Property Tax Form Templates

Documents:

720

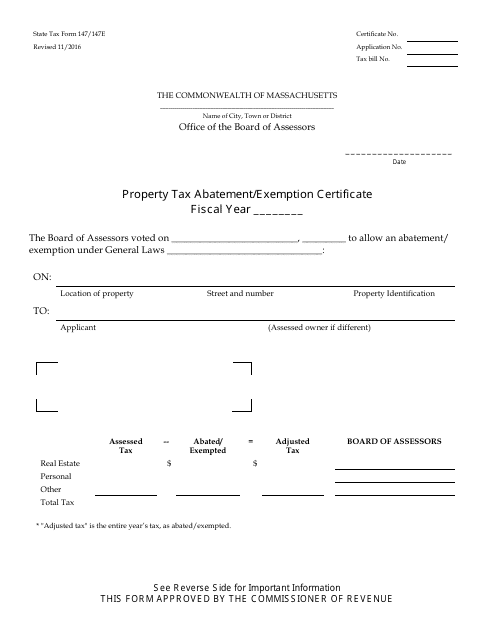

This form is used for requesting property tax abatement or exemption in Massachusetts. It is used to provide information about the property and the reason for seeking the abatement or exemption.

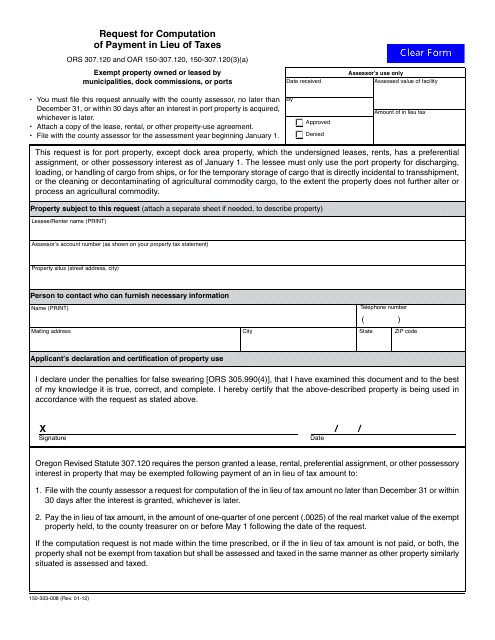

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

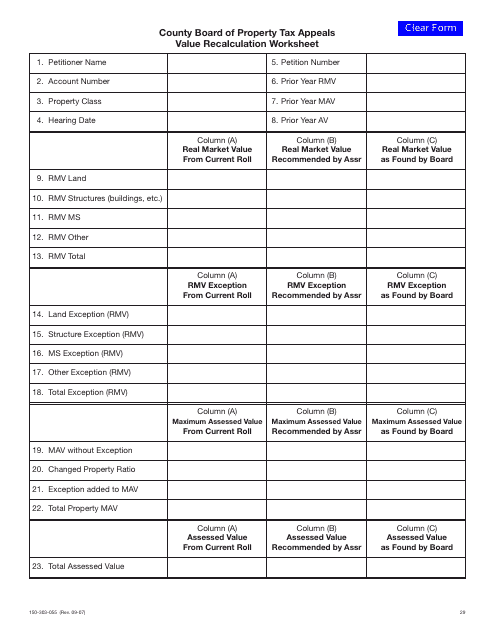

This form is used for property owners in Oregon to request a recalculation of their property's value for tax purposes.

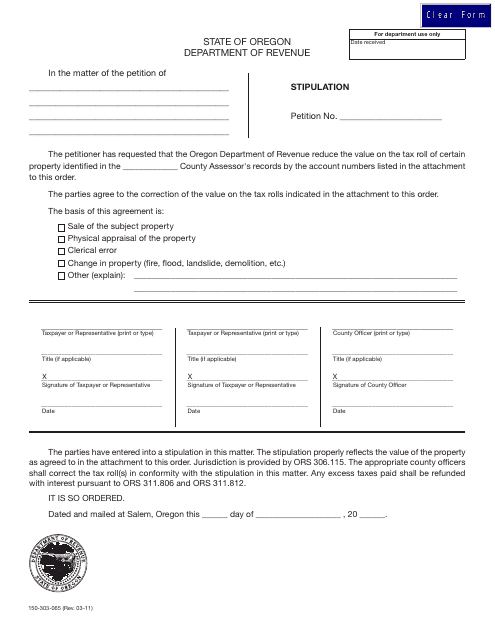

This Form is used for stipulating agreements with the County Assessor in Oregon.

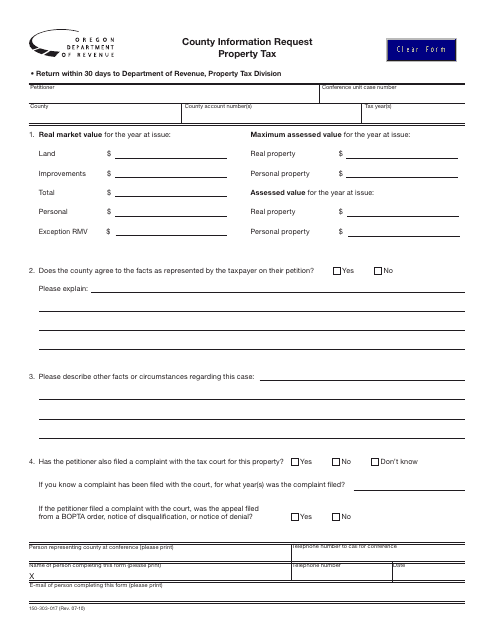

This form is used for requesting county information related to property tax in Oregon. It allows individuals to obtain specific details and records regarding their property taxes within the county.

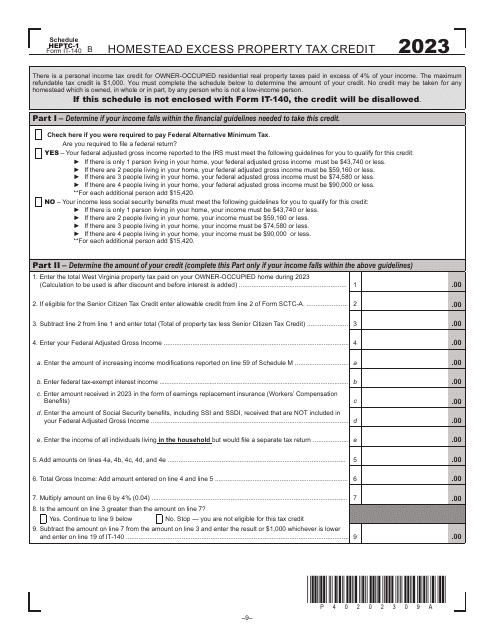

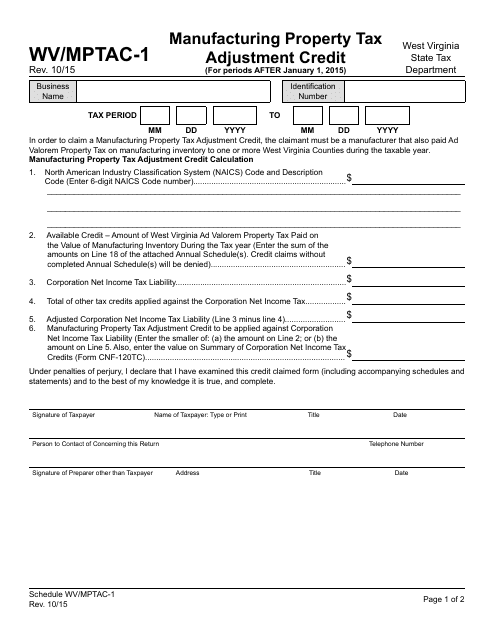

This Form is used for claiming the Manufacturing Property Tax Adjustment Credit in West Virginia. It is specifically for manufacturing companies to seek a reduction in their property tax liability.

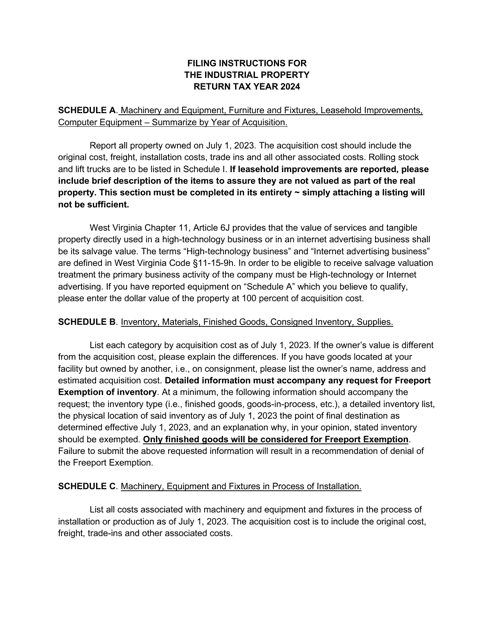

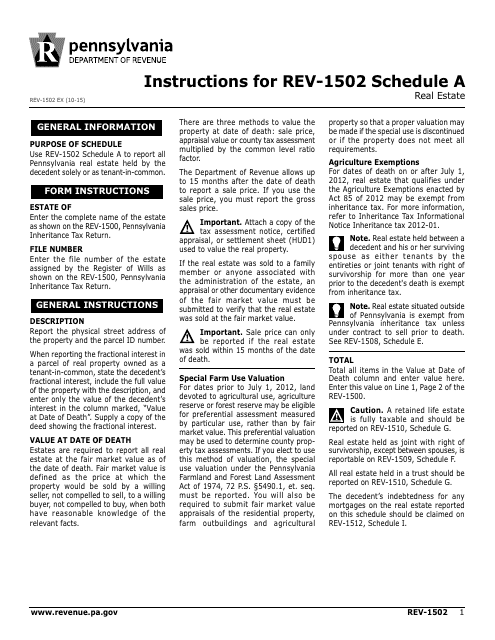

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

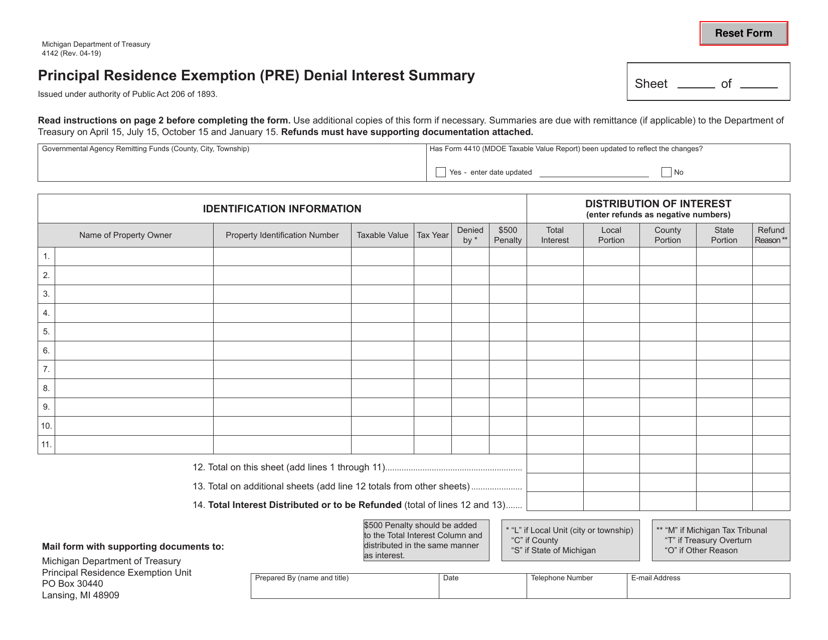

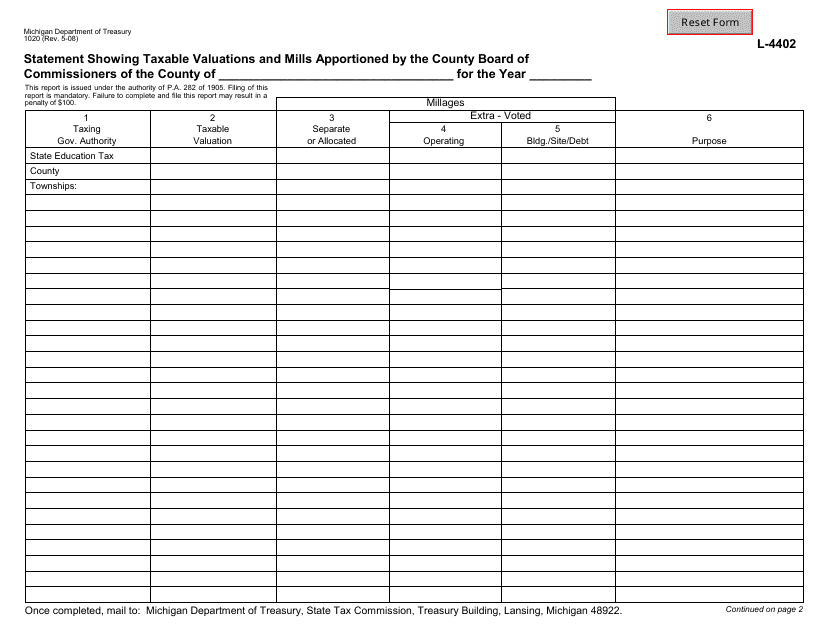

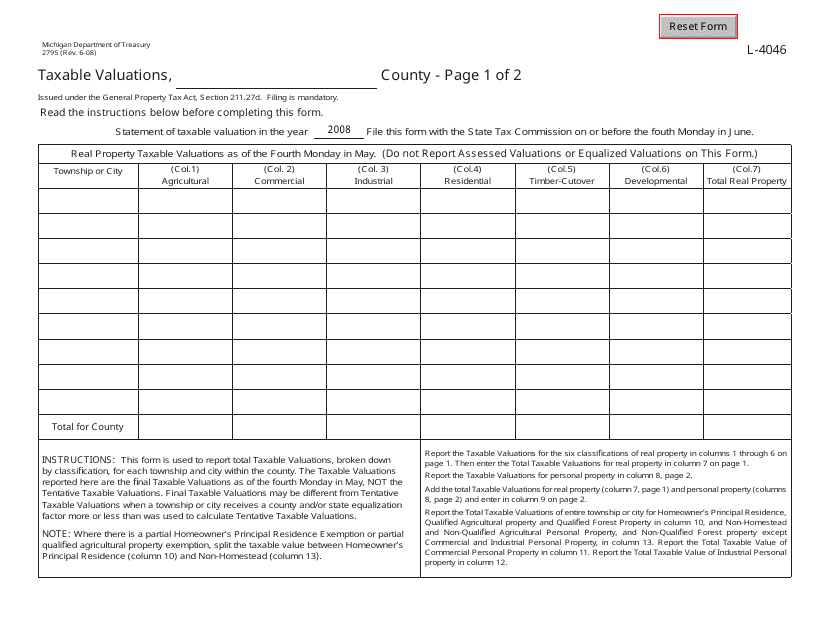

This form is used for showing the taxable valuations and mills apportioned by the County Board of Commissioners in Michigan.

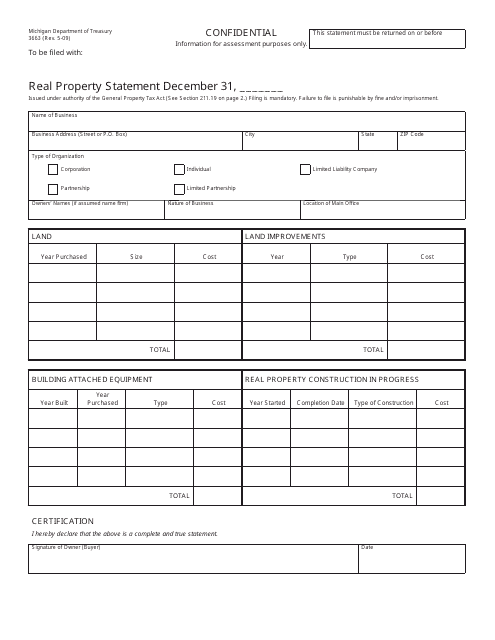

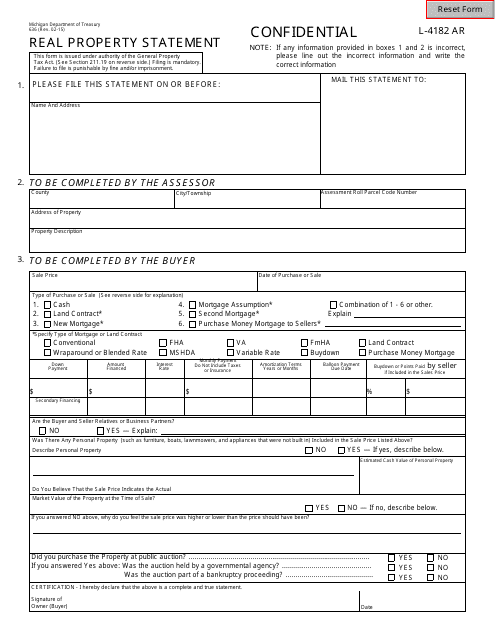

This form is used for reporting real property information in the state of Michigan. It is essential for property owners to provide accurate details about their real estate holdings to comply with state regulations.

This form is used for reporting taxable valuations in the state of Michigan. It is used by property owners to determine the value of their property for tax purposes. The form must be filed annually with the local tax assessor's office.

This Form is used for declaring real property in Michigan. It contains information about the property, its ownership, and its assessed value.

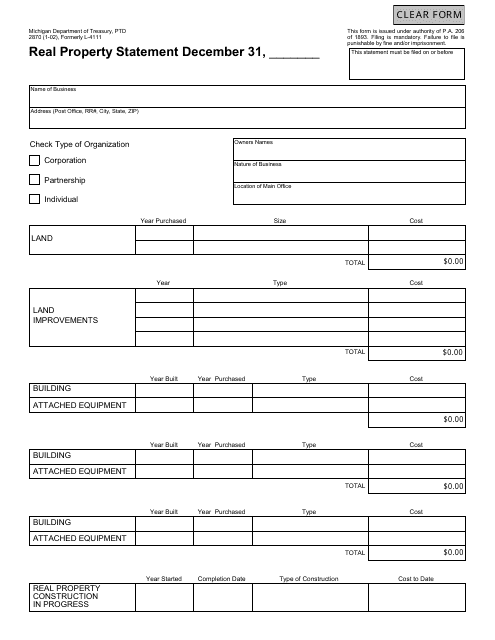

This form is used for filing a Real Property Statement in Michigan. It is also known as Form PTD2870 or Formerly L-4111.

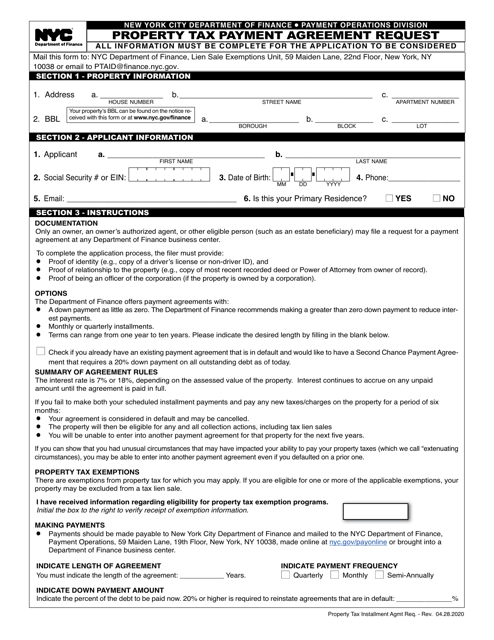

This Form is used for applying for a real property tax exemption for commercial, business or industrial real property in New York.

This Form is used for applying for a real property tax exemption under the Residential-Commercial Urban Exemption Program in New York. It provides instructions for completing the application.

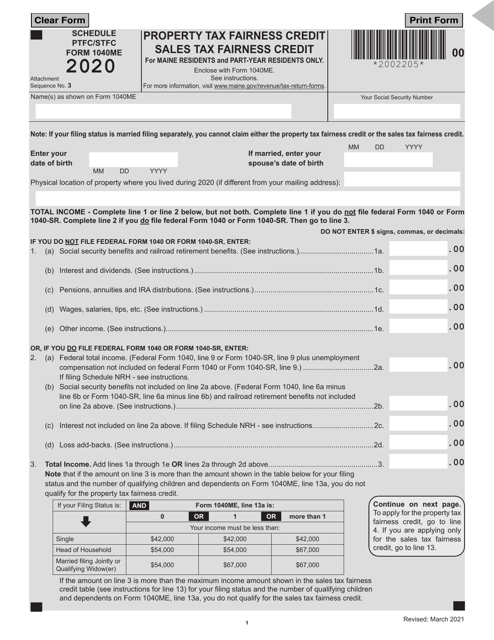

This Form is used for claiming property tax exemption for widowed spouses, minor children, or widowed parents who are shareholders of cooperative housing corporations in Maine.

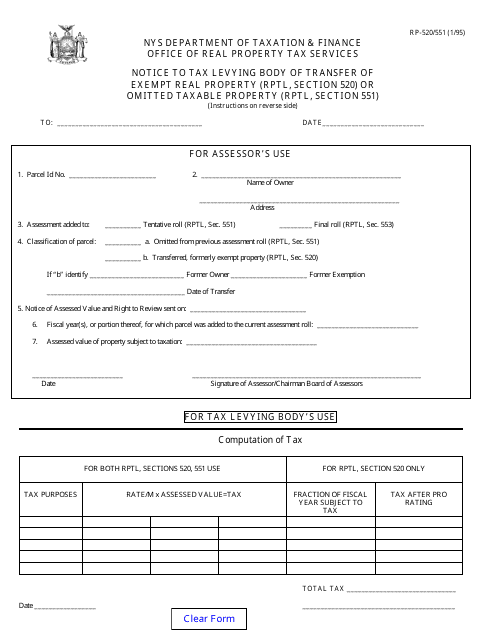

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.

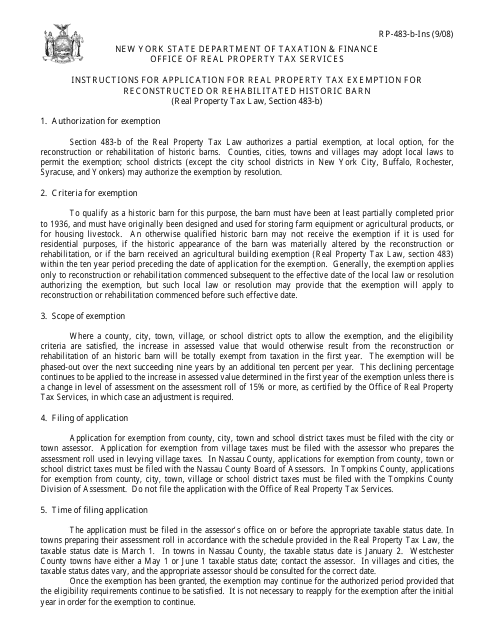

This Form is used for applying for real property tax exemption for reconstructed or rehabilitated historic barn in New York.

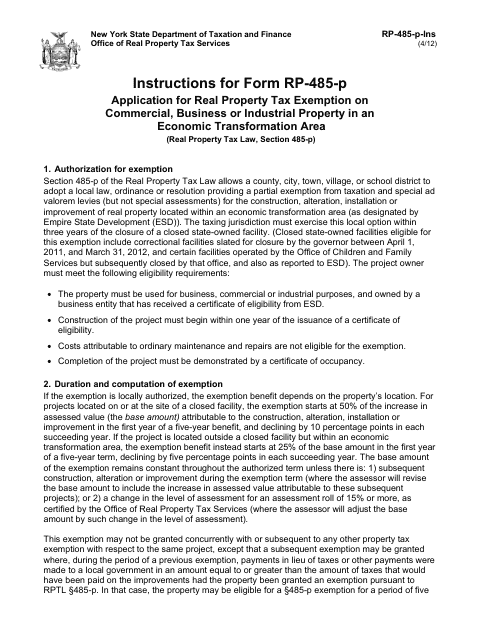

This Form is used for applying for a real property tax exemption on commercial, business or industrial property in an Economic Transformation Area in New York.

This form is used for applying for a tax exemption on residential investment properties in certain school districts in New York.

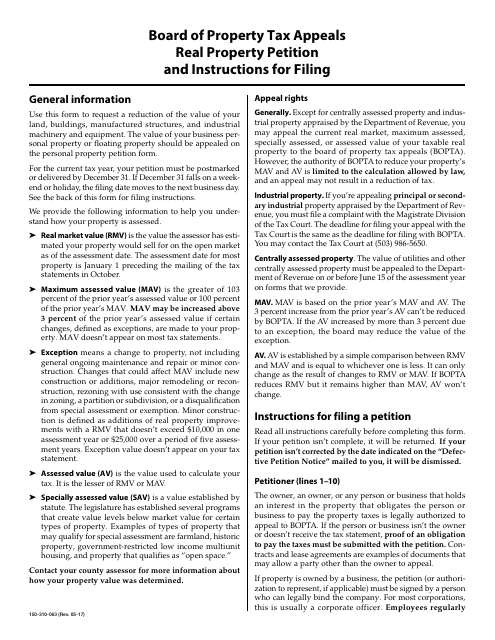

This Form is used for filing a Real Property Petition to the Board of Property Tax Appeals in Oregon.

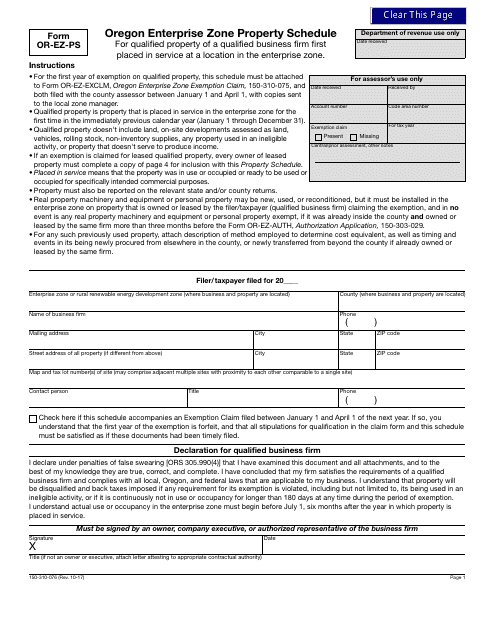

This Form is used for reporting property schedule information for the Oregon enterprise zone program.

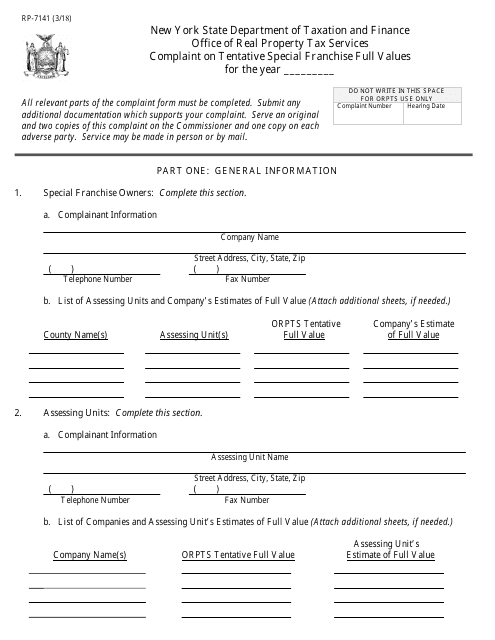

This form is used for filing a complaint about the tentative special franchise full values in New York. It allows individuals to contest the assessed values assigned to special franchises.

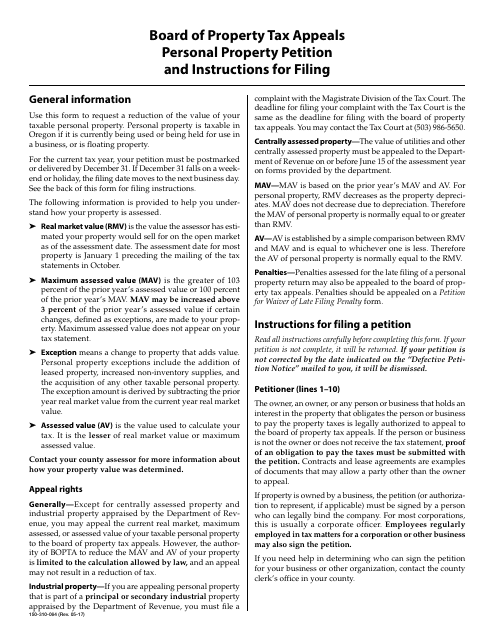

This form is used for filing a personal property petition with the Board of Property Tax Appeals in Oregon. It is used to request a review of the assessed value of personal property for tax purposes.

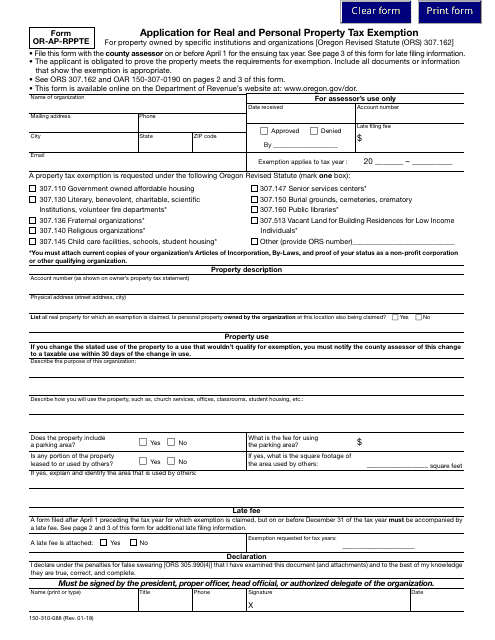

This Form is used for applying for a real and personal property tax exemption in Oregon.

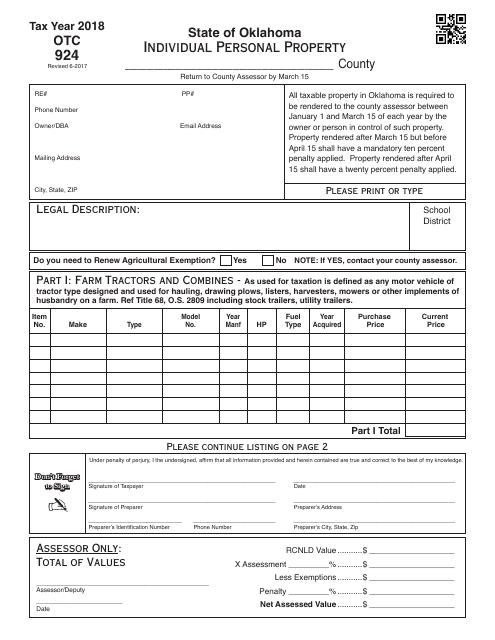

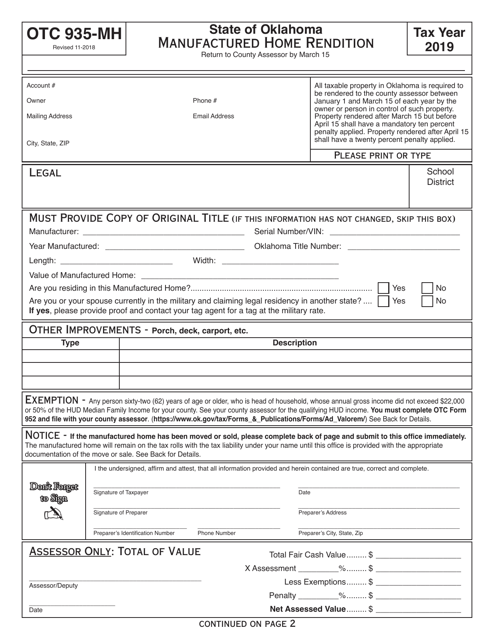

This Form is used for reporting individual personal property in Oklahoma.

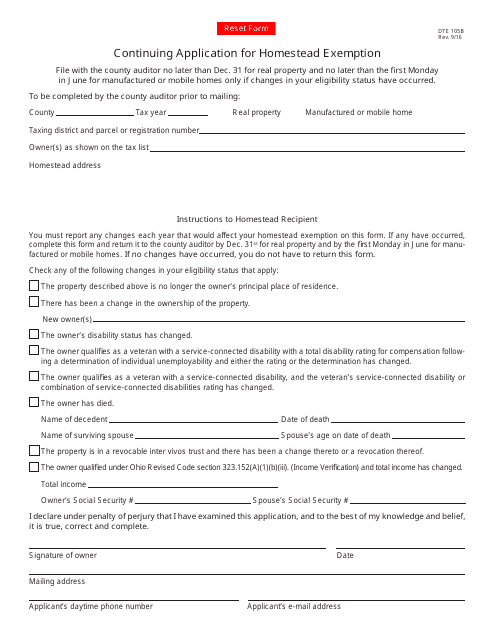

This form is used for applying for a continuing homestead exemption in the state of Ohio. It allows eligible individuals to continue receiving the benefits of the homestead exemption on their property tax.

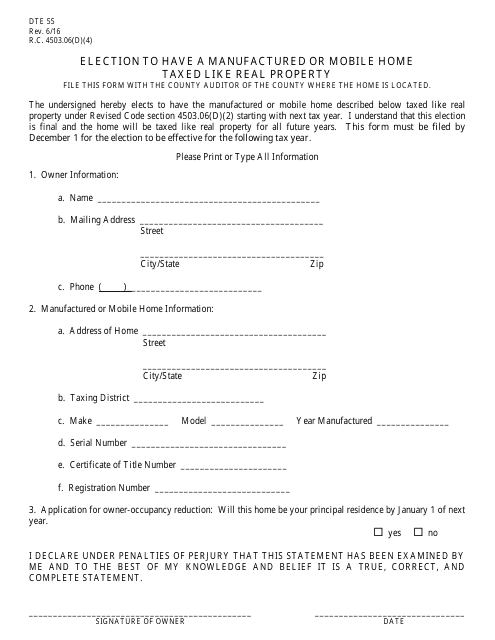

This form is used for electing to have a manufactured or mobile home taxed like real property in the state of Ohio.

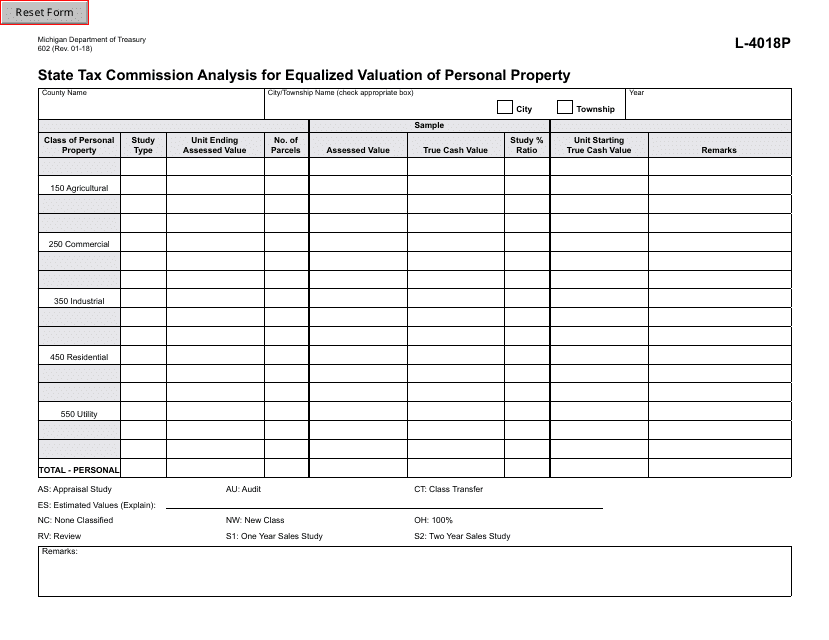

This form is used by the State Tax Commission in Michigan to analyze the equalized valuation of personal property for tax purposes. It helps determine the value of personal property owned by individuals and businesses in Michigan.

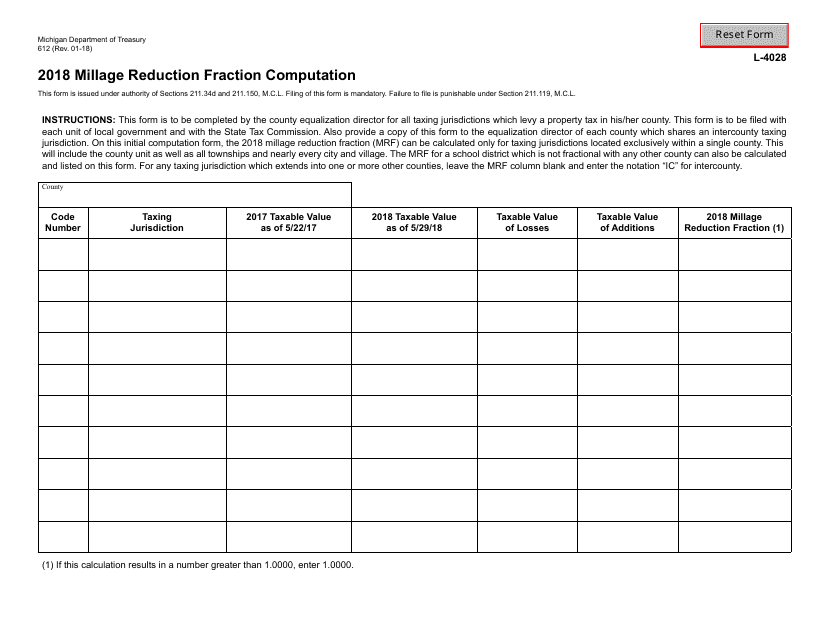

This form is used for calculating the millage reduction fraction in the state of Michigan.

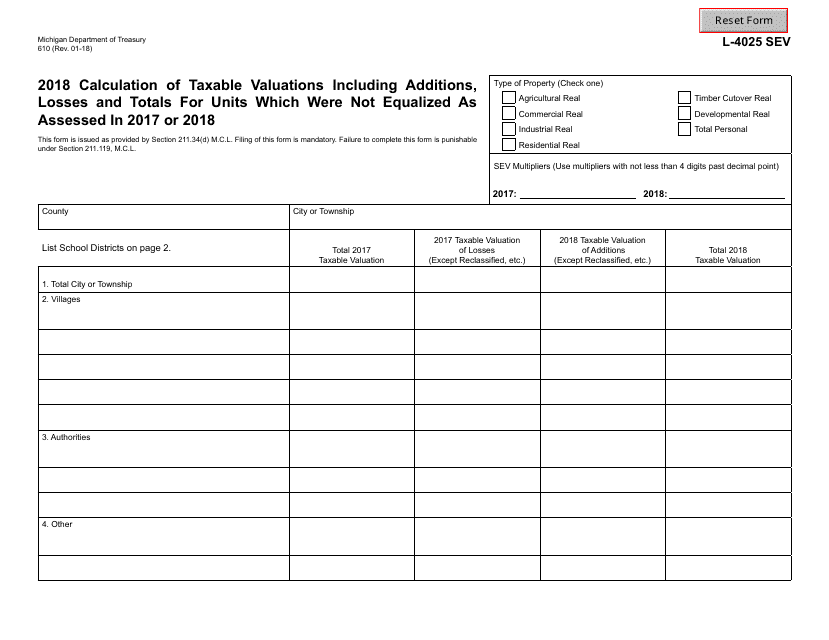

This Form is used for calculating the taxable valuations of units that were not equalized as assessed in 2017 or 2018 in the state of Michigan.

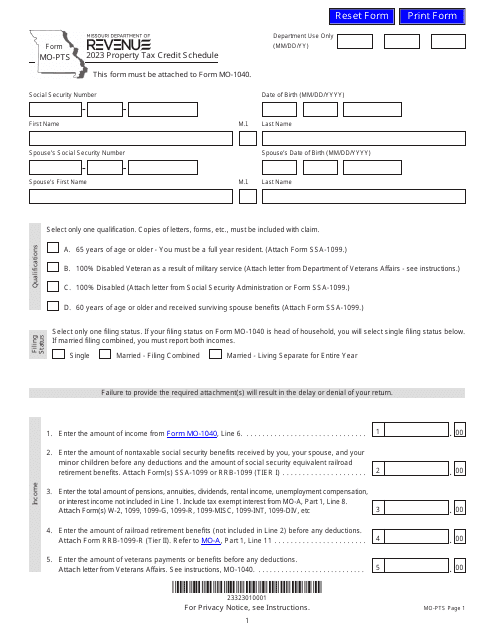

![Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)