Property Tax Form Templates

Documents:

720

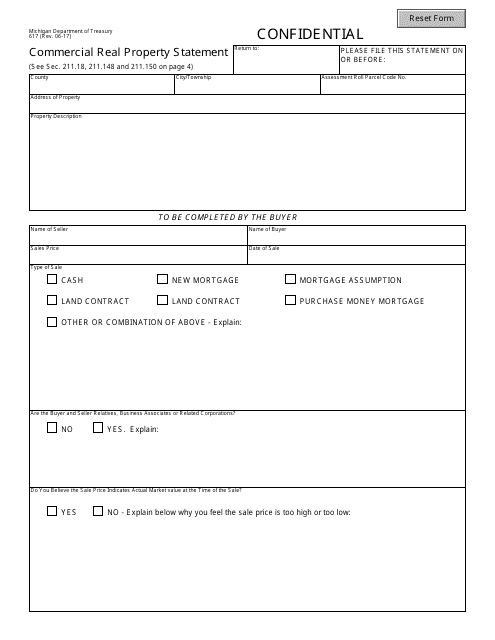

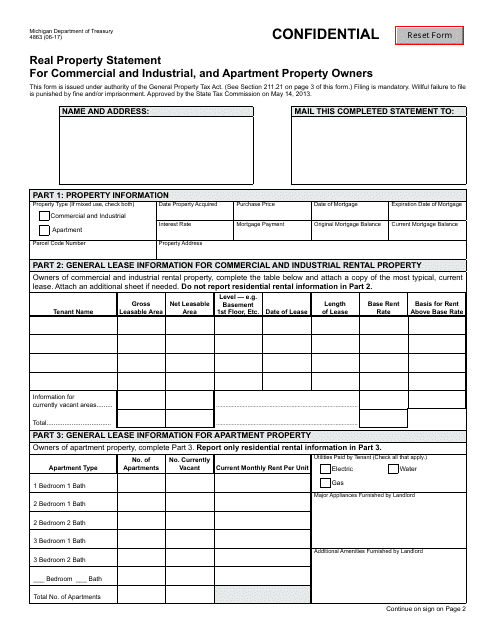

This Form is used for providing a statement of commercial real property in the state of Michigan. It is required for assessment and taxation purposes.

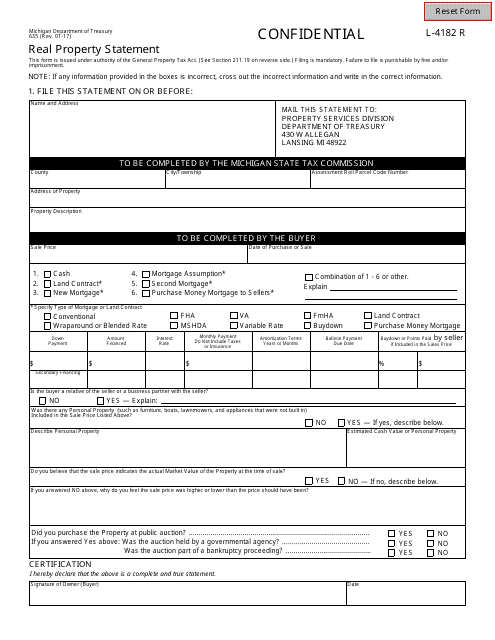

This document is used for providing a statement of real property in the state of Michigan. It is used to report the value of real property for tax assessment purposes.

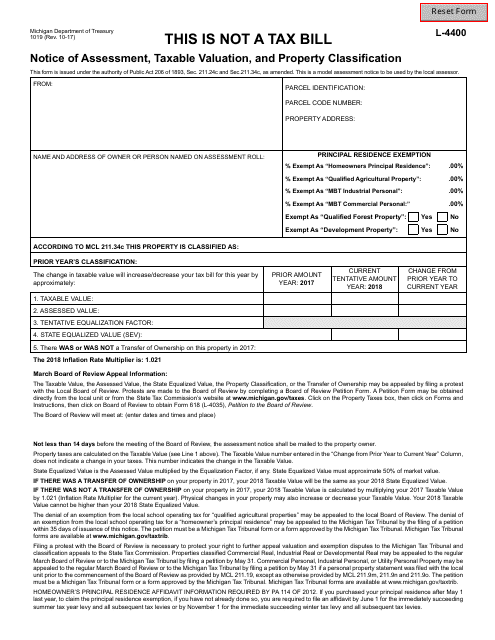

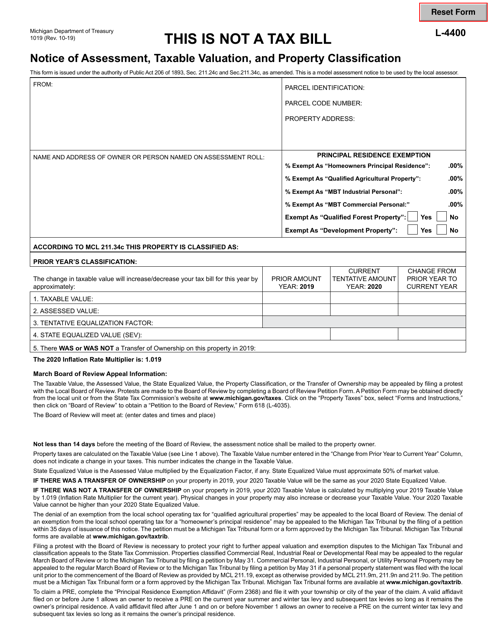

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

This form is used for commercial and industrial, and apartment property owners in Michigan to provide a statement about their real property.

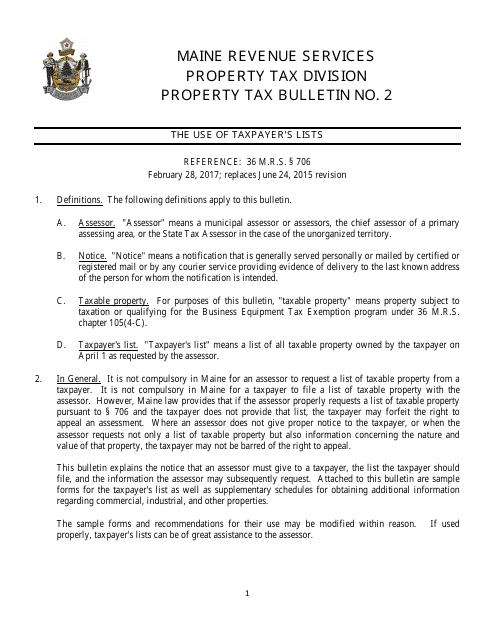

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

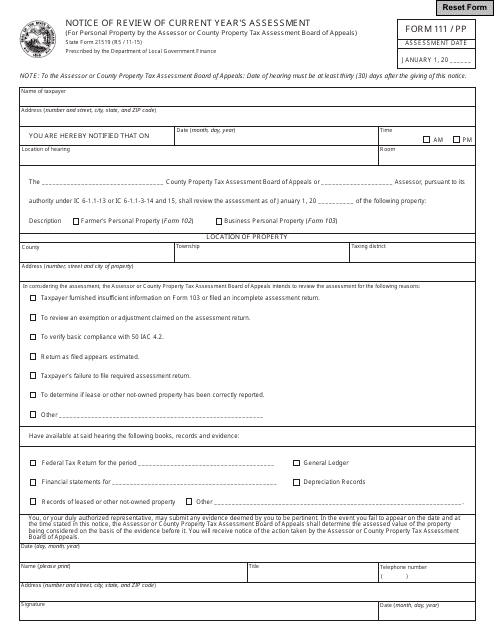

This form is used for notifying Indiana residents about the review of their current year's assessment.

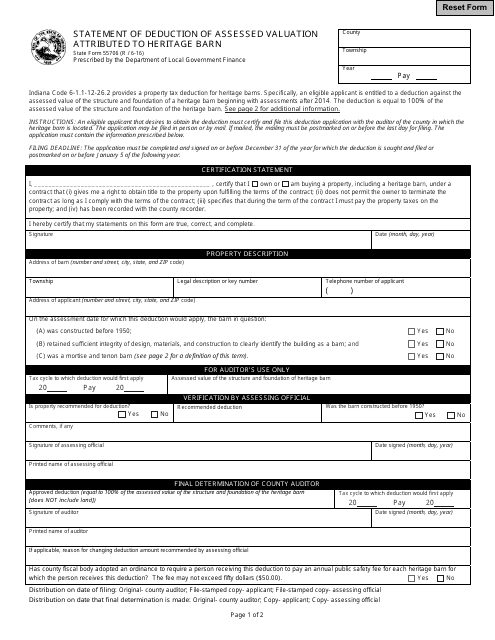

This document is used for recording the deduction of assessed valuation from a heritage barn in Indiana.

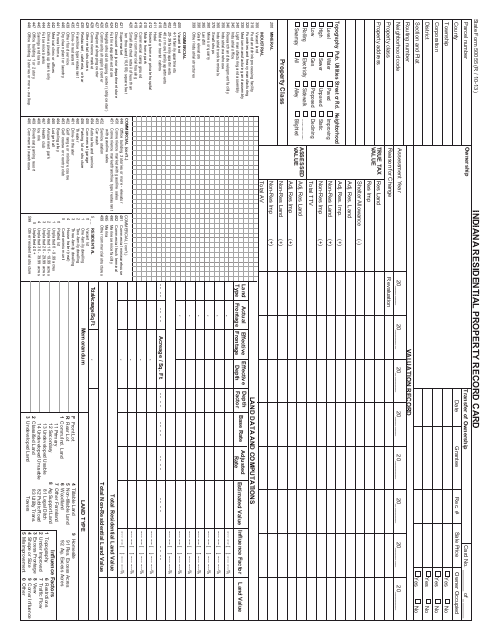

This form is used for recording and maintaining details of residential properties in the state of Indiana. It includes information such as property characteristics, ownership details, and assessment data. The Residential Property Record Card helps the Indiana government keep track of residential properties for taxation and administrative purposes.

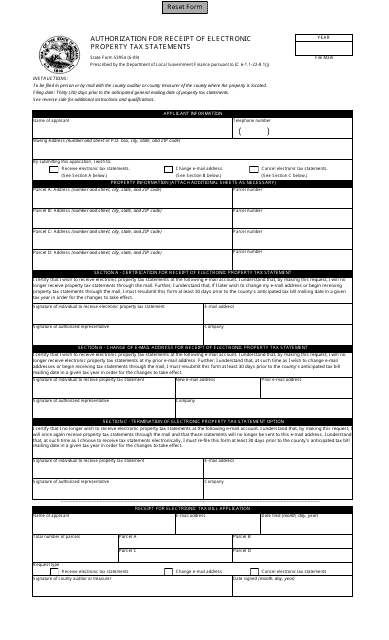

This form is used for authorizing the receipt of electronic property tax statements in Indiana.

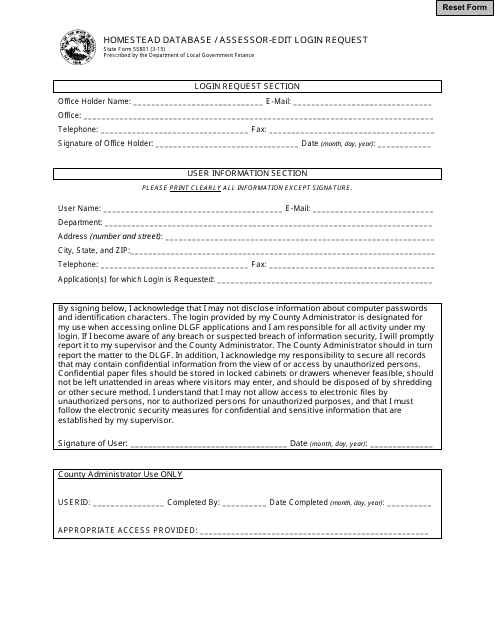

This document is used for requesting to edit login information in the Homestead Database for assessors in the state of Indiana.

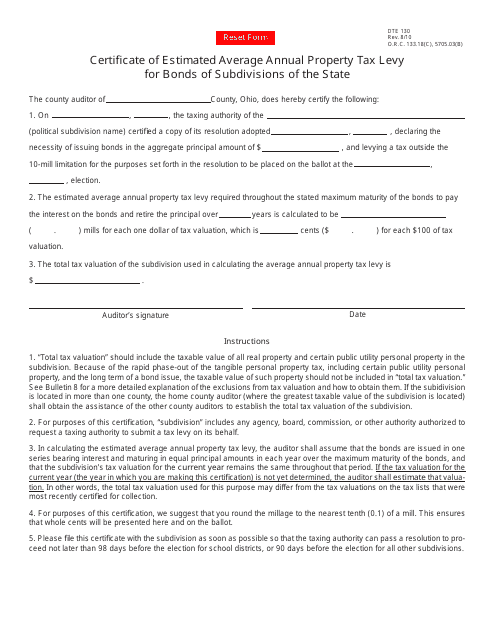

This form is used for reporting the estimated average annual property tax levy on bonds for subdivisions in the state of Ohio.

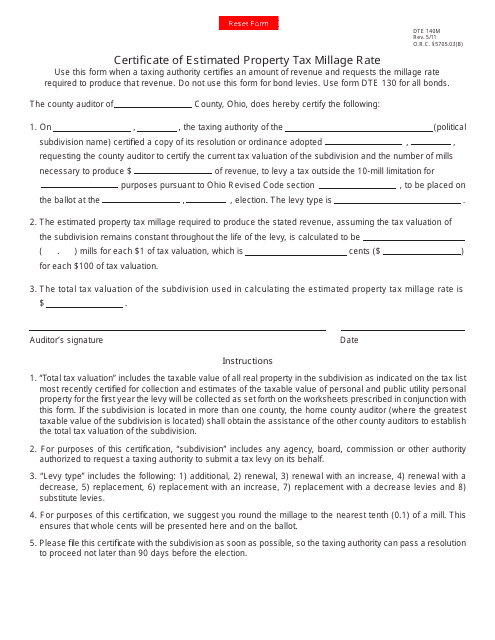

This form is used for obtaining a Certificate of Estimated Property Tax Millage Rate in the state of Ohio. It is used to determine the projected tax rate for a property.

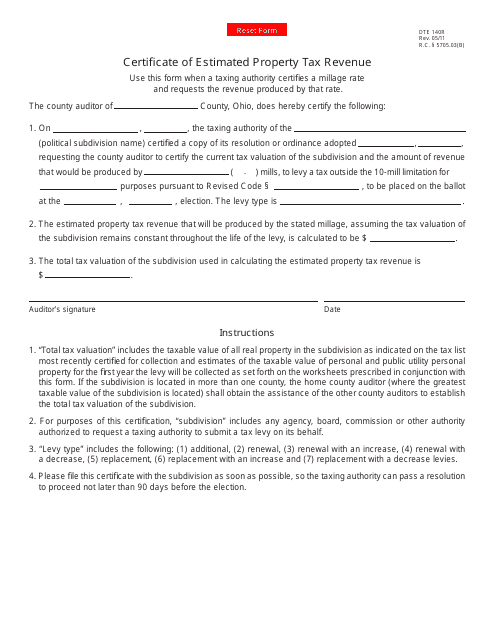

This form is used for reporting and estimating property tax revenue in the state of Ohio. It is used by local governments and agencies to calculate and forecast the revenue that will be generated from property taxes.

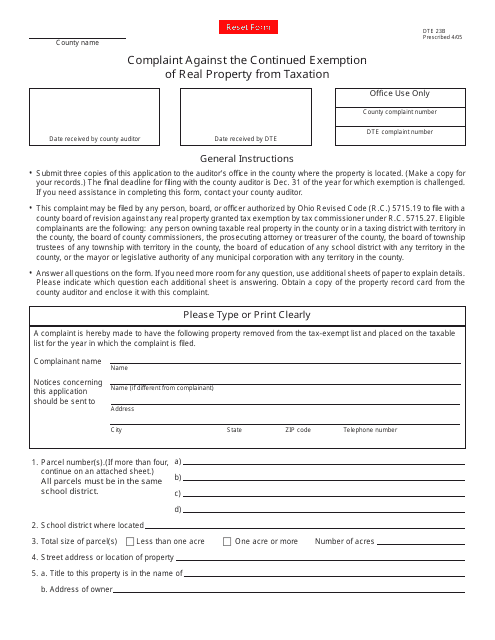

This form is used for filing a complaint against the continued exemption of real property from taxation in Ohio.

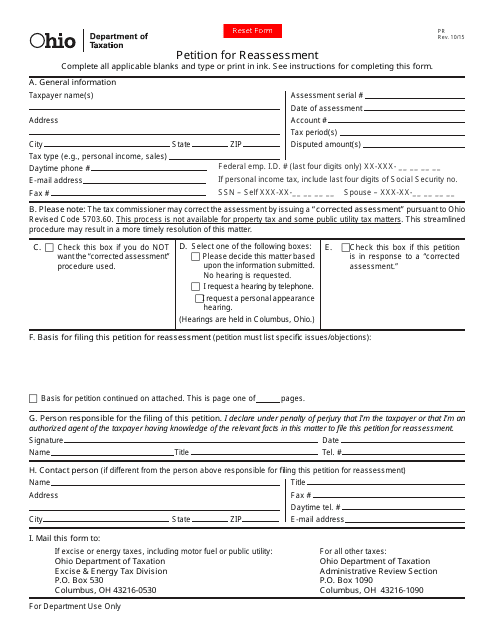

This document is a form used for petitioning for reassessment of property taxes in the state of Ohio.

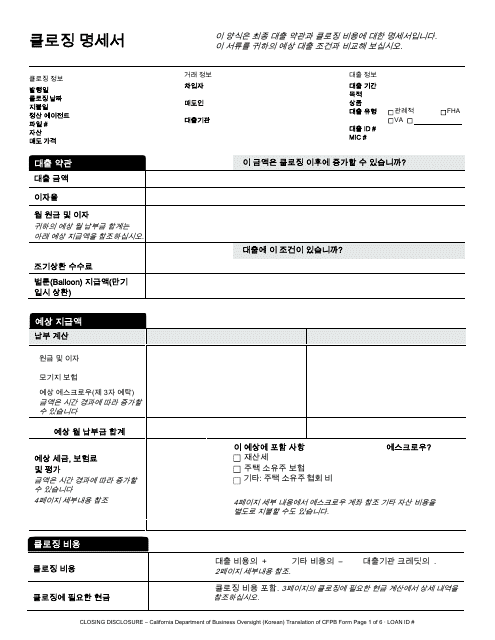

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

This Form is used for notifying the Municipal Tax Assessors in Connecticut about corrections or changes required in the tax assessment records.

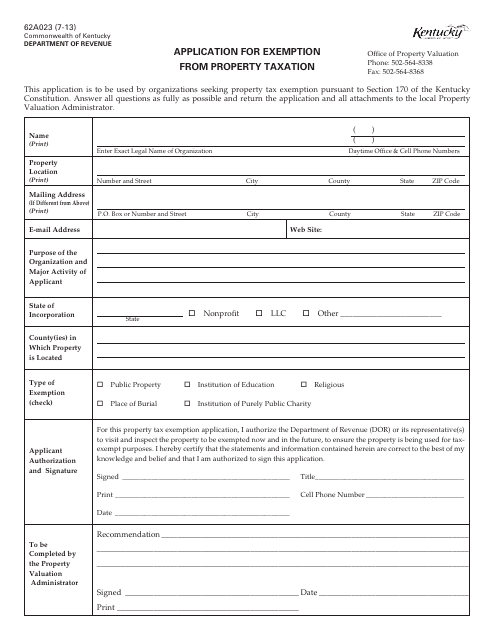

This Form is used for applying for exemption from property taxation in Kentucky. It is required to seek exemption from paying property tax on certain types of properties in the state.

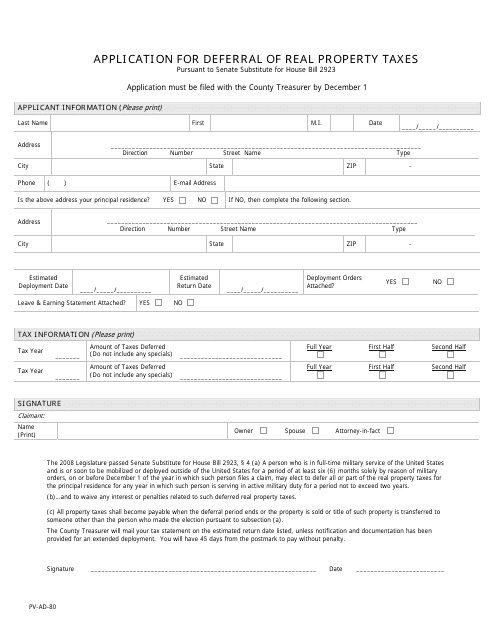

This form is used for applying to defer real property taxes in the state of Kansas. It allows eligible individuals to request a deferral of their taxes, providing financial relief for those who qualify.

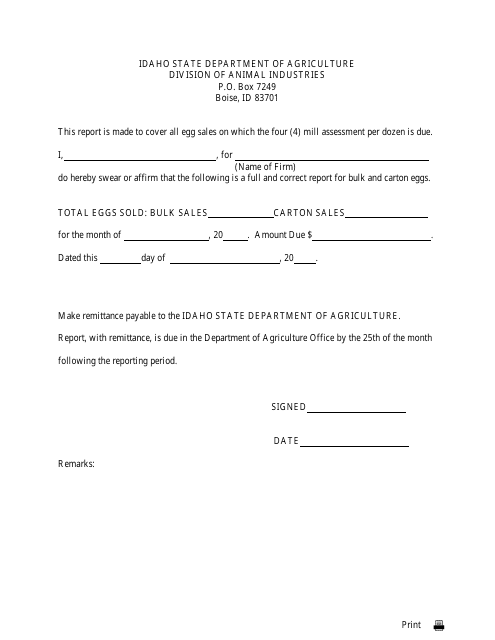

This document is used for calculating and assessing monthly mill levy in the state of Idaho. It determines the amount of property taxes owed by residents and businesses based on the assessed value of their properties.

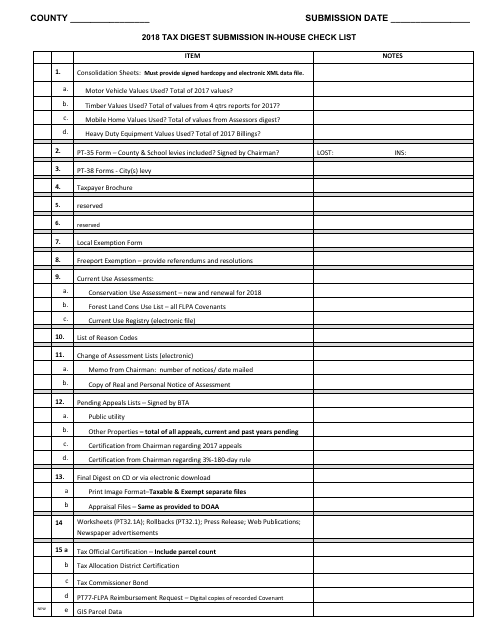

This checklist is used for submitting the tax digest in-house in the state of Georgia, United States. It provides a comprehensive list of items to be reviewed and included when submitting the tax digest.

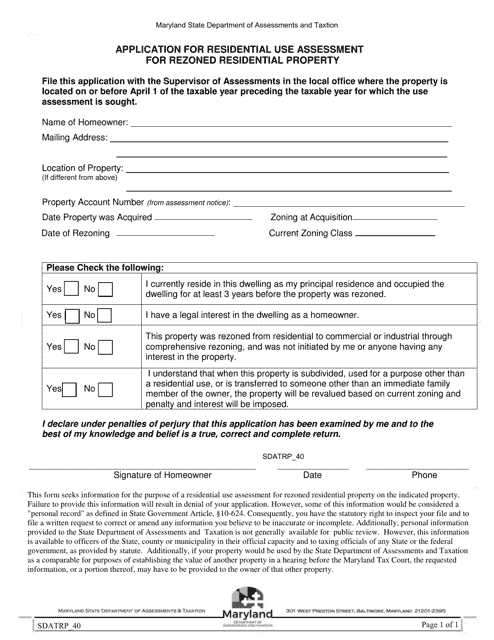

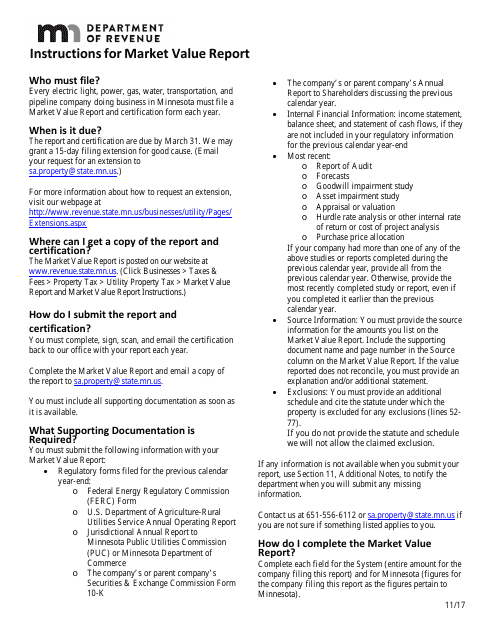

This form is used for reporting the market value of a property in Minnesota. It provides instructions on how to properly fill out the report and submit it to the relevant authorities.

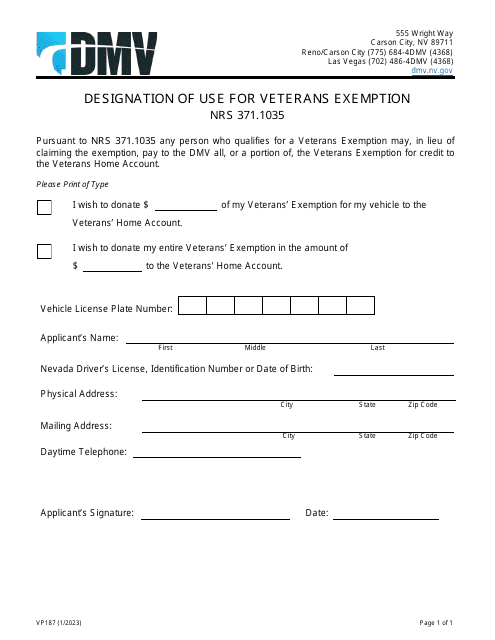

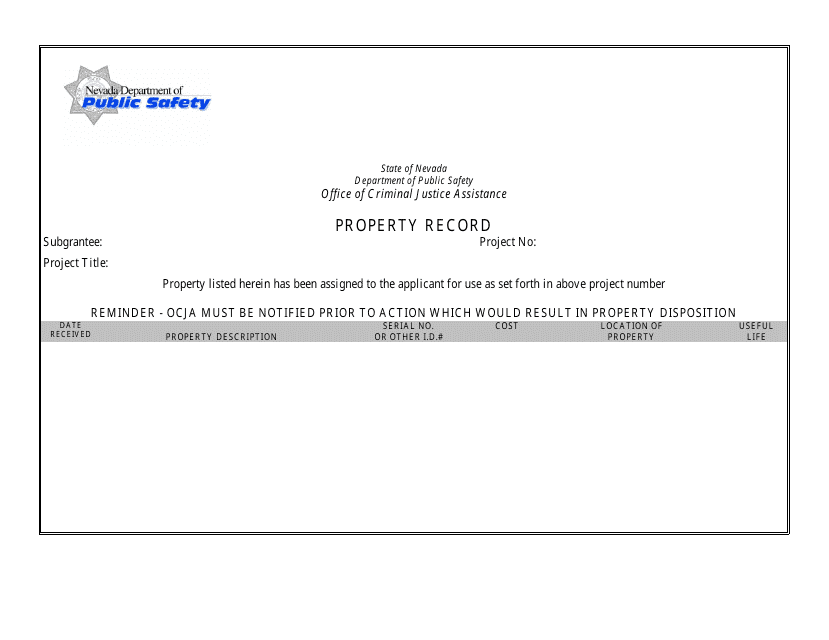

This type of document is used for recording property information in the state of Nevada. It includes details such as the property owner's name, address, and legal description.

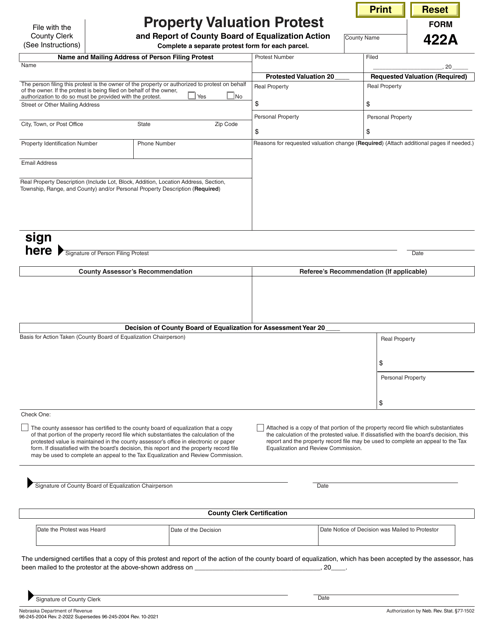

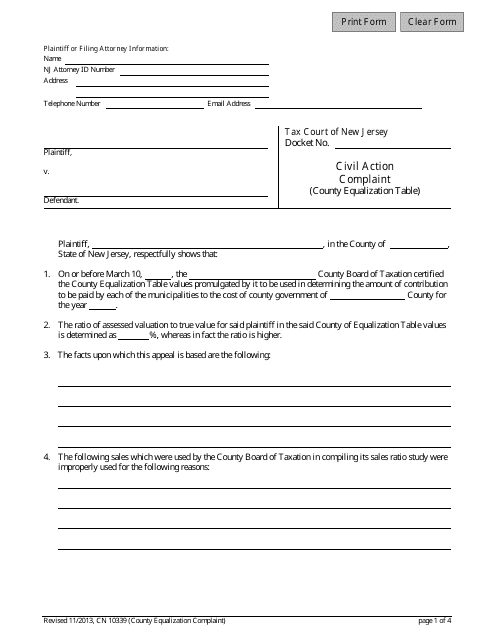

This form is used for filing a complaint regarding property value assessment with the County Equalization Board in New Jersey.

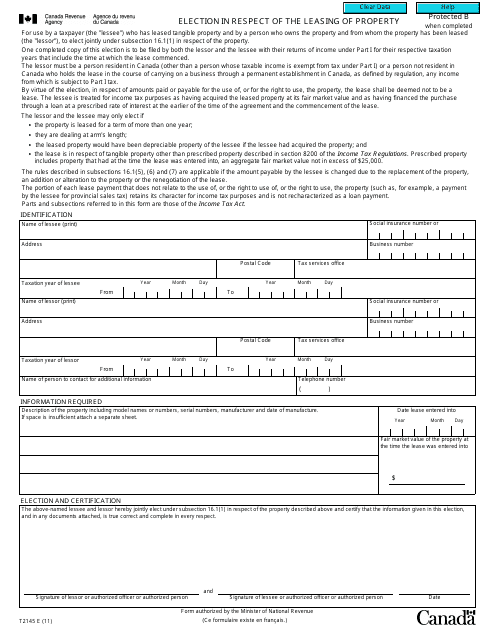

This form is used for making an election related to the leasing of property in Canada. It is used for tax purposes and allows individuals and businesses to choose how they want to report their rental income and expenses.

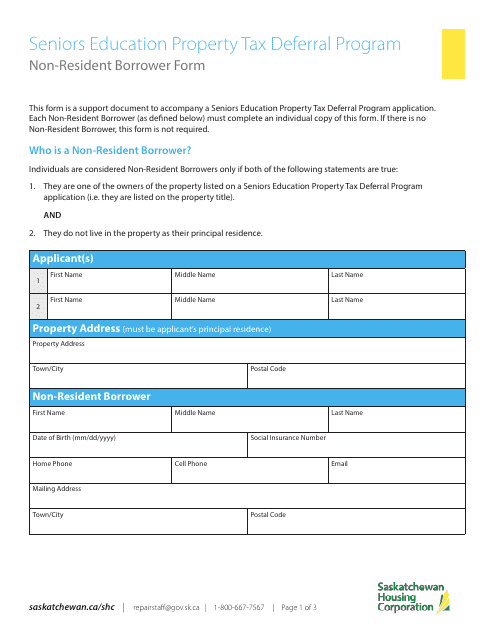

This form is used for the Seniors Education Property Tax Deferral Program in Saskatchewan, Canada. It specifically applies to non-resident borrowers participating in the program.

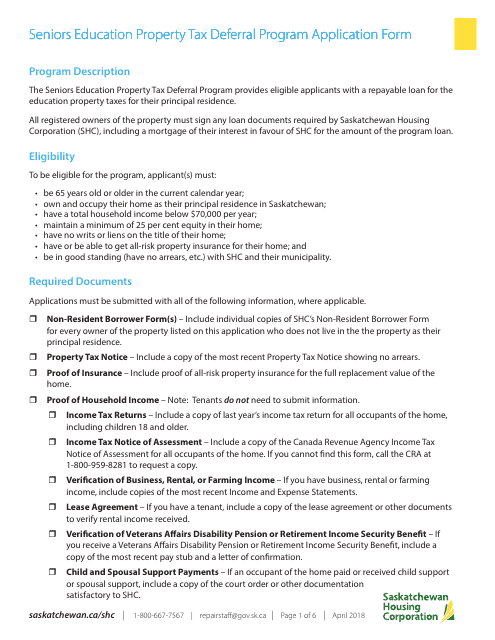

This form is used for applying to the Seniors Education Property Tax Deferral Program in Saskatchewan, Canada. It allows eligible seniors to defer paying property taxes on their primary residence.