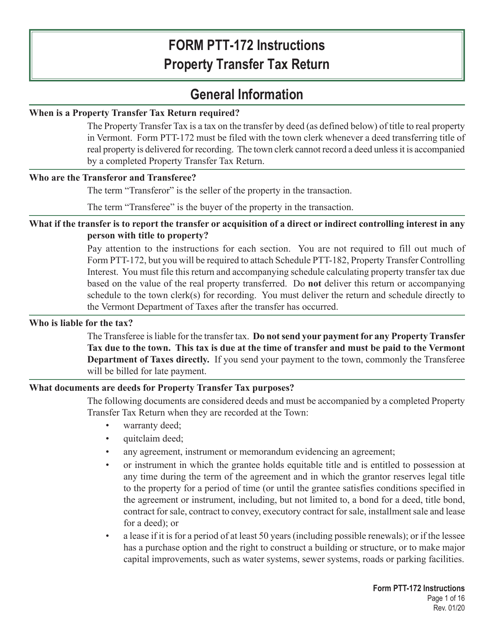

This form is used for residents of Vermont to declare their homestead and claim property tax adjustments.

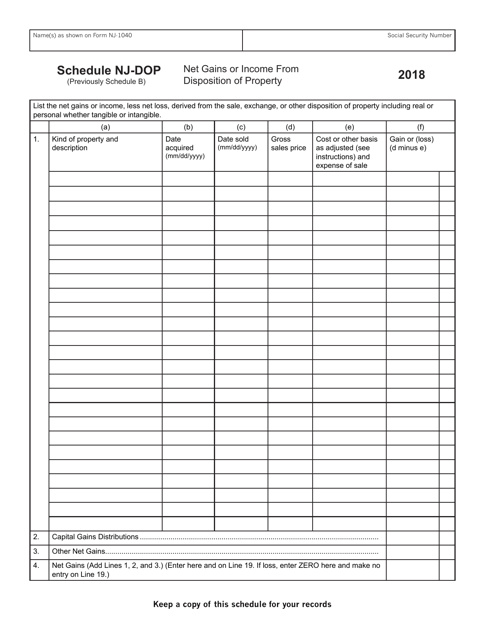

This form is used for reporting any net gains or income obtained from the sale or disposal of property in the state of New Jersey.

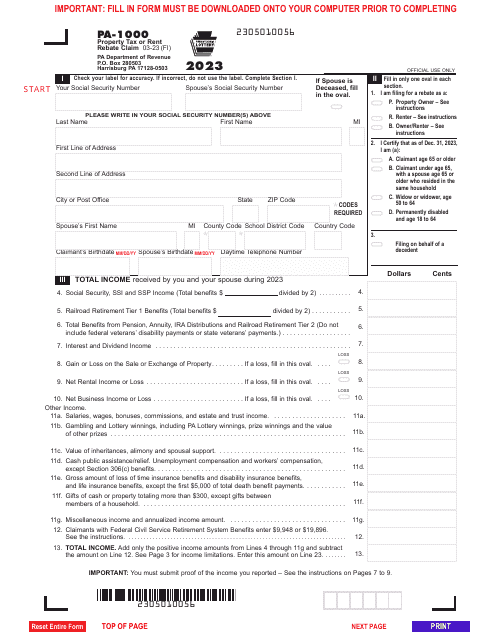

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

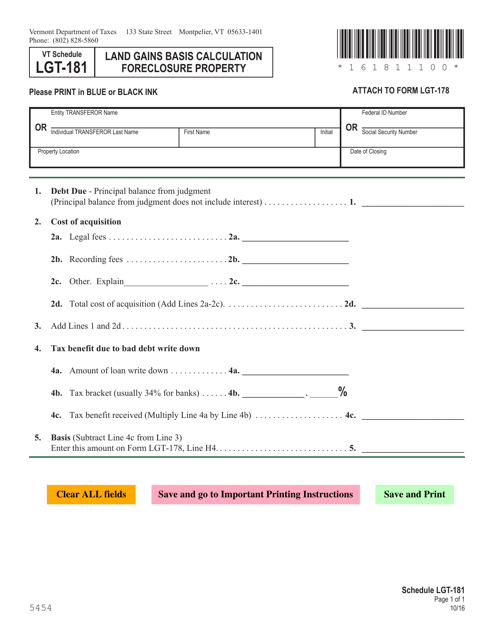

This Vermont form is used for calculating the land gains basis for foreclosure property in Vermont.

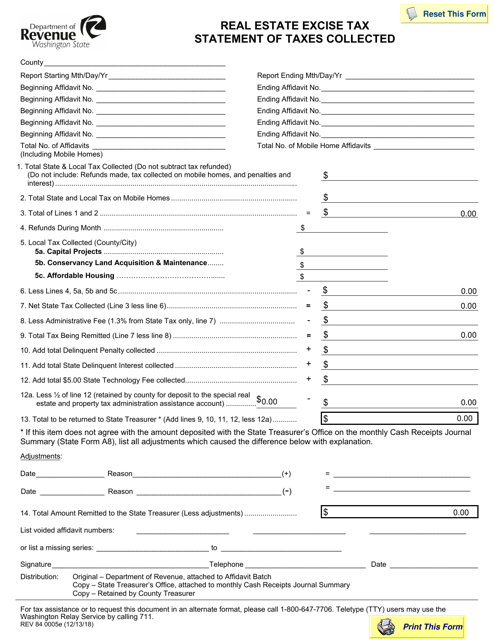

This form is used for reporting and documenting the real estate excise taxes collected in the state of Washington.

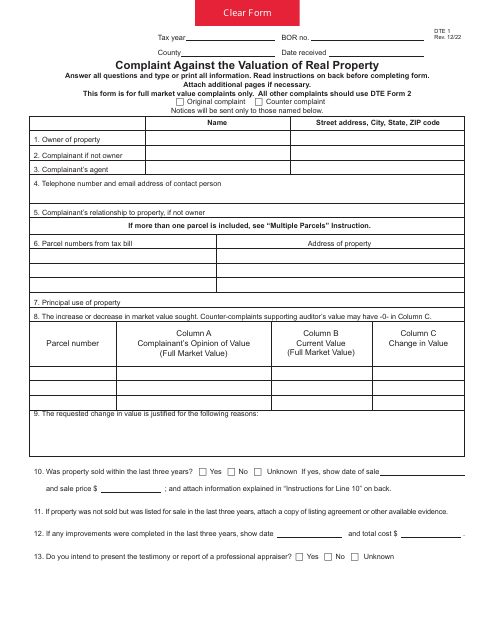

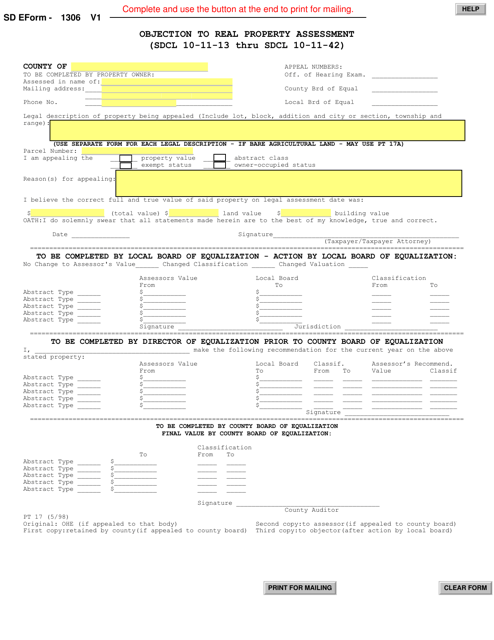

This form is used for filing an objection to the assessment of real property in South Dakota. It allows property owners to dispute the assessed value of their property for tax purposes.

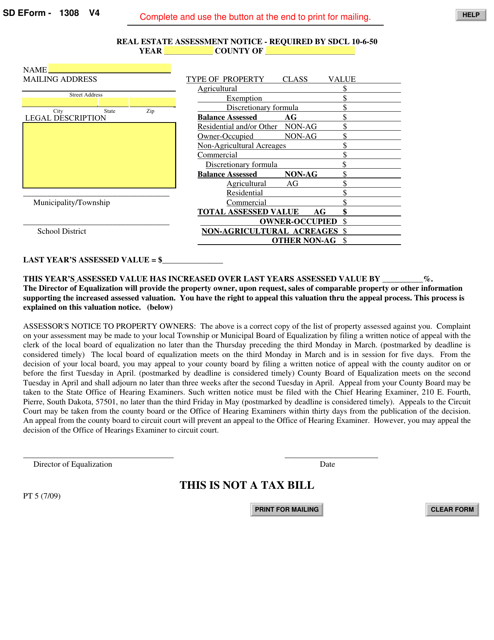

This document is a real estate assessment notice specific to South Dakota. It is used to inform property owners about the assessed value of their property for tax purposes.

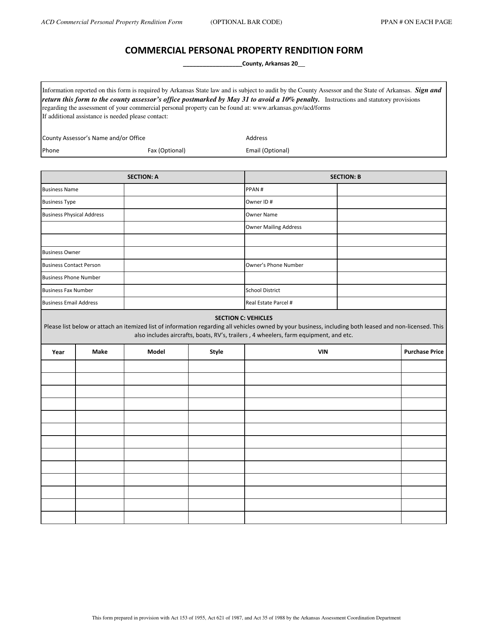

This document is used for reporting commercial and personal property in Arkansas for tax purposes.

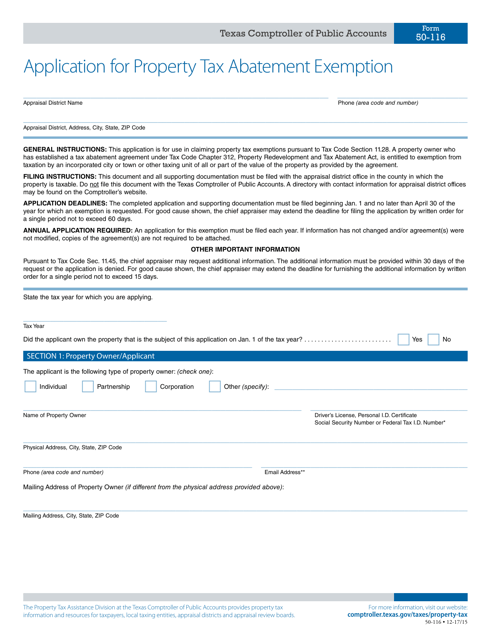

This form is used for applying for a property tax abatement exemption in Texas.

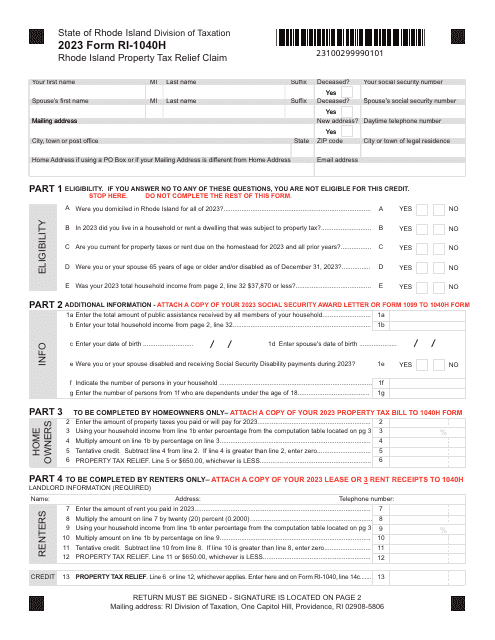

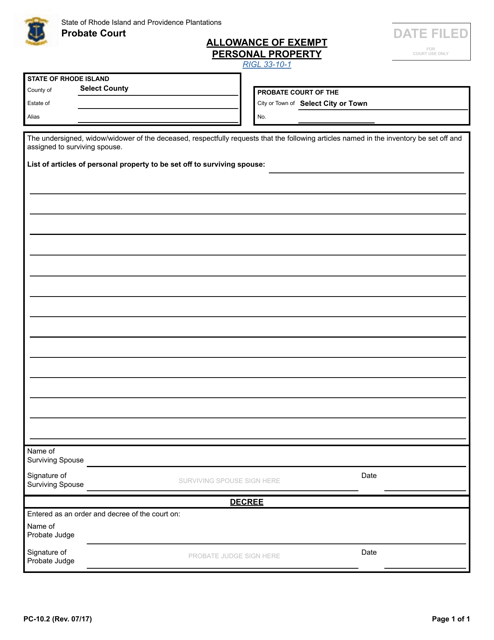

This Form is used for the allowance of exempt personal property in Rhode Island.

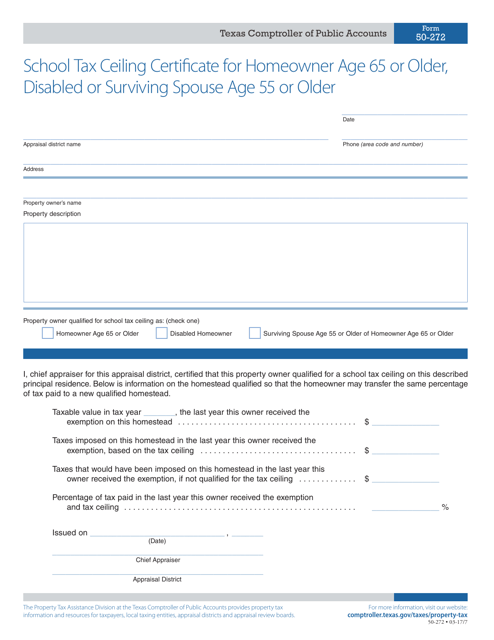

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to certify their eligibility for a school tax ceiling.

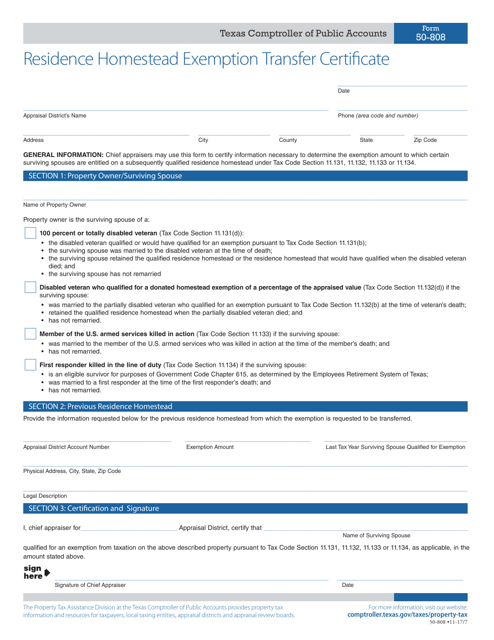

This form is used for transferring residence homestead exemption in Texas. Apply for a transfer certificate to claim tax exemptions on your new homestead property.